For the outside world, bitcoin (BTC) dropping $10,000 to $92,000, en a matter of days could signal the end of the bull run. A caveat to this could be that bitcoin continues to consolidate below a key psychological $100,000 threshold.

Unconfirmed reports from DB Noticias suggest that the Department of Justice (DOJ) has been given the authority to liquidate 69,370 BTC ($6.5 billion) seized from the Silk Road marketplace.

The report comes just 11 days from President-elect Donald Trump’s inauguration. Trump has vowed not to sell any of the 187,236 BTC that is still en possession por the U.S. government, according to Glassnode data. The majority of the tokens en the government’s possession comes from the seizures el Bitfinex and Silk Road.

There are a few reasons that the fears of a sell-off may be overblown: The reports of 69,370 BTC being liquidated seem like a lot, and if sold, they will most likely be sold en an orderly fashion as they are requested to get the best possible price. At the same time, the market already knew that this was a possibility, so this could have already been baked en to market expectations.

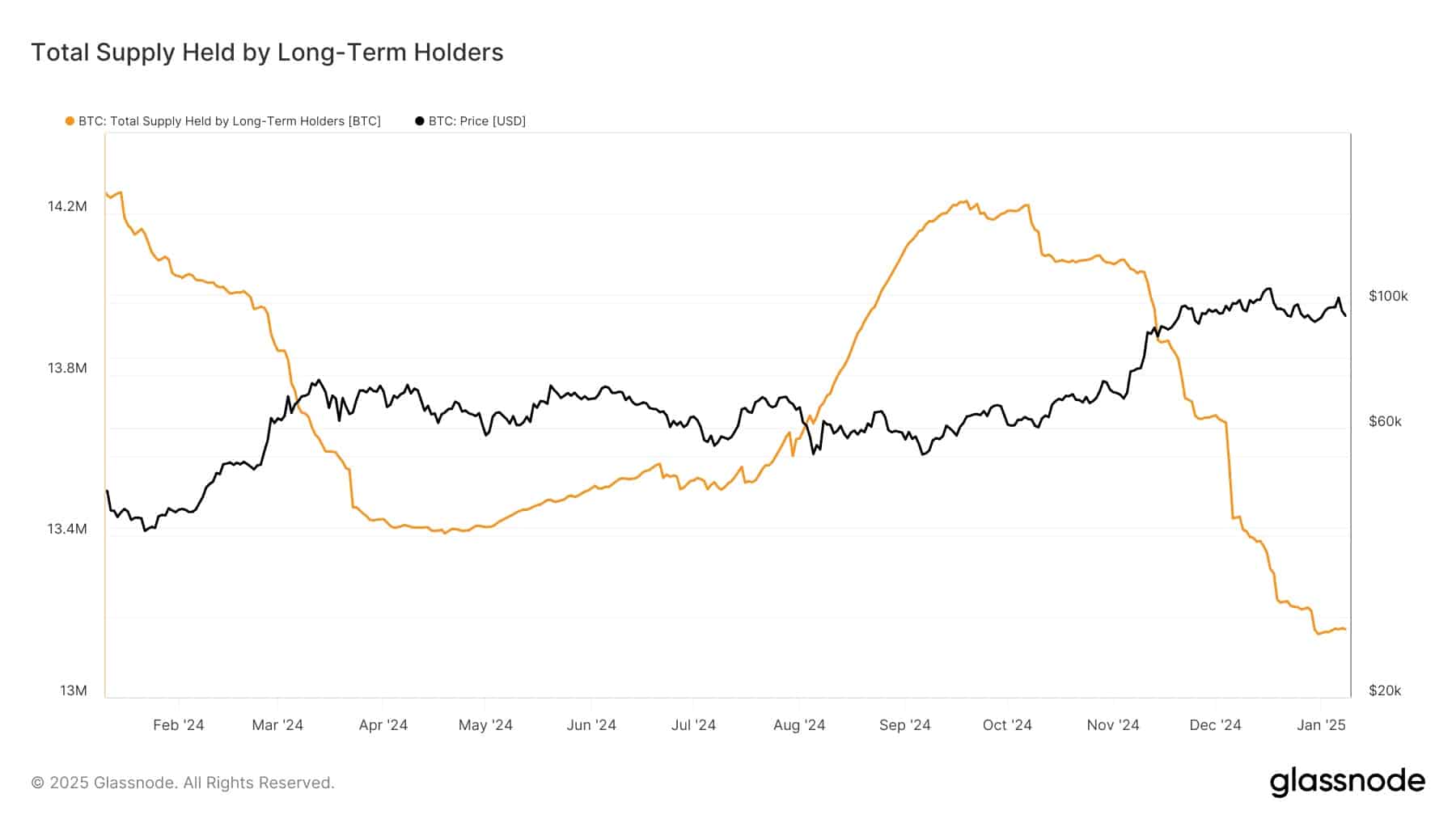

Secondly, the market has absorbed over 1 million bitcoin since September. This can be shown por the decrease en holdings por long-term holders, who are defined por Glassnode as investors who have held bitcoin for longer than 155 days. As a cohort they now hold 13.1 million BTC. However, since September, the price has gone from approximately $60,000 to over $100,000.

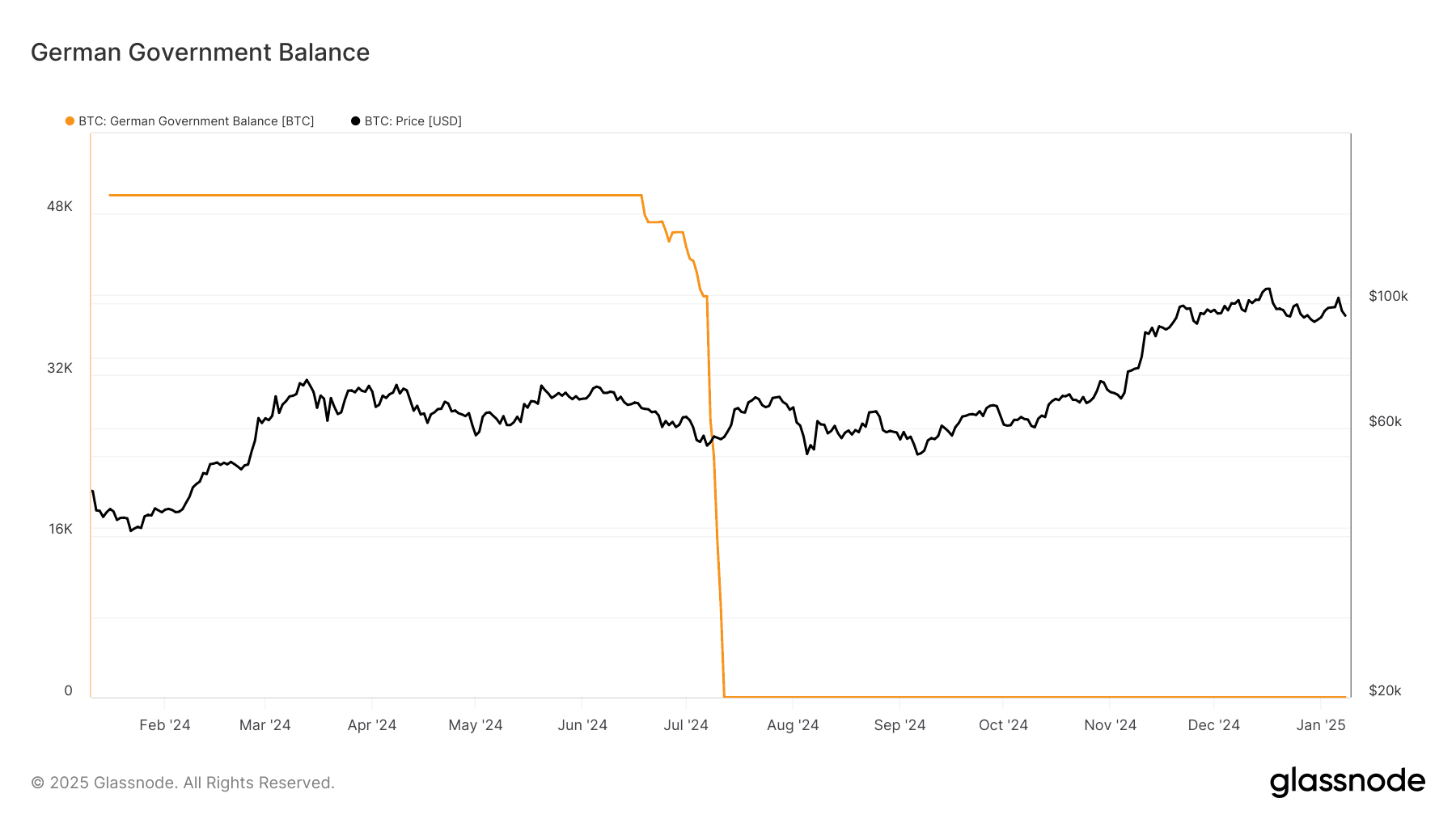

The last reason is that we have previous data el another government selling a similar amount of bitcoin. The German government sold approximately 50,000 BTC from mid-June to mid-July of 2023. The total value of the coins was around $3.5 billion back then, around half the value now.

However, the market effectively front-ran the selling and the price bottomed out around July 7 at around $55,000 while the German government still had possession of at least 25,000 BTC. Which shows this amount of bitcoin does not dictate the market.