RESUMEN DEL MERCADO

Última situación de los criptoactivos

| Activos | Último precio | Change % | Capitalización bursátil. | ||

|---|---|---|---|---|---|

| Weekly | Monthly | Since the Beginning of the Year | |||

| BTC | 94,916.13$ | -1.72% | -3.03% | 0.56% | 1,88 T |

| ETH | 3,306.91$ | -4.06% | -10.50% | -1.41% | 398,32 B |

| XRP | 2.315$ | -4.30% | -0.81% | -0.25% | 133,09 B |

| SOLANA | 192.63$ | -8.78% | -12.93% | -0.65% | 93,18 B |

| DOGE | 0.3366$ | -1.07% | -14.96% | 3.92% | 49,73 B |

| CARDANO | 0.9597$ | -8.71% | -5.07% | 4.78% | 33,80 B |

| TRX | 0.2428$ | -7.40% | -10.97% | -4.89% | 20,93 B |

| AVAX | 37.71$ | -6.88% | -15.90% | -0.15% | 15,51 B |

| ENLACE | 20.36$ | -8.11% | -9.91% | -5.95% | 13,01 B |

| SHIB | 0.00002168$ | -5.27% | -20.99% | 0.17% | 12,78 B |

| DOT | 6.727$ | -10.12% | -21.11% | -4.24% | 10,35 B |

*Table was prepared on 1.10.2025 at 11:30 (UTC). Weekly values are calculated for 7 days based on Viernes.

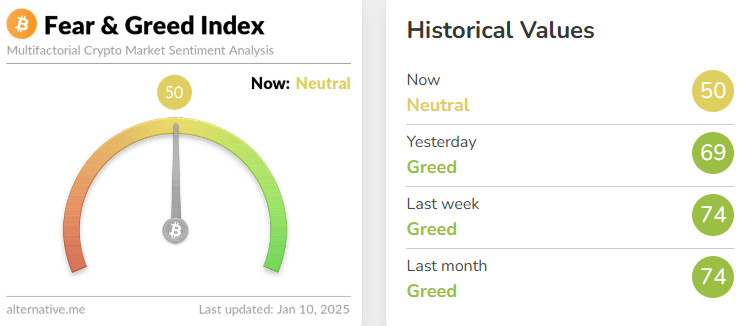

Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: -24

Last Week’s Level: 74

This Week’s Level: 50

This week, the Fear and Greed Index fell from 74 to 50. The approval of the sale of $6.5 billion worth of Bitcoin seized from Silk Road created expectations of significant selling pressure in the markets. The prospect of such a large asset being put on the market weakened investor confidence and had a negative impact on prices.

While the Fed pointed out that inflation risks persist and the pace of interest rate cuts may slow down, this increased uncertainty over digital assets. The SEC Chairman’s statements highlighting the speculative nature of the crypto market triggered regulatory concerns. These developments led to a decline in the Bitcoin price and increased fear in the markets.

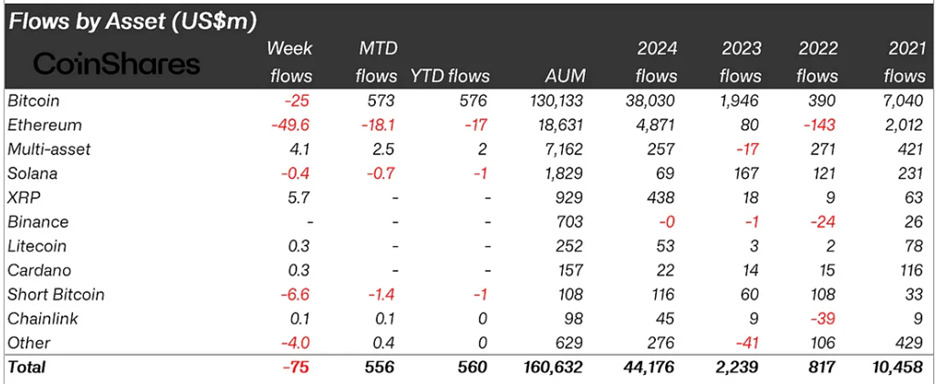

Fund Flow

Source: Coin Shares

” Fund Flow Image to be Added”

Overview: Digital asset investment products saw inflows of $585 million in the first week of this year but saw net outflows totaling $75 million for the full week, which includes the last two trading days of 2024. This shows the low trading volume.

Fund Inputs;

- XRP: $5 million in inflows were seen

- Litecoin (LTC): 3 million $

- Cardano (ADA): $0.3 million saw an entry.

Fund Outflows; In the last week of 2024, bitcoin broke new records and experienced one of the weeks with the most money outflows. In the first week of 2025, this record continues.

- Bitcoin (BTC): – 25 million$ outflows were seen.

- Ethereum (ETH): – outflows reached 49 million $

- Solana (SOL): – Outflows amounting to $0.4 million.

- Assessment: Outflows reached $75 million.

- Other: – $4.0 million outflows.

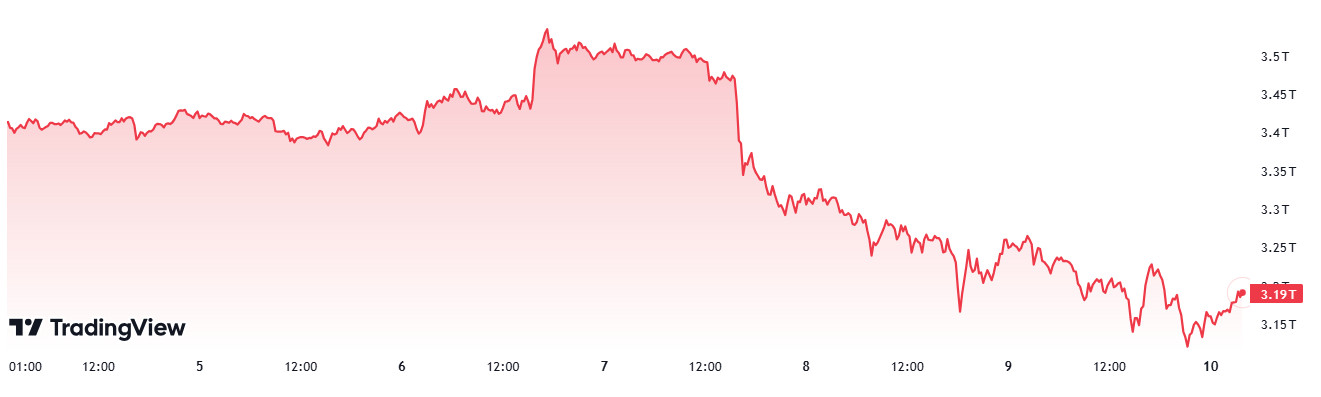

Total MarketCap

Source: Tradingview

“totalmarketcap Image to be Added”

Last Week Market Capitalization : 3.42 Trillion Dollars

Market Capitalization This Week: 3.19 Trillion Dollars

In the cryptocurrency markets, the negative week continues, with a decline of about 6.77% this week after a 6.98% rise last week with an inflow of $ 222.78 billion. It was observed that this week’s decline led to a loss of over 230 billion dollars on Total.

Total 2

It is seen that the previous week closed positively, but this week there was an 8.96% retreat on Total 2, with a loss of $ 132 billion. The deeper decline compared to Total can be taken as an indication that altcoins continue to be dominated by Bitcoin. On the other hand, since $132 billion of the total market loss came out of altcoins, it turns out that about $98 billion of it was lost through Bitcoin. In this case, the altcoin market accounts for 57.39% of the total decline, while Bitcoin accounts for 42.61% of the total decline.

Total 3

When Total 3 is analyzed, similar to Total 2, it closed positive in the previous week and lost $ 83.40 billion in value this week, down 8.09%. Compared to the decline in Total 2, it can be said that 63.18% of it is on Total 3, while 36.82% is due to the Ethereum decline.

According to Total Depreciation, Total, Total 2 and Total 3 data, of this week’s $230 billion market capitalization loss, $98 billion was on Bitcoin, $48.6 billion on Ethereum and $83.40 billion on other altcoins. The breakdown of the market capitalization loss reveals that the long-established Bitcoin continues to dominate the market and that Ethereum’s market performance has lagged behind other altcoins and Bitcoin over the past few weeks.

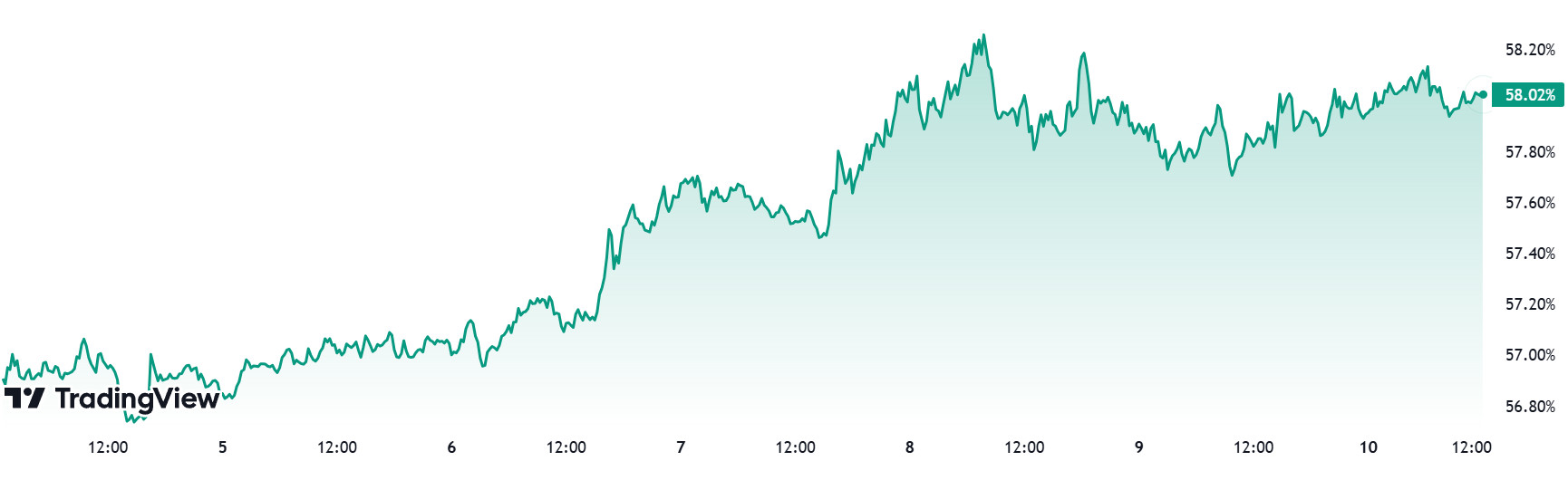

Dominio de Bitcoin

Source: Tradingview

Weekly Change:

Last Week’s Level: 57.02%

This Week’s Level: 58.02%

Bitcoin dominance reached a monthly high of 59.92% in mid-Diciembre. However, it came under pressure from these levels and entered a retracement process, closing at 57.02% in the last week of the month, displaying a negative outlook on a weekly basis. However, as of the new week, it has found support at these levels and started to show a positive trend. The positive trend in the dominance continued throughout the current week and the positive outlook on a weekly basis has not changed.

In this context, Bitcoin dominance closed last week at 57.02% and is moving at 58.02% as of this week.

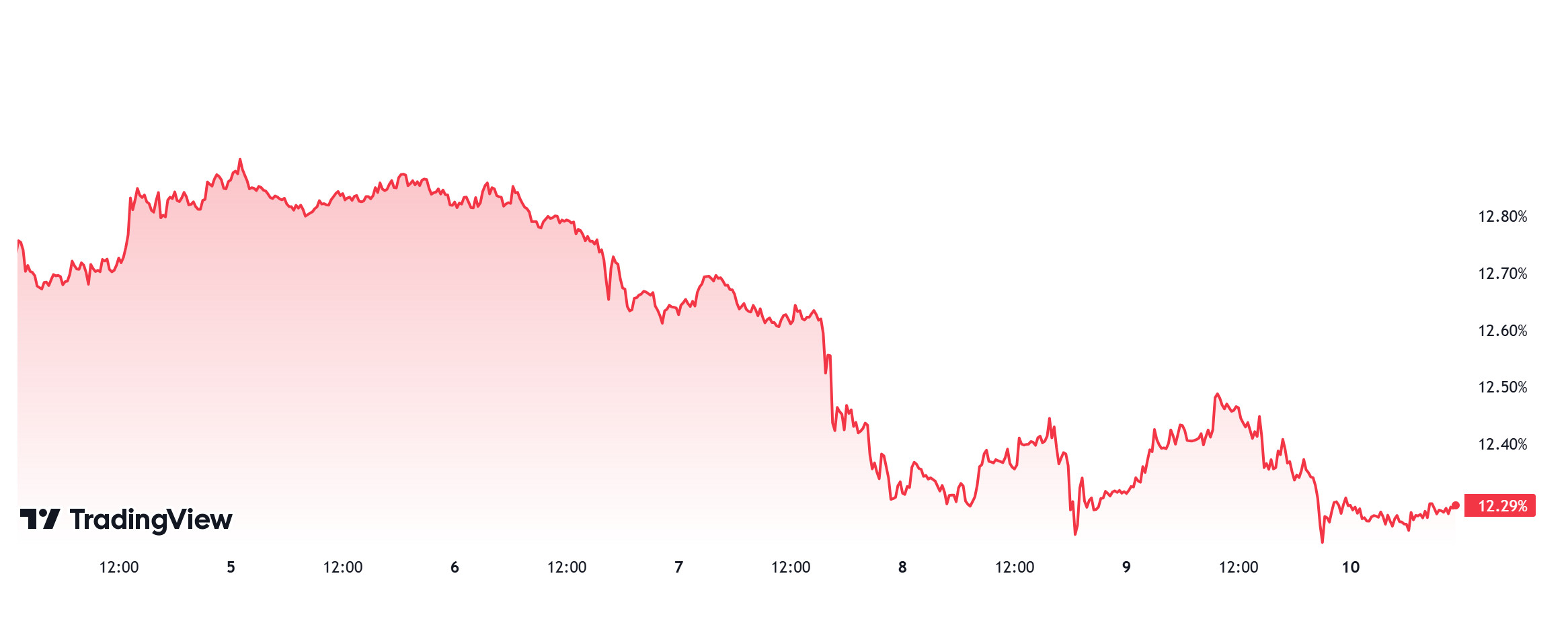

Dominio de Ethereum

Source: Tradingview

Dominio de Ethereum

ETH dominance, which closed last week at 12.82%, entered a downtrend during the week. ETH Dominance is currently at 12.29%.

In the coming week, the producer price index, consumer price index, unemployment claims and retail sales data will be announced on the US side. With the positive evaluation of these data by the market, there may be an increase in ETH dominance after possible decreases in BTC dominance. As a result of this situation, ETH dominance can be expected to rise to 12.5% – 13% levels for the next week.

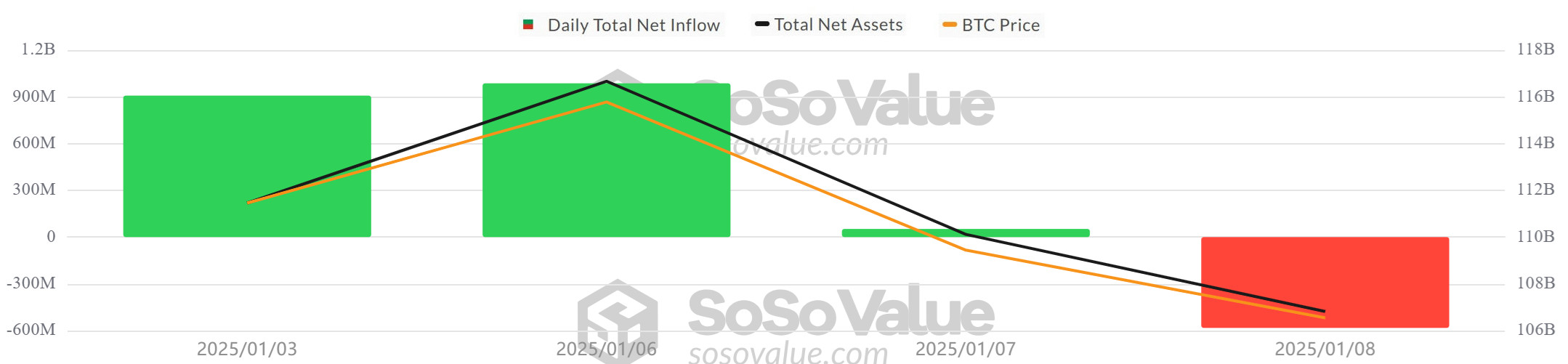

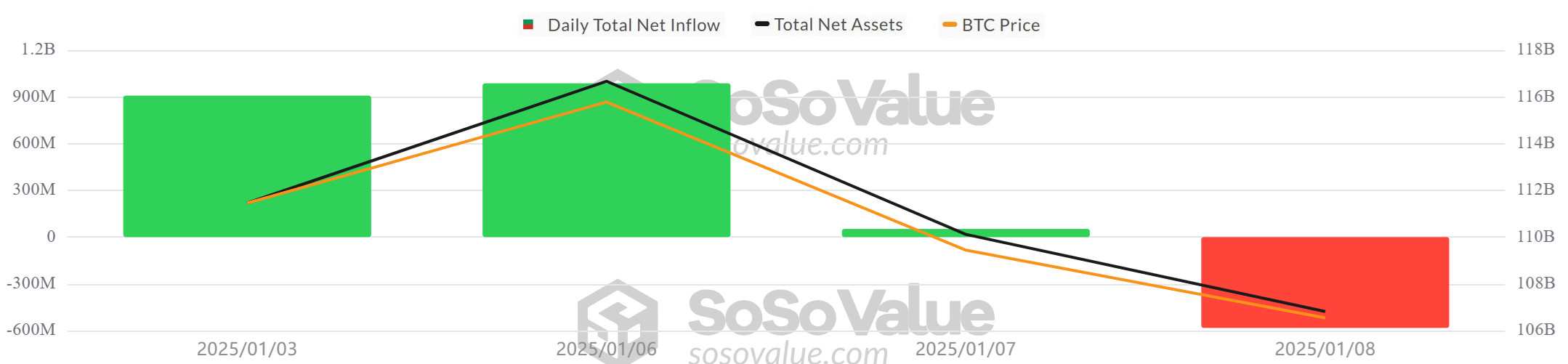

Bitcoin Spot ETF

Source: SosoValue

Featured Developments:

- Net Inflows: Between Enero 03-09, 2025, net inflows totalled $1,370.3 million. Enero 3 ($908.1 million) and Enero 6 ($978.6 million) stood out with net inflows, while Enero 8 (-$568.8 million) stood out with high net outflows. On Enero 3 and Enero 6, ETFs of Fidelity, BlackRock and Ark led the high net inflows. On Enero 7, BlackRock IBIT ETF saw net inflows of $596.1 million, while other ETFs experienced outflows. In particular, outflows from Fidelity and Ark ETFs stood out. On Enero 8, ETFs including BlackRock saw large outflows.

- Bitcoin Price : On Enero 06, the price of Bitcoin surged 3.90% to $102,180, with a total net inflow of $978.6 million into ETFs on the same day. However, over the next two days, the Bitcoin price fell by 5.15% and 1.97% to $95,000. ETFs also saw net outflows during this period.

- Cumulative Net Inflows: Cumulative net inflows into spot Bitcoin ETFs reached $36.37 billion at the end of the 250th trading day.

| DATE | COIN | Price | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 03-Jan-25 | BTC | 96,967 | 98,145 | 1.21% | 908.1 |

| 06-Jan-25 | 98,340 | 102,180 | 3.90% | 978.6 | |

| 07-Jan-25 | 102,180 | 96,920 | -5.15% | 52.4 | |

| 08-Jan-25 | 96,920 | 95,014 | -1.97% | -568.8 | |

| 09-Jan-25 | 95,014 | 92,505 | -2.64% | 0 | |

| Total for 03 – 09 Jan 25 | -4.60% | 1370.3 | |||

Between Enero 03-09, 2025, Bitcoin price fell by 4.60%, while Bitcoin ETFs saw net inflows totaling $1,370.3 million. The highest inflows during this period were recorded by Blackrock IBIT ETF and Fidelity FBTC ETF. The large outflows in spot Bitcoin ETFs on Enero 08 put short-term negative pressure on the market. While the impact of Bitcoin ETFs on the market continues, large net outflows can negatively affect price movements. Investor behavior in spot Bitcoin ETFs fluctuates between short-term profit realization and long-term investment trends. In the future, market-friendly regulations and global economic recovery could lead to more stable and sustainable growth in the ETF market.

Ethereum spot ETF

Source: SosoValue

“ETH ETF – SosoValue Image to be Added”

Ethereum price rose 4.43% to $3,607 on Enero 3 and 1.40% to $3,685 on Enero 6. These increases were supported by inflows into ETFs. However, the Ethereum price fell 6.83% on a weekly basis, with declines of 8.30% on Enero 7, 1.60% on Enero 8 and 3.22% on Enero 9. ETFs also saw outflows during these price declines.

Between Enero 3 and 9, 2025, US Spot Ethereum ETFs recorded a total net outflow of -$58.6 million. On Enero 3 and Enero 6, there were significant net inflows, with BlackRock ETHA ETF leading the way in net inflows on those dates. However, outflows on Enero 7 and Enero 8 were mainly driven by Fidelity FETH ETF; Fidelity recorded a weekly net outflow of -$183.6 million.

| DATE | COIN | Price | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 03-Jan-25 | ETH | 3,454 | 3,607 | 4.43% | 58.9 |

| 06-Jan-25 | 3,634 | 3,685 | 1.40% | 128.7 | |

| 07-Jan-25 | 3,685 | 3,379 | -8.30% | -86.8 | |

| 08-Jan-25 | 3,379 | 3,325 | -1.60% | -159.4 | |

| 09-Jan-25 | 3,325 | 3,218 | -3.22% | 0 | |

| Total for 03 – 10 Jan 25 | -6.83% | -58.6 | |||

During the week of Enero 3-9, 2025, the price of Ethereum fell by 6.83%, resulting in net outflows of -$58.6 million from Spot Ethereum ETFs. While the BlackRock ETHA ETF provided strong inflows in the early days of the week, outflows, particularly on Enero 7-8, were dominated by the Fidelity FETH ETF and negatively impacted weekly net flows. These developments show that Ethereum price and ETF flows are sensitive to investor sentiment and profit realization. Despite weekly net outflows, cumulative net inflows at the end of the 118th trading day were $2.52 billion, suggesting that while long-term institutional interest in Ethereum remains, price volatility and uncertainty may continue to pose risks in the short term.

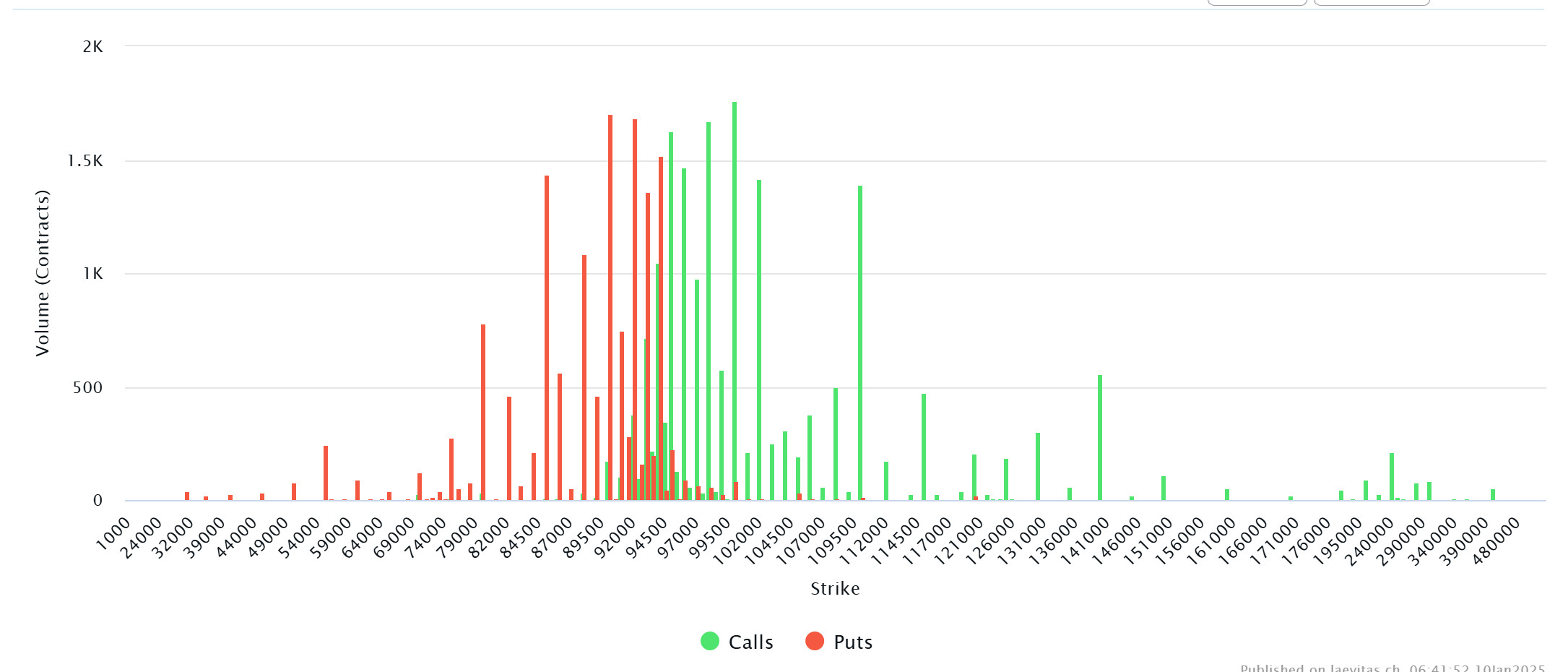

Bitcoin Options Breakdown

Source: Laevitas

Deribit Data: BTC options contracts with a notional value of approximately US$1.783 billion will expire today. On the other hand, on Enero 6, a trader made a $6 million attempt on Deribit last Sábado to buy a $100,000 Bitcoin call option that expires on Marzo 28.

Laevitas Data: When we analyze the chart, if we look at it from a broad perspective, it is seen that approximately put options are concentrated in the 85,000 – 95,000 level band. Call options are concentrated at the level of 95,000 – 105,000. At the same time, resistance has formed at around $ 94,000. On the other hand, it is seen that call options peaked at $ 100,000 and there is a general decline in volume after this level. On the other hand, the prices of call options at $110,000 and $140,000 have intensified. This suggests that there could be a new upward momentum in options activity. At the same time, options market data shows that traders are optimistic that Bitcoin will rise above $120,000. In short, the Bitcoin options market is showing new optimism ahead of Trump’s inauguration.

Option Expiration

Put/Call Ratio and Maximum Pain Point: In the last 7 days of data from Deribit, the number of call options increased by 245% to 100.93K compared to last week. In contrast, the number of put options increased by 216% to 61.84K. The put/call ratio for options was set at 0.71. A put/call ratio of 0.71 indicates a strong preference for call options over puts among investors and a possible uptrend in markets. Bitcoin’s maximum pain point is set at $97,000.

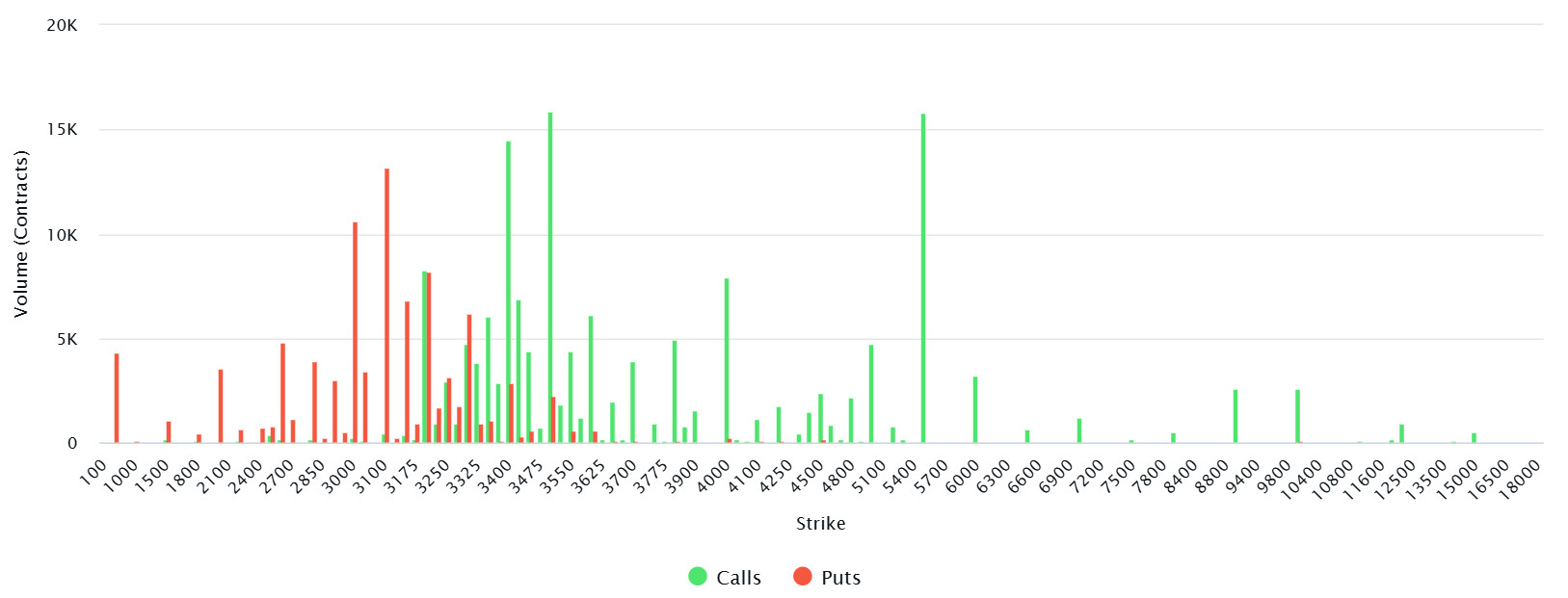

Ethereum Options Distribution

Source: Laevitas

Analysing the chart, there is a noticeable increase in volume for call options between $3000 and $3500. This suggests that market participants are seriously expecting the price to rise. The fact that there is a heavy volume of call options, especially at the $3400 level, seems to strengthen the possibility that the price may move towards these levels.

On the other hand, there is a significant volume of put options at the $3000 level. This suggests that investors are trying to protect themselves against a possible price decline. However, the fact that put volume is generally lower than call options suggests that the market is predominantly bullish.

Maximum Pain Point: $3,500.

Put/Call Ratio: 0.50, indicating that most of the investors in the market have a strong expectation that the price will rise. However, it should be kept in mind that such an intense bullish expectation means that the market has become overly optimistic and carries the risk of a possible correction.

LO QUE QUEDA ATRÁS

Do Kwon Denies Money Laundering Charges: Terraform Labs founder pleads not guilty to charges in US court.

T3 Financial Crimes Unit Freezes 100 Million USDT in Tron: Illegal transactions on the Tron network were intervened.

MetaPlanet Plans to Hold 10,000 BTC by 2025: The Japanese company aims to become one of the world’s largest Bitcoin investors.

Uniswap V4 Release Postponed: The new version has been postponed to 2025.

USDC Treasury Mint 55.23 Million USDC on the Ethereum Chain: 55.23 million USDC has been added to the Ethereum network.

Artificial Superintelligence Alliance Burns 5 Million FET Tokens: The ASI Alliance burned tokens to create a deflationary effect.

Pump.fun Becomes the Leader of the Meme Coin Ecosystem on Solana: Reached 70% share of meme coin issuance on the Solana network.

Ripple and Chainlink Collaborate for RLUSD Utilization: Collaboration to increase the use of the RLUSD stablecoin in DeFi projects.

Backpack Exchange Acquires FTX EU: Backpack Exchange has acquired the European arm of FTX.

South Korea lifts ban on institutional crypto trading: Institutional investors are allowed to trade crypto.

MiCA Regulations Could Create Opportunities in the European Crypto Market: New regulations could boost crypto investments.

President of the Czech National Bank Considers Bitcoin Reserve Strategy: The bank is planning to include Bitcoin in its reserve strategy.

Bitcoin Trading Volume Reaches $19 Trillion in 2024: The Bitcoin network has reversed its downtrend.

MicroStrategy Purchased Another 1,070 Bitcoins: The company’s total Bitcoin holdings reached 447,470.

Fed Governor Waller Supports Rate Cuts: Expectations for a rate cut were voiced.

Fed Renews Rotating Voting Committee in 2025: Updating the composition of FOMC members.

Michael Saylor Hints at Bitcoin Buying: He signaled that MicroStrategy could increase its Bitcoin holdings.

Michael Saylor Open to Crypto Advisor in the Trump Administration: He announced that he is considering becoming an advisor in the Trump administration.

Trump Aides Working on Global Tariff Plan: A tariff for imports is being prepared.

Trump Considers Declaring an Economic Emergency: Emergency planned for import management.

Elon Musk Endorses Canadian Prime Ministerial Candidate Poilievre: Musk praised Poilievre’s statements on inflation.

Ripple CEO Shares Photo with Trump: Ripple CEO shared a photo of himself with Trump during dinner.

China Plans Blockchain-Based National Data Infrastructure: By 2029, a national data infrastructure will be created.

Fed Audit Chairman Michael Barr Resigns: Barr, known for his anti-crypto policies, resigned.

HIGHLIGHTS OF THE WEEK

The past week was a bad one for digital assets. On Enero 20, as Donald Trump prepares to take his place in the White House, the stress caused by the trade tariffs that are expected to be imposed after his inauguration and the expectations that the US Federal Reserve (FED) will slow down the pace of interest rate cuts have negatively affected the appetite for risk-taking. This, in turn, put pressure on cryptocurrencies, which have posted significant gains in recent months.

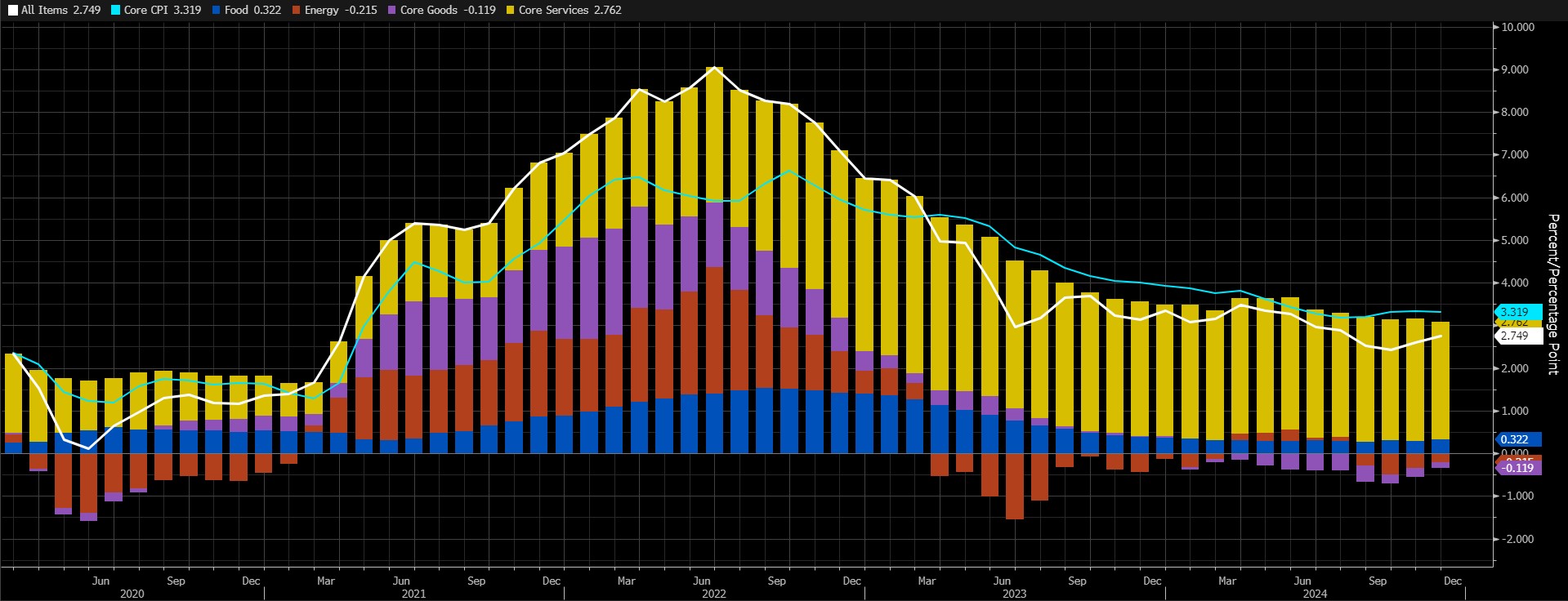

It seems that the tightness of financial conditions in the early part of the new year will continue to have an impact on asset prices. In this context, US macro indicators will continue to shape expectations regarding the FED’s course. In this context, we can say that the prominent headlines of next week will be the data to be announced for the world’s largest economy. Among these, inflation will be noteworthy.

Is inflation at a level that the FED can ignore?

Following the employment data, the US Consumer Price Index (CPI) data to be released next week will be under the spotlight of global markets. In recent months, inflation in the US is no longer slowing down. The annual headline CPI was 2.4% in Septiembre, 2.6% in Octubre and 2.7% in Noviembre. Perhaps this was the biggest factor that prompted the Fed, after the strong rate cuts, to make smaller cuts and then to stop the cycle of rate cuts for the time being.

Source: Bloomberg

Diciembre’s inflation reading will be a key data point that will shape expectations for the FED and could have an impact on pricing behavior ahead of the first Federal Open Market Committee (FOMC) meeting of the year, which ends on Enero 29. A higher-than-expected CPI could reinforce the perception that the FED may have to wait longer without a rate cut, leading to a rise in the dollar and a decline in digital assets. In the opposite case, risk appetite may increase and we may see rises in cryptocurrencies as the first effect of the data.

DEPARTAMENTO DE INVESTIGACIÓN DARKEX ESTUDIOS EN CURSO

Informe mensual de estrategia de Darkex - Enero

Bitcoin Reserve Sounds Rising in the European Union

Ripple’s SEC Case and the Future of XRP

Innovative Applications of Blockchain Technology in Healthcare

Bitcoin Reserve Sounds Rising in the European Union

Haga clic aquí para consultar el resto de nuestros informes Market Pulse.

DATOS IMPORTANTES DEL CALENDARIO ECONÓMICO

Haga clic aquí para ver el calendario semanal de criptomonedas y economía de Darkex.

INFORMACIÓN:

*El calendario se basa en el huso horario UTC (Tiempo Universal Coordinado). El contenido del calendario en la página correspondiente se obtiene de proveedores de datos fiables. Las noticias en el contenido del calendario, la fecha y hora del anuncio de la noticia, los posibles cambios en las cifras anteriores, las expectativas y las cifras anunciadas son realizadas por las instituciones proveedoras de datos.

Darkex no se hace responsable de posibles cambios derivados de situaciones similares. También puede consultar la página del calendario Darkex o la sección del calendario económico en los informes diarios para conocer los posibles cambios en el contenido y el calendario de publicación de datos.

AVISO LEGAL

La información sobre inversiones, los comentarios y las recomendaciones que figuran en este documento no constituyen servicios de asesoramiento en materia de inversiones. Los servicios de asesoramiento en materia de inversión son prestados por instituciones autorizadas con carácter personal, teniendo en cuenta las preferencias de riesgo y rentabilidad de los particulares. Los comentarios y recomendaciones contenidos en este documento son de tipo general. Estas recomendaciones pueden no ser adecuadas para su situación financiera y sus preferencias de riesgo y rentabilidad. Por lo tanto, tomar una decisión de inversión basándose únicamente en la información contenida en este documento puede no dar lugar a resultados acordes con sus expectativas.