Key Differences Between Bitcoin and Altcoins

When delving into the world of cryptocurrencies, understanding the altcoins in cryptocurrency and how they differ from Bitcoin is crucial. Firstly, Bitcoin was created as the first decentralized digital currency in 2009, while altcoins encompass all other cryptocurrencies that emerged following Bitcoin’s success. This key distinction illustrates the original intent behind Bitcoin and highlights the multitude of alternative projects vying for market attention.

Another significant difference lies in their use cases. Bitcoin primarily serves as a store of value and a medium of exchange, whereas popular altcoins often aim to solve specific problems or improve upon Bitcoin’s limitations. For example, some altcoins focus on enhancing transaction speed, while others address privacy concerns. This versatility can appeal to investors looking for more than just a digital asset.

In terms of market capitalization, Bitcoin remains the dominant player, typically accounting for over 40% of the total crypto market. Conversely, the altcoin market trends show a rising interest in Ethereum, Solana, and Cardano, among others, leading to their increasing relevance in the investment landscape.

Investment strategies for altcoins differ notably compared to Bitcoin. While Bitcoin is often viewed as a relatively stable investment, altcoins can exhibit higher volatility, presenting both risks and potential rewards. This requires a different approach to altcoin investment strategies, emphasizing thorough research and understanding of each project’s fundamentals and market behavior.

One of the essential aspects to consider when diving into the world of altcoins in cryptocurrency is understanding effective investment strategies. The landscape is incredibly diverse, with hundreds of alternatives to Bitcoin, each exhibiting unique characteristics and potential for growth. By analysing altcoin market trends and implementing robust strategies, investors can navigate this volatile market confidently.

For instance, altcoin investment strategies often include a mix of long-term holding (HODLing) and active trading, depending on the investor’s risk tolerance and market conditions. It’s vital to conduct thorough research on popular altcoins 2025 projections, as these insights can aid in making informed investment choices. With the rapid evolution of technology behind altcoins, including innovative solutions that enhance functionality, investors must stay updated on the latest developments to capture emerging opportunities.

Furthermore, understanding the Bitcoin vs altcoins dynamics can help investors identify when to shift focus from Bitcoin to promising altcoins that exhibit strong market potential. Keeping an eye on various performance metrics and market indicators will enable investors to capitalize on price movements and optimize their portfolios effectively.

Technological Innovations Driving Altcoin Growth

The rapid development of altcoins in cryptocurrency has been significantly influenced by various technological innovations. As the crypto market evolves, these advancements have provided new use cases, improved security, and increased accessibility, thereby attracting a broader audience. Here are some key innovations that are propelling the growth of altcoins:

- Smart Contracts: Many popular altcoins, such as Ethereum, utilize smart contracts to facilitate self-executing agreements without intermediaries. This technology empowers decentralized applications (dApps) and has opened up new avenues for investment and interaction in the crypto space.

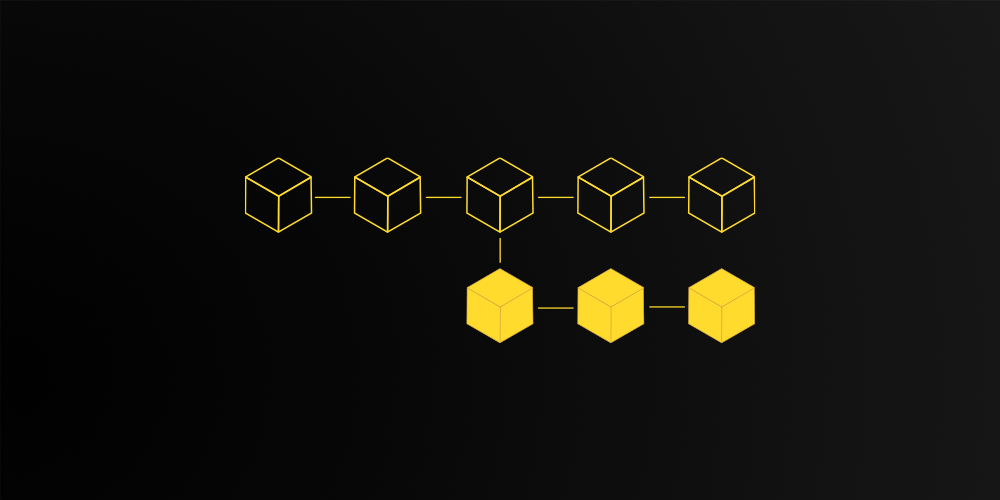

- Layer 2 Solutions: Scaling solutions like Lightning Network for Bitcoin and Ethereum’s Layer 2 solutions address the congestion issues on primary blockchain networks. These innovations enhance transaction speed and reduce fees, making altcoins more viable for everyday use.

- Decentralized Finance (DeFi): The rise of DeFi has transformed the altcoin landscape, allowing users to lend, borrow, and earn interest on their digital assets. Platforms built on various popular altcoins are creating new financial ecosystems that operate without traditional banking systems.

- NFTs and Tokenization: Non-fungible tokens (NFTs) have catapulted several altcoins into the spotlight. By tokenizing assets, artists, and creators can monetize their work, while altcoins that support these transactions gain traction and user adoption.

- Interoperability Protocols: Innovations aimed at improving the interoperability of different blockchains are also pivotal. Projects like Polkadot and Cosmos aim to connect multiple blockchains, enhancing collaboration and liquidity in the altcoin market trends.

These technological advancements not only position altcoins as formidable contenders against Bitcoin but also drive interest among investors looking for altcoin investment strategies that leverage these innovations for better returns. As we move towards 2025, keeping an eye on these trends will be crucial for anyone interested in the evolving landscape of digital currencies.

Understanding altcoins in cryptocurrency is essential for anyone looking to diversify their portfolio beyond Bitcoin. As investors increasingly shift their focus, the analysis of popular altcoins 2025 is crucial for identifying which projects have the potential for long-term growth. In the competitive landscape of the crypto market, assessment of altcoin investment strategies can help investors navigate through various uncertainties while maximizing returns.

The altcoin market trends reveal key insights about emerging projects, their underlying technology, and market capitalization. Keeping an eye on these trends allows investors to make informed decisions about which altcoins may outperform Bitcoin in the future. This not only involves evaluating the fundamentals of each altcoin but also understanding how they position themselves against Bitcoin and each other.

For a successful investment journey, it’s essential to blend traditional investment principles with a keen understanding of the unique characteristics of altcoins. Strategies may range from holding promising altcoins for the long term to engaging in high-frequency trading. Regardless, staying updated on market movements and technological advancements can significantly enhance your chances of success in the dynamic world of altcoins.

Investment Strategies for Altcoins in a Volatile Market

Investing in altcoins in cryptocurrency offers promising opportunities, yet it requires a well-thought-out strategy due to the inherent volatility of the market. One effective approach is diversifying your portfolio by including popular altcoins alongside Bitcoin. By spreading your investments across different projects, you can mitigate risks associated with any single asset’s performance.

Another key strategy is to stay informed about altcoin market trends. Regularly research market dynamics, news, and updates on projects in the altcoin space. Understanding technological innovations and planned developments can provide insights into which altcoins may gain value, especially as we look toward popular altcoins 2025.

Additionally, consider employing a dollar-cost averaging strategy. This involves investing a fixed amount in altcoins at regular intervals regardless of their price. This method allows you to reduce the impact of volatility and avoid the pitfalls of attempting to time the market, which can often lead to unfavourable decisions.

Always keep an eye on the fundamentals of the altcoins you choose. Assessing factors such as the team behind the project, use cases, and market capitalization can help inform your investment decisions and distinguish between potential long-term winners and short-lived trends, sometimes seen in debates of Bitcoin vs altcoins.

Investment Strategies for Altcoins in a Volatile Market

Investing in altcoins in cryptocurrency requires a careful approach, especially given the market’s inherent volatility. Unlike Bitcoin, which has established itself as a benchmark, altcoins often experience sharper price fluctuations. Here, we will explore effective altcoin investment strategies that can help you navigate this unpredictability.

1. Diversification: One of the most effective strategies is to diversify your investment across various popular altcoins 2025. By spreading your investments among multiple altcoins, you reduce the risk associated with any single asset’s poor performance.

2. Market Research: Stay informed about altcoin market trends and developments. Analysing the latest news, technological advancements, and regulatory changes can provide insights that inform your investment decisions.

3. Long-term vs. Short-term: Decide whether you are a long-term holder or a short-term trader. For long-term investors, focusing on projects with strong fundamentals may yield better returns, while short-term traders might capitalize on price swings for quicker gains.

4. Use Technical Analysis: Mastering technical analysis can also enhance your investment strategy. By examining price charts and patterns, you can make more informed decisions regarding entry and exit points for your trades.

5. Set Stop-Loss Orders: Given the high volatility in altcoin markets, setting stop-loss orders can help protect your investments from significant losses. This will automatically sell your altcoins if they reach a certain price point, keeping your losses in check.

By employing these strategies and staying informed, investors can better navigate the challenges presented by altcoins and potentially reap substantial rewards in a dynamic and evolving market.

Risks and Challenges in Altcoin Trading

Trading altcoins in cryptocurrency can be a double-edged sword. While they present lucrative opportunities for profit, they are also fraught with significant risks and challenges that every investor should consider before diving in. Understanding these factors can help you make more informed decisions when dealing with popular altcoins 2025 and other market trends.

One of the primary risks in altcoin trading is volatility. Unlike Bitcoin, which has established itself as a more stable asset, many altcoins are highly susceptible to price fluctuations triggered by market sentiment, regulatory changes, or technological developments. This volatility can lead to substantial losses if not managed carefully.

Another challenge is the lack of information and research. While Bitcoin’s history and utility are well-documented, many altcoins may not offer the same level of transparency. Investors often face difficulties in assessing the legitimacy and potential of new projects, which can lead to impulsive investment decisions. Conducting thorough research is essential to differentiate between promising altcoin investment strategies and those that might be mere hype.

Liquidity is also a significant concern. Many altcoins may have lower trading volumes compared to Bitcoin, making it more challenging to execute trades at desired price levels. In some cases, this can lead to slippage, where the actual execution price is less favorable than the expected price. This can be especially problematic during market downturns.

The regulatory landscape surrounding altcoins is still evolving, leading to uncertainty about future governmental actions that may impact the market. Staying informed about legal developments is crucial in mitigating potential compliance risks, as these could affect both the market dynamics and the value of specific altcoins.

While trading altcoins in cryptocurrency offers enticing opportunities, it is crucial to navigate the associated risks wisely. A well-rounded approach that incorporates strategic planning, diligent research, and an understanding of market trends can help investors capitalize on the dynamic world of altcoins.

Preguntas frecuentes

¿Qué son las altcoins?

Altcoins are any cryptocurrencies that are not Bitcoin. They include various digital currencies that offer alternative features and functionalities.

Why should investors consider altcoins?

Investors may consider altcoins for potential higher returns, diversification of their portfolio, and access to different technologies or use cases that may not be available with Bitcoin.

¿En qué se diferencian las altcoins del Bitcoin?

Altcoins can differ from Bitcoin in various ways, including technology, use cases, supply, and transaction methods. Many altcoins aim to improve upon Bitcoin’s limitations or cater to specific niches.

What are some popular altcoins to watch?

Some popular altcoins include Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Cardano (ADA), and Solana (SOL). Each of these has distinctive features and applications.

What risks are associated with investing in altcoins?

Investing in altcoins can be risky due to high volatility, less market adoption compared to Bitcoin, potential regulatory challenges, and the possibility of scams or failed projects.

How can I research altcoins before investing?

Research altcoins by exploring their whitepapers, project websites, community discussions on platforms like Reddit or Telegram, and tracking their performance on cryptocurrency exchanges.

Are altcoins a good investment for beginners?

While some altcoins offer substantial opportunities, beginners should approach investing cautiously, as altcoins can be more volatile and complex than Bitcoin. It’s essential to do thorough research and understand market dynamics.

Descargo de responsabilidad

This content is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risks, including loss of capital. Always conduct your own research or consult a qualified financial advisor before making investment decisions.