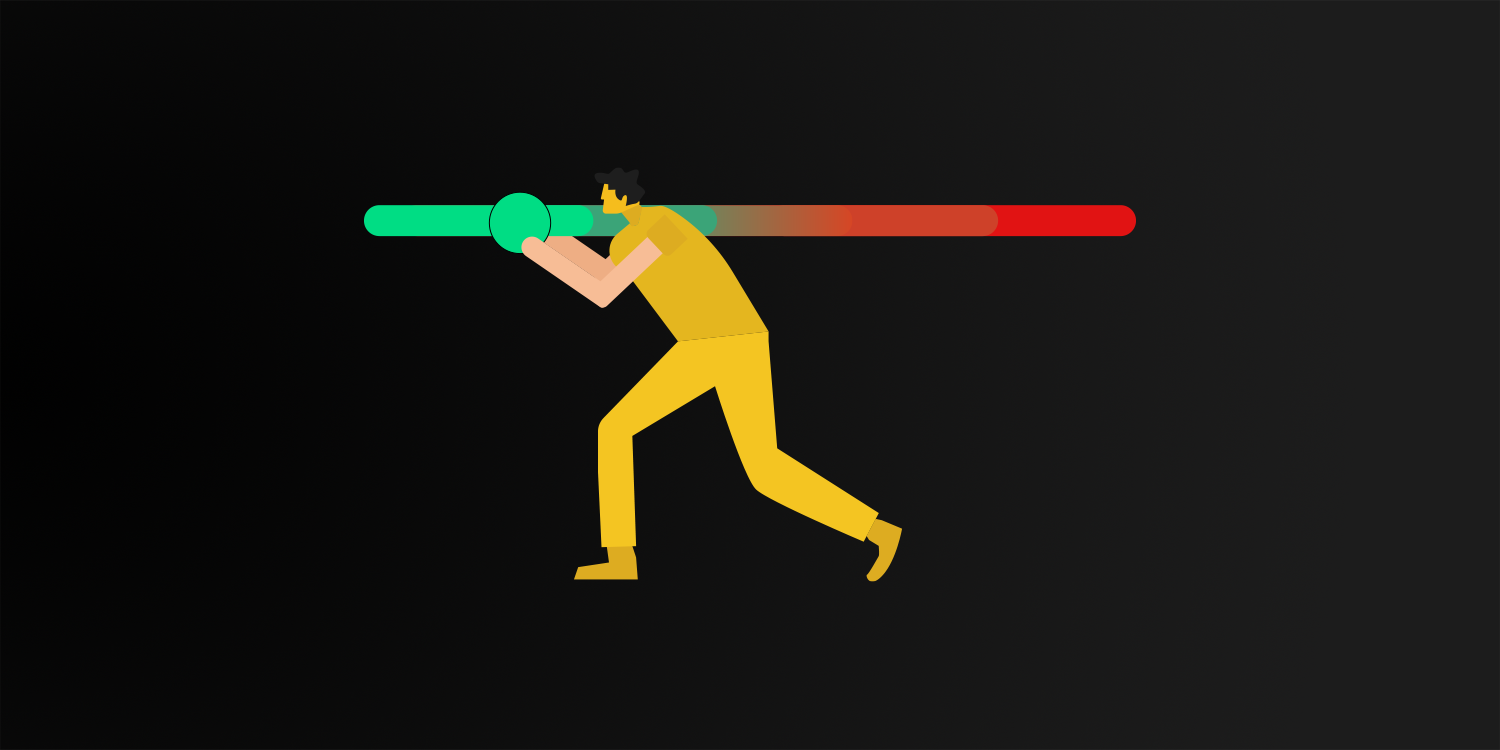

The cryptocurrency fear and greed index is a sentiment indicator that reflects the emotions of fear and greed that dominate the cryptocurrency market. It calculates the emotional sensitivity of the market on a scale of 0-100. A score of 0 represents a state of “Extreme Fear”, reflecting skepticism, uncertainty and potential undervaluation in the market. On the other hand, a score of 100 represents “Extreme Greed”, reflecting overconfidence, over-optimism and potential overvaluation.

One of the most commonly used indices in the crypto world is the Fear and Greed Index. It pulls data on different cryptocurrencies from many platforms, focusing on large cryptocurrencies like Bitcoin. This helps us understand whether the sentiment affecting the crypto market in general is bullish or bearish.

The meaning of Bitcoin fear and greed index values

- 0-24: Extreme fear

- 25-49: Fear

- 50: Neutral

- 51-74: Greed

- 75-100: Extreme greed

The Fear and Greed index is calculated by combining several different market factors

These factors are:

- Volatility (25%): Measures the current value of a cryptocurrency against the last 30 and 90-day averages. The index uses volatility here as an indicator of market uncertainty, with high volatility often signaling fear in the market.

- Market Momentum/Volume (25%): The cryptocurrency’s current trading volume and market momentum are compared to the average values for the last 30 and 90 days and then added together. A consistently high volume of purchases indicates a positive or greedy market sentiment.

- Social media (15%): This factor looks at the number of X (Twitter) hashtags related to a cryptocurrency and, in particular, their engagement rate. Consistently and unusually high engagement is often more about greed than fear.

- Surveys (15%): Focus on the results of surveys conducted in conjunction with some auxiliary organizations. Investors’ opinions are valued. The use of this input has been suspended for some time.

- Dominance (10%): Measures the market dominance of a cryptocurrency. For example, an increase in Bitcoin’s market dominance usually indicates that the market is dominated by fear, indicating that there are new investments in Bitcoin and that funds may have been transferred from altcoins to Bitcoin.

- Trends (10%): This index can offer insights into market sentiment by looking at Google Trends data for cryptocurrency-related searches. For example, an increase in the search for “Bitcoin Scam” could indicate more fear in the market. Google Trends data is used to understand the current level of interest in cryptocurrencies.

The Cryptocurrency Fear and Greed Index is a valuable tool that enables the detection of extreme market sentiment in the cryptocurrency world. Its main use is to predict possible price changes based on sentiment. However, users should also consider using other market indicators or tools to make important decisions and determine trading strategies.