The Evolution of AML Regulations in Decentralized Finance (DeFi)

The regulatory landscape surrounding cryptocurrency has gradually evolved to address the unique challenges posed by Decentralized Finance (DeFi). As the DeFi ecosystem continues to expand, the implementation of Advanced AML in Cryptocurrency has become critical to combat financial crimes such as money laundering and terrorist financing.

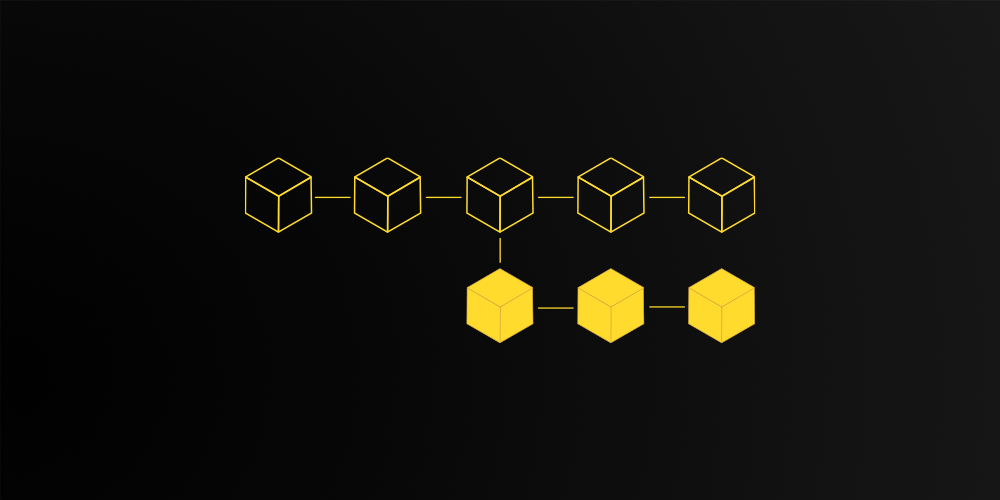

Initially, AML regulations primarily targeted centralized exchanges. However, with the rise of DeFi platforms, regulators have begun to acknowledge the complexities of ensuring compliance in a decentralized framework. The lack of traditional intermediaries complicates the enforcement of crypto compliance frameworks, urging the need for innovative approaches to AML.

One of the most significant challenges in DeFi is the pseudonymous nature of transactions, which can obscure the identities of the parties involved. Consequently, blockchain forensics tools have emerged as essential resources for tracing transactions and uncovering illicit activities. By analysing on-chain data, these tools help in enhancing transparency and facilitating effective regulatory oversight.

Moreover, the automation capabilities of smart contracts are being harnessed to streamline AML processes. AML automation with smart contracts allows for real-time compliance checks at the moment transactions occur. This innovative approach ensures that all necessary due diligence is performed without slowing down the speed of transactions, which is crucial for maintaining user satisfaction in the DeFi space.

As the dialogue between regulators and the crypto industry progresses, addressing DeFi AML challenges remains paramount. The future of AML in decentralized ecosystems will likely see more comprehensive regulations, enhanced technological tools, and collaborative efforts between stakeholders to foster a secure and compliant environment for innovation in finance.

As cryptocurrency exchanges continue to evolve, the necessity for robust crypto compliance frameworks has become increasingly paramount. One of the most effective strategies for ensuring this compliance is the integration of blockchain forensics tools into the existing Anti-Money Laundering (AML) protocols. These tools allow exchanges to trace and analyze transactions on the blockchain, revealing the flow of funds and identifying any suspicious activities that could indicate money laundering.

By employing advanced analytics and machine learning algorithms, these tools enhance the ability of exchanges to proactively detect potentially illicit transactions. This integrates seamlessly with AML automation and enhances the operational efficiency of real-time monitoring systems, thereby substantially mitigating risks associated with DeFi AML challenges.

Moreover, the incorporation of blockchain forensics can facilitate the development of more comprehensive AML policies. As exchanges begin to implement these technologies, they can construct a robust compliance framework that not only satisfies regulatory requirements but also contributes to the integrity of the broader cryptocurrency ecosystem.

It is essential for exchanges to stay ahead of the curve by investing in effective forensics technologies that align with the latest Advanced AML in Cryptocurrency principles. Only then can they ensure they are adequately protected against evolving threats while remaining compliant with regulatory standards.

Smart Contract Automation for Real-Time AML Compliance

In the rapidly evolving landscape of cryptocurrency, the need for Advanced AML in Cryptocurrency is at an all-time high. One of the most innovative solutions for achieving compliance is through the automation of Anti-Money Laundering (AML) processes via smart contracts. This technology has the potential to streamline the complexities associated with crypto compliance frameworks, making them more efficient and effective.

Smart contracts, with their self-executing code, allow for real-time monitoring and enforcement of compliance measures without the need for manual intervention. By integrating AML automation with smart contracts, exchanges can significantly reduce the risk of non-compliance while ensuring that all transactions are compliant with current regulations. This immediate response capability is crucial in a market where rapid transactions can pose substantial AML challenges.

Moreover, the synergy between smart contracts and blockchain forensics tools further enhances the ability to track and analyze transactions. These tools provide invaluable insights, offering a clear trail that regulators and compliance officers can follow to ensure that illicit activities are effectively identified and addressed.

As the industry continues to mature, the implementation of automated AML systems will become essential. With the ongoing pressures of regulations in decentralized finance (DeFi), leveraging smart contract automation can be a game-changer in overcoming DeFi AML challenges. It enables stakeholders to stay ahead in a proactive manner, aligning their operations with the best practices of the industry.

Global Regulatory Trends and Their Impact on Crypto AML Frameworks

As governments and regulatory bodies around the globe adapt to the burgeoning world of cryptocurrency, the landscape of Anti-Money Laundering (AML) regulations is continually evolving. These changes are not just a response to the growing popularity of cryptocurrencies but are also necessitated by the increasing complexity of fraudulent schemes and the need for enhanced crypto compliance frameworks.

One of the notable trends is the harmonization of AML regulations across jurisdictions. Countries are working towards creating a unified approach to regulation, which is vital in countering the cross-border nature of cryptocurrency transactions. This cooperation is essential for ensuring that compliance measures can effectively tackle money laundering activities that cut across multiple regions.

Additionally, regulatory bodies are placing a growing emphasis on the use of advanced technology in AML efforts. The adoption of blockchain forensics tools is becoming more prevalent among exchanges and financial institutions. These tools allow for better tracking of transaction flows and the identification of patterns that may indicate illicit activities. This technological shift is enabling compliance teams to respond more efficiently to suspicious activities.

Furthermore, with the rise of Decentralized Finance (DeFi) platforms, regulatory challenges have become increasingly pronounced. DeFi AML challenges highlight the difficulties in enforcing traditional AML regulations on platforms that prioritize decentralization and user anonymity. As a result, there is a push for innovative solutions such as AML automation with smart contracts that can facilitate compliance in real time without compromising the underlying principles of decentralization.

Looking ahead, it is clear that advanced AML in cryptocurrency will hinge on the ability of regulatory frameworks to adapt swiftly to technological advancements and emerging trends. As regulations evolve, businesses in the crypto space must stay informed and agile, ensuring they meet the necessary compliance requirements while fostering innovation and growth.

Preguntas frecuentes

What is AML technology in the context of cryptocurrency?

AML technology in cryptocurrency refers to tools and solutions used to detect and prevent money laundering activities within digital assets and blockchain transactions. These technologies help ensure compliance with regulations by monitoring transactions for suspicious patterns.

How do regulations impact the development of AML tech in the crypto industry?

Regulations significantly influence the development of AML tech by establishing legal frameworks that companies must follow. As regulatory bodies create guidelines and standards, businesses innovate their AML solutions to meet compliance requirements and mitigate risks.

What are some common AML compliance challenges faced by crypto companies?

Common AML compliance challenges include the lack of standardized regulations across jurisdictions, the pseudo-anonymous nature of cryptocurrencies making user verification difficult, and the rapid pace of technological advancement that can outstrip existing regulatory measures.

How can blockchain technology aid in AML efforts?

Blockchain technology can enhance AML efforts through its transparent and immutable nature, allowing for better tracking of transactions. This transparency enables authorities and companies to trace the flow of funds more effectively and to identify potentially illicit activities.

What role do exchanges play in AML regulations for cryptocurrency?

Cryptocurrency exchanges play a critical role in AML regulations as they are often the first point of contact for users entering the crypto space. They are required to implement robust KYC (Know Your Customer) processes and monitor transactions to comply with AML laws and report suspicious activities.

What is the significance of KYC in the AML framework for crypto?

KYC, or Know Your Customer, is crucial within the AML framework as it helps crypto businesses verify the identities of their clients. This process minimizes the risk of fraud and illicit activities by ensuring that users are legitimate and that any transactions are traceable.

How do emerging technologies like AI impact AML in cryptocurrency?

Emerging technologies like artificial intelligence (AI) impact AML in cryptocurrency by providing advanced analytics and machine learning capabilities that can identify unusual transaction patterns, flag suspicious activities in real-time, and improve overall monitoring efficiency for compliance efforts.

Descargo de responsabilidad

This article is for informational purposes only and does not constitute legal, financial, or regulatory advice. While Darkex applies industry-standard AML practices, users and entities are responsible for understanding applicable laws in their jurisdictions. The technologies and frameworks discussed are subject to evolving regulation and should be evaluated in consultation with qualified legal and compliance professionals.