RESUMEN DEL MERCADO

Última situación de los criptoactivos

| Activos | Último precio | 24h Cambio | Dominación | Capitalización bursátil. |

|---|---|---|---|---|

| BTC | 101,821.42 | 2.35% | 56.25% | 2,02 T |

| ETH | 3,672.83 | 0.19% | 12.34% | 442,40 B |

| XRP | 2.445 | 1.41% | 3.92% | 140,48 B |

| SOLANA | 216.38 | 0.66% | 2.92% | 104,66 B |

| DOGE | 0.3905 | 1.63% | 1.61% | 57,62 B |

| CARDANO | 1.0981 | 1.43% | 1.08% | 38,61 B |

| TRX | 0.2707 | 2.32% | 0.65% | 23,33 B |

| AVAX | 44.11 | 1.22% | 0.50% | 18,09 B |

| ENLACE | 23.63 | -0.49% | 0.42% | 15,08 B |

| SHIB | 0.00002412 | 0.44% | 0.40% | 14,20 B |

| DOT | 7.833 | 1.09% | 0.34% | 12,02 B |

*Prepared on 1.7.2025 at 07:00 (UTC)

LO QUE QUEDA ATRÁS

Anti-crypto Fed Vice Chairman for Supervision Michael Barr Resigns

Federal Reserve Vice Chairman of Supervision Michael Barr announced today that he will resign from his post, Beincrypto reported. Barr was known in the industry as a key figure in the non-involvement of American banks in crypto services.

Do Kwon’s Victims Could Number More Than One Million, US Court Documents Show

According to Cointelegraph, Do Kwon is estimated to have affected more than one million people worldwide after the collapse of the Terra ecosystem. US prosecutors are working on a procedure to inform victims of their rights.

Calamos to Launch Hedged Bitcoin ETF on Enero 22

According to Crypto.news, Calamos Investments is launching a new ETF (CBOJ) that offers 100% protection against Bitcoin volatility. The ETF will be traded on the Chicago Board Options Exchange.

Solana Foundation Proposes a New Hash Type to Improve Account Status Efficiency

The Solana Foundation has announced the proposal of the “Accounts Lattice Hash” (SIMD-0215), which will improve account security and speed. This technology aims to make blockchain account states more efficient.

Babylon will launch the second phase of its test network on Enero 8

Bitcoin staking protocol Babylon is preparing to launch the second phase of its testnet. This phase will include tests of interaction with Bitcoin pawnbrokers and other protocol participants.

Riot Releases Diciembre Production Data: 516 Bitcoins Mined

Riot Platforms announced that it mined a total of 516 Bitcoins in Diciembre, up 4%. Debugging continues at the Corsicana facility.

Solana’s 24-Hour DEX Trading Volume Surpasses Ethereum and Base

According to DefiLlama data, Solana surpassed Ethereum and Base with a DEX trading volume of $3.982 billion in the last 24 hours.

Nvidia’s Share Price Rises More Than 5%, Market Cap Surpasses Apple

In the US stock markets, Nvidia overtook Apple to take the lead in market capitalization with a 5% increase.

Sui TVL Breaks Record by Reaching $2 Billion

Sui announced that it has doubled its total locked value in three months, reaching $2 billion. The platform’s growth has been fueled by innovations in stablecoin and lending protocols.

Pump.fun accounts for more than 70% of Solana token issuance

According to Decrypt, Pump.fun has become the main force of the Meme coin ecosystem on the Solana network. It has issued more than 45,000 tokens in the last 24 hours, bringing its yearly total to 5.5 million.

LO MÁS DESTACADO DEL DÍA

Datos importantes del calendario económico

| Tiempo | Noticias | Expectativa | Anterior |

|---|---|---|---|

| Usual (USUAL) | New Announcement | - | - |

| DUSK (DUSK) | Mainnet Rollout | - | - |

| 13:10 | US FOMC Member Barkin Speaks | - | - |

| 15:00 | US ISM Services PMI (Dec) | 53.5 | 52.1 |

| 15:00 | US JOLTS Job Openings (Nov) | 7.73M | 7.74M |

INFORMACIÓN

*El calendario se basa en el huso horario UTC (Tiempo Universal Coordinado).

El contenido del calendario económico de la página correspondiente se obtiene de proveedores de noticias y datos fiables. Las noticias del contenido del calendario económico, la fecha y hora del anuncio de la noticia, los posibles cambios en las cifras anteriores, las expectativas y las cifras anunciadas son realizadas por las instituciones proveedoras de datos. Darkex no se hace responsable de los posibles cambios que puedan surgir de situaciones similares.

BRÚJULA DE MERCADO

Although global markets started the new week with a mixed sentiment, the rises in selected companies and indices are noteworthy with the purchases in technology companies. While the dollar first declined on news that new US President Trump’s aides were working on softer tariffs, it recovered some of its losses after Trump denied the news on social media. The deregulation optimism caused by the news of the resignation of US Federal Reserve (FED) Vice Chairman Michael Barr had a positive impact on digital assets.

The US macro indicators to be released today will be closely monitored and will be under the scrutiny of investors as they may shape expectations about the FED and prices in parallel, ahead of the critical employment data due on Viernes. For intraday short-term transactions, as we mentioned in our analysis yesterday, we maintain our view that the uptrend may continue with possible intermediate breaks.

Desde el corto plazo hasta el panorama general.

La victoria del expresidente Trump el 5 de noviembre, que era uno de los principales pilares de nuestra expectativa alcista para las perspectivas a largo plazo en los activos digitales, produjo un resultado en línea con nuestras predicciones. Posteriormente, los nombramientos realizados por el presidente electo y las expectativas de una mayor regulación del ecosistema cripto en EEUU continuaron siendo una variable positiva en nuestra ecuación. Aunque se espera que continúe a un ritmo más lento, la señal de la FED de que continuará su ciclo de recortes de los tipos de interés y el volumen en ETF de criptoactivos que indica un aumento del interés de los inversores institucionales (además de las compras de BTC de MicroStrategy, las opciones de ETF de BTC de BlackRock comienzan a cotizar...) respaldan por ahora nuestra previsión alcista para el panorama general. A corto plazo, dada la naturaleza del mercado y el comportamiento de los precios, creemos que no sería sorprendente ver pausas o retrocesos ocasionales en los activos digitales. Sin embargo, llegados a este punto, merece la pena insistir de nuevo en que la dinámica fundamental sigue siendo alcista.

ANÁLISIS TÉCNICO

BTC/USDT

Spot Bitcoin ETFs in the US ended yesterday’s trading day with a total net investment of $987 million. Fidelity received $370 million, BlackRock $209 million, ARK Invest $152 million and Grayscale’s two funds received a total of $150 million. These resumed positive inflows into spot ETFs show that institutional investors’ interest in Bitcoin is growing and these developments continue to be an important driver and catalyst for Bitcoin.

When we look at the technical outlook, BTC, which forms an upward trend channel in a rectangular pattern, realized the region where it could not break at levels 2 and 4 at level 6. Coming to the levels we identified as the liquidation area in the previous analysis, BTC came to the level of 102,700 and cleared the weekly liquidation zone. While oscillators for BTC, which is currently trading at 101,800, give a sell signal on the hourly chart, there is an increase in the momentum indicator and risk appetite with the rise. In the continuation of the rise, the 103,000 level appears as a resistance area, while we can accept the 100,000 level as a reference point again in the bullish correction.

Supports 99,100 – 98,000 – 97,200

Resistances 101,400 – 103,000 – 105,000

ETH/USDT

With Bitcoin surpassing the $100,000 level again yesterday evening, Ethereum managed to break the $3,670 level with a bullish rally. However, the selling pressure immediately following this move caused the price to regain a weak outlook.

When technical indicators are analyzed, it is seen that negative divergences, especially in the Relative Strength Index (RSI), put pressure on the price. Chaikin Money Flow (CMF), on the other hand, continued its downward movement after a sharp reversal after yesterday’s rally, indicating that the market has weakened somewhat in terms of liquidity. On the other hand, the Cumulative Volume Delta (CVD) data presents a positive picture. It is noteworthy that the number of buyers in the spot market has increased significantly compared to the buyers on the futures side. This can be considered as a positive catalyst despite the pressure on the price. Weaknesses in technical indicators suggest that the price may retreat for a while, while the positive outlook in CVD suggests that this retracement may be a correction and then bullish movements may resume.

The 3.510 level remains a strong support zone. In upward movements, the 3.841 level stands out as a critical resistance point. Volatility may continue in the short term, but the overall market outlook should be carefully monitored.

Supports 3,510 – 3,382- 3,293

Resistances 3,670 – 3,841 – 4,001

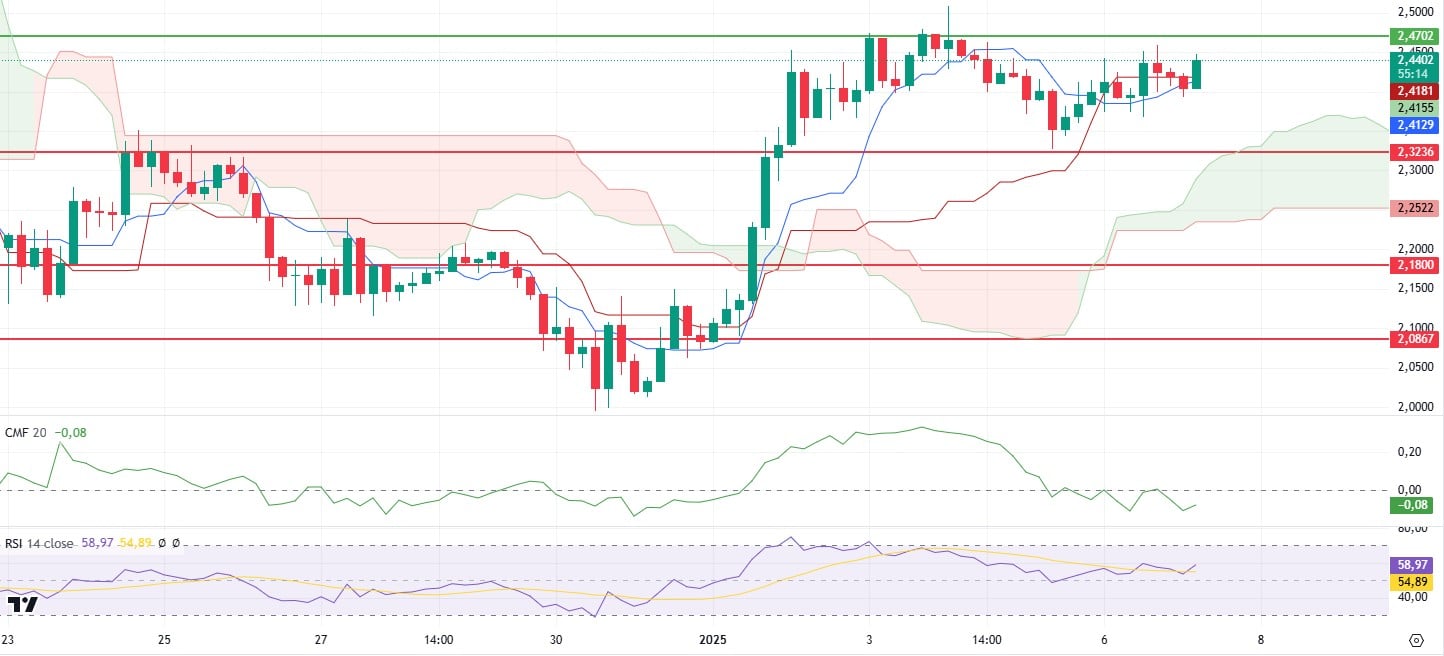

XRP/USDT

XRP surpassed the 2.42 level yesterday in parallel with the general rise of the market, but retreated with the selling pressure in the night hours. XRP, which managed to hold above the 2.42 level again as of this morning, displays a complex outlook in terms of technical indicators.

When we look at the Ichimoku indicator, we see that the current “sell” signal continues. For this signal to become invalid, Tenkan Sen rising above Kijun Sen stands out as a critical threshold. Chaikin Money Flow (CMF) shows a horizontal consolidation in the negative territory, signaling the market’s weakness in terms of liquidity. On the other hand, RSI continues to paint a negative picture by failing to accompany the price rise. These indicators reveal that the fundamentals of the current uptrend are not solid and exhibit a fragile structure in the short term.

Although it is possible for the price to rise up to 2.47 during the day, it is critical that the 2.47 resistance is strongly exceeded for the upward movements to be permanent. Unless closes above this level are seen, selling pressure is likely to re-engage. In downward movements, the 2.32 level stands out as the most important support point. A break of this level could lead to deeper declines in XRP.

Supports 2.3236 – 2.1800 – 2.0867

Resistances 2.4702 – 2.6180 – 2.8528

SOL/USDT

According to BlockBeats, on Enero 7, the Solana Foundation introduced proposal SIMD-0215, which aims to expand Solana’s infrastructure to accommodate billions of user accounts. This proposal includes the addition of a new hash called ‘Accounts Lattice Hash’. On the other hand, Solayer introduced InfiniSVM, a hardware-accelerated blockchain for Solana, targeting network speeds of 100 Gbps with atomic state consistency. InfiniSVM claims to target Solana’s bandwidth consumption issues, reducing validator failures and network outages for smoother transactions. The Solana ecosystem has increased its dominance in 24-hour DEX volume to 40%. At the time of writing, the volume stands at $4 billion. At the same time, Solana’s total locked value (TVL) is now approaching $12 billion.

SOL tested the major resistance level at 222.61. However, it failed to break this resistance. On the 4-hour timeframe, the 50 EMA (Blue Line) broke the 200 EMA (Black Line) to the upside. This could start a medium-term uptrend. When we examine the Chaikin Money Flow (CMF)20 indicator, money outflows seem to have increased, albeit in positive territory. However, the Relative Strength Index (RSI)14 indicator reached the overbought level. At the same time, bearish divergence should be taken into account. This may start the decline again. The 247.53 level appears to be a very strong resistance point in the rises driven by both the upcoming macroeconomic data and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 200.00 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 209.93 – 200.00 – 189.54

Resistances 222.61 – 237.53 – 247.53

DOGE/USDT

Dogecoin whales accumulated 140 million coins, instilling optimism in the market. DOGE recorded an increase of 1.23% in the last 24 hours, although it has generally moved sideways.

When we look at the chart, it is moving horizontally at yesterday’s levels. The horizontal asset accumulated the swelling RSI indicator and moved it away from the overbought zone. This could be a bullish harbinger. At the same time, the Relative Strength Index (RSI)14 indicator shows a bearish mismatch. This should be taken into consideration. On the 4-hour timeframe, the 50 EMA (Blue Line) broke the 200 EMA to the upside. This may reinforce the uptrend. When we examine the Chaikin Money Flow (CMF)20 indicator, it is in positive territory but money outflows are increasing. However, Relative Strength Index (RSI)14 is in positive territory. On the other hand, a flag pennant pattern has been formed. The 0.42456 level stands out as a very strong resistance place in the rises due to both the upcoming macroeconomic data and the innovations in the Doge coin. If DOGE catches a new momentum and rises above this level, the rise may continue strongly. In case of possible pullbacks due to macroeconomic reasons or negativity in the ecosystem, the 0.33668 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.28164

Resistances 0.42456 – 0.45173 – 0.50954

AVISO LEGAL

AVISO LEGAL

La información sobre inversiones, los comentarios y las recomendaciones que figuran en este documento no constituyen asesoramiento en materia de inversiones. Los servicios de asesoramiento en materia de inversión son prestados individualmente por instituciones autorizadas teniendo en cuenta las preferencias de riesgo y rentabilidad de los particulares. Los comentarios y recomendaciones aquí contenidos son de carácter general. Estas recomendaciones pueden no ser adecuadas para su situación financiera y sus preferencias de riesgo y rentabilidad. Por lo tanto, tomar una decisión de inversión basándose únicamente en la información aquí contenida puede no producir resultados acordes con sus expectativas.