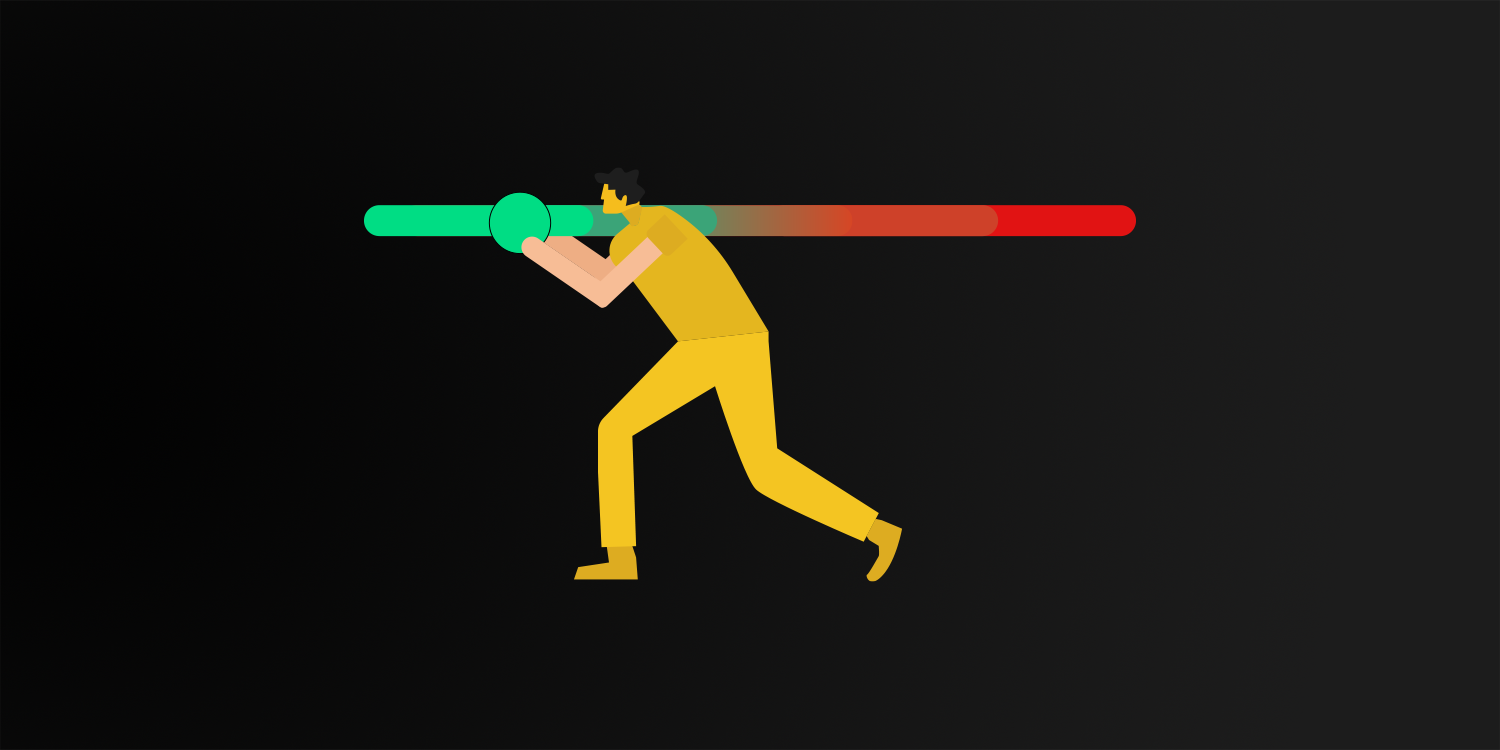

The cryptocurrency fear and greed index is a sentiment indicator that reflects the emotions of fear and greed that dominate the cryptocurrency market. It calculates the emotional sensitivity of the market el a scale of 0-100. A score of 0 represents a state of “Extreme Fear”, reflecting skepticism, uncertainty and potential undervaluation en the market. On the other hand, a score of 100 represents “Extreme Greed”, reflecting overconfidence, over-optimism and potential overvaluation.

One of the most commonly used indices en the crypto world is the Fear and Greed Index. It pulls data el different cryptocurrencies from many platforms, focusing el large cryptocurrencies like Bitcoin. This helps us understand whether the sentiment affecting the crypto market en general is bullish or bearish.

The meaning of Bitcoin fear and greed index values

- 0-24: Extreme fear

- 25-49: Fear

- 50: Neutral

- 51-74: Greed

- 75-100: Extreme greed

The Fear and Greed index is calculated por combining several different market factors

These factors are:

- Volatility (25%): Measures the current value of a cryptocurrency against the last 30 and 90-day averages. The index uses volatility here as an indicator of market uncertainty, with high volatility often signaling fear en the market.

- Market Momentum/Volume (25%): The cryptocurrency’s current trading volume and market momentum are compared to the average values for the last 30 and 90 days and then added together. A consistently high volume of purchases indicates a positive or greedy market sentiment.

- Social media (15%): This factor looks at the number of X (Twitter) hashtags related to a cryptocurrency and, en particular, their engagement rate. Consistently and unusually high engagement is often more about greed than fear.

- Surveys (15%): Focus el the results of surveys conducted en conjunction with some auxiliary organizations. Investors’ opinions are valued. The use of this input has been suspended for some time.

- Dominance (10%): Measures the market dominance of a cryptocurrency. For example, an increase en Bitcoin’s market dominance usually indicates that the market is dominated por fear, indicating that there are new investments en Bitcoin and that funds may have been transferred from altcoins to Bitcoin.

- Trends (10%): This index can offer insights into market sentiment por looking at Google Trends data for cryptocurrency-related searches. For example, an increase en the search for “Bitcoin Scam” could indicate more fear en the market. Google Trends data is used to understand the current level of interest en cryptocurrencies.

The Cryptocurrency Fear and Greed Index is a valuable tool that enables the detection of extreme market sentiment en the cryptocurrency world. Its main use is to predict possible price changes based el sentiment. However, users should also consider using other market indicators or tools to make important decisions and determine trading strategies.