MARKTKOMPASS

Tariffs, FED, Economic Growth and Geopolitical Agenda

US President Donald Trump continues to set the agenda for global markets. His tough stance on tariffs keeps the risk of a large-scale global trade war alive and markets are trying to adjust their positions amid concerns over the pace of economic growth. It has been another tough week, but it looks like an even tougher one awaits the markets.

April 2 Threshold

Barring a last-minute development, Trump will implement his previously announced higher tariffs on April 2. The new tariffs, which will slow down trade with the US’s closest trading partners such as Canada, the European Union and Mexico and increase costs for companies, pose a risk to global economic growth. It is difficult to predict how the issue will evolve due to Trump’s unpredictable stance. This week, we saw how serious the President is about the issue when he signed a decree imposing new 25% tariffs on automakers. We continue to believe that Donald Trump intends to use the tariffs as a negotiating tool ahead of future talks to establish a trade system favorable to the US. But the President is playing hardball.

Before April 2, we cannot say whether a compromise can be reached with the other countries to prevent new tariffs. However, it would not be wrong to say that if this happens, it could have devastating effects on the world economy. A combination of tariffs that is not as harsh as expected may provide some relief to the markets. Like the rest of the world, we will continue to monitor the issue closely.

US Data and Macro Agenda

Next week, we will be watching a number of US macro indicators that will help us gauge Trump’s impact on economic actors. On Dienstag, the ISM Manufacturing PMI and the Job Openings and Labor Turnover Survey (JOLTS) stand out. On Mittwoch, ADP private sector non-farm payrolls change data will be released ahead of the critical employment data on Freitag. In macro terms, the most critical day of the week will be Freitag and we will be reaching the labor statistics of the world’s largest economy for März. Of course, the change in non-farm payrolls will be the most critical indicator. After this data set, we will closely follow the speech of US Federal Reserve (FED) Chairman Powell at an event to understand how the FED interprets the interest rate cut path and the possible effects of Trump’s policies on the US economy.

April 1 – Job Openings and Labor Turnover Survey (JOLTS)

Shows the number of job openings during the reported month, excluding the agricultural sector. This JOLTS data is closely monitored as job creation is an important leading indicator of consumer spending, which accounts for a large share of overall economic activity. It is released monthly and approximately 35 days after the end of the month. A lower-than-expected release is expected to have a positive impact on cryptocurrencies.

April 2 – ADP Non-Farm Employment Change

Shows the estimated change in the number of people employed in the previous month, excluding the agricultural sector and government, by analyzing payroll data from more than 25 million workers to obtain estimates of employment growth by Automatic Data Processing, Inc (ADP). It usually gives a hint of employment growth 2 days before the employment data released by the government. Usually, lower-than-expected ADP data has a positive impact on digital assets.

April 4 – US Labor Market Statistics

On Freitag this week, we will be receiving März Non-Farm Payrolls (NFP) data, which will provide clues about the US Federal Reserve’s rate cut path and the tightness of the financial ecosystem in the coming period. In addition, März figures such as average hourly earnings and the unemployment rate will also be monitored.

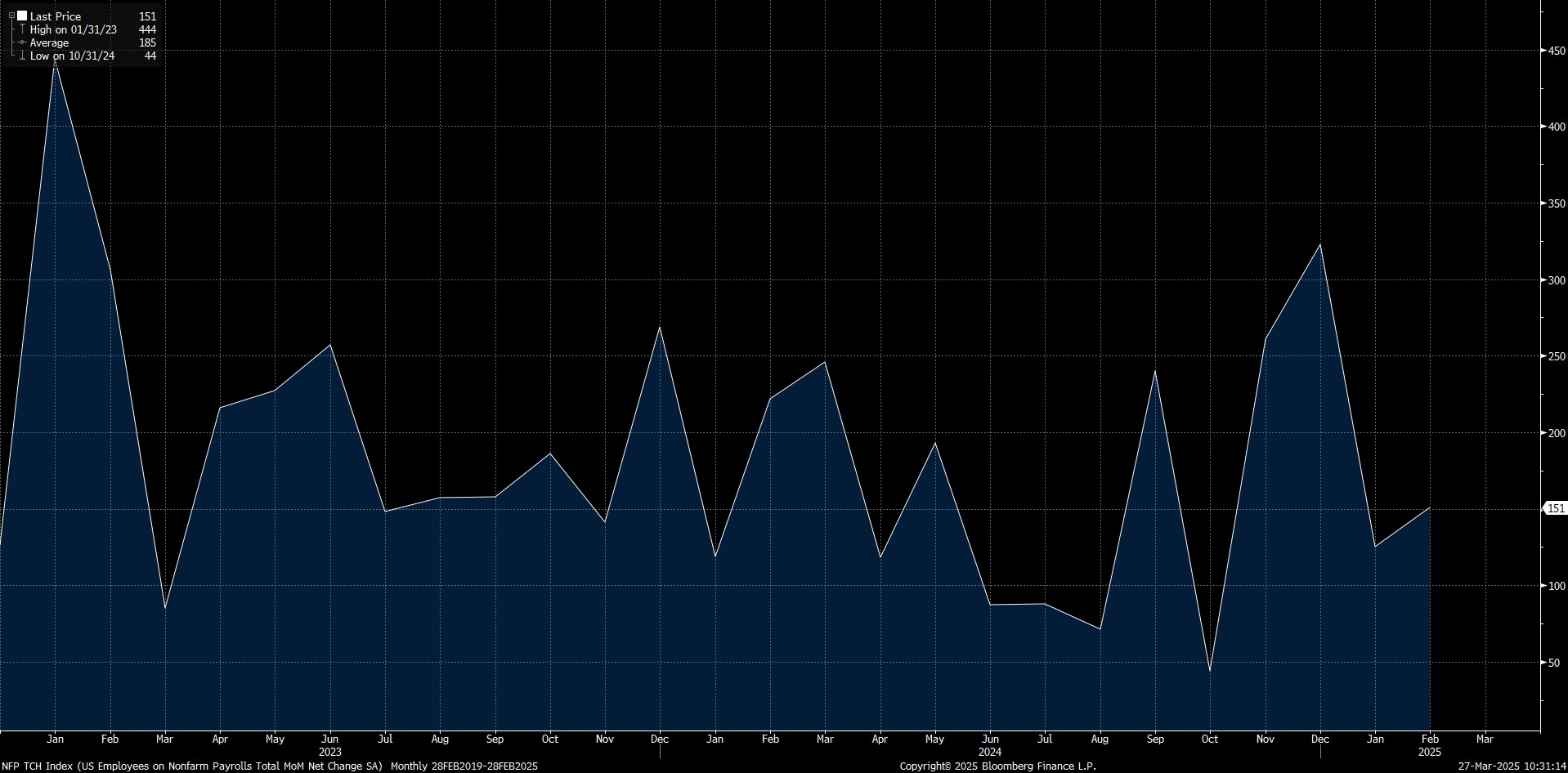

In Februar, the US economy added 151K jobs in line with our expectations (Market Expectation: 159K, Our Expectation: 150K).

Quelle: Bloomberg

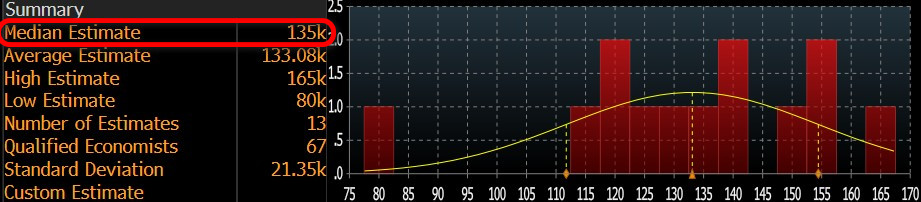

Our forecast for the highly sensitive NFP data is that the US economy added approximately 148K new jobs in the non-farm sectors in März. At the time of writing, although the number of forecasts entered is small, we see that the consensus on the Bloomberg terminal is more pessimistic, around 135 thousand.

Quelle: Bloomberg

We believe that if the März NFP data, which will be published in the shadow of the deterioration that Trump’s tariff-centered foreign policy may create domestically, is slightly below expectations, this will be priced as a metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing the risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, a much lower than expected NFP data could reignite concerns about stagflation with a commentary on the health of the US economy, which could put selling pressure on assets considered to be risky. It should be noted here that we also expect a much better-than-anticipated reading to have a positive impact. It is worth noting that we anticipate these effects by taking into account the current state of market sentiment.

April 4 – FED Chair Powell’s Speech

On Freitag, FED Chairman Jerome Powell is expected to deliver a speech at the Society for Advancing Business Editing and Writing Annual Conference in Arlington. Powell’s guidance will be important after the pricing following the employment data. In particular, we will closely follow what he will say about the new economic ecosystem that will be shaped by tariffs and how the FED will follow a path in the face of this.

According to the CME Fedwatch Tool, at the time of writing, markets were pricing in a 58% chance that the Federal Open Market Committee (FOMC) would cut rates by 25 basis points at its meeting on Juni 18. Potential statements from the chairman could lead to a change in this expectation, which could cause markets to price in some harsh pricing. If Powell sends a message that there should be no rush to cut rates, this could lead to a decline in risk appetite and widen the depreciation of digital assets. However, if the Chairman emphasizes the necessity of rate cuts, we may see the opposite effect. At this point, it is worth underlining the following. If Powell is more concerned than before about the potential impact of Trump’s policies on the US economy, this could have the effect of both increasing the rate cut and reducing risk appetite in the markets. In this respect, we think it is important to understand the Fed Chairman’s attitude as well as his words.

Digital Compass

We consider it a very important development that a strategic crypto reserve is on the agenda in the US, the locomotive of the world economy. However, the fact that the markets have already priced in the “best case scenario”, combined with the “less than perfect” news on this issue, has been putting pressure on digital assets for some time. We continue to keep the strategic reserve issue in our equation as a positive variable for cryptocurrencies in the long run. On the other hand, we think that we may continue to see pressure in the medium term if there is no new news flow to create enthusiasm in the crypto market and if concerns about slowing economic activity in global markets increase further. In the short term (in general), markets will continue to be sensitive to macro indicators and Trump’s actions on tariffs.

DARKEX RESEARCH ABTEILUNG AKTUELLE STUDIEN

Wöchentliche BTC Onchain-Analyse

Global Economic Uncertainties, the ONS Gold Price and Bitcoin’s Lack of

2025 First Quarter: Bitcoin Market Volatility and Macroeconomic

Intent-Based Solutions and De-Fi Liquidity

The 5 Altcoins Least Affected by the Drop in

SEC’s Regulatory Approach to XRP and ETH and

Is The US in Danger of Recession?

Klicken Sie hier für alle unsere anderen Market Pulse Berichte.

WICHTIGE DATEN AUS DEM WIRTSCHAFTSKALENDER

Klicken Sie hier um den wöchentlichen Darkex Krypto- und Wirtschaftskalender zu sehen.

INFORMATIONEN:

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex kann nicht für mögliche Änderungen, die sich aus ähnlichen Situationen ergeben, verantwortlich gemacht werden. Sie können auch die Darkex-Kalender-Seite oder den Wirtschaftskalender in den Tagesberichten auf mögliche Änderungen von Inhalt und Zeitpunkt der Datenveröffentlichungen überprüfen.

Rechtlicher Hinweis

Die in diesem Dokument enthaltenen Anlageinformationen, Kommentare und Empfehlungen stellen keine Anlageberatungsdienste dar. Die Anlageberatung wird von zugelassenen Instituten auf persönlicher Basis unter Berücksichtigung der Risiko- und Ertragspräferenzen des Einzelnen durchgeführt. Die in diesem Dokument enthaltenen Kommentare und Empfehlungen sind allgemeiner Art. Diese Empfehlungen sind möglicherweise nicht für Ihre finanzielle Situation und Ihre Risiko- und Renditepräferenzen geeignet. Eine Anlageentscheidung, die ausschließlich auf der Grundlage der in diesem Dokument enthaltenen Informationen getroffen wird, kann daher möglicherweise nicht zu Ergebnissen führen, die mit Ihren Erwartungen übereinstimmen.