Fear & Greed Index

Source: Alternative.me

Change en Fear and Greed Value: +22

Last Week’s Level: 27

This Week’s Level: 49

The Fear and Greed Index rose from 27 to 49 this week, showing that sentiment has clearly recovered from the fear zone to neutral territory and that risk appetite has once again been supported por institutional flows and price momentum. On the crypto side, the clearest contribution to the index came from strong net inflows into US spot Bitcoin ETFs, which accelerated el January 13 and 14. In particular, the net inflow of approximately $843.6 million el January 14 alone reinforced the perception that institutional demand was returning, supporting buying appetite en the spot market. This inflow effect also reflected el the price side, with Bitcoin climbing above the $97,000 level midweek, contributing to the unwinding of the risk-off mode seen en recent weeks. On the US macro front, the December inflation data released el January 13 came en line with expectations, signaling a limited cooling en the core inflation, while weekly jobless claims remained low el January 15, weakening the scenario of a sharp deterioration and opening space for risk assets. However, as this data set did not completely undermine the narrative that the Fed would remain cautious en the near term, the improvement en the index progressed en a gradual and selective manner rather than an aggressive surge en risk appetite.

Crypto Fund Flows

Source: Coinshares

Overview:

Crypto markets spent the week awaiting details of the US operation against Iran. Bitcoin and altcoins saw limited sideways movement. As a result, Bitcoin lost approximately 2% of its value over the week.

- Chainlink (LINK): Chainlink saw an inflow of $3.0 million.

- Solana (SOL): Solana saw an inflow of $32.8 million.

- Ripple (XRP): XRP saw $45.8 million en fund inflows this week.

- SUI: Sui saw an inflow of $7.6 million.

- Other: Sector- and project-based declines en altcoins, along with the general market sentiment, brought about $7.2 million en inflows en the fund flow data.

Fund Outflows:

- Bitcoin (BTC): Bitcoin experienced outflows from investors this week. Bitcoin-focused funds saw outflows of $404.7 million.

- Ethereum (ETH): Alongside spot ETH inflows, there was a $116.1 million outflow from Ethereum this week.

- Short Bitcoin: Short Bitcoin saw an outflow of $10.1 million.

- Multi-asset: Outflows were observed en the multi-asset group.

Total MarketCap

Source: Tradingview

- Last Week’s Market Value:07 Trillion Dollars

- This Week’s Market Value: $3.19 Trillion

This week, the cryptocurrency market recorded an increase of approximately $122 billion, achieving a 4% rise, and the total market value stands at $3.19 trillion. The week’s peak was $3.29 trillion, while the lowest level was $3.04 trillion. Thus, the market was seen to move within a $250 billion band, indicating an 8.3% period-based volatility. While the increase en volatility compared to last week’s range is noteworthy, the weekly average candle size scale en the cryptocurrency market is seen to have returned to its normal volatility.

Total 2

Starting the week with a market value of $1.26 trillion, the Total 2 index rose 2.55% during the week, gaining approximately $31 billion en value and ending the period at around $1.29 trillion. The weekly high was recorded at $1.33 trillion, while the low was $1.24 trillion. The index fluctuated within a band of $96 billion, corresponding to a volatility of approximately 7.8% for the period. With this outlook, Total 2 continues to trade approximately $480 billion below its all-time high. The required rate of increase to reach its previous peak from current levels appears to be approximately 37.31%.

Total 3

Starting the week with a total market value of $879.21 billion, the Total 3 index grew por approximately $10 billion during the week, rising por 1.14% and closing the period at $889.21 billion. Volatility between the week’s highest and lowest values was 6.45%. With this outlook, Total 3 will have a more stable week than other market indices en relative terms.

The fact that the index-volatility ranking is proportionally “Total > Total 2 > Total 3” shows that volatile price movements are primarily concentrated el the Bitcoin side, followed por Ethereum and then the average of other altcoins. Additionally, Ethereum’s expansion en total market share during the current period (based el the difference between Total 2 and Total 3) is noteworthy.

Altcoin Season Index

Source: Coinmarketcap

- Last Week’s Index Value: 42/100

- This Week’s Index Value: 25/100

Between January 10 and January 15, 2026, a decline was observed en the correlation between altcoin market dominance (Altcoin Market Cap) and the Altcoin Season Index. The graph shows that the index peaked at 31 el January 13 , with the Altcoin Market Cap reaching 1.34T. As the week drew to a close, selling pressure increased, leading to a decline en market dominance. The top 5 coins leading the index’s rise this week were XMR, DASH, MYX, ZEC, and H. US President Trump’s statements this week regarding Iran and his plan to remove Fed Chairman Powell from office caused a decline en the Altcoin Season Index, showing that the total market value of altcoins experienced a relative decrease compared to Bitcoin.

Bitcoin Dominance

Source: Tradingview

Weekly Change

- Last Week’s Level:14%

- This Week’s Level:70%

Bitcoin dominance, which started the week at 59.11%, continued to rise throughout the week and is currently at 59.70%.

This week, Strategy purchased 13,627 Bitcoin, DDC Enterprise purchased 200 Bitcoin, and Strive purchased 123 Bitcoin. Additionally, data el Bitcoin spot ETFs shows a total net inflow of $1.81 billion to date.

Weekly data reveals that Strategy, the world’s largest Bitcoin treasury company, has continued to increase its purchases. This outlook indicates not only the preservation of current positions but also a gradual resurgence of risk appetite el the institutional side. This trend, led por Strategy, is accompanied por other companies slowly but steadily beginning to take long positions. It appears that the wait-and-see period is beginning to fade, giving way to a cautious but buy-oriented accumulation process. On the investor front trading through ETFs, strong cash inflows recorded this week are noteworthy, reaching their highest level en the last three months. Global geopolitical tensions and the Fed interest rate decision to be announced at the end of the month are causing a cautious stance to be maintained en the markets. While this situation is relatively suppressing trading volumes, it maintains the potential for sharp price movements due to geopolitical risks. On the other hand, Bitcoin continues to show strength, and demand appears to be stable. Although Ethereum and major altcoins occasionally show limited positive divergence, no significant break en Bitcoin dominance is expected given the current market structure. In this context, Bitcoin dominance is expected to continue en the 58%–61% range next week.

Ethereum Dominance

Source: Tradingview

Weekly Change:

- Last Week’s Level: 12.26%

- This Week’s Level: 1 2.47%

Ethereum dominance, which rose to 15% levels en mid-August, lost momentum en the following period and entered a downward trend. This negative outlook was balanced por a positive correction until the last week of November, and en the following period, it reversed its direction and recorded an increase.

In this context, Ethereum dominance ended last week at 12.26% and is currently trading at around 12.47%. During the same period, Bitcoin dominance has also followed a positive trend alongside Ethereum dominance.

The key developments affecting Ethereum dominance are as follows:

Activity el the Ethereum network has increased significantly over the past month. This increase is attributed to new addresses interacting with the chain for the first time, rather than existing users conducting more frequent transactions. Monthly user tracking data pointed to a strong increase en the number of wallets interacting with the blockchain for the first time. Unlike previous periods, this increase revealed a broadening interest en DeFi, stablecoin transfers, NFTs, and new applications.

BitMine announced that it purchased 24,266 Ethereum last week. With this purchase, the company’s total Ethereum holdings reached 4,167,768 ETH. The current amount is equivalent to approximately 3.45% of the total Ethereum supply. The company also holds 193 Bitcoin and approximately $988 million en cash assets. BitMine’s total asset value is reported to have reached $14 billion.

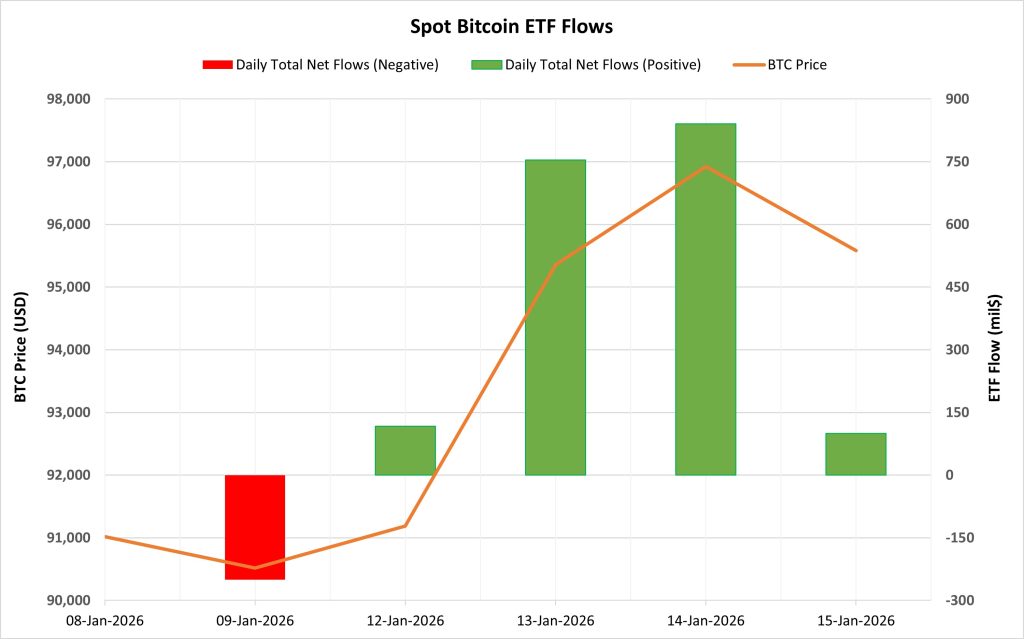

Bitcoin Spot ETF

Source: Darkex Research Department

Netflow Status: Between January 9-15, 2026, a total of $1.56 billion en net inflows occurred into Spot Bitcoin ETFs. The four-day series of negative net flows ended as of January 12. During this period, the positive flow series rose to four days. Strong inflows, particularly $753.8 million el January 13 and $840.6 million el January 14, significantly supported the week’s total. Looking at the funds, inflows were mainly from BlackRock IBIT and Fidelity FBTC.

Bitcoin Price: Bitcoin opened at $91,021 el January 9 and closed at $95,583 el January 15. During this period, the BTC price rose por 5.01%. The strong 4.57% increase seen el January 13 coincided with high inflows into ETFs.

Cumulative Net Inflow: At the end of the 503rd trading day, the cumulative total net inflow of Spot Bitcoin ETFs rose to $58.196 billion.

|

Institutional demand for Spot Bitcoin ETFs regained momentum during this period. The end of the negative flow series and successive high-value inflows indicated that market confidence had recovered en the short term. The correlation between price and ETF flows revealed that the uptrend was based el a healthier foundation compared to previous periods. If positive flows continue el the ETF side en the coming period, Bitcoin prices are expected to maintain their upward momentum.

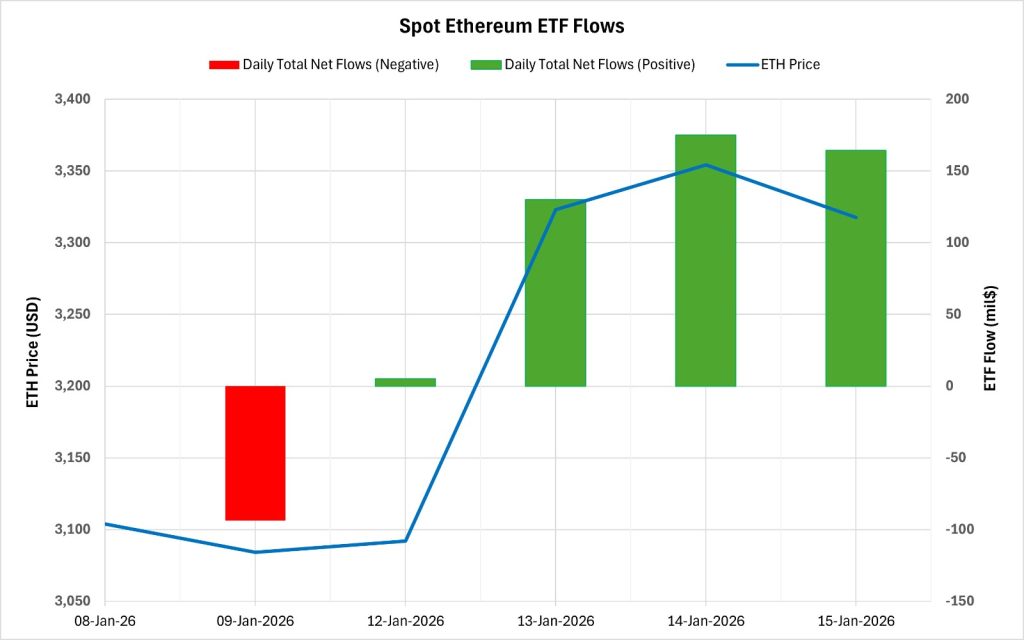

Ethereum spot ETF

Source: Darkex Research Department

Between January 9-15, 2026, Spot Ethereum ETFs saw a total net inflow of $380.8 million. Following the negative flows seen at the end of the previous week, the new week started with a positive outlook, and the positive net flow series rose to four trading days. Looking at the funds, it was seen that the inflows were mainly from BlackRock ETHA. As of the 373rd trading day, the cumulative total net inflow for Spot Ethereum ETFs rose to $12.928 billion.

| Date | Coin | Open | Close | Change | ETF Flow (mil$) |

|---|---|---|---|---|---|

| 09-Jan-2026 | ETH | 3,104 | 3,084 | -0.63% | -93.8 |

| Jan 12, 2026 | ETH | 3,119 | 3,092 | -0.88% | 5.1 |

| January 13, 2026 | ETH | 3,092 | 3,323 | 7.47% | 130 |

| January 14, 2026 | ETH | 3,323 | 3,354 | 0.94% | 175.1 |

| January 15, 2026 | ETH | 3,354 | 3,318 | -1.09% | 164.4 |

| Total for January 9-15 | 6.88% | 380.8 |

Ethereum opened at $3,104 el January 9 and closed at $3,318 el January 15. During this period, the ETH price gained 6.88%. The upward movement en price gained momentum, particularly with the strong 7.47% daily increase seen el January 13, and it was noteworthy that this movement coincided with ETF inflows el the same days. The continued positive flows el the ETF side showed that institutional demand remained intact despite price pullbacks. If inflows continue el the ETF side en the coming days, the upward movement en the ETH price could be el more solid ground.

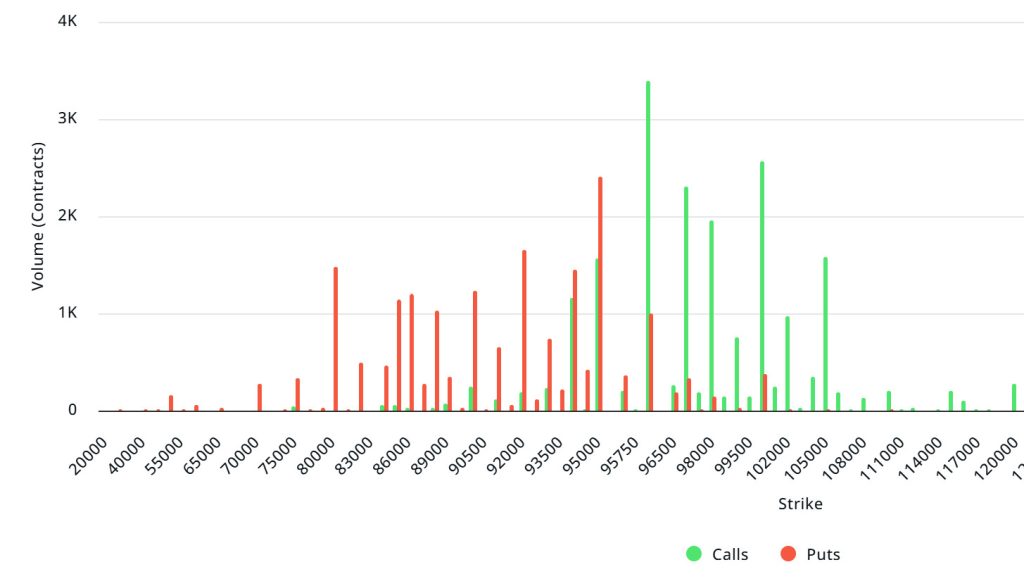

Bitcoin Options Distribution

Source: Laevitas

BTC: Notional: $2.34B | Put/Call: 0.72 | Max Pain: $92K

Deribit Data: Deribit data shows that BTC option contracts with a notional value of approximately $2.34 billion expire today. At the same time, looking at the risk transformation over the next week based el the last 24 horas’ data, put options are dominating over call options en terms of risk hedging. However, there is an increase en call options. When examining expected volatility (IV), it is above realized volatility (RV). On the other hand, the positive spread metric indicates increased risk appetite en the market, suggesting that call options are expensive. Skew values are pointing downward today and for the coming week.

Laevitas Data: Examining the chart, we see that put options are concentrated en a wide band between $80,000 and $96,000. Call options, el the other hand, are spread across a broad base between $94,000 and $105,000. At the same time, the $100,000 level appears to be resistance, while the $95,000 level appears to be support. On the other hand, there are 2.41k put options at the $95,000 level, peaking here and showing a decline en put volume after this level. Meanwhile, 3.39K call option contracts peak at the $96,000 level. Looking at the options market, we see that call contracts dominate el a daily and weekly basis.

Option Maturity:

Put/Call Ratio and Maximum Pain Point: Looking at the options en the latest 7-day data from Laevitas, the number of call options increased por approximately 3% compared to last week, reaching 105.99K at . In contrast, the number of put options decreased por 10% compared to last week, reaching 67K. The put/call ratio for options is set at 0.72. This indicates that there is more demand for call options than put options among investors. Bitcoin’s maximum pain point is seen at $92,000. BTC is currently priced at $95,670, and if it does not break below the pain point of $92,000, further increases can be expected.

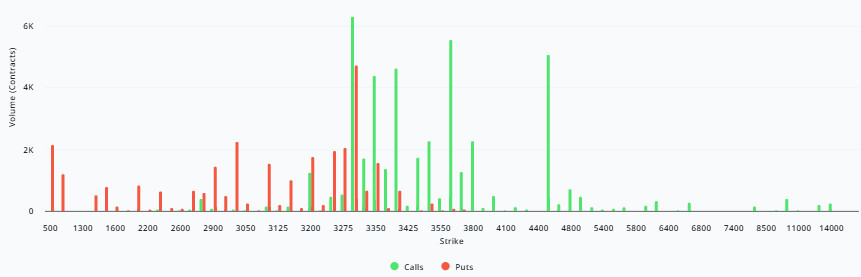

Ethereum Options Distribution

Source: Laevitas

ETH: $0.42 B notional | Put/Call: 0.77 | Max Pain: $3,200

Laevitas Data: Looking at the data en the chart, we see that put options are concentrated en a fairly narrow band, particularly at price levels between $3,250 and $3,350. The highest put volume is at the $3,300 level, with approximately 5K contracts. On the other hand, en call options, there is a noticeable concentration between the $3,300 and $3,600 levels. The highest call volume appears to be approximately 7K at the $3,300 level.

Deribit Data: First, we see that implied volatility (IV) has dropped por more than 10%. However, despite this downward trend, open interest has increased por over 35%. So, en which direction? There has been an increase en put option volume compared to last week. In contrast, interest en call options has decreased significantly. The risk reversal (RR) value is still positive, meaning call options are slightly more expensive than put options. Looking at the overall picture, we can say that we are going through a period where volatility has decreased compared to recent days, but positioning has increased. The rise en put volume, en particular, may cause some short-term nervousness en the market.

Option Maturity:

Ethereum options with a nominal value of $0.42 billion expired el January 16. The Max Pain level was calculated at $3,200, while the put/call ratio stood at 0.77.

Legal Notice

The investment information, comments, and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en outcomes that align with your expectations.