RESUMEN DEL MERCADO

Última situación de los criptoactivos

| Activos | Último precio | 24h Cambio | Dominación | Market Cap |

|---|---|---|---|---|

| BTC | 99,063.76 | 2.09% | 59.46% | 1,96 T |

| ETH | 3,373.67 | 7.93% | 12.33% | 406,28 B |

| SOLANA | 259.26 | 8.72% | 3.73% | 123,07 B |

| XRP | 1.397 | 25.82% | 2.42% | 79,66 B |

| DOGE | 0.3931 | 2.29% | 1.75% | 57,75 B |

| CARDANO | 0.8828 | 12.92% | 0.94% | 30,93 B |

| TRX | 0.1991 | 0.85% | 0.52% | 17,20 B |

| AVAX | 36.10 | 6.74% | 0.45% | 14,79 B |

| SHIB | 0.00002484 | 3.17% | 0.44% | 14,63 B |

| ENLACE | 15.27 | 4.90% | 0.29% | 9,58 B |

| DOT | 6.186 | 8.50% | 0.29% | 9,42 B |

*Prepared on 11.22.2024 at 06:00 (UTC)

LO QUE QUEDA ATRÁS

Gary Gensler’s Shock Resignation

US Securities and Exchange Commission (SEC) Chairman Gary Gensler announced that he will leave his post on Enero 20, 2025. In a statement on his social media account, Gensler did not mention the details of his decision to leave, but the news of his resignation resonated widely in the market.

Charles Schwab Enters Spot Crypto Market

American financial giant Charles Schwab has announced that it will enter the spot cryptocurrency market. This move of the company is seen as an effort to adapt to the growing crypto sector. It is stated that Schwab aims to provide investors with a wide range of products with the new solutions it offers. This development created movement in the markets.

MARA Holdings Raises $1 Billion for Bitcoin

Bitcoin mining company MARA Holdings raised $1 billion from convertible bond sales. The company plans to use the proceeds for additional Bitcoin purchases. MARA, which currently has about 27,000 BTC reserves, has the second largest Bitcoin reserves among publicly traded companies.

Record Net Inflows to Bitcoin Spot ETFs

Bitcoin spot ETFs recorded net inflows of $1.005 billion yesterday, according to SoSoValue data. This marks a net inflow trend that has continued for four consecutive days. The total net asset value of spot ETFs reached $105.908 billion, accounting for 5.46% of Bitcoin’s total market capitalization.

Four Institutions Apply for Solana ETF

According to Bloomberg analyst James Seyffart, Bitwise, VanEck, 21Shares, and Canary Funds have filed applications for four different Solana-focused ETFs on the Cboe BZX exchange. If the applications are accepted by the SEC, final approval is expected to be announced in early Agosto 2025.

Trump Media Plans Crypto Payment Service ‘TruthFi’

Donald Trump’s social media company Trump Media & Technology Group has filed a trademark application for crypto payment service TruthFi, the New York Times reported. The platform aims to offer crypto payments, digital asset trading and financial custody services.

Genius Group Increases Bitcoin Reserves

Artificial intelligence company Genius Group has purchased an additional $4 million worth of Bitcoin, bringing its total holdings to 153 BTC. The company aims to keep 90% of its reserves in Bitcoin as part of its “Bitcoin First” strategy and plans to purchase $120 million worth of Bitcoin as a long-term goal.

LO MÁS DESTACADO DEL DÍA

Datos importantes del calendario económico

| Tiempo | Noticias | Expectativa | Anterior |

|---|---|---|---|

| 12:00 | SPACE ID (ID) 18.49MM Token Unlock | - | - |

| 12:00 | KARRAT (KARRAT) 11.36M Token Unlock | - | - |

| 14:45 | US Manufacturing PMI (Nov) | 48.8 | 48.5 |

| 14:45 | US Services PMI (Nov) | 55.2 | 55.0 |

| 15:00 | US Michigan Consumer Sentiment (Nov) | 74.0 | 73.0 |

INFORMACIÓN

*El calendario se basa en el huso horario UTC (Tiempo Universal Coordinado). El contenido del calendario económico de la página correspondiente se obtiene de proveedores de noticias y datos fiables. Las noticias del contenido del calendario económico, la fecha y hora del anuncio de la noticia, los posibles cambios en las cifras anteriores, las expectativas y las cifras anunciadas son realizadas por las instituciones proveedoras de datos. Darkex no se hace responsable de los posibles cambios que puedan surgir de situaciones similares.

BRÚJULA DE MERCADO

Fundamental dynamics for digital assets remain supportive. After Trump’s election as president, the fact that he formed his team for Congress with people who could loosen regulations and the news that SEC Chairman Gary Gensler will resign on Enero 20 created the basis for the acceleration of the rise in cryptocurrencies. Increasing institutional investor interest in BTC and ETH through ETFs and the launch of BTC ETF options were among the driving forces. Applications are also coming in for Solana ETFs. In addition, the strategic steps of companies to collect BTC reserves and the related news flows (MicroStrategy, Mara Holdings…) With the acceleration of significant fund inflows from the traditional investment world, Bitcoin has broken price records in a row. Thus, we have seen value gains in cryptocurrencies this week, led by BTC, with occasional respites.

Trump’s possible statements and how his team will be shaped will continue to have an impact on prices in the coming days. On the other hand, it seems that investors do not want to overestimate the rising Ukraine-Russia tensions at the moment. Expectations that the US Federal Reserve (Fed) will cut interest rates in Diciembre remain high, but according to the CME FedWatch Tool, the probability of leaving rates unchanged is not small (56%-44%). In the coming days, besides the Trump effect and geopolitical risks, the Fed and the US economy are likely to be on the agenda a bit more. In this context, we think it will be useful to closely monitor the PMI data to be released today.

Desde el corto plazo hasta el panorama general.

The victory of former President Trump on Noviembre 5, which was one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our forecasts. The continuation of the Fed’s rate cut cycle (albeit with cautious messages from Powell in his last speech…) and the volume in BTC ETFs, indicating an increase in institutional investor interest (in addition, MicroStrategy’s BTC purchases, Microsoft starting to evaluate the purchase issue, BlackRock’s BTC ETF options starting trading…) support our upside forecast for the big picture for now.

In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional respite or pullbacks in digital assets. At this point, it is worth reiterating that fundamental dynamics remain bullish. While Bitcoin, the largest digital currency, extending each of its record highs may continue to whet the appetite of buyers to take new, upside positions, we will watch this group struggle with the masses who may be looking for profit realizations and speculators looking to exploit potential declines after rapid rises. On the BTC front, we can say that buyers are leading the battle for now.

ANÁLISIS TÉCNICO

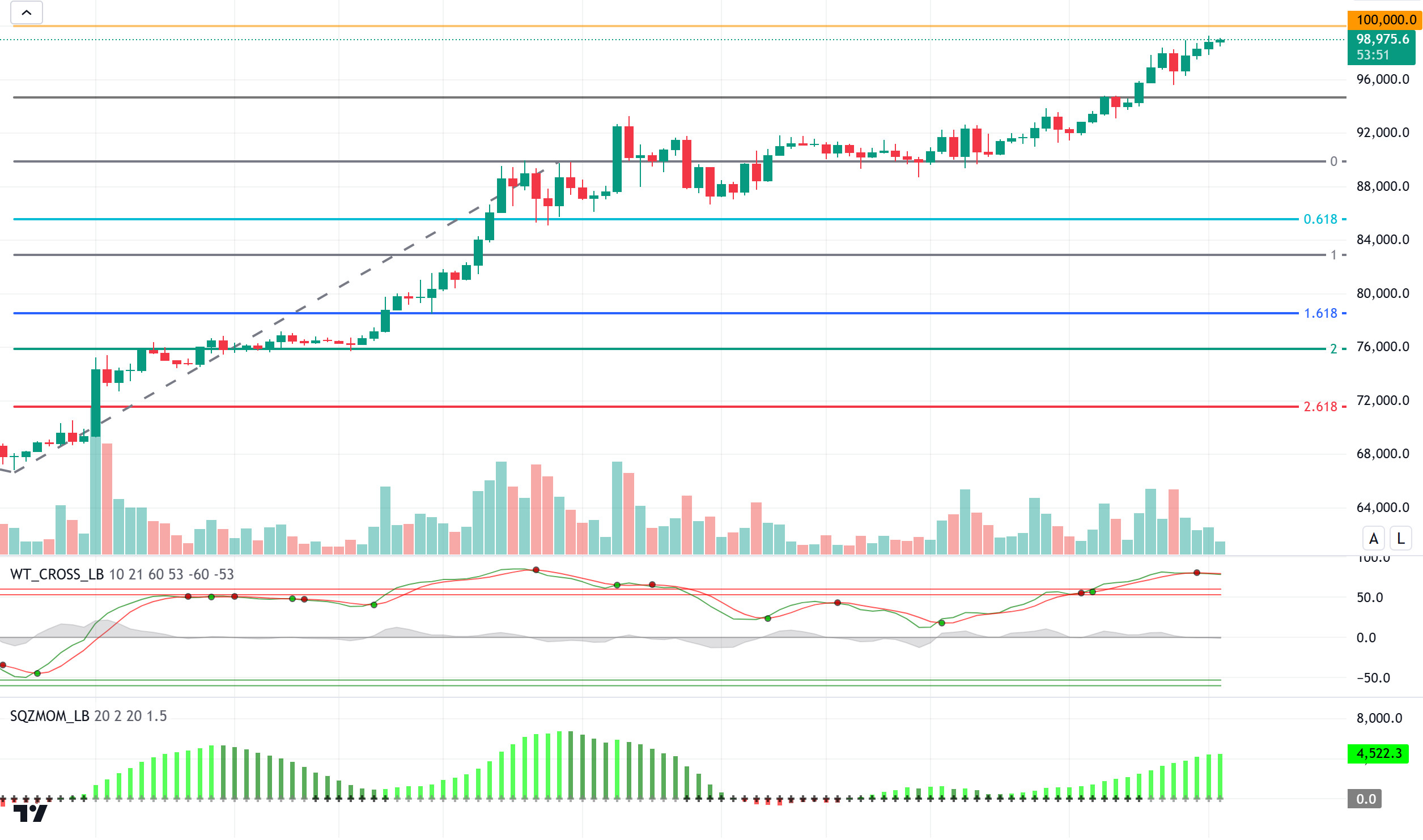

BTC/USDT

The cryptocurrency world is in an intense news flow with one development after another, especially on the Bitcoin side. US Securities and Exchange Commission (SEC) Chairman Gary Gensler’s announcement that he will leave his post on Enero 20, 2025 has created movement in the market. Bitcoin purchases were made from mining company MARA Holdings and artificial intelligence company Genius Group, which are publicly traded companies on the US side. In addition, American financial giant Charles Schwab announced that it will enter the spot cryptocurrency market. With all these developments, Bitcoin spot ETFs recorded a net inflow of 1.005 billion dollars yesterday.

When we look at the technical outlook with the positive atmosphere on the fundamental side, we see that BTC is based on the 100,000 limit, which appears to be a psychological threshold. The 100,000 level is expected to be exceeded in the BTC price, which carries the ATH level to 99,314. Currently priced at 98,800, BTC continues to be priced with fundamental developments. As a matter of fact, the fact that technical oscillators move in the overbought zone along with the RSI confirms this. The Squeeze momentum indicator continues to maintain its strong trend structure since the 67,000 level.

Supports 95,000 – 92,500 – 90,000

Resistances 99,314 – 100,000 – 105,000

ETH/USDT

ETH managed to rise above the 3.353 level again after retesting the 3.256 level after yesterday’s rise. Chaikin Money Flow (CMF) retreated but remains in positive territory. Relative Strength Index (RSI), on the other hand, maintains its positive outlook without any divergence but has started its horizontal movement in the overbought zone. When Cumulative Volume Delta (CVD) is analyzed, spot-weighted purchases continue. In the light of all these data, we can see rises towards 3,534, provided that the 3,353 level is not lost during the day. Loss of the 3,353 level may weaken the momentum and bring a correction to 3,256 levels. Loss of the 3,256 level may cause sharp declines by creating a very bearish structure.

Supports 3,353 – 3,256 – 3,145

Resistances 3,534 – 3,680 – 3,755

XRP/USDT

The European branch of ETF issuer WisdomTree announced a new XRP-based ETP. This product is currently available in four EU countries and this has caused the price of XRP to rise slightly. After breaking the 1.12 intermediate support yesterday, XRP rose rapidly to the 1.23 level and gained this level in the overnight hours and approached the 1.44 resistance. Volume levels have also reached very good levels in the rise that comes with momentum. The positive outlook on the Commodity Channel Index (CCI) indicates that the price may continue to rise with small pullbacks. Especially with the gain of the 1.44 level, the rise may accelerate. A break of the 1.34 level may lead to a re-test of the 1.23 level.

Supports 1.3486 – 1.2382 – 1.0710

Resistances 1.4469 – 1.5517 – 1.7043

SOL/USDT

Manufacturing PMI and services PMI data from the US will be among the data to be monitored today.

Negotiations between the US Securities and Exchange Commission (SEC) and issuers of the Spot Solana (SOL) Exchange Traded Fund (ETF) have made significant progress, Odaily reported. According to a report by Fox reporter Eleanor Terrett on the X platform, two informed sources revealed that the SEC is currently processing S-1 filings related to the ETF. These sources said it is “very likely” that exchange representatives will submit several 19b-4 forms for potential issuers in the coming days, marking the next step in the ETF approval process. Two years after FTX’s scandal, Solana reached an all-time high price. Solana, which fell to almost $ 8 in 2022, reached its highest level above $ 260 for the first time on Jueves.

Solana reached $31 billion in transfer volume and 22 million active addresses, signaling the network’s growth. Open interest in Solana futures increased by 96% to $5.64 billion. This boosted investors’ confidence. The new record of $264.3 reflects an 11% increase in the last 24 hours and a remarkable 160% rise since the beginning of 2024. However, at the time of writing, it is trading at $258, having retreated.

On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). Since Noviembre 4, SOL, which has been in an uptrend, continues to be priced by maintaining this trend. However, when we examine the Chaikin Money Flow (CMF)20 indicator, although money inflows are positive, there is a decline in inflows again. At the same time, Relative Strength Index (RSI)14 is in the overbought zone. This may bring profit sales. The 275.00 level is a very strong resistance point in the uptrend driven by both macroeconomic conditions and innovations in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 222.61 and 193.78 can be triggered again. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 259.13 – 247.53 – 237.53

Resistances 275.00 – 290.00 – 312.46

DOGE/USDT

Manufacturing PMI and services PMI data from the US will be among the data to be monitored today.

Whales continue to hoard the coin. Dogecoin volume in the spot and futures market has increased. Data shows that this volume amounted to over $10 billion in the last 24 hours. On the other hand, investors think there will be a DOGE ETF in 2025, citing Elon Musk’s recent leadership of the Department of Government Efficiency (DOGE).

Technically, Doge continues to consolidate above 0.35 since our analysis yesterday. However, a falling triangle formation seems to have formed. If the formation works, 0.28164 may be the target. On the 4-hour timeframe, the 50 EMA (Blue Line) is above the 200 EMA (Black Line). But the gap between the two averages is still too wide. This may cause pullbacks. At the same time, the Relative Strength Index (RSI)14 has moved from overbought to neutral. However, when we examine the Chaikin Money Flow (CMF)20 indicator, it remains neutral. The 0.42456 level stands out as a very strong resistance point in the rises driven by both macroeconomic conditions and innovations in the Doge coin. If DOGE, which tested here, maintains its momentum and rises above this level, the rise may continue strongly. In case of retracements due to possible macroeconomic reasons or profit sales, the support levels of 0.33668 and 0.28164 can be triggered again. If the price hits these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.36600 – 0.33668 – 0.28164

Resistances 0.42456 – 0.45173 – 0.50954

AVISO LEGAL

La información sobre inversiones, los comentarios y las recomendaciones que figuran en este documento no constituyen asesoramiento en materia de inversiones. Los servicios de asesoramiento en materia de inversión son prestados individualmente por instituciones autorizadas teniendo en cuenta las preferencias de riesgo y rentabilidad de los particulares. Los comentarios y recomendaciones aquí contenidos son de carácter general. Estas recomendaciones pueden no ser adecuadas para su situación financiera y sus preferencias de riesgo y rentabilidad. Por lo tanto, tomar una decisión de inversión basándose únicamente en la información aquí contenida puede no producir resultados acordes con sus expectativas.