TECHNICAL ANALYSIS

BTC/USDT

Trump Media announced that it will develop a blockchain-based digital wallet and token for its video platform Truth+, while BlackRock announced that Bitcoin ETF investments are now shifting to institutional investors. While the US city of Roswell established a strategic Bitcoin reserve, CZ stated that they provide consultancy to multiple countries en this field. On the other hand, China announced that there has been no consultation with the US el tariffs. Tether announced that it holds over 7.7 tons of physical gold for XAUT reserves.

Looking at the technical outlook, compared to the previous analysis, BTC continues to consolidate with low volatility and volume. Price action is stuck en a very narrow band and although it tested the 95,000 level during the day, it failed to break above this resistance. This suggests that the technical upside breakout is not supported for the time being. The indecisive structure el the Wave Trend oscillator and the weak momentum indicator are among the signals that strengthen the possibility of a correction en the current outlook. In addition, the negative outlook en the futures market supports this technical weakness. On the spot ETF side, positive inflows so far have continued to be one of the main factors supporting the price. However, if the positive flow weakens, technically BTC is likely to test the 50-day moving average (SMA 50) of 94,000 and if this support is lost, the next technical level will be 92,800. If these levels hold, the technical structure can be expected to recover and push the 95,000 level once again. However, en the opposite scenario, that is, if technical weakness deepens and key supportive factors such as ETFs disappear, it may prevent BTC from making an upward leap. Accordingly, the market will continue to be shaped por macro data, Fed statements or news flows that will change market sentiment.

Supports 94,000 – 92,800 – 91,450

Resistances 95,000 – 97,000 – 98,000

ETH/USDT

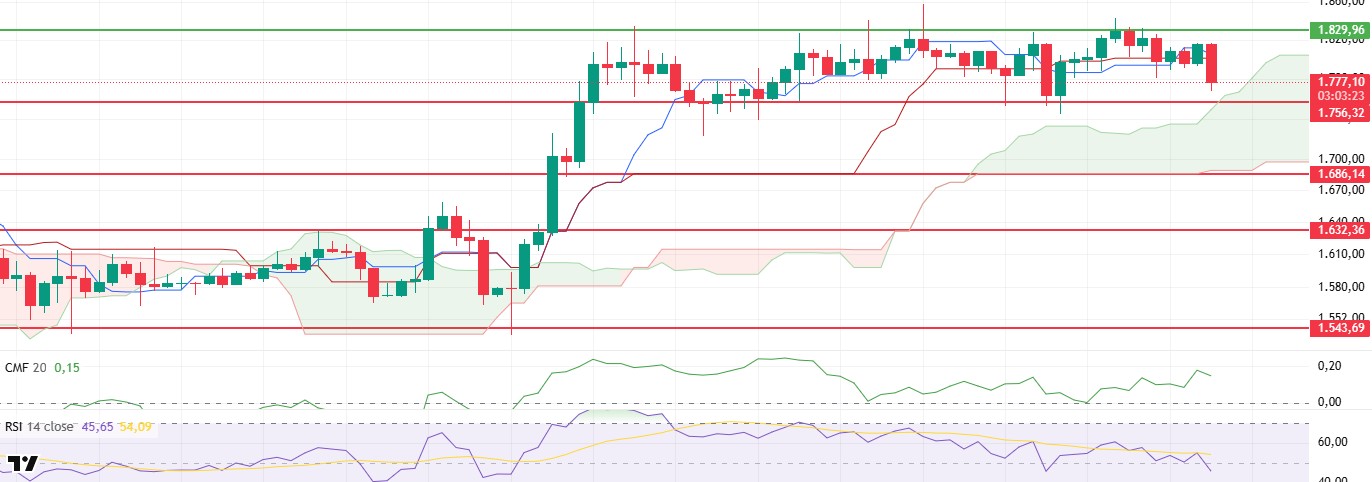

The cryptocurrency market was under selling pressure during the day and a general retracement was experienced due to the impact of macroeconomic data from the US today. This negative sentiment also affected ETH, which dipped below the critically important $1,800 level. With the loss of this threshold, signals of weakness en technical indicators became more pronounced and the deterioration en market structure became clear.

When technical indicators are analyzed en detail, it is seen that the Relative Strength Index (RSI) indicator continues its downward movement and moves towards the oversold zone. This indicates that the loss of momentum en the market is deepening, while buyers remain weak. This weakening en momentum is an important warning that the downtrend is not over yet. On the other hand, the Chaikin Money Flow (CMF) indicator signaled a short-term recovery during the day, but turned down again as the price came under selling pressure again. This indicates that money entering the market is decreasing and capital outflows are accelerating. In the evaluation made el the Ichimoku Cloud indicator, although there was a short-term recovery signal en the morning horas with the Tenkan level cutting the Kijun level upwards, it is observed that this movement could not be permanent and the Tenkan level fell below the Kijun level again. This development suggests that the uptrend remains weak and the market is starting to display a directionless outlook. In addition, the fact that the price has retreated to the lower boundary of the Ichimoku cloud indicates that a technically important support level has been tested.

In line with this technical outlook, if the price breaches the $1,756 level downwards later en the day, it is possible that selling pressure may increase further and the price may retreat towards deeper support levels. In this scenario, the $1,680 level stands out as the next critical support point. A decline below this level could lead to an acceleration of the downtrend. However, if the price manages to hold at $1,756, it may be possible to see a short-term recovery movement towards the Tenkan level again with the purchases coming from this level.

Supports 1,756 – 1,632 – 1,543

Resistances 1,829 – 1,925 – 2,131

XRP/USDT

As predicted en the technical analysis en the morning horas, XRP continued its decline por breaking the support line at the $2.21 level downwards and the price fell to the kumo cloud area. This technical breakout further reinforced the market’s weak outlook and strengthened the negative signals en the indicators. This continuation of the price action indicates that the short-term negative outlook is deepening and buyers are losing ground en the market.

Analyzes el the Ichimoku indicator show that the sell signal formed por the Tenkan level cutting the Kijun level downwards is still valid and the price has retreated en a way that confirms this signal. The price, which approached the lower boundary of the Kumo cloud, especially withstood the cloud support at the $2.17 level. This level is technically a very critical threshold. If this support level is breached to the downside, the downtrend en XRP may accelerate and the price is likely to fall to the next support level of $2.12. On the other hand, other technical indicators continue to support the bearish trend. The Chaikin Money Flow (CMF) indicator continues to trend lower, indicating a continued outflow of money from the market, while the Relative Strength Index (RSI) remains bearish, heading towards oversold territory.

As a result, if the $2.17 level breaks down en the evening horas, XRP’s drop to the $2.12 level stands out as a technically possible scenario. However, if the price rises above the $2.21 level again, this move may weaken the negative outlook en the market and pave the way for the possibility of a short-term recovery.

Supports 2.1204 – 2.0201 – 1.8932

Resistances 2.2154 – 2.3938 – 2.4721

SOL/USDT

SOL price continued its sideways movements during the day. The asset continues to trade below the resistance level of the ascending line that started el April 6. As of now, it has managed to get support por staying above the 50 EMA (Blue Line). In case this level is broken downwards, the $138.73 level should be followed as an important support level. On the 4-hora chart, the 50 EMA (Blue Line) remains above the 200 EMA (Black Line). This indicates that the upward trend may continue en the medium term. In addition, the fact that the price remains above both moving averages suggests that buying pressure continues across the market. Chaikin Money Flow (CMF20) hovers en positive territory; however, a decline en daily volume may cause CMF to move into negative territory. Relative Strength Index (RSI14), el the other hand, remains below the downtrend that started el April 23 and has moved into negative territory amid selling pressure. The $163.80 level stands out as a strong resistance point en case of a bullish breakout el the back of macroeconomic data or positive news el the Solana ecosystem. If this level is broken upwards, the rise can be expected to continue. If there are pullbacks due to contrary developments or profit realizations, the $138.73 level may be retested. In case of a decline to these support levels, the increase en buying momentum may offer a potential bullish opportunity.

Supports 144.35 – 138.73 – 133.74

Resistances 150.67 – 163.80 – 171.82

DOGE/USDT

DOGE price moved sideways during the day. Starting el March 6, it tested the downtrend line as resistance but failed to break it and retreated. After breaking the 50 EMA (Blue Line) to the downside, the asset tested the 200 EMA (Black Line) and made a limited rise from there, but is now testing the 200 EMA moving average as support again. In case of a downside break of the 200 EMA, the $0.16686 level should be followed as a strong support. On the 4-hora chart, the 50 EMA is still above the 200 EMA. The fact that the price is between both moving averages indicates that the search for direction en the medium term continues. Chaikin Money Flow (CMF20) indicator remains en positive territory, but inflows are decreasing. On the other hand, the downtrend that started el April 22 has been broken to the upside, suggesting that bullish movements may continue. However, Relative Strength Index (RSI14) is still en negative territory and bullish momentum is weakening. Moreover, the downtrend that started el April 23rd is still en effect. The $0.18954 level stands out as a strong resistance zone en case of possible rises en line with political developments, macroeconomic data or positive news flow en the DOGE ecosystem. In the opposite case or possible negative news flow, the $0.16686 level may be retested. In case of a decline to these levels, the increase en momentum may start a new bullish wave.

Supports 0.16686 – 0.16203 – 0.14952

Resistances 0.17766 – 0.18566 – 0.18954

Legal Notice

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually por authorized institutions taking into account the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained herein may not produce results en line with your expectations.