MARKET SUMMARY

*Table was prepared el 10.11.2024 at 14:30 (UTC). Weekly values are calculated for 7 days based el Friday.

Fear & Greed Index

Source: Alternative

Market Developments

This week, the Chinese government’s movement of ETH held por the PlusToken case drew attention en crypto markets. Some 542,000 ETH was sent to exchanges, raising concerns about potential selling pressure. Also, the Fed’s FOMC minutos were en the spotlight. While the vast majority of officials called for a 50 basis point rate cut, there were also suggestions that a more gradual reduction may be appropriate. This uncertainty may affect investors’ risk perception.

On the other hand, FTX’s payments to crypto clients were approved, while Japanese investment firm Metaplanet’s purchase of 108 Bitcoin showed continued institutional investment interest en the sector. However, Crypto.com’s regulatory issues with the SEC continue to weigh el the market.

Fear and Greed Index

In the light of all these developments, the Fear & Greed Index, which was 41 last week, dropped to 32 this week, revealing the growing anxiety en the markets and the rise en risk perception.

Bitcoin Dominance

Source: Tradingview

Last week, as a result of Iran’s attack el Israel along with geopolitical risks, Bitcoin price came below 60,000 levels and Bitcoin dominance rose to 58.17% with outflows from risky assets again. As a result of the macroeconomic data announced this week, the expectation of interest rate cuts fell from 50 basis points to 25 basis points, and the Bitcoin price fell from 64,000 levels to 59,000 levels again and declined from its dominance.

The Shift en Bitcoin Dominance

- Last Week’s Level: 58.17%

- This Week’s Level: 57.72%

Geopolitical Risks and Market Reaction

Geopolitical events, such as tensions between Iran and Israel, can cause investors to exit risky assets. Digital assets, such as Bitcoin, may come under selling pressure en such situations and experience price declines.

Macroeconomic Data and Interest Rate Expectations

Rate cut expectations may reduce investors’ willingness to hold risky assets. However, a reduction en rate cut expectations from 50 basis points to 25 basis points creates the expectation of a more limited monetary easing, which could prevent the Bitcoin price from rising.

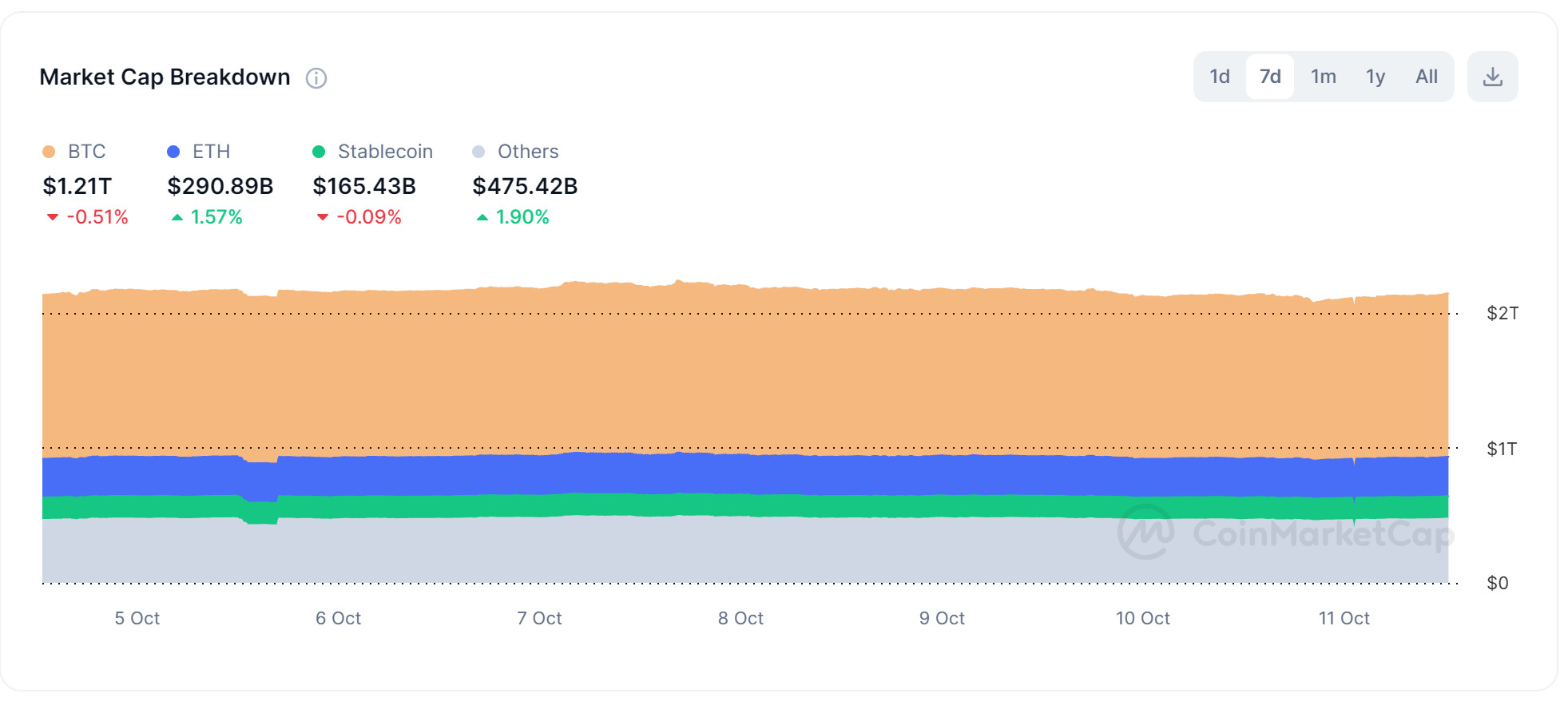

Total MarketCap

Source: Tradingview

Last week, there was a sharp decline en market capitalization due to the impact of geopolitical risks that unsettled the crypto market. This week, geopolitical tensions, macroeconomic data and the US elections created uncertainty el the market, leaving market capitalization unchanged.

Change en Market Value

- Market Capitalization en the Last Week: $2.090 Trillion

- This Week’s Market Cap: $2.090 Trillion

Market Stability

This week, despite the persistence of uncertainties, the lack of change en market capitalization suggests that investors are adopting a wait-and-see approach. Investors may be hesitant to make major decisions until factors such as geopolitical tensions, the US elections and macroeconomic developments become clearer.

Impact of Uncertainties

We observe that geopolitical and macroeconomic uncertainties continue to put pressure el the market, but investors do not show a significant reaction and do not make big moves.

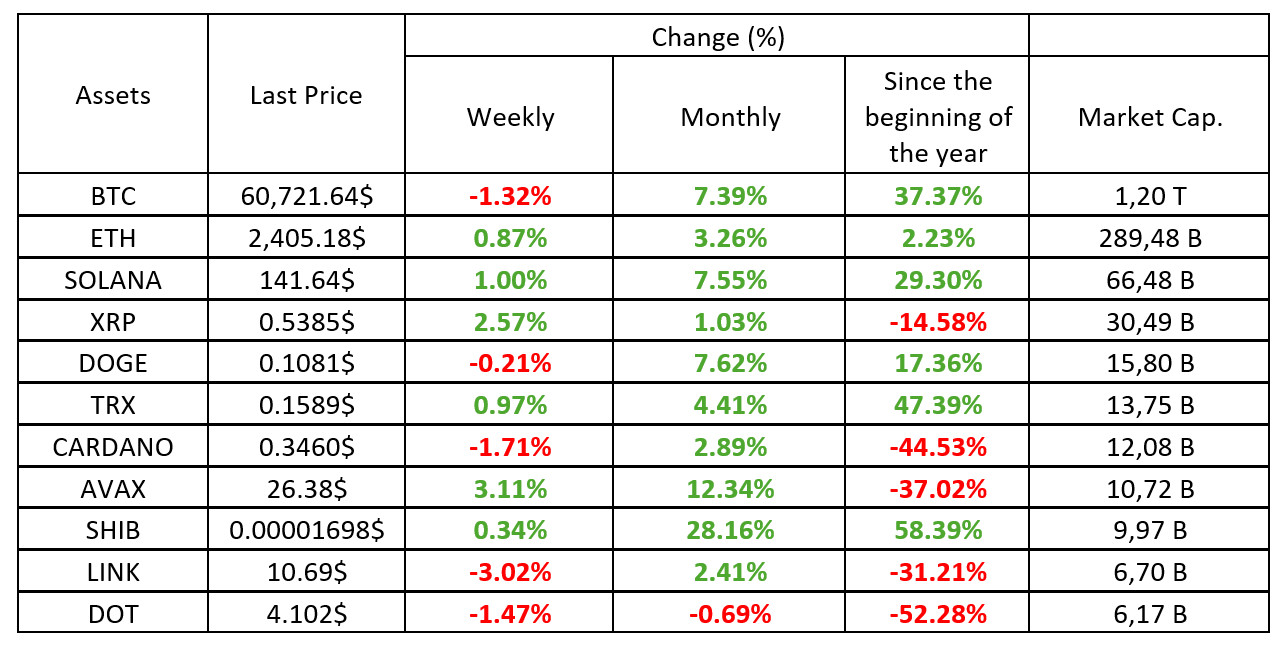

Weekly Crypto Market Breakdown

Source: CoinMarketCap

Bitcoin Performance

- Down This Week: 0.51%

- Market Cap: $1.210 Trillion

Bitcoin fell slightly this week, down 0.51%, while its market capitalization held steady at $1.210 trillion.

Ethereum Performance

Increase This Week: 1.57%

Market Capitalization: $286.67 Billion

Ethereum outperformed other assets en the market with an increase of 1.57%, while its market capitalization was $286.67 billion.

Stablecoin Performance

- Down This Week: 0.09%

- Market Cap: $165.6 Billion

Investors showed more interest en risky assets such as altcoins and Ethereum this week, while stablecoins performed more steadily.

Altcoin Performance

- Increase This Week: 1.90%

- Market Cap: $475.42 Billion

Altcoins, el the other hand, showed a bullish performance with an increase of 1.90% and the market capitalization reached $475.42 billion.

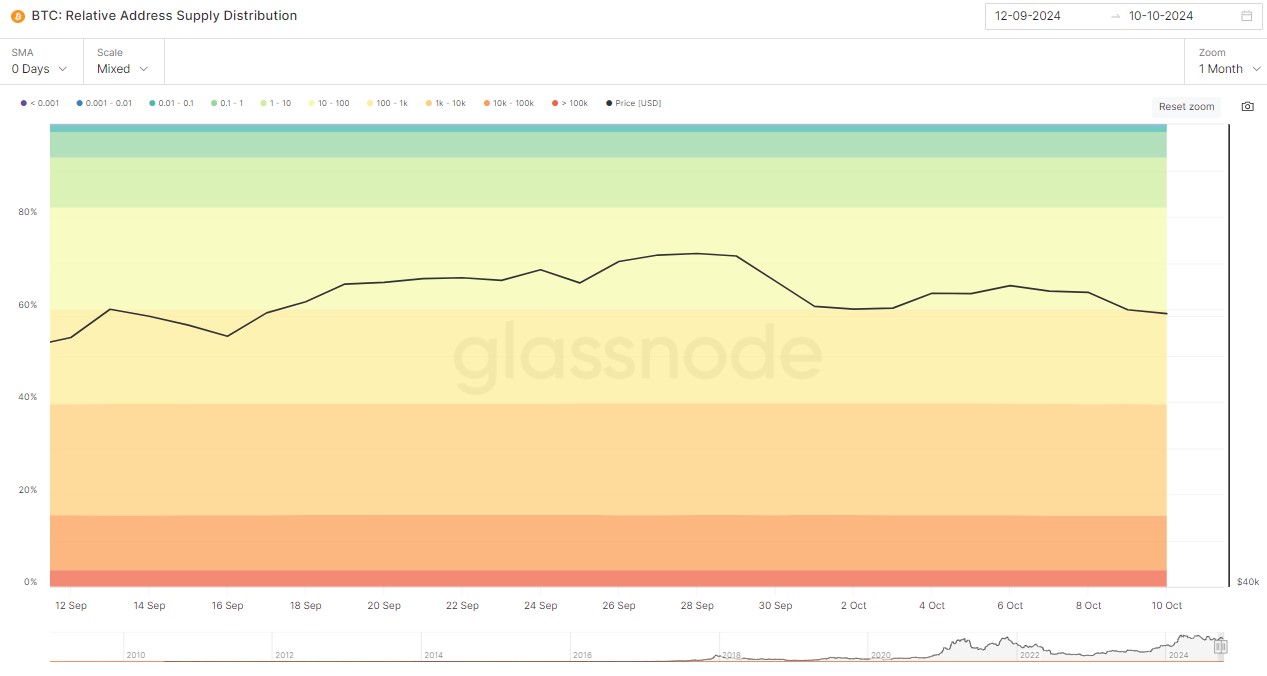

Bitcoin Supply Breakdown

Source: Glassnode

| Address Range | October 3, 2024 | October 10, 2024 | Change | Analysis |

|---|---|---|---|---|

| < 0.001 BTC | 0.028% | 0.028% | Fixed | The number of micro-investors has not changed. Addresses at this level still have a negligible impact el total supply. |

| 0.001 – 0.01 BTC | 0.217% | 0.217% | Fixed | Addresses with low balances also remained stable. The number of small traders has not changed en this range, meaning that this audience may not yet be active en the market. |

| 0.01 – 0.1 BTC | 1.397% | 1.400% | 0.002% increase | There is a slight growth among small investors. This small increase indicates that new investors are entering the market or that existing investors are continuing to save. |

| 0.1 – 1 BTC | 5.570% | 5.576% | 0.006% increase | There is also a very small increase among mid-cap investors. This may indicate that confidence en the market continues to grow, as this range indicates a tendency among investors to hold for the longer term. |

| 1 – 10 BTC | 10.830% | 10.830% | Fixed | We see that large individual investors maintain their positions at this level. Stability prevails en this range. |

| 10 – 100 BTC | 22.003% | 22.014% | 0.011% increase | There is also a slight increase among large investors. This could indicate that whales are accumulating more BTC en the market. |

| 100 – 1k BTC | 20.086% | 20.487% | 0.401% increase | The significant increase en this tranche suggests that whales are accumulating more BTC. We understand that the big players en the market are still actively accumulating. |

| 1k – 10k BTC | 24.167% | 24.070% | 0.097% decrease | There is a small drop among the big whales. Some of the investors en this tranche probably sold or transferred their BTC to a different address. |

| 10k – 100k BTC | 11.900% | 11.775% | 0.125% decrease | Some of the very large whales seem to have slightly reduced their positions. This suggests that some large investors holding large amounts of BTC may have made profit realizations. |

| > 100k BTC | 3.603% | 3.603% | Fixed | These largest addresses have remained stable. This slice, usually controlled por exchanges or large organizations, maintains its position and has not changed. |

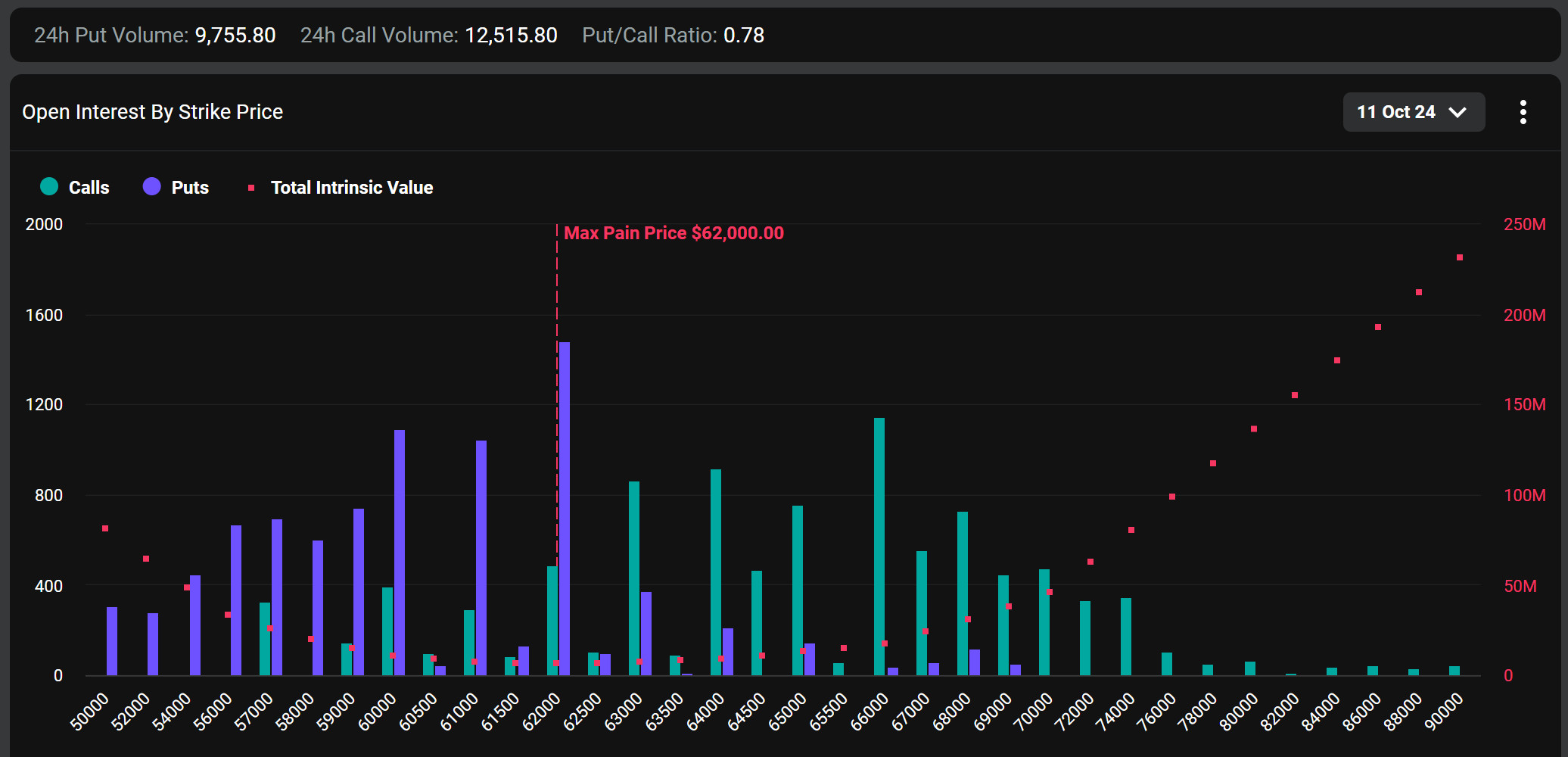

Bitcoin Options Breakdown

Source: Deribit

Bitcoin ETF options could be available en the US as early as 2025, according to Bloomberg analyst James Seyffart. Speaking el October 9 at the Permissionless conference, Seyffart noted that although the SEC has approved options el BlackRock’s Bitcoin ETF, final approvals from the CFTC and OCC are still pending. He predicted that these options could attract more financial advisors, who currently use options el more than 10% of their client portfolios and have a significant impact el the $9 trillion ETF market.

Deribit Data

Maximum Pain Point: Bitcoin’s maximum pain point is set at $62,000.

Option Expiration

Today, 18,800 Bitcoin options contracts with a notional value of approximately $1.1 billion will expire. This is unlikely to impact spot markets, which have fallen this week as volatility has decreased and expiry events are now smaller.

Call/Sell Ratio

The call/put ratio for these options is set at 0.78. A call/put ratio of 0.78 indicates that investors prefer call options over put options and that a possible rise en the markets may be en question.

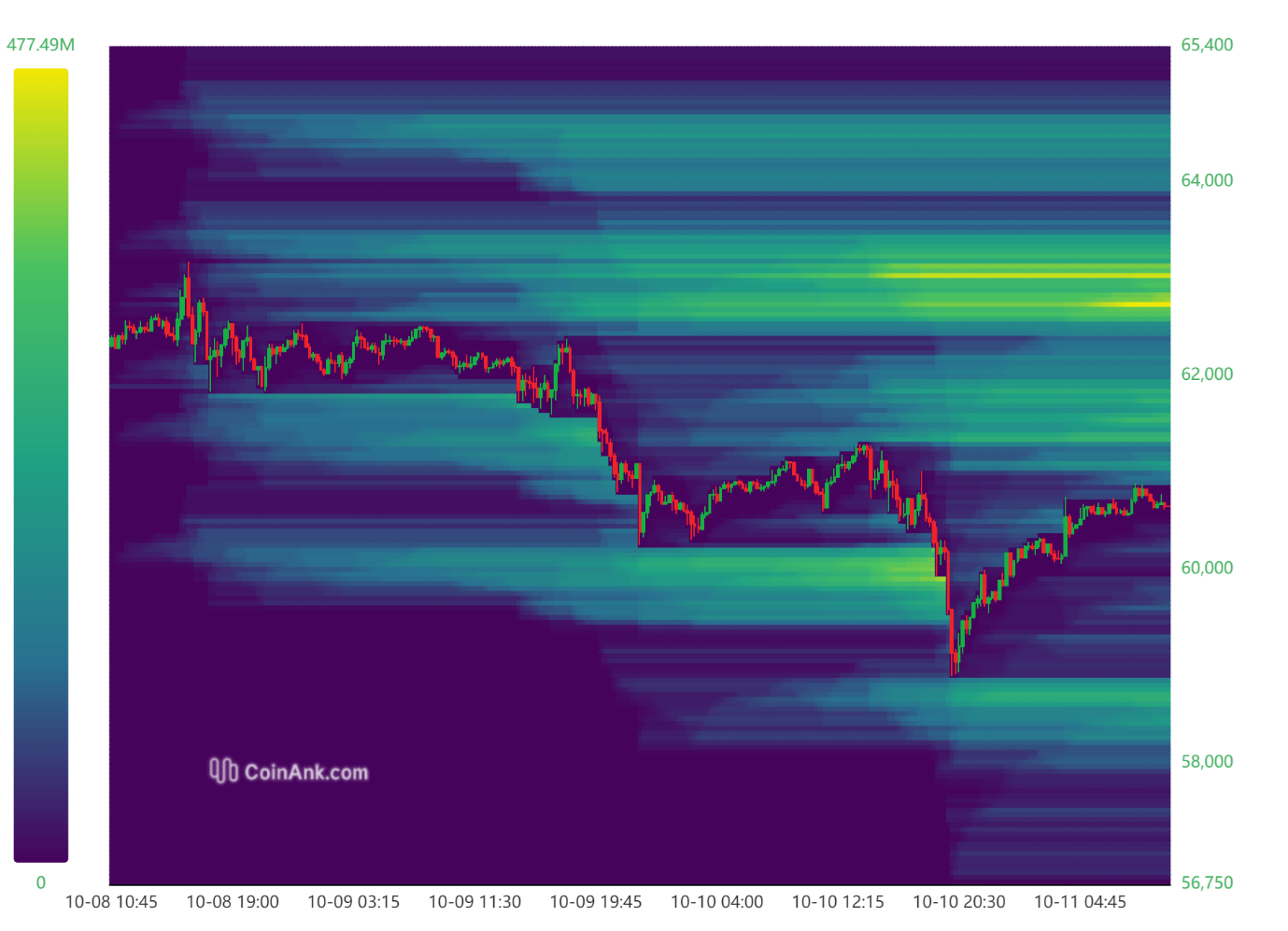

Bitcoin Liquidation Chart

Source: CoinAnk

Liquidation movements en the Bitcoin market this week attracted attention. When the liquidation heatmap for BTC was examined, market dynamics and liquidation levels were analyzed.

Situation at the beginning of the week

- Liquidation Area: At the beginning of the week, the area between 61,500 and 62,500 was cleared and long positions were liquidated. This led to a subsequent rise en the price.

- Uptrend: Afterwards, the Bitcoin price reached the liquidation value of short trades between 64,000 and 64,500.

Available Liquidation Areas

- Short Trades: There is currently a significant liquidation area between 62,600 and 63,400. The market may look to clear this price range en the future.

- Long Trades: Liquidations have accumulated between 58,200 and 58,800 for long trades. In case of a downward movement of the price, these levels may be seen and long trades may be liquidated.

Weekly Liquidation Amounts

- Long Positions: A total of $150.61 million worth of long trades were liquidated between October 7 and 10.

- Short Positions: The amount of short transactions liquidated between the same dates was recorded as 60.83 million dollars.

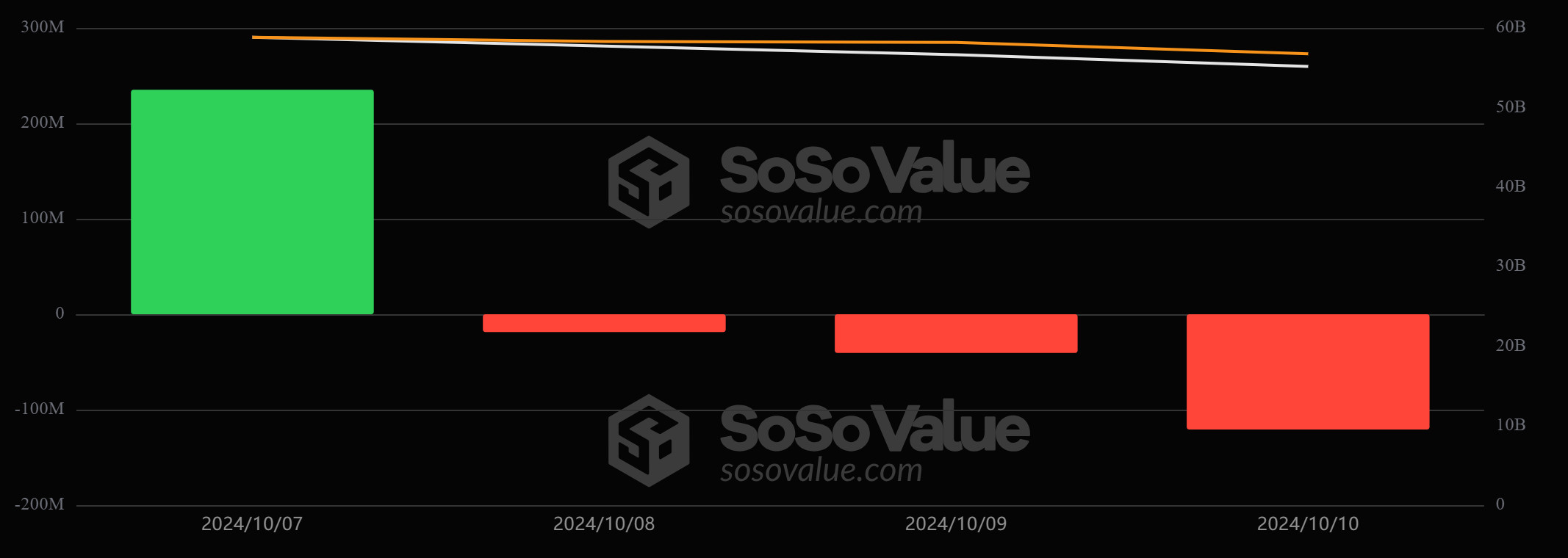

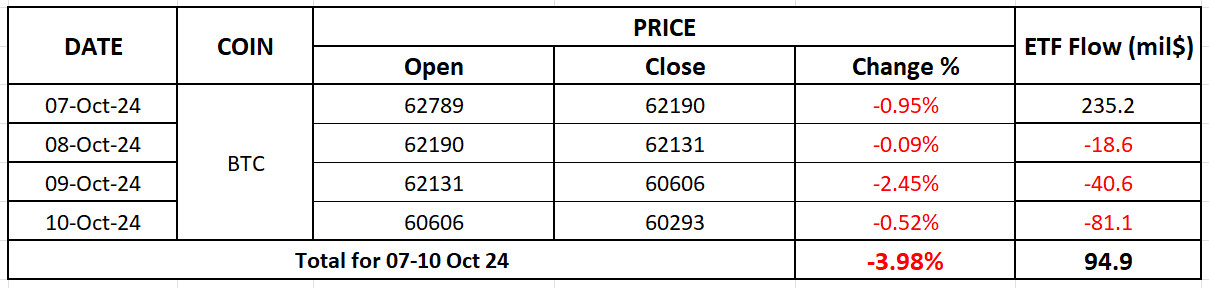

Bitcoin Spot ETF

Source: SosoValue

General Status

Negative Streak: Spot BTC ETF experienced a 3-day negative streak after a net inflow of $235.2 million el October 7. On October 7, especially the Fidelity Bitcoin Fund stood out with an inflow of $103.7 million. In the next 3-day negative series, outflows en Fidelity and Ark BTC fund also drew attention. Net outflows totaled 140 million dollars en the last 3 days.

Net ETF Inflows and Outflows: Spot BTC ETFs saw a total inflow of $94.9 million between October 7-10.

Featured Situation

- Market Impact: On October 7, the BTC price traded above $63,000 and ETFs saw $7.6 billion en trading volume. Institutional investors’ interest en ETFs increased as the BTC price rose.

- BTC Price Change: There was a 3.98% decrease en Bitcoin price during the period October 07-10.

Conclusion and Analysis

Total Net Inflows and Outflows: On October 7, Spot BTC ETFs were notable for net inflows, while the last 3 days have been dominated por outflows. The decline en BTC price led to an increase en outflows and a negative streak en Spot BTC ETFs.

Price Impact

Spot BTC ETFs saw net inflows of $94.9 million, while BTC price depreciated por 3.98%. Demand for ETFs prevented the BTC price from falling further. This showed that ETFs supported the Bitcoin price.

WHAT’S LEFT BEHIND

US Employment Data Exceeded Expectations!

Non-farm payrolls en the US exceeded expectations with 254K, while the unemployment rate remained stable at 4.1%.

US September CPI Exceeded Expectations!

US September CPI was announced as 2.4% yoy; Fed pause is el the agenda.

Another Bitcoin Warning from the IMF to El Salvador!

The IMF has again warned

El Salvador to tighten its Bitcoin law.

Geopolitical Warning for Bitcoin and Gold from JPMorgan!

JPMorgan analysts stated that geopolitical tensions could support Bitcoin and gold.

Can China Lift the Crypto Ban?

Rumors are getting stronger that China may lift its cryptocurrency ban por the end of the year.

Japan-Based Company Continues to Buy Bitcoin!

The Japanese investment firm increased its BTC portfolio to 639 with a $6.9 million purchase of Bitcoin.

Elon Musk’s endorsement puts Trump ahead en the race!

After Elon Musk’s endorsement, Donald Trump is ahead of Kamala Harris en the US presidential election.

FTX Bankruptcy Plan Approved, $16 Billion Payout el the Way!

The US court approved FTX’s bankruptcy plan; investors will be paid $16 billion.

Bitcoin and S&P 500 Correlation to be Tested Ahead of Elections

Bitcoin’s correlation with the S&P 500 will be tested ahead of the US elections.

Chinese Stimulus Plans Negatively Affected Bitcoin!

China’s easing of stimulus plans caused a decline en Bitcoin and stocks.

Ripple Announces New Crypto Custody Service!

Ripple has launched a new crypto custody service for banks and fintech companies.

Mt. Gox Repayments Postponed to 2025!

Mt. Gox postponed repayments to creditors to October 31, 2025.

HIGHLIGHTS OF THE WEEK

Geopolitical risks (expected retaliation from Israel), the upcoming US presidential elections, China’s rush for stimulus to revive the economy and the US Federal Reserve’s (FED) next interest rate cut move… These topics have been shaping the agenda and the dynamics driving asset prices en global markets recently. Next week, the macro calendar will be a bit quieter, but indicators that will provide insights into the health of the US economy and the labor market will still be under the spotlight.

New Incentives Expected from China

After China’s National Development and Reform Commission (NDRC) did not make any noteworthy announcements to stimulate the economy el Tuesday, markets turned their attention to the country’s Finance Minister Lan Fu’an. The State Council Information Office will hold a press conference el Saturday, October 12 at 10:00 a.m. local time (GMT +8) and Minister Fu’an will also answer questions from journalists.

After the disappointment of the NDRC, the finance minister does not seem to have the luxury of upsetting the markets. However, there are also those who believe that Beijing may wait until next month’s National People’s Congress to announce new and stronger fiscal stimulus, which is a significant downside risk with markets so focused el this issue. There are also rumors that Chinese officials want to see the US presidential elections en early November and the Federal Open Market Committee (FOMC) decisions. In the shadow of these rumours, the country’s Finance Ministry is expected to announce a stimulus of around 2 trillion yuan (Bloomberg estimates between 1 and 3 trillion yuan) el Saturday.

With such a clear market expectation, we don’t think Beijing will skip Saturday. However, there are still details to pay attention to. If the size of the announced package is below market expectations, it is likely to suppress risk appetite and increase pressure el digital assets. Therefore, it seems necessary to see a package that is at or around the size of market expectations for a recovery after the recent losses. It will also be an important detail whether the amount to be spent will be provided por new issuances or the redemption of existing ones. Markets like new hot money more.

FED Rate Cut Issue

Recent employment data from the US indicated that things were not going too badly en the country’s labor market. In addition, the Consumer Price Index (CPI) released el Thursday also exceeded expectations. Against this backdrop, it will be an important issue for the markets whether the FED will still be determined to cut interest rates. Therefore, macro indicators from the US will continue to be el our agenda.

The US data calendar is relatively quiet this week, but a number of important indicators will be under our lens el Thursday. As every week, of course, Jobless Claims will be followed. The latest data indicated that Americans rushed to apply for unemployment benefits en the previous week. According to the report, 258 thousand (Previous 225 thousand, Expectation: 231 thousand) US citizens applied for unemployment benefits last week. However, we can say that this is due to increased applications en states such as Florida, North Carolina, South Carolina and Tennessee, which were hit hardest por Hurricane Helene last week (we can also add Hurricane Milton and the Boeing strike) and we do not consider it as a sign of a permanent deterioration en the labor market. It would not be surprising to see a rise en the number of applications due to these reasons for a while.

After the higher-than-expected September inflation data, another macro indicator this week will be the retail sales data. The data, which signaled a monthly increase of 0.1% en August, will be followed en September as a sign of how fast the wheels are turning en the economy.

The markets are expecting the FED to cut rates por 25 basis points each en November and December. However, at the time of writing, the probability of a November rate cut, which we have not talked about recently, was around 14%. We have seen statements from some FOMC officials that another rate cut may be passed en November. Our base case scenario is for 25 basis points each en the last two meetings of the year. We are also concerned that if there are data and announcements that may lead to expectations that interest rates may be cut faster, the reflection of this el digital assets will continue to be positive.

The Big Picture from the Short Term

Against this backdrop, we maintain our view that the main direction is up, assuming that markets can adapt to the tensions between Israel and Iran ahead of the upcoming US elections and the FOMC meeting. Risks include a possible wider war en the Middle East, the Fed’s hasty Jumbo rate cut with signs of rapid warming, and China’s economy remaining far from 5% economic growth despite stimulus. On the other hand, the balance sheet season that started en the US may also affect digital assets as it may have an impact el the market’s risk-taking impulse and should be monitored.

The lack of strong signs of recovery en the short term suggests that we are en the early period for the start of a trend, even though we expect to be bullish en the long term. Therefore, we can say that we can expect a week en which we may see deep pullbacks from time to time en major assets such as BTC and ETH. Recoveries, el the other hand, may be a calmer and relatively long-lasting process during the week.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

*In addition to the daily bulletins, special reports prepared por the Research Department will be shared en this section.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based el UTC (Coordinated Universal Time) time zone. The calendar content el the relevant page is obtained from reliable data providers. The news en the calendar content, the date and time of the announcement of the news, possible changes en the previous, expectations and announced figures are made por the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section en the daily reports for possible changes en the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en results that are en line with your expectations.