Market Compass

Pension Fund Regulation, Tariffs and the FED…

Although the week was relatively quiet en terms of data flow, the agenda was quite active. Market participants followed Trump’s high tariffs, developments regarding the US Federal Reserve (FED), geopolitical agenda and the regulation that allows pension funds to invest en alternative investment instruments, which is closely related to digital assets.

Pension funds, known as 401(K) en the US, have reached a position to invest en a group of different instruments, including cryptocurrencies, with the latest decree signed por President Trump. The size of the funds en question is said to be over $12 billion, but the size of the money that will flow into digital assets is not entirely clear at the moment. Nevertheless, this news made a positive contribution to the value of cryptocurrencies during the week. We will continue to follow the details of the issue.

The issue of tariffs will continue to occupy the agenda of the markets, but for this issue, we can say that the worst days are behind us (although not for Switzerland). Therefore, we can say that among the headlines el the Trump front, the FED may stand out a little more. On this front, Trump’s announcement that he is considering Stephen Miran to replace the resigning Kugler was important, as he is one of the President’s advisors and is known for his predisposition towards dollar depreciation and expansionary monetary policies. He is unlikely to vote at the September meeting of the Federal Open Market Committee (FOMC), but he could be an influential figure at the October and December meetings.

We can say that the new week will be mostly busy with the topics mentioned above again. However, this time our economic calendar is a bit busier. Especially the Consumer Price Index (CPI) data for July will be important for the FED’s interest rate cut course. Other indicators will also need to be closely monitored and we will also follow the statements of some FOMC officials.

Based en the US, we maintain our upside expectation for the long term en cryptocurrencies with regulations that will accelerate the adoption of digital assets por wider masses. We have a similar view for the medium term, and we think that the determining factors for the short term will be the macro indicators that will shape expectations for the FED and the statements of the officials. Of course, new developments specific to the ecosystem will be under our lens as always.

August 12 – Critical US Consumer Price Index: CPI

One of the important macro indicators that may provide information el the timing of the US Federal Reserve’s (FED) interest rate cut will be the July inflation, Consumer Price Index (CPI) change. In the current difficult conjuncture, the CPI data, which may give a sign of the course, will be closely monitored as it may have an impact el pricing behavior.

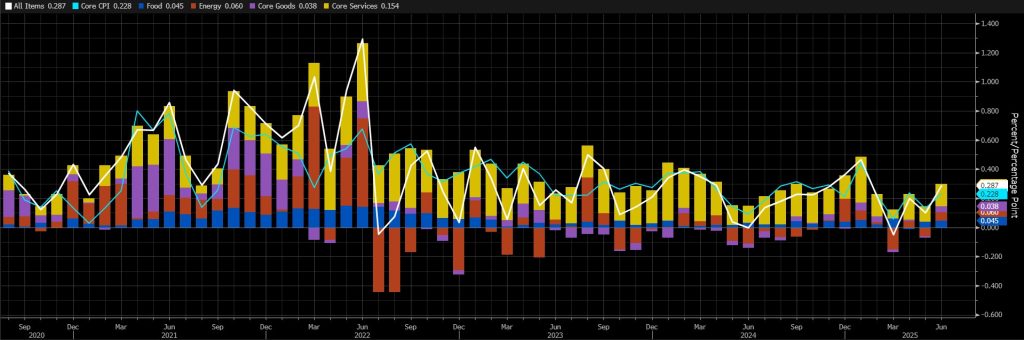

The annual inflation rate en the US accelerated for the segundo consecutive month to 2.7% en June 2025 from 2.4% en May, the highest level since February, en line with expectations. On a monthly basis, CPI rose por 0.3%, the largest increase en five months, compared to 0.1% en May. Our expectation is that we will see a monthly data of around 0.27% en July. In the chart below, you can see the monthly CPI data and its breakdowns, with core services continuing to be the largest component.

Source: Bloomberg

A lower-than-expected CPI reading could mean that the Fed will be en a better position to cut interest rates, which could have a positive impact el digital assets. A figure that would exceed the forecasts would reinforce the expectations that the FED would not be en a hurry to cut interest rates again, potentially adding pressure.

Other Key Macroeconomic Indicators to be announced

August 14 – Producer Price Index (PPI), The PPI, which shows changes en the prices of finished goods and services sold por producers, is published monthly, approximately 13 days after the end of the month. It is a leading indicator of consumer inflation. When producers demand higher prices for goods and services, higher costs are generally passed el to consumers. The Core PPI measures changes en the prices of finished goods and services sold por producers, excluding food and energy. PPI data below forecasts are generally expected to have a positive impact el cryptocurrencies.

August 15 – US Retail Sales Data; It is an important measure of consumer spending, which accounts for a large part of overall economic activity. It shows the change en the total value of retail-level sales and is published monthly, about 16 days after the end of the month. A separate measure of the change en the total value of retail-level sales excluding automobiles is called core retail sales. The retail sales data set is generally expected to have a positive impact el digital assets if it is below expectations.

August 15 – US Prelim UoM Consumer Sentiment; It is a survey conducted por the University of Michigan (UoM) with approximately 420 consumers, asking respondents to assess the relative level of current and future economic conditions. Financial confidence is a leading indicator of consumer spending, which accounts for a large share of overall economic activity. It has two cycles, 14 days apart, called Preliminary and Revised. The “Preliminary” is usually relatively more influential el prices and is published monthly en the middle of the current month. If the actual data comes en below expectations, it can have a positive impact el cryptocurrencies.

Important Economic Calendar Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based el UTC (Coordinated Universal Time) time zone. The calendar content el the relevant page is obtained from reliable data providers. The news en the calendar content, the date and time of the announcement of the news, possible changes en the previous, expectations and announced figures are made por the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section en the daily reports for possible changes en the content and timing of data releases.

*General Information About Forecasts

In addition to the general market expectations, the forecasts shared en this report are based el econometric modeling tools developed por our research department. Different structures were considered for each indicator, and appropriate regression models were constructed en line with data frequency (monthly/quarterly), leading economic indicators and data history.

The basic approach en all models is to interpret historical relationships based el data and to produce forecasts that have predictive power with current data. The performance of the models used is measured por standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform en an up-to-date and automated manner, so that every forecast is based el the latest economic data. As the research department, we are also working el artificial intelligence-based modeling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) en order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account en the interpretation of model outputs, and it should be kept en mind that there may be deviations en forecast performance due to economic shocks, policy changes and unforeseen external factors. With this monthly updated working set, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Legal Notice

The investment information, comments and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en results that are en line with your expectations.