Furcht & Gier Index

Source: Alternative

Change in Fear and Greed Value: +11

Last Week’s Level: 54

This Week’s Level: 65

The Fear and Greed Index rose from 54 to 65 this week, indicating a strong rebound in market sentiment. In the early days of the week, global risk appetite weakened significantly due to Israeli-Iranian tensions and the US attack on Iranian nuclear facilities. The sharp rise in oil prices reignited inflation expectations. Leading PMI data released in the Eurozone indicated that growth remained sluggish, temporarily increasing the fear sentiment. However, as of the middle of the week, rumors of a ceasefire sparked a wave of buying in risky assets and US indices approached record highs. President Trump’s support for the GENIUS Stablecoin Act and his call for its enactment by the end of the year strengthened expectations for regulatory clarity in the crypto market. On the institutional investment side, Procap’s purchase of 3,724 Bitcoin worth 386 million dollars was one of the most important developments that significantly fed the greed trend. Despite Fed Chairman Powell’s cautious stance on interest rate cuts, markets quickly started to price in the expectation of two rate cuts in 2025. In light of these developments, the index reversed last week’s weak course and reached 65, indicating that a more optimistic outlook is gaining strength in the market.

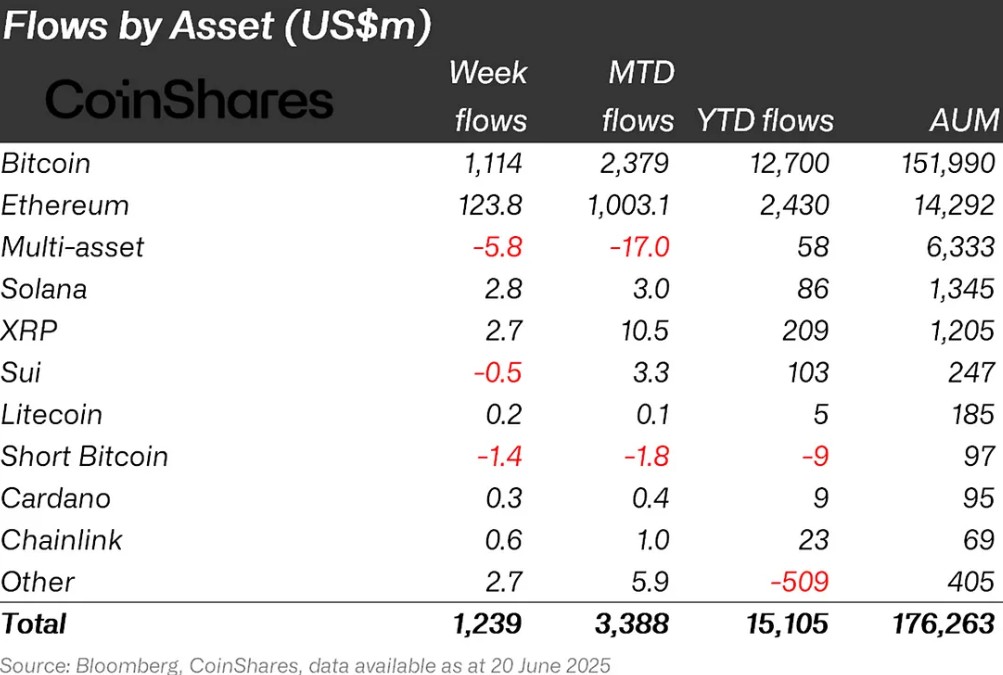

Fondsströme

Source: Coin Shares

Overview While the crypto market had an up and down week due to macroeconomic uncertainties and regulatory news, the IRAN-ISRAEL stalemate in the Middle East and the US involvement in the war created a lot of volatility in Bitcoin. The loss in Bitcoin reached 2%.

Fondszuflüsse:

Bitcoin (BTC): Macroeconomic uncertainties and ongoing geopolitical tensions in the Middle East and the recent US attack on Iran reduced risk appetite and increased fund outflows. This caused fund inflows to remain at low levels. Despite this, interest in Bitcoin continues, with inflows into Bitcoin funds reaching $1.1 billion this week.

Ethereum (ETH): Spot ETH performed strongly on the back of institutional interest. This week, Ethereum saw inflows of $123.8 million.

Litecoin (LTC): A partnership was formed between Mastercard and Chainlink that will allow cardholders to purchase crypto using on-chain liquidity. This is an important development in terms of bridging traditional finance (TradFi) and decentralized finance (DeFi) and mainstream adoption of cryptocurrencies. Ltc saw $0.2 million in fund inflows this week.

Ripple (XRP): US District Judge Analisa Torres rejected the SEC and Ripple’s joint settlement proposal. This decision means that the Ripple case will not end early and the legal process will continue. Fund inflow in Xrp this week was $2.7 million.

Solana (SOL): Major asset managers such as Invesco filing spot Solana ETF applications created excitement in the market. Solana, which is thought to significantly increase the likelihood of approval, saw an inflow of $ 2.8 million.

Cardano (ADA): Cardano continues to work on the Voltaire upgrade, which aims to implement full on-chain management. This week, Cardano saw $0.3 million in inflows.

Chainlink (LINK): Chainlink has made significant strides in its goal to gain market share by partnering with major financial institutions such as UBS Asset Management and Swift for tokenized funding deals. Link saw inflows of $0.6 million this week on the announcement of this collaboration.

Other: Altcoins saw sectoral and project-based rallies. These attacks brought an inflow of 1.9 million dollars in fund flow data.

Mittelabflüsse:

Multi-asset: The volatility observed in the market caused outflows in the multi-asset group despite ETF data.

Short Bitcoin: Inflows into short bitcoin positions totaled -1.4 million dollars.

SUI: Aurora Mobile US-listed Chinese technology firms announced that they will invest in Sui as part of their treasury diversification strategy. Sui saw inflows of -$0.5 million this week.

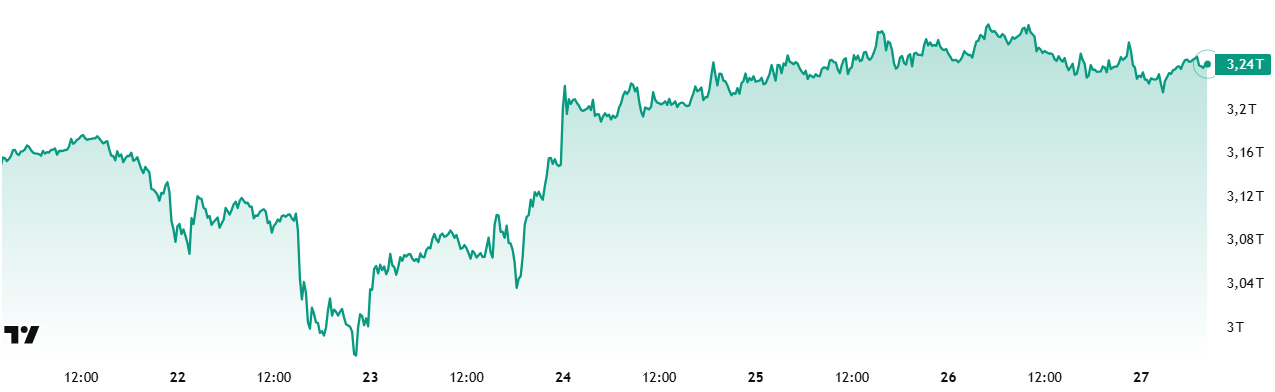

Marktkapitalisierung insgesamt

Quelle: Handelsansicht

Last Week Market Capitalization : 3.06 Trillion Dollars

Market Capitalization This Week: 3.24 Trillion Dollars

The cryptocurrency market rose 6.03% this week with a value increase of approximately $184 billion. Thus, the total market capitalization advanced to $3.24 trillion. This rise will end a streak of four consecutive weeks of declines with this week’s close. While it seems positive that the total market ended its negative streak, the fact that it has not yet recovered last week’s loss raises the possibility that the decline may only be a minor pause.

Insgesamt 2

Total2 started the new week with a market capitalization of $1.05 trillion, rising 5.53% to approximately $57.90 billion. With this move, it rose to $1.11 trillion. Compared to the Total market, the value increase in Bitcoin is approximately 68.1 billion dollars. The fact that Total2 increased less compared to the overall rise of the Total market shows that the inflow of money into altcoins remains more limited compared to Bitcoin. In short, the long-awaited positive divergence in the altcoin market has yet to begin.

Insgesamt 3

Total3, which started the week at $779.04 billion, rose by 4.05% to $810.61 billion, with a weekly increase of approximately $31.5 billion. With this move, it will end its four-week negative streak this week. Although the Total 3 index, whose current levels hover around the 50-week periodic moving average, looks positive this week, it has been below the $1 trillion threshold for quite some time.

It can be said that the altcoin market had a weaker positive performance this week compared to Bitcoin. Between Ethereum and other altcoins, the rise in non-Ethereum altcoins, which make up about 25% of the market, remains lower in quantity compared to Ethereum, which accounts for about 9% of the total market; Ethereum’s positive divergence compared to the altcoin market average shows that Ethereum has started to diverge positively.

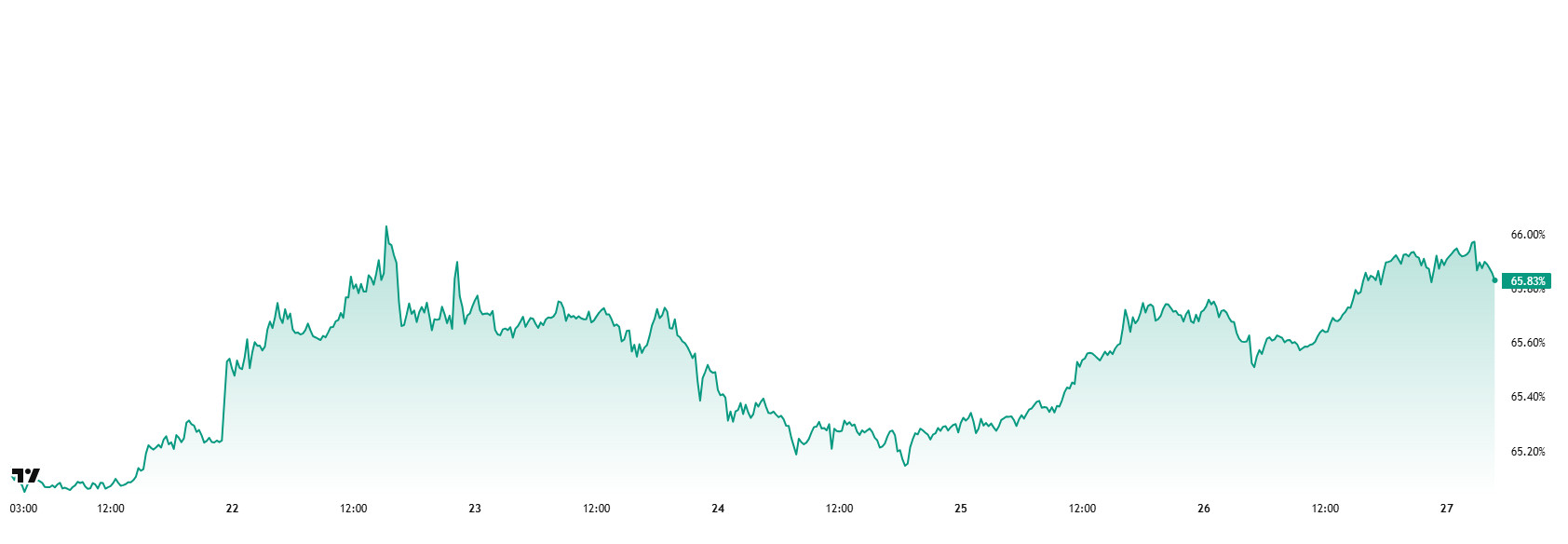

Bitcoin-Dominanz

Source: Tradingview

Bitcoin-Dominanz

Bitcoin dominance, which started the week at 65.71%, fell to 65.08% during the week. After this decline, the dominance recovered and is currently at 65.83%.

This week, Strategy bought 245 Bitcoin, Metaplanet bought 2,345 Bitcoin and The Blockchain Group, Europe’s first Bitcoin treasury company, bought 75 Bitcoin.

Data on Bitcoin spot ETFs show a total net inflow of $1.71 billion to date.

With the easing of tensions in the Middle East, the risk appetite in the markets has revived. This development led to an increase in investor confidence and accelerated capital inflows. As a result, demand for risky assets has increased, which has led to a surge in purchases of Bitcoin in particular. The increased demand triggered an upward movement in Bitcoin dominance and led to a stronger performance of Bitcoin compared to altcoins.

Continued institutional investor demand, strong net capital inflows into spot Bitcoin ETFs and reduced geopolitical uncertainties have led to an improvement in risk perception across the market and a reallocation of capital back into digital assets. These developments have increased investors’ appetite for risk and led to a reallocation of capital not only to Bitcoin but also to Ethereum and other altcoins. In the event of a positive price-based divergence in other altcoins, especially Ethereum, a decline in Bitcoin dominance is likely. In light of all this, Bitcoin dominance can be expected to consolidate in the 63% – 65% band next week.

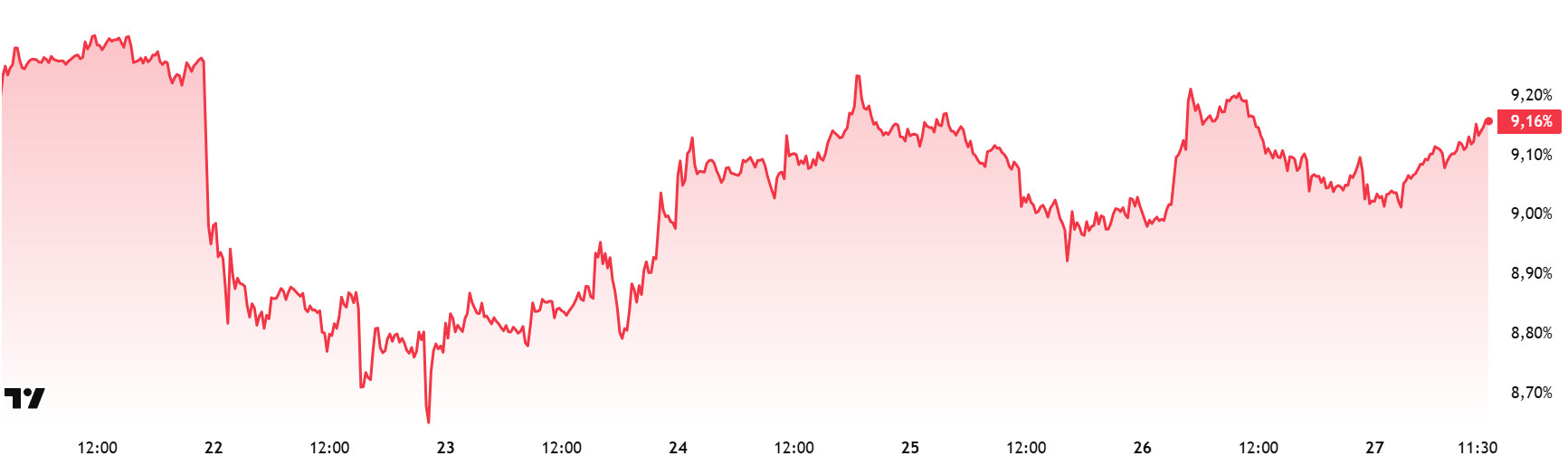

Ethereum-Dominanz

Source: Tradingview

Last Week’s Level: 8.80%

This Week’s Level: 9.16%

Ethereum dominance continued its upward trend, which started at around 7% as of April, and reached up to 10% as of last week. However, the dominance, which failed to exceed this level, has generally followed a horizontal course in the last six weeks. Following this flat outlook, there was an accelerated retreat last week due to geopolitical risks. In the current week, however, positive movements in Ethereum dominance were observed as geopolitical tensions eased.

In this context, Ethereum dominance ended last week at 8.80%, while it is trading at 9.16% as of current data.

Similar to Ethereum, Bitcoin dominance also displayed a positive outlook and showed an upward trend in the same period.

On the other hand, looking at the fundamental developments supporting Ethereum dominance; According to Cointelegraph, the Ethereum ($ETH) strategic reserve managed by 38 institutional actors has exceeded $ 3 billion. The size of this reserve reinforces the strategic importance and value of Ethereum to institutional investors.

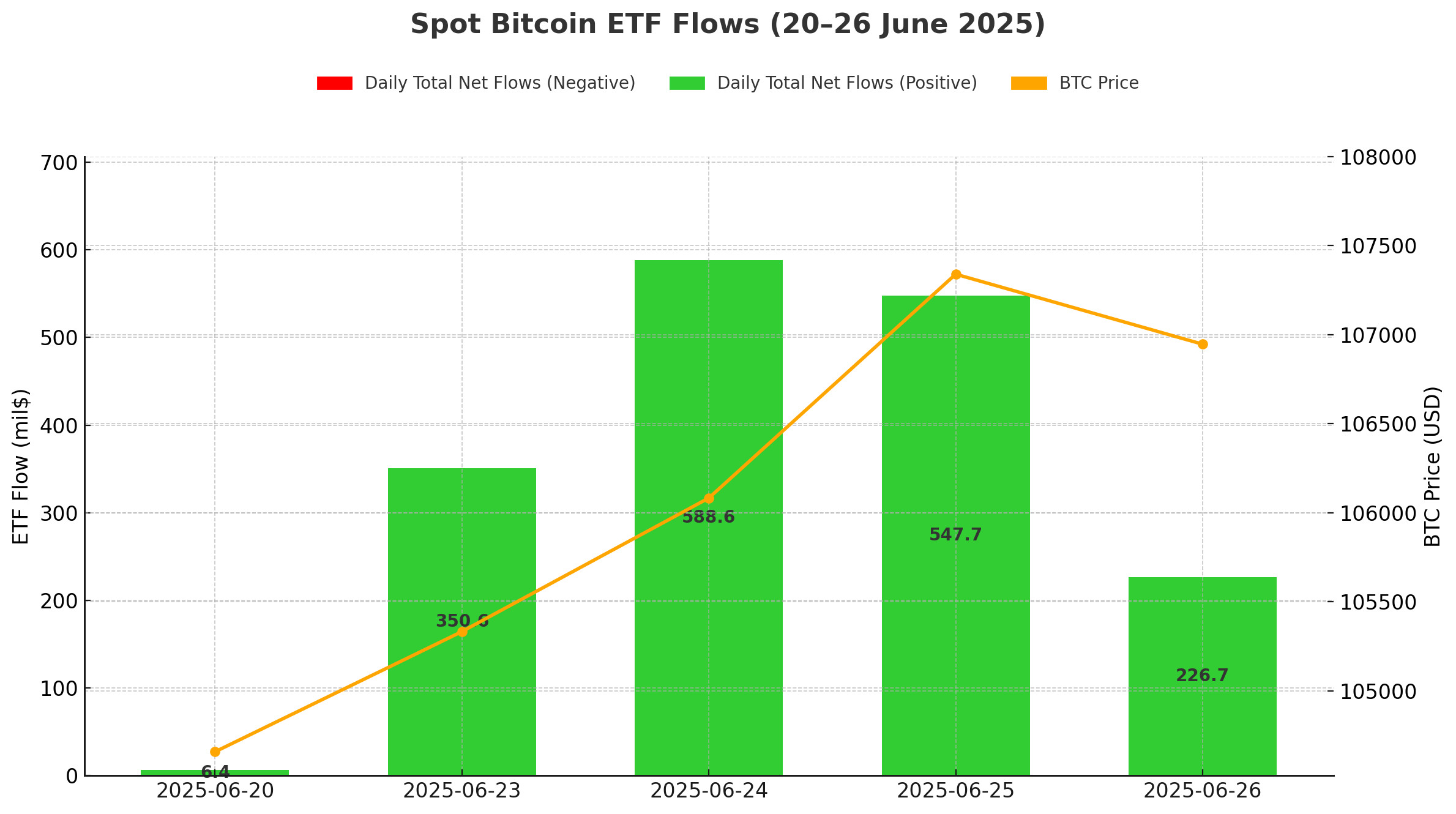

Bitcoin-Spot-ETF

Netflow Status: Between Juni 20-26, 2025, Spot Bitcoin ETFs saw net inflows totaling $1.72 billion. Juni 24 saw the strongest inflows of the week at $588.6 million, followed by another strong inflow of $547.7 million on Juni 25. Weekly net inflows of $1.2 billion into BlackRock’s IBIT ETF, $298.5 million into Fidelity’s FBTC ETF and $117.9 million into ARK’s ARKB ETF showed continued institutional interest.

Bitcoin Price: Bitcoin, which opened at $104,658 on Juni 20, tended to recover during this period. On Juni 25, the week’s peak was seen at $107,340, while it closed the week at $106,947 with limited sales on Juni 26. BTC price gained 2.19% during this period.

Cumulative Net Inflows: The total cumulative net inflows of spot Bitcoin ETFs reached $48.35 billion by the end of the 365th trading day.

| Datum | Münze | Öffnen Sie | Schließen Sie | Veränderung in % | ETF-Fluss (Mio. $) |

|---|---|---|---|---|---|

| 20-Jun-25 | BTC | 104,658 | 103,297 | -1.30% | 6.4 |

| 23-Jun-25 | BTC | 100,963 | 105,333 | 4.33% | 350.6 |

| 24-Jun-25 | BTC | 105,333 | 106,083 | 0.71% | 588.6 |

| 25-Jun-25 | BTC | 106,083 | 107,340 | 1.18% | 547.7 |

| 26-Jun-25 | BTC | 107,340 | 106,947 | -0.37% | 226.7 |

| Total for 20–26 Jun 25 | 2.19% | 1720.0 | |||

Spot Bitcoin ETFs went 13 trading days without negative flows, while Spot Bitcoin ETFs ended with positive net flows for the 5th consecutive trading day between Juni 20-26, 2025. Despite limited outflows from the Grayscale GBTC ETF, heavy inflows, especially into large funds such as IBIT and FBTC, show that institutional investor interest remains strong. The steady demand for ETFs signals investors’ continued confidence in Bitcoin. In the medium term, this positive outlook could herald a more sustained uptrend in BTC price.

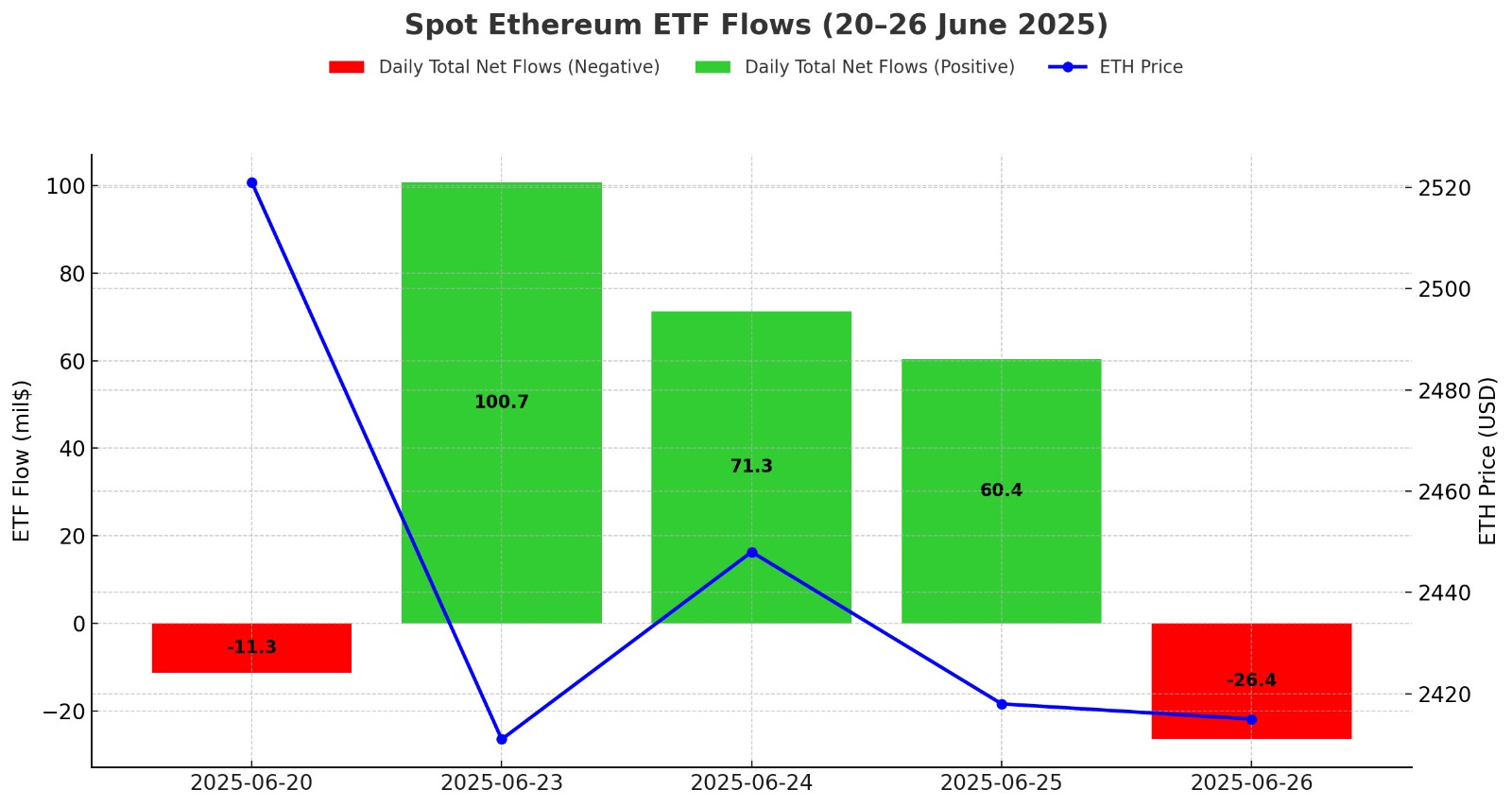

Ethereum-Spot-ETF

Between Juni 20-26, 2025, Spot Ethereum ETFs saw a total net inflow of $194.7 million. The strongest inflow in this process took place on Juni 23 with $100.7 million. BlackRock’s ETHA ETF attracted inflows of $ 165.2 million, while Grayscale’s ETHE ETF attracted outflows of $ 27.4 million. Total cumulative net inflows of spot Ethereum ETFs at the end of the 233rd trading day rose to $4.12 billion.

| Datum | Münze | Öffnen Sie | Schließen Sie | Veränderung in % | ETF-Fluss (Mio. $) |

|---|---|---|---|---|---|

| 20-Jun-25 | ETH | 2,521 | 2,406 | -4.56% | -11.3 |

| 23-Jun-25 | ETH | 2,227 | 2,411 | 8.26% | 100.7 |

| 24-Jun-25 | ETH | 2,411 | 2,448 | 1.53% | 71.3 |

| 25-Jun-25 | ETH | 2,448 | 2,418 | -1.23% | 60.4 |

| 26-Jun-25 | ETH | 2,418 | 2,415 | -0.12% | -26.4 |

| Total for 20–26 Jun 25 | -4.20% | 194.7 | |||

Between Juni 20-26, 2025, the Ethereum price fell by 4.20%, while institutional interest continued in the Spot Ethereum ETF market. Between Juni 23 and 25, consecutive positive inflows to ETFs attracted attention. The fact that these inflows coincided with the days when prices recovered strengthened the tendency of institutional investors to use declines as opportunities. Total flows in spot Ethereum ETFs remain in positive territory, indicating that institutional investors are maintaining their long-term outlook, which could have an upward impact on the Ethereum price if institutional interest continues in the coming weeks.

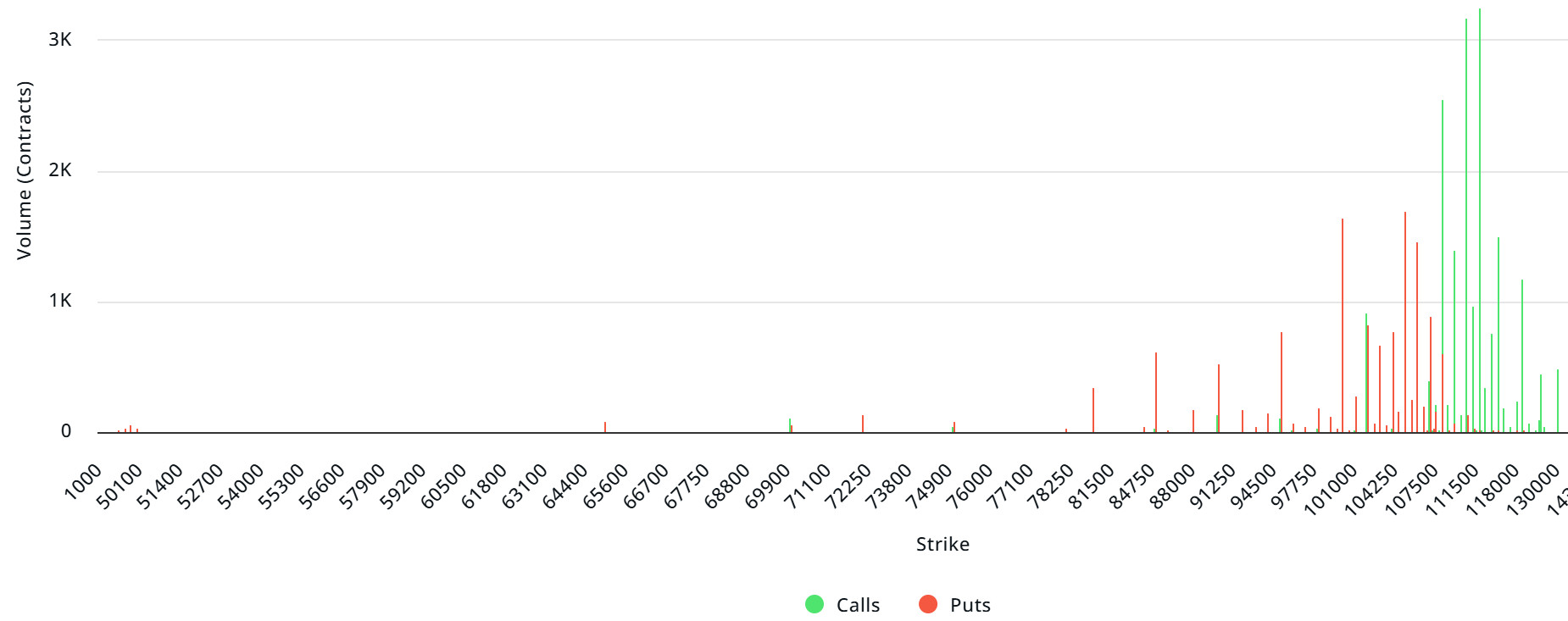

Bitcoin Optionen Vertrieb

Source: Laevitas

BTC: Notional: $15B | Put/Call: 0.74 | Max Pain: $102K

Deribit Data: Deribit data shows that BTC options contracts with a notional value of approximately $15 billion expired today. At the same time, according to the data in the last 24 hours, if we look at the risk conversion in the next 1-week period, call options are the dominant side in hedging more than put options. This indicates that the bullish expectation is increasing. When we look at the expected volatility, it is below the realized volatility. This shows that put option fees are expensive. On the other hand, the negative spread value shows that investors are cautious. Skew values suggest that there is selling pressure today and next week.

Laevitas Data: When we examine the chart, it is seen that put options are concentrated in the band of 95,000 – 108,000 dollars. Call options are concentrated between the levels of 108,000 – 120,000 dollars and the concentration decreases towards the upper levels. At the same time, the level of approximately 105,000 dollars is seen as support and 110,000 dollars as resistance. On the other hand, there are 1.69K put options at the $105,000 level, where there is a peak and there is a decrease in put volume after this level. However, it is seen that 3.24K call option contracts peaked at $112,000. When we look at the options market, we see that call contracts are dominant on a daily and weekly basis.

Fälligkeit der Option:

Put/Call Ratio and Maximum Pain Point: In the last 7 days of data from Laevitas, the number of call options increased by approximately 51% compared to last week to 117.34K. In contrast, the number of put options was 97.64K, up 7% from last week. The put/call ratio for options was set at 0.74. This indicates that call options are much more in demand among investors than put options. Bitcoin’s maximum pain point is seen at $106,000. It can be predicted that BTC is priced at $106,400 and if it does not break the pain point of $102,000 downwards, the rises will continue. Looking ahead, there are 4.17K call and 1.38K put options at the time of writing.

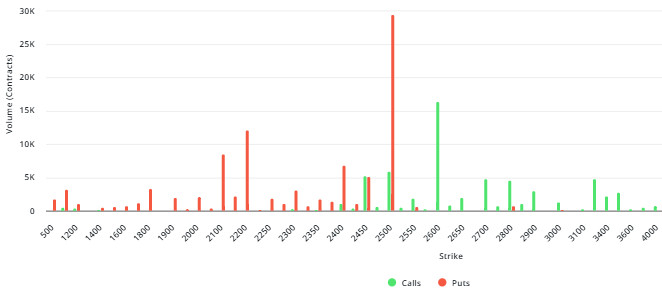

Ethereum Optionen Vertrieb

Source: Laevitas

ETH: $2.3B notional | Put/Call: 0.52 | Max Pain: $2,200

Laevitas Data: Looking at the chart, put options are concentrated between $2,050 and $2,500. The highest put contract volume is around 29K at the $2,500 level. On the other hand, there is a heavy volume of call options at the $2,500 and $2,700 levels. Especially $2,600 stands out as a possible resistance zone due to the high volume (around 16K).

Deribit Data: Looking at ETH options, the ATM (At-the-Money) volatility rate stands at 54.22%. This rate shows that volatility in the market increases significantly as the expiry date approaches and investors are more cautious about price movements. Likewise, the 25 Delta Risk Reversal (RR) data stands at -2.94, showing a decline of 3.73% during the day. This suggests that the market’s demand for put options is higher than for call options, meaning that downside risks are more reflected in pricing.

Fälligkeit der Option:

Ethereum options with a notional value of $2.3 billion expire on Juni 27. The Max Pain level is calculated at $2,200, while the put/call ratio is at 0.52.

Rechtlicher Hinweis

Die in diesem Dokument enthaltenen Anlageinformationen, Kommentare und Empfehlungen stellen keine Anlageberatungsdienste dar. Die Anlageberatung wird von zugelassenen Instituten auf persönlicher Basis unter Berücksichtigung der Risiko- und Ertragspräferenzen des Einzelnen durchgeführt. Die in diesem Dokument enthaltenen Kommentare und Empfehlungen sind allgemeiner Art. Diese Empfehlungen sind möglicherweise nicht für Ihre finanzielle Situation und Ihre Risiko- und Renditepräferenzen geeignet. Eine Anlageentscheidung, die ausschließlich auf der Grundlage der in diesem Dokument enthaltenen Informationen getroffen wird, kann daher möglicherweise nicht zu Ergebnissen führen, die mit Ihren Erwartungen übereinstimmen.