Absolute Advantage in Cryptocurrency

In the context of the rapidly evolving cryptocurrency landscape, Adam Smith’s theory of absolute advantage takes on new dimensions. Traditionally, Smith argued that a nation should produce goods it can make more efficiently than others. Today, this principle can be reinterpreted in the digital economy, where the focus shifts to the efficiency of algorithmic trading and technological innovations. The ability to leverage advanced algorithms and high-performance trading systems provides a competitive edge, allowing crypto assets to flourish under favorable market conditions.

This strategic efficiency resonates within the ethos of blockchain economic theory, where participants aim to maximize their returns by exploiting unique market positions. The emergence of decentralized finance (DeFi) platforms further exemplifies this shift, where a DeFi competitive advantage can lead to significant market dominance in crypto. Here, the accessibility of on-chain data and advanced analytics facilitates the deployment of quantitative trading strategies, creating a dynamic interplay between technology and market behavior.

As cryptocurrencies continue to mature, understanding this recalibrated interpretation of absolute advantage is paramount. It highlights the necessity for players within the crypto ecosystem to adapt and innovate, ensuring they maintain relevance and superiority in a competitive marketplace. Ultimately, embracing this evolution of economic theory promises to shape the future trajectory of digital assets.

The integration of technology in cryptocurrency markets has allowed for a significant enhancement in trading capabilities, marking a shift towards algorithmic trading efficiency. By employing advanced algorithms, traders can analyze vast amounts of market data in real-time, positioning themselves to identify and exploit inefficiencies faster than traditional trading methods. This capability not only provides an edge in decision-making but also leads to higher profitability, contributing to their market dominance in crypto.

Moreover, the principles of blockchain economic theory facilitate this technological leverage. Smart contracts and decentralized applications (dApps) are crucial in streamlining transactions and automating processes, which further enhances trading efficiency. With these tools, traders can execute complex quantitative trading strategies that account for liquidity, volatility, and other market dynamics, redefining competitive benchmarks in the cryptocurrency landscape.

Understanding the technological factors at play is essential for anyone looking to gain a DeFi competitive advantage. As the market continues to evolve, those who harness the full potential of technology and algorithmic processes will not only achieve absolute advantage in cryptocurrency but will also shape the future of digital finance.

Comparative vs. Absolute Advantage in Blockchain Ecosystems

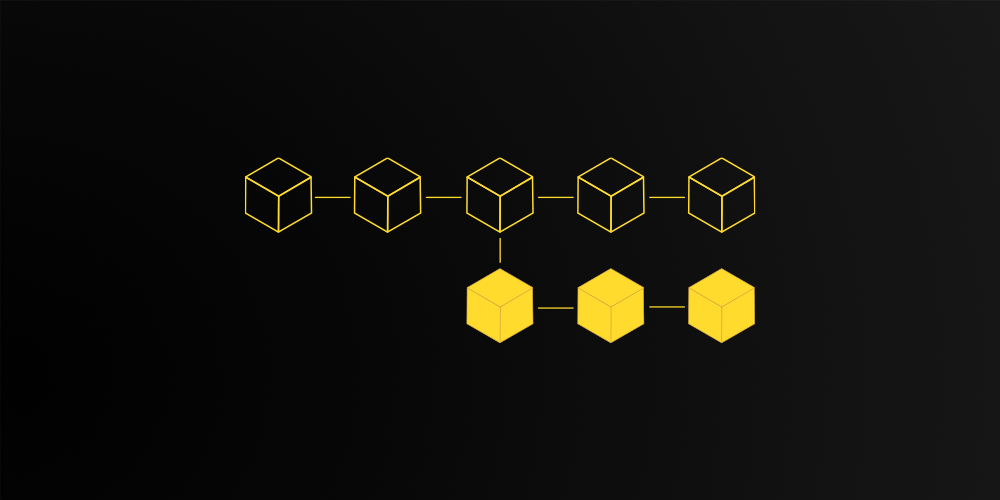

In the evolving landscape of blockchain ecosystems, distinguishing between comparative and absolute advantage in cryptocurrency is vital for understanding the competitive dynamics at play. Comparative advantage allows entities to focus on specific strengths while capitalizing on external efficiencies, leading to enhanced algorithmic trading efficiency. This is particularly evident in decentralized finance (DeFi), where various protocols develop unique advantages based on their specialized functions.

On the other hand, absolute advantage centers around the capacity of certain networks or algorithms to outperform others in specific tasks, which can result in substantial market dominance in crypto. For instance, platforms that utilize superior coding and algorithmic strategies can complete transactions faster and at lower costs, thus establishing themselves as leaders in the market. This strategy often creates a competitive edge essential for thriving in the rapidly changing blockchain space.

Moreover, the juxtaposition of these two advantages plays a significant role in the formulation of quantitative trading strategies. By examining the strengths and weaknesses of various blockchain projects, traders can identify opportunities and risks that are unique to each ecosystem. Understanding how different entities capitalize on their advantages can inform investment decisions and strategic partnerships.

Recognizing the nuances of comparative versus absolute advantages within blockchain technology enhances our comprehension of the broader blockchain economic theory. This understanding is crucial as we navigate the complexities of the crypto market, ensuring that players can effectively leverage their strengths for sustainable benefits.

Quantitative Frameworks for Measuring Trading Efficiency

In the rapidly evolving landscape of cryptocurrency, measuring trading efficiency is crucial for firms vying for an absolute advantage in cryptocurrency. By leveraging sophisticated quantitative trading strategies, market participants can enhance their algorithmic trading efficiency, adjusting their approaches based on real-time market data. These strategies often incorporate advanced mathematical models and statistical techniques to identify profitable opportunities while minimizing risk.

Different quantitative frameworks such as machine learning algorithms, time-series analysis, and backtesting methods are employed to assess trading performance. These frameworks not only aid in empirical analysis but also allow traders to simulate various market conditions, bolstering their decision-making processes. This simulation aspect becomes imperative in the context of market dominance in crypto, where timely execution and accurate predictions can drive significant returns.

Moreover, in DeFi platforms, where competitive landscapes are continually shifting, establishing a solid quantitative foundation is indispensable. As firms assess the sustainability of their DeFi competitive advantage, they must regularly evaluate their trading efficiency metrics. This ongoing evaluation ensures they remain agile, adapting to trends that can rapidly affect their market standing.

A comprehensive understanding of these quantitative frameworks not only facilitates more informed trading decisions but also contributes to the overall health and efficiency of the blockchain ecosystem. Balancing theoretical perspectives with practical applications within cryptocurrency markets will allow traders to maintain their edge in an increasingly crowded field.

Sustainability and Shifting Dynamics of Advantage in DeFi and Layer-1 Systems

The landscape of Decentralized Finance (DeFi) and Layer-1 systems is rapidly evolving, presenting a complex tapestry of opportunities and challenges for participants in the cryptocurrency market. As these ecosystems develop, the concept of absolute advantage in cryptocurrency becomes increasingly pertinent, especially in shedding light on how market dominance is established and maintained.

One key aspect influencing sustainability within these frameworks is the innovative use of algorithmic trading efficiency. Platforms that harness advanced algorithms can execute trades at lightning speed, providing them with a significant edge in liquidity and price execution. This capability not only enhances their competitive positioning but also attracts a broader user base seeking reliability and reducing slippage during transactions.

Moreover, the integration of quantitative trading strategies enables participants to continuously analyze market conditions and adapt to shifts with precision. As DeFi continues to streamline and democratize financial services, the platforms that can leverage data effectively will be positioned as leaders, reinforcing their DeFi competitive advantage in an increasingly crowded marketplace.

However, sustainability is not solely derived from technological prowess. The regulatory environment, user trust, and operational transparency play critical roles in the long-term success of DeFi innovations. As these elements coalesce, the dynamics of advantage may shift, with new entrants potentially disrupting established players, leading to a reevaluation of what constitutes market dominance in crypto.

Overall, the intersection of technology, market conditions, and regulatory frameworks will continue to shape the competitive landscape of DeFi and Layer-1 systems, necessitating that stakeholders remain agile and prepared for an ever-evolving environment.

Frequently Asked Questions

What is absolute advantage in the context of cryptocurrency?

Absolute advantage refers to the ability of an entity to produce a good or service more efficiently than others. In cryptocurrency, this can mean having superior technology, lower mining costs, or faster transaction speeds that allow a company or miner to dominate the market.

How does strategic efficiency play a role in cryptocurrency trading?

Strategic efficiency in cryptocurrency trading involves making informed decisions based on market data, trends, and analytical tools. Traders who can leverage these insights are more likely to gain an advantage over others.

What are algorithmic trading strategies in cryptocurrency?

Algorithmic trading strategies in cryptocurrency use automated software to execute trades based on predefined conditions. These algorithms can analyze market conditions in real-time and make trades at a speed and volume that human traders cannot match.

What is the significance of having an algorithmic edge?

Having an algorithmic edge means that a trader or entity can utilize technology to outperform competitors in execution speed, accuracy, and efficiency. This can lead to higher profits, better risk management, and increased market dominance.

How can miners achieve absolute advantage in cryptocurrency?

Miners can achieve absolute advantage by utilizing advanced hardware, optimizing energy consumption, and employing superior mining techniques that lower costs and increase output, allowing them to compete effectively in the cryptocurrency ecosystem.

What market factors contribute to achieving dominance in cryptocurrency?

Market factors contributing to dominance include market liquidity, trading volume, technological innovation, regulatory compliance, and network effects, which can enhance a cryptocurrency’s adoption and success.

How can understanding absolute advantage influence investment decisions in cryptocurrency?

Understanding absolute advantage can influence investment decisions by helping investors identify cryptocurrencies or projects with superior potential for growth, operational efficiency, and competitive strength within the market.

Disclaimer

This article is intended for advanced educational and informational purposes only and should not be considered financial, investment, or trading advice. The concepts discussed—such as algorithmic efficiency, DeFi strategies, and quantitative frameworks—are complex and subject to significant market, technological, and regulatory risks. Cryptocurrency markets are highly volatile, and even entities with technological advantages may experience financial losses.

Readers should conduct independent research (DYOR) and consult professional financial advisors before applying any strategies discussed herein. Darkex and its affiliates assume no responsibility for losses resulting from reliance on this content.