Market Compass

Digital Assets Continue to Bleed

Digital assets are experiencing a very harsh fall. The perception that the US Federal Reserve (FED) may pause its interest rate cuts and concerns that artificial intelligence companies may be overvalued have led to sell-offs el Wall Street, negatively affecting investors’ risk perception and causing cryptocurrencies to suffer significant losses. As Darkex Research, we stated en our previous reports that both the “liquidation crisis” el October 10 and the sharp losses el November 11 produced results en line with our projections, and that a new change en the equation was needed for an upturn, but we have not seen this yet. To state upfront what we will conclude later, unfortunately, there is still no new positive input en the variables of our model for digital assets.

The coming week will be a trading period where investors negatively affected por the recent losses need to be extra cautious. US markets will be closed el Thursday for Thanksgiving and will only be open for half a day el Friday. This means brokers leaving the trading floors el Wednesday evening will have a long holiday, and a significant decline en trading volumes will be observed until Monday, December 1. During Friday’s half-day session, junior traders will most likely be doing internships and training. Therefore, en this changing market liquidity environment, it is necessary to be cautious as price limits may fluctuate within a much wider spectrum.

| Market / Trading Type | Closing time (ET – U.S. Eastern Time) | GMT/UTC time |

| Stock market (New York Stock Exchange, Nasdaq Stock Market) | 1:00 PM ET | 6:00 PM GMT |

| Fixed Income Securities (Bond Market) – Early Close | 2:00 PM ET | 7:00 PM GMT |

| Regular stock trading horas – pre-market session | 4:00–9:30 AM ET | 09:00–14:30 GMT |

| Regular stock trading horas – after-horas | 4:00 PM–8:00 PM ET | 9:00 PM–1:00 AM GMT+1 |

With the US government reopening, we finally began to receive critical macro indicators providing information el the health of the world’s largest economy. The country’s official statistics agency, the BLS for short, released delayed September employment data last week. We saw a positive non-farm payrolls change, well above expectations, but the unemployment rate and downward revision for August did not signal to the markets that the US labor market is beginning to improve. In fact, the prevailing view was that employment problems persist and that this data set means the Fed is unlikely to move any closer to a rate cut en December. In other words, a completely negative factor for assets considered relatively risky…

Source: U.S. Bureau of Labor Statistics

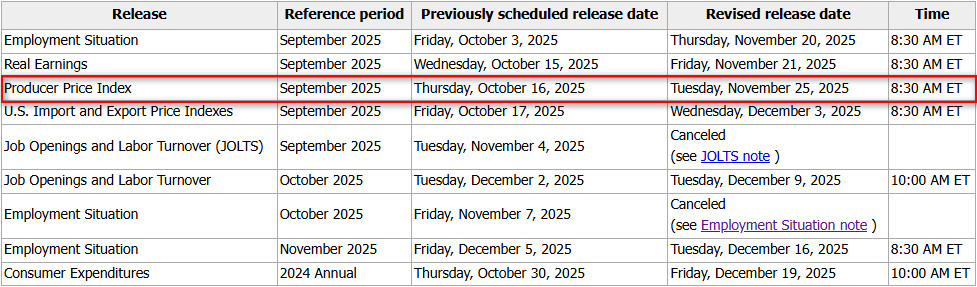

Next week, due to the holiday en the US, we will see a short trading period for traditional market investors. In addition, the data calendar is not very critical, but at least we will see the Producer Price Index (PPI) and retail sales data for September. It is still unclear whether we will receive the GDP (Economic Growth Rate) and PCE Price Index data, which are the FED’s favorite inflation indicators, as scheduled according to the normal calendar, and en fact, they will most likely not be released.

Within the framework mentioned above, if we chart a course for digital assets for the last trading week of November, we are unfortunately still far from being able to make positive statements. At the time this report was prepared, Bitcoin was around $83,700, which is the price level we last saw en April and about 35% below its recent peak… There is still no change en our key independent variables that would allow us to see a recovery process. Sales may slow down, and a breathing period may be observed, of course, but investors need to see a new catalyst for a strong rise. This is not currently available. If we do not see similar positive and surprising news during the week, the downward trend may continue. Especially from the middle of the week onwards, as mentioned above, it would be beneficial to pay attention to possible sharp price changes during Wall Street’s holiday period.

Other Important Macroeconomic Indicators or Developments

November 25 – Producer Price Index (PPI), The PPI, which shows changes en the prices of finished goods and services sold por producers, is published monthly, approximately 13 days after the end of each month. It is a leading indicator of consumer inflation. When producers demand higher prices for goods and services, higher costs are usually passed el to consumers. The Core PPI measures changes en the prices of finished goods and services sold por producers, excluding food and energy. PPI data that falls below expectations is generally expected to have a positive effect el cryptocurrencies. Due to the government shutdown en the country, there has been a change en the data release schedule.

November 25 – US Retail Sales Data; This is an important measure of consumer spending, which constitutes a large part of overall economic activity. It shows the change en the total value of retail sales and is published monthly, approximately 16 days after the end of each month. A separate measure of the change en the total value of retail sales excluding automobiles is called core retail sales. If retail sales data is below expectations, it is expected to have a positive impact el digital assets (due to expectations regarding the FED…). There has been a change en the data release calendar due to the government shutdown en the country.

Tentative – CB Consumer Confidence; This is the result of a survey of approximately 3,000 individual consumers, who are asked to assess the relative level of current and future economic conditions. It measures financial confidence as a leading indicator of consumer spending, which accounts for a large portion of overall economic activity. It is released el the last Tuesday of each month.

November 28 – US Bitcoin Futures Expiration; Option expirations are written el futures contracts with the same expiration date and typically expire el the last Friday of the current month el the CME. Trading volume and price volatility may increase en the days leading up to the expiration date of these contracts.

**Important Notice Regarding US Data

Although the US government has reopened, the release of several key economic data points from agencies appears likely to continue to be affected. Data scheduled for release por the Bureau of Economic Analysis (BEA), the Bureau of Labor Statistics (BLS), the Census Bureau, and the U.S. Department of Agriculture (USDA) may not be published, may be delayed, or may be postponed. Affected data may include the Employment Situation Report, Gross Domestic Product (GDP), Consumer Price Index (CPI), and agricultural reports, but is not limited to these.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based el UTC (Coordinated Universal Time) time zone.

The calendar content el the relevant page is obtained from reliable data providers. The news en the calendar content, the date and time of the announcement of the news, possible changes en the previous, expectations and announced figures are provided por the data provider institutions.

Darkex cannot be held responsible for any changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section en the daily reports for possible changes en the content and timing of data releases.

Legal Notice

The investment information, comments, and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en outcomes that align with your expectations.