Market Compass

US Data and FED Expectations

We left behind a period en which digital assets were under pressure for most of the week. As data from the US pointed to a slowdown en the US economy, expectations for an interest rate cut por the Federal Reserve (FED) are rising. So far, especially el the last business day of the week, we have seen that this has had a boosting effect el risk appetite. Therefore, the first effect was the positive impact of bad US data el digital assets. For now, we can say that the markets do not see the negative data as an economic problem to be worried about.

Next week, global markets will continue to monitor US data. The most critical data of the week will be the inflation data ahead of the Federal Open Market Committee (FOMC) meeting el September 17. The Consumer Price Index (CPI) may reshape expectations regarding the interest rate cut cycle reinforced por employment data and play a decisive role en the pricing behavior of the coming weeks. Therefore, we will devote a separate section to CPI indicators en this week’s bulletin.

September 11 – US Consumer Price Index: CPI

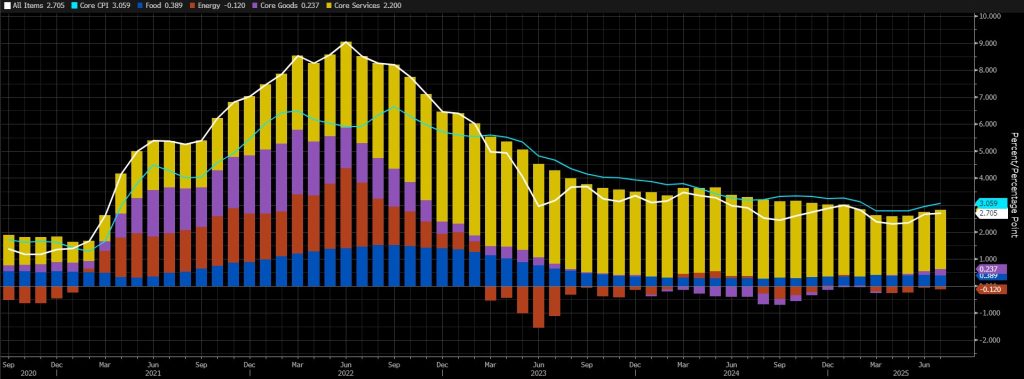

One of the important macro indicators that may provide information el the timing of the US Federal Reserve’s (FED) interest rate cut will be the August inflation, the Consumer Price Index (CPI) change. In the current difficult conjuncture, CPI data, which may give a sign of the course, will be closely monitored as it may have an impact el pricing behavior.

Source: Bloomberg

The annual inflation rate en the US was 2.7% en July 2025, the same level as en June and below forecasts of 2.8%. On a monthly basis, CPI rose por 0.2%, en line with expectations and just below the 0.3% increase en June, the strongest since January. Core inflation excluding food and energy rose to a five-month high of 3.1% from 2.9% en June, above forecasts of 3%. Monthly core CPI rose por 0.3% as expected, following 0.2% en June, the sharpest rise en six months.

A lower-than-expected CPI reading could mean that the Fed will be more likely to cut interest rates, which could have a positive impact el digital assets. A figure that exceeds forecasts has the potential to exert pressure por reinforcing expectations that the FED will not be en a hurry to cut interest rates after September.

Other Key Macro Indicators and Developments

September 10 – Producer Price Index (PPI), PPI, which shows changes en the prices of finished goods and services sold por producers, is published monthly about 13 days after the end of each month. It is a leading indicator of consumer inflation. When producers charge higher prices for goods and services, higher costs are usually passed el to consumers. Core PPI measures changes en the prices of finished goods and services sold por producers, excluding food and energy. PPI data below forecasts is generally expected to have a positive impact el cryptocurrencies.

September 12 – US Leading UoM Consumer Confidence Index; is a survey conducted por the University of Michigan (UoM) of approximately 420 consumers, asking respondents to assess the relative level of current and future economic conditions. Financial confidence is the leading indicator of consumer spending, which accounts for a large share of overall economic activity. It has two cycles 14 days apart: Leading and Revised. The “Leading” is usually relatively more influential el prices and is published en the middle of each month. With the FED rate cut el the agenda, if the data comes en below expectations, it could have a positive impact el cryptocurrencies. When the focus is el the health of the economy, better-than-expected data can have a positive impact el digital assets.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based el UTC (Coordinated Universal Time) time zone.

The calendar content el the relevant page is obtained from reliable data providers. The news en the calendar content, the date and time of the announcement of the news, possible changes en the previous, expectations and announced figures are made por the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section en the daily reports for possible changes en the content and timing of data releases.

Legal Notice

The investment information, comments and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en results that are en line with your expectations.