Monthly Report – October

What Awaits Us?

U.S Macroeconomic Data

Non-Farm Payrolls Data (NFP) – 03 October

This data, which shows the employment strength in the US economy, will play a key role in the FED’s assessment of the direction of the interest rate path.

Consumer Price Index (CPI) – October 15

Consumer inflation data for October will shape the inflation expectations of the markets.

US Fed Rate Decision (FOMC) – October 29

The US Fed will announce its interest rate decision. Chairman Powell will be in front of the cameras on monetary policy.

Gross Domestic Product (GDP) – 30 October

US economic growth data will be released.

Personal Consumption Expenditures (PCE) – October 31

PCE data, which stands out as the FED’s inflation indicator, will be announced.

Other Developments

Customs Tariffs – 01 October

Trump says 100% tariffs on some imported medicines will be implemented on October 1

SEC Spot ETF Decisions – October

October marks the beginning of a critical period for the crypto sector. The US Securities and Exchange Commission (SEC) has to make a decision. This decision will be made in the coming weeks.

- October 02: Deadline for Canary’s Litecoin ETF.

- October 10: Decision expected for Grayscale’s Solana and Litecoin trust conversion.

- October 24: Final date for WisdomTree’s XRP fund.

Crypto Insigth

| Market Metric | Current Value | 30-Day Change |

|---|---|---|

| Bitcoin Price | $113,300 | +3.94% 📈 |

| Ethereum Price | $4,160 | -4.92% 📉 |

| Bitcoin Dominance | 58.87% | +1.23% 📈 |

| Ethereum Dominance | 13.11% | -7.43% 📉 |

| Tether Dominance | 4.56% | +1.13% 📈 |

| Total Market Cap | $3.83T | +2.67% 📈 |

| Fear and Greed Index | Neutral (50) | Neutral (48) |

| Altcoin Season Index | 64 / 100 | 58 / 100 |

| Crypto ETFs Net Flow | $1.061B | — |

| Open Interest – Perpetuals | $1.12T | — |

| Open Interest – Futures | $3.47B | — |

*Prepared on 30.09.2025 at 09:45 am. (UTC)

Metrics – Summary of the September

Flow by Asset

| Asset | Week 1 | Week 2 | Week 3 | Week 4 | Net Total $ (m) |

|---|---|---|---|---|---|

| Bitcoin (BTC) | 748 | 524 | 2,407 | 977.0 | 4,656.0 |

| Ethereum (ETH) | 1,419.4 | -912.4 | 645.9 | -772.0 | 380.9 |

| XRP (Ripple) | 14.7 | 14.7 | 125.9 | -69.4 | 85.9 |

| Solana (SOL) | 177.1 | 16.1 | 198.4 | 127.3 | 518.9 |

| Litecoin (LTC) | – | – | – | 0.5 | 0.5 |

| Cardano (ADA) | 5.2 | -0.4 | 1.0 | 1.1 | 6.9 |

| SUI | -5.8 | 0.6 | 14.0 | 2.1 | 11.9 |

| Other’s | -2.7 | -0.8 | 3.4 | 0.1 | 0.0 |

Interest in digital assets reached remarkable heights in September. Total monthly inflows amounted to $5 billion, with a general uptrend in the crypto market. Bitcoin showed that it has regained investors’ confidence with net inflows of $4,656.0 million. Ethereum was weaker than Bitcoin, with inflows totaling $380.9 million. Ripple (XRP) was one of the notable altcoins with inflows of $85.9 million. While investments in Solana continued to increase, Litecoin remained weak in terms of investor interest. Cardano (ADA), on the other hand, showed a decline in investor interest with only $6.9 million in inflows. However, other altcoins saw weak inflows but increased diversity in the market.

Total Market Cap

The cryptocurrency market gained about $93 billion in value this month, recording a 2.53% increase in total market capitalization. Thus, the market capitalization reached 3.8 trillion dollars. During the month, the value rose to $4.08 trillion, close to the record high seen last month. In contrast, the monthly low was $3.64 trillion. This data shows that the market moved within a wide range of about $0.44 trillion (about 12% of the total market) during the month. This fluctuation indicates that the market remained highly volatile on a monthly basis and also points to an increase in investors’ risk appetite.

Spot ETF

September 2025 was a month of strong net inflows for Spot Bitcoin ETFs again. Between September 01-28, net inflows totaled $2.56 billion and institutional demand remained strong. Thus, as of September 29, cumulative net inflows to Spot Bitcoin ETFs reached $56.78 billion. Especially in the second week, positive flows were noteworthy for 7 consecutive days. During this period, while institutional demand strengthened, the Bitcoin price rose simultaneously. However, there was no clear direction after this series and fluctuating flows in the last week of the month attracted attention and net outflows seen in Spot Bitcoin ETFs increased the uncertainty on the market. On a fund basis, BlackRock IBIT ETF stood out with a net inflow of $2.51 billion. Bitcoin price closed 3.52% higher in this process. ETF inflows were the main factor supporting the price. In general, September 2025 was a period when institutional demand for Spot Bitcoin ETFs revived and supported the price. Continued inflows in October may support the rise, while increased outflows may create pressure.

September 2025 was a month of weakness and net outflows for Spot Ethereum ETFs. There was a total net outflow of 388.8 million dollars during the month. Thus, after the strong inflows seen in August, the market mood reversed in September. On a fund basis, BlackRock ETHA ETF made a limited positive contribution with an inflow of $33.3 million, while outflows from Fidelity, Bitwise and Grayscale funds caused the overall picture to turn negative. The notable development of the month was the negative net flows on 5 consecutive trading days between September 22-26. This series showed that ETF investors are more cautious in the short term. As of the 297th trading day of Spot Ethereum ETFs, the cumulative net inflow decreased to $ 13.14 billion.

Options Data

In the Bitcoin options market, about $1.63 billion worth of BTC contracts will expire until the last day of this month, while this figure will total $27.28 billion this month. Call options were concentrated in the $112,000-$118,000 band with a total of 485.77 thousand expiry transactions, while put options were in the $103,000-$108,000 range with 429.88 thousand expiry transactions. With a put/call ratio of 1.09, the maximum pain point will be realized at an average of $112,600.

In Ethereum options, ETH contracts worth $64.09 million will expire on September 30. The number of call options totaled 7,084, with a density of over 6,000, especially in the $4,200 – $4,300 band. Put options totaled 8,460, with a significant concentration in the $3,800 – $3,900 range. The Put/Call ratio is at 1.19 and the maximum pain point is calculated at $4,075. The total value of options contracts expiring this month will be approximately $9.41 billion.

CryptoSide – October

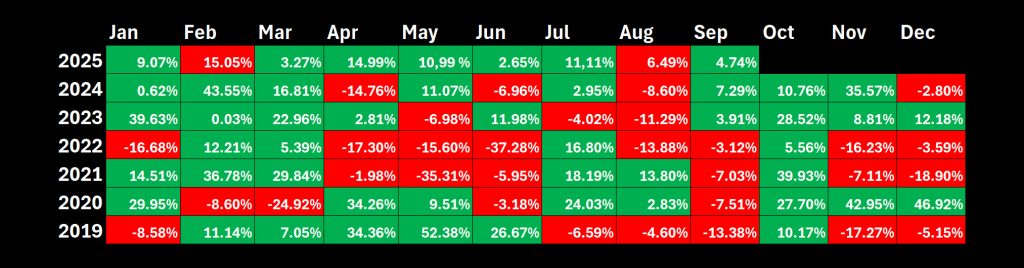

Bitcoin’s September Performance: Unexpected Attack

Historically, September has been known as a weak period for Bitcoin, but this year the picture is different. With an average increase of 4.74%, Bitcoin is performing well above the negative average of 3.12% in the past. In 2023 and 2024, similar trends are seen, making September a possible trend reversal month.

October: “Uptober” and Crypto’s Shining Period

October can be described as “prime time” for Bitcoin investors. In this month, which has witnessed double-digit increases almost every year since 2019, an average value increase of 21.89% stands out. The only exceptions were negative closes in 2014 and 2018, while Bitcoin gained 10.76% last year.

However, despite these strong statistics, it is important to remember that markets are highly sensitive and volatile in the face of macroeconomic dynamics and geopolitical developments. Therefore, positive expectations for October should be accompanied by a cautious strategy.

*Prepared on 30.09.2025 at 10:00 am. (UTC)

Source: Darkex Research Department

Here are some important headlines that may have an impact on the market in October:

Customs Tariffs: As of October 1, the new tariffs will come into effect, which stands out as a critical development in terms of trade balances.

Spot ETF Results: A critical period begins for the crypto sector in October. The decisions of the US Securities and Exchange Commission (SEC) will be decisive for the markets and altcoins.

Geopolitical Tensions: The ongoing instability in the Middle East and the delayed reconciliation between Russia and Ukraine continue to play a decisive role on investor sentiment.

Market Pulse

Macro Outlook in the Shadow of FED and Futures Markets…

We cannot say that September started badly for digital assets. In mid-August, Bitcoin, which suffered sharp losses immediately after hitting a record high of 124 thousand dollars, fell to 107 thousand at the end of the relevant month. The largest cryptocurrency, which stood at $118,000 until the day after the Federal Open Market Committee (FOMC) meeting, where the US Federal Reserve (FED) decided to cut interest rates, started to record deep losses again on September 18. So, in fact, before this downward pressure, September was going quite well for digital assets.

So, what happened next? Following the FOMC’s rate cut on the back of deteriorating employment data, the markets, which had already priced in the best-case scenario, started to liquidate the large, long positions accumulated in futures, which turned into a chain that triggered each other. We can also consider Powell’s refraining from giving a message that a new rate cut cycle has begun despite the rate cut decision, and the AI rally on Wall Street starting to be questioned as dynamics that contributed to these declines.

At the end of the day, we can say that the much-anticipated Fed rate cut was once again far from producing the outcome that everyone had hoped to see once it materialized. Once again, a typical pricing behavior that we see in periods when traders are frontally and strongly pricing in the best possible scenario once again caught many traders by surprise.

We continue to see that macro dynamics play an important role among the variables that determine the value of digital assets. In October, which is called “Uptober” for cryptocurrencies, we think that developments regarding the US economy will continue to be effective and in this parallel, step by step, we detail the headlines waiting for investors.

October 3 – US Employment Data

We are amid a period of surprising macroeconomic data on the US economy and global markets will be closely watching the employment indicators for September, especially in an environment where retrospective revisions by the agencies releasing the figures are gaining attention. The Non-Farm Payrolls Change (NFP) will be in focus among the data set that will provide valuable information about the next interest rate change move by the US Federal Reserve (if the US government gets the necessary funds to make federal payments and the parliament approves the necessary bill to prevent a partial government shutdown by avoiding the risk of non-disclosure of the data).

The Bureau of Labor Statistics (BLS) announced the deepest downward revisions in history for the previous months, revealing that the labor market in the world’s largest economy may not be as tight and strong as previously thought. This data caused the FED to change its stance on interest rates, leading to a redistribution of cards in financial markets. On October 3, the new NFP for September will be of critical importance ahead of the Federal Open Market Committee (FOMC) meeting on October 29.

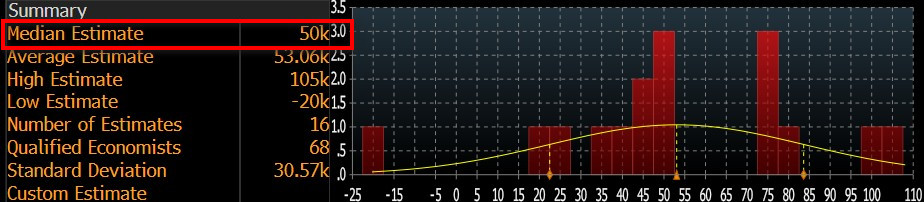

Source: Bloomberg

Our forecast for the highly sensitive NFP data is that the US economy in the non-farm sectors in September will be higher than the market expectation. At the time of writing, although the number of forecasts entered is small, we see that the consensus (median forecast) in the Bloomberg survey is more pessimistic, around 50 thousand (This expectation figure may change later with the entry of new forecasts and surveys).

Source: Bloomberg

We believe that if the NFP data for September is slightly below expectations, this may strengthen expectations that the FED may act more boldly to cut interest rates, thus increasing risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect . On the other hand, a much lower-than-expected figure could lead to a perception that the risk of a recession in the US economy has re-emerged. In this case, risk appetite may be suppressed, leading to a depreciation of cryptocurrencies. Therefore, we underline that we think it will be important for traders to know this difference.

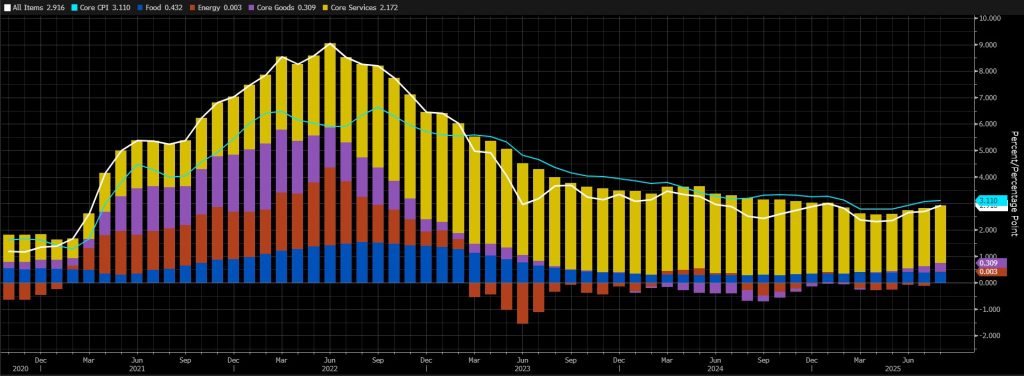

October 15 – US Consumer Price Index: CPI

One of the important macro indicators that may provide information about the US Federal Reserve’s (FED) interest rate cut course will be the September inflation, Consumer Price Index (CPI) change. In the current difficult conjuncture, CPI data, which may give a sign of the course, will be closely monitored as it may have an impact on pricing behavior.

Source: Bloomberg

The annual inflation rate in the US accelerated in line with market expectations to 2.9% in August 2025, the highest level since January, after coming in at 2.7% in June and July. Prices of food (2.9% vs. 3.2% in July) used cars and trucks (4.8% vs. 6%) and new vehicles (0.4% vs. 0.7%) rose faster. On a monthly basis, CPI rose by 0.4%, the highest rate since January, above forecasts of 0.3%. Shelter accounted for the biggest upward pressure, rising by 0.4%. On the other hand, core inflation held steady at 3.1%, the same level as in July and the peak of February, while core CPI rose by 0.3% mom, in line with the July pace and market forecasts.

A lower-than-expected CPI reading could mean that the FED will be in a better position to cut interest rates, which could have a positive impact on digital assets. A higher-than-expected number would reinforce expectations that the Fed will not rush into another rate cut, potentially adding pressure.

October 29 – FOMC Statement

The US Federal Reserve’s (FED) seventh Federal Open Market Committee (FOMC) meeting of the year will be held on October 28-29, and decisions will be announced on October 29. The FOMC is expected to cut the policy rate by 25 basis points (according to the CME FedWatch Tool at the time of writing) and the decisions, rationale and announcements will be critical for global markets.

On October 29, investors will be trying to catch any clues in the FOMC’s statements that could lead to a major shift in market expectations. The first thing to look for is whether the interest rate was cut by 25 basis points as expected. Half an hour after this decision and the release of the text of the statement, Fed Chair Powell will step behind the lectern and hold a press conference.

1-Will the interest rate be cut?

As we mentioned, a 25-basis point rate cut is expected from the Committee following the recent developments and the statements of the FOMC members. A surprise decision may be to keep the interest rate unchanged, which we see as a low probability. We define a rate hike as unlikely. If the policy rate is cut by 25 basis points as expected, we do not expect this to lead to a new pricing in the markets. If the interest rate is left unchanged, we can state that this may lead to appreciation in the dollar and losses in digital assets.

2-Powell’s Press Conference

As is the case after every FOMC meeting, half an hour after the decisions are published, FED Chairman Jerome H. Powell will speak at a press conference on October 29. Powell will first read the text of the decision and explain the reasons for the decisions taken. Then there will be a question-and-answer session where press members’ questions will be answered. In this part, volatility in the markets may increase a little more.

We do not expect a major change in Powell’s stance in his recent speeches. The Chairman acknowledged the deterioration in the labor market but emphasized that rate cuts are not a foregone conclusion and that they will be data-driven. Of course, the importance of the President’s speech will depend on what the interest rate decision is. After a decision taken in line with expectations, Powell will be more likely to give clues about whether there will be a rate cut at the next meeting. However, if a surprise decision is made to keep interest rates unchanged, his assessments on the reasons for this decision will be followed.

In the face of questions from the press, Powell’s more hawkish stance than before may strengthen expectations and pricing that the Fed will not be in a hurry to continue rate cuts. This may have some negative impact on digital assets. However, his evaluations on both inflation and the labor market and his mention of the necessity of a new interest rate cut may increase the risk appetite and this may have positive effects on cryptocurrencies.

October 30 – GDP

With Donald Trump taking over the Oval Office on January 20 following his election victory, a new era began for the US economy. In particular, tariffs and their impact on global trade flows, as well as their repercussions on the decisions to be taken by economic actors, had some side effects. In the first quarter of the year, the US economy contracted by 0.6% due to the uncertainty and other various dynamics. In the previous quarter, it grew by 1.9%.

According to the latest data, the world’s largest economy managed to grow by 3.8% in the second quarter of 2025. The previous calculation for the relevant quarter by the agency that prepared this data was 3.3%, and this (revised to 2.8%) represented a major update.

After this surprise data, there were expectations that the US Federal Reserve (FED) might not be too hasty in cutting interest rates. Because in a fast-growing economy, there is another indicator that we will see as a by-product, and that is inflation. A metric that the FED would not want to see rise.

For now, we think that this figure will not significantly affect the FED’s rate cut course, as there is serious evidence that the labor market is deteriorating. This is because the deferred demand in the first quarter has piled up in the second quarter and the import-export balance has come out of its seasonal cycle, and the FED will take this into account. Therefore, we consider the economic growth (GDP) data as an indicator that should be closely monitored, and we think that it is valuable to see the next data sets. In this context, the new data may have a lot to say.

Source: Bloomberg

The new data will be the first estimate for the third quarter of the year and is therefore important.

In terms of instant market reaction, we think that a data above the consensus expectation in the market may have a negative impact on digital assets with the pricing of expectations regarding the FED’s interest rate course. A figure that will be below the forecasts, on the other hand, may create a ground for rises . Let us underline that these expectations are based on market behavior. Changes that may occur in the conjuncture until the announcement date of the data in question may lead to a change in the market reaction after the announcement of the data. Therefore, it will be useful to follow Darkex’s weekly bulletins to closely monitor any updates we may make.

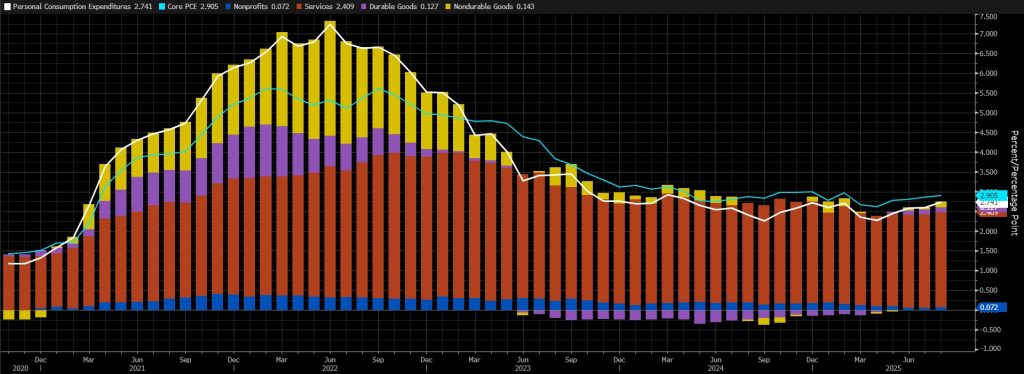

October 31 – FED’s Favourite Inflation Indicator PCE

Markets will be watching the Personal Consumption Expenditures (PCE) data for September closely for clues on whether a rate cut will be decided at the Federal Open Market Committee (FOMC) meeting in October. This indicator is known as the preferred gauge for FOMC officials to monitor changes in inflation.

Source: Bloomberg

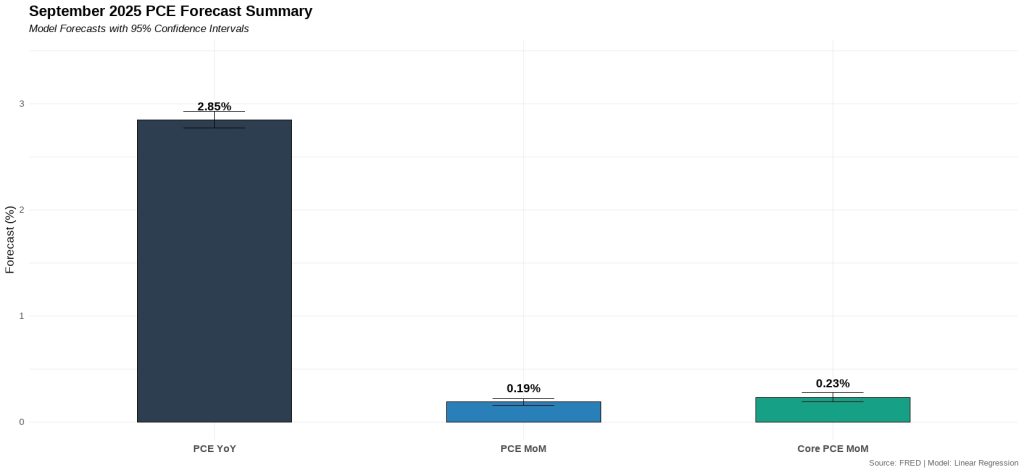

According to the latest data, PCE prices in the US increased by 2.7% yoy in August 2025, reaching the highest level in the last six months, but the figures were in line with market expectations. The monthly change in core PCE was 0.2%, again in line with market forecasts. Our expectation is that the annual PCE Price Index will rise to 2.85% in September, while the monthly change will be 0.19%, close to the increase in August.

Source: Darkex Research

A higher-than-expected data may support expectations that the FED will maintain its cautious stance on interest rate cuts, reducing risk appetite and putting pressure on digital assets. A lower-than-expected data may pave the way for value gains with the opposite effect.

*General Information About Forecasts

In addition to the general market expectations, the forecasts shared in this report are based on econometric modeling tools developed by our research department. Different structures were considered for each indicator, and appropriate regression models were constructed in line with data frequency (monthly/quarterly), leading economic indicators and data history.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform in an up-to-date and automated manner, so that every forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modeling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) in order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account in the interpretation of model outputs, and it should be kept in mind that there may be deviations in forecast performance due to economic shocks, policy changes and unforeseen external factors. With this monthly updated working set, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.