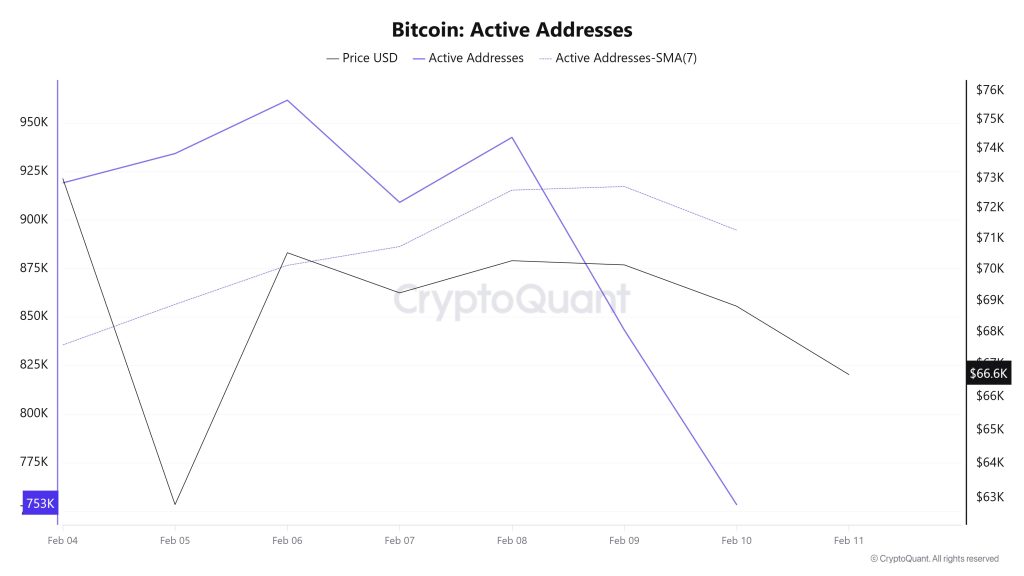

Active Addresses

Between February 4 and February 11, recorded 961,697 active addresses on the Bitcoin network. During this period, Bitcoin’s price fell from $73,000 at the beginning of the week to $68,825 on February 4. From a technical perspective, the 7-day simple moving average (SMA) shows a downward trend.

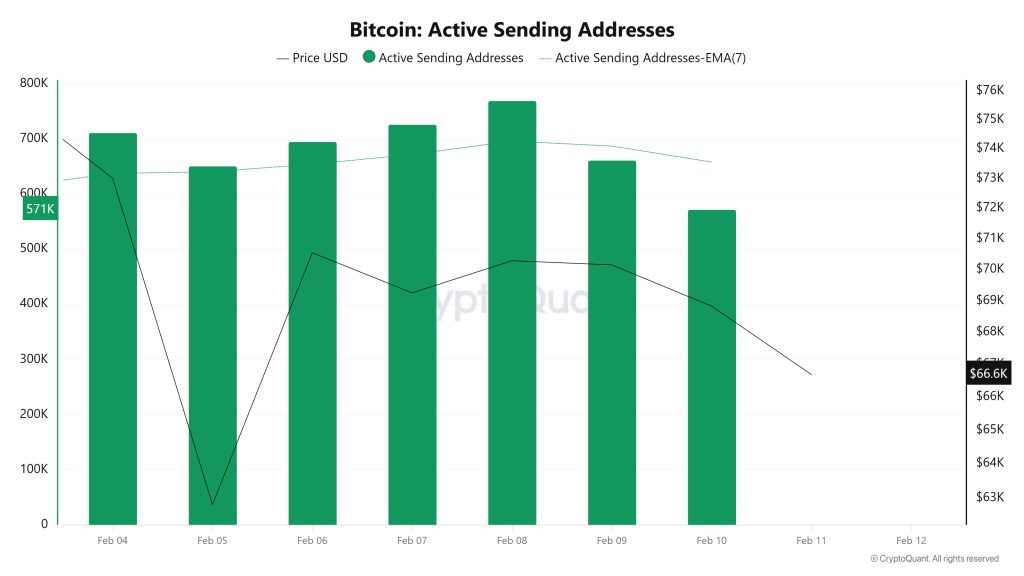

Active Sending Addresses

Between February 4 and February 11, an upward trend was observed in the active sending addresses metric. On the day the price reached its highest level, this metric stood at 769,246, indicating that user activity on the Bitcoin network was moving in parallel with the price. This data shows that the $70,000 level is supported not only by price but also by on-chain address activity. Overall, the Active Sending Addresses metric has followed a high trajectory during this period.

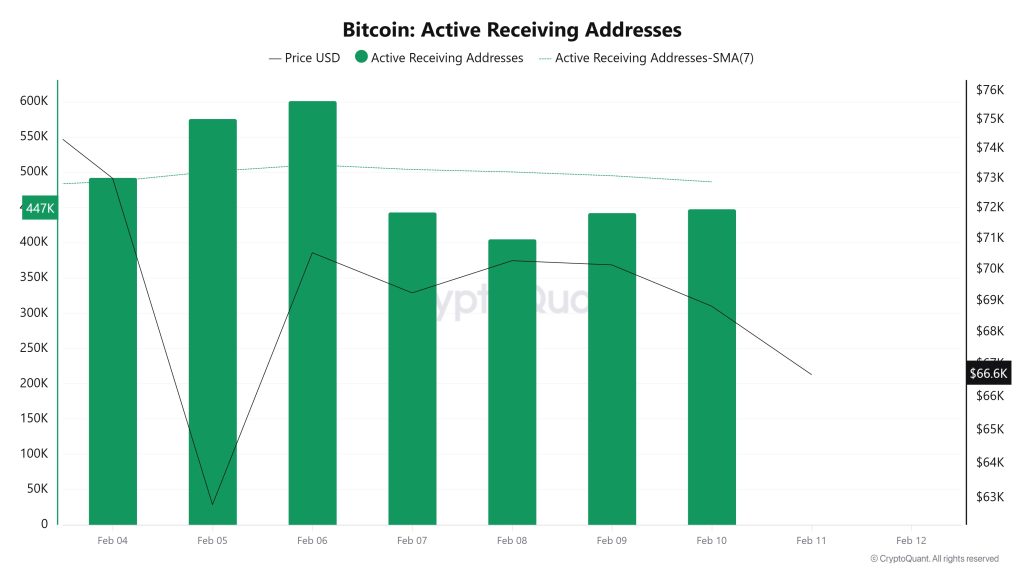

Active Receiving Addresses

Between February 4 and February 11, active receiving addresses experienced a typical rise alongside the Black Line (price line). On the day the price reached its peak, active receiving addresses rose to 601,437 levels, indicating that buyers acquired Bitcoin at around the $70,500 level.

Breakdowns

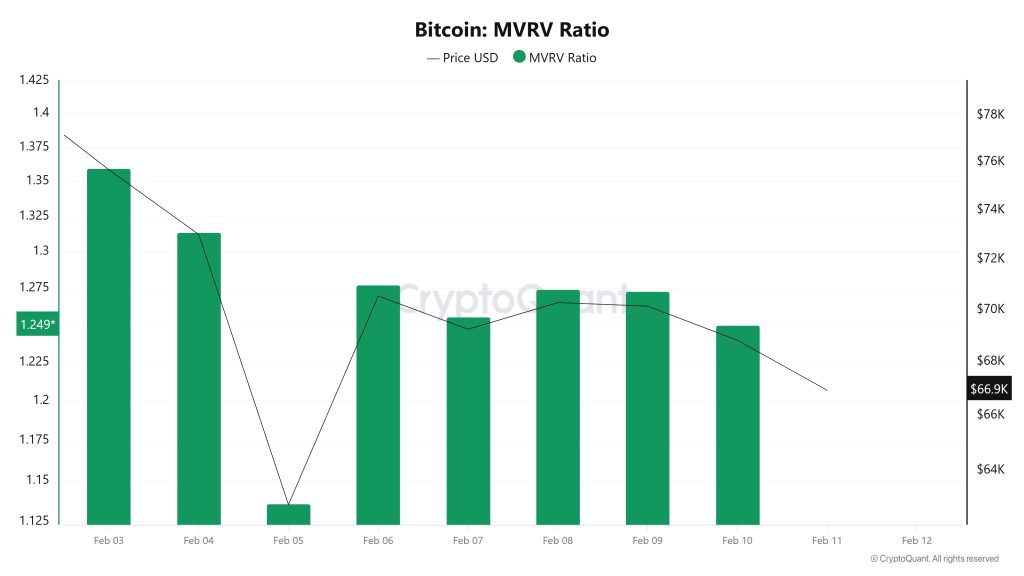

MVRV

On February 4, while the Bitcoin price was trading at $73,007, the MVRV Ratio was at 1.313. As of February 10, the Bitcoin price fell to $68,825, recording a 5.73% decline, while the MVRV Ratio fell to 1.249, recording a 4.88% decline. The pullback in the MVRV Ratio indicates that the premium relative to the realized cost basis continues to narrow and that unrealized profits maintain their tendency to compress. This outlook suggests that risk appetite remains weak in the short term, and as long as price pressure persists, upward attempts are likely to be met with caution.

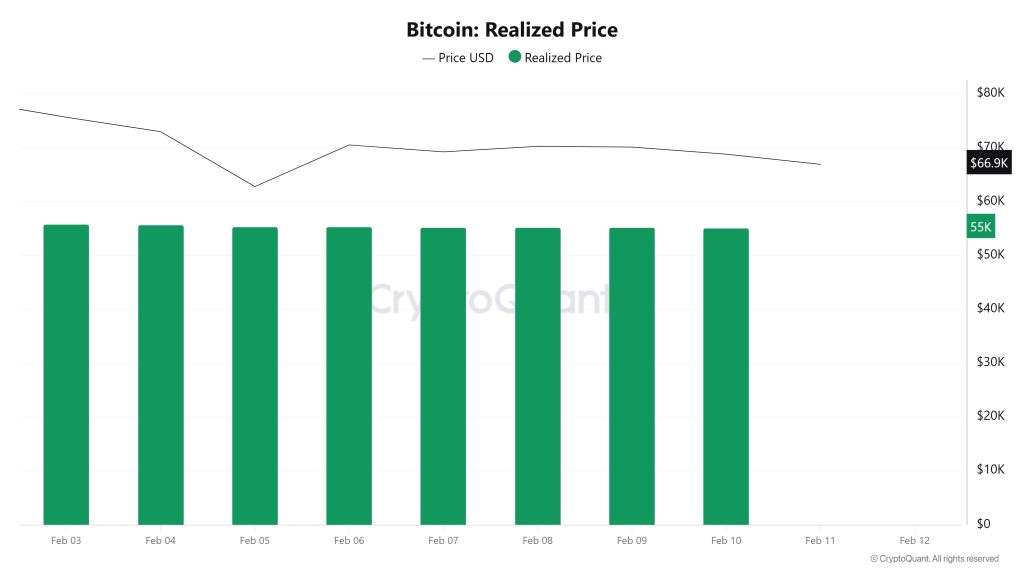

Realized Price

On February 4, while the Bitcoin price traded at $73,007, the Realized Price was at $55,581. As of February 10, the Bitcoin price fell to $68,825, recording a 5.73% decline, while the Realized Price fell to $55,082, recording a limited 0.90% decline. The slight pullback in the Realized Price indicates a limited downward adjustment in the network’s average cost basis, confirming that the spot price’s premium over the cost basis has narrowed again this week. This picture suggests that while spot pricing remains the main driver of selling pressure, the cost basis is also following suit, albeit weakly, on the downside.

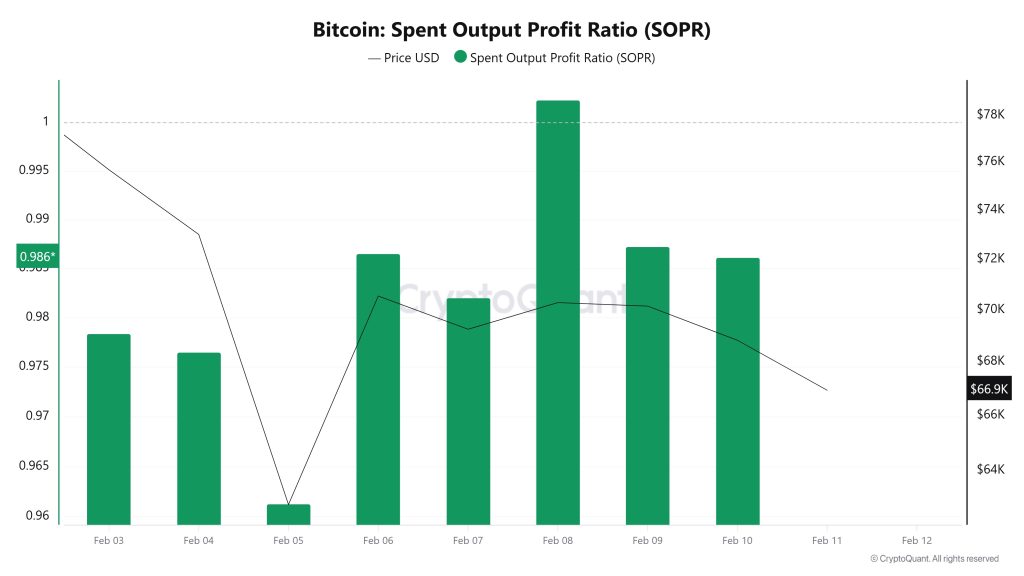

Spent Output Profit Ratio (SOPR)

On February 4, while the Bitcoin price traded at $73,007, the SOPR metric was at 0.976. As of February 10, the Bitcoin price fell to $68,825, recording a 5.73% decline, while the SOPR metric rose to 0.986, recording a 1.02% increase. The SOPR remaining below 1 indicates that coins are changing hands at a loss on average, while the upward recovery signals a decrease in the intensity of loss-making sales and a greater number of break-even transactions. This outlook suggests that although selling pressure may persist in the short term, efforts to stabilize at the bottom may be gaining momentum.

Derivatives

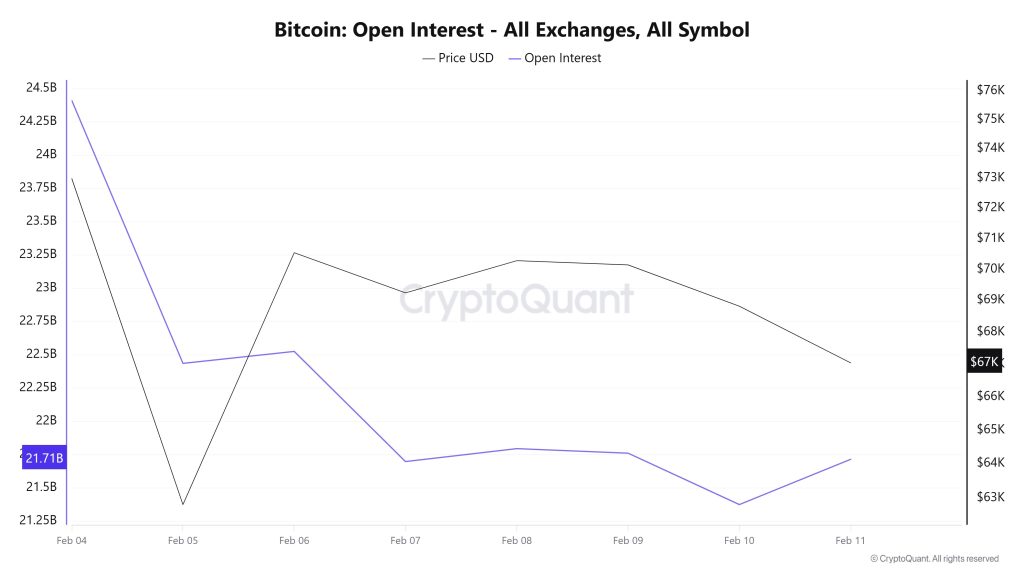

Open Interest

On February 4, open interest experienced a rapid decline from a very high level, and a significant liquidation wave was observed on February 5. This indicates that leveraged positions were closed to a significant extent. Although open interest recovered briefly on February 6, it has remained flat to slightly downward in the following days. In summary, the structure indicates that leverage appetite in the market has weakened and that aggressive position entries strong enough to form a new trend have not yet been seen.

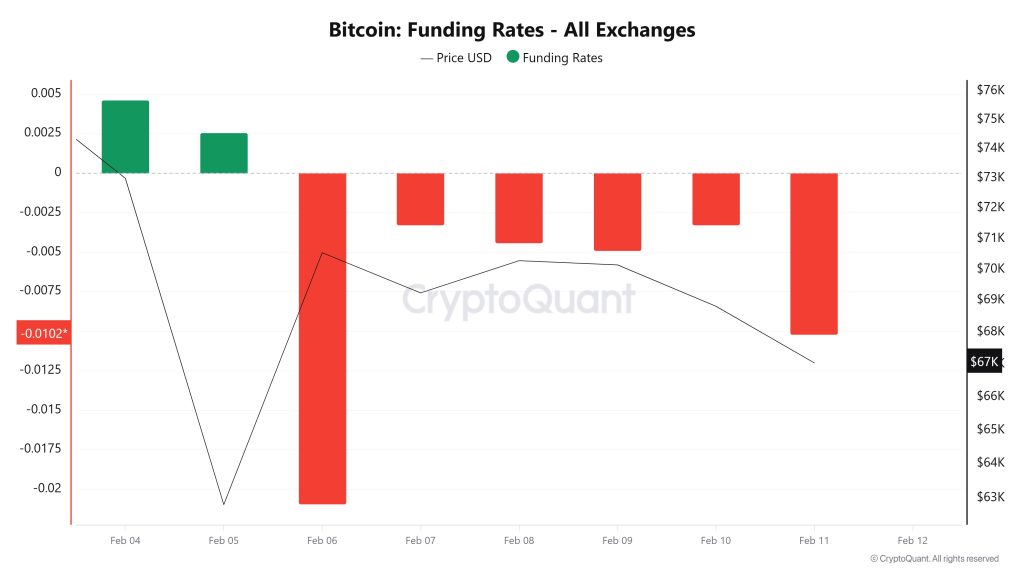

Funding Rate

On February 4, the funding rate was briefly positive but quickly turned negative and fell sharply into negative territory on February 6. This outlook indicates that short positions are dominant in the market. In the following days, the funding rate remained negative, but the severity of the decline decreased.

In summary, the structure indicates that the short trend in the leveraged market is continuing and that there is a cautious positioning against rallies.

Long & Short Liquidations

Last week, the BTC price fell sharply to the $60,000 level. As a result, a total of $1.913 billion in long positions were liquidated, while $688 million in short positions were liquidated.

| Date | Long Amount (Million $) | Short Amount (Million $) |

|---|---|---|

| February 4 | 99.38 | 25.10 |

| February 5 | 688.45 | 204.78 |

| February 6 | 601.50 | 234.44 |

| February 7 | 111.79 | 66.94 |

| February 8 | 223.42 | 84.69 |

| February 9 | 67.36 | 46.94 |

| February 10 | 122.05 | 23.58 |

| Total | 1,913.95 | 686.47 |

Supply Distribution

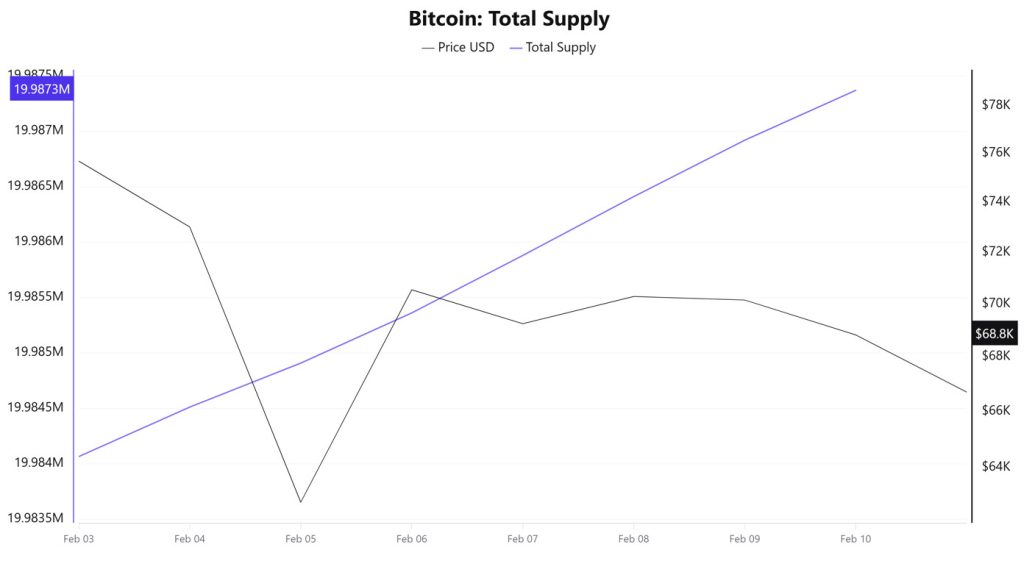

Total Supply: Reached 19,987,371 units, an increase of approximately 0.0166% compared to last week.

New Supply: The amount of BTC produced this week was 3,307.

Velocity: The velocity, which was 12.32 last week, reached 12.68 as of February 10.

| Wallet Category | 03.02.2025 | 02/09/2025 | Change (%) |

| < 1 BTC | 8.4632 | 8.4668% | 0.0425 |

| 1 – 10 BTC | 11.2838% | 11.2868% | 0.0266% |

| 10 – 100 BTC | 22.9137% | 22.8971% | -0.0724% |

| 100 – 1k BTC | 28.2702% | 28.2239% | -0.1638% |

| 1k – 10k BTC | 21.1940 | 21.1871% | -0.0326% |

| 10k+ BTC | 7.8748% | 7.9379% | 0.8013 |

The limited increase in <1 and 1–10 BTC indicates that retail investors remain cautious. The decline in the 10–100 and 100–1,000 BTC segments points to a distribution in the middle segment, while the significant increase in 10k+ BTC indicates that supply is concentrated in large wallets.

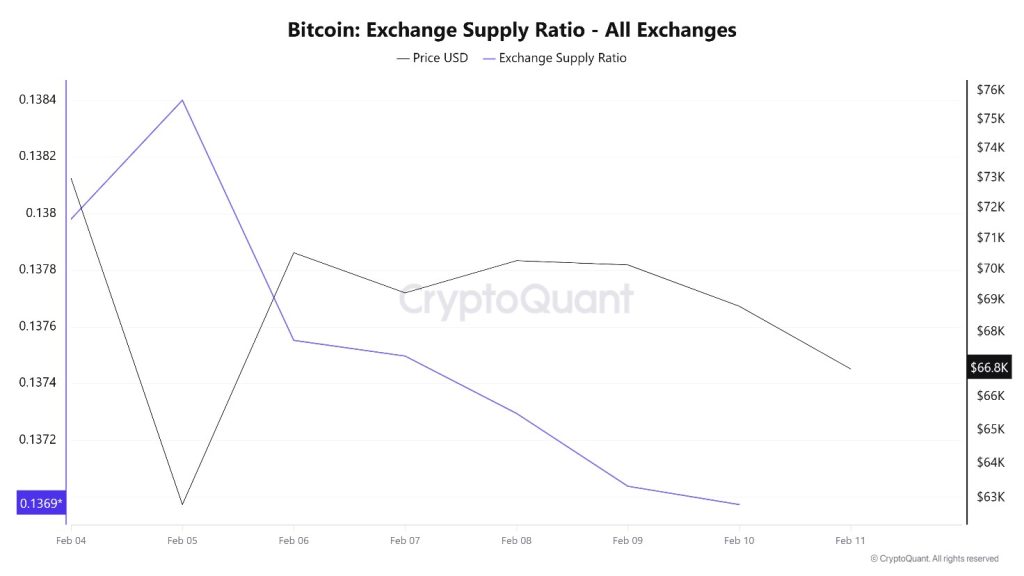

Exchange Supply Ratio

According to Bitcoin Exchange Supply Ratio data, a gradual decline in the Bitcoin supply ratio held on exchanges was observed throughout the week under review. This week, a positive correlation between the Bitcoin price and the supply ratio on exchanges was dominant. The decline in the Exchange Supply Ratio indicates that Bitcoins are being withdrawn from exchanges and held in cold wallets, limiting selling pressure in the short term. Between February 4 and February 11, the Bitcoin Exchange Supply Ratio declined slightly from approximately 0.13798179 to 0.13703817. During the same period, the Bitcoin price retreated from the $73,000 level to the $70,000 range.

The fact that both the price and the Exchange Supply Ratio moved downwards in the same direction during this period indicates that risk appetite among market participants has weakened and that new Bitcoin inflows into exchanges have remained limited.

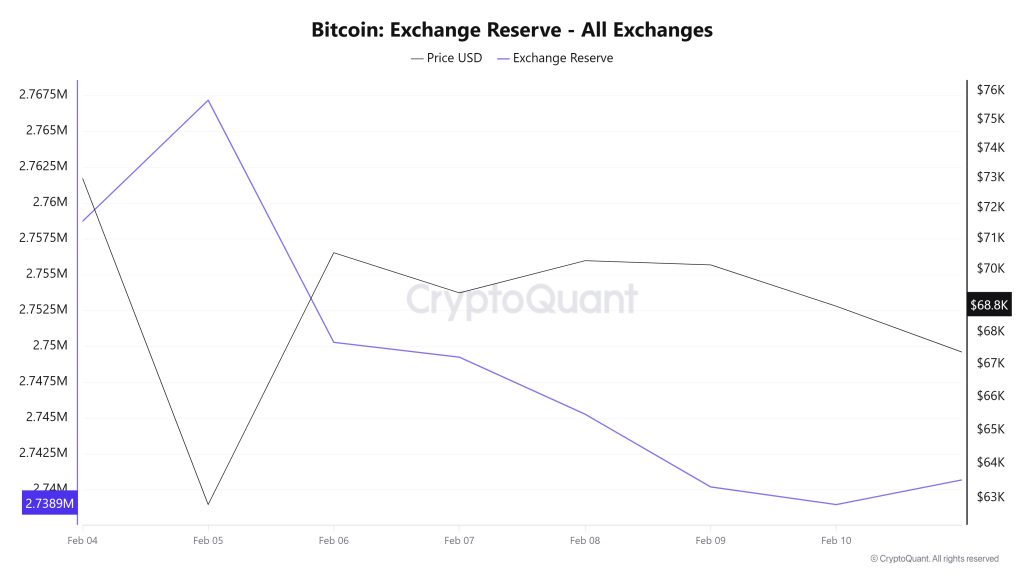

Exchange Reserve

Between February 4 and 10, 2026, Bitcoin reserves on exchanges declined from 2,749,549 BTC to 2,738,959 BTC, resulting in a net outflow of 10,590 BTC. During this period, reserves decreased by approximately 0.39%, while the BTC price fell from $75,657 to $68,826, losing 9.03% of its value. During this period, exchange reserves increased along with net inflows seen particularly on February 4-5, while selling pressure increased and the BTC price experienced a sharp decline. With the start of net outflows as of February 6, a short-term recovery was seen in the price. This indicated that selling pressure had eased. The decrease in reserves while the price was falling shows that panic selling did not become permanent and that a cautious waiting period began after the decline.

| Date | Exchange Inflow | Exchange Outflow | Exchange Netflow | Exchange Reserve | BTC Price |

|---|---|---|---|---|---|

| 04-Feb | 62,200 | 53,030 | 9,170 | 2,749,549 | 75,657 |

| 05-Feb | 92,764 | 84,315 | 8,448 | 2,767,168 | 62,809 |

| 06-Feb | 86,794 | 103,683 | -16,889 | 2,750,279 | 70,544 |

| 07-Feb | 23,870 | 24,908 | -1,038 | 2,749,240 | 69,249 |

| 08-Feb | 12,109 | 16,082 | -3,973 | 2,745,267 | 70,285 |

| February 9 | 45,714 | 50,790 | -5,075 | 2,740,192 | 70,149 |

| February 10 | 33,285 | 34,518 | -1,233 | 2,738,959 | 68,826 |

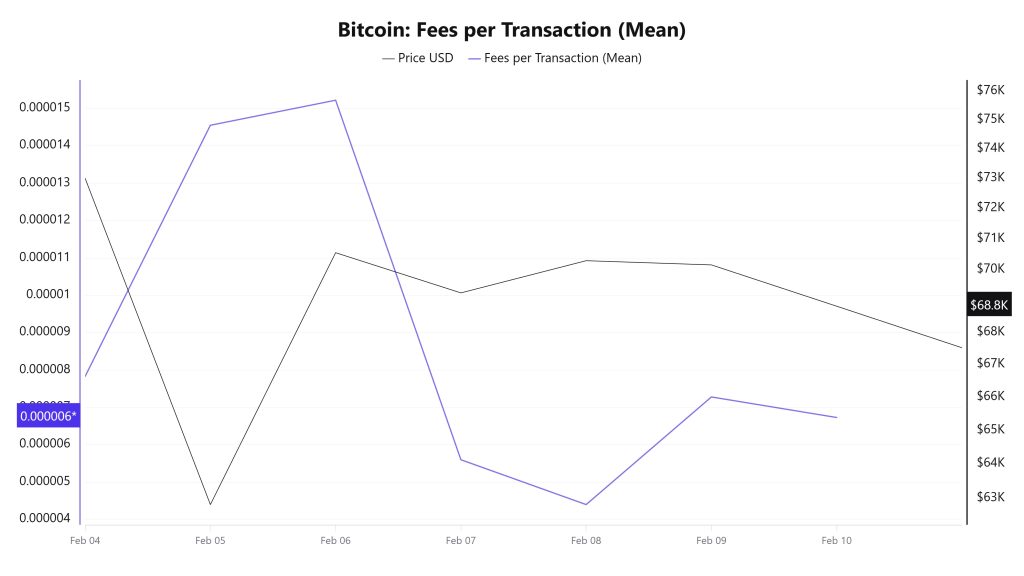

Fees and Revenues

When examining the Bitcoin Fees per Transaction (Mean) data between February 4 and 10, it is observed that the indicator reached 0.00000783 on February 4, the first day of the week.

A decline was observed until February 8, and on this date, the indicator recorded the week’s lowest value at 0.0000044.

In this context, as a result of the increase in Bitcoin price volatility as of February 8, the indicator regained momentum and followed a positive trend due to the impact of price volatility.

On February 10, the last day of the weekly period, the indicator closed the week at 0.00000673.

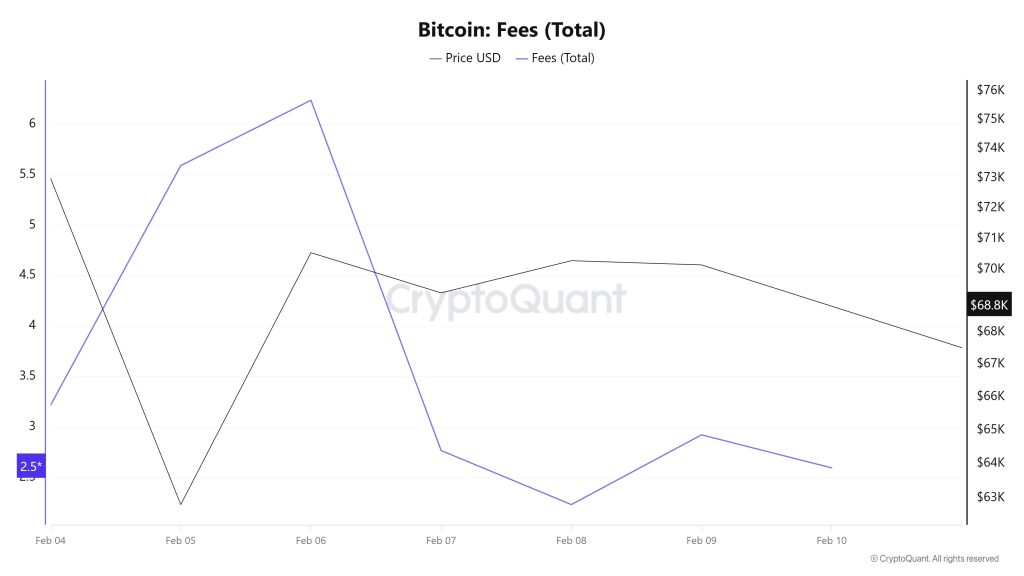

Bitcoin: Fees (Total)

Similarly, when examining the Bitcoin Fees (Total) data for the period between February 4 and 10, it is observed that the indicator reached 3.21760022 on February 4, the first day of the week.

A decline was observed until February 8, and on that date, the indicator recorded the week’s lowest value at 2.23211711.

In this context, as a result of the increase in Bitcoin price volatility as of February 8, the indicator regained momentum and followed a positive trend due to the impact of price volatility.

On February 10, the last day of the weekly period, the indicator closed the week at 2.5959583.

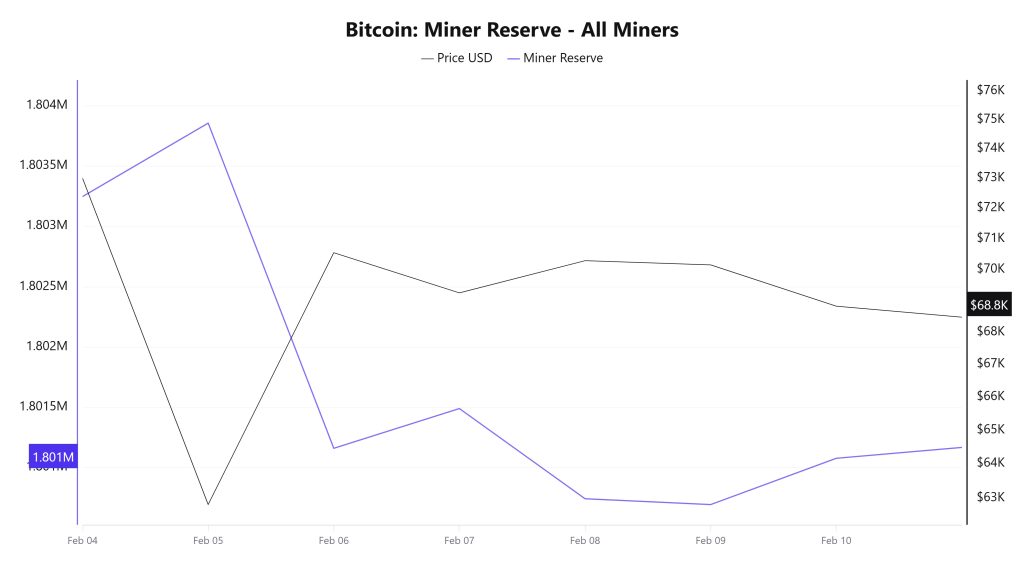

Miner Flows

According to data obtained from the Miner Reserve table, a decrease in Bitcoin reserves held in miners’ wallets was observed this week. A time-dependent correlation structure between the Bitcoin price and miner reserve was observed during the period under review. However, the general trend shows that a negative correlation between these two variables is dominant.

Miner Inflow, Outflow, and Netflow

Between February 4 and 10, 89,391 Bitcoin flowed out of miners’ wallets, while 86,419 Bitcoin flowed into miner wallets during the same period. This week’s Miner Netflow was -2,972 Bitcoin. Meanwhile, the Bitcoin price was $73,007 on February 4 and $68,825 on February 10.

Throughout the week, Bitcoin inflows into miner wallets (Miner Inflow) were less than Bitcoin outflows from miner wallets (Miner Outflow), resulting in a negative net flow (Miner Netflow).

| Date | Miner Inflow | Miner Outflow | Miner Netflow |

|---|---|---|---|

| Feb. 04 | 14,212.93 | 15,012.63 | -799.70 |

| Feb. 05 | 29,215.37 | 28,605.43 | 609.94 |

| Feb. 06 | 17,470.86 | 20,169.94 | -2,699.08 |

| Feb. 07 | 5,823.44 | 5,493.67 | 329.77 |

| Feb. 08 | 3,421.03 | 4,169.25 | -748.22 |

| Feb. 9 | 10,815.76 | 10,864.33 | -48.58 |

| Feb. 10 | 5,460.20 | 5,075.89 | 384.31 |

Transaction

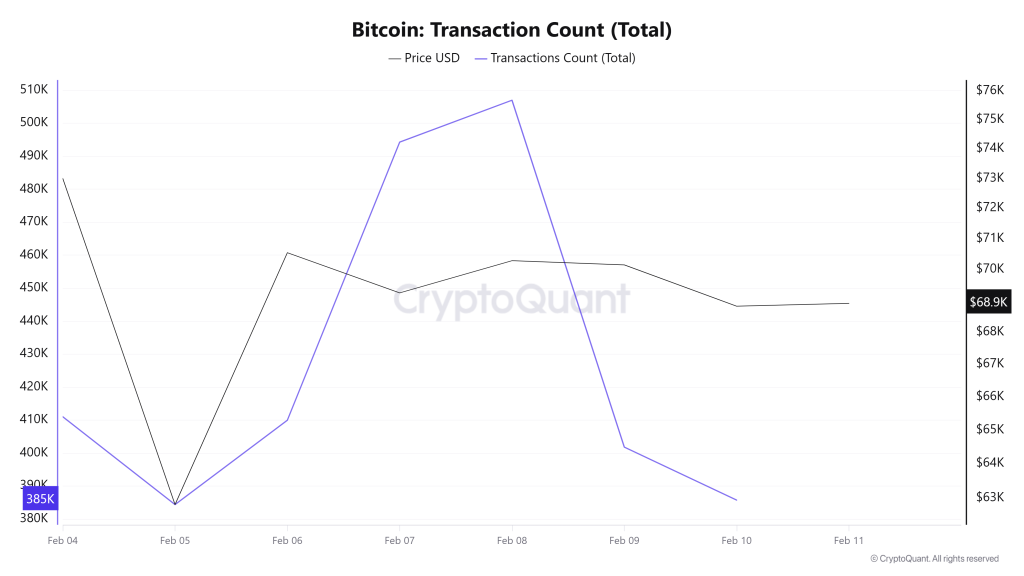

Last week, 3,052,468 transactions took place on the Bitcoin network, while this week the number of transactions fell to 2,994,527, recording a decrease of approximately 1.9%. The highest daily transaction count during the period was 507,041 on February 8, while the lowest transaction count was measured at ~385k on February 5 and 10, with nearly identical performance.

When evaluating the transaction count alongside the price chart, the relationship between transfer amounts and price shows a positive correlation. However, the downward price movement throughout the period indicates that transactions on the network may have been predominantly sales-oriented transfers.

Tokens Transferred

While a total of 7,317,360 BTC was transferred in the previous period, this week’s volume increased by 20.4% to 8,811,646 BTC. The highest daily transfer volume in the analyzed time frame was recorded on February 5 at 1,898,413 BTC, while the lowest daily volume was recorded on February 8 at 857,453 BTC. The correlation between the amount of BTC transferred and the price followed a predominantly negative trend throughout the period.

On the other hand, the decline in transaction count data, parallel to the high increase in the total amount of Bitcoin transferred, indicates that the amount of BTC per transaction on the network has increased compared to the previous period. This indicates that higher-volume transactions gained prominence during the analyzed period.

When evaluating the overall structure, it can be said that Bitcoin network usage has increased significantly compared to the previous period, and active users have exhibited a more dynamic profile in terms of transaction sizes.

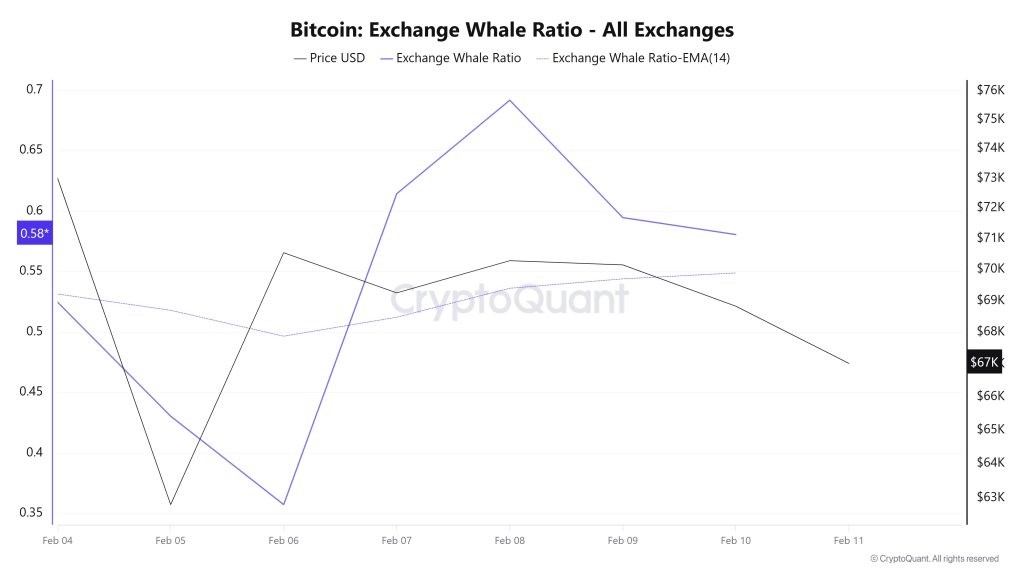

Whale Activities

Whale Data:

Looking at whale activity on centralized exchanges over the past 7 days based on crypto market data, the metric experienced a slight pullback at the beginning of the period but rose during the remainder of the period. This signaled an increase in activity on these centralized exchanges. Looking at the Exchange Whale Ratio metric, on February 4, the first day of the 7-day period, the ratio of whales using centralized exchanges was 0.524. The lowest point of the process occurred on February 6, falling to 0.357. After this date, the metric began to rise, reaching its peak on February 8 at 0.691. When this ratio is above the 0.35–0.45 band, it generally means that whales are frequently using centralized exchanges. Currently, the metric is valued at 0.580, close to its peak. During this period, it traded in a wide range between $77,000 and $60,000. This indicated that whales were moving to offload BTC on centralized exchanges. At the same time, total BTC transfers have increased by approximately 84% compared to last week, with 8,811,643 BTC moving. The Bitcoin price has reached $60,000 for the first time since October 2024. The data shows that Bitcoin is receiving renewed support from its largest holders. However, the return of demand remained limited enough to raise doubts about whether this is a recovery or merely damage control. Whale wallets accumulated approximately 53,000 coins last week, following weeks of intense selling. This was the largest buying wave since November. Such purchases did not help stabilize prices after a sharp decline. As a result, while the largest whales are buying, retailers continue to sell. As seen in the metrics, although the data showing a decline from the peak is decreasing, centralized exchanges are still frequently used. This shows us that the selling pressure continues.

BTC Onchain Overall

| Metric | Positive 📈 | Negative 📉 | Neutral ➖ |

|---|---|---|---|

| Active Addresses | ✓ | ||

| Breakdowns | ✓ | ||

| Derivatives | ✓ | ||

| Supply Distribution | ✓ | ||

| Exchange Supply Ratio | ✓ | ||

| Exchange Reserve | ✓ | ||

| Fees and Revenues | ✓ | ||

| Miner Flows | ✓ | ||

| Transaction | ✓ | ||

| Whale Activity | ✓ |

*The metrics and guidance provided in the table do not alone explain or imply any expectation regarding future price changes in any asset. Digital asset prices can fluctuate based on numerous variables. The on-chain analysis and related guidance are intended to assist investors in their decision-making process, and basing financial investments solely on the results of this analysis may lead to unfavorable outcomes. Even if all metrics produce positive, negative, or neutral results simultaneously, the expected outcomes may not materialize depending on market conditions. It would be beneficial for investors reviewing the report to take these warnings into consideration.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.

NOTE: All data used in Bitcoin on-chain analysis is based on CryptoQuant.