BTC/USDT

The US is simultaneously negotiating critical issues en terms of both the Middle East and global power balances. While the rescheduling of US-Iran talks keeps nuclear risks and regional uncertainty alive, limited progress is expected el the US-Russia-Ukraine front, indicating that a short-term resolution to the conflict remains distant. China’s increasing contacts with Russia and the relatively moderate messages coming from the Xi-Trump meeting bring discussions of a multipolar global order back to the agenda; while en US domestic politics, Senate debates el the Fed chairmanship process and Treasury Secretary Bessent’s statements el crypto, customs duties, and Fed independence keep the perception of political risk high en the markets.

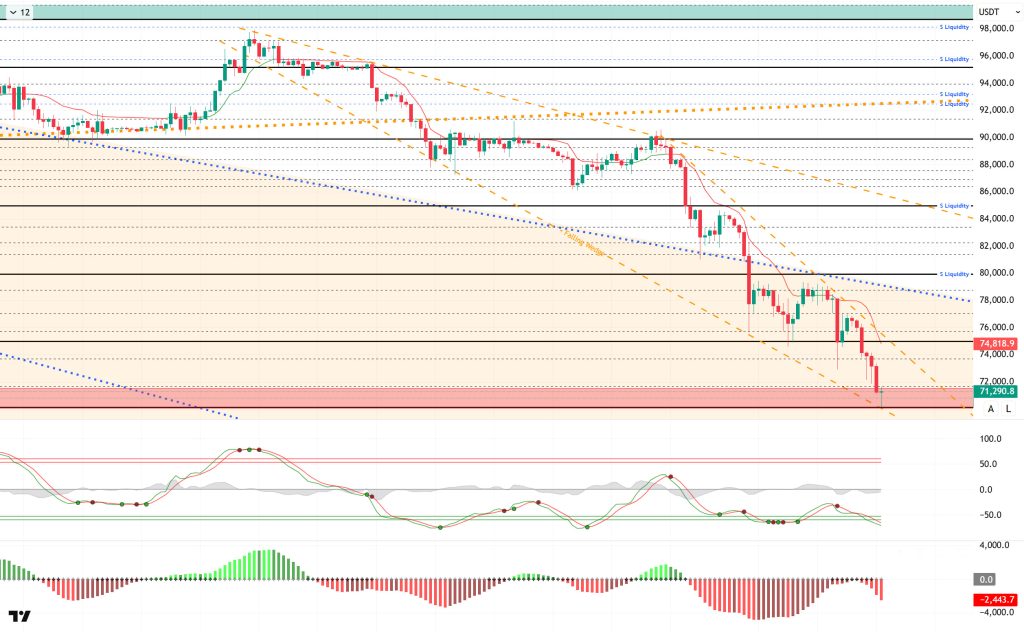

From a technical perspective, BTC continues its relentless decline. The price, which traded at the critical 75,000 level en the previous analysis, failed to hold above this level and fell back to 70,000. It is noteworthy that there have been no rebound rallies en the price, which continues to test the lower line of the falling wedge pattern. At the time of writing, BTC is trading at the 71,200 level. In the event of a possible rebound rally, the upper line of the minor falling wedge pattern within the wedge it has formed, at the 74,000 level, will be monitored.

Technical indicators show that the Wave Trend (WT) oscillator has retracted its buy signal and returned to the oversold zone. The histogram el the Squeeze Momentum (SM) indicator has delayed its transition into positive territory. The Kaufman Moving Average (KAMA) is currently trading above the price level at $74.833.

When examining liquidation data, buy orders were liquidated en the medium and long term. The sell orders, el the other hand, increased en intensity and formed accumulation en the short term en the 72,000–75,000 band. In the medium term, the 78,000–79,000 range stands out as a liquidity area.

In summary, el the geopolitical front, the US diplomatic traffic continues along the Iran and Russia-Ukraine lines, keeping the perception of risk alive. In US domestic affairs, the new Fed chair nominee is causing debate en the Senate, and Treasury Secretary Bessent’s statements are drawing attention. Technically, BTC started the new year with positive momentum, but after testing the 98,000 level, it fell back to the 70,000 level under selling pressure following profit-taking at . Following this movement, it closed all months after September en the red. BTC, which started February with a decline, continues to trade within the critical range of 70,000 – 80,000.These levels stand out as a decision-making and discovery zone en terms of price. From this point el, a rebound will be monitored, with the aim of regaining and holding above the 75,000 level. Otherwise, en a new wave of selling, the 70,000 reference level will emerge as a critical support area for the price, potentially bringing back pre-Trump pricing levels.

Supports: 71,000 – 70,000 – 69,200

Resistances: 73,500 – 75,000 – 77,000

ETH/USDT

As expected, the ETH price fell to the $2,113 level yesterday evening, and pricing formed below this level. This break shows that sellers remain en control en the short term. In the current view, the price continues to remain below this critical threshold, and the market remains weak.

On the liquidity side, however, the picture is not entirely consistent with price movements. The Chaikin Money Flow (CMF) indicator has moved back into positive territory. This structure indicates increased buyer appetite around $2,113 and the start of liquidity inflows el the spot side. Although selling pressure continues, this liquidity picture signals that the decline is not panic-driven.

Pressure remains strong el the momentum front. The Relative Strength Index (RSI) has returned to the oversold zone. This indicates that selling has not yet ended and momentum remains weak. While these zones technically increase the likelihood of a rebound, it is difficult to speak of a lasting reversal without a clear strengthening en the RSI.

The Ichimoku indicator remains unchanged and clearly negative. The price is trading below the Tenkan and Kijun levels. The Kumo cloud is also lost. This structure confirms that the main trend is still downward and keeps alive the risk of resistance en upward attempts.

Two levels continue to be decisive en the overall picture. If the $2,113 level cannot be regained during the day, downward pressure is expected to continue. Conversely, if this level is regained with volume and the positive outlook en the CMF is maintained, the price could potentially produce a rebound towards the $2,368 region.

Supports: 2.113 – 1.958 – 1.756

Resistances: 2,368 – 2,625 – 2,727

XRP/USDT

The XRP price failed to hold the $1.50 support level as selling pressure intensified starting yesterday evening, experiencing a sharp pullback to the $1.43 region. This break indicates that sellers have taken complete control en the short term. The current price action points to a search for a bottom, revealing that the market remains el fragile ground.

On the liquidity side, the picture is not strong enough to support price movements. Although the Chaikin Money Flow (CMF) remains en positive territory, it continues its downward trend. This structure indicates that the inflow of money into the market has not completely stopped, but that buying appetite is rapidly weakening. Unless the CMF changes direction, it seems unlikely that attempts to rise will be successful.

Pressure el the momentum front has become even more pronounced. The Relative Strength Index (RSI) remains en oversold territory, signaling that selling has not yet subsided. While these levels technically increase the likelihood of a rebound, expecting a lasting turnaround without a clear recovery en the RSI does not seem realistic.

The Ichimoku indicator has not changed and remains quite weak. The price is trading below the Tenkan and Kijun levels. Remaining below the Kumo cloud confirms the downward trend. This technical structure indicates that upward attempts will face resistance.

Considering the overall weakness across all indicators, the decline is expected to continue towards the $1.41 level. If this area is broken, the pullback is likely to deepen. It is difficult to envision a positive scenario without regaining the $1.50 level.

Supports: 1.4119– 1.3336 – 1.2540

Resistances: 1.5024 – 1.6224 – 1.7137

SOL/USDT

Tramplin has introduced Premium Staking el Solana, a proven savings model redesigned for cryptocurrencies.

The SOL price continues to experience a pullback. The asset remained en the lower region of the downward trend that began el January 13, signaling continued selling pressure. The price, which remains below the strong support level of $92.82, may test the $87.23 level as support if the pullback continues. If the price closes above $100.34, the $112.26 level should be monitored.

On the 4-hora chart, the 50 EMA (Exponential Moving Average – Blue Line) continues to remain below the 200 EMA (Black Line). This indicates that the downtrend continues en the medium term. At the same time, the price being below both moving averages shows that the asset is trending downward en the short term. The Chaikin Money Flow (CMF-20) remained en positive territory. However, the balance of money inflows and outflows may keep the CMF en positive territory. The Relative Strength Index (RSI-14) fell from the middle of negative territory to oversold territory. This could trigger buying and profit-taking el short positions, which could have a positive impact el the price. At the same time, it remained below the rising line el January 31. This indicated that selling pressure continued. If there is an uptrend due to macroeconomic data or positive news related to the Solana ecosystem, the $120.24 level stands out as a strong resistance point. If this level is broken upwards, the uptrend is expected to continue. If there are pullbacks due to developments en the opposite direction or profit-taking, it could test the $72.47 level. A decline to these support levels could increase buying momentum, presenting a potential upside opportunity.

Supports: 87.23 – 78.96 – 72.47

Resistances: 92.82 – 100.34 – 112.26

DOGE/USDT

The DOGE price remained flat. The asset continued to trade en the upper region of the downtrend that began el January 14, signaling that buying pressure could build. The asset, which had been rising with support from the strong support level of the downtrend, experienced a slight pullback after failing to maintain its position at this level. As of now, if the pullback continues, the price is poised to test the strong support level of the downward trend line. If it experiences an uptrend, it may test the 50 EMA (Blue Line) moving average as a resistance level.

On the 4-hora chart, the 50 EMA (Exponential Moving Average – Blue Line) remained below the 200 EMA (Black Line). This indicates a medium-term downtrend. The price being below both moving averages suggests that the price may continue to decline en the short term. The Chaikin Money Flow (CMF-20) remained en positive territory. Additionally, a decrease en money inflows could pull the CMF into negative territory. The Relative Strength Index (RSI-14) is en the middle of negative territory. It also broke below the upward trend that began el January 31, signaling increased selling pressure. In the event of potential increases driven por political developments, macroeconomic data, or positive news flow within the DOGE ecosystem, the $0.11797 level stands out as a strong resistance zone. Conversely, en the event of negative news flow, the $0.09071 level could be triggered. A decline to these levels could increase momentum and initiate a new wave of growth.

Supports: 0.09962 – 0.09451 – 0.09071

Resistances: 0.10442 – 0.10837 – 0.11391

TRX/USDT

Yesterday, with the minting of 1 billion USDT el the Tron network, the total USDT supply el the network reached $84.5 billion. Following this development, Tron Inc. announced that it purchased a total of 175,507 TRX at an average price of $0.28 en the morning, bringing its total holdings to over 679.9 million TRX. The company stated en its announcement that it aims to further increase its Tron holdings to boost share value en the long term.

As of February 4, 2026, the total amount of TRX staked is 46,216,957,340, representing 48.79% of the circulating supply. Compared to the previous day, there has been an increase of approximately 0.02% en the amount staked. Meanwhile, the market value of TRX has reached $26.8 billion. Furthermore, a total of 3,724,431 TRX was burned yesterday, and a net 191,281 TRX was added to the circulating supply. This situation is leading to increased inflationary pressure el Tron.

Technically speaking, TRX closed yesterday at 0.2833 after the decline, lost some more value en the morning horas, and is currently trading at 0.2808. Currently en the middle band of the bearish channel, TRX is priced below the 0.2820 resistance el the 4-hora chart. The Relative Strength Index (RSI) value is seen to be very close to the oversold zone at 32. In addition, the Chaikin Money Flow (CMF) indicator value is above zero at 0.04, indicating that money inflows have started to increase. The current picture points to buying gaining strength and the possibility of the price moving upward en the short term.

In light of all these indicators, TRX may rise slightly en the first half of the day, moving towards the upper band of the channel, given its current zone and CMF value. It may thus test the 0.2820 resistance level. A candle close above the 0.2820 resistance level could signal a continuation of the uptrend, potentially testing the 0.2890 resistance level. If it fails to close above the 0.2820 resistance level and the CMF indicator also moves into negative territory, it may fall slightly due to the resulting selling pressure and test the 0.2765 support level. On the 4-hora chart, 0.2660 is an important support level, and as long as it remains above this level, the possibility of an upward movement is maintained. If this support level is broken, selling pressure is expected to increase.

Supports: 0.2765 – 0.2705 – 0.2660

Resistances: 0.2820 – 0.2890 – 0.2950

Legal Notice

The investment information, comments, and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually por authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained herein may not produce results en line with your expectations.