MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Change (%) | Weekly | Monthly | Since the Beginning of the Year | Market Cap |

|---|---|---|---|---|---|---|

| BTC | $67,920.64 | 11.71% | 13.23% | 53.81% | $1.34 T | |

| ETH | $2,628.18 | 8.94% | 13.38% | 11.72% | $316.38 B | |

| SOLANA | $153.70 | 8.39% | 17.81% | 40.45% | $72.26 B | |

| XRP | $0.5498 | 2.16% | -4.60% | -12.66% | $31.20 B | |

| DOGE | $0.1340 | 24.12% | 32.67% | 45.79% | $19.64 B | |

| TRX | $0.1590 | -0.78% | 5.97% | 47.53% | $13.76 B | |

| CARDANO | $0.3471 | -0.17% | 4.89% | -44.25% | $12.15 B | |

| AVAX | $27.54 | 4.31% | 17.83% | -34.06% | $11.23 B | |

| SHIB | $0.00001876 | 10.65% | 42.46% | 75.64% | $11.06 B | |

| LINK | $11.39 | 6.61% | 8.80% | -26.63% | $7.15 B | |

| DOT | $4.242 | 3.46% | 4.14% | -50.66% | $6.39 B |

*Table was prepared on 10.18.2024 at 14:30 (UTC). Weekly values are calculated for 7 days based on Friday.

Source: Alternative

Investor Confidence Increases

Tether’s lending plans, positive crypto regulatory developments, BlackRock CEO Larry Fink’s statements on Bitcoin and Ethereum, the launch of Australia’s first Ethereum ETF, and a decline in the amount of Bitcoin on exchanges increased investors’ risk appetite, causing the Fear & Greed Index to rise from 32 to 73.

Fear & Greed Index Change

The Fear & Greed Index rose from 32 last week to 73 this week. This increase indicates that the risk appetite in the markets has recovered and investors have more positive expectations. Increased investor confidence could herald a possible uptrend in the market and revitalize interest in crypto assets.

Bitcoin Dominance

Bitcoin Dominance

Last week, demand for risky assets increased as market volume expanded. Accordingly, Bitcoin dominance was flat, but this week saw a record rise in dominance amid interest from institutional investors.

The Shift in Bitcoin Dominance

- Last Week’s Level: 57.63%

- This Week’s Level: 58.91%

Institutional Investors Turning to Bitcoin

This increase can be attributed to increased interest in Bitcoin, especially from institutional investors. Institutional capital may have shifted from risky assets to Bitcoin, which is seen as a safer haven.

Expectation of a Price Increase

This rise in the dominance may indicate that investors are expecting a rise in the price of Bitcoin. Usually, when large investors enter the market, upward movements in the Bitcoin price can be observed.

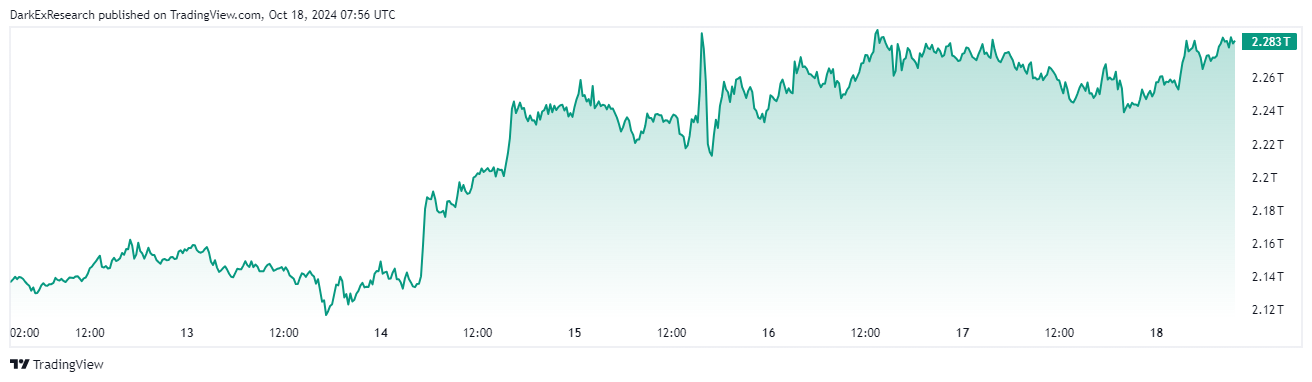

Total MarketCap

Last week, Microstrategy purchases, an increase in ETF inflows, Kamala Harris’ promise to support the cryptocurrency market and the Chinese government’s stimulus packages led to a significant increase in total market capitalization. This week, we see a continuation of the increase in the total marketcap value with the increase in risk appetite with the historical rise in October and with the approach of the US presidential elections, we see the continuation of the increase in the total marketcap value as the presidential candidate D. Trump takes the lead in the polls.

Change in Market Value

- Market Capitalization in the Last Week: $2.248 Trillion

- This Week’s Market Cap: $2.283 Trillion

Corporate Acquisitions Continue

Microstrategy’s cryptocurrency purchases contribute to the increase in market capitalization. Institutional investors’ interest in the market is boosting overall market confidence.

Rise in ETF Inflows

The entry of ETFs into the market allows investors to attract more capital. This increases the liquidity of the market and positively affects the total market capitalization.

The Impact of Presidential Elections

The approach of the US presidential elections and Donald Trump’s lead in the polls may create opportunities for some investors despite increased political uncertainty. This affects market dynamics and contributes to the increase in total market capitalization.

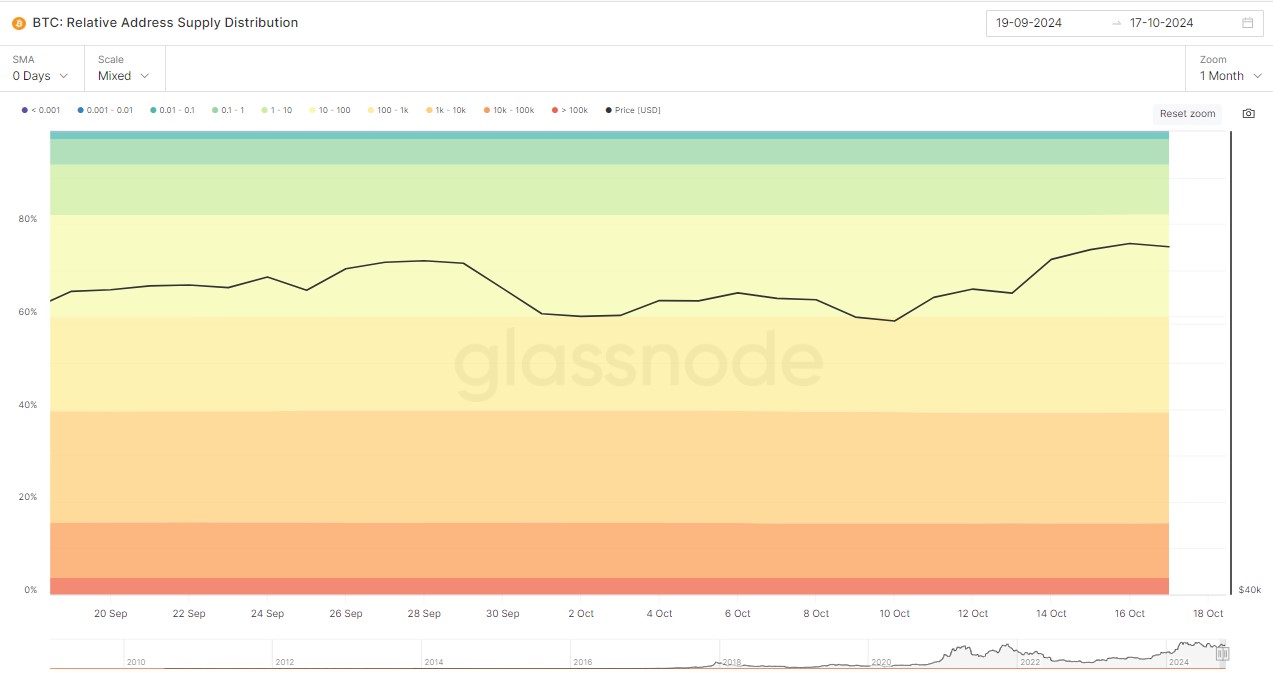

Bitcoin Supply Breakdown

Source: Glassnode

| Address Range | 10.10.2024 | 17.10.2024 | Change | Analysis |

|---|---|---|---|---|

| (< 0.1 BTC) | 1.645 | 1.644 | 0.001 Decrease | Small investors’ positions are generally stable, with a very small decrease. |

| (0.1 – 10 BTC) | 16.407 | 16.381 | 0.026 Decrease | Mid-sized investors may have made a slight profit realization. A slight decrease was observed in this segment. |

| (100 – 1k BTC) | 20.487 | 20.643 | 0.156 Increase | Large investors are accumulating Bitcoin, increasing their positions despite price increases. |

| (10k – 100k BTC) | 11.775 | 11.788 | 0.013 Increase | The ultra-large whales have bought slightly and increased their position. |

| (> 100k BTC) | 3.603 | 3.602 | 0.001 Decrease | The biggest whales have made a small sale, but this change is very minimal and negligible. |

General Evaluation

Although small investors have started to take profits in the short term, large players are increasing their positions. This is a sign that the market in general has a positive expectation for the long term. Especially the fact that big whales continue to buy as the price increases can be said to be promising for the market.

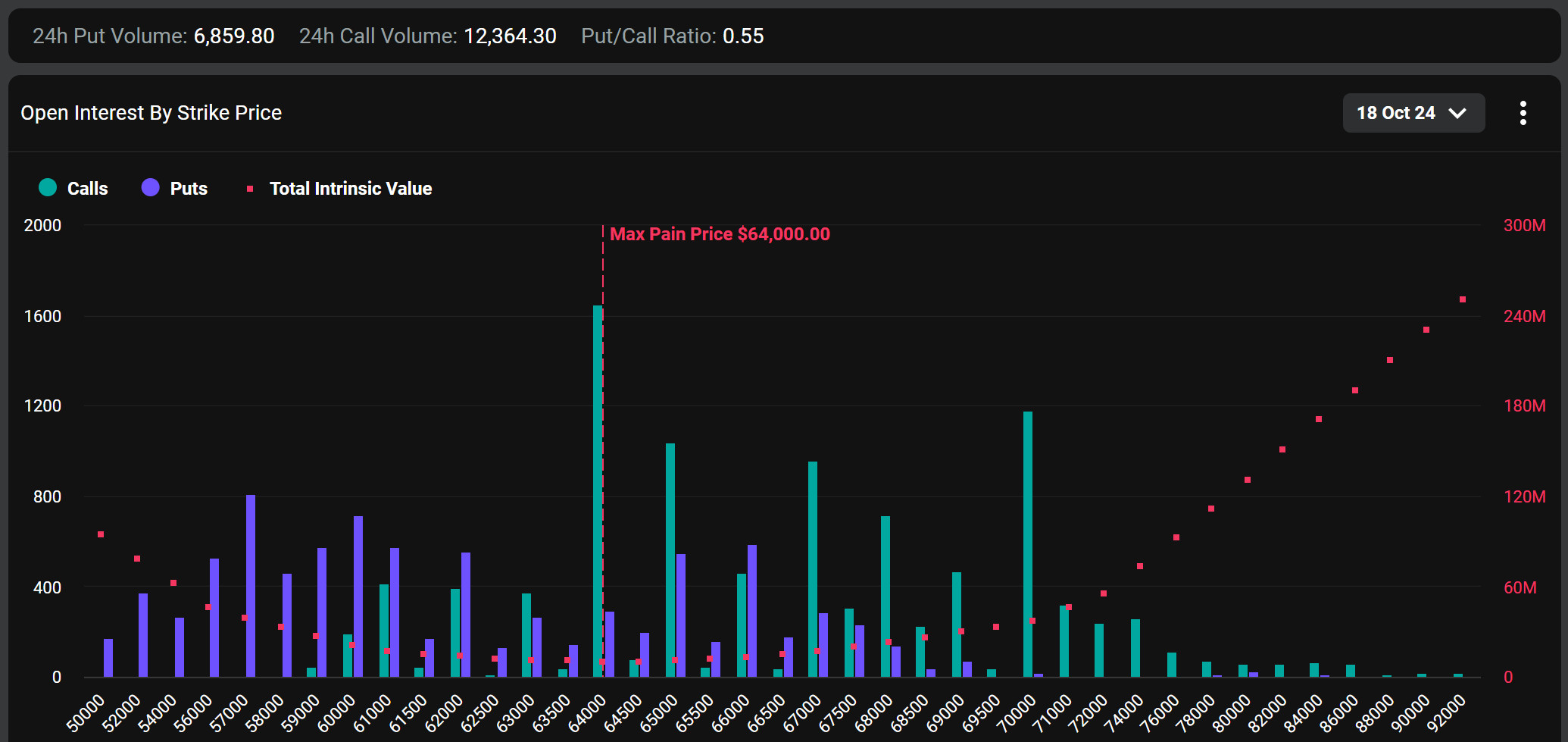

Bitcoin Options Breakdown

Source: Deribit

Options Market Analysis

The options market is bullish for Bitcoin, with open positions mostly concentrated at the $70,000 and $80,000 strike prices.

Deribit Data

Deribit data shows that BTC options contracts with a notional value of approximately $1.174 billion will expire today.

Maximum Pain Point

Bitcoin’s maximum pain point is set at $64,000. This level is an important reference point that affects the liquidation points in the markets.

Option Maturity and Call / Put Ratio

The call/put ratio for these options is set as 0.55. A call/put ratio of 0.55 indicates that investors prefer call options over put options and that a possible upturn in the markets is possible.

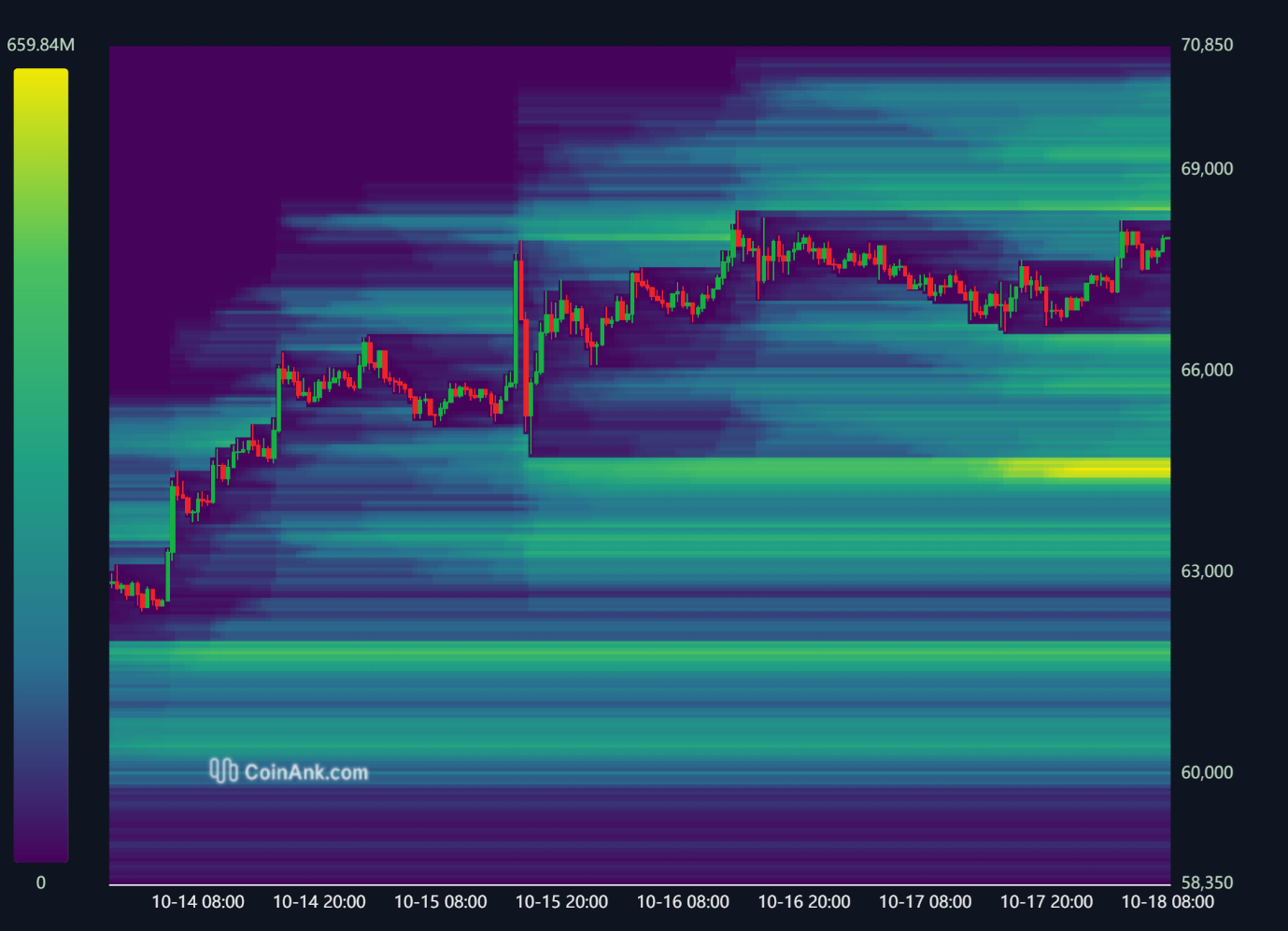

Bitcoin Liquidation Chart

Source: CoinAnk

Total Liquidation Amounts

Between October 14 and 17, a total of $57.32 million worth of long transactions were liquidated in Bitcoin, while the amount liquidated for short transactions in the same period was recorded as $167.05 million.

When the Bitcoin (BTC) liquidation heatmap is analyzed, it is seen that the area between 64,700 and 65,100 was cleared at the beginning of the week and long positions were liquidated. Then, the price rallied, reaching the liquidation value of shorts between 63,500 and 64,700 and between 67,600 and 68,100.

Available Liquidation Areas

Currently, there is a significant liquidation area between 68,400 and 69,400 for short trades and may want to clear this price range in the coming period. In terms of long transactions, liquidations are observed to accumulate between 64,400 and 65,000. If these levels are tested with the downward movement of the price, long transactions may also be liquidated.

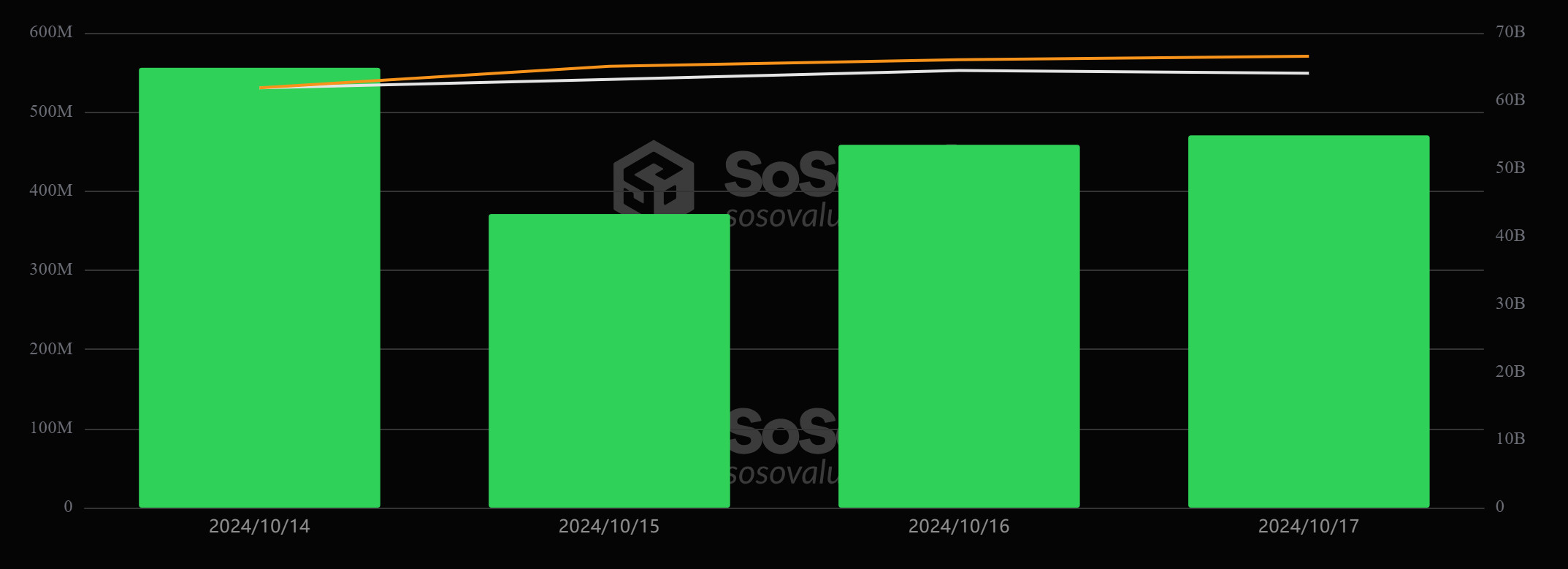

Bitcoin Spot ETF

Source: SosoValue

General Status

- Positive Net Inflow Series: The positive net inflows in the Spot BTC ETF, which started on October 11, continued between October 14-17, extending the positive net inflow streak to 5 days. Between October 14-17, net inflows totaled $1.855 billion. During this period, all Spot BTC ETFs experienced positive net inflows.

- Blackrock IBIT ETF Net Inflows: Between October 14-17, the Blackrock IBIT Spot BTC ETF net total inflows exceeded $1 billion.

Featured Situation

- Market Impact: Spot BTC ETFs saw the largest daily inflows since June. Spot BTC ETFs saw inflows of $555.9 million on October 14 as the BTC price traded above $66,000.

- BTC Price Change: There was a 7.26% increase in Bitcoin price between October 14-17.

Conclusion and Analysis

Total Net Inflows and Outflows

Net inflows in Spot BTC ETFs were noteworthy between October 14-17. While net inflows were seen in all ETFs during this period, the total net inflows totaled 1.855 billion dollars during the period in question.

Price Impact

This week saw a 7.26% price increase in BTC price and increased institutional investor interest in Spot BTC ETFs. All Spot BTC ETFs saw net inflows between October 14-17. This suggests that Spot BTC ETF purchases increased as the BTC price rose.

WHAT’S LEFT BEHIND

US September CPI Increased Faster Than Expected

September CPI data in the US disappointed the market by rising faster than expected.

US PPI in September Below Expectations

Producer Price Index (PPI) in the US remained unchanged on a monthly basis in September, below the expectations. However, it increased by 1.8% yoy, above the forecasts.

Mt. Gox Repayments Extended to 2025

Crypto exchange Mt. Gox has extended the repayment process to its creditors after the 2014 attack until October 31, 2025.

Bitcoin Whales Raise 1.5 Million BTC in 6 Months

According to CryptoQuant analyst Axel Adler, whales have amassed 1.5 million BTC during Bitcoin’s price declines, and these purchases are attracting attention in the crypto market.

MicroStrategy on its Way to Become a Bitcoin Bank

Michael Saylor, founder of MicroStrategy, stated that the company aims to reach a valuation of $ 1 trillion and emphasized that he believes Bitcoin is a long-term investment tool.

Kamala Harris’ Economic Support Package for Crypto

Kamala Harris, who is trailing in the polls, aims to balance the race by including cryptocurrencies in her economic support package for black Americans.

China’s $850 Billion Financial Support Package May Affect Crypto Markets

China aims to generate 6 trillion yuan ($850 billion) in revenue through private bonds to be issued over three years. This step is thought to move the crypto markets up.

Bitcoin Futures Open Positions Hit Record High Open positions in Bitcoin futures on the

CME exchange reached an all-time high of 172,430 BTC.

JPMorgan’s Bullish Scenario for Bitcoin While

JPMorgan analysts maintained their cautious approach for 2024, they stated that they have shifted to a bullish scenario in Bitcoin for 2025.

Tesla Transferred $765 Million in Bitcoin Assets

Tesla drew attention by transferring all its Bitcoin assets worth $765 million to unknown wallets in 26 separate transactions.

ECB’s Second Consecutive Rate Cut

The European Central Bank decided to cut interest rates in October after September, the third rate cut in total this year.

Bitcoin Exchange Reserves Reach Low Levels

Bitcoin exchange reserves have fallen to historically low levels. In the last month, 51,000 BTC have been withdrawn from exchanges, supporting the long-term holding trend.

U.S. Elections Create Movement in Crypto Markets

Trump’s criticism of central bank policies created an expectation of an increase in cryptocurrencies. Trump leads with 60.9% in Polymarket polls.

MARKET PULSE

For digital assets, the past week was worthy of the phrase “Uptober”. On October 24, Bitcoin, which tested below $59,000, reached over $68,000 on the 18th. Thus, it became the locomotive of the rise with dominance reaching 59%. Although there was no major change in the theme of risks and other fundamental dynamics for global markets, there were changes in the weight of the variables on the agenda affecting prices. In the new week, it will be watched how these metrics will shape the recent bullish trend.

From America to Asia…

The US economy seems to be progressing in line with the Federal Reserve’s “soft landing” scenario. Although inflation seems to have paused its retreat in September, the focus of the markets has been on avoiding a recession, with figures such as employment and retail sales data showing that the health of the economy is better than previously thought. The Fed, which is expected to continue its rate-cutting cycle, albeit not in big steps, and a US economy that has managed to avoid recession seem to be a perfect match. The Bank is expected to cut rates by another 25 basis points on November 7th.

Another important development on the continent is the US presidential election. Democrat Harris joined the camp of Trump, whose proximity to the crypto front is registered. Although not as sharp as Trump, Harris gave the green light to the digital world, stating that she would take a regulatory approach to crypto assets, not a prohibitive one. Still, Trump is thought to be the ideal candidate of the crypto front. However, the fact that the equation consists of both candidates who have not turned their backs on this technology may result in a “win-win” result for crypto assets. In recent days, Trump seems to have closed the gap and even taken the lead according to the polls.

While the future of the Federal Open Market Committee’s (FOMC) rate cut dosage seems to have become clearer, investors have been paying more attention to the Chinese front lately. Failing to meet its 5% growth target, the Communist Party has pushed the button to support the economy with all its institutions. Finally, the country’s Central Bank (PBOC) announced a series of measures aimed at easing the financial system and the housing sector. At the moment, the fear that investors will sell their digital assets to take advantage of the cheapness of Chinese stocks with the coming stimulus seems to have passed. In this parallel, feeding the world’s second largest economy with incentives is a positive dynamic for risky assets.

The Big Picture in the Short Term – Approaching The Critical Week

Tensions in the Middle East are unlikely to escalate further in the run-up to the upcoming US presidential election, in order to avoid causing problems for the Democrats by causing a possible rise in oil prices. The conflict is still ongoing, but a war scenario involving more countries in a wider geography seems highly unlikely. As a note, the seriousness of the process will of course continue to be important for the markets.

Unabated tensions in the Middle East, China taking steps to support its economy, a US economy that may be able to avoid a recession, and other major central banks such as the Fed and the European Central Bank (ECB) continuing to cut interest rates… All of these components may keep interest in instruments that are considered relatively riskier, such as crypto assets, alive. However, it is important to keep in mind that potential downside risks always increase when markets incorporate the best-case scenario into prices. In this regard, it would not be wrong to say that there are important points to pay attention to. After the recent rally in digital assets, the US labor market statistics on November 1, the US elections on November 5 and the FOMC statement on November 7 will determine whether this trend will continue. Until these dates, changing and evolving expectations regarding these topics will guide prices.

Against this backdrop, we maintain our view that the main direction is up, assuming that markets can adapt to the tensions between Israel and Iran ahead of the upcoming US elections and the FOMC meeting. Risks include a potential wider war in the Middle East, the Fed’s hasty Jumbo rate cut (rising inflation) with signs of rapid warming, and the Chinese economy remaining far from 5% economic growth despite stimulus. After a week of significant value gains, we would not be surprised to see short-term corrections due to the nature of the market.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

*In addition to the daily bulletins, special reports prepared by the Research Department will be shared in this section.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.