MARKET SUMMARY

Latest Situation in Crypto Assets

| Asset | Last Price | Weekly Change (%) | Monthly Change (%) | Change Since Beginning of the Year (%) | Market Cap |

|---|---|---|---|---|---|

| BTC | 76,038.39$ | 8.92% | 22.56% | 72.16% | 1.50 T |

| ETH | 2,918.26$ | 16.62% | 20.00% | 24.07% | 351.45 B |

| SOLANA | 202.50$ | 19.86% | 42.58% | 84.92% | 95.49 B |

| XRP | 0.5504$ | 6.06% | 3.42% | -12.66% | 31.30 B |

| DOGE | 0.1970$ | 29.06% | 83.70% | 114.00% | 28.90 B |

| CARDANO | 0.4361$ | 25.97% | 27.63% | -30.04% | 15.26 B |

| TRX | 0.1616$ | -3.75% | 1.07% | 49.93% | 13.97 B |

| AVAX | 27.97$ | 11.66% | 6.29% | -33.25% | 11.38 B |

| SHIB | 0.00001905$ | 8.66% | 34.86% | 78.06% | 11.21 B |

| LINK | 12.93$ | 14.32% | 20.60% | -16.83% | 8.10 B |

| DOT | 4.319$ | 9.63% | 5.53% | -49.84% | 6.54 B |

*Table was prepared on 11.8.2024 at 14:30 (UTC). Weekly values are calculated for 7 days based on Friday.

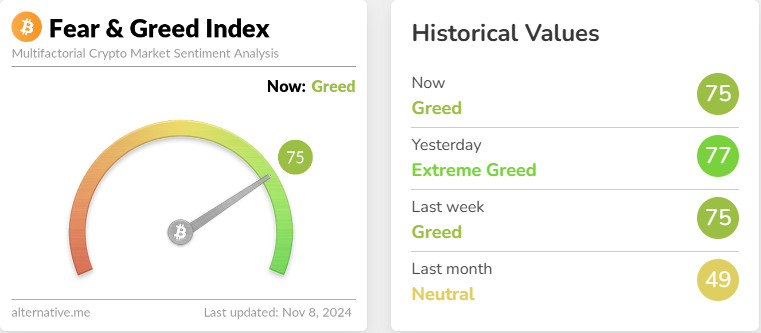

Fear & Greed Index

Source: Alternative

This week, Donald Trump’s presidential election win had a positive impact on the markets by removing political uncertainties. At the same time, US jobless claims came in below expectations at 221K, showing that the labor market remains strong and boosting investor confidence. With these developments, Bitcoin hit a new record high of 76,900 and increased interest in risky assets. The Fed’s 25 basis point rate cut reinforced expectations of a low interest rate environment, leading to increased demand for cryptocurrencies in particular. The index remained stable at 75, indicating that risk appetite and investor confidence in the market remained strong. In general, the data released this week indicate that investors’ interest in risky assets continues and a positive sentiment prevails in the markets.

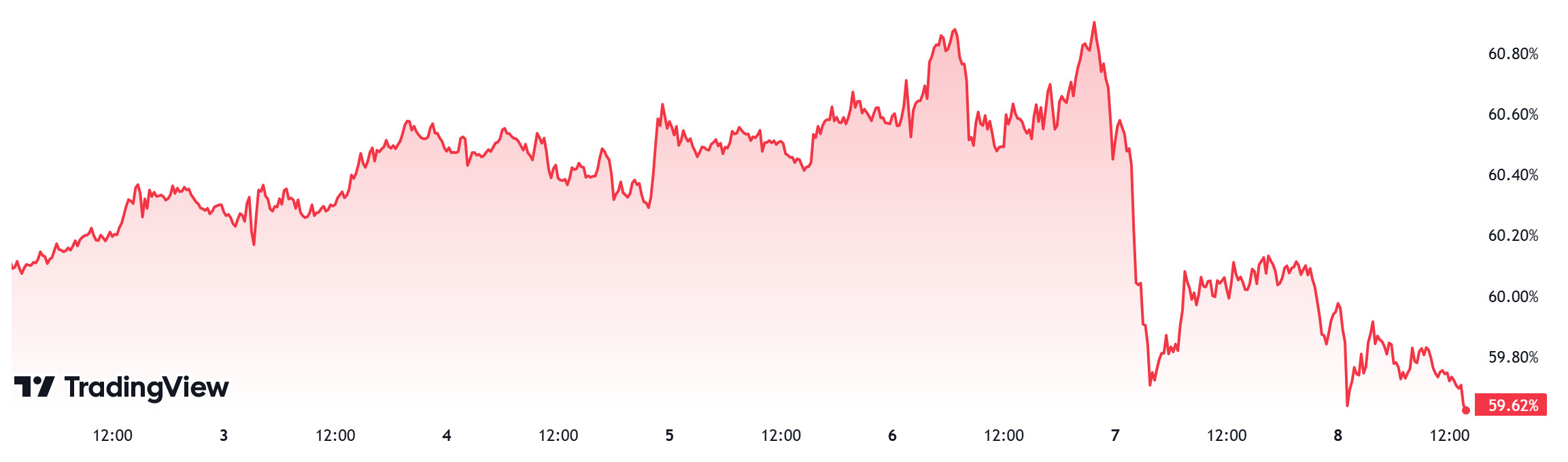

Bitcoin Dominance

Source: Tradingview

Bitcoin Dominance

Last week, institutional investors’ intense interest in ETFs pushed the dominance back above 60% after a long break. This week, there has been some pullback from Bitcoin dominance. This could create an opportunity for other instruments in the market.

The Shift in Bitcoin Dominance:

- Last Week’s Level: 60.17%

- This Week’s Level: 59.62%

This change in Bitcoin dominance could be an indication that Bitcoin’s dominance in the market is waning slightly and that there is growing interest in altcoins. Last week’s 60.17% dominance declined to 59.62% this week, indicating that investors are more likely to turn to alternative cryptocurrencies. This could create an opportunity for projects other than Bitcoin. Altcoins in particular can be expected to receive more trading volume and investment. This kind of dominance decline could signal market diversification.

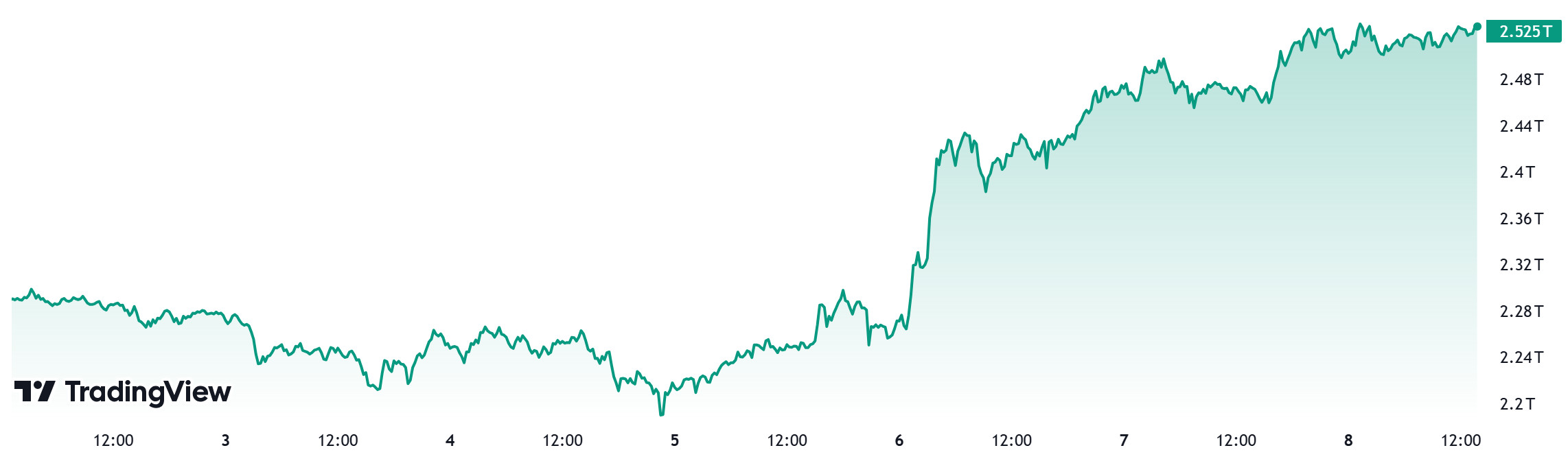

Total MarketCap

Source: Tradingview

The total market capitalization, which fluctuated with geopolitical tensions last week, showed a significant increase this week with the election of D. Trump, known as the “crypto president” of the USA, as the 47th US President. With this development, Bitcoin reached an all-time high of $76,946.

Change in Market Value:

- Market Capitalization in the Last Week: $2.302 Trillion

- Market Capitalization This Week: $2.525 Trillion

This shows that with the election of the new US president, confidence in the market has increased and the cryptocurrency market has gained significant momentum. Bitcoin’s historic high signals that investor confidence in market capitalization is growing and that Bitcoin continues to be recognized as a strong store of value among digital assets.

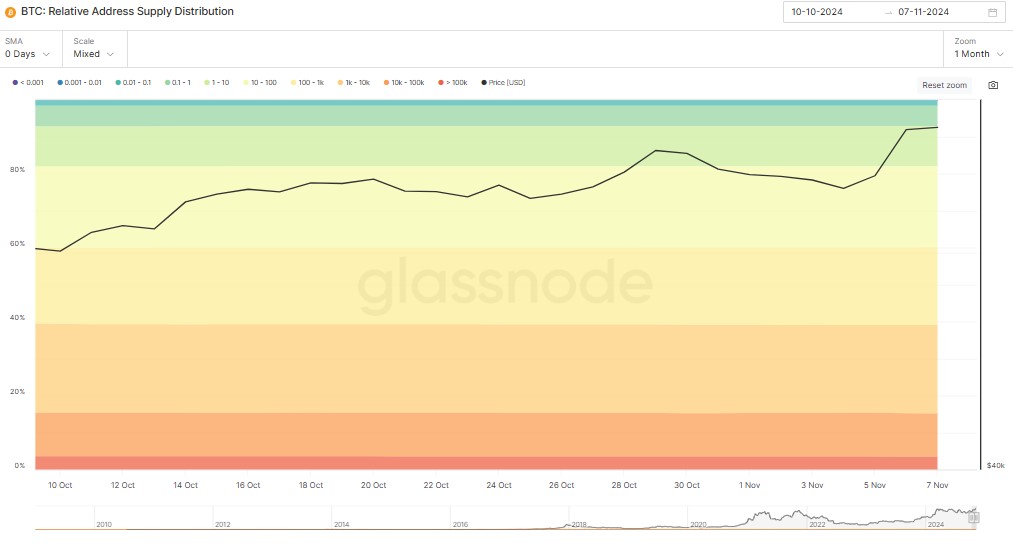

Bitcoin Supply Breakdown

Source: Glassnode

| Address Range | 31.10.2024 | 7.11.2024 | Change | Analysis |

|---|---|---|---|---|

| 0.01 – 0.1 BTC | 1,395% | 1,394% | Decline | There is a slight decrease. In terms of small-scale investors, activity is slightly narrower. We can say that this segment is among the investors aiming for safe earnings. |

| 0.1 – 1 BTC | 5,565% | 5,555% | Decline | There was a slight retreat in this group. It can be assumed that medium-sized individual investors reassessed their portfolios in the face of price fluctuations. |

| 1 – 10 BTC | 10,787% | 10,774% | Decline | There is a small decrease. There may have been some selling among mid to high level investors. However, the fact that the movement is not very large shows that there is no fear or panic in the market. |

| 10 – 100 BTC | 21,961% | 21,94% | Decline | Again, there is a minimal decline. It shows that large individual investors or small institutions continue to hold their positions, making only minor corrections. |

| 100 – 1k BTC | 20,873% | 20,972% | Increase | There is a slight increase. It is seen that investors in this group have increased their positions, gaining confidence in the market and increasing their accumulation tendency. |

| 1k – 10k BTC | 23,895% | 23,935% | Increase | There has been a growth in this group. It shows that large investors are buying positions. This could put a positive pressure on the market. |

| 10k – 100k BTC | 11,715% | 11,684% | Decline | There was a slight decline. There may have been some position reduction among large-scale funds or institutional investors. However, the overall trend seems to be stable. |

| > 100k BTC | 3,565% | 3,503% | Decline | A decline is also observed here. Some of the largest holders may have reduced positions. This may reflect some profit-taking or repositioning according to market conditions. |

General Evaluation

In sum, the price increase seems to have had a confidence boosting effect for medium and large investors. These investors supported the rise and strengthened their positions in the market. On the other hand, profit realization by the largest holders suggests that the market may be in search of balance.

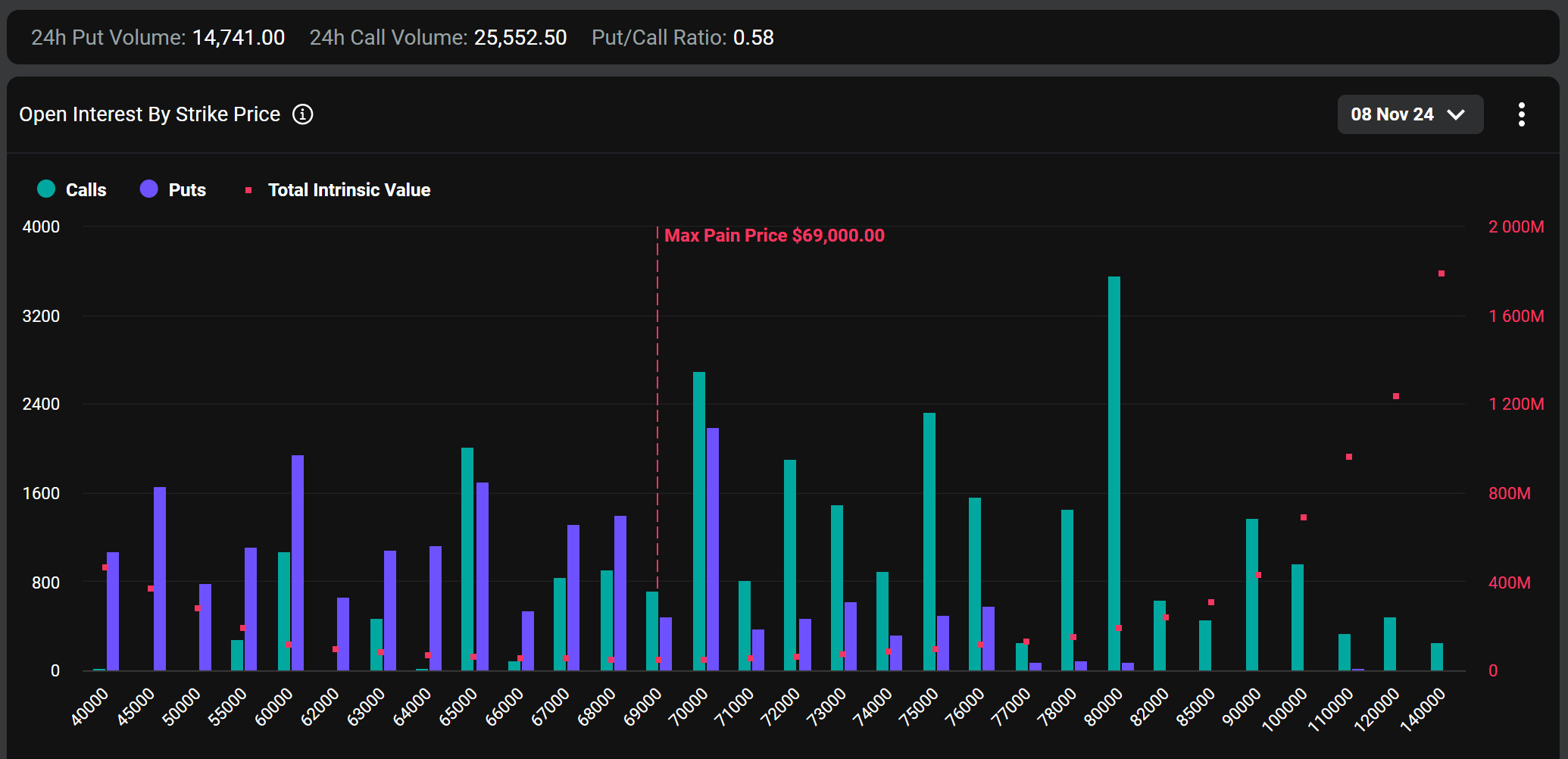

Bitcoin Options Breakdown

Source: Deribit

“OptionsDeribit1Image to be Added”

The implied volatility of Bitcoin’s month-end options fell below 50% and the implied volatility on all key indicators decreased significantly. Greeks.live’s latest analysis summarized the impact of the recent US election on crypto options contracts expiring today. Analysts noted that as the excitement around Donald Trump’s victory waned, the options market closed profit-taking to end the election season. Trading volumes surged to an all-time high of $10.8 billion per day on November 6 amid the excitement around the election. This was at the peak of expectations for a Donald Trump victory. This coincided with BTC re-setting an all-time high of $75,100.

Deribit Data

According to data from Deribit, 48,794 Bitcoin options contracts worth approximately $3.7 billion expire today.

Maximum Pain Point

Bitcoin’s maximum pain point is set at $69,000.

Option Expiration

Call/Sell Ratio: The call/put ratio for these options is set at 0.58. A call/put ratio of 0.58 indicates that there is a strong preference for call options over put options among investors and a possible uptrend in the markets.

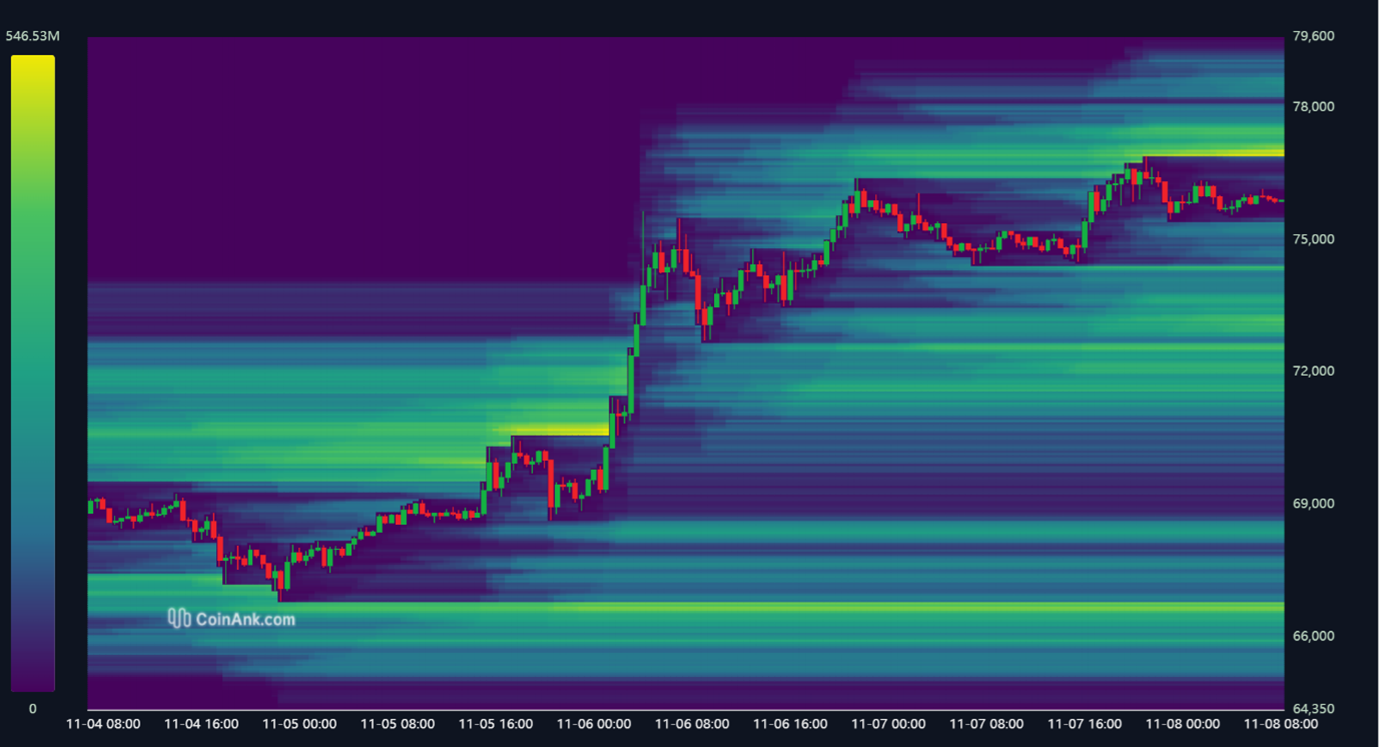

Bitcoin Liquidation Chart

Source: CoinAnk

When the liquidation heat map for BTC is examined, it is seen that long positions were liquidated by clearing the area between 66,800 and 67,300 during the week, and as a result of the subsequent rise, short transactions between 70,600 and 71,400 reached the liquidation value.

Currently, there is a significant liquidation area between 76,900 and 77,200 for short transactions and may want to clear the area in this price range in the coming period. For long transactions, liquidations seem to have accumulated between 74,700 and 75,200. These levels can be seen with the downward movement of the price and long transactions may be liquidated.

When the weekly liquidation amounts of Bitcoin are analyzed, a total of 170.4 million dollars of long transactions were liquidated between November 4 and 7, and the amount of short transactions liquidated between the same dates was 344.8 million dollars.

Weekly Bitcoin Liquidation Amounts

| History | Long Amount (Million$) | Short Amount (Million$) |

| November 4 | 43.6 | 13.81 |

| November 5 | 36.49 | 17.82 |

| November 6 | 60.99 | 242.1 |

| November 7 | 29.32 | 71.07 |

| Total | 170.4 | 344.8 |

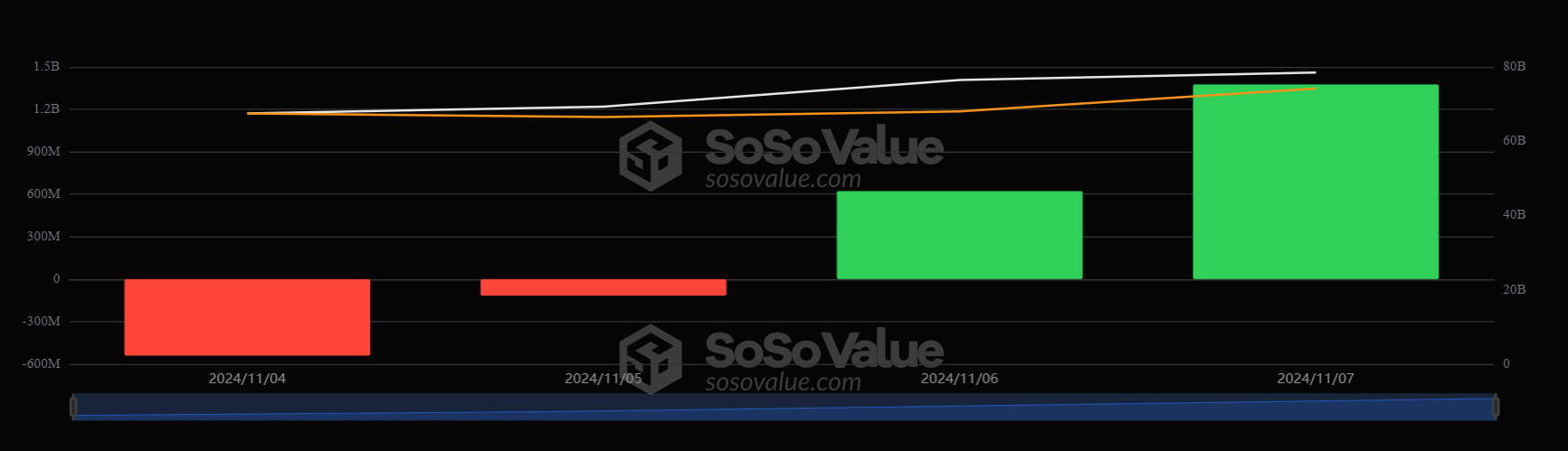

Bitcoin Spot ETF

Source: SosoValue

General Status

- Positive Net Inflow Series

Negative net inflows in the Spot BTC ETF started on November 1 and continued until November 5. With the outcome of the US elections, net inflows turned positive on November 6 and positive net inflows continued on November 7. The net inflow between November 4-7 was recorded as 1.34 billion dollars, turning positive in the week that started negative.

- Blackrock IBIT ETF Net Inflows

Between November 4-7, Blackrock IBIT Spot BTC ETF net total inflows increased by $1.04 billion. Blackrock IBIT Spot BTC ETF value reached $27.18 billion with this week’s increase. On November 7, with a net inflow of $ 1.12 billion in 1 day, it was recorded as a single-day record for Blackrock IBIT ETF net inflows.

- Record Inflows

On November 7, net inflows of $1.38 billion were recorded as the highest single-day net inflow in ETFs.

Featured Situation

- Market Impact

The net inflows in spot ETFs, which positively influenced the price increases in BTC this week, also indicate that institutional investors are increasingly interested in Bitcoin. It can be said that the record net inflows in spot ETFs played a significant role in the new record price levels in BTC price.

- BTC Price Change

BTC, which rose 10.30% between November 4-7, reached new highs with its bullish performance.

Conclusion and Analysis

Total Net Inflows and Outflows

The net inflows in Spot BTC ETFs between November 4-7 were noteworthy, with net inflows totaling $1.34 billion.

Price Impact

This week saw a 10.30% increase in the BTC price, while Spot BTC ETFs saw a lot of interest from institutional investors. Although there were positive and negative net inflows in the diaries of Spot BTC ETFs between November 4-7, the net total was positive. It was a very positive week for the ETF and Bitcoin price.

WHAT’S LEFT BEHIND

Donald Trump Becomes President of the United States

Donald Trump was re-elected as the 47th President of the United States.

FED Interest Rate Decision Announced

He reported that the Federal Reserve cut its benchmark interest rate by 25 basis points to 4.50%-4.75%, in line with market expectations, marking the second consecutive rate cut.

New ATH in Bitcoin

Bitcoin, which broke a record after Republican candidate Donald Trump won the US elections, renewed its record after the Fed cut interest rates. After the Fed cut the policy rate by 25 basis points at its first meeting after the US elections, it rose above 76 thousand 956 dollars and broke a new record.

MicroStrategy’s Bitcoin Assets Top $9 Billion

Based on Bitcoin’s current price of $75,129.5 last week, MicroStrategy’s Bitcoin position has a floating profit of more than $9 billion.

Tether Treasury Injects 1.845 Billion USDT

Spot On Chain announced that its monitoring shows that Tether Treasury injected 1.845 billion USDT into the CEX exchange via the Ethereum chain in the last 12 hours.

Mt.Gox Sends $2.2 Billion in Bitcoin to Two Wallets

Mt. Gox transferred more than 32,000 BTC to unidentified wallets.

Tether Publishes Third Quarter Financial Report

Tether announced a net profit of 2.5 billion dollars in its third quarter financial performance.

Immutable (IMX) Faces SEC Threat

Immutable received a Wells notice from the SEC and this caused a drop in the IMX price.

US Economic Data Released

US unemployment and non-farm payrolls data were announced at expected levels.

Bitcoin Spot ETF

Last week, Bitcoin spot ETFs received a net capital inflow of $2.22 billion.

Elon Musk’s Squirrel-themed Memecoin Pnut Attracts Great Interest

The squirrel-themed “Pnut” memecoin shared by Elon Musk gained value.

A First in the UK

For the first time in the UK, a pension fund invested in Bitcoin.

HIGHLIGHTS OF THE WEEK

The most important week of the month and perhaps of the year is behind us. After the US President-elect Trump and the US Federal Reserve (FED) continuing to cut interest rates, the markets will continue the new week with the traces left by these two developments. So what awaits us now? Will the rise in digital assets continue with new data and developments? We summarize the prominent market dynamics of the week as follows.

Powell on Stage Again

Throughout the week, we will hear statements from many Federal Open Market Committee (FOMC) officials at various events. However, Fed Chair Powell’s speech will again stand out among them. He will be speaking on a panel titled “Global Perspectives”. Although we don’t expect him to take a different stance than he did on November 7, a Fed chairman’s statements are always important and can have an impact on the markets.

After the FOMC’s 25 bps rate cut, Powell stepped behind the lectern and refrained from addressing the agenda regarding Trump’s election as the new US President and what the Fed thinks about the fiscal policies of the new era. Underlining that the FED will continue to make data-driven decisions, Powell left the impression that they should be cautious about the course of interest rate cuts (by slightly increasing the dose).

The President will take the microphone at Thursday’s event and his comments on inflation and the labor market will be important, as he will speak after the Consumer Price Index (CPI) data for October, which will be released on Wednesday. We will be carefully following how he will interpret the latest data. We think that if the President gives messages that will point to the continuation of interest rate cuts, the rise in digital assets may be supported. However, Powell’s more cautious stance (about interest rate cuts) compared to his previous speeches may reduce the risk appetite, which may be an excuse to see a correction in cryptocurrencies.

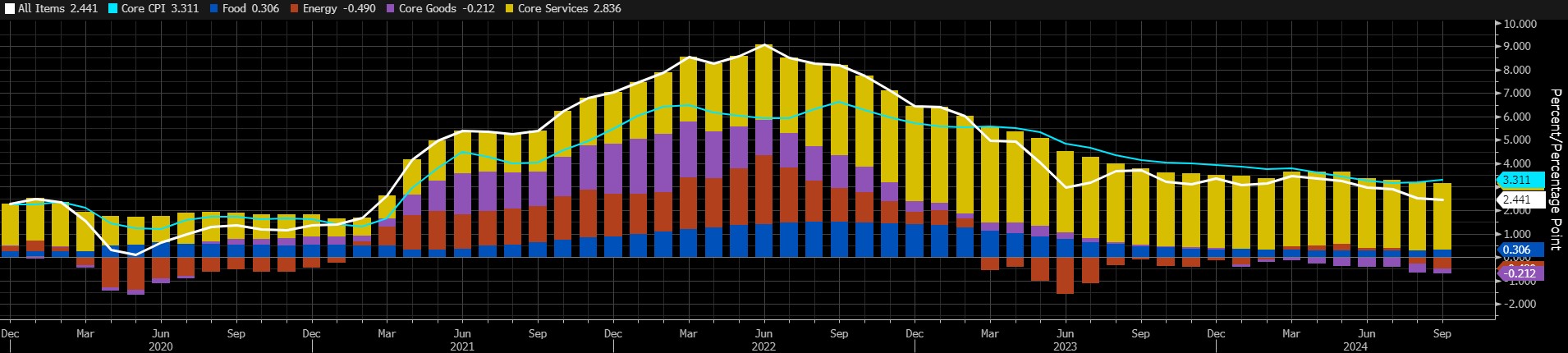

Will Macro Data Vindicate the Fed?

This week, we will be watching macro indicators that may provide information about the FED’s rate cut path. These include CPI, Producer Price Index (PPI), Jobless Claims and retail sales data. All of them will provide clues about the health of the US economy and hence the FED’s monetary policy decisions. Within this data set, we can state that inflation figures may stand out a little more.

Source: Bloomberg

We can see that the annual CPI, which started to decline after June 2022, has slowed down in the last month. This data, which declined from 2.5% in August to 2.4% in September, was expected to be announced as 2.3%. We also saw higher than expected figures in the monthly CPI data. According to Bloomberg, the annual CPI is expected to rise to 2.6% in October (there are some who think it will stay the same), and if we see a figure at or above this level, it would mean an inflation rate above the FED’s 2% target and an upward (if not temporary) trend. Such a situation may highlight the rumors that the FED may not be very comfortable with interest rate cuts, or even that it may have started rate cuts early. We can state that this is a factor that will create an increase in the dollar and a decrease in risk appetite. Therefore, such a scenario may produce a negative result for digital assets. However, inflation indicators that will remain below forecasts have the potential to justify the FED, which may reinforce confidence that further interest rate cuts will continue. In such a case, the continuation of the rise in digital assets may gain ground.

After Everything…

The US elections and the November 7th FOMC meeting, which clarified what the FED will do after the 50 basis points “Jumbo” rate cut, are behind us. We expect markets to focus more on US data for the rest of the year, while expectations of what Trump might do once he takes the White House in January will further dominate prices.

The direction of the Middle East and geopolitical risks in general are likely to be discussed more after the new president takes office on January 20. However, these risks, which have been overshadowed by critical developments for some time, do not seem to bother investors, whose risk appetite has increased. In this context, the dose of financial tightness may continue to play a more dominant role in asset prices for a while. At this point, the FED and the US economy are the major headlines. It should also be noted that Trump’s policies such as tariff hikes, tax cuts and deregulation may fuel growth and inflation.

The victory of former President Trump, one of the main pillars of our bullish expectation for the long term perspective in digital assets, produced a result in line with our forecasts. The continuation of the Fed’s interest rate cut cycle and the inflows into BTC ETFs, indicating increased institutional investor interest, support our big picture upside forecast for now. Underlining that it would not be surprising to see short-term respites and intermediate corrections in digital assets, we can state that the fundamental dynamics in our equation continue to support the rise.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Special reports prepared by Darkex Research Department will be shared in this section.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.