BRÚJULA DE MERCADO

Tariffs – Government Spending – Geopolitical Agenda

In global markets, the agenda and new announcements on the tariffs used as a weapon by US President Trump continue to determine the direction of asset prices. The new tariffs imposed on Canada, Mexico and China showed that the President was serious about the issue and brought selling pressure on many risky asset category instruments with concerns of a new “trade war”. Afterwards, the US Secretary of Commerce said that the tariffs could not be suspended but could be relaxed, contributing to a slight decrease in tension.

Continent of Europe Influential in Global Risk Perception

In addition to Minister Lutnick’s statements, Trump’s and Zelensky’s statements and the renewed hopes for peace on the Ukraine front played a role in the recent pessimistic mood in the markets. Also in Europe, the approval of the spending increase both in Germany and at the European Commission level played an important role in increasing the risk appetite again. These components reinforced the expectation that increased defense spending and borrowing would help revive the struggling Eurozone economy. Moreover, the European Central Bank (ECB) is expected to cut its policy rate by 25 basis points tomorrow. Add to the continental agenda the summit of heads of state in Brussels tomorrow, where they will discuss military and financial aid to Ukraine, strengthening the defense of the European Union and geopolitical strategy.

Digital World

In the fast-changing fabric of the world agenda, digital asset prices continue to follow a volatile course. The most prominent headline was Lutnick’s announcement that Donald Trump will unveil his Bitcoin reserve strategy at the Crypto Summit at the White House. Nevertheless, it is worth underlining that the flow of “big capital”, which fluctuates with the global agenda, remains the biggest dynamic that can determine the value of cryptocurrencies.

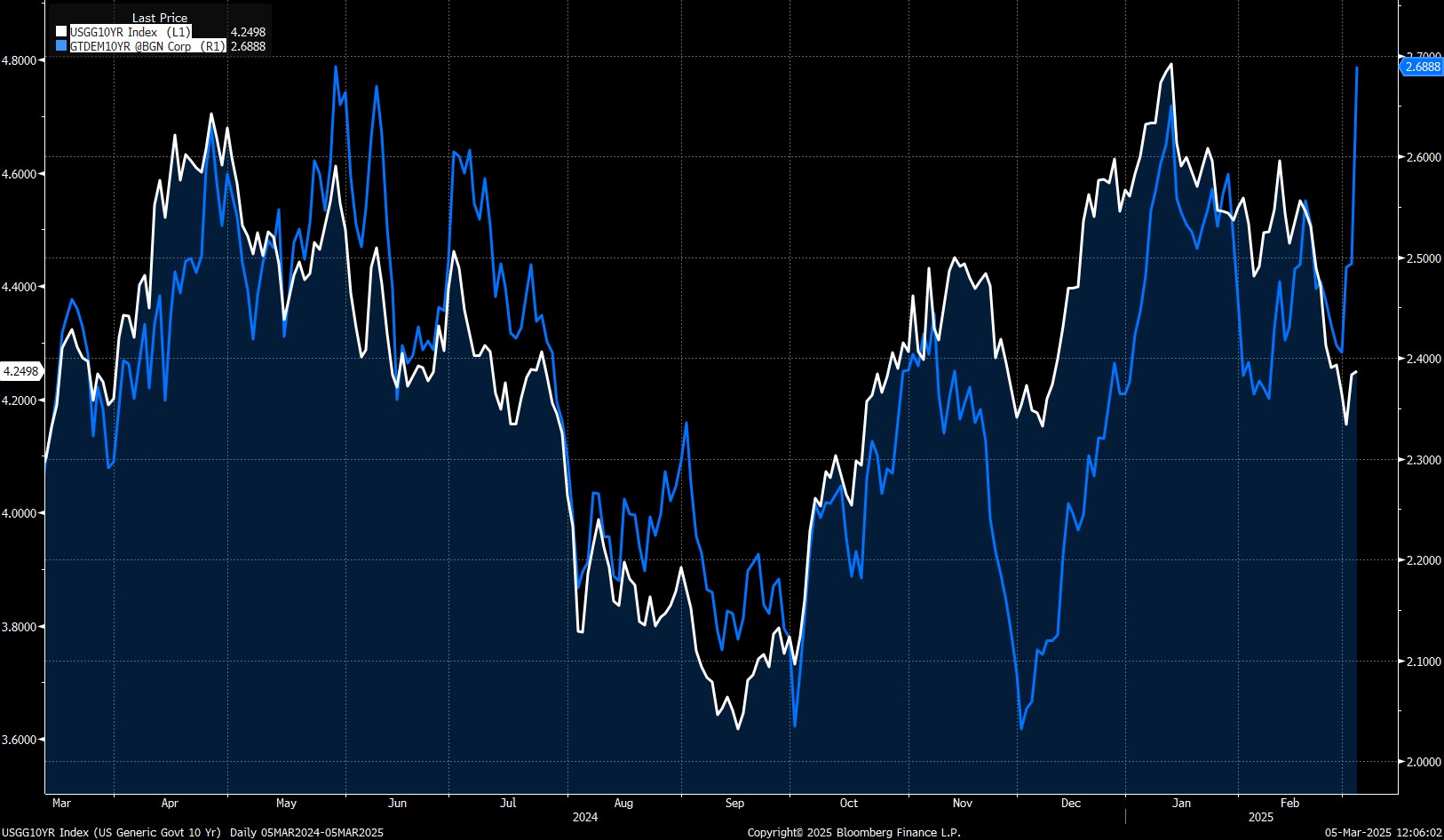

Source: Bloomberg

The dollar’s decline due to the additional inflation that will be created in the country with the tariffs and the strengthening expectations that the US Federal Reserve (FED) will move closer to interest rate cuts and the Euro’s appreciation with the recent agenda have differentiated the equation, albeit slightly. In addition, we see the recent rises in the yields of benchmark government bonds such as the US and Germany as important. We believe that these yields need to stabilize in order to accelerate the flow of funds into the asset class, which includes digital assets such as Bitcoin. In particular, an easing in US ten-year yields could be an important catalyst. Later in the day, in addition to the political and geopolitical agenda, macro data releases for the US may affect pricing behavior. In particular, ADP Nonfarm Employment Change will be closely monitored today ahead of the labor market statistics to be released on Viernes.

The Big Picture

For a long time, in our analysis of digital assets, we have been saying that “we expect volatility in the short term, pressure in the medium term and bullishness in the long term.” The uncertainty created by Trump in the political environment, especially with the tariff tool, and the roadmap he followed on Ukraine were an important dynamic. However, we can state that the lack of catalyst for the undeniable rise of digital assets has largely ended with the President’s latest crypto asset assessment. Therefore, by adjusting the new weighting in our equation, despite the uncertainties that still exist, we change our overall view to “bullish with intermediate corrections“. At this point, as we mentioned yesterday, it is worth noting that although the first statement on the reserve issue, which the crypto ecosystem is eagerly awaiting, it is necessary to continue to closely monitor political, geopolitical and macro dynamics.

LO MÁS DESTACADO DEL DÍA

Datos importantes del calendario económico

| Tiempo | Noticias | Expectativa | Anterior |

|---|---|---|---|

| 13:15 | US ADP Nonfarm Employment Change (Feb) | 141K | 183K |

| 14:45 | US Final Services PMI (Feb) | 49.7 | 49.7 |

| 15:00 | US ISM Services PMI (Feb) | 52.5 | 52.8 |

| 19:00 | US Beige Book |

INFORMACIÓN

*El calendario se basa en el huso horario UTC (Tiempo Universal Coordinado).

El contenido del calendario económico de la página correspondiente se obtiene de proveedores de noticias y datos fiables. Las noticias del contenido del calendario económico, la fecha y hora del anuncio de la noticia, los posibles cambios en las cifras anteriores, las expectativas y las cifras anunciadas son realizadas por las instituciones proveedoras de datos. Darkex no se hace responsable de los posibles cambios que puedan surgir de situaciones similares.

DEPARTAMENTO DE INVESTIGACIÓN DARKEX ESTUDIOS EN CURSO

Informe mensual de estrategia de Darkex - Marzo

Análisis semanal de BTC Onchain

Análisis semanal de ETH Onchain

Farcaster’s Rise with Brian Quintenz and the Revival of SocialFi

The Combination of Ethereum Staking and ETFs: A New Era for Investors?

Impact of Tether’s Possible Bitcoin Sale on Crypto Markets Under the US Stable and Genius Acts

Why Tether Chose the Arbitrum Infrastructure Network for Stablecoin USDT0?

Haga clic aquí para consultar el resto de nuestros informes Market Pulse.

AVISO LEGAL

La información sobre inversiones, los comentarios y las recomendaciones que figuran en este documento no constituyen servicios de asesoramiento en materia de inversiones. Los servicios de asesoramiento en materia de inversión son prestados por instituciones autorizadas con carácter personal, teniendo en cuenta las preferencias de riesgo y rentabilidad de los particulares. Los comentarios y recomendaciones contenidos en este documento son de tipo general. Estas recomendaciones pueden no ser adecuadas para su situación financiera y sus preferencias de riesgo y rentabilidad. Por lo tanto, tomar una decisión de inversión basándose únicamente en la información contenida en este documento puede no dar lugar a resultados acordes con sus expectativas.