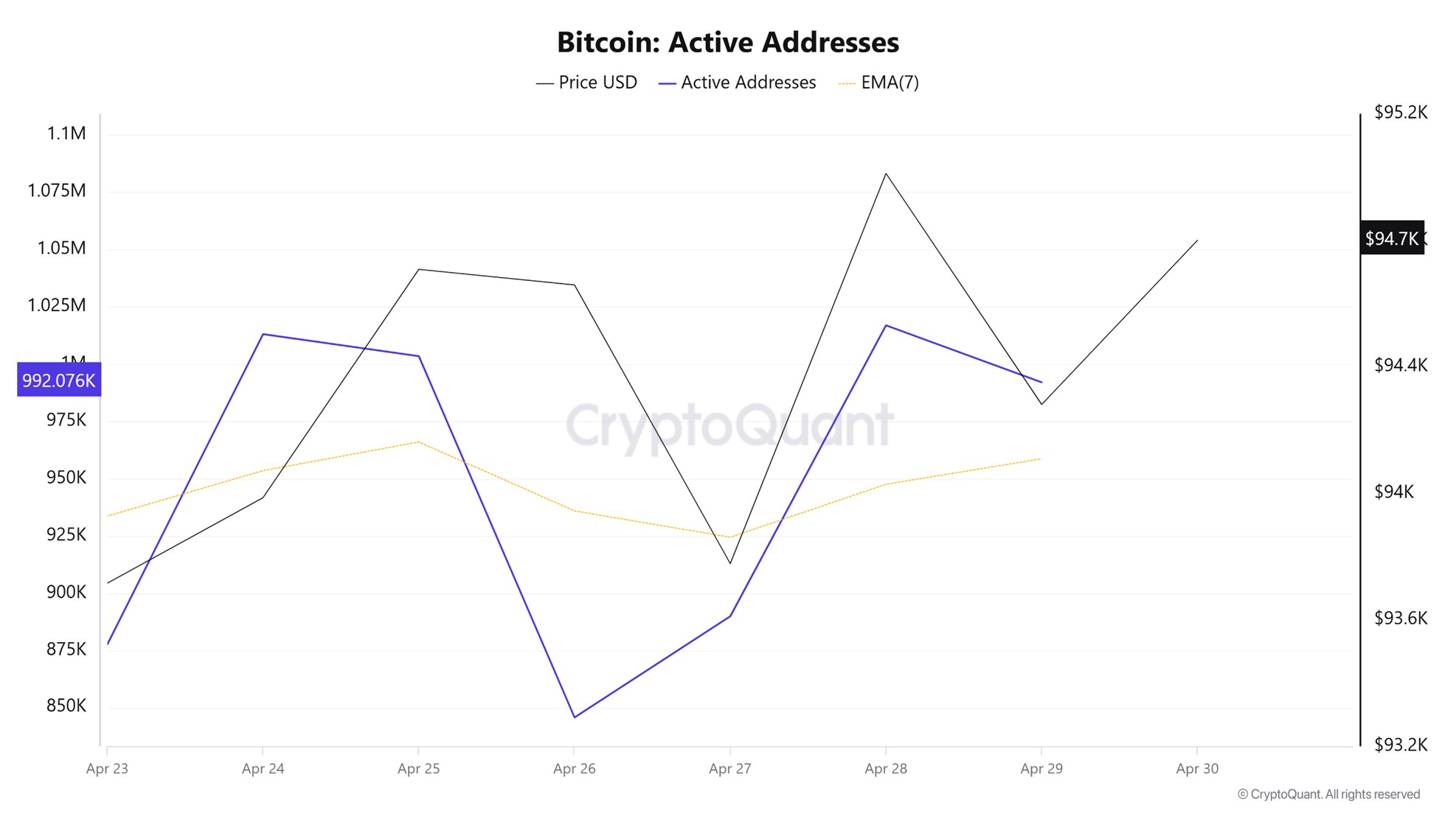

Active Adresses

In terms of active addresses, there were 1,016,940 active entries el the BTC network this week between April 23 and April 30, 2025. During this period, Bitcoin rose to $95,011. In the region marked el the chart, where the price and the number of active addresses intersect, we see that Bitcoin purchases have changed direction. When we follow the 7-day simple moving average, it is observed that the price follows an upward trend el the dates when this average cuts the price. This situation indicates that the Bitcoin price is experiencing entries at $93,000 levels.

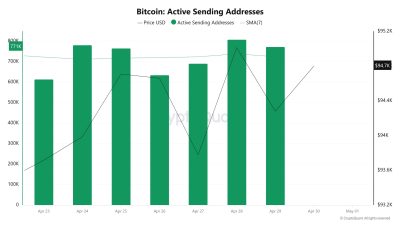

Active Sending Addresses

With the Black Line (price line) en active shipping addresses, there has been a significant drop en active shipping addresses after April 26. On the day when the price hit its lowest point, active sending addresses rose as high as 634,644 indicating that buyers sold their positions as Bitcoin stayed around the $94,000 level for a while. As a result, it is seen that price drops cause an acceleration en sending addresses.

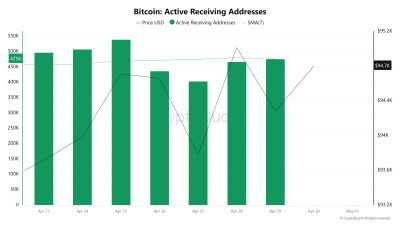

Active Receiving Addresses

With the Black Line (price line) en active shipping addresses, there has been a significant rise en active shipping addresses after April 28. On the day of the price high point, active shipping addresses fell as low as 403,217 indicating that buyers took their positions at Bitcoin’s $93,000 levels.

Breakdowns

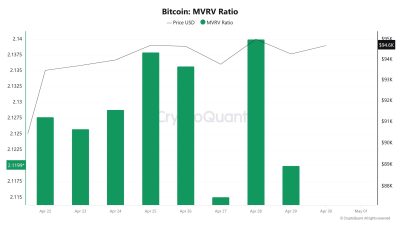

MRVR

On April 23rd, Bitcoin price was 93,715 while MVRV Ratio was 2.12. As of April 29, the Bitcoin price was 94,280, while the MVRV Ratio was 2.11. Compared to last week, Bitcoin price increased por 0.60% while MVRV Ratio decreased por 0.47%.

On April 23rd, Bitcoin price was 93,715 while MVRV Ratio was 2.12. As of April 29, the Bitcoin price was 94,280, while the MVRV Ratio was 2.11. Compared to last week, Bitcoin price increased por 0.60% while MVRV Ratio decreased por 0.47%.

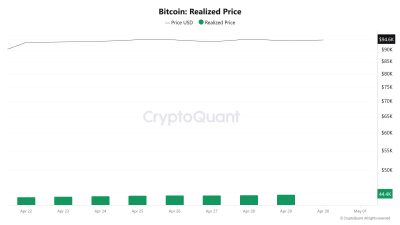

Realized Price

On April 23rd, Bitcoin price was 93,715 while Realized Price was 44,084. As of April 29, the Bitcoin price was 94,280 while the Realized Price was 44,472. Compared to last week, there was a 0.6% increase en Bitcoin price and a 0.88% increase en Realized Price.

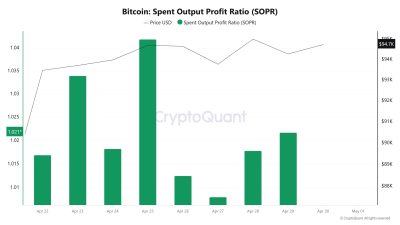

Spent Output Profit Ratio (SOPR)

On April 23, the Bitcoin price was at 93,715 while the SOPR metric was at 1,033. As of April 29, the Bitcoin price rose to 94,280 while the SOPR metric fell to 1,021. Compared to last week, Bitcoin price increased por 0.6% while the SOPR metric decreased por 1.16%.

Derivatives

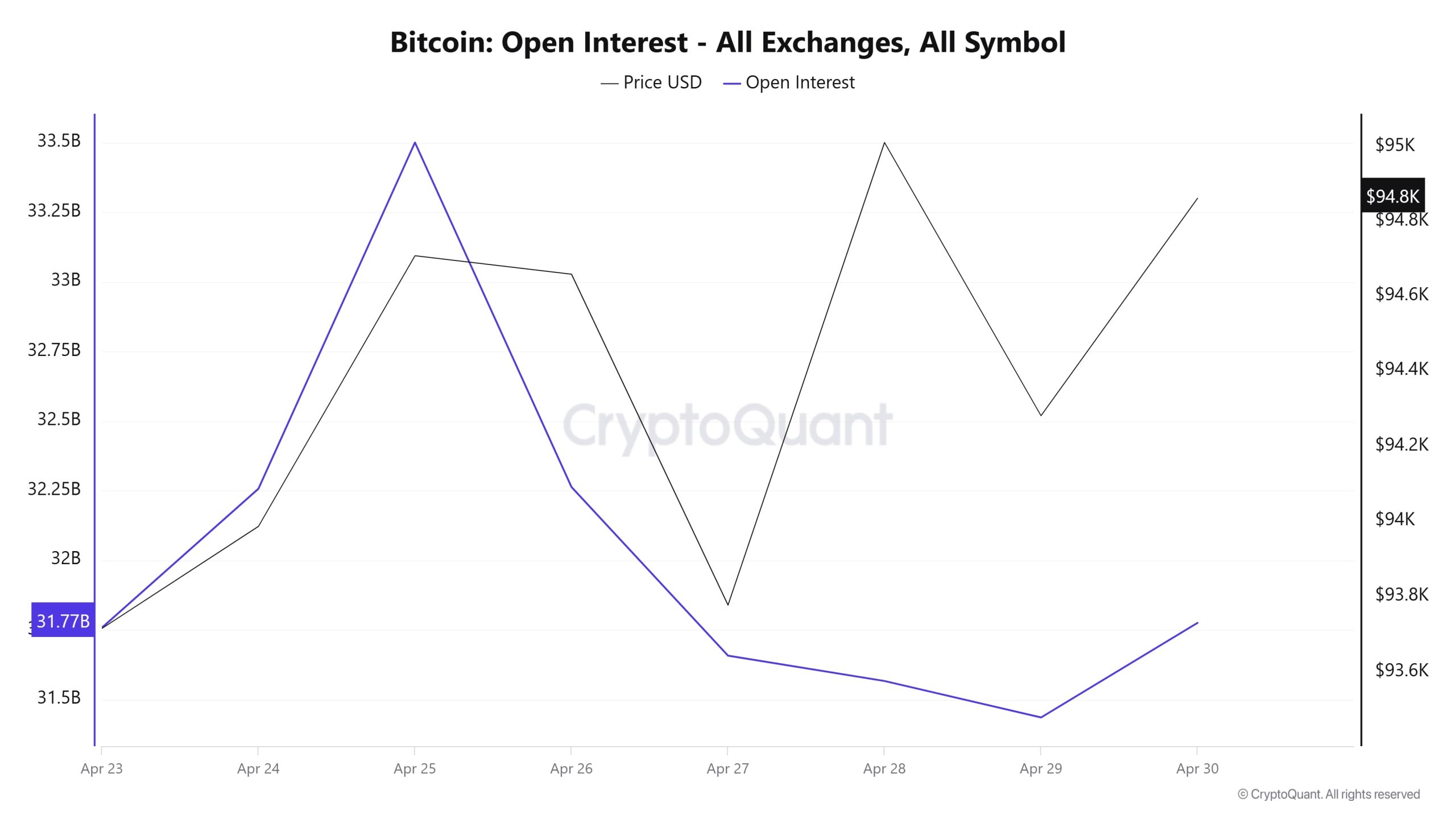

Open Interest

At the beginning of the week, el April 23, open interest was at $31.77 billion while the price hovered around $93,600. By April 25, both open interest and price increased, with open interest reaching a weekly high of $33.5 billion, while the price seems to have accompanied this rise. This parallel movement indicates that long positions intensified en the market and the increased participation supported the price. However, as of April 26, both price and open interest declined rapidly. This sharp decline, especially en open interest, indicates that long positions have been largely closed or liquidations have taken place. This, en turn, seems to have put downward pressure el the price. On April 27, although the price made a short-lived bounce, the downward trend en open interest continued, suggesting that the market was rising el spot weighted buying and selling el the futures side. By April 29, open interest fell to a weekly low of $31.4 billion. At this point, although the price showed a temporary rebound, the low open interest level indicates weak participation en the market. Finally, el April 30th, both price and open interest show a limited recovery trend and the futures side also seems to be gaining weight.

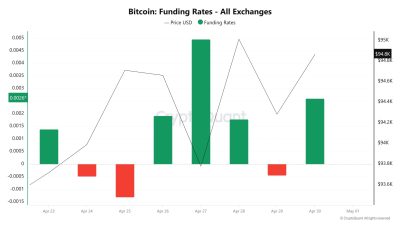

Funding Rate

Last week, the Bitcoin futures market saw remarkable fluctuations en funding rates. On the first day of the week, the funding ratio was positive, indicating that long positions were gaining weight. However, the ratio turned negative el April 24 and 25; especially the significant negative ratio el April 25 revealed that short positions increased significantly and the market entered a downward expectation. From April 26 onwards, funding ratios turned positive again, reaching their highest level of the week el April 27, indicating that the market was overly long. This high level of long positioning usually signals that the market is overheating and a possible correction is imminent. As a matter of fact, there was a sharp pullback el the price side el the same day. In the following days, the funding ratio remained positive, but price action was limited, suggesting that upward momentum was weak despite the long positions. On April 29, the funding rate turned negative again while the price declined, indicating that the cautious stance en the market continued. On April 30, the funding rate turned positive again and the price reacted upwards. This simultaneous rise suggests that buyers have re-engaged en the short term.

Long & Short Liquidations

As BTC moved sideways en a relatively narrow range this week, long and short liquidation rates remained low compared to previous weeks. 234 million dollars of long and 256 million dollars of short transactions were liquidated.

| Date | Long Amount (Million $) | Short Amount (Million $) |

|---|---|---|

| April 23 | 50.35 | 105.79 |

| April 24 | 66.24 | 22.72 |

| April 25 | 19.29 | 56.07 |

| April 26 | 7.20 | 9.12 |

| April 27 | 13.99 | 7.42 |

| April 28 | 53.90 | 33.39 |

| April 29 | 23.82 | 22.11 |

| Total | 234.79 | 256.62 |

Supply Distribution

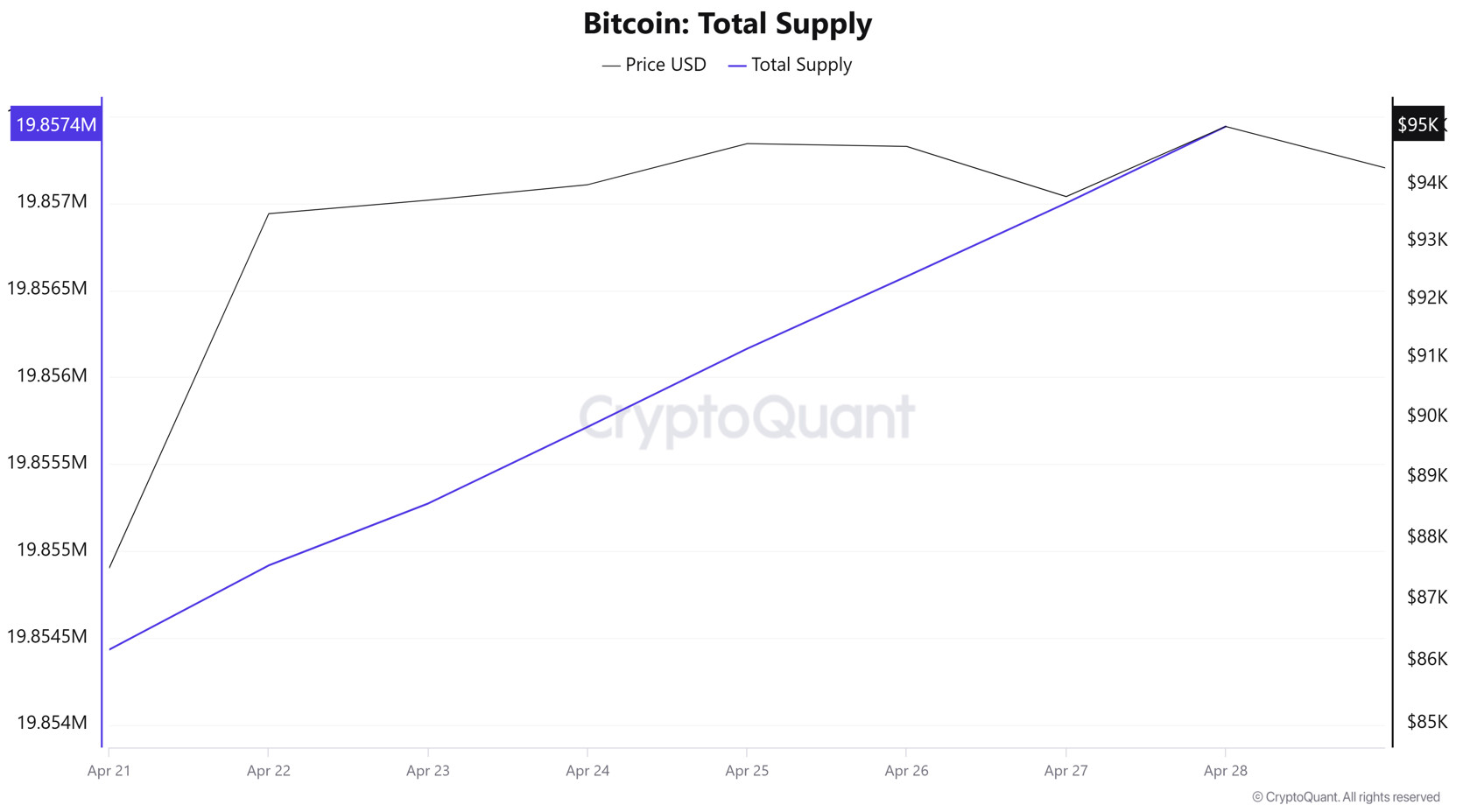

Total Supply: It reached 19,854,433 units, up about 0.01515% from last week.

New Supply: The amount of BTC produced this week was 3,009.

Velocity: Velocity, which was 13.03 last week, was 13.02 as of April 28.

| Wallet Categoría | 21.04.2025 | 28.04.2025 | Change (%) |

|---|---|---|---|

| < 1 BTC | 8.5442% | 8.5392% | -0.0585% |

| 1 – 10 BTC | 11.7060% | 11.6663% | -0.3394% |

| 10 – 100 BTC | 24.7852% | 24.7460% | -0.1585% |

| 100 – 1k BTC | 28.2169% | 28.4193% | 0.7177% |

| 1k – 10k BTC | 18.2797% | 18.2761% | -0.0197% |

| 10k+ BTC | 8.4675% | 8.3528% | -1.3568% |

Looking at the wallet distribution of the current supply, a limited decrease of 0.0585% was observed en the < 1 BTC category, while holders of 1 – 10 BTC experienced a similarly limited decrease of 0.3394%. The 10 – 100 BTC range showed a slight decline of 0.1585%, while the 100 – 1K BTC segment showed a significant increase of 0.7177%. While 1K – 10K BTC holders experienced a flat decrease of 0.0197%, the most notable change occurred en the 10K+ BTC category, with a strong decrease of 1.3568% en this segment.

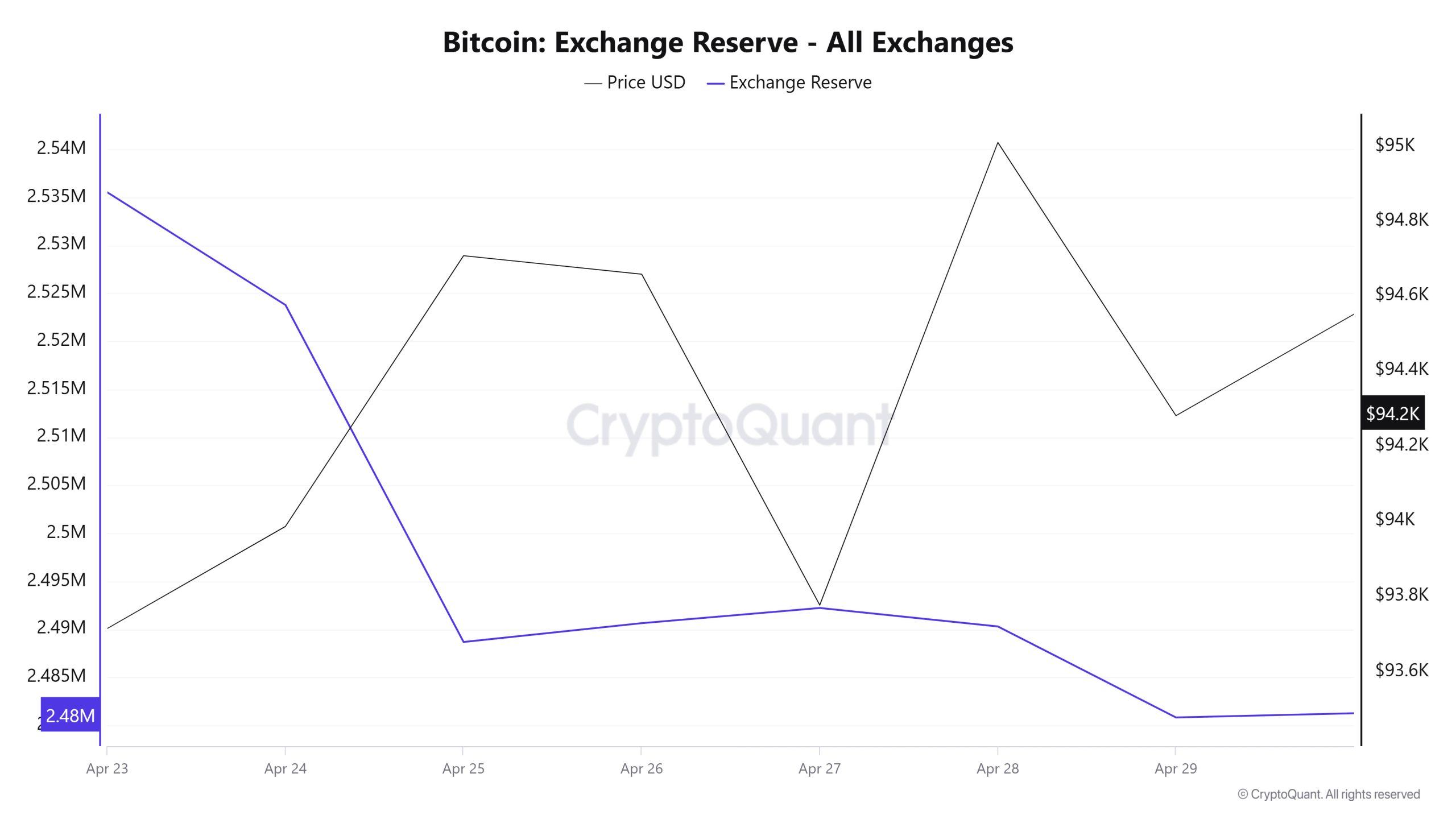

Exchange Reserve

Between April 23-29, 2025, Bitcoin reserves el exchanges decreased from 2,535,533 BTC to 2,480,838 BTC. In total, there was a net outflow of 54,695 BTC during this period, and exchanges’ Bitcoin reserves decreased por 2.16%. The Bitcoin price increased por approximately 0.6% over the same period. Bitcoin, which closed at $93,715 el April 23, 2025, closed at $94,281 el April 29, 2025. The significant decline en reserves el exchanges indicates that investors are increasing their long-term custody tendency and selling pressure is decreasing. These outflows el crypto exchanges may put upward pressure el the Bitcoin price por causing supply to shrink.

| Date | 23-Apr | 24-Apr | 25-Apr | 26-Apr | 27-Apr | 28-Apr | 29-Apr |

|---|---|---|---|---|---|---|---|

| Exchange Inflow | 45,087 | 49,627 | 57,142 | 15,611 | 13,106 | 35,160 | 48,186 |

| Exchange Outflow | 50,275 | 61,359 | 92,244 | 13,648 | 11,532 | 37,079 | 57,666 |

| Exchange Netflow | -5,188 | -11,732 | -35,102 | 1,963 | 1,575 | -1,919 | -9,480 |

| Exchange Reserve | 2,535,533 | 2,523,801 | 2,488,699 | 2,490,662 | 2,492,237 | 2,490,319 | 2,480,838 |

| BTC Price | 93,715 | 93,986 | 94,708 | 94,659 | 93,777 | 95,011 | 94,281 |

Fees and Revenues

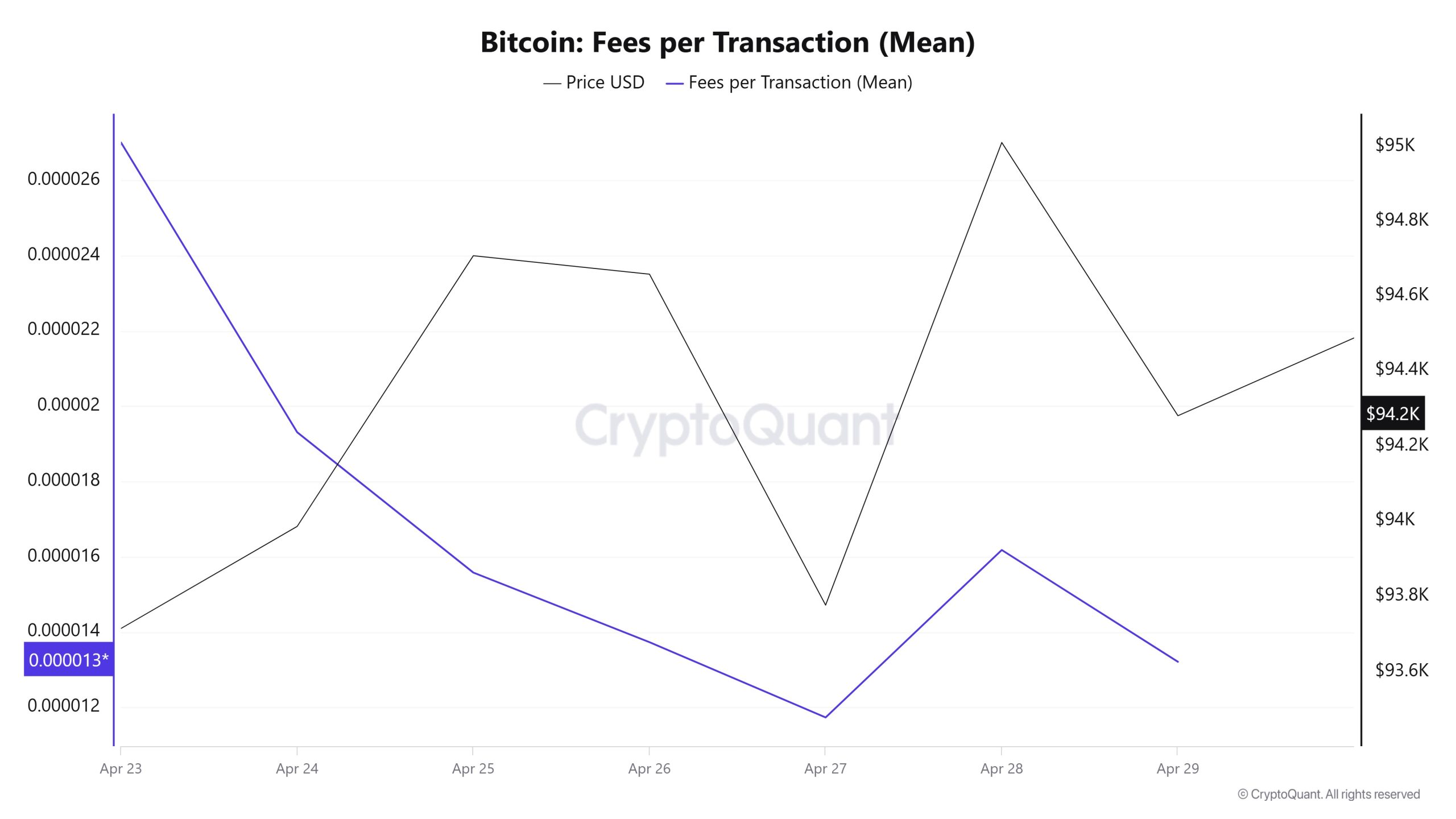

Analyzing the Bitcoin Fees per Transaction (Mean) data between April 23 and 29, it was observed that this value was at 0.00002701 el April 23, the first day of the weekly period. The value, which followed a decreasing trend until April 27 with the effect of the horizontal course seen en the Bitcoin price, decreased to 0.00001173 el this date and recorded its lowest value el a weekly basis.

After April 27, Bitcoin Fees per Transaction (Mean) value, which entered an upward trend with the movements observed en Bitcoin price, closed at 0.00001321 el April 29, the last day of the weekly period, with a slight increase.

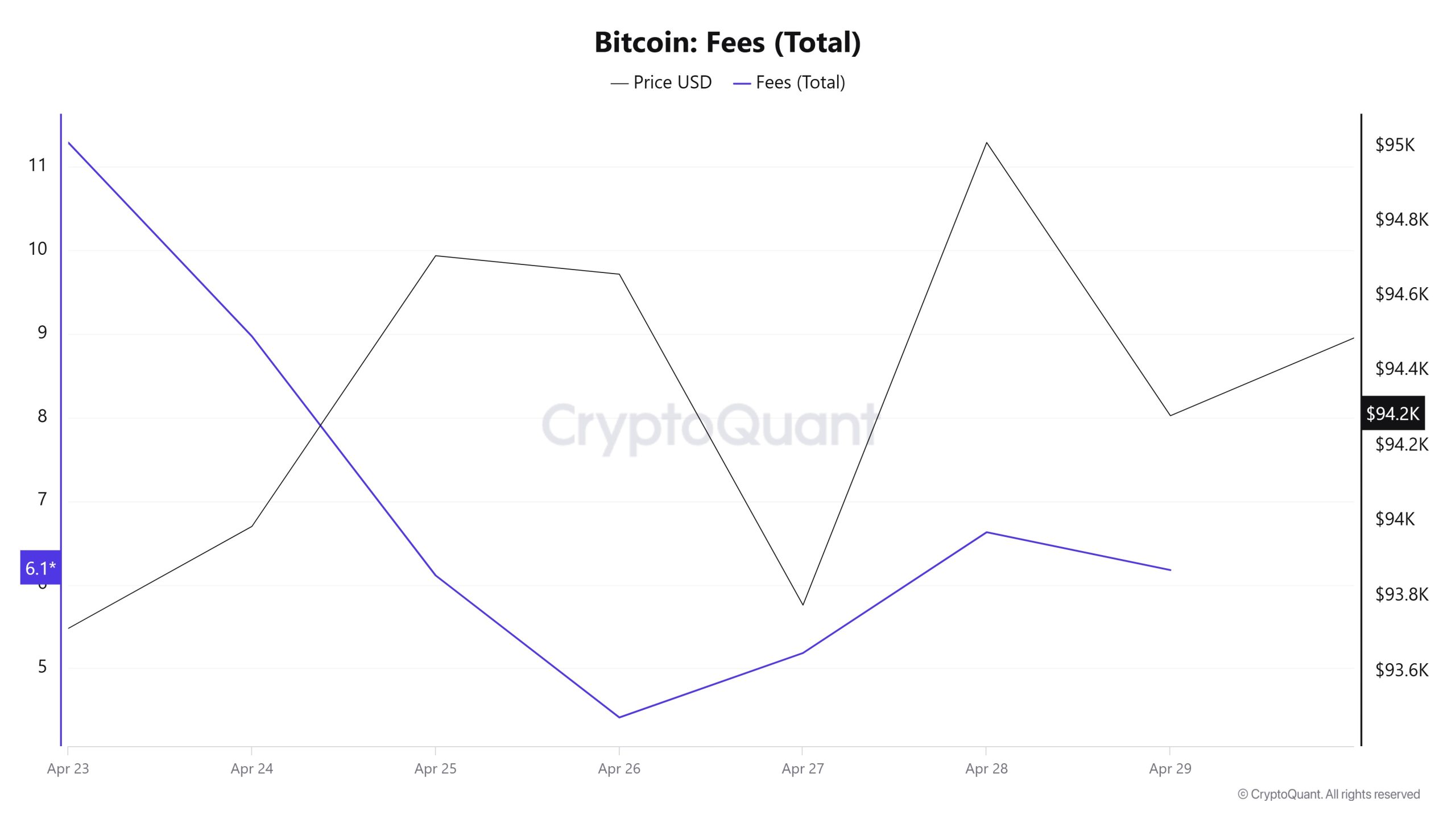

Bitcoin: Fees (Total)

Similarly, when the Bitcoin Fees (Total) data between April 23 and 29 are analyzed, it is seen that this value was at 11.29144978 el April 23, the first day of the weekly period. The value, which followed a decreasing trend until April 26 with the effect of the horizontal course seen en the Bitcoin price, decreased to 4.411245459 el this date and recorded its lowest value el a weekly basis.

After April 26, Bitcoin Fees per Transaction (Mean) value, which entered an upward trend with the movements observed en Bitcoin price after April 26, rose slightly el April 29, the last day of the weekly period, and closed at 6.17471382.

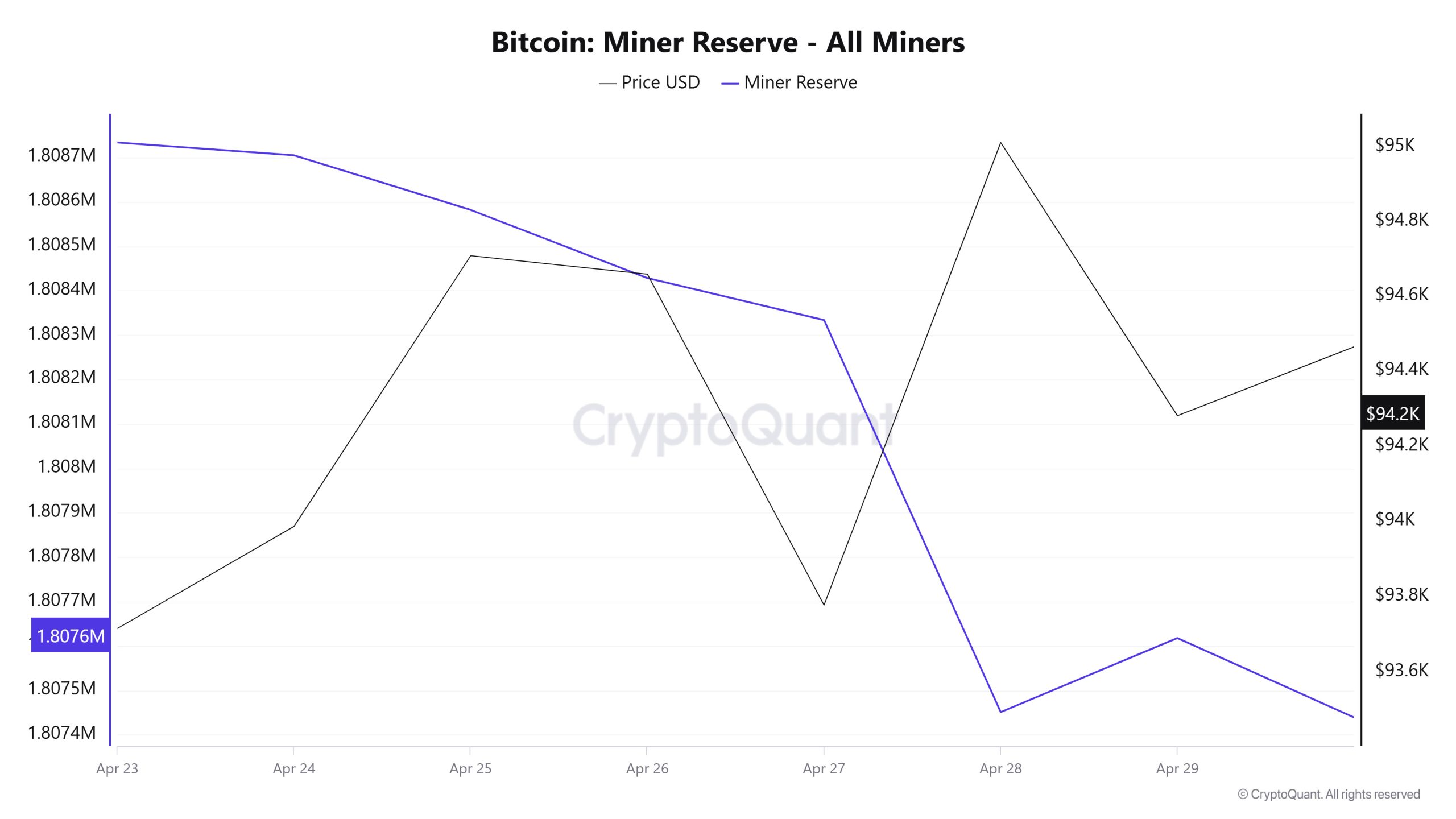

Miner Flows

As seen en the Miner Reserve table, the number of Bitcoins en miners’ wallets decreased this week. There is a negative correlation between Miner Reserve and Bitcoin price throughout the week.

Miner Inflow, Outflow and Netflow

Between April 23 and April 29, 43,892 Bitcoins were outflowed from miners’ wallets and 42,823 Bitcoins were inflowed into miners’ wallets between the same dates. The Miner Netflow for this week was -1069 Bitcoin. Meanwhile, the Bitcoin price was $93,715 el April 23 and $94,280 el April 29.

For the week, the net flow (Miner Netflow) was negative as Bitcoin inflow into miner wallets (Miner Inflow) was less than Bitcoin outflow from miner wallets (Miner Outflow).

| April 23 | April 24 | April 25 | April 26 | April 27 | April 28 | April 29 | |

|---|---|---|---|---|---|---|---|

| Miner Inflow | 6524.13 | 6981.57 | 8270.10 | 4839.23 | 4341.41 | 6207.11 | 5659.63 |

| Miner Outflow | 6478.15 | 7010.31 | 8393.14 | 4992.57 | 4436.02 | 7089.54 | 5493.06 |

| Miner Netflow | 45.98 | -28.74 | -123.04 | -153.34 | -94.61 | -882.44 | 166.57 |

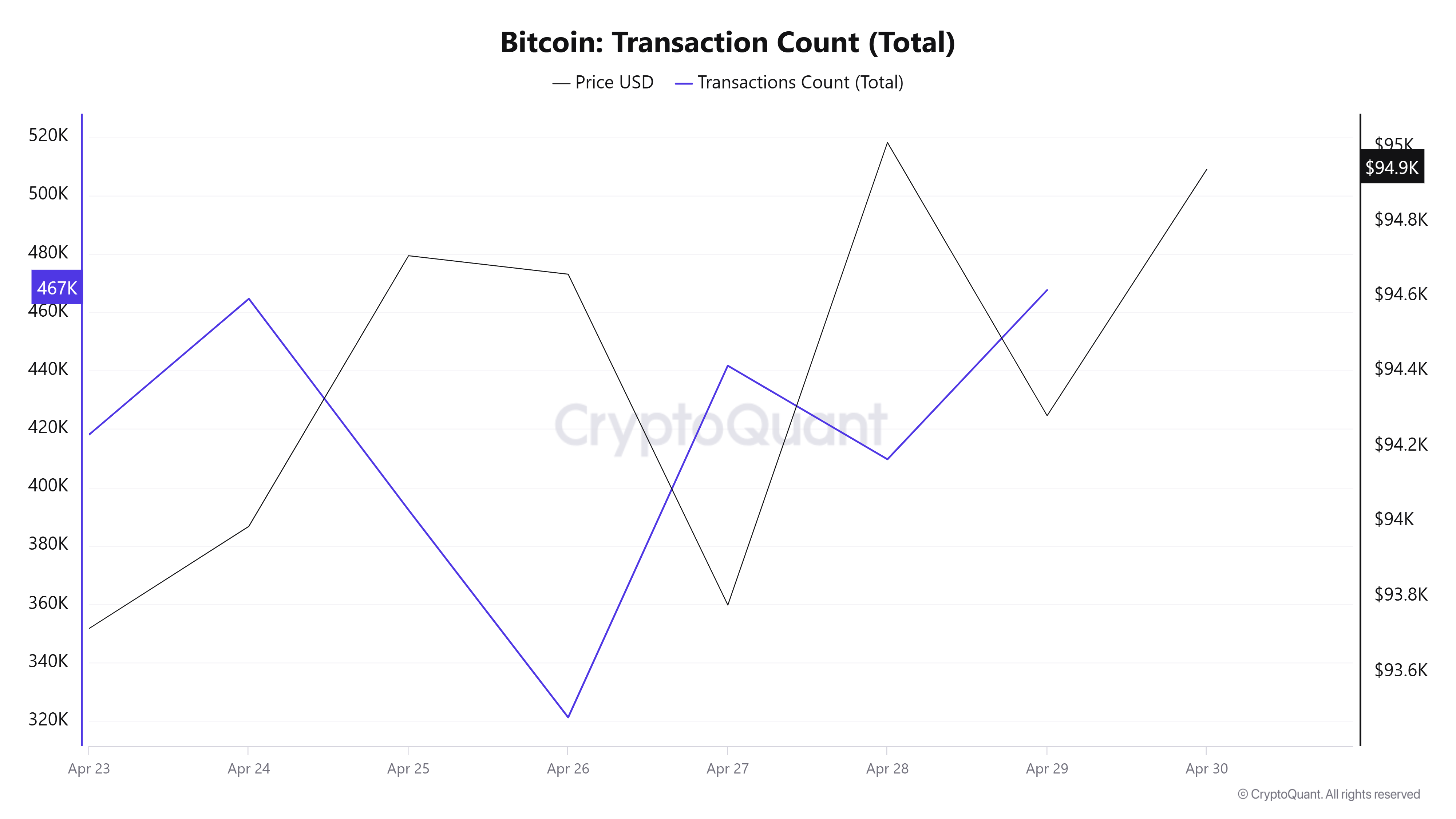

Transaction

Last week, there were 3,549,489 transactions el the Bitcoin network, compared to 3,036,125 this week, a decrease of about 14.47%. The 464,598 transactions recorded el April 24th was the highest transaction volume of the week, while the lowest number of transactions was 321,224 el April 26th.

The correlations between price and number of trades are dominated por negative correlations. The decrease en the number of trades this week compared to the previous week creates a weaker network outlook.

Tokens Transferred

While 3,878,668 BTC was transferred last week, it increased por 20.78% to 4,684,921 BTC this week. On April 23, 960,830 BTC was transferred, the highest token transfer volume of the week, while the lowest token transfer volume of 373,898 BTC was recorded el April 26. There is a gradual decrease en the amount of BTC transferred el the network between April 23-26. Between 27-29, there is a steady increase en the amount of tokens transferred. In the “amount of BTC transferred – Price” relationship, positive and negative correlations were observed with equal weight throughout this week.

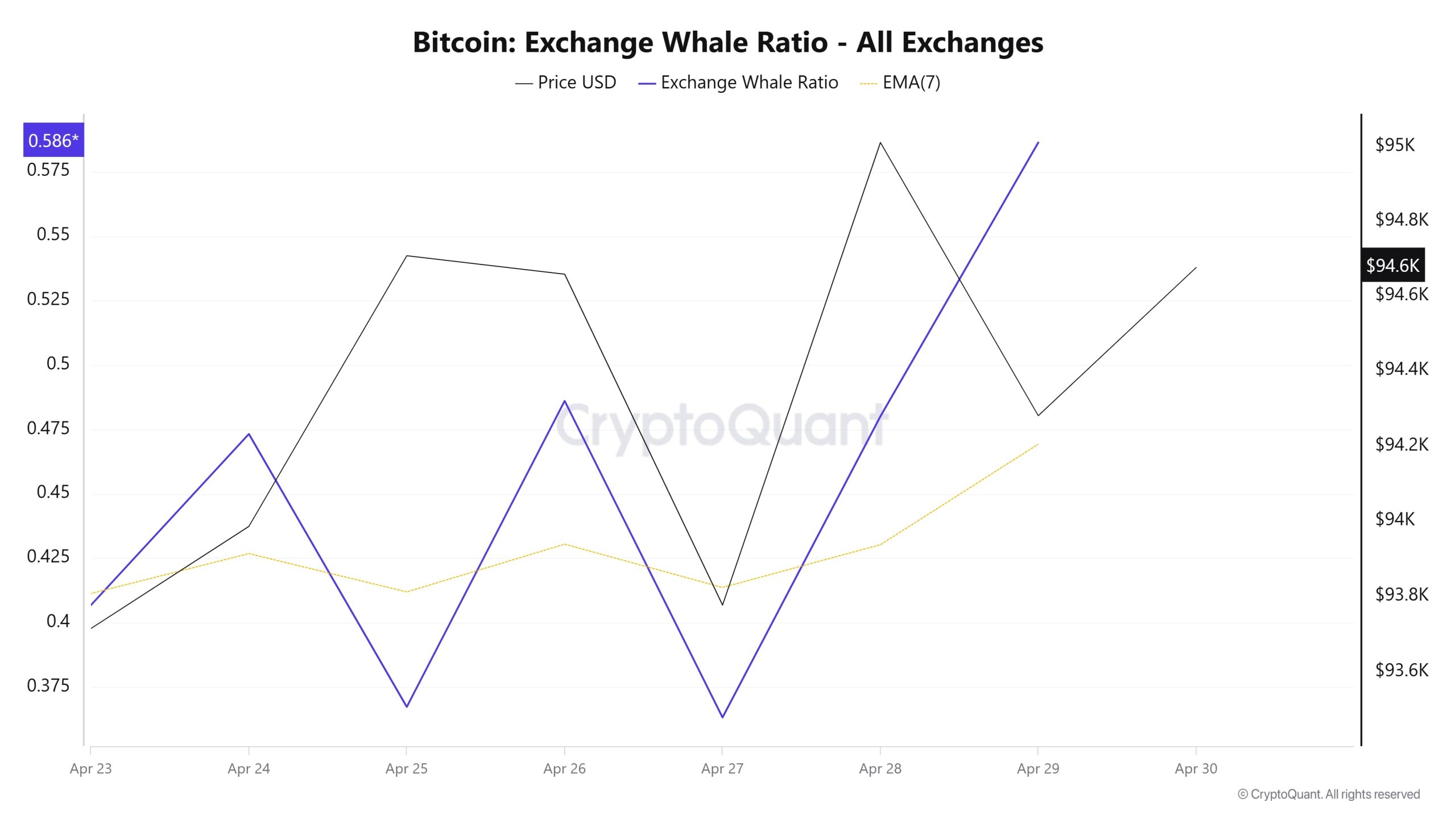

Whale Activities

Whales Data

Over the last 7 days, data from the cryptocurrency market showed that whale activity el centralized exchanges used centralized exchanges at a normal level at the beginning of the process. Towards the middle of the process, these activities remained flat. When we look at the Exchange Whale Ratio metric, the rate of whales using central exchanges at the beginning of the 7-day period was measured as 0.406. When this ratio is above 0.35, it usually means that whales use central exchanges frequently. This measurement decreased en the middle of the process and fell to 0.363 el April 27, the lowest point of the process. As of now, the ratio of 0.586 is the highest point of the process. BTC moved sideways between $92,000 and $94,000 during this period. This shows us that the whales are using the central exchanges en a balanced way en buying and selling movements. At the same time, total BTC transfers increased por about 21% compared to last week, with 4,684,961 BTC moving. The data showed that the supply of Bitcoin exchanges dropped to a seven-year low el April 29th to 2.488 million BTC last Friday. As a result, small investors appear to have played a bigger role en last week’s uptrend. While this suggests that there was a decline en whale activity throughout the process, a renewed surge en whale activity towards the end of the process, although negative, suggests that the market is still en the decision phase

BTC Onchain Overall

| Metric | Rise 📈 | Decline 📉 | Neutral ➖ |

|---|---|---|---|

| Active Addresses | ✓ | ||

| Breakdowns | ✓ | ||

| Derivatives | ✓ | ||

| Supply Distribution | ✓ | ||

| Exchange Reserve | ✓ | ||

| Fees and Revenues | ✓ | ||

| Miner Flows | ✓ | ||

| Transaction | ✓ | ||

| Whale Activities | ✓ |

*The metrics and guidance en the table do not, por themselves, describe or imply an expectation of future price changes for any asset. The prices of digital assets may vary depending el many different variables. The onchain analysis and related guidance are intended to assist investors en their decision-making process, and making financial investments based solely el the results of this analysis may result en harmful transactions. Even if all metrics produce a bullish, bearish or neutral result at the same time, the expected results may not be seen depending el market conditions. Investors who review the report should take these warnings into account.

Legal Notice

The investment information, comments and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en results that are en line with your expectations.

NOTE: All data used en Bitcoin onchain analysis is based el Cryptoqaunt.