Weekly Ethereum Onchain Report

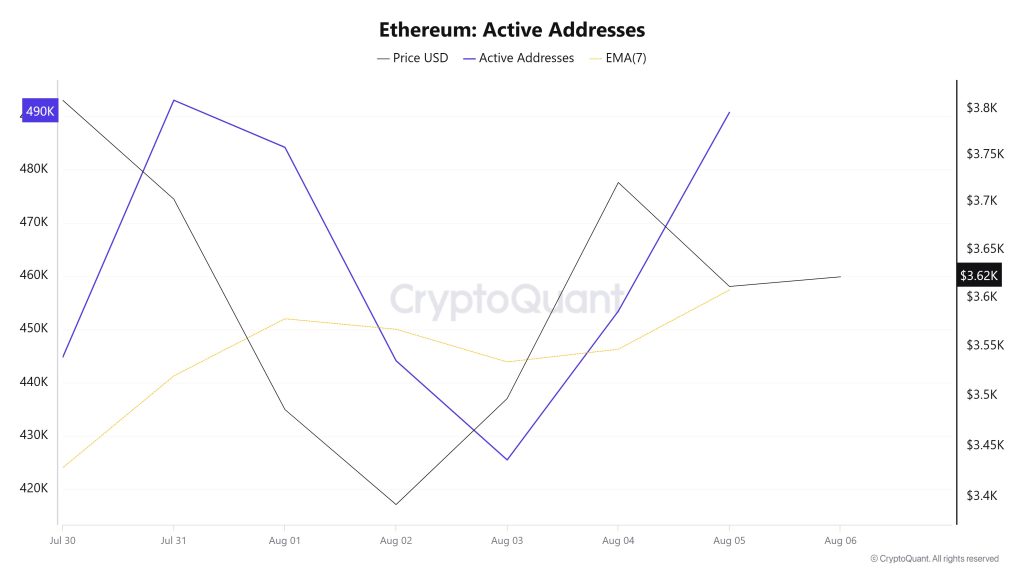

Active Addresses

Between July 30 and August 6, a total of 493,077 active addresses entered the Ethereum network. During this period, the Ethereum price rose from $3,497 to $3,703. Especially el July 31, at the intersection of the price and the number of active addresses, there was a significant decrease en the number of active addresses while the price continued to rise. This suggests that despite the price increase en the following days, short-term participation decreased and was probably dominated por trades among existing investors. When the 7-day simple moving average (SMA) is analyzed, it is seen that a general upward trend is dominant en the Ethereum price.

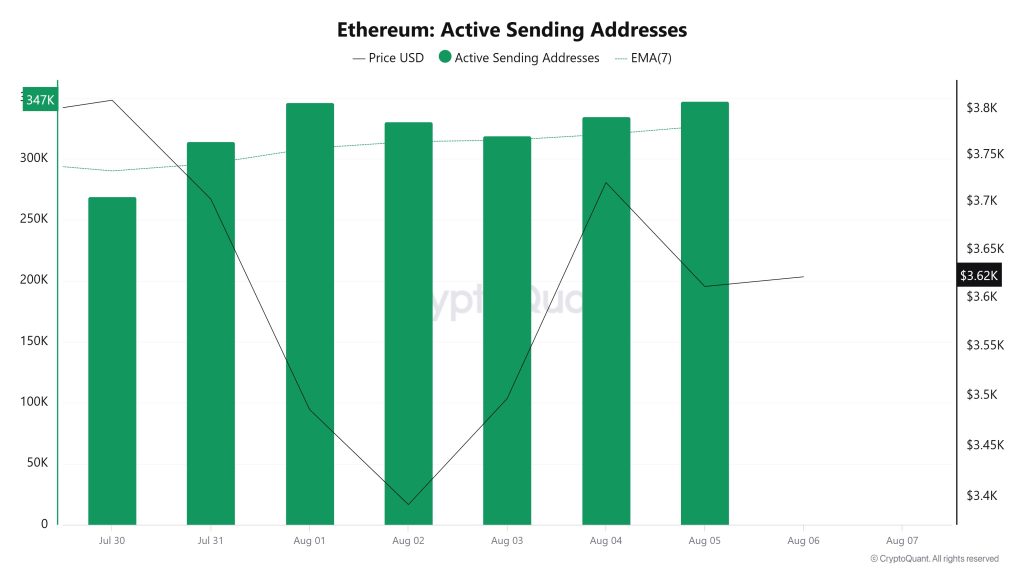

Active Sending Addresses

Between July 30th and August 6th, there was an upward movement en active shipping addresses with the Black Line (price line). On the same day that the price reached a weekly high, active sending addresses rose to 346,230.

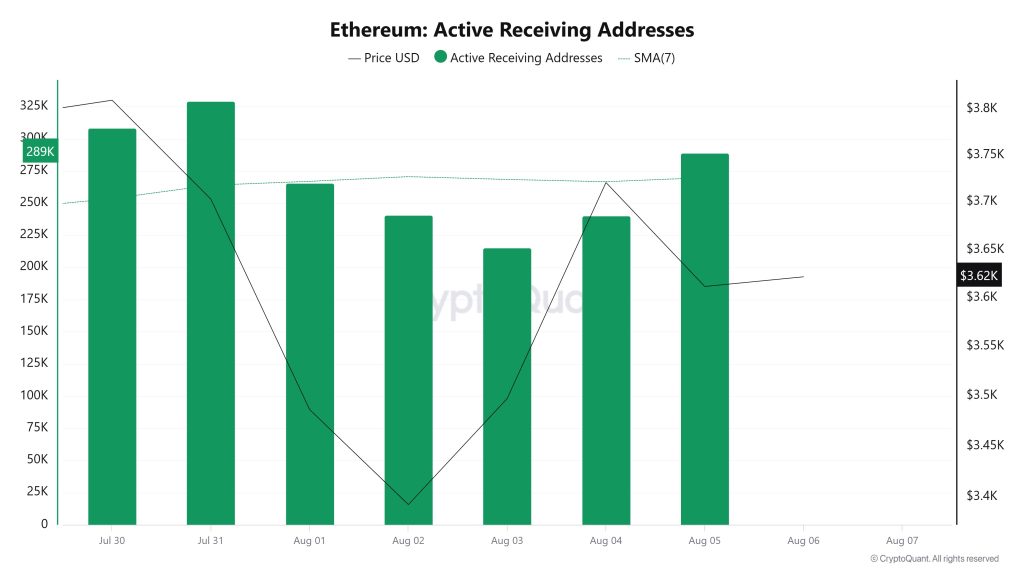

Active Receiving Addresses

Between July 30 and August 6, there was an upward consolidation en active buying addresses and a parallel upward consolidation en the price. On the day of the price high, active receiving addresses dropped to 229,093, indicating that buying is slowing down.

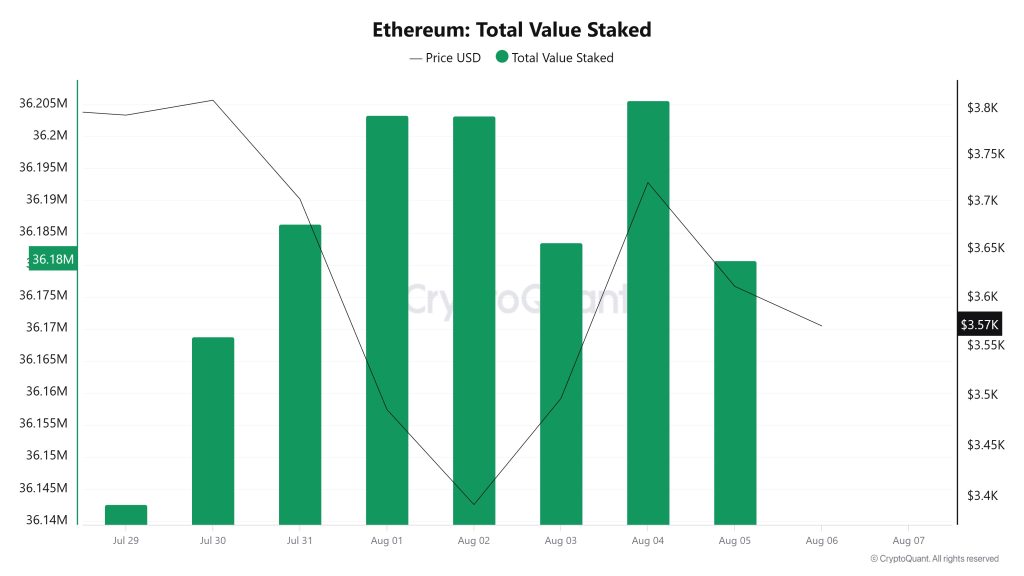

Total Value Staked

On July 30th, ETH price was 3.809 while Total Value Staked was 36.168.745. As of August 5, ETH price fell to 3,611, a decrease of 5.20%, while Total Value Staked rose to 36,180,645, an increase of 0.03%.

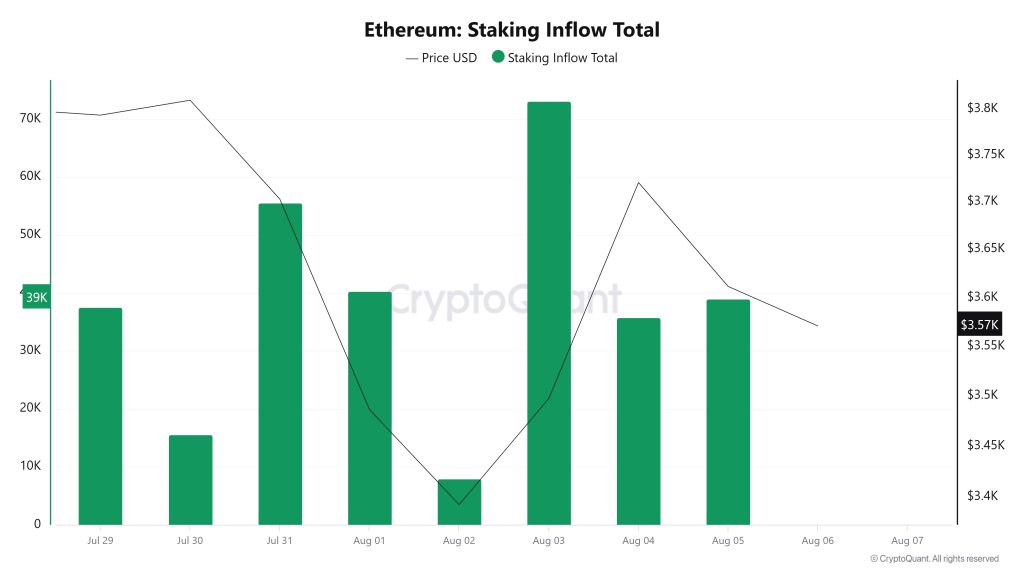

Staking Inflows

On July 30th, ETH price was at 3,809, while Staking Inflow was at 15,532. As of August 5, ETH price fell to 3,611, a decrease of 5.20%, while Staking Inflow rose to 39,030, an increase of 151.38%.

Derivatives

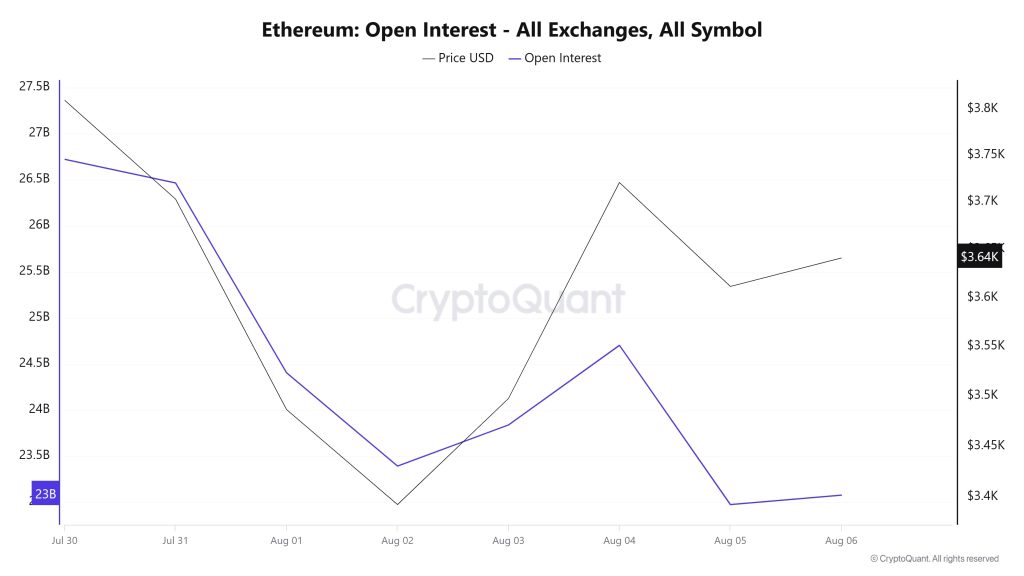

Open Interest

Open positions, which were around $26.7 billion at the end of July, fell sharply to $23 billion en the first days of August. In the same period, the price fell similarly, suggesting a general retreat or cautious behavior en the market. On August 2, after both price and open interest hit their lows, a recovery began. On August 3 and 4, the rise en the price is more prominent, while open interest accompanies it, but with a more limited momentum. As of August 5, open interest starts to decline again and settles at a flat level. Price similarly retreated sharply el that day, before recovering slightly el August 6. Overall, this chart shows that en the short term, both investor interest and price movements are fluctuating, and the market remains indecisive and cautious. Since open positions could not increase permanently during this period, it is understood that there is no expectation of a strong direction en the market.

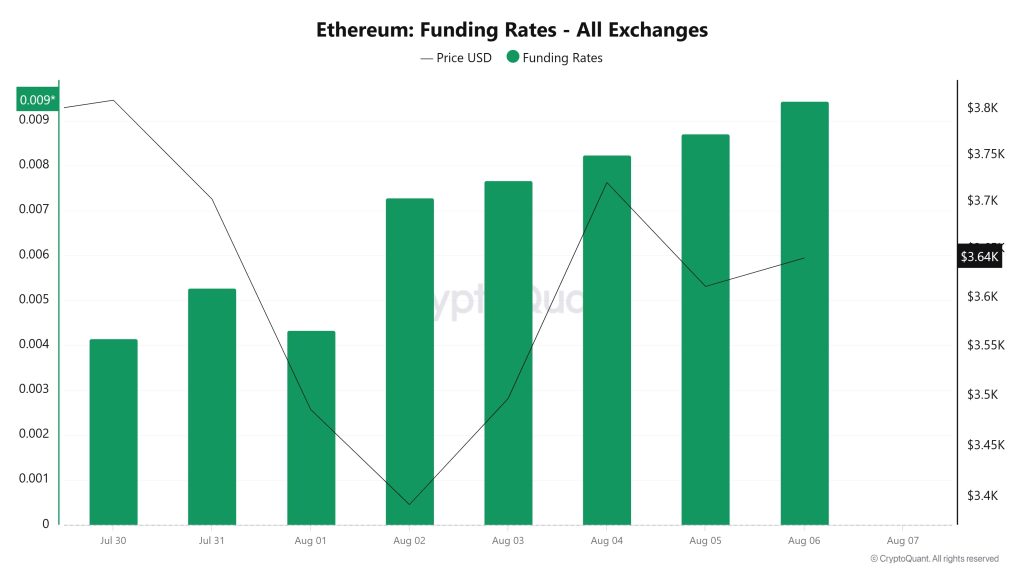

3.2. Funding Rate

Looking at the chart en general, Ethereum’s funding rates have been el an upward trend since August 2. Rates, which were at lower levels before this date, suddenly moved upwards and reached their highest level as of August 6. This shows that long positions are gaining weight en the market and investors are expecting the price to rise. But interestingly, the price movement is not as strong as the funding rate. Although the price declined significantly from the end of July to August 2, the funding rate started to increase from August 2, meaning that investors continued to open long positions despite the decline. After August 4, the price rebounded somewhat, but not en line with the aggressive rise en the funding rate. This suggests that the market may be too optimistic. Although the funding rate is high, the fact that the price does not fully support this may indicate that caution should be exercised en the short term.

Long & Short Liquidations

With the ETH price falling to $3,354, approximately $1.1 billion worth of long positions were liquidated. During the same period, a short position of 359 million dollars was liquidated.

| Date | Long Amount (Million $) | Short Amount (Million $) |

|---|---|---|

| July 30 | 114.50 | 40.11 |

| July 31 | 94.30 | 30.89 |

| August 01 | 373.88 | 40.97 |

| August 02 | 152.93 | 31.68 |

| August 03 | 28.93 | 57.00 |

| August 04 | 17.15 | 115.86 |

| August 05 | 337.88 | 42.91 |

| Total | 1119.57 | 359.42 |

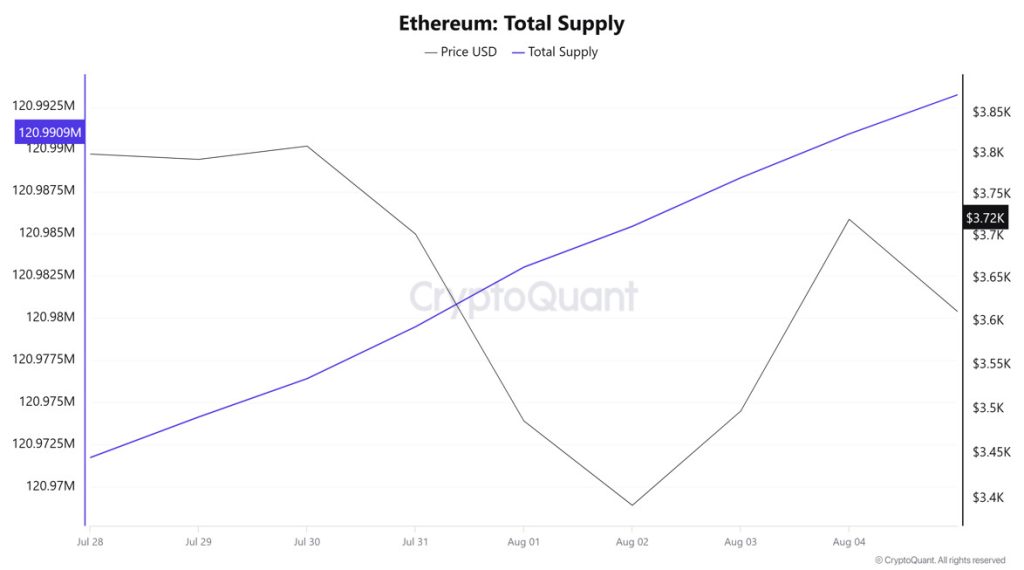

Supply Distribution

Total Supply: 120,993,223 units, up about 0.01775% from last week.

New Supply: The amount of ETH produced this week was 21,487.

Velocity: Velocity was 8.91 as of August 4, up from 8.85 last week.

| Wallet Categoría | 28.07.2025 | 04.08.2025 | Change (%) |

|---|---|---|---|

| 100 – 1k ETH | 8.8642M | 8.7981M | -0.746% |

| 1k – 10k ETH | 12.6256M | 12.7372M | 0.884% |

| 10k – 100k ETH | 18.1479M | 18.4725M | 1.789% |

| 100k+ ETH | 4.3805M | 4.2244M | -3.564% |

According to the latest weekly data, Ethereum wallet distribution is mixed. While wallet balances en the 100 – 1k ETH range experienced a limited decrease of 0.746%, a moderate increase of 0.884% was recorded en the 1k – 10k ETH segment. In contrast, there was a notable increase of 1.789% en the 10k – 100k ETH range, while the 100k+ ETH category saw a significant decrease of 3.564%.

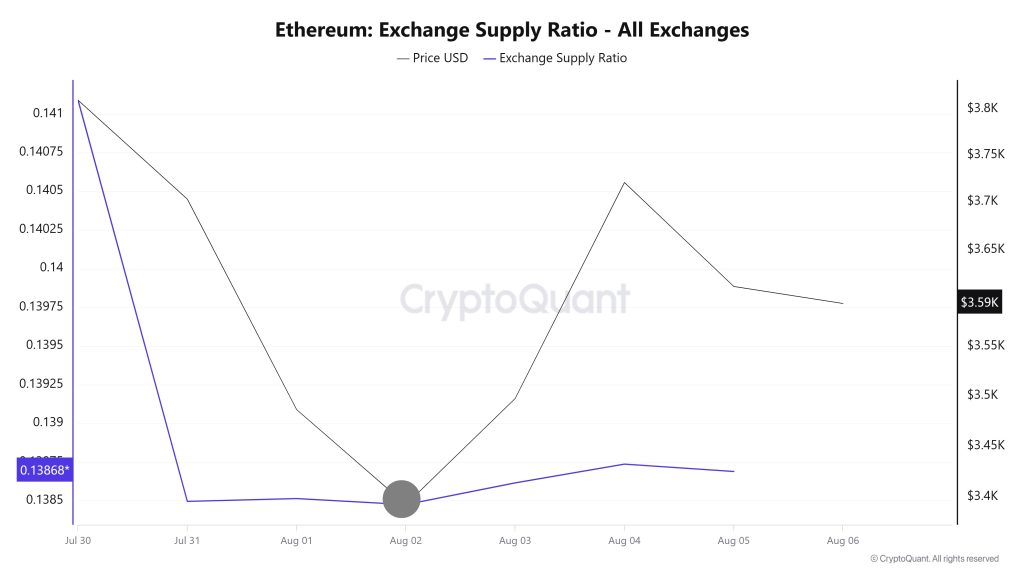

Exchange Supply Ratio

Between August 30th and August 5th, the Ethereum Exchange Supply Ratio increased from 0.13849551 to 0.13873636. During this period, the Ethereum price rose from $3,703 to $3,720. At the intersection of the price and the Exchange Supply Ratio, especially el August 2, there was a significant increase en the Exchange Supply Ratio as the price continued to fall. This suggests that despite the price decline, the amount of Ethereum supplied to exchanges has increased, possibly indicating that long-term investors have stopped holding their holdings. It is seen that a downward trend is generally dominant en the Ethereum price.

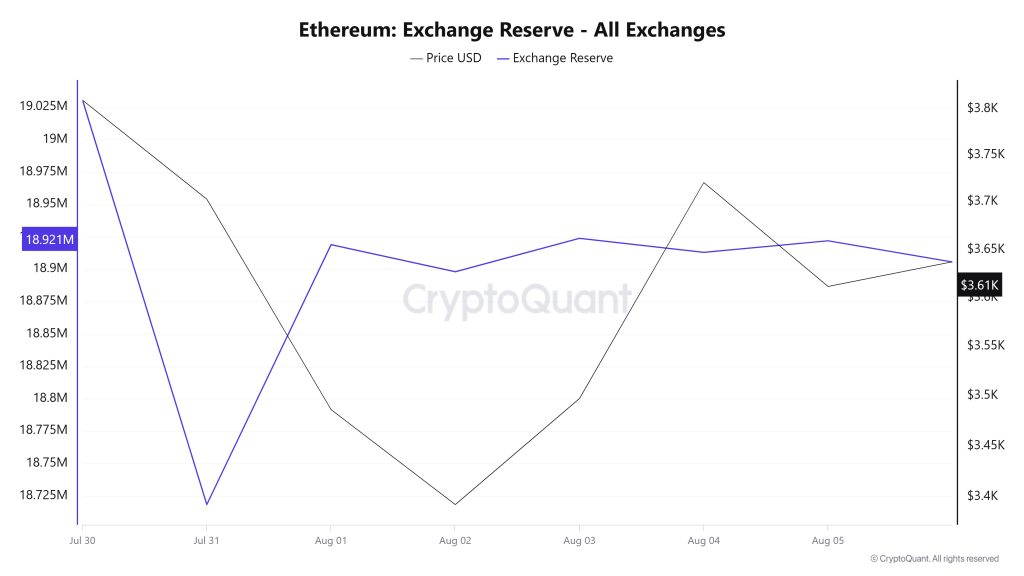

Exchange Reserve

Between July 30 and August 5, 2025, Ethereum reserves el exchanges decreased from 19,030,470 ETH to 18,921,976 ETH. During this period, there was a total net outflow of 108,494 ETH, a decrease of about 0.57% en exchange reserves. During the same period, the Ethereum price fell 5.2%, from $3,810 to $3,612. The decline en the price despite the continued reduction en reserves indicates that investors are following a cautious strategy of profit realization or selling. In the long term, the decline en reserves continues to support bullish potential, while en the short term, continued stock market outflows and selling pressure may cause the price to remain en a more sideways trend.

| Date | 30-Jul | 31-Jul | 1-Aug | 2-Aug | 3-Aug | 4-Aug | 5-Aug |

|---|---|---|---|---|---|---|---|

| Exchange Inflow | 1,010,735 | 1,009,376 | 1,350,715 | 496,083 | 383,635 | 957,304 | 1,159,541 |

| Exchange Outflow | 1,007,639 | 1,321,446 | 1,150,141 | 516,965 | 357,842 | 968,146 | 1,150,609 |

| Exchange Netflow | 3,095 | -312,070 | 200,574 | -20,881 | 25,793 | -10,842 | 8,932 |

| Exchange Reserve | 19,030,470 | 18,718,400 | 18,918,974 | 18,898,092 | 18,923,885 | 18,913,043 | 18,921,976 |

| ETH Price | 3,810 | 3,703 | 3,486 | 3,393 | 3,497 | 3,721 | 3,612 |

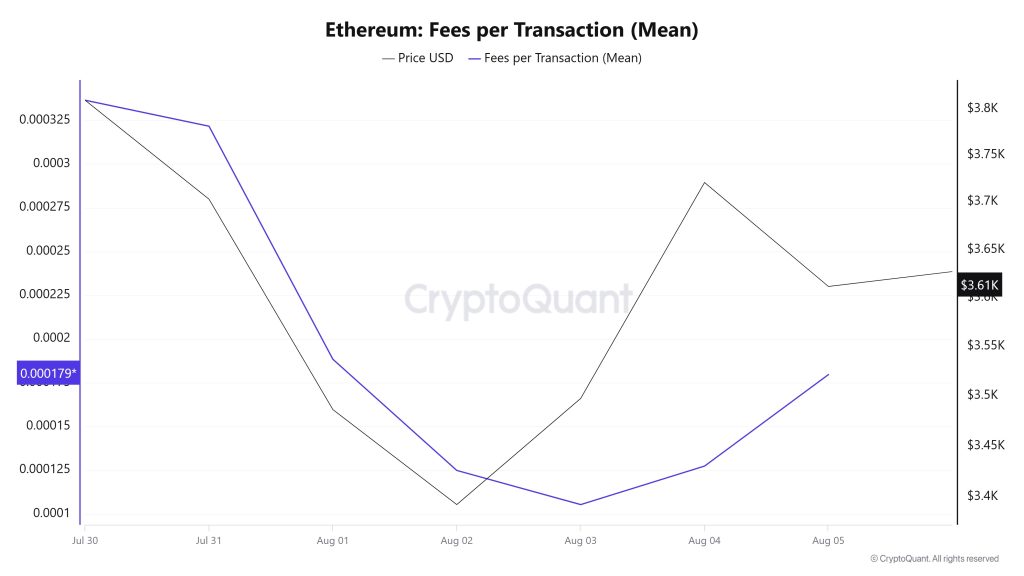

Fees and Revenues

When the Ethereum Fees per Transaction (Mean) data between July 30 and August 5 is analyzed, it is seen that this indicator was realized at the level of 0.000336440317944061 el July 30, the first day of the week.

As of this date, a downward trend was observed due to the volatile movements en the Ethereum price; as of August 3, it reached 0.000105307312637154, reaching the lowest level of the week.

In the following days, Ethereum Fees per Transaction (Mean) started to rise again and closed at 0.00017961704632878 el August 5, the last day of the week.

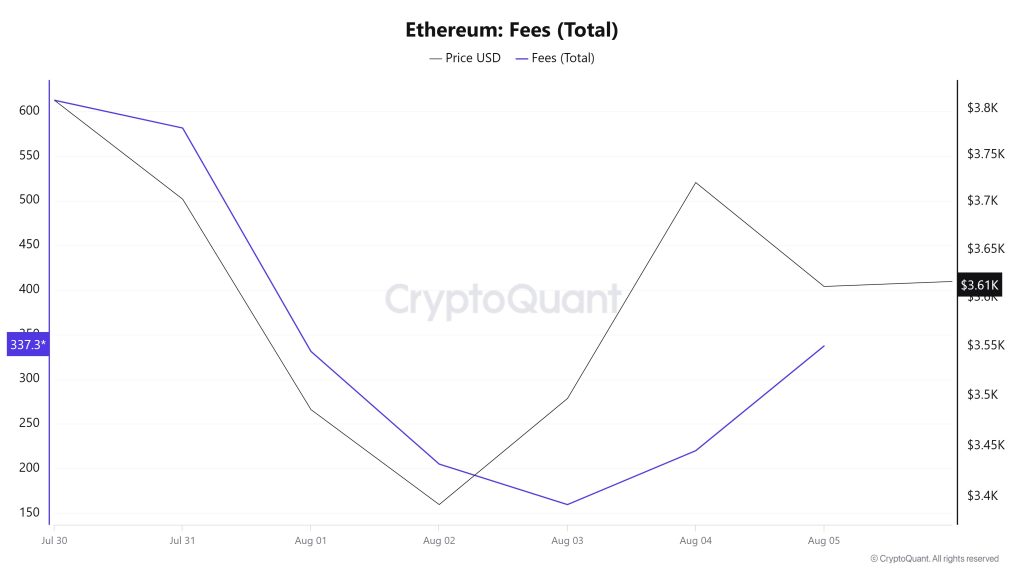

Bitcoin: Fees (Total)

Similarly, an analysis of Ethereum Fees (Total) data between July 30 and August 5 shows that el July 30, the first day of the week, this indicator stood at 612,6568096551816.

As of this date, a downward trend was observed due to the volatile movements en the Ethereum price; as of August 3, it reached 159.64114712885606, the lowest level of the week.

In the following days, Ethereum Fees (Total) started to rise again and closed at 337,32638113388487 el August 5, the last day of the week.

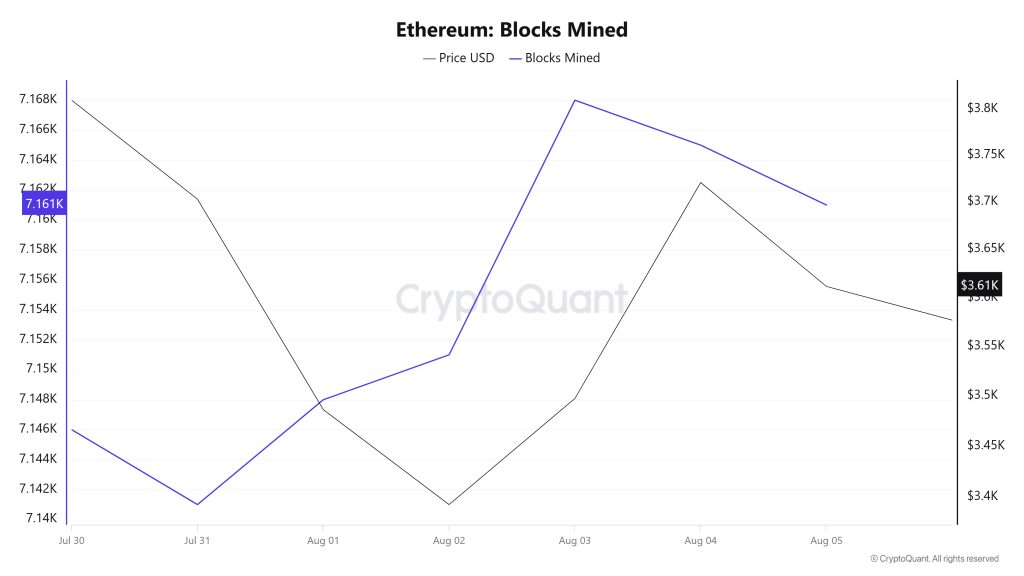

Blocks Mined

Between July 30 and August 5, Ethereum block production data showed an increase throughout the week. While 7,146 blocks were produced el July 30, this number increased to 7,161 as of August 5. The increase en the number of blocks produced indicates that the network was used more intensively during this period. There was a positive correlation between the Ethereum price and the number of blocks produced throughout the week.

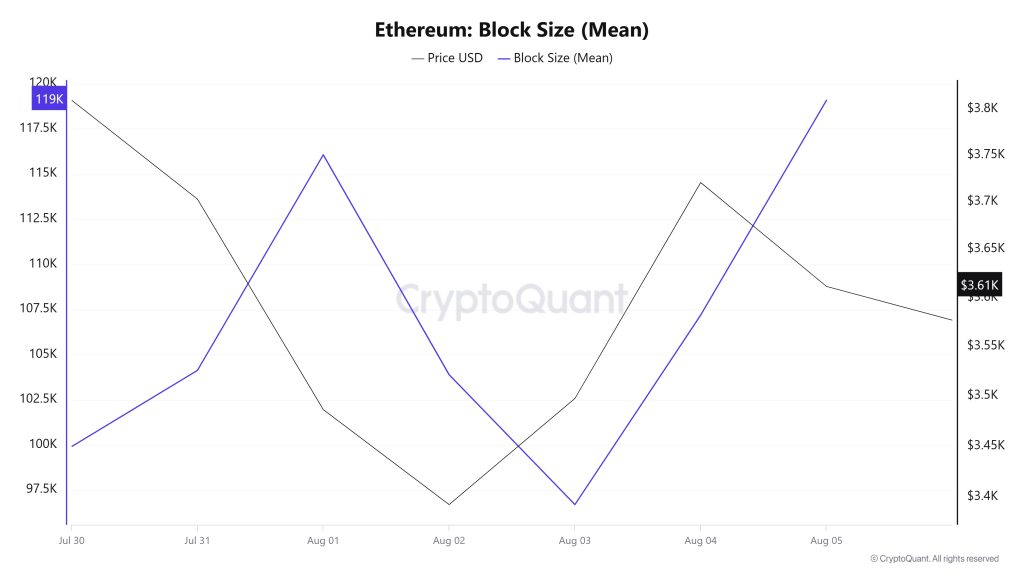

Block Size

Between July 30 and August 5, Ethereum block size data showed a significant increase throughout the week. On July 30th, the average block size was 99,914 bytes, while as of August 5th, this value increased to 119,084 bytes. There was a negative correlation between block size and Ethereum price during the week.

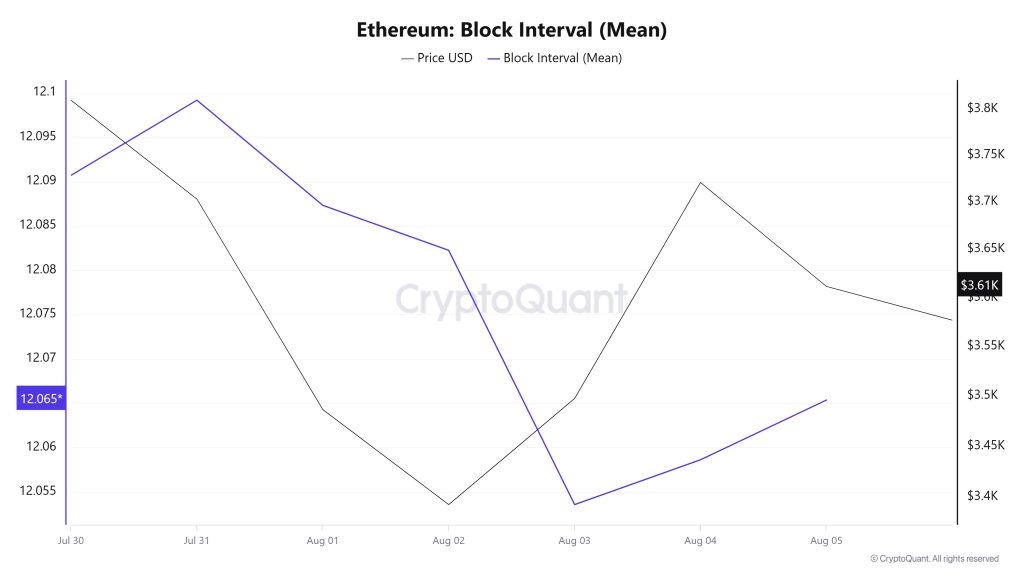

Block Interval

Between July 30 and August 5, Ethereum block data showed a slight decrease throughout the week. On July 30, the average block duration was 12.09 segundos, while it decreased to 12.06 segundos as of August 5. During the period en question, Ethereum block duration and price movement were positively correlated throughout the week.

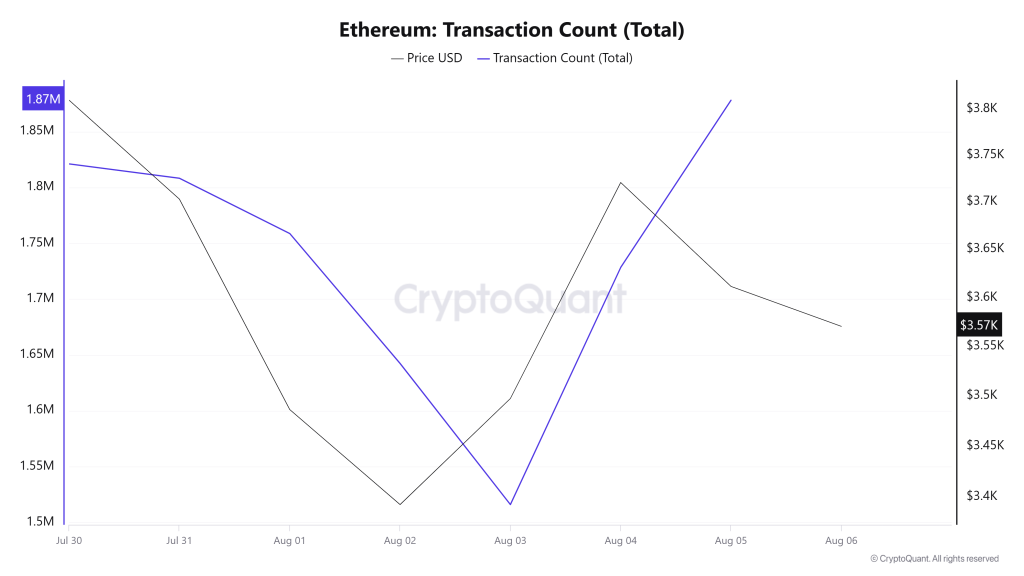

Transaction

Last week, a total of 11,143,025 transactions were executed el the Ethereum network, while this week this number decreased por about 4.82% to 10,605,471. The highest number of transactions el a weekly basis was 1,878,031 el August 5, while the lowest number of transactions was 1,515,955 el August 3.

This change en the number of transactions suggests that the usage el the network has stopped increasing and stabilized a bit, and Ethereum burns have decreased compared to last week. The correlation between the price and the number of transactions was positively weighted throughout the week.

Tokens Transferred

While the total amount of ETH transferred el the Ethereum network last week was 16,952,280, this week this amount decreased por approximately 23.81% to 12,913,505. 2,530,694 ETH transfers el August 1 was the highest daily token transfer amount of the week, while August 3 recorded the lowest value of the week with only 1,019,774 ETH transfers. When the relationship between the price and the amount of tokens transferred was analyzed throughout the week, a balanced correlation was observed.

The fact that the number of transfers en network usage has decreased, but the total amount of tokens transferred has decreased much more, suggests that user activity el the Ethereum network has decreased, but the volume of smaller users has increased. This can be interpreted as Ethereum expanding its user base to small investors el DeFi, NFT and other Web3 applications.

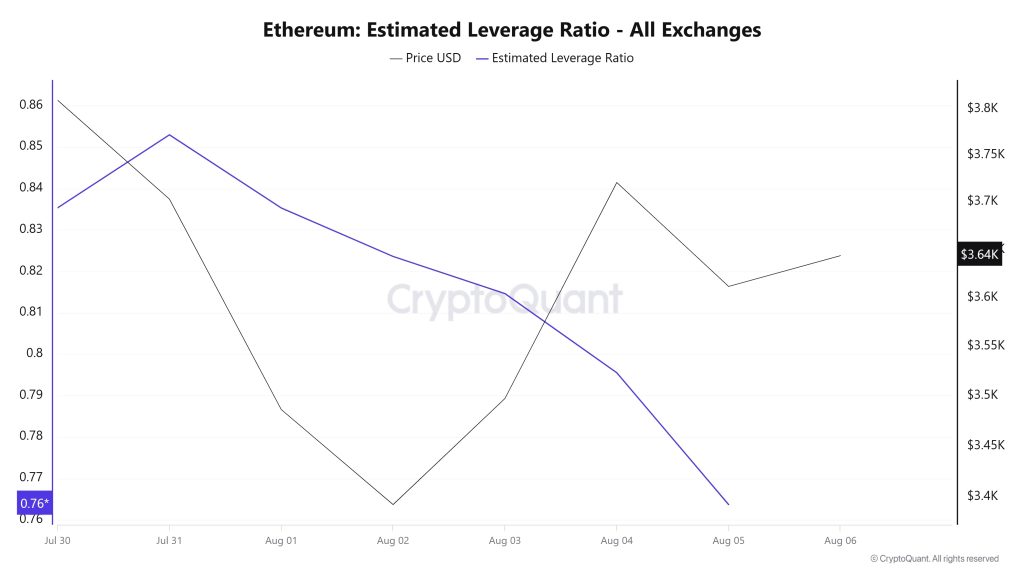

Estimated Leverage Ratio

During the 7-day period, the metric generally declined. ELR (Estimated Leverage Ratio), which had a value of 0.835 at the beginning of the process, increased after the day and reached its highest value of 0.852 el July 31. After this point, the metric declined to 0.763 at the time of writing. A higher ELR means that participants are willing to assume more risk and generally indicates bullish conditions or expectations. It should be noted that these rallies can also be caused por dwindling reserves. When we look at Ethereum reserves, there were 19.03 million reserves at the beginning of the process, while this figure decreased during the rest of the process and is currently seen as 18.93 million. At the same time, Ethereum’s Open Interest is seen as 55.64 billion dollars at the beginning of the process. As of now, the volume decreased en the process and the open interest value stood out as 47.27 billion dollars. With all this data, the ELR metric has retreated for most of the process. The price of the asset, el the other hand, experienced the highest point of the process with all this data el July 31 and set it at $ 3,878. The lowest point was realized el August 3 at $ 3,353. As of now, the risk appetite of investors and traders seems to have decreased. This was reflected en the ETH price, causing the price to remain flat at the moment. The decline en the ELR rate and the decrease en open interest throughout the process shows us that investors are hedging. As a result, the decline en reserves and open interest indicates that the market has lost its appetite and is el a bearish approach.

ETH Onchain Overall

| Metric | Positive 📈 | Negative 📉 | Neutral ➖ |

|---|---|---|---|

| Active Addresses | ✓ | ||

| Total Value Staked | ✓ | ||

| Derivatives | ✓ | ||

| Supply Distribution | ✓ | ||

| Exchange Supply Ratio | ✓ | ||

| Exchange Reserve | ✓ | ||

| Fees and Revenues | ✓ | ||

| Bloks Mined | ✓ | ||

| Transaction | ✓ | ||

| Estimated Leverage Ratio | ✓ |

*The metrics and guidance en the table do not, por themselves, describe or imply an expectation of future price changes for any asset. The prices of digital assets may vary depending el many different variables. The onchain analysis and related guidance are intended to assist investors en their decision-making process, and making financial investments based solely el the results of this analysis may result en harmful transactions. Even if all metrics produce a positive, negative or neutral result at the same time, the expected results may not be seen according to market conditions. Investors reviewing the report would be well advised to heed these caveats.

Legal Notice

The investment information, comments and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en results that are en line with your expectations.

NOTE: All data used en Ethereum onchain analysis is based el Cryptoqaunt.