MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Change (%) | Market Cap. | ||

|---|---|---|---|---|---|

| Weekly | Monthly | Since the Beginning of the Year | |||

| BTC | 101,846.96$ | 7.38% | -2.08% | 7.84% | 2,02 T |

| ETH | 3,405.50$ | 3.01% | -11.95% | 1.48% | 410,06 B |

| XRP | 3.292$ | 42.14% | 30.51% | 41.37% | 188,99 B |

| SOLANA | 214.79$ | 11.73% | -0.99% | 10.81% | 104,54 B |

| DOGE | 0.4102$ | 21.87% | 6.16% | 26.41% | 60,53 B |

| CARDANO | 1.117$ | 16.55% | 7.81% | 21.81% | 39,30 B |

| TRX | 0.2467$ | 1.55% | -9.65% | -3.35% | 21,26 B |

| AVAX | 41.26$ | 9.27% | -11.63% | 9.48% | 16,98 B |

| LINK | 24.26$ | 18.68% | -11.19% | 11.97% | 15,49 B |

| SHIB | 0.00002414$ | 11.00% | -6.98% | 11.45% | 14,22 B |

| DOT | 7.418$ | 10.03% | -10.53% | 5.49% | 11,41 B |

*Table was prepared on 1.17.2025 at 11:30 (UTC). Weekly values are calculated for 7 days based on Friday.

Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: +25

Last Week’s Level: 50

This Week’s Level: 75

This week, the Fear and Greed Index rose from 50 to 75. The fact that the inflation data released in the US did not surprise as feared and the CPI came in lower than expected increased investors’ risk appetite and revived interest in digital assets. These developments contributed to the strengthening of the positive sentiment in the market and pushed the index to the “greed” level.

The news that Donald Trump will consider cryptocurrencies as a “national priority” and the fact that he will take office on Monday further increased positive expectations for the crypto ecosystem. While investors closely monitored the impact of the new administration on digital assets, these developments were among the important factors supporting the rise in the index. In particular, the expectation that Trump’s first steps in this area could be decisive on the value of cryptocurrencies accelerated the upward movement of the index.

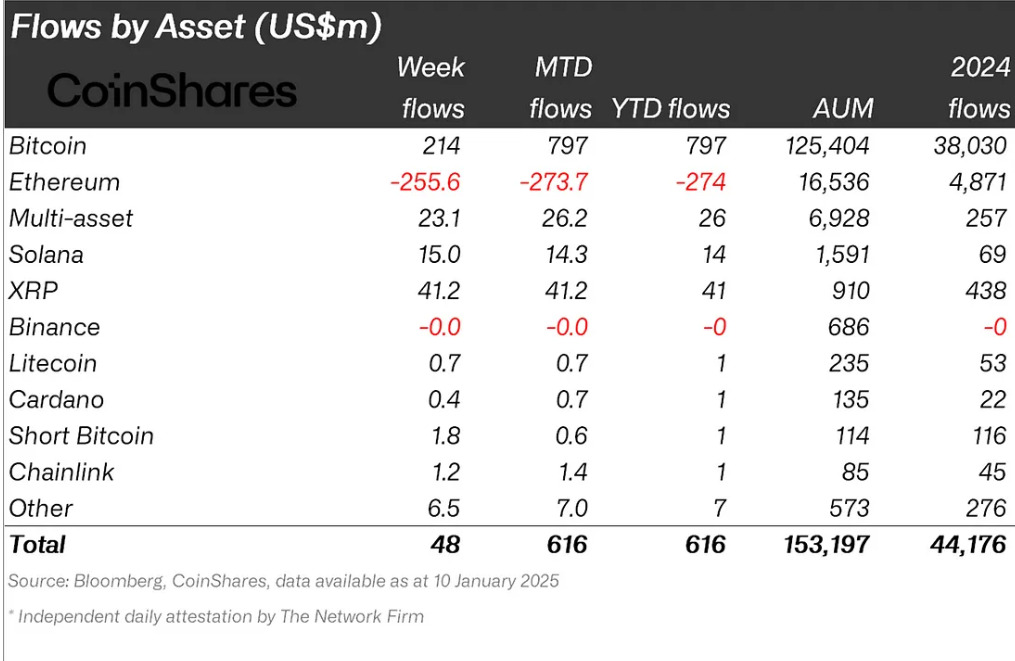

Fund Flow

Source: CoinShares

Fund Inputs;

- Bitcoin (BTC): Inflows amounted to $214 million.

- Solana (SOL): Inflows amounting to 15 million dollars.

- XRP: Inflows amounted to $41 million

- Litecoin (LTC): Inflows amounted to $0.7 million.

- Cardano (ADA): $0.4 million inflows were seen.

- Other: 6 million dollars in inflows seen.

Fund Outflows;

- Ethereum (ETH): – Saw an outflow of $256 million.

Digital asset investment products saw inflows amounting to $48 million last week. Despite poor price performance, altcoins also saw inflows. The most notable were Aave, Stellar and Polkadot with inflows of $2.9 million, $2.7 million and $1.6 million, respectively.

In terms of outflows, Ethereum suffered the most last week, with $256 million in outflows this week, which may be due to broader tech sell-offs rather than any specific issues with the asset.

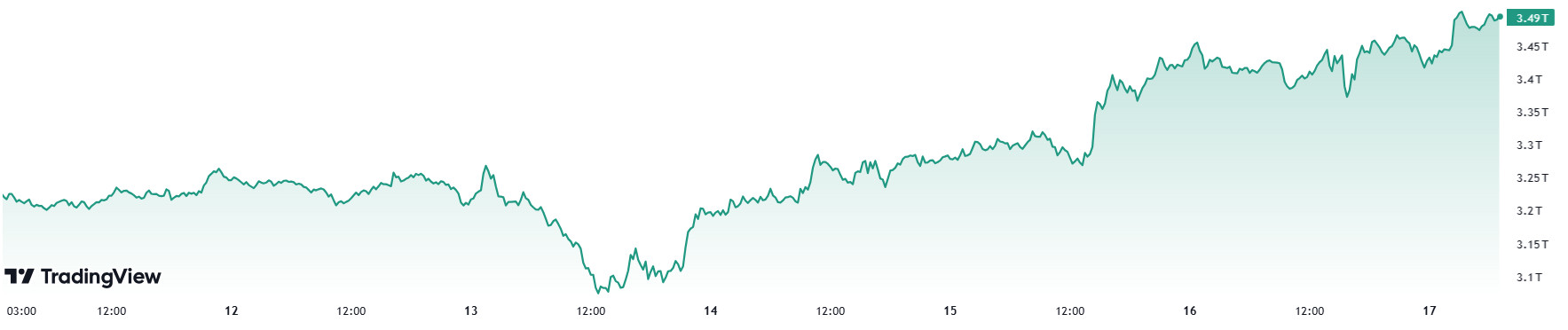

Total MarketCap

Source: Tradingview

- Last Week Market Capitalization: 3.19 trillion dollars

- This Week Market Capitalization: 3.49 trillion dollars

After a 5.49% decline last week with a net outflow of $187.41 billion on the total market, this week saw a net inflow of $188.47 billion and the market is on a positive trend with an increase of 8.22%. This recovery shows that the risk appetite in the markets has increased again, and investors’ confidence has returned. This rise, especially in large-scale assets, can be considered as an important sign of a positive turn in market dynamics.

Total 2

Despite closing the previous week negatively, this week saw an increase of 9.29% on Total 2, with an increase of $125.45 billion. When the percentage increases compared to Total are compared, it is observed that altcoins continue to be dominated by Bitcoin, but they have had a more positive week compared to Bitcoin. This can be considered as a signal that movements in the altcoin market have begun.

Total 3

When Total 3 is analyzed, similar to Total and Total 2, it shows a positive outlook with an increase of 11.97% this week, despite closing last week negative. The higher performance of Total 3 compared to Total 2 reveals that altcoins in general had a more profitable week than Ethereum.

While $125.45 billion of the $188.74 billion that provided the total increase in the market flowed into altcoins, $63.02 billion was collected on Bitcoin. Considering that more than half of the total value in the market is created by Bitcoin, it is evaluated that if this picture continues, Bitcoin’s dominance in the cryptocurrency market may continue to decrease compared to altcoins.

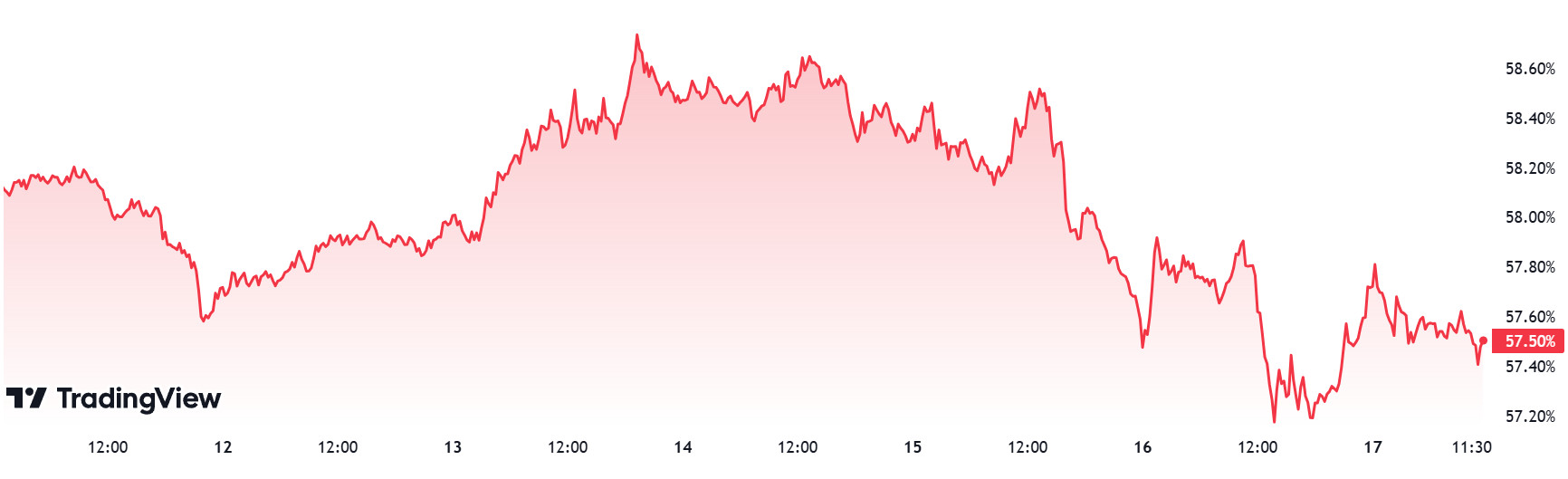

Bitcoin Dominance

Source: Tradingview

Weekly Change:

Last Week’s Level: 57.98%

This Week’s Level: 57.50%

Bitcoin dominance has been under pressure since the 59.92% levels and entered a retracement process and fell as low as 56.63% in the last week of December. However, as of last week, it found support at these levels and started to exhibit a positive trend. This positive trend led to a rise up to 58.65% in the current week. However, Bitcoin dominance, which has come under pressure again from this level, has returned to a negative outlook on a weekly basis.

In this context, Bitcoin dominance ended last week at 57.98%, while it has been on a negative course at 57.50% as of this week.

Ethereum Dominance

Source: Tradingview

Ethereum Dominance

ETH dominance, which closed last week at 12.19%, completed this week in a mixed course. ETH dominance, which started the week with a decline, tried to recover in the middle of the week, but as the end of the week approached, it declined again and saw its levels in March 2021. ETH Dominance is currently at 11.70%.

In the coming week, unemployment claims data will be announced on the US side. With the positive evaluation of this data by the market, there may be an increase in ETH dominance after possible decreases in BTC dominance. As a result of this situation, ETH dominance can be expected to rise to 12% – 12.5% levels for the next week.

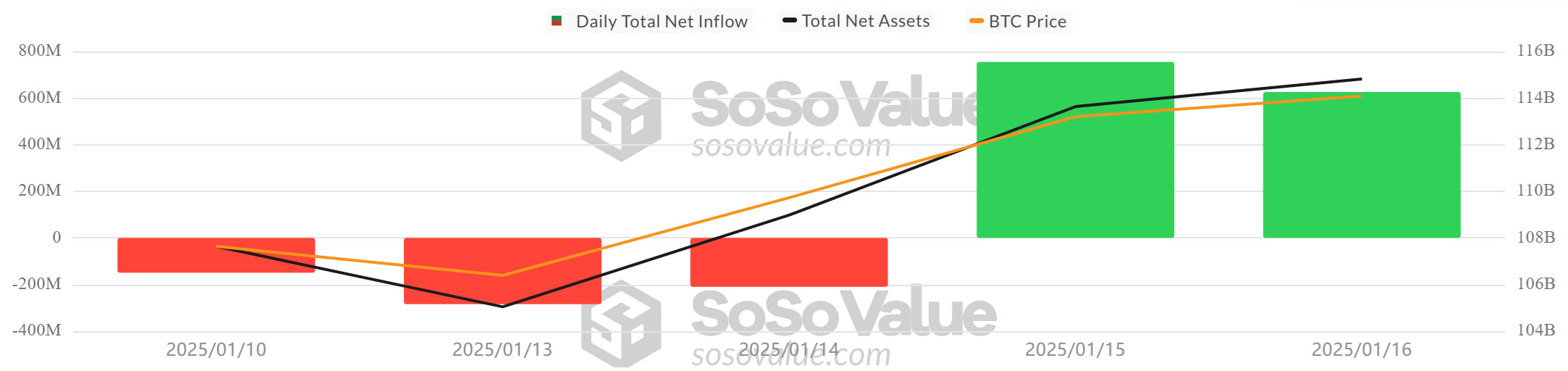

Bitcoin Spot ETF

Source: SosoValue

Featured Developments:

- Net Inflows: Between January 10-16, 2025, net inflows totaled USD 737.9 million. January 15 and January 16 stood out with high net inflows, while January 10 and January 13 attracted attention with net outflows. On January 15, Fidelity and Ark ETFs led the high net inflows. On January 16, there was a large inflow of $527.9 million into the BlackRock IBIT ETF.

- Bitcoin Price: Bitcoin, which opened at $92,506 on January 10, closed at $99,937 on January 16, up 8.03% on a weekly basis. In this process, Bitcoin also managed to rise above the $ 100,000 level. On January 15, the price of Bitcoin rose 4.09% to $100,460 and on the same day, ETFs saw net inflows of $755.1 million. However, on January 16, the price fell 0.52% to $99,937. Although ETF inflows continued during this period, there was some pressure on the price.

- Cumulative Net Inflows: Spot Bitcoin ETFs saw a total net inflow of $737.9 million between January 10-16, 2025. Cumulative net inflows into Spot Bitcoin ETFs reached $37.11 billion at the end of the 255th trading day.

| DATE | COIN | Price | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 10-Jan-25 | BTC | 92,506 | 95,882 | 3.65% | -149.4 |

| 13-Jan-25 | 94,499 | 94,485 | -0.01% | -284.1 | |

| 14-Jan-25 | 94,485 | 96,514 | 2.15% | -209.8 | |

| 15-Jan-25 | 96,514 | 100,460 | 4.09% | 755.1 | |

| 16-Jan-25 | 100,460 | 99,937 | -0.52% | 626.1 | |

| Total for 10 – 16 Jan 25 | 8.03% | 737.9 | |||

Between January 10-16, 2025, the Bitcoin price rose by 8.03%, while inflows to Bitcoin ETFs also rebounded. ETFs owned by Fidelity and BlackRock stood out as the main source of large inflows. High ETF inflows, especially on January 15 and January 16, were among the main factors supporting the price increase. However, a small price decline on January 16 signaled that profit taking was in effect.

These dynamics in the market revealed that investors’ appetite for risk has increased and price movements have shown a strong correlation with ETF flows. This momentum in the spot Bitcoin ETF market continues to increase Bitcoin’s importance in financial markets.

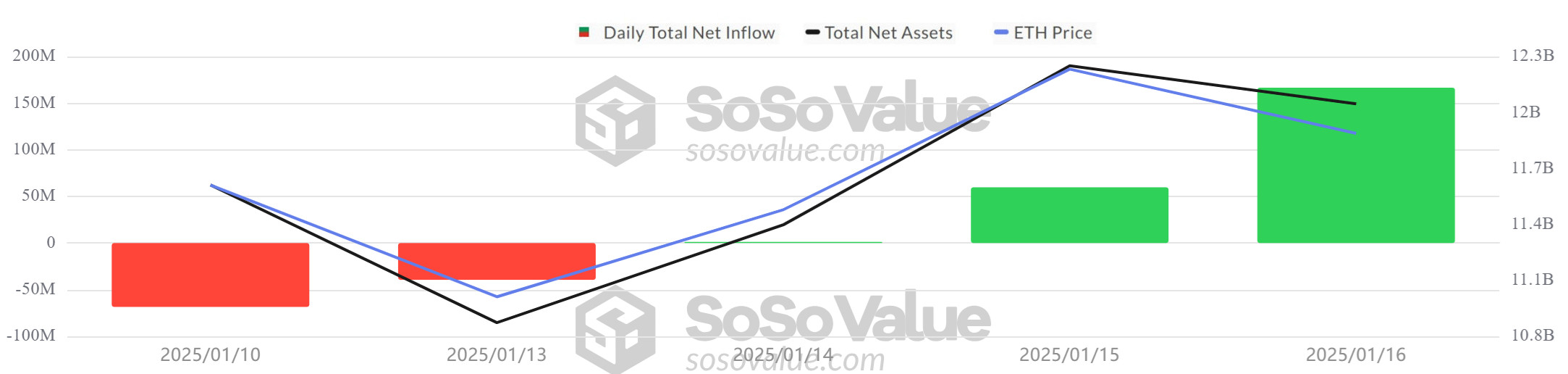

Ethereum spot ETF

Source: SosoValue

Between January 10-16, 2025, Spot Ethereum ETFs saw a total net inflow of $119.6 million. On January 16, there was a large inflow of $111.2 million into the BlackRock ETHA ETF. However, there were net outflows of -$68.5 million and -$39.4 million from ETFs on January 10 and January 13, respectively. Grayscale ETHE and Fidelity FETH ETFs were the main sources of outflows. In this process, Ethereum, which opened at $ 3,218 on January 10, closed at $ 3,306 on January 16, with a weekly increase of 2.73% on a weekly basis. Ethereum rose 7.01% to $3,449 on January 15, with a net inflow of $59.7 million into ETFs on the same day. However, on January 16, the price fell 4.15% to $3,306. While this decline signaled profit realizations, a large inflow of $166.6 million was recorded in ETFs.

| DATE | COIN | PRICE | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 10-Jan-25 | ETH | 3,218 | 3,265 | 1.46% | -68.5 |

| 13-Jan-25 | 3,265 | 3,136 | -3.95% | -39.4 | |

| 14-Jan-25 | 3,136 | 3,223 | 2.77% | 1.2 | |

| 15-Jan-25 | 3,223 | 3,449 | 7.01% | 59.7 | |

| 16-Jan-25 | 3,449 | 3,306 | -4.15% | 166.6 | |

| Total for 10 – 16 Jan 25 | 2.73% | 119.6 | |||

While Ethereum ETFs have been sensitive to investor sentiment and market conditions, price movements have fluctuated due to high volatility. In the long term, the increase in cumulative net inflows indicates continued institutional interest in Ethereum. However, in the short term, price volatility and profit selling continue to have an impact on the market.

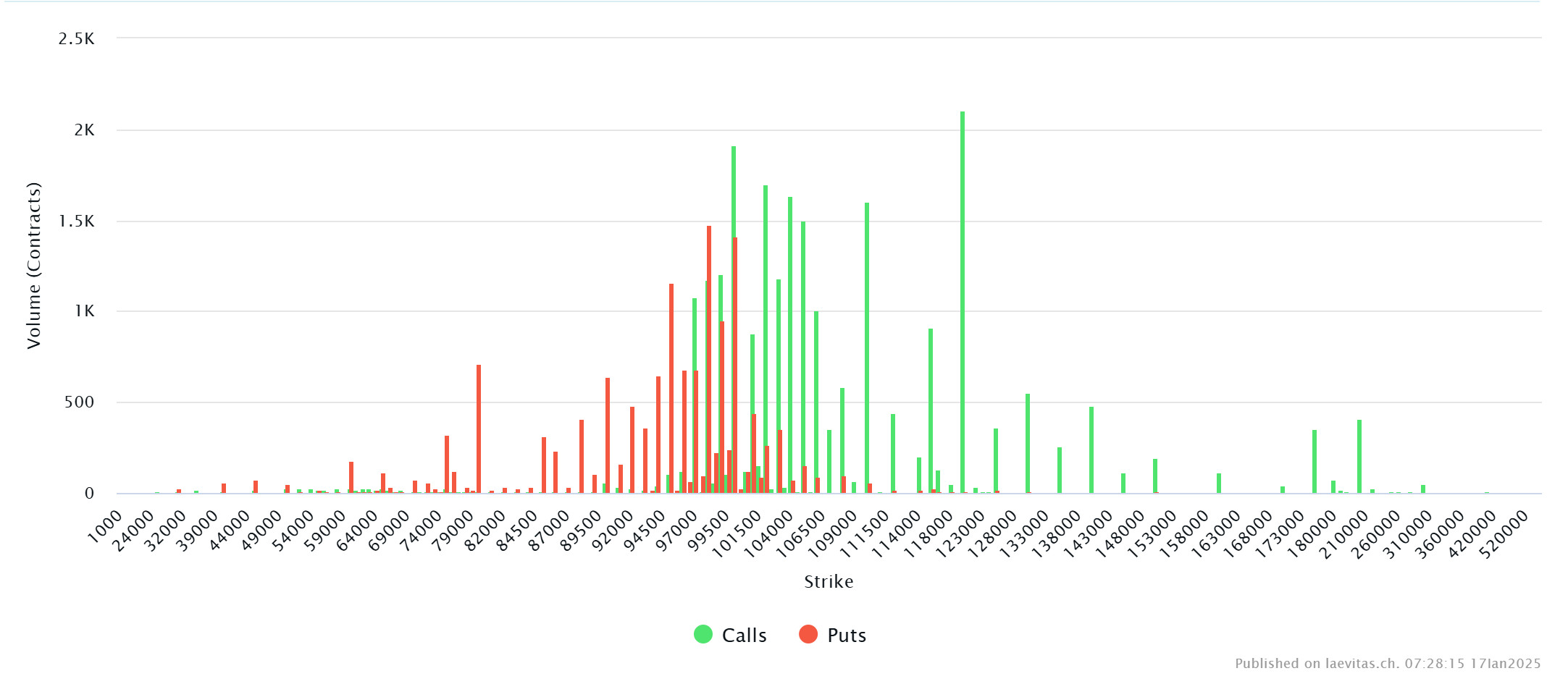

Bitcoin Options Breakdown

Source: Laevitas

Deribit Data: 22,000 BTC options contracts with a notional value of approximately USD 2.19 billion will expire today. On the other hand, Deribit’s trading volume has almost doubled in the last year, with total notional options trading volume increasing by 99%. This shows that the options market is becoming increasingly important for the market. Indeed, on January 15, Bloomberg reported that Bitcoin options trading platform Deribit has attracted interest from potential buyers and is working with financial advisor Financial Technology Partners LLC to evaluate related opportunities. However, on January 13, it was reported that Lin Chen, head of Deribit’s Asia-Pacific business unit, shared on the X platform that the probability of BTC exceeding $100,000 by the end of the month in the options market is only 32%.

BlackRock Bitcoin ETF option open positions have a notional value of $11 billion and account for approximately 50% of Deribit’s open positions. On January 15th, The Block reported that the Bitcoin derivatives market showed an increase in volatility expectations as Donald Trump prepares for his second inauguration on January 20th. All of this was triggered by the Fed’s adjustment in interest rate cut expectations, and options data showed that market volatility will continue in January.

Laevitas Data: When we examine the chart, if we look from a broad perspective, it is seen that approximately put options are concentrated in the 85,000 – 102,000 level band. Call options are concentrated at 97,000 – 112,500 and the concentration decreases towards the upper levels. At the same time, resistance has formed at around $ 100,000. On the other hand, it is seen that call options peaked at the $120,000 level and there is a general decline in volume after this level. On the other hand, it may be possible to predict that BTC will move upwards as call options are concentrated at the $110,000 level. This suggests that options activity may have a new bullish momentum. In short, the Bitcoin options market is showing a new optimism ahead of Trump’s inauguration.

Option Expiration

Put/Call Ratio and Maximum Pain Point: If we look at the options in the last 7 days data, the number of call options decreased by about 21% compared to last week to 79.04K. In contrast, the number of put options was 59.69K, flat compared to last week. The put/call ratio for options was set at 0.47. A put/call ratio of 0.47 indicates a strong preference for call options over puts among investors and a possible uptrend in the markets. Bitcoin’s maximum pain point is set at $97,000.

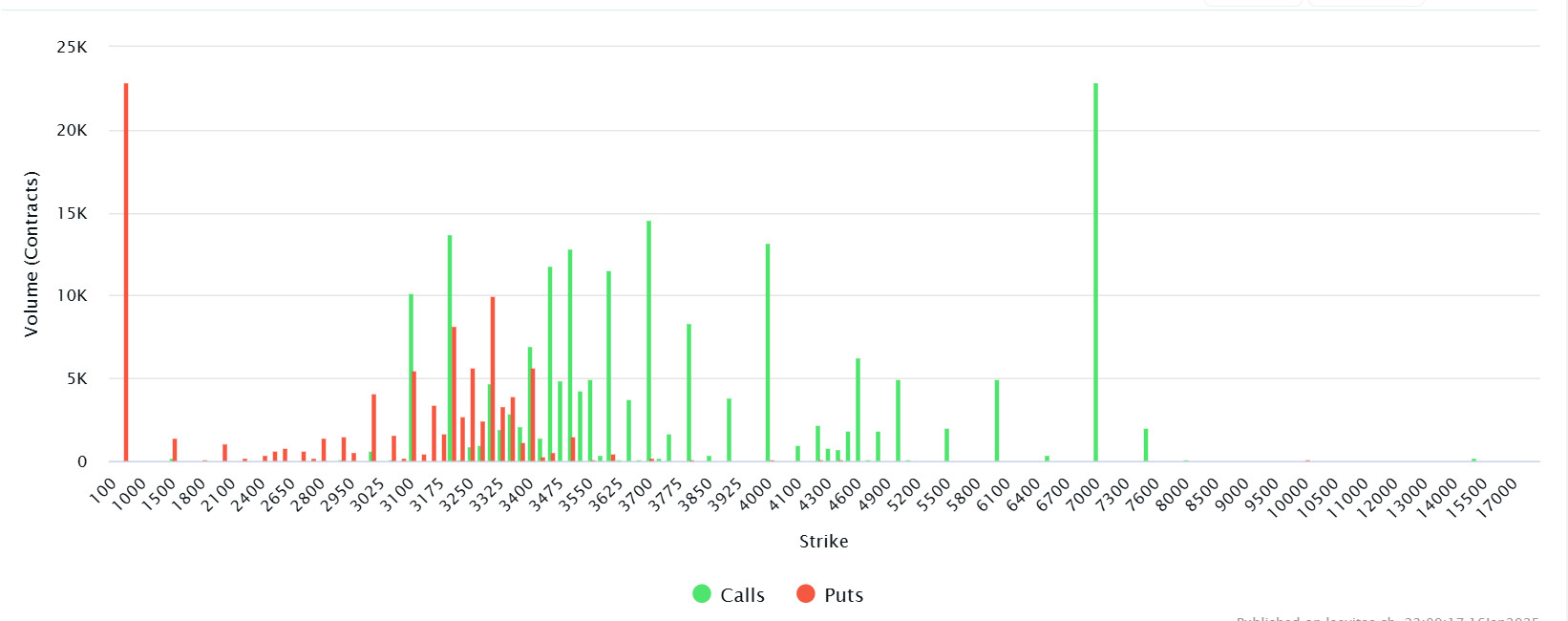

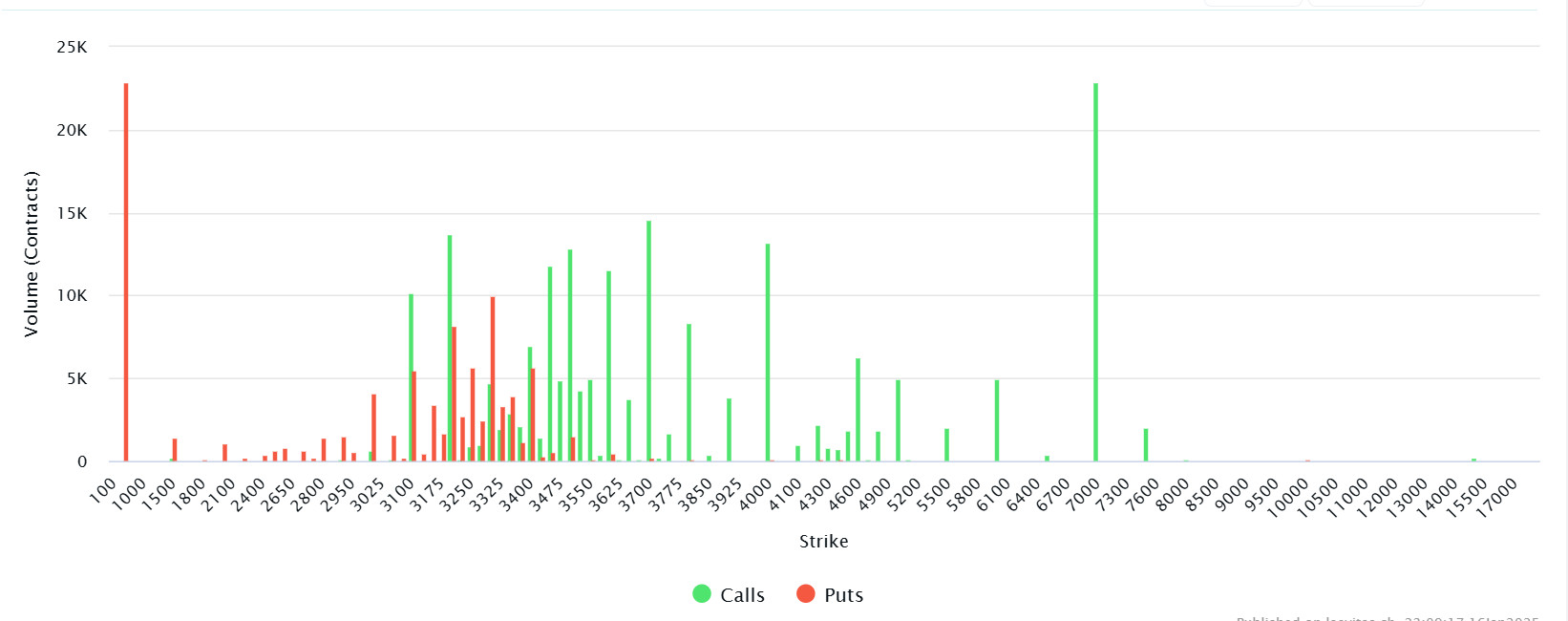

Ethereum Options Distribution

Source: Laevitas

Deribit Data: Ethereum options with a notional value of $602 million expire on January 17.

Maximum Pain Point: $3,250.

Put/Call Ratio: 0.36. This shows that investors in the market are in a strong position to expect the price to rise.

When we examine the chart, the transactions concentrated in the range of $ 3200-4000 in Call contracts indicate an expectation of a rise in the Ethereum price towards these levels. The remarkable call volume at the $7000 strike level can be considered as transactions made in the hope of a more speculative rise. Call contracts at more distant levels reflect the preferences of investors seeking high risk, high reward.

In put contracts, we see a concentration around the $1000 level. This shows that investors need to hedge against price declines. In general, we can say that the market is in balance, both in terms of evaluating a possible rise and taking precautions against declines. This shows that uncertainty and the expectation of volatility still play an important role in the Ethereum market.

WHAT’S LEFT BEHIND

Strong Non-Farm Payrolls Growth in the US

In the US, non-farm payrolls increased by 256K in December, well above the expectations, while the unemployment rate was realized as 4.1%.

US Consumer Price Index Announced

US Consumer Price Index (CPI) was realized as 2.9% yoy and 0.4% mom, in line with expectations.

Trump’s Cryptocurrency Strategy

The Trump administration plans to make cryptocurrencies a national priority, creating a crypto council, developing a strategic reserve of digital currencies and providing regulatory guidance to the sector.

FTX Debt Distribution

FTX plans to start the first payments in the debt distribution process to creditors in early 2025.

Artificial Intelligence Startups Break Records in the US

US-based artificial intelligence startups reached a record high in 2024, raising a total of $97 billion in funding.

MicroStrategy Continues Bitcoin Purchases

MicroStrategy bought another 2,530 BTC, spending a total of $243 million on these purchases.

Semler Scientific Buys Bitcoin

Semler Scientific bought 237 BTC, bringing its total assets to 2,321 BTC.

BlackRock’s Bitcoin ETF Move

BlackRock has launched Bitcoin ETF trading in Canada, aiming to make it easier for retail investors to access crypto assets.

Fed Beige Book Signals Positive Signals for 2025

The Fed’s Beige Book report showed increased economic optimism for 2025, while also highlighting risks that could affect economic activity in some regions.

eToro’s IPO Plan

eToro filed for an IPO with US regulators with a valuation target of $5 billion.

Great Expectation for Litecoin ETFs

Litecoin ETFs are expected to attract high capital inflows if they gain market acceptance similar to the Bitcoin ETF.

Tether Aims for Growth in the US

Tether is considering expanding its operations in the US and plans to take advantage of improvements in crypto regulations.

North Korea Crypto Hack Threats

The US, Japan and South Korea have called for increased international cooperation against threats from North Korea-linked hackers.

Trump Supports US-Based Crypto Projects

According to the New York Post, Trump favors the use of US-based digital currencies in strategic reserve projects.

Bitcoin Proposal to Meta

Meta shareholders suggested that the company should treat Bitcoin as a treasury asset.

Michael Saylor’s Bitcoin Shares

Michael Saylor, founder of MicroStrategy, continues to make motivational posts about Bitcoin.

Tether Obtains License in El Salvador

Tether has obtained a Digital Asset Service Provider license in El Salvador, preparing to expand its operations in the country.

Pump.fun is Being Sued by Investors

Pump.fun is being sued by investors for allegedly high fees and harmful content.

Eric Trump Announces Crypto Portfolio

Eric Trump revealed that he personally holds Bitcoin, Ethereum, Solana and SUI.

MARKET COMPASS

Last week was a positive trading period for digital assets. Expectations regarding the US Federal Reserve’s (FED) interest rate cut course, shaped by the macroeconomic indicators released, played an important role in this. In addition, ETF news about major cryptocurrencies other than BTC and ETH and, of course, expectations about Trump’s behavior during his presidential term also played an important role. While BTC has once again surpassed the $100,000 threshold, the rises in XRP and DOGE have reached remarkable heights on the back of news and expectations specific to these coins.

The digital world expects a lot from Trump, who will take over the presidency on Monday. Therefore, January 20 will be an extremely important date for the cryptocurrency ecosystem. In addition, it should be noted that we are witnessing a period in which we are once again witnessing how important the general economic outlook and expectations are for every financial instrument without exception. Therefore, as important as the Trump era and the policies to be implemented are, the tightness of the global financial ecosystem and the expectations regarding the FED’s next monetary policy decisions will continue to be just as decisive a dynamic.

The macro data agenda in the US next week will be relatively weak. In the shadow of this environment, we will hear words like tariffs, regulation and reserves much more. Trump and his team’s statements are likely to bring news-driven price changes. At this point, it would be useful to be prepared for good and bad surprises.

As we have consistently stated in our daily bulletins, we maintain our long-term bullish outlook for digital assets. Let us remind the main variables of our equation once again;

- President Trump’s victory and potential crypto-friendly policies during his 4-year term

- Expectations that the FED will continue its interest rate cut cycle, albeit at a slower pace

- Interest in crypto-asset ETFs and the potential for new ETFs to gain approval

For now, these variables continue to support a bullish expectation in our equation. The fact that digital assets are accessible and accepted by a wider investor base is a positive outcome. Of course, the news that the agenda will bring and the changes that occur due to the nature of the market may cause us to experience periods of retracement and respite pricing in the short term. We will continue to try to guide our investors in our daily bulletins.

Monetary Policy Shifts – FED and BoJ

The FED is expected to cut interest rates by 25 basis points once or twice this year. The latest inflation data and the statements of some Federal Open Market Committee (FOMC) members have further increased the belief that the Fed could ease rates by a total of 50 basis points. The economic calendar is weak in terms of US data in the coming week, but FOMC members will continue to closely monitor future data.

If we look outside the US and look to the Far East, we can see that this week we should also pay attention to the news coming out of Japan. The Bank of Japan (BoJ) manages the monetary policy of the world’s third largest economy and its officials are at an important juncture. Given the impact of the drastic changes in expectations about the BoJ in the summer of last year on the prices of financial instruments, including digital assets, it is easy to see that it is worth paying attention to the news from the BoJ on Friday.

The BoJ is expected to decide on a rate hike at its first monetary policy meeting of the year. According to the Nikkei News Agency, a majority of BoJ Board members will approve a rate hike next week, although some members may abstain. If this happens, the Bank’s policy rate will rise to 0.50% for the first time since October 2008. The current rate is 0.25%.

Although very unlikely, a larger rate hike by the BoJ could lead to a sharp decline in digital assets. We believe that such a step is extremely unlikely. On the other hand, leaving the interest rate unchanged could contribute positively to global risk appetite and support the recent rally in cryptocurrencies. Following the rate decision, we will monitor Governor Ueda’s statements and look for clues about the course of interest rate changes for the rest of the year.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

The Most Important Airdrop Projects Expected in 2025

Transparency And Reliability Review For USDC

World Liberty Financial and Crypto Investments

Meme Coin Craze in 2024: Market Share, Featured Projects and Why?

Analysis of Exchanges’ Bitcoin Reserves and Bitcoin Price Change

USDT’s Struggles and Compliance Challenges in the European Market under MiCA Regulation

The Fragile Balance Between Derivatives Pressure and Spot Demand in the Ethereum Market

Click here for all our other Market Pulse reports.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.