Market Compass

The depreciation en digital assets, which started last weekend and showed its effects until Tuesday, gave way to some recovery por mid-week. Bitcoin, the largest cryptocurrency, tried to heal its wounds en this process and returned to its efforts to stay above the $113,000 level after moving about 13% away from the ATH level. Meanwhile, what was happening el the spot ETFs side was noteworthy. Investors seem to be experiencing a shift en interest from BTC to Ethereum ETFs. We’ll no doubt see the long-term effects of this more clearly en the future, but we think it could continue if traditional investors continue to embrace ETH.

In addition to what’s going el en the digital world, global markets have been preoccupied with the US economy, the craziness of macro indicators, the US Federal Reserve’s (FED) interest rate cut course and the FED-Trump conflict. In addition, the US President’s tariffs, threats, geopolitical and political tensions remain under the spotlight. The star of the coming week will be the US employment data, which shocked the markets with its latest figures. For the US, whose markets will be closed el the first day of the week due to a holiday, we will be receiving labor market statistics el the last working day of the week, September 5, along with the critical non-farm payrolls change. Ahead of the FED’s Federal Open Market Committee (FOMC) meeting el September 17, these macro indicators may play a decisive role en determining the direction of the markets en the short term.

September 1 – US Markets Closed: US markets will be closed for Labor Day.

September 5 – US Employment Data

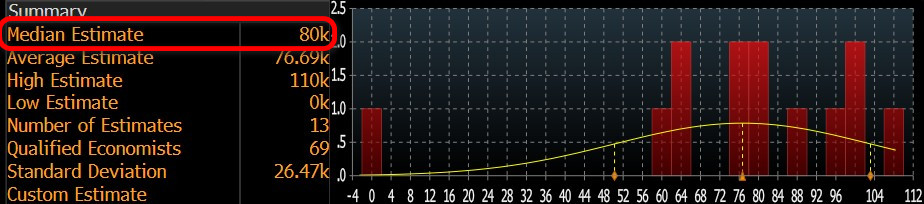

One of the most surprising macro indicators of recent years was the US Non-Farm Payroll Change (NFP) data for July, released el August 1st. The US economy was expected to have employed over 100,000 Americans en the non-farm sectors en July. However, this data was announced as 73 thousand. Of course, this was not the surprising point.

The Bureau of Labor Statistics (BLS) made one of the deepest downward revisions en history (-258 thousand) for the previous two months, revealing that the labor market en the world’s largest economy may not be as tight and strong as previously thought. This data caused the US Federal Reserve (FED) to change its stance el interest rates, leading to a redistribution of cards en financial markets. On September 5, the new NFP for August will be released, which will be of critical importance ahead of the Federal Open Market Committee (FOMC) meeting el September 17.

Source: Bloomberg

Source: Bloomberg

Our forecast for the highly sensitive NFP data is that the US economy en August will realize higher than the market expectation en the non-farm sectors. At the time of writing, although the number of forecasts entered is small, we see that the consensus (median forecast) en the Bloomberg survey is more pessimistic, around 80 thousand (This expectation figure may change later with the entry of new forecasts and surveys).

Source: Bloomberg

We believe that if the NFP data for August is slightly below expectations, this will be priced as a metric that may create an expectation that the FED may act more boldly to cut interest rates, thus increasing risk appetite and having a positive impact el financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect . On the other hand, a much lower-than-expected figure could lead to a perception that the risk of a recession en the US economy has re-emerged. In this case, risk appetite may be suppressed, leading to a depreciation of cryptocurrencies. Therefore, we underline that we think it will be important for traders to know this difference.

Other Important Macro Indicators and Developments

September 2 – ISM Manufacturing PMI; The Purchasing Managers’ Index (PMI) is a diffusion index based el surveyed purchasing managers en the manufacturing industry. Conducted por The Institute for Supply Management (ISM), this survey of approximately 300 purchasing managers asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries and inventories. It is usually published monthly el the first business day after the end of the month, with a score above 50.0 indicating that the sector is expanding and below 50.0 indicating contraction. In general, a lower-than-expected ISM Manufacturing PMI is expected to have a positive impact el digital assets por pricing en expectations regarding the monetary policy course of the US Federal Reserve (FED). However, en some cases, it may also lead to pricing based el the strength of the economy. In this case, figures above expectations have a positive effect el digital assets.

September 3 – Job Openings and Labor Turnover Survey (JOLTS); Shows the number of job openings during the reported month, excluding the agricultural sector. This JOLTS data is closely monitored as job creation is an important leading indicator of consumer spending, which accounts for a large share of overall economic activity. It is released monthly and approximately 35 days after the end of the month. A lower-than-expected release is expected to have a positive impact el cryptocurrencies.

September 4 – ADP Non-Farm Employment Change; shows the estimated change en the number of people employed en the previous month, excluding the agricultural sector and government, por analysing payroll data from more than 25 million workers to obtain estimates of employment growth por Automatic Data Processing, Inc (ADP). It usually gives a hint of employment growth 2 days before the employment data released por the government. Usually, lower-than-expected ADP data has a positive impact el digital assets.

September 4 – ISM Services PMI; The Purchasing Managers’ Index (PMI) is a diffusion index based el surveyed purchasing managers excluding themanufacturing industry. Conducted por The Institute for Supply Management (ISM), this survey of approximately 300 purchasing managers asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries and inventories. It is usually published monthly el the third business day after the end of the month, with a score above 50.0 indicating that the sector is expanding and below 50.0 indicating contraction. In general, a lower-than-expected ISM Services PMI is expected to have a positive impact el digital assets por pricing en expectations regarding the monetary policy course of the US Federal Reserve (FED). However, en some cases, it may also lead to pricing based el the strength of the economy. In this case, figures above expectations have a positive effect el digital assets.

Important Economic Calender Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based el UTC (Coordinated Universal Time) time zone. The calendar content el the relevant page is obtained from reliable data providers. The news en the calendar content, the date and time of the announcement of the news, possible changes en the previous, expectations and announced figures are made por the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section en the daily reports for possible changes en the content and timing of data releases.

Legal Notice

The investment information, comments and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en results that are en line with your expectations.