MARKTKOMPASS

Tariff Agenda Continues

- Risk aversion continues to dominate global markets ahead of the US tariffs, which will go into effect on April 2 unless there is a last minute deal with the other countries.

- European stock markets extended their losses to the fourth session, while Wall Street futures are also indecisive and slightly negative. US indices also ended the day with a decline yesterday. US 10-year treasury bond yields and safe-haven gold rose, while digital currencies lost value.

- US Federal Reserve (FED) officials made assessments on the additional inflation that tariffs may bring. Boston Fed President Susan Collins said that the tariffs imposed by the Trump administration will raise US inflation, but it is unclear how permanent this effect will be.

- Later in the day, the FED’s favorite inflation indicator, the PCE Price Index, will be released and will be closely monitored as it may give clues about the Bank’s interest rate cut course. Possible figures that may come far from expectations may cause wavelengths in asset prices to increase.

FED’s Favorite Inflation Indicator: PCE

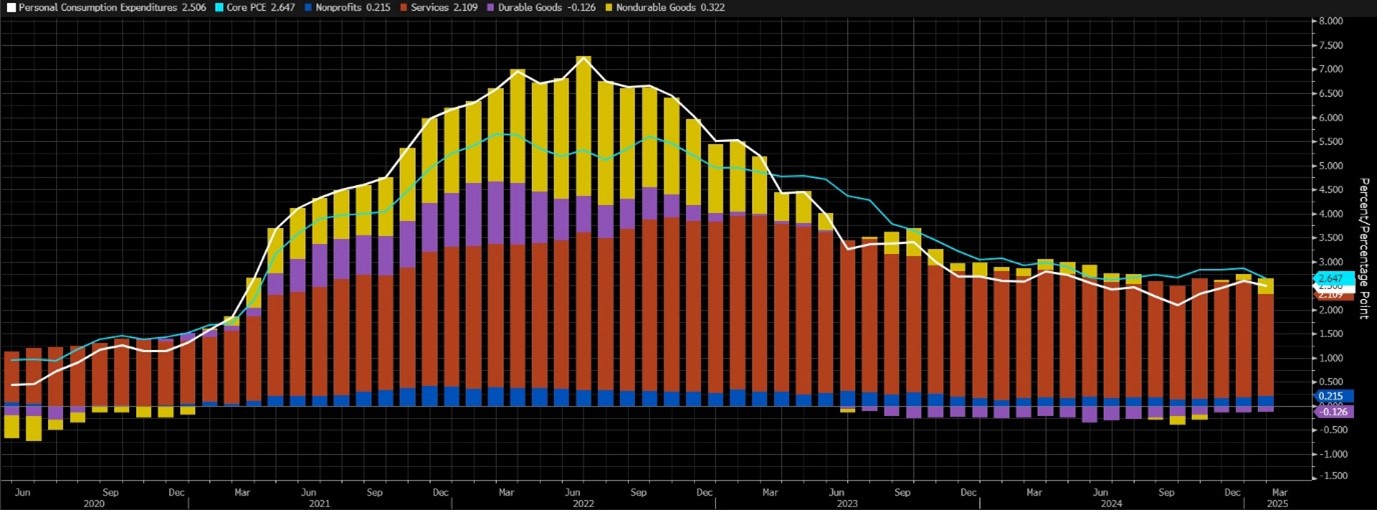

Personal Consumption Expenditures (PCE) shows the change in the price of goods and services purchased by consumers and is an inflation indicator. It is a macro indicator that the US Federal Reserve (FED) monitors more closely than the Consumer Price Index (CPI) to measure changes in consumer prices. It differs from the core CPI in that it measures only goods and services for and consumed by individuals. It is published monthly, about 30 days after the month ends and about 10 days after the CPI.

FED Chairman Powell’s speech at the Jackson Hole Symposium last year led to a significant shift in the equation. Powell’s remarks shifted the focus from inflation to the strength of the labor market and conveyed the message that the Fed would now give more importance to the strength of the labor market in its decisions. Or at least that is how the markets interpreted the statements. Recent months have shown that this may not be the right approach.

Quelle: Bloomberg

We will evaluate the annual core Personal Consumption Expenditures (PCE) data for Februar. However, core data and monthly data will also be important. PCE, which signaled an increase of 2.6% in Dezember, rose by 2.5% in Januar, according to the latest data. This was the first slower increase in four months. At the last FOMC meeting, it raised its PCE forecast to 2.7% for 2025 from 2.5% previously. We can say that this reflects the uncertainty that comes with the fast-changing decisions of the new US President Trump and the burden of tariffs. Analyzing the forecasts, we see that in general, the PCE data set is not expected to be very different from the previous figures.

A data above the median forecast may support expectations that the FED will maintain its cautious stance on interest rate cuts, reducing risk appetite and putting pressure on digital assets. A lower-than-expected data, on the other hand, may have the opposite effect and pave the way for value gains.

Digital Compass

We consider it a very important development that a strategic crypto reserve is on the agenda in the US, the locomotive of the world economy. However, the fact that the markets have already priced in the “best case scenario”, combined with the “less than perfect” news on this issue, has been putting pressure on digital assets for some time. We continue to keep the strategic reserve issue in our equation as a positive variable for cryptocurrencies in the long run. On the other hand, we think that we may continue to see pressure in the medium term if there is no new news flow to create enthusiasm in the crypto market and if concerns about slowing economic activity in global markets increase further. In the short term (in general), markets will continue to be sensitive to macro indicators and Trump’s actions on tariffs.

Click here for a detailed review of our twice daily technical analysis report and the latest developments in digital assets.

HIGHLIGHTS OF THE DAY

Wichtige Daten des Wirtschaftskalenders

| Zeit | Nachrichten | Erwartung | Vorherige |

|---|---|---|---|

| - | Ronin (RON): Alchemy Integration | - | - |

| - | PancakeSwap: Istanbul Meetup (Turkey) | - | - |

| 12:30 | US PCE Price Index (MoM) (Feb) | 0.3% | 0.3% |

| 12:30 | US Core PCE Price Index (MoM) (Feb) | 0.3% | 0.3% |

| 12:30 | US PCE Price Index (YoY) (Feb) | 2.5% | 2.5% |

| 12:30 | US Core PCE Price Index (YoY) (Feb) | 2.7% | 2.6% |

| 14:00 | US Michigan Consumer Sentiment (Mar) | - | 57.9 |

| 19:45 | FOMC-Mitglied Bostic spricht | - | - |

INFORMATIONEN

*Der Kalender basiert auf der Zeitzone UTC (Coordinated Universal Time).

Der Inhalt des Wirtschaftskalenders auf der entsprechenden Seite wird von zuverlässigen Nachrichten- und Datenanbietern bezogen. Die Nachrichten im Wirtschaftskalender, das Datum und die Uhrzeit der Bekanntgabe der Nachrichten, mögliche Änderungen der bisherigen, erwarteten und angekündigten Zahlen werden von den datenliefernden Institutionen vorgenommen. Darkex kann nicht für mögliche Änderungen verantwortlich gemacht werden, die sich aus ähnlichen Situationen ergeben können.

DARKEX RESEARCH ABTEILUNG AKTUELLE STUDIEN

Wöchentliche BTC Onchain-Analyse

Global Economic Uncertainties, the ONS Gold Price and Bitcoin’s Lack of

2025 First Quarter: Bitcoin Market Volatility and Macroeconomic

Intent-Based Solutions and De-Fi Liquidity

The 5 Altcoins Least Affected by the Drop in

SEC’s Regulatory Approach to XRP and ETH and

Is The US in Danger of Recession?

Klicken Sie hier für alle unsere anderen Market Pulse Berichte.

Rechtlicher Hinweis

Die in diesem Dokument enthaltenen Anlageinformationen, Kommentare und Empfehlungen stellen keine Anlageberatungsdienste dar. Die Anlageberatung wird von zugelassenen Instituten auf persönlicher Basis unter Berücksichtigung der Risiko- und Ertragspräferenzen des Einzelnen durchgeführt. Die in diesem Dokument enthaltenen Kommentare und Empfehlungen sind allgemeiner Art. Diese Empfehlungen sind möglicherweise nicht für Ihre finanzielle Situation und Ihre Risiko- und Renditepräferenzen geeignet. Eine Anlageentscheidung, die ausschließlich auf der Grundlage der in diesem Dokument enthaltenen Informationen getroffen wird, kann daher möglicherweise nicht zu Ergebnissen führen, die mit Ihren Erwartungen übereinstimmen.