MARKET SUMMARY

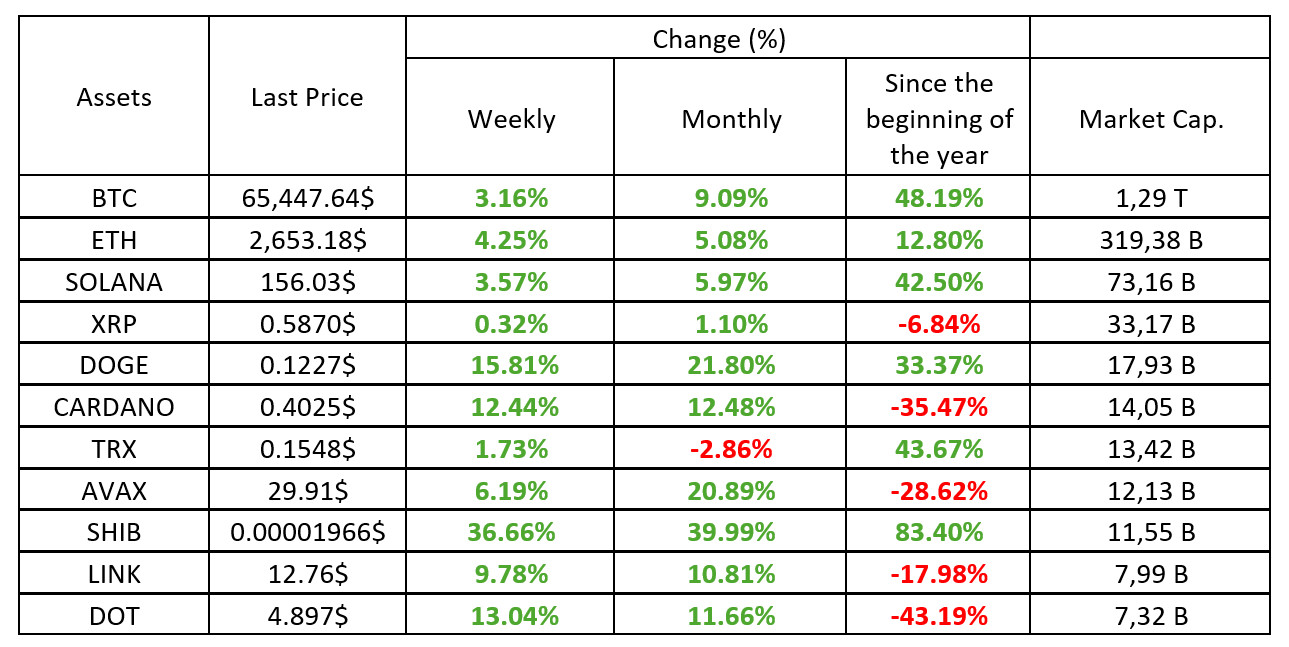

Latest Situation in Crypto Assets

*Table was prepared on 27.09.2024 at 14:30 (UTC). Weekly values are calculated for 7 days based on Friday.

Fear & Greed Index

Source: Alternative

This week, US presidential candidate Harris’ announcement that she would support the growth of artificial intelligence and digital assets was welcomed in the tech and crypto world. Visa is working on a tokenized asset platform for banks, while Paypal announced that it will allow business accounts to trade and hold cryptocurrencies. In the economy, US Gross Domestic Product (GDP) data came in line with expectations with 3.0%, while unemployment claims were announced as 218K, below expectations. Bitcoin also broke the $65,000 level and created a positive atmosphere in the markets.

The Fear&Greed Index rose to 61 from last week’s level of 54. This increase indicates that rising Bitcoin prices and positive macroeconomic data in the markets, investors prefer to take more risks and optimism in the market has increased.

Bitcoin Dominance

Source: Tradingview

Last week, Bitcoin dominance reached 58% after 3.5 years. This week, with the expansion of market volume, it increased the demand for risky assets. Although Bitcoin reached the $ 65 level, we see some retracement in its dominance.

The Shift in Bitcoin Dominance

- Last Week’s Level: 58.08%

- This Week’s Level: 57.63%

Market Confidence and the Shift to Bitcoin

This means that market volume is expanding and investors’ demand for altcoins, which are riskier assets, is increasing. Such a trend signals that investors are starting to diversify their search for yield and are turning to assets that offer the potential for higher returns. So, while Bitcoin is still in a strong position, it marks a time when altcoins are coming into play as the market expands

Total MarketCap

Source: Tradingview

Last week, the FED’s 50 basis point interest rate cut supported the uptrend in the market and accelerated the value increase. This week, Microstrategy purchases, an increase in ETF inflows, Kamala Harris’ promise to support the cryptocurrency market and the Chinese government’s stimulus packages led to a significant increase in total market capitalization.

Change in Market Value

- Market Capitalization in the Last Week: $2.162 Trillion

- Market Capitalization This Week: $2.248 Trillion

Impact of Developments on the Market

It shows that monetary expansion and political support in the global economy have increased confidence in the cryptocurrency market and attracted investor interest. In particular, institutional investments (MicroStrategy, ETF inflows) and government policies (China and Kamala Harris’ statements) have played an important role in the growth of the crypto market. In addition, the increase in liquidity brought about by low interest rates has led investors to turn to risky assets, which has accelerated the growth of the crypto market.

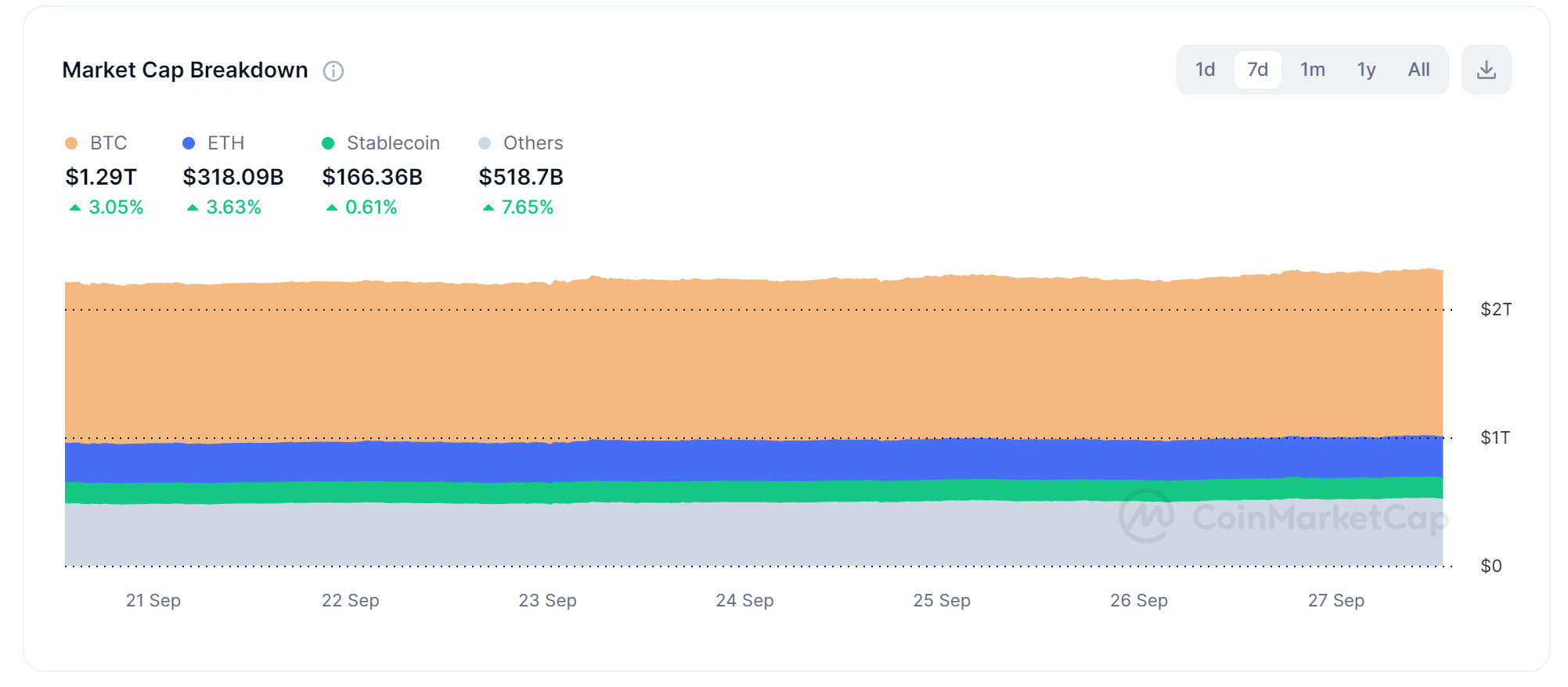

Weekly Crypto Market Breakdown

Source: CoinMarketCap

Bitcoin Performance

- Increase this Week: 3.05 %

- Market Capitalization: $1.290 Trillion

Bitcoin’s 3.05% rise and market capitalization reaching $1.290 trillion reflects the impact of positive developments on the market, such as the FED rate cut, MicroStrategy purchases and an increase in ETF inflows.

Ethereum Performance

- Increase this week: 3.69 %

- Market Capitalization: $318.09 Billion

Ethereum’s outperformance of 3.69% indicates continued growth in the DeFi and NFT ecosystems, with Ethereum gaining more traction in these areas.

Stablecoin Performance

- Increase this Week: 0.61 %

- Market Capitalization: $166.36 Billion

Stablecoins’ limited rise of just 0.61% suggests that investors are moving out of safe havens and into riskier assets, and that overall risk appetite is increasing.

Altcoin Performance

- Increase this week: 7.65 %

- Market Capitalization: $518.7 Billion

The strong performance of altcoins at 7.65% reflects the expansion in the market and increased demand for altcoins as risk appetite increases.

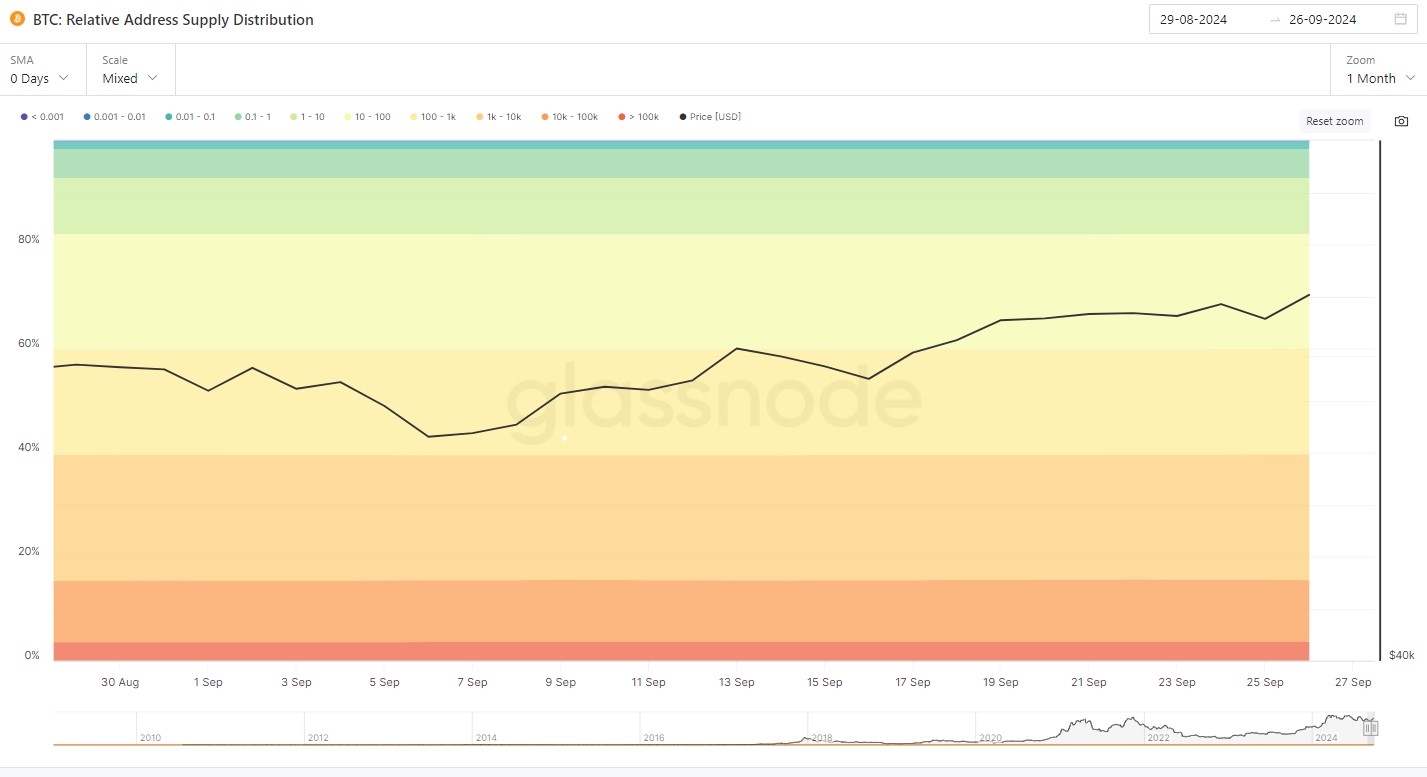

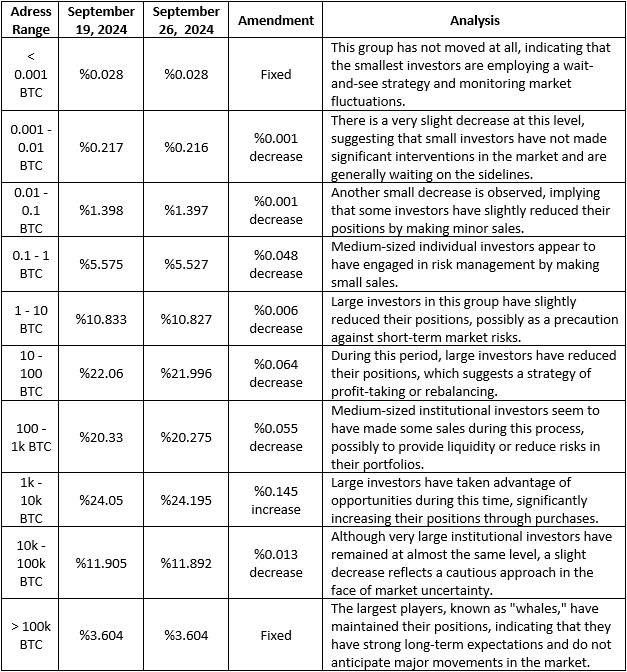

Bitcoin Supply Breakdown

Source: Glassnode

General Evaluation

In general, all groups seem to be reducing risks. However, large investors have significantly increased their positions by expanding their portfolios. This is an important data for the medium to long term and it can be said that we have come to a period when the buying appetite may gradually increase.

Bitcoin Options Breakdown

Source: Deribit

Source: Deribit

The US SEC’s green light on options linked to BlackRock’s Bitcoin ETF is expected to boost institutional adoption.

Deribit Data

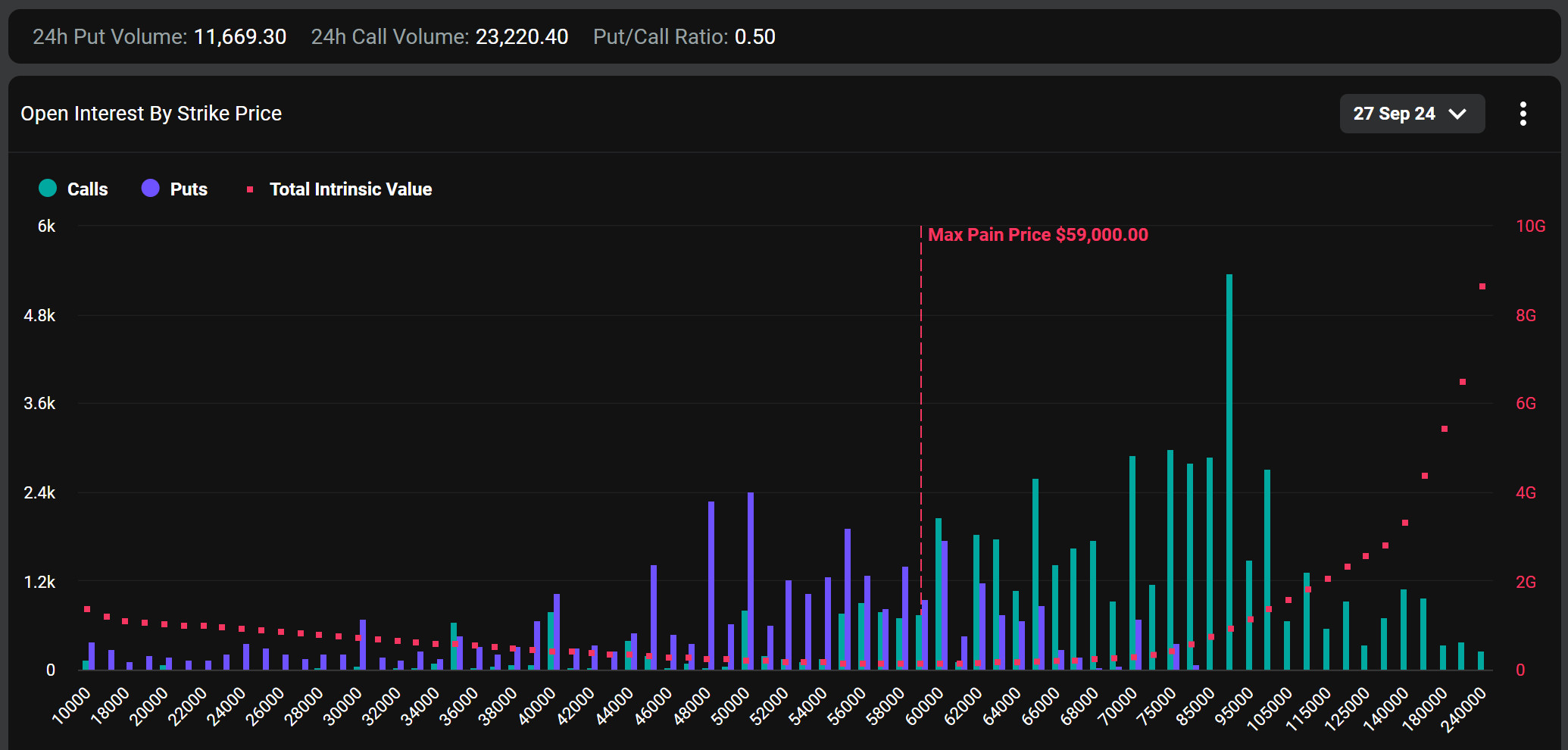

Maximum Pain Point

Bitcoin’s maximum pain point is set at $59,000. This may bring selling pressure.

Option Expiry

According to data from Deribit, 90,000 Bitcoin options contracts worth approximately $5.8 billion expire today. About 20% of the total $5.8 billion Bitcoin open positions are in profit. This increases the likelihood of profit-taking and a pullback in the BTC price. Open interest in Bitcoin options is concentrated around $100,000, $90,000, $70,000 and $65,000 across all maturities.

Call/Sell Ratio

The call/put ratio for these options is set at 0.50. A call/put ratio of 0.50 indicates that there is a preference for call options over put options among investors and a possible rise in the markets.

Bitcoin Liquidation Chart

Source: CoinAnk

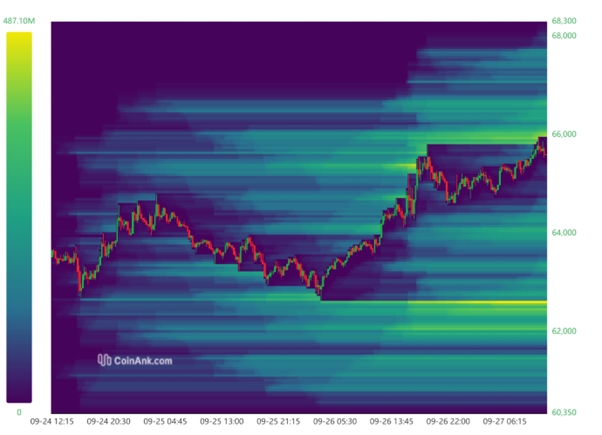

Market Overview

An analysis of the Bitcoin liquidation heatmap shows that both long and short positions were liquidated at certain price ranges on a weekly basis. At the beginning of the week, there was a large liquidation of long positions, followed by an upward price move, leading to the liquidation of short positions. In the current market structure, liquidation zones in certain price ranges will be critical for investors in the coming days.

Liquidation Zones and Price Movements

- 62,700 – 63,000 Dollar Range (Long Liquidation): At the beginning of the week, long positions in this price range were liquidated and the market cleared this level and started an upward move.

- 64,000 – 64,500 Dollar Range (Short Liquidation): As the price rose, short positions in this range were liquidated and the upward pressure continued.

- 66,000 – 66,500 Dollar Range (Short Liquidation Potential): Currently, there is a significant short liquidation area in this price range. The market may make an upward move to clear this area.

- 62,000 – 62,600 Dollar Range (Long Liquidation Potential): Accumulated long positions at this level may be liquidated if the price moves downwards.

Weekly Liquidation Amounts

• Long Positions: A total of USD 50.55 million worth of long transactions were liquidated between September 23-26.

• Short Positions: Between the same dates, USD 75.24 million worth of short transactions were liquidated.

Bitcoin Spot ETF

Source: SosoValue

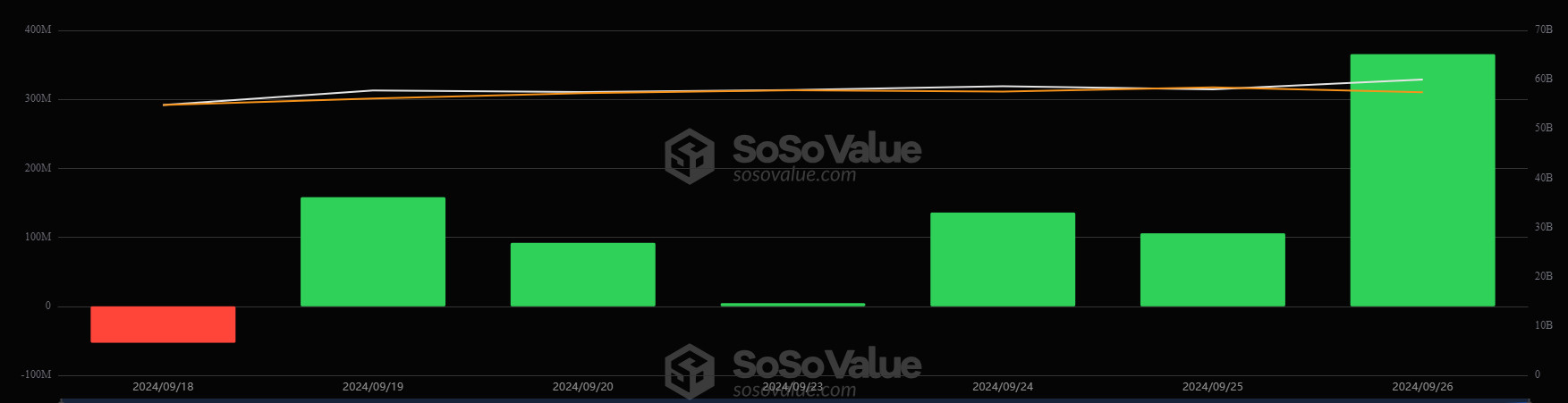

General Status

Net Inflows Positive Streak: The positive streak in the Spot BTC ETF extended to 5 days as daily net inflows were positive after the FED interest rate decision. Total net inflows amounted to $612.1 million during September 23-26.

Featured Situation

The Blackrock IBIT ETF net inflow streak is back: The Blackrock IBIT ETF, which for a long time traded only on Mondays, saw total net inflows of $388.2 million during September 23-26 after the Fed and Japan interest rate decision.

Final Performance

- Total Net Inflows: Spot BTC ETFs saw a total net inflow of $612.1 million between September 23-26.

- BTC Price: There was a 2.49% increase in the Bitcoin price between September 23-26.

Conclusion and Analysis

Total Net Inflows: Spot BTC ETFs extended their positive net inflow streak to 5 days this week. In Spot BTC ETFs, where a positive environment was created after the FED and Japan interest rate decision, Blackrock IBIT ETF stood out with a net inflow of 388.2 million dollars.

Price Impact: Spot BTC ETFs saw total net inflows of $612.1 million between September 23 and 26, with the price of BTC also rising. While the crypto market rallied after the FED and Japanese interest rate decision, the series of positive net inflows in Spot BTC ETFs continued.

WHAT’S LEFT BEHIND

Citi’s Rate Cut Forecasts

Citi analysts expect a total of 125 basis points of rate cuts in November and December.

Bank of Japan Keeps Interest Rates Steady

The Bank of Japan kept its policy rate unchanged at 0.25%.

Kamala Harris Speaks About Crypto

Kamala Harris stated that she would encourage the growth of digital assets.

BlackRock Publishes Bitcoin Report

BlackRock report highlights Bitcoin’s divergence from traditional risk-return factors.

MicroStrategy’s Bitcoin Strategy Succeeds

MicroStrategy’s Bitcoin strategy outperformed the S&P 500 by a wide margin.

Crypto Funds Close in Plus After Interest Rate Decision

Crypto funds closed 321 million dollars plus after the Fed’s 50 basis point interest rate decision.

Bernstein Predicts Crypto Rally on Trump Win

Bernstein predicts a strong rise in the crypto market if Trump becomes president.

Crypto Demand Grows in China

Crypto demand in China continues to grow despite regulatory restrictions.

Visa to Offer Tokenization and Smart Contracts

Visa will offer tokenized assets and smart contracts to banks.

Bitcoin’s correlation with the S&P 500

Bitcoin is increasing its correlation with the S&P 500.

US Gross Domestic Product

US Gross Domestic Product was announced as 3%.

China Adds 285 billion to Economy

China announced a new 285-billion-dollar support package for the economy.

Kamala Harris Blockchain Technology

Kamala Harris stated that blockchain and digital assets will create economic opportunities.

HIGHLIGHTS OF THE WEEK

It has been a productive week for digital assets. With the interest rate cuts by the US Federal Reserve (FED) and the People’s Bank of China (PBOC), the steps taken to support the economy have increased the appetite for risk-taking in the markets. For investors preparing to enter the last quarter of the year, the most important question is whether this positive mood will continue. So, what awaits the markets in the new week?

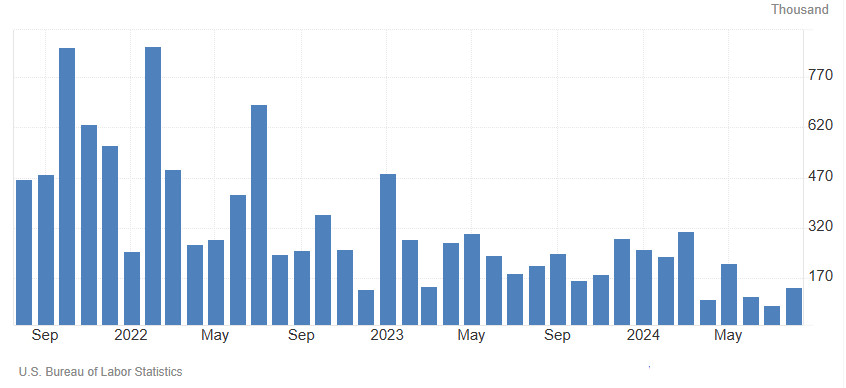

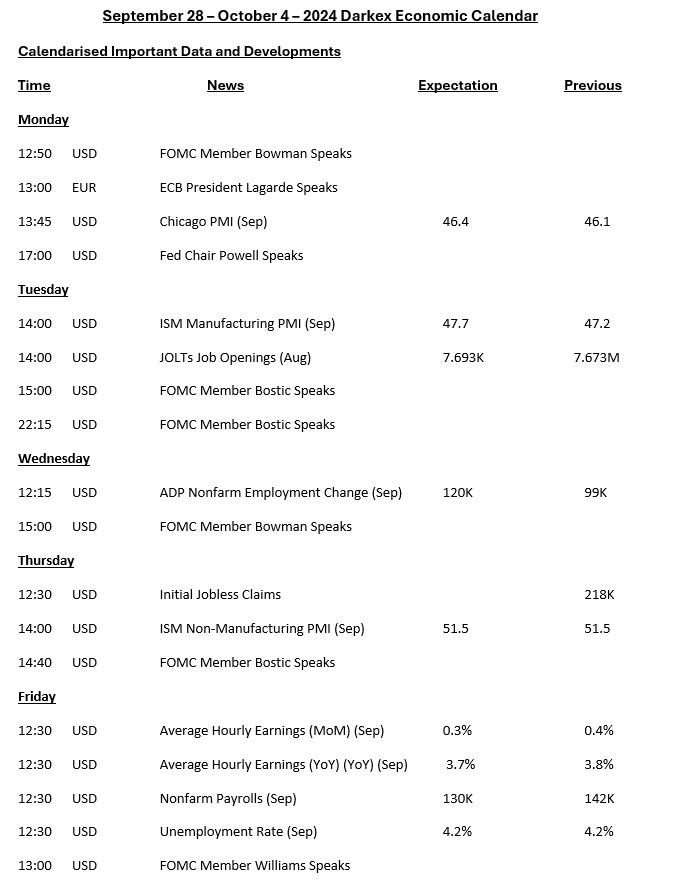

Eyes on Non-Farm Employment Change Data

After FED Chairman Powell’s speech at the Jackson Hole meeting, where he pointed out that the main focus of their attention is shifting from inflation to the labor market, the labor statistics in the US have become a bit more important for global markets. Of course, the course of inflation will remain on the FED’s radar, but employment indicators, especially the non-farm payrolls change (NFP) to be released on Friday this week, will be extremely important as they can be decisive for pricing.

Source: Tradingeconomics

NFP indicated that the US economy created 142 thousand jobs in non-farm sectors in August. The market expectation was for this to be realized at 164 thousand. With the same report, July data was revised from 114 thousand to 89 thousand. After this data set, which was thought to indicate that the labor market might be starting to have problems in creating new jobs, expectations in the markets that the Federal Open Market Committee (FOMC) might take faster and larger steps in interest rate cuts increased, and the fear that the country’s economy might enter a recession process re-emerged.

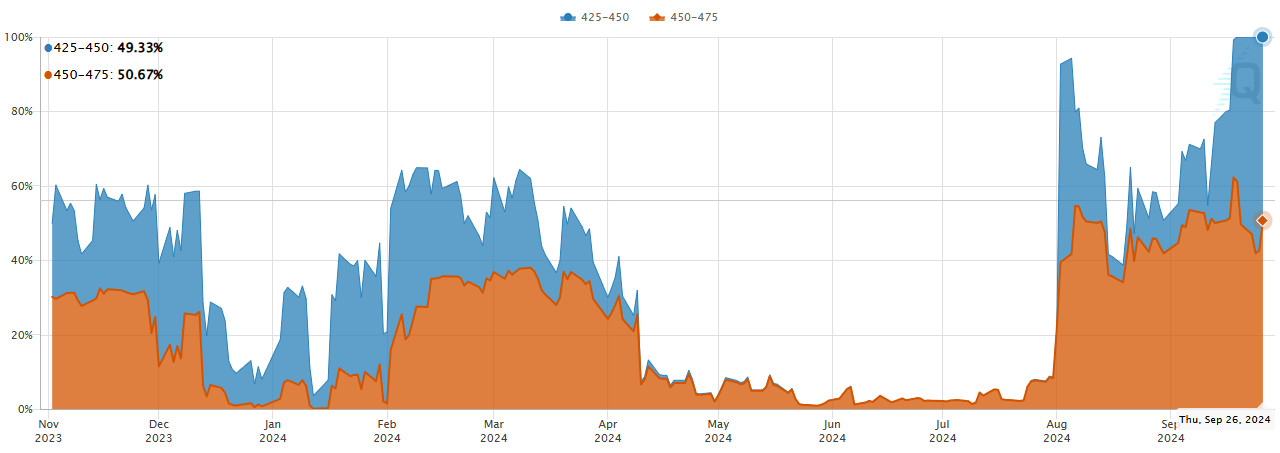

After the September 6 announcement, the FOMC announced a “jumbo” rate cut of 50 basis points on September 18. One of the noteworthy points was that there was no consensus in the markets on the expectations of a 25 to 50 basis points cut. Ahead of the November 7th FOMC meeting, we see that the situation is (for now) similar again.

Source: CME Group

Source: CME Group

At the time of writing, according to the CME FedWatch Tool, the odds of the FOMC cutting rates by 25 and 50 basis points at its most recent meeting were split almost 50-50. It’s hard to say whether these expectations will be weighted in one direction or the other, but Friday’s employment data may be of some help.

Delicate Balance in Market Perception

It would be more accurate to consider the upcoming data set as a whole, but it would not be wrong to state that the market sensitivity will be more on NFP. Last Thursday’s data set (GDP, Initial Jobless Claims and Durable Goods Orders), which came in better than expected, was followed by a positive sentiment in the markets. At this point, expectations that the US economy could avoid a recession had an impact on prices. However, it should be noted that even bad data from the US has the potential to keep hopes alive that the FED may continue its rapid rate cuts. In other words, both good and bad data can be welcomed positively in the markets. At this point, however, we would like to warn our investors about this dangerous equation. In such situations, where markets are pricing in the best-case scenarios, strong negative indicators of the health of the economy can turn into fear pricing at unexpected moments. Therefore, it is important to keep in mind that the rosy outlook is a trend that cannot continue indefinitely.

Nevertheless, we still believe that if the current market ecosystem and pricing model persists, a below-expected NFP reading could lead to negative pricing in digital assets, while a below-expected reading could lead to positive pricing. Of course, a negative set of data, which could indicate that the labor market is in a really bad shape, could trigger recessionary concerns, and could provide grounds for thinking that the economy may have difficulty recovering despite the Fed’s rapid rate cuts. Such a combination of data could have a negative impact on digital assets despite a lower-than-expected NFP reading. We think it would be useful for investors to take note of this situation.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

*In addition to the daily bulletins, special reports prepared by the Research Department will be shared in this section.

IMPORTANT ECONOMIC CALENDAR DATA

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results tha