Elliott Wave Theory is a technical analysis method developed by Ralph Nelson Elliott that suggests that price movements in financial markets form repeating patterns based on human psychology and investor sentiment. Used especially in the stock market, currency markets and commodity trading, this theory aims to predict future price movements by recognizing specific wave patterns.

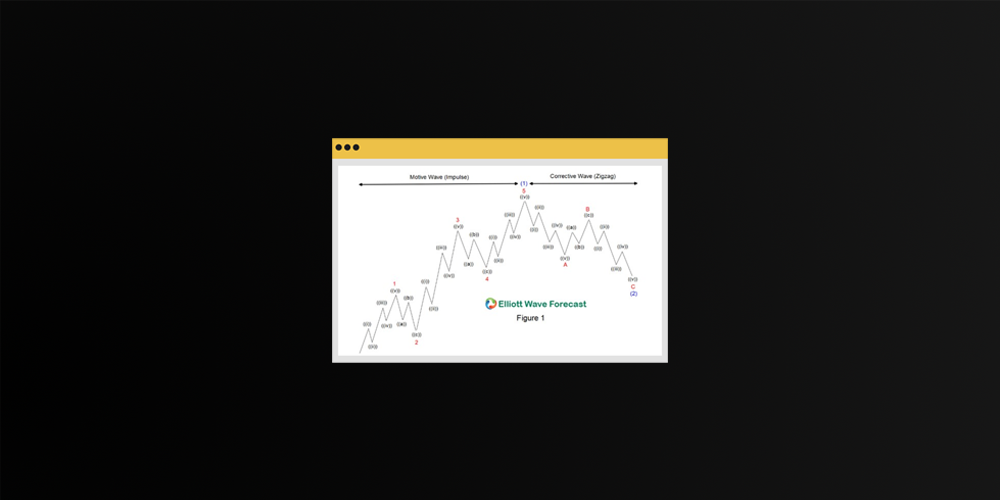

Elliott Wave Theory states that market prices move in two main types of waves: Impulse waves and corrective waves.

Source: elliottwave-forecast

- Impulse waves: These waves occur in the direction of the main trend and usually consist of 5 waves. Impulse waves represent the main movements of the market.

Wave 1: Indicates the beginning of a new trend.

Wave 2: A retraction, usually correcting part of the first wave.

Wave 3: The strongest wave, usually representing a continuation of the trend.

Wave 4: It is again a correction, undoing part of the third wave.

Wave 5: Marks the final phase of the trend and usually the point at which momentum declines. - Corrective waves: They occur in the opposite direction of the main trend and consist of 3 waves: A, B and C. These waves reverse part of the trend but do not form a new trend.

The Role of Psychology: Elliott Wave Theory emphasizes the influence of human behavior on market prices, as it is based on investor sentiment and mass psychology. Optimism causes prices to rise and pessimism causes prices to fall. Elliott argues that these changes in sentiment can be measured by wave patterns.

Fibonacci Relationship: The Elliott Wave Theory helps identify potential targets for market movements using Fibonacci ratios. Specifically, the price is expected to retrace or expand at 38.2%, 50% and 61.8%. These ratios play a critical role in creating trading strategies by measuring the levels of correction and expansion.

Wave Degrees: The Elliott Wave Theory has various wave degrees to analyse market movements on different time frames. There are nine wave degrees, ranging from the smallest to the largest, and each one represents trends of different magnitudes in the market:

- Minuette (smallest)

- Minute

- Small

- Middle

- Primary

- Super Loo

- Large Super Loop (largest)

Application and Strategies: Elliott Wave Theory is used to understand the phase of the current trend in the market. By recognizing impulse and corrective wave cycles, traders can better identify entry and exit points. Especially in currency, stock and crypto trading, Elliott waves can be used to predict potential price targets and retracements.

In summary, Elliott Wave Theory is a powerful tool for predicting price movements in financial markets. However, it requires experience and practice due to its subjective nature and complex rules.