Weekly Fundamental Analysis Report

Fear & Greed Index

Source: Alternative.me

- Change en Fear and Greed Value: -1

- Last Week’s Level: 30

- This Week’s Level: 29

Sentiment en the crypto market closed the week en the fear zone. Although inflows into spot products brought a brief recovery, the sharp net outflows en the middle reversed this improvement, and the perception of fear resurfaced as Bitcoin tested the $108,000 level. The FOMC’s decision to cut interest rates por 25 basis points provided limited support to pricing, while the lack of guarantees for further cuts en forward-looking messages dampened risk appetite. The US-China leaders’ meeting resulted en a reduction en tariff rates, the removal of barriers to rare earths, dialogue el chip restrictions, and an emphasis el cooperation el fentanyl and Ukraine, reducing the likelihood of tension, weakening safe-haven demand, and opening space for risky assets. On the corporate front, Coinbase’s revenue of $1.87 billion, exceeding expectations, showed that transaction and custody revenues were carried even during periods of weak volume, reducing doubts about the sector’s profitability. Strategy’s revenue of $128.7 million, exceeding consensus, and maintaining its year-end Bitcoin target of $150,000 supported the thesis of institutional demand. On the liquidity side, Bitmine’s purchase of 44,036 ETH during the decline reinforced the perception that the buyer base en Ethereum is strengthening. In summary, flow volatility is dominant, policy communication is cautious, and institutional news flow is balancing; the index is maintaining its near-flat trajectory at the 29 level.

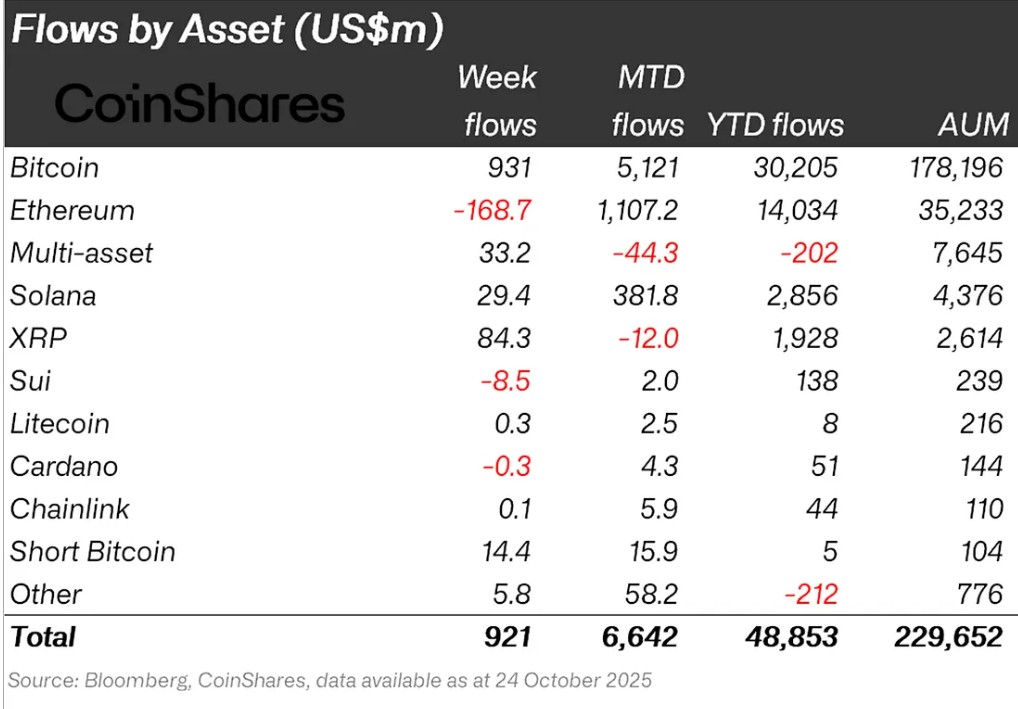

Fund Flows

Source: CoinShares

Overview: Crypto markets started the week down despite the interest rate cut, Fed Chair Powell’s positive statements, and positive customs agreements with China. As a result of these developments, Bitcoin lost approximately 7% of its value during the week.

Bitcoin (BTC): Bitcoin saw inflows from investors this week. Although the interest rate cut en global markets, the customs agreement with China, and general market optimism supported inflows into Bitcoin, only $931 million flowed into Bitcoin-focused funds this week.

Ripple (XRP): XRP saw $84.3 million en fund inflows this week.

Solana (SOL): Solana saw inflows of $156.1 million.

Chainlink (LINK): Chainlink continues to strengthen its potential por providing reliable data and updates to the tokenization and DeFi sectors. This week, there was an inflow of $1.8 million into Link.

Litecoin (LTC): LTC saw $1.0 million en inflows.

Short Bitcoin: Short Bitcoin saw $14.4 million en inflows.

Multi-asset: Inflows were observed en the multi-asset group.

Other: Sector-specific and project-based increases en altcoins, along with the general market outlook, brought en $14.6 million en fund flow data.

Fund Outflows:

Ethereum (ETH): Due to spot ETH outflows, there was a $168.7 million outflow from Ethereum this week.

Cardano (ADA): Cardano saw an outflow of $0.3 million this week.

SUI: A token unlock is scheduled for November 1st el Sui. This led to an outflow of approximately $8.5 million from Sui.

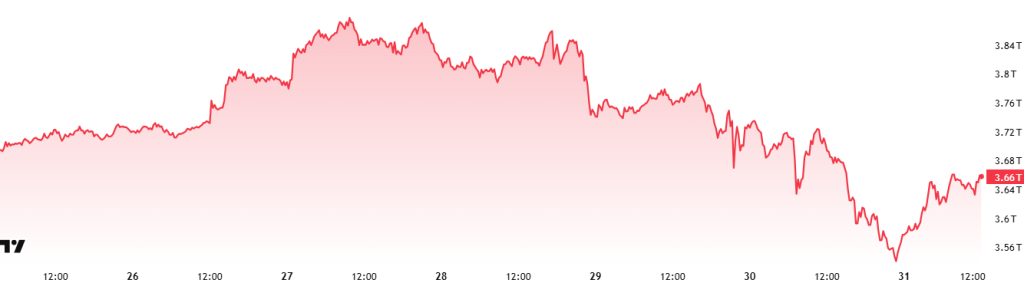

Total MarketCap

Source: Tradingview

- Last Week’s Market Value: $3.83 Trillion

- This Week’s Market Value: $3.66 Trillion

This week, the cryptocurrency market fell por approximately 169 billion dollars, or 4.41%, and the total market value declined to 3.66 trillion dollars. The weekly peak was recorded at 3.9 trillion dollars, while the lowest level was 3.53 trillion dollars. Thus, the market was observed to move within a band of approximately $368 billion. This indicates volatility within a band of approximately 10% el a weekly basis. This shows that the market moved within a relatively wider range compared to last week’s 8.8% movement band.

Total 2

Starting the week with a market value of $1.55 trillion, Total 2 declined por 5.38% during the week, falling to $1.46 trillion with a loss of approximately $83 billion. The highest level during the week was $1.58 trillion, while the lowest level was $1.41 trillion. Thus, the index moved within a fairly wide band of $168 billion over the period. This shows that Total 2 moved within an 11.97% band during the period, experiencing a more volatile week compared to both the previous week and the Total index.

With the pullback movement that occurred during this period, the Total 2 index is now more than 20% below its all-time high.

Total 3

Starting the week with a market value of $1.04 trillion, Total 3 lost approximately $46 billion en value during the week, falling 4.42% and closing the period at $0.997 trillion. A difference of 10.3% emerged between the highest and lowest values during the week. According to this calculation, Total 3 lost the title of “most volatile index” to the Total 2 index, which showed 11.97% volatility this week, as it did last week .

While the market generally presented a negative outlook, the strongest performance was observed en the Total and Total 3 indices, which showed almost the same rate of change. This picture shows that Ethereum’s weight en the ecosystem has decreased and that the weekly average returns of other altcoins remained stronger compared to Ethereum. Additionally, it is noteworthy that Bitcoin presents a more moderate picture compared to Ethereum. It appears that Ethereum’s market dominance over altcoins has continued to decline this week, as it did en the previous three weeks.

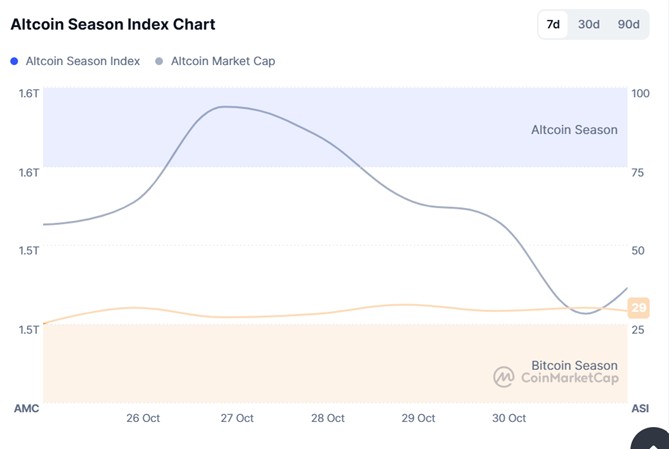

Altcoin Season Index

Source: Coinmarketcap

- Last Week’s Index Value: 23/100

- This Week’s Index Value: 30/100

Between October 24 and October 31, 2025, there was an increase en the correlation between altcoin market dominance (Altcoin Market Cap) and the Altcoin Season Index. The graph shows that this week, el October 30 , the index pulled back to 30, with Altcoin Market Cap reaching 1.74T. This indicates an upward trend en the market dominance of altcoins. When the index rose this week, the top 5 coins leading the rise were Aster, Zec, H, M, and OKB. On October 31, the index rose from 23 to 30, indicating a short-term upside potential for the altcoin season.

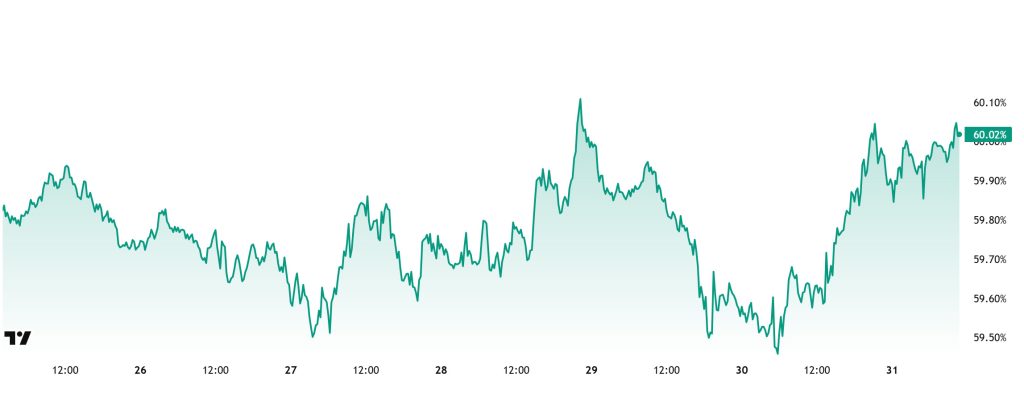

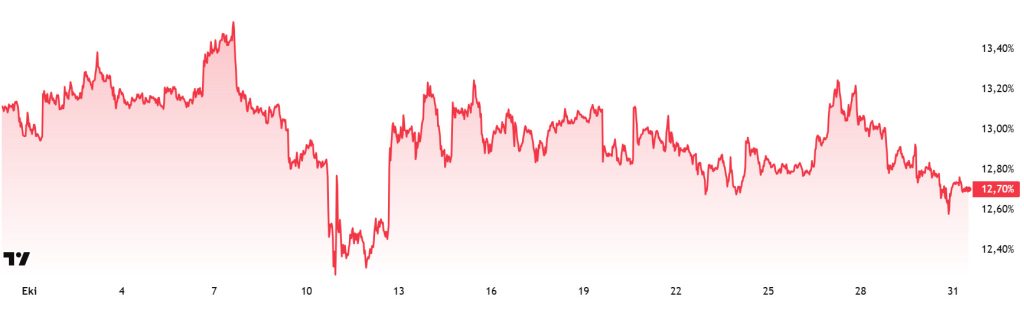

Bitcoin Dominance

Source: Tradingview

Bitcoin dominance started the week at 59.64% and rose to 60.17% during the week but then fell back slightly and is currently at 60.02%.

This week, Strategy purchased 390 Bitcoin and Strive purchased 72 Bitcoin. Additionally, data el Bitcoin spot ETFs shows a net outflow of $488.4 million to date.

Throughout the week, the weakening of Bitcoin purchases por institutional investors continued, while retail investors trading through the spot ETF channel also showed an increased tendency to close their positions.

The volatile outlook, with markets still searching for direction, is causing a slowdown en capital inflows into Bitcoin. The recent net outflows observed en spot ETFs indicate that selling pressure may increase en the short term. The weak capital inflows are limiting the buying momentum el Bitcoin. However, Bitcoin is showing a more resilient performance en the short term compared to Ethereum and other major altcoins. If institutional demand continues to grow cautiously, BTC dominance is expected to maintain its strong structure. Accordingly, it is predicted that Bitcoin’s market dominance will have limited upside potential en the short term and will continue its consolidation process en the 58%–61% range next week.

Ethereum Dominance

Source: Tradingview

Weekly Change:

- Last Week’s Level: 13.11%

- This Week’s Level: 12.70%

Ethereum dominance, which rose to 15% levels en mid-August, lost momentum en the following period and entered a downward trend, which continues as of this week.

Accordingly, Ethereum dominance ended last week at 13.11%, and based el current data, it is trading at around 12.70%.

During the same period, Bitcoin dominance followed a positive trend, unlike Ethereum.

The key developments affecting Ethereum dominance are as follows:

The Ethereum Foundation announced December 3, 2025, as the official date for the next mainnet hard fork, “Fusaka.” According to developers, the upgrade will increase efficiency, reduce transaction costs, and strengthen Layer-2 compatibility. Fusaka is considered a critical step en Ethereum’s scalability roadmap. Crypto mining company BitMine announced that it holds 3,313,069 ETH (at an average cost of $4,164).

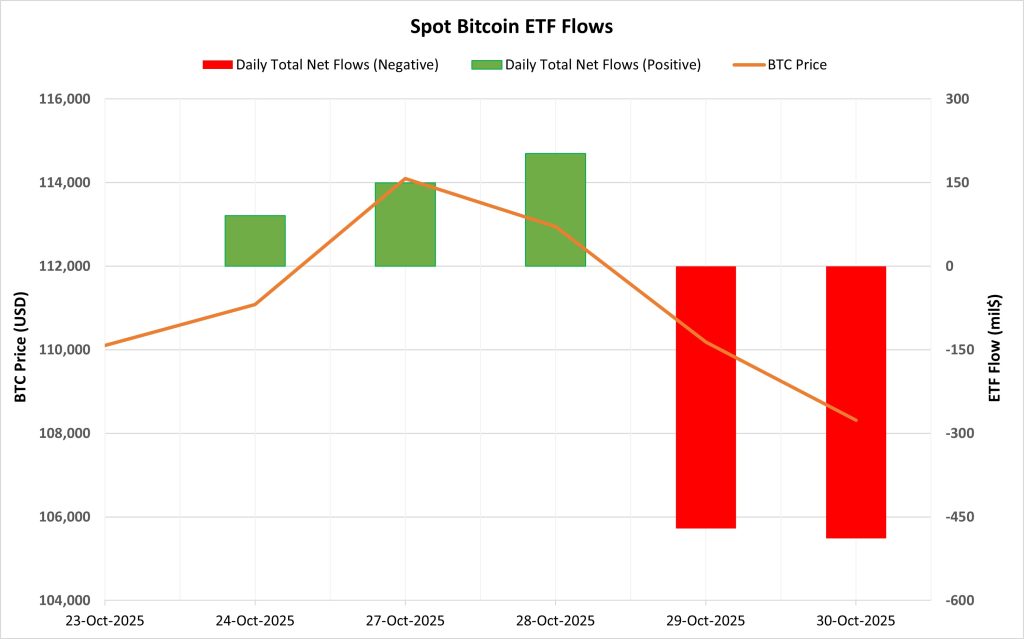

Bitcoin Spot ETF

Source: Darkex Research Department

Netflow Status: Between October 24-30, there was a total net outflow of $516.8 million from Spot Bitcoin ETFs. Although flows started positively during this period, gaining momentum briefly with a net inflow of $202.4 million el October 28, the total outflow of $959 million el October 29 and 30 turned the outlook negative. By fund, BlackRock IBIT led with a net outflow of $221.4 million, followed por Fidelity FBTC with a net outflow of $86 million.

Bitcoin Price: Bitcoin opened at $110,105 el October 24 and closed at $108,309 el October 30. During this period, the price declined por 1.63%. The heavy outflows seen en the last two trading days put pressure el the price.

Cumulative Net Inflow: By the end of the 453rd trading day, the cumulative total net inflow into Spot Bitcoin ETFs fell to $61.34 billion.

| DATE | COIN | PRICE | ETF Flow (mil$) | ||

| Open | Close | Change % | |||

| October 24, 2025 | BTC | 110,105 | 111,081 | 0.89 | 90.6 |

| October 27, 2025 | 114,552 | 114,098 | -0.40% | 149.3 | |

| October 28, 2025 | 114,098 | 112,940 | -1.01% | 202.4 | |

| October 29, 2025 | 112,940 | 110,187 | -2.44% | -470.7 | |

| October 30, 2025 | 110,187 | 108,309 | -1.70% | -488.4 | |

| Total for Oct 24-30, 2025 | -1.63% | -516.8 | |||

Between October 24-30, profit-taking and cautious positioning stood out en the ETF market. Short-term inflows seen el October 28 gave way to sharp outflows without signaling a strong recovery. The lack of direction en flows during this period of weakened risk appetite among institutional investors created a temporary cooling en market confidence. If fund inflows recover steadily, Bitcoin’s market outlook could strengthen. However, continued outflows could continue to put pressure el prices en the medium term.

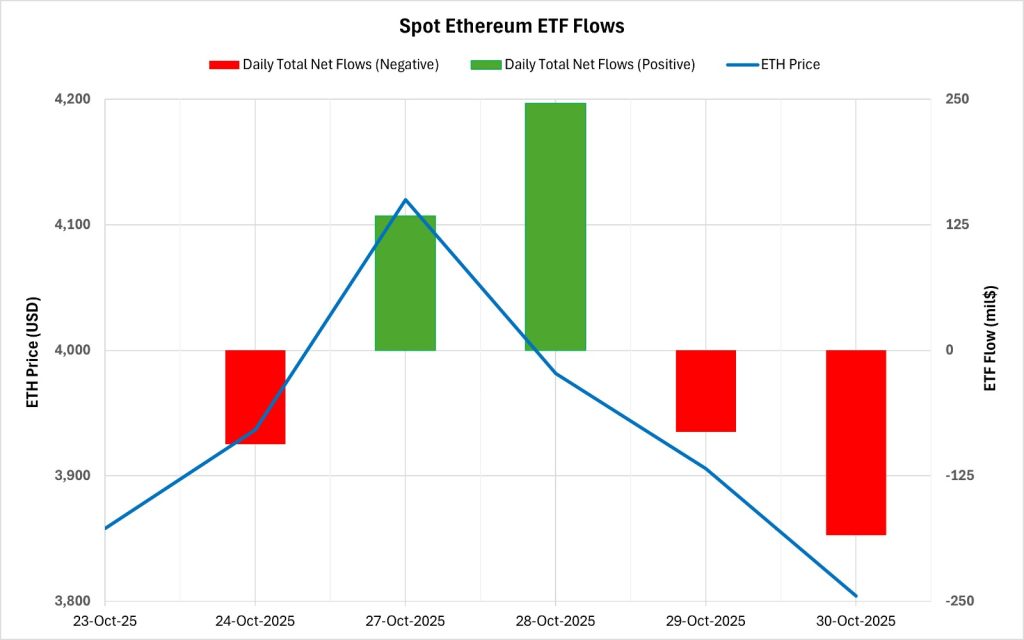

Ethereum spot ETF

Source: Darkex Research Department

Between October 24-30, 2025, there was a total net inflow of $20.7 million into Spot Ethereum ETFs. The strongest daily inflow occurred el October 28, with $246 million. In terms of funds, BlackRock ETHA saw a net outflow of $48.7 million, while GrayScale ETH saw a net inflow of $75.5 million. No clear direction emerged en the flows, and short-term fluctuations prevailed. At the end of the 321st trading day, the cumulative total net inflow of Spot Ethereum ETFs rose to $14.485 billion.

| DATE | COIN | PRICE | ETF Flow (mil$) | ||

| Open | Close | Change % | |||

| October 24, 2025 | ETH | 3,858 | 3,937 | 2.04% | -93.6 |

| October 27, 2025 | 4,159 | 4,120 | -0.93% | 133.9 | |

| October 28, 2025 | 4,120 | 3,981 | -3.36% | 246 | |

| October 29, 2025 | 3,981 | 3,906 | -1.90% | -81.4 | |

| October 30, 2025 | 3,906 | 3,804 | -2.60% | -184.2 | |

| Total for October 24-30, 2025 | -1.40% | 20.7 | |||

The Ethereum price opened at $3,858 el October 24 and closed at $3,804 el October 30. During this period, the Ethereum price lost 1.40% of its value. The continued volatility en prices paralleled the uncertain nature of ETF flows. In particular, the outflows seen en the last two days of the week showed that investors remained cautious en the short term. Overall, while no clear trend emerged en flows, investor behavior remained cautious. If fund inflows regain steady momentum en the coming weeks, this could support Ethereum’s market outlook. However, if the current volatile structure persists, weak momentum el the ETF side could continue to put pressure el the price.

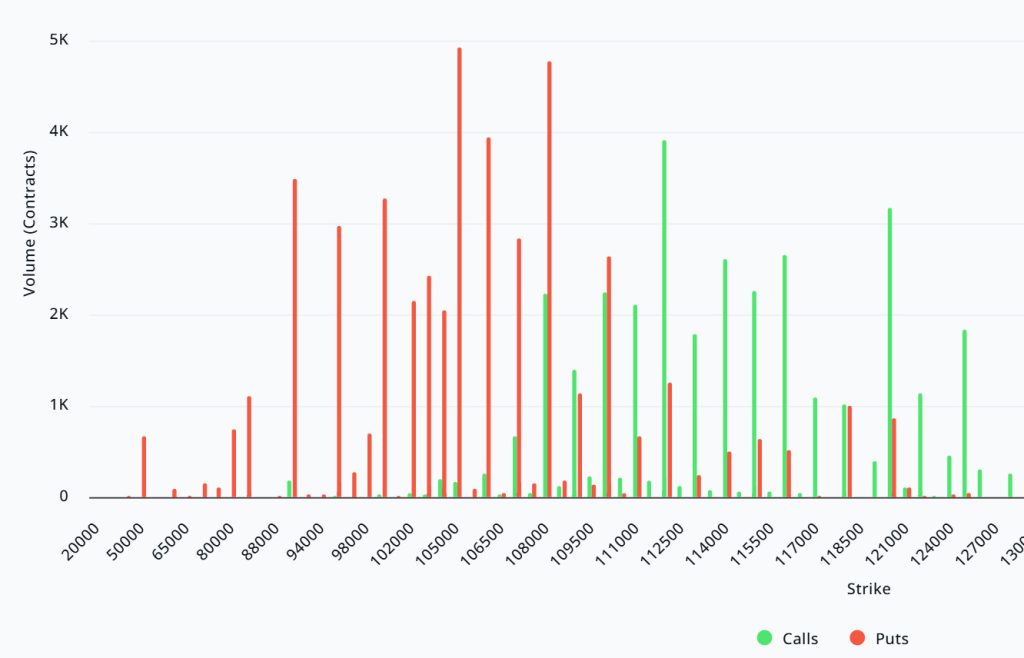

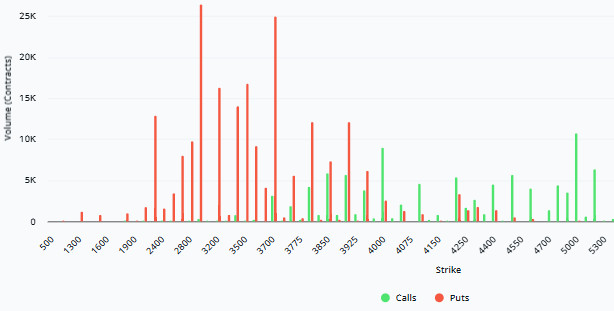

Bitcoin Options Distribution

Source: Laevitas

BTC: Notional: $13.38B | Put/Call: 0.73 | Max Pain: $114K

Deribit Data: Deribit data shows that BTC option contracts with a notional value of approximately $13.38 billion expire today. At the same time, looking at the risk transformation over the next week based el data from the last 24 horas, put options are dominating over call options en terms of risk hedging. However, call options have been el the rise recently. Despite the prevailing negative outlook today, call options have been increasing throughout the week. When examining the implied volatility (IV), it is significantly higher than the realized volatility (RV). On the other hand, the positive trend en the spread metric indicates increased risk appetite en the market, suggesting that call options are expensive. Skew values are pointing downward today and for the coming week.

Laevitas Data: Examining the chart, we see that put options are concentrated en a wide band between $90,000 and $110,000. Call options, el the other hand, are concentrated between $108,000 and $120,000, with concentration decreasing towards higher levels. At the same time, the $108,000 level appears to be support, while the $112,000 level appears to be resistance. On the other hand, there are 4.94K put options at the $105,000 level, peaking here and showing a decrease en put volume after this level. Meanwhile, 3.9K call option contracts peak at the $112,000 level. Looking at the options market, we see that put contracts dominate el a daily and weekly basis.

Option Maturity

Put/Call Ratio and Maximum Pain Point: Looking at the options en the latest 7-day data from Laevitas, the number of call options increased por approximately 14% compared to last week, reaching 181.10K. In contrast, the number of put options decreased por 28% compared to last week, reaching 131.65K. The put/call ratio for options is set at 0.73. This indicates that there is less demand for call options than put options among investors. Bitcoin’s maximum pain point is seen at $114,000. BTC is currently priced at $109,500, and if it fails to break above the pain point of $114,000, a continued decline is foreseeable.

Ethereum Options Distribution

Source: Laevitas

ETH: $2.4 B notional | Put/Call: 0.72 | Max Pain: $4,100

Laevitas Data: Looking at the data en the chart, we see that put options are concentrated en a fairly wide band between the $3,000 and $3,700 price levels. The highest put volume is at the $3,000 level, with approximately 27K contracts. We can understand that the increase en the number of put contracts here is for protection against possible sudden price movements, as the concentration zone is spread over a wide band. Looking at the number of put contracts closest to this level and at the price, the $3,700 level can be considered a support zone with approximately 25K contracts. On the other hand, en call options, there is a noticeable concentration between $3,800 and $4,000. The $4,000 level stands out with a high call volume of approximately 9K contracts. This level can be considered an important resistance zone en the market.

Deribit Data: Looking at ATM volatility, we see it at 61.08 and down 8.30% over the last 24 horas. This indicates some short-term pressure el option premiums and a slight easing en volatility pricing. The 25 delta risk reversal (RR) value is at -4.58, showing a 4.58% decline when evaluated daily. Therefore, it indicates that the market’s demand for put options is still stronger than that for call options, meaning that market players find downside risks quite high en the short term and are managing risk accordingly. Looking at the open interest (OI) side, we see that it is at $92.42 million and has increased por 87.76%. This increase shows that the number of players en the market is still actively rising.

Option Maturity:

Ethereum options with a nominal value of $2.4 billion expired el October 31. The Max Pain level was calculated at $4,100, while the put/call ratio stood at 0.72.

Legal Notice

The investment information, comments, and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en outcomes that align with your expectations.