Market Compass

August 26 – US Durable Goods Orders

This indicator shows the change en the total value of new purchase orders placed with manufacturers for durable goods. This data is usually revised with the Factory Orders report released about a week later and “Durable Goods” are defined as products that last longer than 3 years, such as automobiles, computers, appliances and airplanes. It is a leading indicator of production and gives a preliminary indication of the vitality of the economy. Core Durable Goods Orders shows the change en the total value of new purchase orders placed with manufacturers for durable goods, excluding transportation items. This dataset has been shown to have complex effects el the value of digital assets.

August 28- US GDP Change

Donald Trump’s unpredictable policy choices continue to be a challenging factor for the entire world. Economic actors are also facing the challenges of this highly uncertain environment as they formulate their expectations and plan for the future. This situation has some implications. The most important of these is a slowdown or fluctuation en economic activity… In this respect, it will be important to see how much the US economy grew en the segundo quarter of the year. According to the first estimate, the US economy grew por 3% en the segundo quarter, after contracting en the previous quarter. According to the Bureau of Economic Analysis, which prepares this statistic, the US economy contracted por 0.5% en the first quarter of 2025 (the previous estimate for the period was -0.2%), reflecting the consequences of Trump’s unpredictable policies. This was the first decline since the first quarter of 2022. In the following quarter, we can say that we saw a relatively enthusiastic growth data.

As can be seen en the chart below, the main driver of the fluctuation en GDP (0.% contraction en the first quarter and 3% growth en the segundo quarter) is the change en net exports. In January, when President Trump took office, trade wars were el the agenda, which affected the direction of economic activity, especially foreign trade. Then, en the April-May-June period, we saw that this item recorded a significant increase with the easing of concerns over the issue and became the biggest catalyst en the GDP rise.

Source: Bloomberg

The new data will be the segundo estimate for the segundo quarter of the year. It is still difficult to quantify and measure the impact of Trump’s policies el consumer behavior. The data will allow for healthier and longer-term projections el the direction of economic growth.

In terms of immediate market reaction, we think that a data above the consensus expectation may increase risk appetite and have a positive impact el digital assets. A lower-than-expected GDP data may have a negative impact from this point of view.

August 29 – FED’s Favourite Inflation Indicator PCE

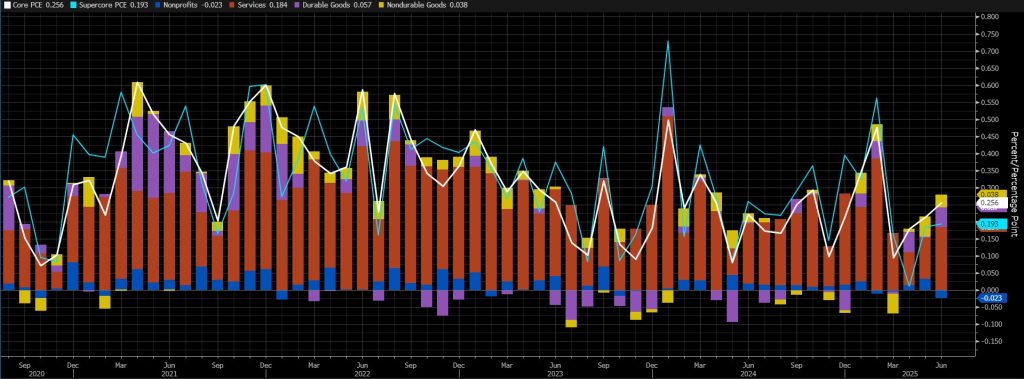

Markets will be closely watching July’s Personal Consumption Expenditures (PCE) data for July for clues el whether a rate cut will be decided at the Federal Open Market Committee (FOMC) meeting en September. This indicator is known as the preferred indicator for FOMC officials to monitor changes en inflation.

Source: Bloomberg

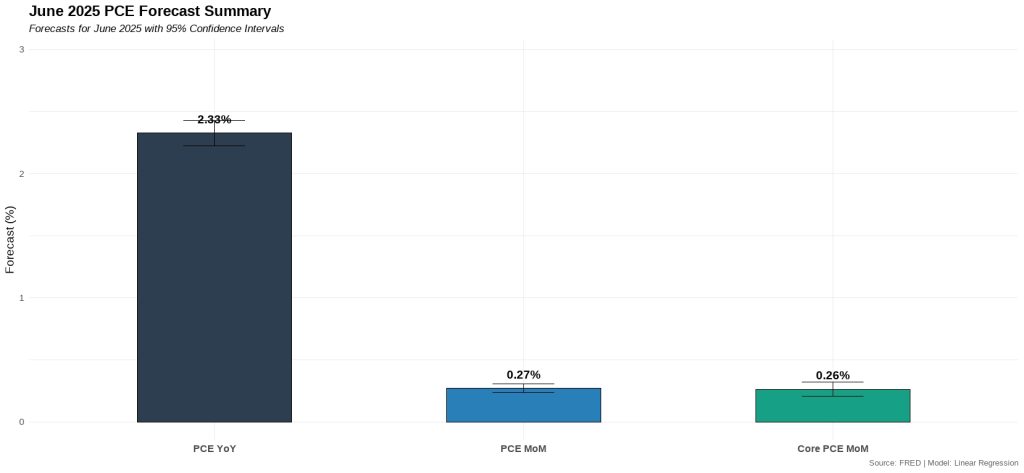

According to the latest data, core PCE increased por 0.3% mom en June. On an annual basis, core PCE increased por 2.8%. We can say that we continue to feel the Trump effect en this data. Our expectation is that the core PCE data will increase por around 0.26% en July.

Source: Darkex Research

A higher-than-expected data may support expectations that the FED will maintain its cautious stance el interest rate cuts, reducing risk appetite and putting pressure el digital assets. A lower-than-expected data may have the opposite effect and pave the way for value gains.

August 29 – US Bitcoin Futures Expiration; Options expirations are written el futures contacts with the same expiration date and usually expires el the last Friday of the current month. Trading volume and price volatility may increase en the days leading up to the expiry of these contracts.

*General Information About Forecasts

In addition to the general market expectations, the forecasts shared en this report are based el econometric modelling tools developed por our research department. Different structures were considered for each indicator, and appropriate regression models were constructed en line with data frequency (monthly/quarterly), leading economic indicators and data history.

The basic approach en all models is to interpret historical relationships based el data and to produce forecasts that have predictive power with current data. The performance of the models used is measured por standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform en an up-to-date and automated manner, so that every forecast is based el the latest economic data. As the research department, we are also working el artificial intelligence-based modelling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) en order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account en the interpretation of model outputs, and it should be kept en mind that there may be deviations en forecast performance due to economic shocks, policy changes and unforeseen external factors. With this monthly updated working set, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

FRED (Federal Reserve Economic Data)

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based el UTC (Coordinated Universal Time) time zone. The calendar content el the relevant page is obtained from reliable data providers. The news en the calendar content, the date and time of the announcement of the news, possible changes en the previous, expectations and announced figures are made por the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section en the daily reports for possible changes en the content and timing of data releases.

Legal Notice

The investment information, comments and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en results that are en line with your expectations.