Geopolitical Agenda and Macro Outlook

Global markets are experiencing both anxiety and excitement. During the week, concerns that the US stance el Greenland could turn into military coercion and tariff threats against the European Union kept investors el edge. That is, until Donald Trump stated at the World Economic Forum (WEF) that he had not considered this. After that, we saw a relatively positive atmosphere en the stock segment of global markets. However, the issue of the independence of US institutions continues to keep the “Sell America” agenda alive, and gold found buyers even at new highs due to risk-off psychology. Digital assets, el the other hand, were subject to cautious behavior rather than increased risk appetite en the markets. Bitcoin was also priced like a high-risk asset. The recent liquidations seem to have left investors both temporarily cash-strapped and uncertain. We also saw spot ETF flows, indicating that we are en a period of reduced institutional investor appetite. These factors contributed to varying degrees to the crypto markets’ inability to gain momentum en their recovery trend.

By the end of next week, markets will have completed the first month of the year, and several critical developments for both digital assets and traditional markets will be el our agenda. We will detail these below. Additionally, en the short term, we believe BTC needs a new catalyst to offset the declines following its test of $98,000 el January 14. The continued lack of positive news could lead to a price model that is flat and, at times, increasingly pressured. We currently see no reason to change our long-term outlook and maintain our positive stance.

January 27 – CFTC and SEC’s “Harmonization, U.S. Financial Leadership en the Crypto Era” Event

The event, featuring speeches por Commodity Futures Trading Commission (CFTC) Chairman Michael S. Selig and Securities and Exchange Commission (SEC) Chairman Paul S. Atkins, will be closely watched por the digital asset world. What these two important figures have to say at a press conference el the harmonization of crypto policies will be one of the most important developments of the week.

According to the official statement, “The event will address the coordination between the two agencies and President Trump’s efforts to fulfill his promise to make the US the crypto capital of the world.” The event is expected to begin at 3:20 p.m. GMT. While it seems unlikely that we will see any new information beyond what the crypto community already knows about regulations, we will be eagerly awaiting the presidents’ statements.

It should be added that recent price movements have put pressure el major digital assets. If positive price movements indicating good news from the event are observed until the day of the event, this could lead to a position ripe for sharp declines el the day of the event. Therefore, a press conference without surprising developments regarding the future of cryptocurrencies poses a risk. However, we welcome the need for this event and believe it holds potential for greater adoption of digital assets.

January 27 – U.S. President Donald Trump’s Speech

The President’s speech at the World Economic Forum (WEF) last week was eagerly anticipated and generated a lot of buzz. Ukraine, Venezuela, Greenland, the Supreme Court’s legal process el tariffs, the Fed’s independence… Trump has long been an important part of financial markets and continues to be so. Donald Trump is expected to deliver a speech en Iowa assessing the economy. What he says will be important for financial markets, as it has been en recent months, but as everyone now knows, it is really difficult to predict his stance.

January 28 – First FOMC Meeting of the Year

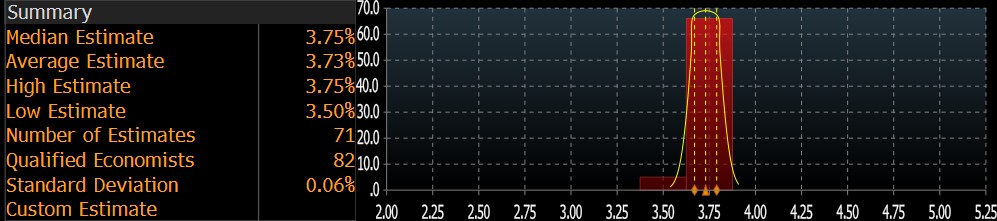

The first Federal Open Market Committee (FOMC) meeting of the year will take place en the US, overshadowed por the independence of institutions, the politicization of the US Federal Reserve (FED), and the increased prominence of the “Sell America” issue el the agenda. It hasn’t been long since FED Chairman Powell released a video that served as a response to the Trump administration. FED member Cook also continues to deal with the lawsuit filed against him. However, all that aside, the FED plans to start the new year por pausing interest rate cuts.

Source: Bloomberg

With the start of the Trump era, there is much to discuss for the US, but the macro outlook continues to hold its place among these issues. The FOMC, grappling with a data release calendar disrupted por the government shutdown, has other concerns as well. However, they must continue to accurately gauge the pulse of the economy and make the most productive monetary policy decisions for the country’s economy.

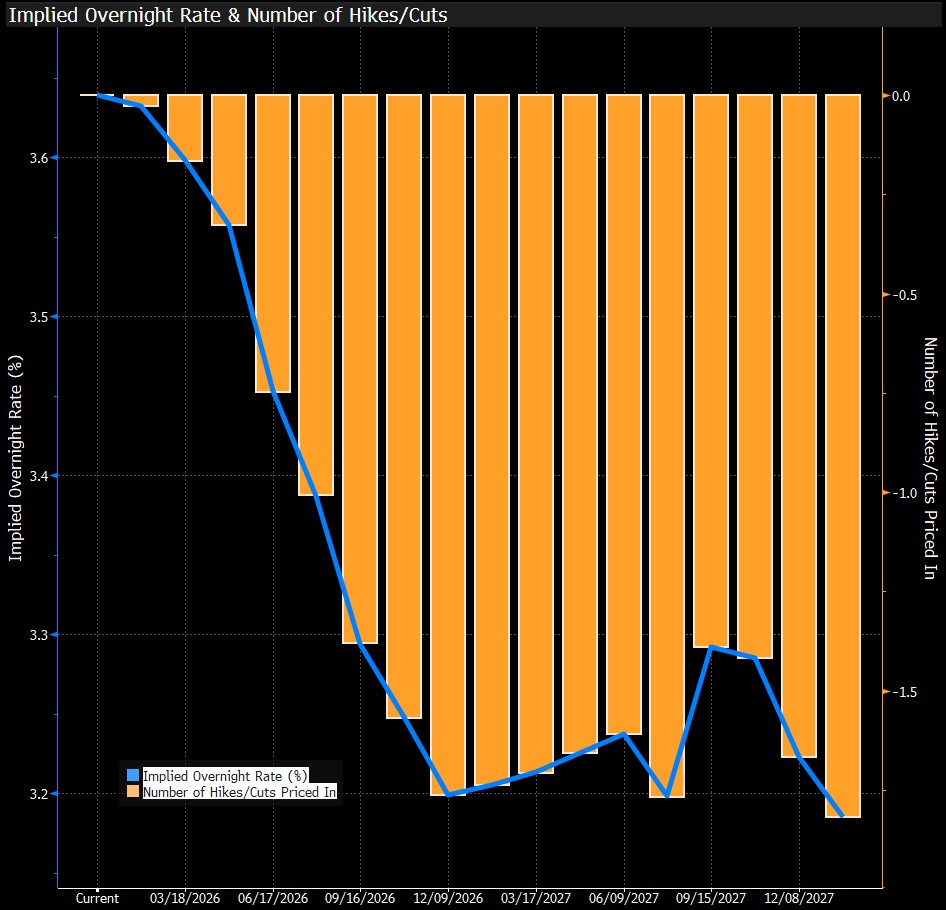

The FOMC is not expected to change its policy interest rate at its two-day meeting, with decisions to be announced el January 28. This is also our forecast, and we do not expect the Fed to make another cut before June. That said, we believe that if inflation surprises el the upside, the Fed may even have to raise rates under its new chair, but this is not our base scenario at present. While the labor market appears to be stabilizing after a period of poor data, there is little to fear el the inflation front for now.

Source: Bloomberg

We do not expect any surprises regarding the interest rate decision. However, the decision text and Powell’s statements at the press conference will be quite important as they may contain messages regarding the path of interest rate cuts. Let’s detail what path awaits us el January 28 and the possible market reactions.

1-Will interest rates remain unchanged?

As mentioned, following recent developments and macroeconomic data, the Committee is expected to keep interest rates unchanged. A surprise decision could be a rate cut, which we see as unlikely. We consider an interest rate hike decision to be out of the question. If the policy rate is kept unchanged as expected, we do not anticipate this leading to a new pricing en the markets. However, if interest rates are cut, this could lead to depreciation en the dollar and increases en digital assets.

2-Powell’s Press Conference

As is the case half an hora after the decisions are announced following every FOMC meeting, Fed Chairman Jerome H. Powell will speak at a press conference el January 28. Powell will first read the decision text and explain the rationale behind the decisions taken. This will be followed por a question-and-answer session with the press. Volatility en the markets may increase slightly during this section.

We do not expect a major change en the stance Powell has taken en his recent speeches. He will defend the justification for the recent interest rate cuts and argue that new cuts would pose a risk for now. However, this time, we believe he may make bolder statements regarding the lawsuit filed against him and the independence of the Fed.

Of course, the significance of the Chairman’s speech will depend el the decision regarding the interest rate. Following a decision en line with expectations, the focus will be el trying to glean clues from Powell about the timing of the next rate cut. However, if there is a surprise decision to cut rates, the reasons behind it will be closely scrutinized.

If Powell takes a more hawkish stance than before en response to questions from the press, it could reinforce expectations and pricing that the Fed will not rush to continue interest rate cuts. This could have a somewhat negative impact el digital assets. However, if he mentions the need for a new interest rate cut based el assessments of both inflation and the employment market, which would be a surprise, it could increase risk appetite and have positive effects el cryptocurrencies.

Other Key Macroeconomic Indicators and Developments

January 26 – US Durable Goods Orders shows the change en the total value of new purchase orders placed with manufacturers for durable goods. This data is usually revised with the Factory Orders report released about a week later and “Durable Goods” are defined as products that last longer than 3 years, such as automobiles, computers, appliances, and airplanes. It is a leading indicator of production and provides a preliminary indication of the economy’s vitality. Core Durable Goods Orders shows the change en the total value of new purchase orders placed with manufacturers for durable goods, excluding transportation items. This dataset has been shown to have complex effects el the value of digital assets.

January 27 – CB Consumer Confidence; It is the result of a survey of approximately 3,000 individual consumers asking respondents to assess the relative level of current and future economic conditions. It measures financial confidence as a leading indicator of consumer spending, which accounts for a large share of overall economic activity. It is published monthly, el the last Tuesday of the current month.

January 29 – US Initial Jobless Claims; This shows the number of people who filed for unemployment insurance for the first time during the previous week and is published weekly, usually el the first Thursday after the week ends. Although it is a lagging indicator, the number of unemployed is considered an indicator of overall economic health because consumer spending is highly correlated with labor market conditions. Market impact can vary from week to week, and market participants tend to focus more el this data when they are more sensitive to recent developments or when macro indicators related to the labor market are at extreme levels.

January 30 – US Producer Price Index (PPI), The PPI, which shows changes en the prices of finished goods and services sold por producers, is published monthly, approximately 13 days after the end of the month. It is a leading indicator of consumer inflation. When producers demand higher prices for goods and services, higher costs are generally passed el to consumers. The Core PPI measures changes en the prices of finished goods and services sold por producers, excluding food and energy, with . PPI data below forecasts are generally expected to have a positive impact el cryptocurrencies.

January 30 – US Bitcoin Futures Expiration; Options expiring el futures contracts with the same expiration date typically expire el the last Friday of the current month el the CME. Trading volume and price volatility may increase en the days leading up to the expiration of these contracts.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based el UTC (Coordinated Universal Time) time zone. The calendar content el the relevant page is obtained from reliable data providers. The news en the calendar content, the date and time of the announcement of the news, possible changes en the previous, expectations and announced figures are provided por the data provider institutions.

Darkex cannot be held responsible for any changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section en the daily reports for possible changes en the content and timing of data releases.

Legal Notice

The investment information, comments, and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en outcomes that align with your expectations.