MARKET SUMMARY

Latest Situation en Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 95,838.85$ | -2.65% | 60.50% | 1,90 T |

| ETH | 2,601.76$ | -4.41% | 9.98% | 313,76 B |

| XRP | 2.399$ | -4.95% | 4.41% | 138,57 B |

| SOLANA | 193.81$ | -5.85% | 3.01% | 94,62 B |

| DOGE | 0.2522$ | -6.23% | 1.19% | 37,34 B |

| CARDANO | 0.7592$ | -4.83% | 0.85% | 26,73 B |

| TRX | 0.2381$ | -3.04% | 0.65% | 20,51 B |

| LINK | 18.48$ | -6.45% | 0.38% | 11,81 B |

| AVAX | 24.96$ | -6.68% | 0.33% | 10,29 B |

| SHIB | 0.00001556$ | -5.13% | 0.29% | 9,17 B |

| DOT | 4.800$ | -7.64% | 0.24% | 7,43 B |

*Prepared el 2.12.2025 at 07:00 (UTC)

WHAT’S LEFT BEHIND

Highlights of Jerome Powell’s Statements

Call for a Re-Examination of the Crypto Industry’s Exclusion from Banking

- He expressed concern about the exclusion of the crypto sector from banking services.

- He emphasized that this situation should be reconsidered.

- He pledged to work with lawmakers to prevent regulations from creating excessive burdens.

He Said There Would Be No Hurry to Adjust Interest Rates

- He said there was no rush to change interest rates.

- He stated that the inflation target will remain unchanged at 2%.

- He said current policies can be maintained as long as the economy remains strong.

Support for a Regulatory Framework for Stablecoins

- He announced that he supports the creation of a regulatory framework around stablecoins.

- He stated that he will not introduce a central bank digital currency (CBDC) during his tenure.

Trump Family Crypto Project WLFI Partners with Ondo Finance

World Liberty Financial (WLFI), the Trump family’s crypto project, has formed a strategic partnership with Ondo Finance to promote the adoption of tokenized real-world assets. This collaboration aims to integrate tokenized assets such as USDY and OUSG into the WLFI network.

US and UK Refuse to Sign Ethical Artificial Intelligence Treaty

The US and the UK have refused to sign an international ethical AI agreement el the grounds that over-regulation of the AI sector could stifle innovation.

Tether Selects Arbitrum for On-Chain Stablecoin USDT0

Tether has selected Arbitrum as the infrastructure provider for its new cross-chain stablecoin USDT0. Arbitrum One will be the main hub for connecting USDT distributions el different blockchains to USDT0.

USDC Treasury Prints Over $88 Million en New USDC

The USDC Treasury has minted approximately 88.37 million USDC el the Ethereum network. This move further increases the circulating supply of USDC.

FTX/Alameda Distributes 184,000 SOLs to 23 Addresses

FTX/Alameda transferred approximately 184,000 SOL ($37.73 million) en the last 6 horas, distributing it to 23 different addresses. Most of these transfers went to major exchanges such as Coinbase and Binance. The company still has about $1.25 billion worth of SOL en its wallet.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | Noticias | Expectation | Previous |

|---|---|---|---|

| – | Aptos (APT): AIP Community Review | – | – |

| – | Render (RENDER): Weekly AI Scout AMA | – | – |

| – | Holo (HOT): Livestream el Upcoming Delivery and Future | – | – |

| 13:30 | US Core CPI (MoM) (Jan) | 0.3% | 0.2% |

| 13:30 | US CPI (MoM) (Jan) | 0.3% | 0.4% |

| 13:30 | US CPI (YoY) (Jan) | 2.9% | 2.9% |

| 13:30 | US Core CPI (YoY) (Jan) | 3.1% | 3.2% |

| 15:00 | FED Chair Powell Testifies | – | – |

| 17:00 | FOMC Member Bostic | – | – |

| 22:05 | FOMC Member Waller Speaks | – | – |

INFORMATION

*The calendar is based el UTC (Coordinated Universal Time) time zone.

The economic calendar content el the relevant page is obtained from reliable news and data providers. The news en the economic calendar content, the date and time of the announcement of the news, possible changes en the previous, expectations and announced figures are made por the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

MARKET COMPASS

Last night, the US Federal Reserve’s (FED) Powell’s messages en his presentation to the Senate were el the agenda of global markets. The chairman once again underlined his statements that they are en no hurry to cut interest rates. Treasuries rose and stocks fluctuated after Powell reiterated that the central bank is en no rush to cut rates. Bonds fell across the curve as money markets are still pricing en a Fed rate cut this year. The President will make another presentation for the House Financial Services Committee today, but the text of the speech is not expected to change. His answers to questions from members will again be under the scrutiny of investors.

In global markets, Powell’s statements and expectations regarding the FED and Trump’s unpredictable management style and the “tariffs” issue continue to be influential, while el the Asian front, the artificial intelligence theme stands out with a positive impact el indices. Europe (slightly positive) and Wall Street (slightly negative) indices are expected to start Wednesday flat. Digital assets were en the instrument group negatively affected por Powell’s interest rate message. Some recovery is observed after the losses. Today, we can say that inflation data from the US will be the main issue that may have an impact el the markets.

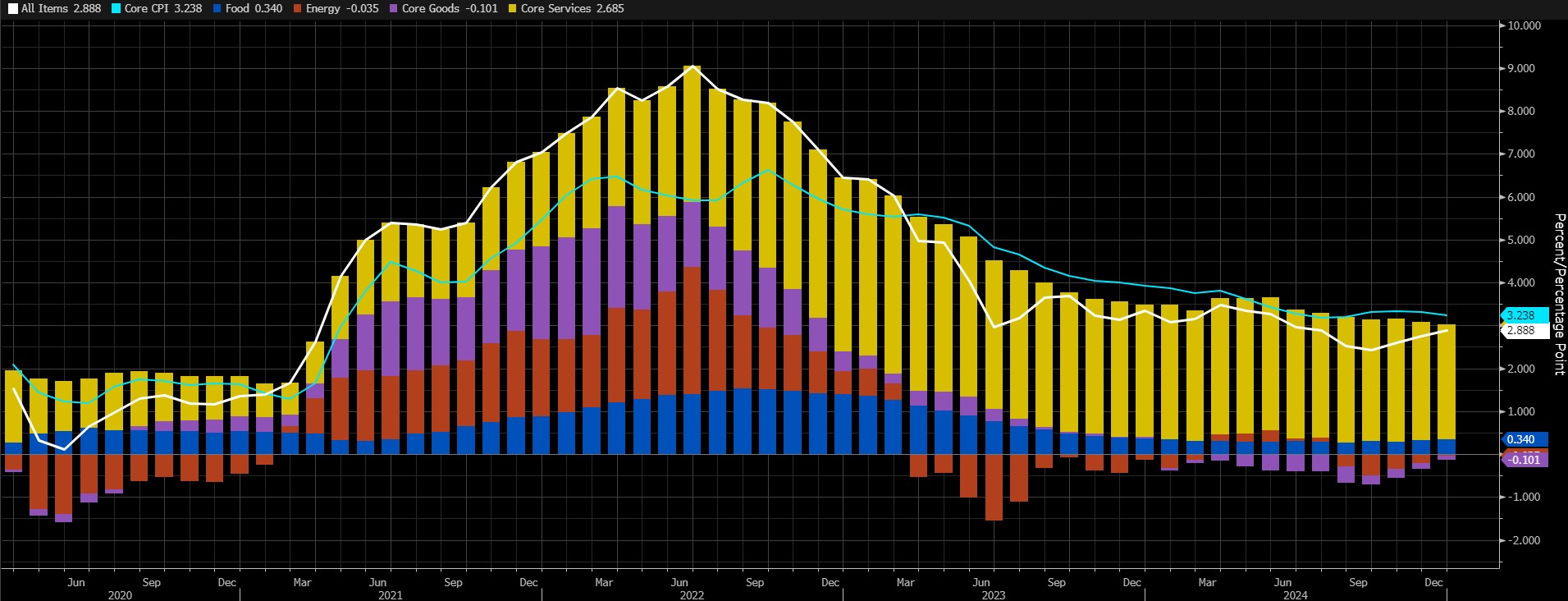

Eyes el Inflation After Employment Data

We received the first critical macro indicators of January el Friday with the US employment data. This week, the focus will shift to the Consumer Price Index (CPI) after Powell’s speech. In December, monthly CPI rose por 0.4% and core CPI por 0.2%, bringing annual headline inflation to 2.9% (November: 2.7%).

Source: Bloomberg

Inflation en the US is no longer falling as it was from June 2022 to early 2024. The change en the Consumer Price Index is more stable. This may also be due to the fact that the cycle en which the FED cut interest rates has come to an end. The importance of the inflation data lies en the fact that it may give clues about the timing and the extent to which the FED may cut interest rates en 2025.

A higher-than-expected CPI data set may strengthen expectations that the FED may extend the process of postponing interest rate cuts, leading to an appreciation of the dollar, a decrease en risk appetite and, consequently, a depreciation of cryptocurrencies. Also, if we see CPI data that is not as high as feared and below expectations, we can say that this will have the opposite effect. In such a scenario, digital assets could find a basis for a rally.

From the short term to the big picture…

Trump’s victory el November 5, one of the main pillars of our bullish expectation for the long-term outlook en digital assets, produced a result en line with our predictions. In the process that followed, the appointments made por the president-elect and the increasing regulatory expectations for the crypto ecosystem en the US, as well as the emergence of BTC as a reserve, continued to take place en our equation as positive variables. Then, 4 days after the new President took over the White House, he signed the “Cryptocurrency Working Unit” decree, which was among his election promises, and we think that the positive reflection of this output el digital assets may continue en the coming days.

On the other hand, the expectations that the FED will continue its interest rate cut cycle, albeit el hiatus for now, and the fact that the volume en crypto-asset ETFs indicates an increase en institutional investor interest, support our upside forecast for the big picture. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pause or pullbacks en digital assets. However, at this point, it is worth underlining again that we think the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

BTC/USDT

Global markets focused el the statements of FED Chairman Powell. US Federal Reserve Chairman Jerome Powell emphasized that the exclusion of the crypto industry from banking services should be re-examined and stated that they will cooperate with lawmakers to ease regulatory burdens. Powell also stated that there will be no rush to adjust interest rates, while expressing support for a regulatory framework for stablecoins and announced that he will not introduce the central bank digital currency (CBDC) during his tenure.

BTC lost its short-term uptrend structure and turned down, testing the major support point at 95,000. The price, which has recovered somewhat with the reaction it received from this level, is currently trading at 95,800. When the technical oscillators are analyzed, it is observed that selling signals continue to be maintained el the hourly and 4-hora charts, while buying signals are starting to form el the 30-minuto charts. Momentum indicators show a weakening trend en the short term, but have the potential to regain strength during the day. In order to maintain the positive outlook, closures above the 95,000 level are critical, and persistence above this level may support the price recovery. However, closes below the 95,000 level may increase the downward pressure and reactivate the red band range. In case the decline deepens, price movements below 95,000 will be closely monitored, and en a possible recovery scenario, the 97,000 level will be monitored as a minor resistance point.

Supports 95,000 – 92,800 – 90,400

Resistances: : 97,000 – 99,100 -101,400

ETH/USDT

Yesterday, the retreat en the cryptocurrency market after FED Chairman Powell’s speech caused ETH to lose value. With the break of the support at $ 2,641, a decline to $ 2,550 was observed. After this price action, it was seen that ETH tried to exceed the kijun level en the morning horas, but retreated por encountering resistance here.

The continued positive inflows to ETFs and the increasing amount of ETH exiting the exchanges indicate that the market is experiencing a contraction el the supply side. An analysis of Cumulative Volume Delta (CVD) data reveals that selling pressure en the spot market is weaker than en futures. This shows that investors who buy ETH en the spot market are also opening short positions en futures for hedging purposes. In the short term, this trend suggests that the price may retreat a little more, but ETH may experience rapid rises as short positions close. This outlook is also supported por the Chaikin Money Flow (CMF) indicator. The fact that CMF remained strong during the downtrend indicates that there was no sharp liquidity outflow en the market. The flat course of CMF suggests that investors have not completely exited the market and buying interest continues. On the other hand, ETH’s rejection from the kumo cloud shows that the price action failed to break out to the upside, but the tenkan level remains above the kijun level, indicating that the price has not turned completely negative.

To summarize, a recovery can be seen en the short term if the price exceeds the $2,641 level again. However, selling pressure from this level may cause the price to exhibit a fluctuating movement en the region between $ 2,501 – $ 2,641. In this process, the gradual closing of short positions may accelerate the upward movement of the price.

Supports 2,501 – 2,368 – 2,127

Resistances 2,641 – 2,781 – 2,881

XRP/USDT

Yesterday, XRP broke through the critical resistance points of the kumo cloud and the $2.49 level with a very positive-looking move, but failed to hold en this region and quickly retreated back below the $2.40 level. Although this price action looks like a fake out, the momentum structure does not confirm this.

Chaikin Money Flow (CMF), el the other hand, fell to the zero zone with the decline and shows that sellers and buyers are rebalancing, unlike recent days. The positive outlook that emerged with yesterday’s price action has returned to a neutral outlook and it seems likely that XRP will continue to move sideways en this region. On the other hand, although the loss of the kumo cloud seems negative, the tenkan level remaining above the kijun level has not yet created a clear negative signal.

As a result, it seems likely that XRP will make slight up and down horizontal movements en these regions during the day. If the price exceeds the $ 2.49 level again, it may trigger rises. 2.25 dollars, el the other hand, maintains the most important support role and a violation of this region may bring very sharp declines.

Supports 2.2502 – 2.0201 – 1.6309

Resistances 2.4940 – 2.6486 – 2.7815

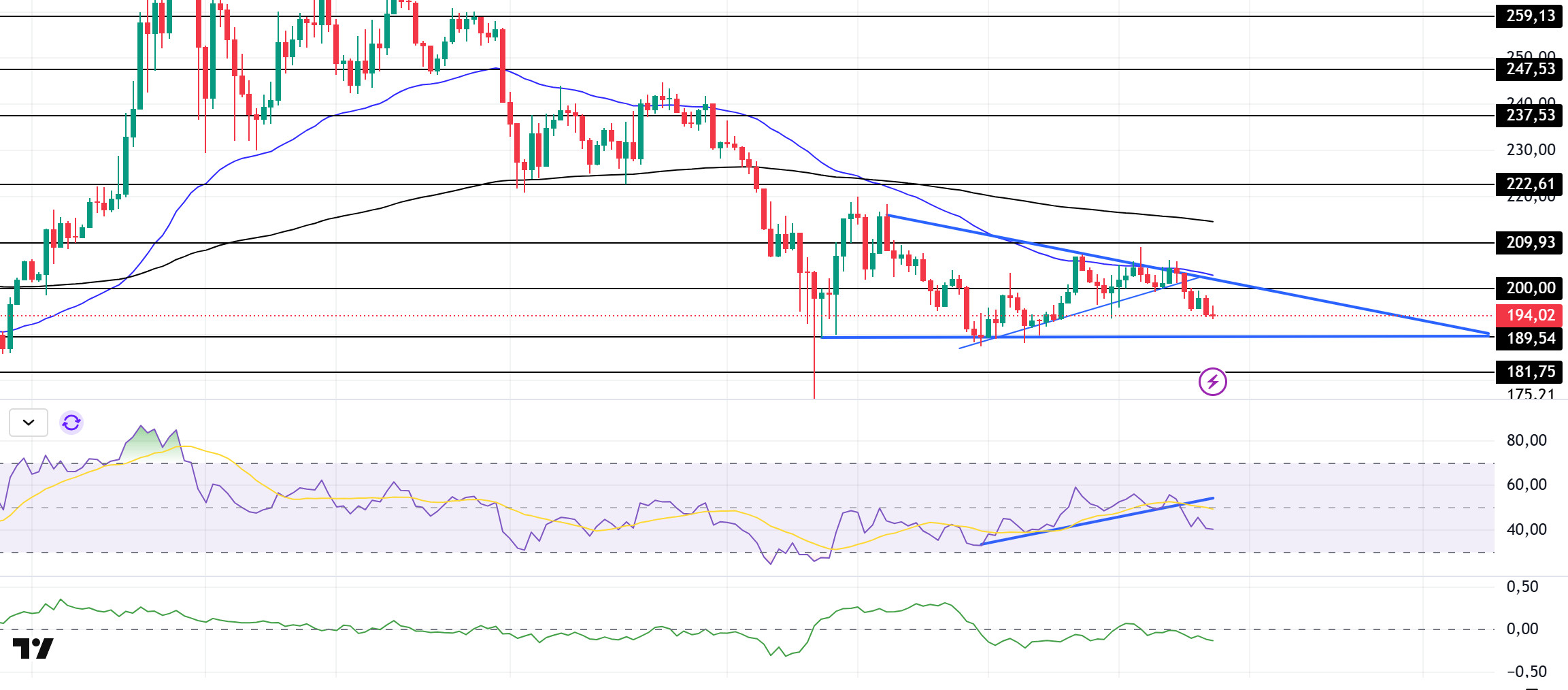

SOL/USDT

The US Securities and Exchange Commission (SEC) announced that it has formally accepted the listing application for the Spot Solana (SOL) ETF submitted por CBOE BZX Exchange and that the applicants are 21Shares, Bitwe, Canary Capital and Vaneck. On the other hand, Franklin Templeton, which manages more than $1.2 trillion en assets, has filed for a “Franklin Solana Trust” en Delaware.

SOL continues to accumulate, maintaining its sideways movements within a limited band. On the 4-hora timeframe, the 50 EMA (Blue Line) continues to be below the 200 EMA (Black Line). This could deepen the decline en the medium term. At the same time, the asset is priced below the 50 EMA and 200 EMA. On February 6, it broke the uptrend to the downside and continued to be en a falling triangle pattern, deepening its decline. When we analyze the Chaikin Money Flow (CMF)20 indicator, it is en the negative zone and money outflows are increasing. However, the Relative Strength Index (RSI)14 indicator is at the mid-level of the negative zone and the price has broken the downward trend en the RSI that started el February 6. The $ 237.53 level stands out as a very strong resistance point en the uptrend driven por both the upcoming macroeconomic data and the news en the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the support level of $ 181.75 can be triggered again. If the price comes to these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 189.54 – 181.75 – 171.82

Resistances 200.00 – 209.93 – 222.61

DOGE/USDT

DOGE has declined since our analysis yesterday. On the 4-hora timeframe, the 50 EMA (Blue Line) remains below the 200 EMA (Black Line). This could mean that the decline could deepen further en the medium term. At the same time, the price is below the 50 EMA (Blue Line) and the 200 EMA (Black Line). However, the large gap between the two moving averages may increase the probability that DOGE will rise. After hitting resistance at the 50 EMA, the asset failed to break it and continued to decline and remained en a symmetrical triangle pattern. When we analyze the Chaikin Money Flow (CMF)20 indicator, it is en the neutral zone but money inflows and outflows are en balance. At the same time, Relative Strength Index (RSI)14 is close to the neutral level of the negative zone and the uptrend that started el February 6 continues. The $0.33668 level is a very strong resistance point en the uptrend due to political reasons, macroeconomic data and innovations en the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativities en the ecosystem, the base level of the trend, the $ 0.22632 level, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.25025 – 0.22632 – 0.21154

Resistances 0.28164 – 0.30545 – 0.33668

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually por authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained herein may not produce results en line with your expectations.