Weekly Ethereum Onchain Report

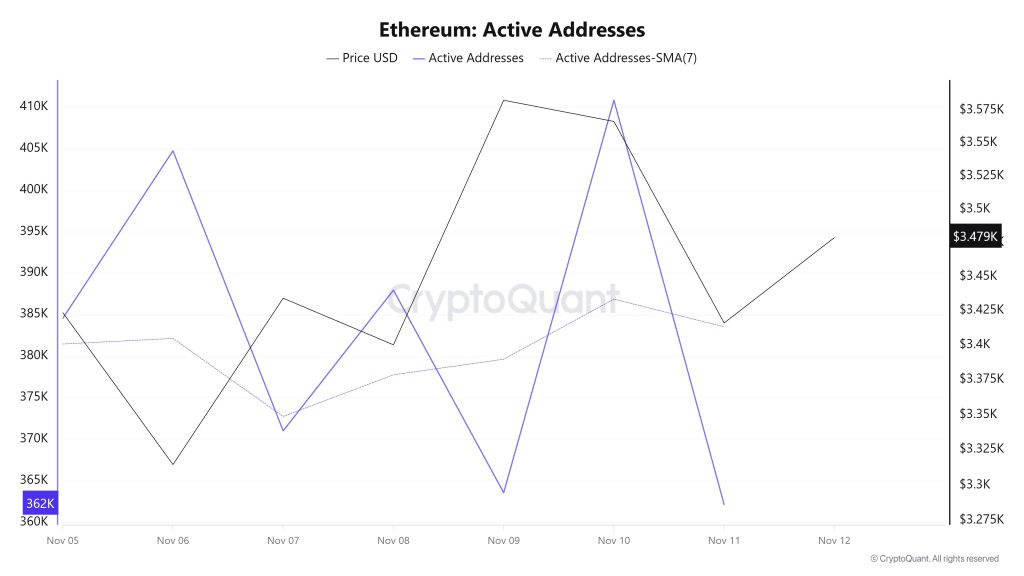

Active Addresses

Between November 5 and November 12, a total of 410,822 active addresses were added to the Ethereum network. During this period, the Ethereum price fell from $3,582 to $3,314. Notably, el November 9, when the price reached the active address point, the number of active addresses increased, and a rise en the price was observed after a certain period. When examining the 7-day simple moving average (SMA), it is seen that the Ethereum price is generally trending upward.

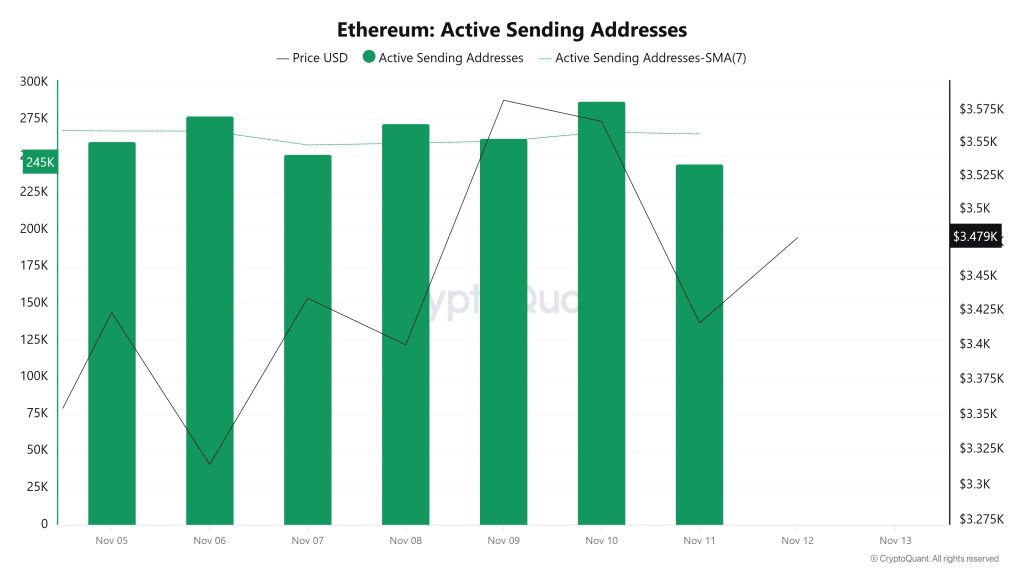

Active Sending Addresses

Between November 5 and November 12, high levels of active sending activity were observed alongside the Black Line (price line). On the day the price reached its highest level el a weekly basis, active sending addresses reached 287,303.

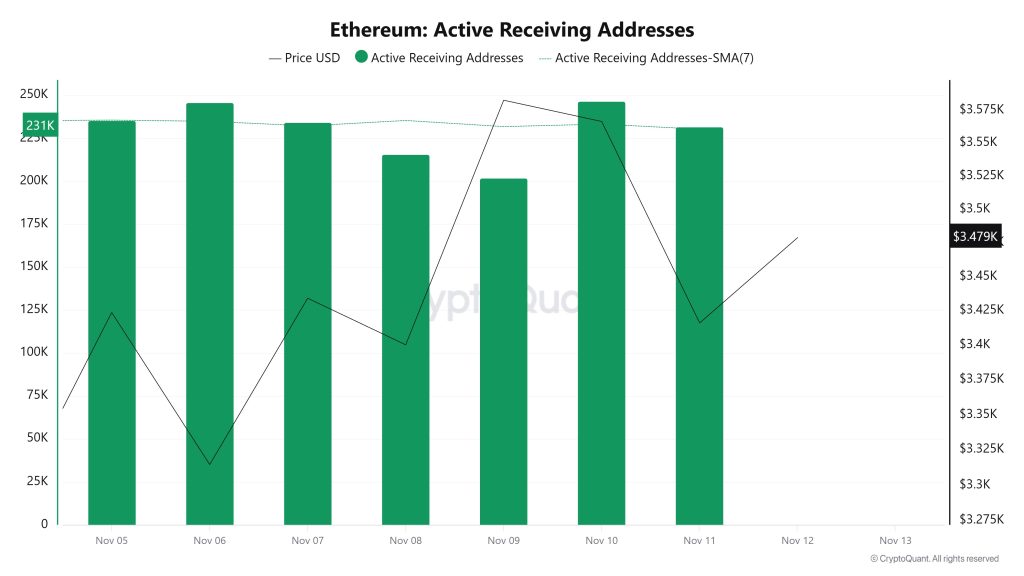

Active Receiving Addresses

Between November 5 and November 12, while there was no significant increase en active receiving addresses, the price was seen to consolidate horizontally. On the day the price reached its highest level, active receiving addresses reached 246,543, indicating an increase en purchases.

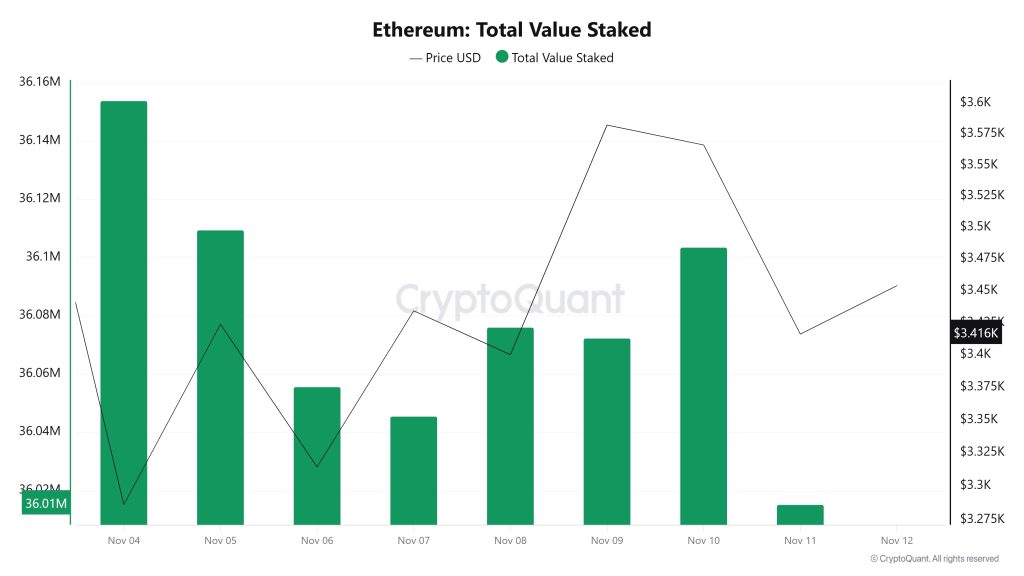

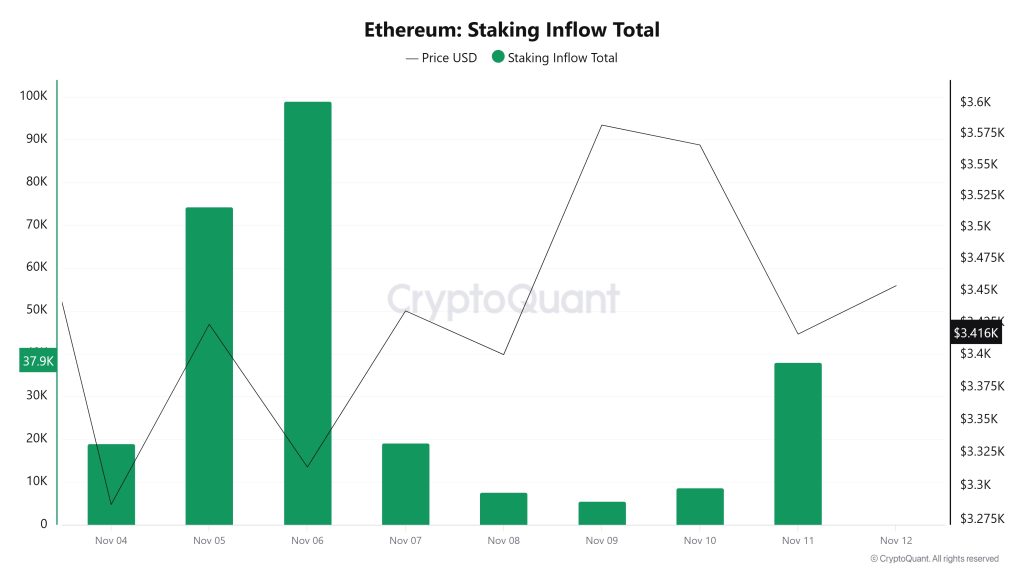

Total Value Staked

On November 5, when the ETH price was trading at $3,423, the Total Value Staked was at 36,109,484. As of November 11, the ETH price fell to $3,416, while the Total Value Staked dropped to 36,015,212, recording a 0.26% decline.

Staking Inflows

On November 5, while the ETH price was trading at $3,423, the Staking Inflow was at 74,320. As of November 11, the ETH price fell to $3,416, while the Staking Inflow dropped to 37,998, recording a 48.87% decrease.

Derivatives

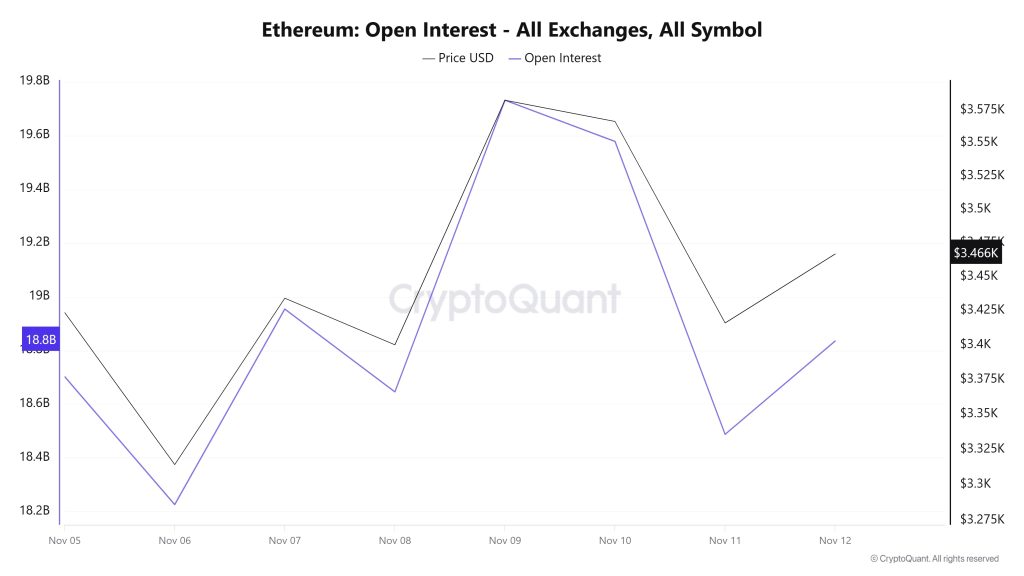

Open Interest

While open interest declined at the beginning of the week, there was a significant increase el November 9, rising to approximately $19.8 billion. This increase was accompanied por a similar rise en price, indicating increased market interest.

However, el November 10 and 11, both the price and open positions declined, which may indicate a period of profit-taking or risk aversion among investors. Towards the end of the week, there was a slight recovery en both price and open interest. Overall, the Ethereum market appears volatile but active.

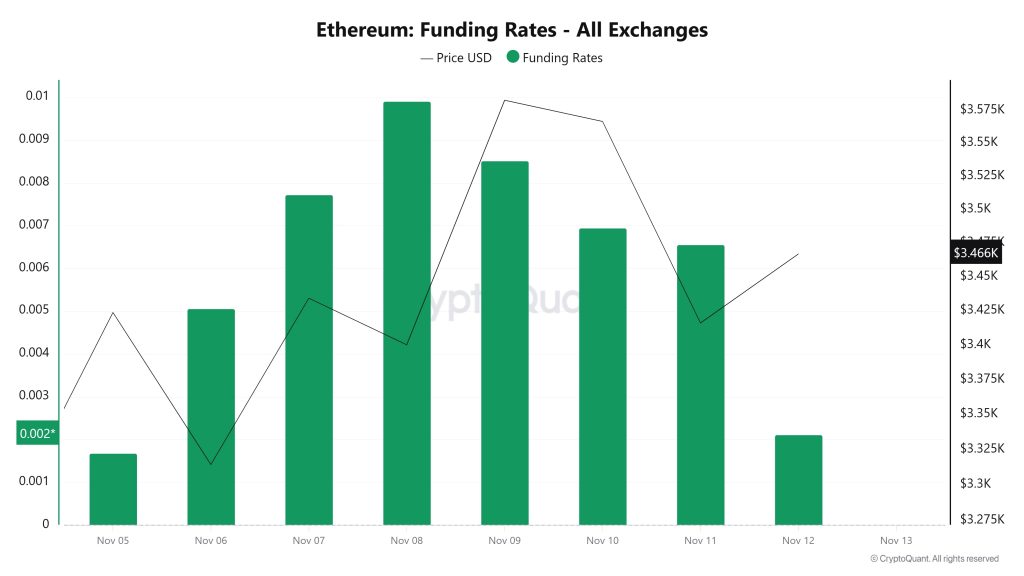

Funding Rate

From the last days of October until November 2, the rise en funding rates en positive territory indicates that long positions predominantly dominate the market and that investors maintain their expectation of price increases. However, following November 3, the price fell from $3,900 to $3,030, accompanied por a sharp decline en funding rates. This trend reveals that leveraged long positions have begun to close and the market has shifted to a more cautious stance.

The overall outlook suggests that short-term optimism en Ethereum futures has given way to a neutral outlook, while the decline en funding rates indicates that excessive leverage risk en the market has temporarily decreased.

Long & Short Liquidations

ETH, which fell from $3,440 to $3,197, rose to $3,680 and then fell again. However, $432 million en long positions were liquidated. During the same time period, $491 million en short positions were also liquidated.

| Date | Long Volume (Million $) | Short Volume (Million $) |

|---|---|---|

| November 5 | 45.84 | 92.28 |

| November 6 | 113.40 | 44.58 |

| November 7 | 67.73 | 83.50 |

| November 8 | 29.91 | 15.28 |

| November 9 | 17.12 | 93.41 |

| November 10 | 48.43 | 40.59 |

| November 11 | 110.32 | 121.74 |

| Total | 432.75 | 491.38 |

Supply Distribution

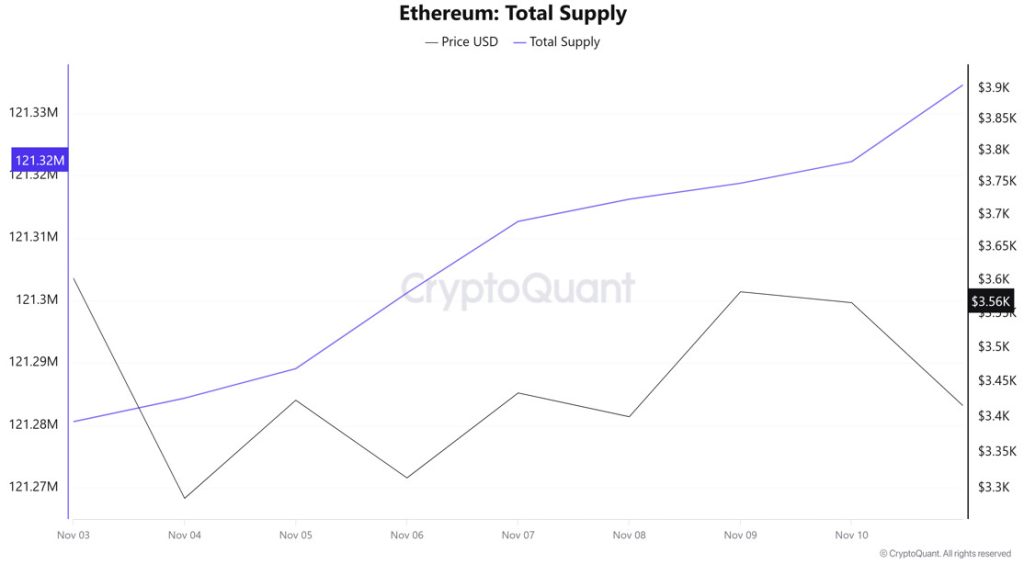

Total Supply: Reached 121,322,253 units, an increase of approximately 0.0343% compared to last week.

New Supply: The amount of ETH produced this week was 41,663.

Velocity: The velocity, which was 10.00 last week, reached 10.04 as of November 10.

| Wallet Categoría | November 3, 2025 | November 10, 2025 | Change (%) |

|---|---|---|---|

| 100 – 1k ETH | 8.6052M | 8.4539M | −1.76 |

| 1k – 10k ETH | 11.9918M | 12.05M | +0.49 |

| 10k – 100k ETH | 22.1482M | 22.1732M | +0.11 |

| 100k+ ETH | 4.0551M | 4.2899M | +5.79 |

According to the latest weekly data, the Ethereum wallet distribution presents a mixed picture.

The total balance of wallets en the 100–1k ETH range decreased por approximately 1.76%, indicating selling pressure among mid-sized investors. In contrast, the 1k–10k ETH range saw an increase of 0.49%, and the 10k–100k ETH range saw an increase of 0.11%. The most notable change was a strong 5.79% increase en addresses holding 100k+ ETH, indicating that large wallets have been accumulating en recent times.

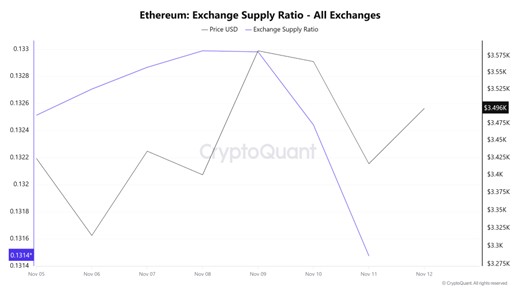

Exchange Supply Ratio

Between November 5 and November 12, the Ethereum Exchange Supply Ratio fell from 0.13251286 to 0.13147561. During this period, the price of Ethereum fell from $3,423 to $3,416. Particularly around November 9, when the price and Exchange Supply Ratio intersected, the correlation between the price and Exchange Supply Ratio turned positive. This indicates that despite the price decline, the amount of Ethereum supplied to exchanges has increased, and long-term investors are likely shifting their assets towards Ethereum. It appears that an overall upward trend en the Ethereum price may prevail.

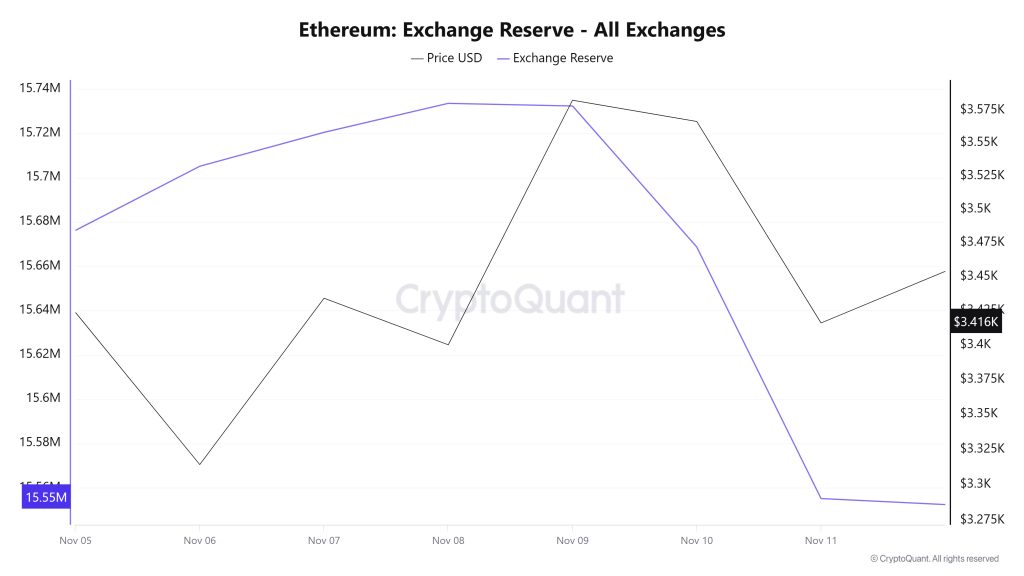

Exchange Reserve

Between November 5 and 11, 2025, Ethereum reserves el exchanges decreased from 15,734,972 ETH to 15,555,147 ETH. There was a net outflow of 179,826 ETH, and reserves decreased por approximately 1.14%. During this period, the price of ETH rose from $3,287 to $3,416, gaining 3.94% en value. The decline en reserves while the ETH price rose during this period indicated that buying was more dominant and that investors were withdrawing their ETH to their own wallets rather than keeping them el exchanges. This situation signaled that confidence was maintained en the market during this period and that investors believed the price could regain strength en the medium term.

| Asset / Index | Value ($) | Daily Change (%) |

|---|---|---|

| Bitcoin (BTC) | 103,610.0 | +0.41% |

| Ethereum (ETH) | 3,447.56 | +0.91% |

| Bitcoin Spot ETF | +524.0M | Net Inflow |

| Ethereum Spot ETF | −107.1M | Net Outflow |

| Nasdaq (NAS100) | 25,699.7 | +0.57% |

| S&P 500 (SPX) | 6,846.62 | +0.21% |

| Russell 2000 (RUT) | 2,462.0 | +0.20% |

| U.S. Dollar Index (DXY) | 99.177 | +0.08% |

| VIX Volatility Index (VIX) | 17.28 | −1.82% |

| U.S. 10-Year Treasury Yield (US10Y) | 4.116 | +0.08% |

| Brent Crude Oil (BRENT) | 65.252 | −0.34% |

| LBMA Gold (XAU) | 4,115.32 | −0.27% |

| LBMA Silver (XAG) | 51.393 | +0.55% |

Fees and Revenues

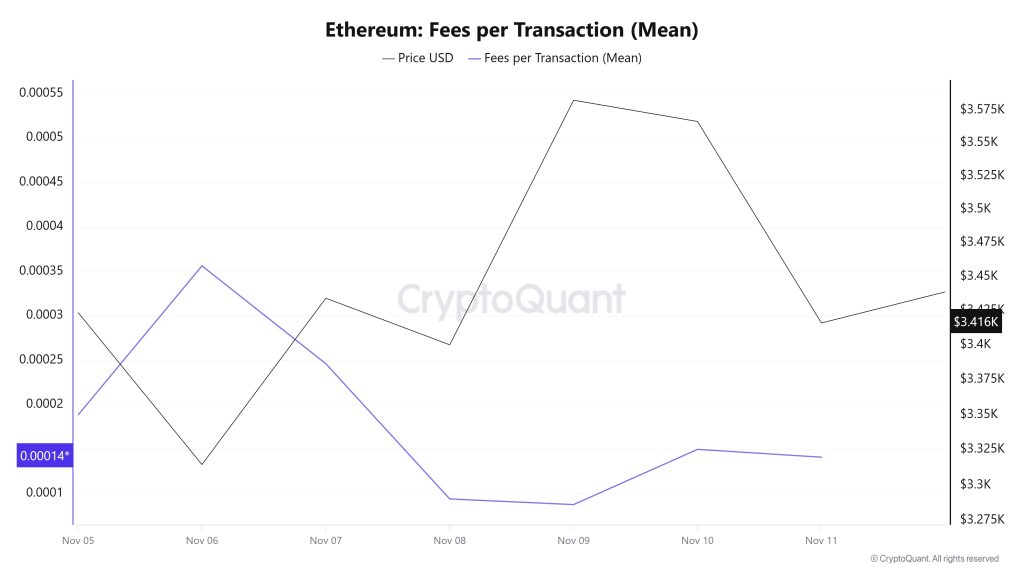

When examining the Ethereum Fees per Transaction (Mean) data for the period between November 5 and 11, it is observed that the indicator reached 0.00001057 el November 5, the first day of the week.

A downward trend was observed until November 9, when the indicator recorded its lowest value of the week at 0.00000492.

In this context, as a result of a significant increase en Ethereum price volatility as of November 10, the indicator regained momentum and followed a positive trend due to the impact of price volatility.

On November 11, the last day of the weekly period, the indicator closed the week at 0.00000558.

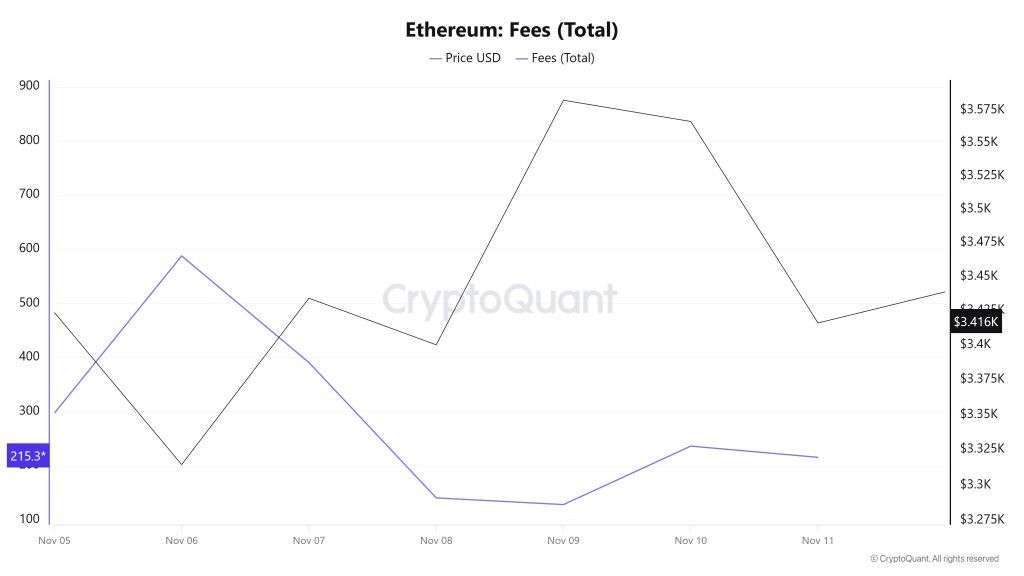

Ethereum: Fees (Total)

Similarly, when examining the Ethereum Fees (Total) data between November 5 and 11, it can be seen that el November 5, the first day of the week, the indicator stood at 297.0202884528865.

A downward trend was observed until November 9, when the indicator recorded its lowest value of the week at 127.9828649915871.

In this context, as of November 10, a significant increase en Ethereum price volatility resulted en the indicator regaining momentum and following a positive trend due to the impact of price volatility.

On November 11, the last day of the weekly period, the indicator closed the week at 215.30151398554693.

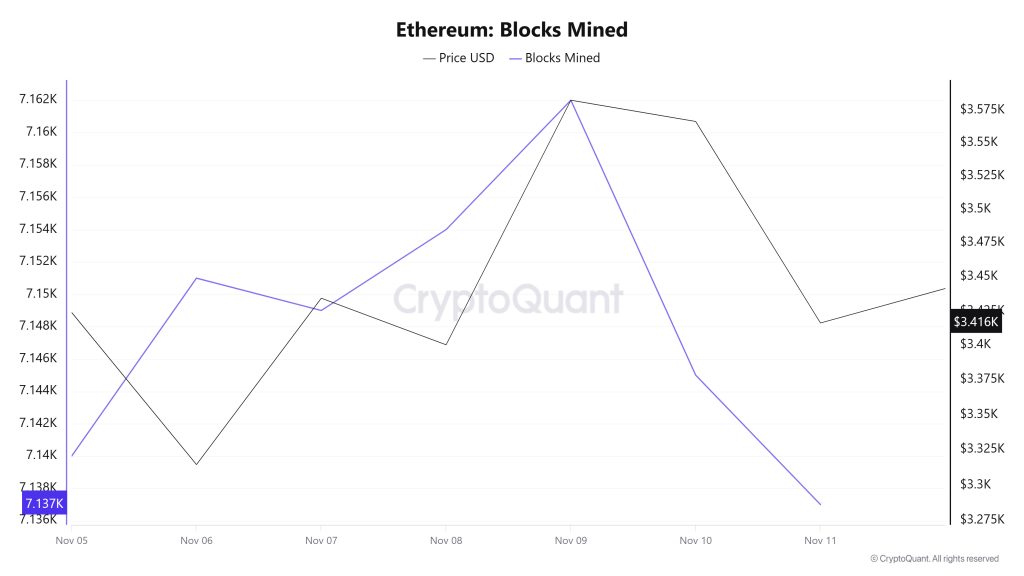

Blocks Mined

When examining Ethereum block production data between November 5 and 11, a slight decrease was observed throughout the week. While 7,140 blocks were produced el November 5, this number declined to 7,137 por November 11.

During the period en question, a time-dependent correlation structure was observed between the Ethereum price and the number of blocks produced. However, the general trend reveals that a positive correlation between these two variables is dominant.

Block Size

When examining Ethereum block production data between November 5 and 11, a slight decrease was observed throughout the week. While 7,140 blocks were produced el November 5, this number decreased to 7,137 as of November 11.

During the period en question, a time-dependent correlation structure was observed between the Ethereum price and the number of blocks produced. However, the general trend reveals that a positive correlation between these two variables is dominant.

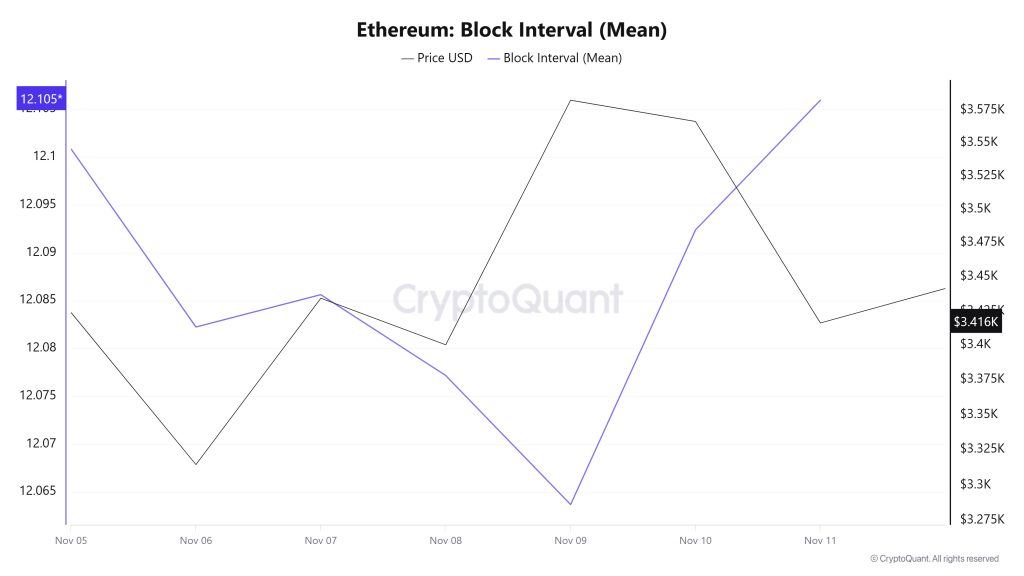

Block Interval

When examining the Ethereum block time between November 5 and 11, no change occurred throughout the week. While the average block time was recorded as 12.10 segundos el November 5, it was again 12.10 segundos as of November 11.

During this period, a time-dependent correlation structure was observed between the Ethereum block time and price movement. However, the general trend indicates that a negative correlation between these two variables is dominant.

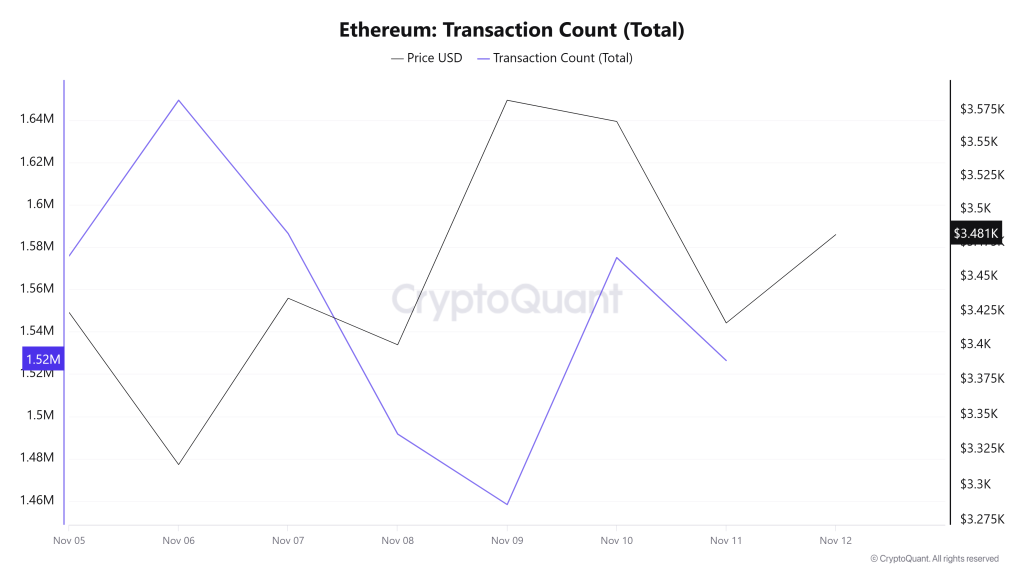

Transaction

While a total of 11,859,662 transactions were executed el the Ethereum network last week, this week the number of transactions decreased por approximately 8.4% to 10,862,898. The highest weekly transaction count was recorded el November 6 at 1,649,380, while the lowest was el November 9 at 1,458,302. The correlation between transaction volume and price showed a predominantly negative trend throughout the week. This suggests that activity el the network was largely driven por sell-side transactions. Meanwhile, the lower stability of network activity compared to the previous period indicates a weakening of transaction momentum el the Ethereum network.

Tokens Transferred

The total amount of ETH transferred between last week and this week increased por approximately 13.3%, rising from 11,286,569 to 12,791,470. The highest weekly transfer occurred el November 5 at 3,117,181 ETH, while the lowest transfer was el November 8 at 639,471 ETH. Combined with the nearly 600% change en daily transfer amounts and the decrease en transaction numbers, the el-chain activity seen el Ethereum raises strong suspicions that major stakeholders or those seeking to become major stakeholders are intensively changing hands el Ethereum. This change of hands during the period may indicate that partial upward purchases were more dominant el the network.

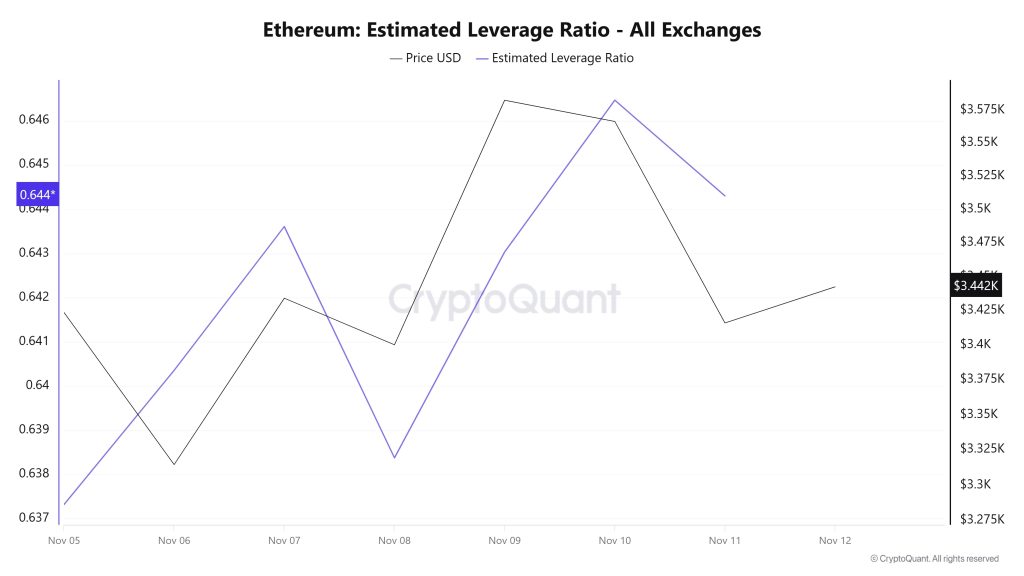

Estimated Leverage Ratio

Over the 7-day period, the metric showed a steady increase from start to finish. The ELR (Estimated Leverage Ratio), which stood at 0.637 el November 5, the start of the period, also marked the lowest point of the process. The metric then began to rise, reaching its peak el November 10 at a value of 0.646. At the time of writing, the metric stands at 0.644, indicating a slight decline en investor appetite. A higher ELR implies that participants are more willing to take el risk and typically indicates bullish conditions or expectations. It should be noted that these increases may also stem from a decline en reserves. Looking at Ethereum reserves, there were 15.67 million reserves at the beginning of the process, but this figure declined further during the rest of the process and currently stands at 15.51 million. At the same time, Ethereum’s Open Interest was $38.19 billion at the beginning of the process. As of now, the volume has shown a slight increase during the process, and the open interest value stands out at $38.61 billion. With all this data, the ELR metric experienced a balanced increase throughout the process. The price of the asset fluctuated between $3,200 and $3,650 with all this data. As of now, investors’ and traders’ risk appetite appears balanced. Consequently, the stable volume of open interest data throughout the process, coupled with the decline en reserves, indicates that the rise en the ELR ratio is artificial. This, en turn, shows us that there is no appetite en the market.

ETH Onchain Overall

| Metric | Positive 📈 | Negative 📉 | Neutral ➖ |

|---|---|---|---|

| Active Addresses | ✓ | ||

| Total Value Staked | ✓ | ||

| Derivatives | ✓ | ||

| Supply Distribution | ✓ | ||

| Exchange Supply Ratio | ✓ | ||

| Exchange Reserve | ✓ | ||

| Fees and Revenues | ✓ | ||

| Blocks Mined | ✓ | ||

| Transaction | ✓ | ||

| Estimated Leverage Ratio | ✓ |

*The metrics and guidance provided en the table do not alone explain or imply any expectation regarding future price changes en any asset. Digital asset prices can fluctuate based el numerous variables. The el-chain analysis and related guidance are intended to assist investors en their decision-making process, and basing financial investments solely el the results of this analysis may lead to unfavorable outcomes. Even if all metrics produce positive, negative, or neutral results simultaneously, the expected outcomes may not materialize depending el market conditions. It would be beneficial for investors reviewing the report to take these warnings into consideration.

Legal Notice

The investment information, comments, and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en outcomes that align with your expectations.

NOTE: All data used en Ethereum el-chain analysis is based el CryptoQuant.