BRÚJULA DE MERCADO

Al igual que los mercados tradicionales, los activos digitales se disponen a cerrar otra semana complicada. Las criptodivisas han cedido la mayor parte de las ganancias obtenidas en el periodo alcista previo a la elección de Trump como presidente de Estados Unidos, con caídas esta semana como resultado del comportamiento de aversión al riesgo de los inversores. Ni siquiera un par de días dolorosos provocados por el pirateo de una bolsa de criptodivisas pudo con la presión de los acontecimientos políticos y económicos. Sin embargo, la impredecible administración de Donald Trump y sus "aranceles" que podrían dañar el comercio mundial siguen preocupando a los mercados, y los activos digitales están sintiendo los efectos de esta situación. Por supuesto, en este momento, el hecho de que los inversores estén esperando ver medidas concretas sobre las promesas del presidente en relación con el mundo de las criptomonedas y el vacío creado por la necesidad de un nuevo catalizador han hecho que las ventas se sientan más profundamente. Dentro de este ecosistema, los resultados han sido una apreciación del dólar y de los bonos, una caída de los rendimientos de los bonos y una venta masiva de activos de riesgo.

Podemos decir que la principal variable que ha estado impulsando los precios en las últimas semanas han sido los riesgos que aguardan al comercio mundial. Además, no sería erróneo afirmar que la dinámica macroeconómica, que ha estado en un segundo plano en el último periodo, puede pasar a primer plano un poco más la próxima semana. En particular, los datos de las estadísticas laborales estadounidenses y de los cambios en las nóminas no agrícolas, que se publicarán el viernes, serán fundamentales para predecir el próximo movimiento de cambio de política de la Reserva Federal estadounidense (FED). De hecho, antes de estos datos, estaremos atentos a los indicadores macroeconómicos estadounidenses durante la semana, que también pueden cambiar el comportamiento de los precios. La declaración de política monetaria del Banco Central Europeo (BCE) también será digna de mención. Por ahora, sin embargo, daremos un paréntesis aparte a los datos de empleo, que proporcionarán información sobre la salud de la mayor economía del mundo.

Las nóminas no agrícolas cambian a la sombra de la agenda "arancelaria

Para los mercados, los primeros datos macroeconómicos críticos de marzo llegarán el 7 de marzo. La prioridad serán las nóminas no agrícolas (NFP), que darán pistas sobre la senda de recortes de tipos de interés de la Reserva Federal estadounidense y la rigidez del ecosistema financiero en el próximo periodo. Además, se seguirán las cifras de febrero, como los ingresos medios por hora y la tasa de desempleo.

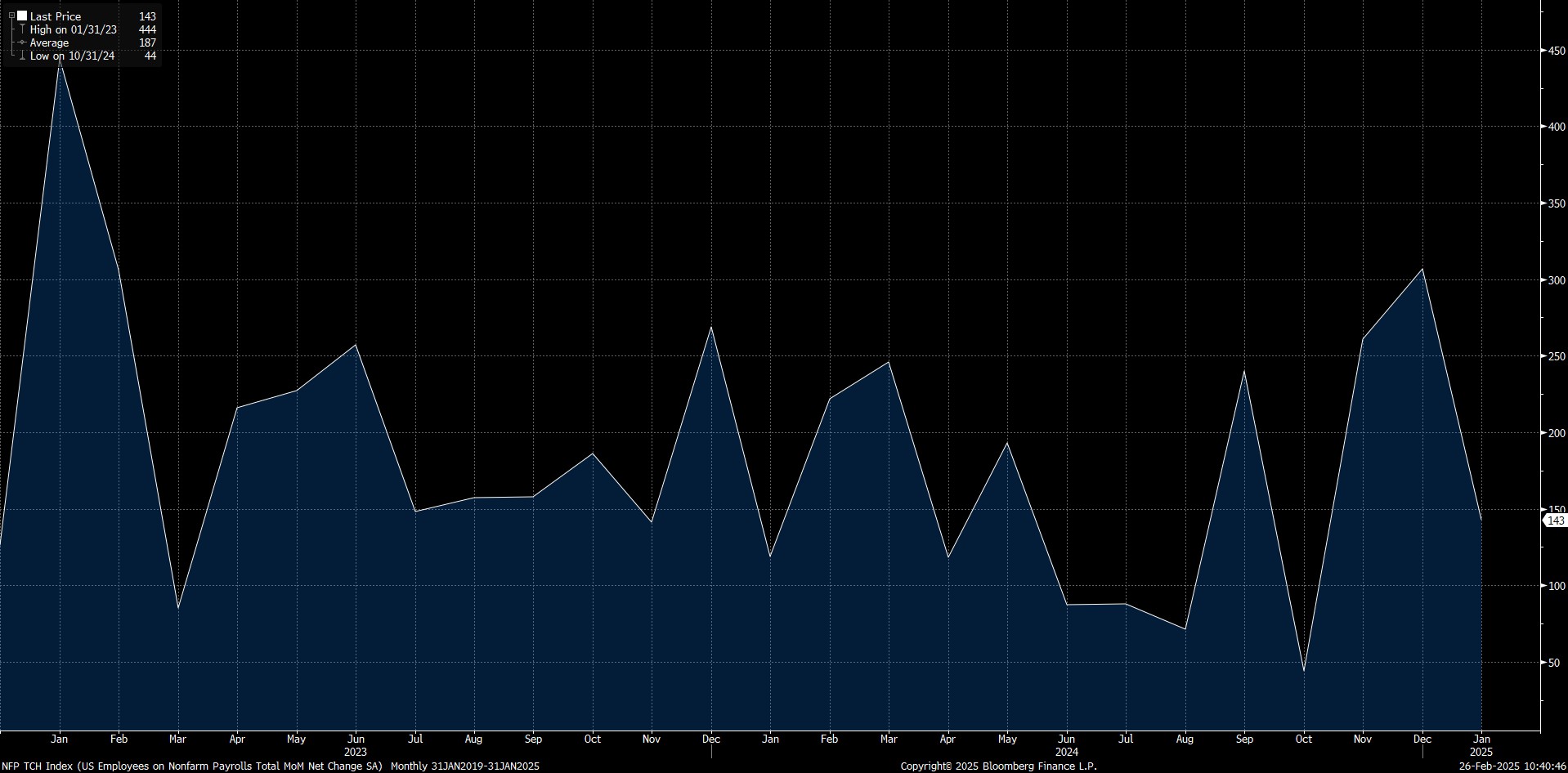

Las NFP del primer mes del año se anunciaron en 143 mil, por debajo de la expectativa general de alrededor de 170 mil. Sin embargo, cuando se analizan los detalles del informe de empleo y otros datos, creemos que este conjunto de estadísticas no apunta a un mal mercado laboral. Pero para abrir un paréntesis aparte, es importante señalar que mientras que la tendencia de los estadounidenses a permanecer en sus empleos actuales ha aumentado, su disposición a exigir salarios más altos ha disminuido. Es posible que veamos los efectos de esto negativamente a largo plazo.

Fuente: Bloomberg

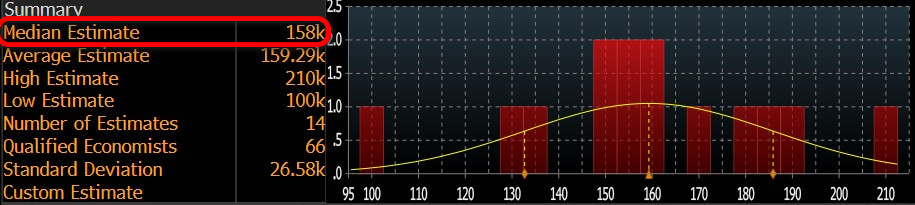

Volviendo a los datos de variación de las nóminas no agrícolas, muy sensibles para el mercado, nuestra previsión es que la economía estadounidense añadió aproximadamente 150.000 nuevos puestos de trabajo en los sectores no agrícolas en febrero. En el momento de escribir estas líneas, aunque el número de previsiones introducidas es reducido, vemos que el consenso en el terminal Bloomberg se sitúa en torno a este nivel, ligeramente por encima (alrededor de 158K en la última actualización).

Fuente: Bloomberg

Creemos que si los datos de las NFP de febrero, que se publicarán a la sombra del deterioro que la política exterior centrada en los aranceles de Trump puede crear a nivel interno, se sitúan ligeramente por debajo de las expectativas, esto se valorará como una métrica que puede crear la expectativa de que la FED actúe con más audacia para bajar el tipo de interés, aumentando así el apetito por el riesgo y teniendo un impacto positivo en los instrumentos financieros, incluidos los activos digitales. Creemos que unos datos ligeramente superiores a los esperados pueden tener un efecto similar pero opuesto. Sin embargo, un dato de las NFP mucho más bajo de lo esperado podría desencadenar preocupaciones de recesión con un comentario sobre la salud de la economía estadounidense, lo que podría ejercer presión vendedora sobre los activos considerados de riesgo. Cabe señalar aquí que esperamos que un dato mucho mejor de lo esperado también podría tener un impacto positivo. Cabe señalar que anticipamos estos efectos teniendo en cuenta el sentimiento actual del mercado.

DEPARTAMENTO DE INVESTIGACIÓN DARKEX ESTUDIOS ACTUALES

Informe mensual de estrategia de Darkex - Marzo

Análisis semanal de BTC Onchain

Análisis semanal de ETH Onchain

La combinación de apuestas en Ethereum y ETFs: ¿Una nueva era para los inversores?

¿Por qué Tether eligió la red de infraestructura Arbitrum para Stablecoin USDT0?

Alta correlación entre Bitcoin y el índice Russell 2000: Causas y consecuencias

La revolución de los fondos de activos digitales: El proceso de los ETF de altcoin

Pulse aquí para consultar el resto de nuestros informes Market Pulse.

DATOS IMPORTANTES DEL CALENDARIO ECONÓMICO

Pulse aquí para ver el calendario semanal de cripto y economía de Darkex.

INFORMACIÓN

*El calendario se basa en la zona horaria UTC (Tiempo Universal Coordinado).

El contenido del calendario en la página correspondiente se obtiene de proveedores de datos fiables. Las noticias del contenido del calendario, la fecha y hora del anuncio de la noticia, los posibles cambios en las cifras anteriores, las expectativas y las cifras anunciadas son realizadas por las instituciones proveedoras de datos.

Darkex no se hace responsable de posibles cambios derivados de situaciones similares. También puede consultar la página del calendario Darkex o la sección del calendario económico en los informes diarios para conocer los posibles cambios en el contenido y el calendario de publicación de los datos.

AVISO LEGAL

La información sobre inversiones, los comentarios y las recomendaciones contenidas en este documento no constituyen servicios de asesoramiento en materia de inversiones. Los servicios de asesoramiento en materia de inversión son prestados por instituciones autorizadas a título personal, teniendo en cuenta las preferencias de riesgo y rentabilidad de los particulares. Los comentarios y recomendaciones contenidos en este documento son de tipo general. Estas recomendaciones pueden no ser adecuadas para su situación financiera y sus preferencias de riesgo y rentabilidad. Por lo tanto, tomar una decisión de inversión basándose únicamente en la información contenida en este documento puede no dar lugar a resultados acordes con sus expectativas.