Eyes on US Employment Data

- US President Donald Trump announced a trade deal with Vietnam. It was also stated that the US lifted the requirement for export licenses for chip design software sales to ease China’s recent restrictions on critical technologies.

- European stock markets are slightly up, while Wall Street futures, which will be closed tomorrow, are flat. US stock markets will have half a day of trading today and will be closed tomorrow due to a holiday. This may cause trading volumes to fall in global markets.

- For the rest of the day, whether Trump’s tax bill will pass the House of Representatives, potential new news flows on trade deals and critical US macro indicators will be monitored.

- Major digital assets tend to hold their recent gains and continue to be positively affected by the moderate climate in global markets. In addition, the ecosystem-specific expectations play an important role in the upside. Hopes that the adoption of cryptocurrencies will increase with the developments in the US contribute to the value gains.

- In the rest of the day, the directional developments will be determined by the US employment data and expectations regarding the US Federal Reserve’s (FED) interest rate cut course will affect asset prices.

For a detailed review of our twice-daily technical analysis report and the latest developments in digital assets click here.

US-Beschäftigungsdaten

Having left the first half of the year behind, markets will be receiving the Juni Non-Farm Payrolls (NFP) data today, which will provide clues about the tightness of the financial ecosystem in the coming period, which will provide information about the US Federal Reserve’s (FED) interest rate cut course. In addition, März figures such as average hourly earnings and the unemployment rate will also be monitored.

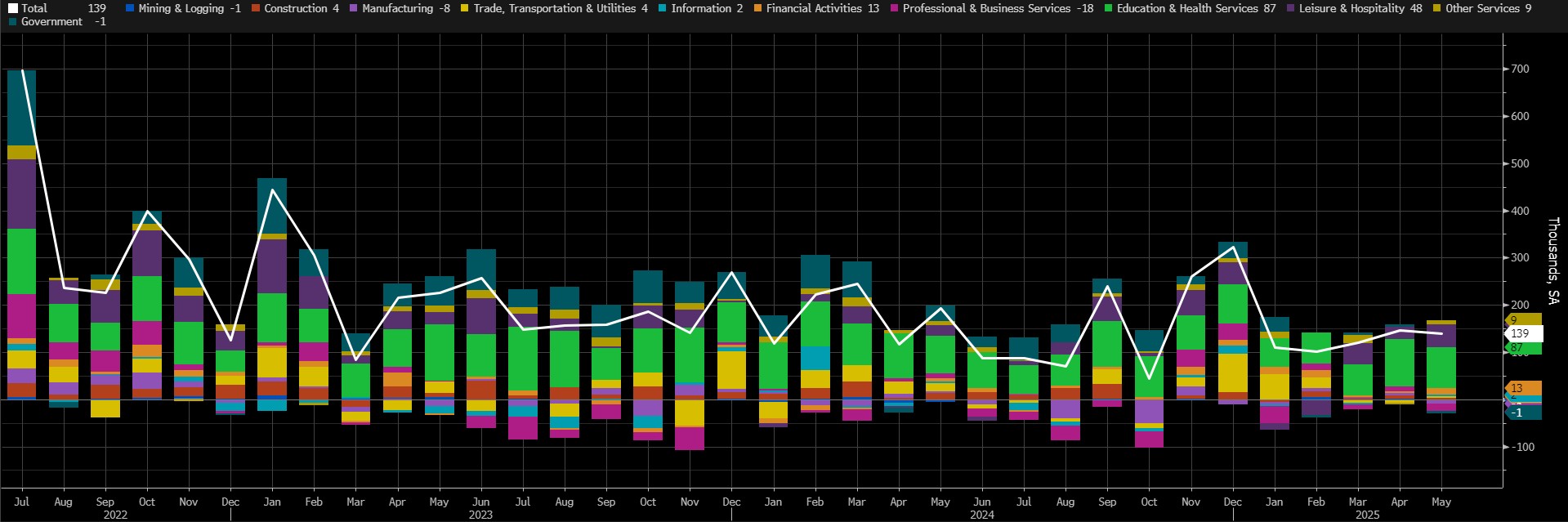

In Mai, the US economy added 139K jobs (Market Expectation: 126K).

Quelle: Bloomberg

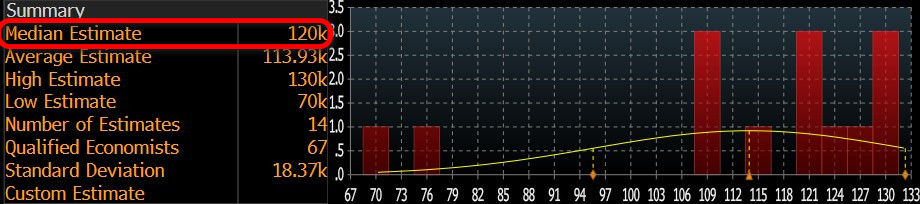

Our forecast for the NFP data, which is highly sensitive to the market, is that we may see a data in the non-farm sectors of the US economy in Juni, well above the general forecasts. At the time of writing, although the number of forecasts entered is small, we see that the consensus on the Bloomberg terminal is more pessimistic, around 120 thousand.

Quelle: Bloomberg

We believe that if the Juni NFP data, which will be published in the shadow of Trump’s tariff-oriented foreign policy, the disruptions it may create domestically and the developments in the Middle East, is slightly below expectations, this will be priced as a potential metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, a much lower than expected NFP data may trigger recession concerns again with a commentary on the health of the US economy, which may put selling pressure on assets considered to be risky. It should be noted here that we expect that a much better-than-expected data release could also have a positive impact. It is worth noting that we anticipate these effects by taking into account the current state of market sentiment.

Andere Makroindikatoren

ISM Services PMI; Der Einkaufsmanagerindex (PMI) ist ein Diffusionsindex, der auf der Befragung von Einkaufsmanagern mit Ausnahme des verarbeitenden Gewerbes basiert. In dieser vom Institute for Supply Management (ISM) durchgeführten Umfrage werden rund 300 Einkaufsmanager gebeten, das relative Niveau der Geschäftslage zu bewerten, einschließlich Beschäftigung, Produktion, Auftragseingänge, Preise, Lieferantenlieferungen und Lagerbestände. Er wird in der Regel monatlich am dritten Werktag nach Monatsende veröffentlicht, wobei ein Wert über 50,0 auf ein Wachstum des Sektors und ein Wert unter 50,0 auf einen Rückgang hindeutet. Im Allgemeinen wird erwartet, dass sich ein niedriger als erwartet ausgefallener ISM-Dienstleistungs-PMI positiv auf digitale Vermögenswerte auswirken wird, da er die Erwartungen hinsichtlich des geldpolitischen Kurses der US-Notenbank (FED) einpreist. In einigen Fällen kann es jedoch auch zu einer Preisbildung aufgrund der Stärke der Wirtschaft kommen. In diesem Fall haben Zahlen, die über den Erwartungen liegen, einen positiven Effekt auf digitale Vermögenswerte.

Highlight des Tages

Wichtige Daten des Wirtschaftskalenders

| Zeit | Nachrichten | Erwartung | Vorherige |

|---|---|---|---|

| 12:30 | US Erstanträge auf Arbeitslosenunterstützung | 240K | 236K |

| 12:30 | US Average Hourly Earnings (MoM) (Jun) | 0.3% | 0.4% |

| 12:30 | US Nonfarm Payrolls (Jun) | 111K | 139K |

| 12:30 | US Unemployment Rate (Jun) | 4.3% | 4.2% |

| 14:00 | US ISM Services PMI (Jun) | 50.8 | 49.9 |

| 15:00 | FOMC-Mitglied Bostic spricht | - | - |

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

*General Information About Forecasts

In addition to the general market expectations, the forecasts shared in this report are based on econometric modeling tools developed by our research department. Different structures were considered for each indicator and appropriate regression models were constructed in line with data frequency (monthly/quarterly), leading economic indicators and data history.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, it also aims to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform in an up-to-date and automated manner, so that every forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modeling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) in order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account in the interpretation of model outputs, and it should be kept in mind that there may be deviations in forecast performance due to economic shocks, policy changes and unforeseen external factors. With this set of monthly updates, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Rechtlicher Hinweis

Die in diesem Dokument enthaltenen Anlageinformationen, Kommentare und Empfehlungen stellen keine Anlageberatungsdienste dar. Die Anlageberatung wird von zugelassenen Instituten auf persönlicher Basis unter Berücksichtigung der Risiko- und Ertragspräferenzen des Einzelnen durchgeführt. Die in diesem Dokument enthaltenen Kommentare und Empfehlungen sind allgemeiner Art. Diese Empfehlungen sind möglicherweise nicht für Ihre finanzielle Situation und Ihre Risiko- und Renditepräferenzen geeignet. Eine Anlageentscheidung, die ausschließlich auf der Grundlage der in diesem Dokument enthaltenen Informationen getroffen wird, kann daher möglicherweise nicht zu Ergebnissen führen, die mit Ihren Erwartungen übereinstimmen.