MARKET SUMMARY

Latest Situation en Crypto Assets

| Assets | Last Price | Change (%) – Weekly | Change (%) – Monthly | Change (%) – Since the beginning of the year | Market Cap. |

|---|---|---|---|---|---|

| BTC | 67,695.64$ | -0.32% | 6.03% | 53.10% | 1.34 T |

| ETH | 2,529.18$ | -4.05% | -3.73% | 7.32% | 303.94 B |

| SOLANA | 171.58$ | 11.54% | 14.00% | 56.88% | 80.76 B |

| XRP | 0.5255$ | -4.62% | -10.84% | -16.63% | 29.81 B |

| DOGE | 0.1379$ | 2.58% | 26.26% | 49.91% | 20.21 B |

| TRX | 0.1649$ | 3.65% | 9.54% | 53.05% | 14.27 B |

| CARDANO | 0.3411$ | -1.74% | -10.77% | -45.22% | 11.94 B |

| AVAX | 26.38$ | -4.52% | -4.85% | -36.97% | 10.74 B |

| SHIB | 0.00001766$ | -6.05% | 18.03% | 65.42% | 10.42 B |

| LINK | 11.81$ | 3.38% | -4.23% | -23.89% | 7.41 B |

| DOT | 4.154$ | -2.19% | -10.46% | -51.66% | 6.28 B |

*Table was prepared el 10.25.2024 at 14:30 (UTC). Weekly values are calculated for 7 days based el Friday.

Fear & Greed Index

Source: Alternative

Market Summary

Fed member Logan’s statements el the possibility of gradual rate cuts suggest that the low interest rate environment may increase risk appetite and direct investors to risky assets. Logan’s emphasizing that liquidity is still abundant is considered as a factor that supports market confidence. However, the lack of clear information el the timing of the rate cut continues to create uncertainty.

The fact that open positions en Bitcoin futures reached an all-time high en this process reveals the vitality of the market and investors’ future price expectations. In addition, Tesla’s continued holding of Bitcoin assets en its third quarter financial report points to continued institutional support and long-term confidence en Bitcoin.

Fear and Greed Index

The slight decline en the index to 72 from 73 last week may indicate a partial increase en market uncertainty. This change suggests that investors’ cautious behavior continues and that they are raising questions about the market.

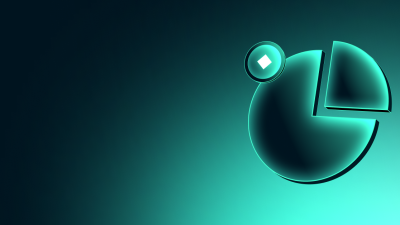

Bitcoin Dominance

Source: Tradingview

Bitcoin Dominance

Last week saw a record rise en dominance with the interest of institutional investors. When we look at this week, we see that the dominance rate has decreased slightly. As a matter of fact, bullish movements en the altcoin market attracted attention from time to time.

The Shift en Bitcoin Dominance

- Last Week’s Level: 59.20%

- This Week’s Level: 59.01%

Impact of Institutional Investors

Last Week’s Rally

Institutional investors’ interest en Bitcoin has led to an increase en dominance to 59.20%. This shows that confidence en Bitcoin is growing and that large investors are favoring Bitcoin more.

This Week’s Decline

The decline en dominance to 59.01% suggests that interest has waned somewhat, or that investors are starting to turn to alternatives other than Bitcoin.

Total MarketCap

Source: Tradingview

Last week, with the historical rise en October, we saw an increase en risk appetite and with the approach of the US presidential elections, we saw an increase en the total marketcap value as presidential candidate D. Trump took the lead en the polls. When we look at this week with the correction movement en Bitcoin, the decline en total market capitalization gave back last week’s gains.

Change en Market Value

- Last Week’s Market Capitalization: $2.283 Trillion

- This Week’s Market Cap: $2.272 Trillion

Election Impact

Trump’s Lead en the Polls: The approach of the US presidential elections and Donald Trump’s lead en the polls created hope en the markets for a move away from uncertainty and possible new regulations. This, en turn, increased investors’ risk-taking tendencies.

Market Responsiveness

Investor Sentiment

A decline en market capitalization may indicate that investors have become more wary of uncertainty. Market volatility is common, especially during election periods. This may require investors to act more cautiously and strategically.

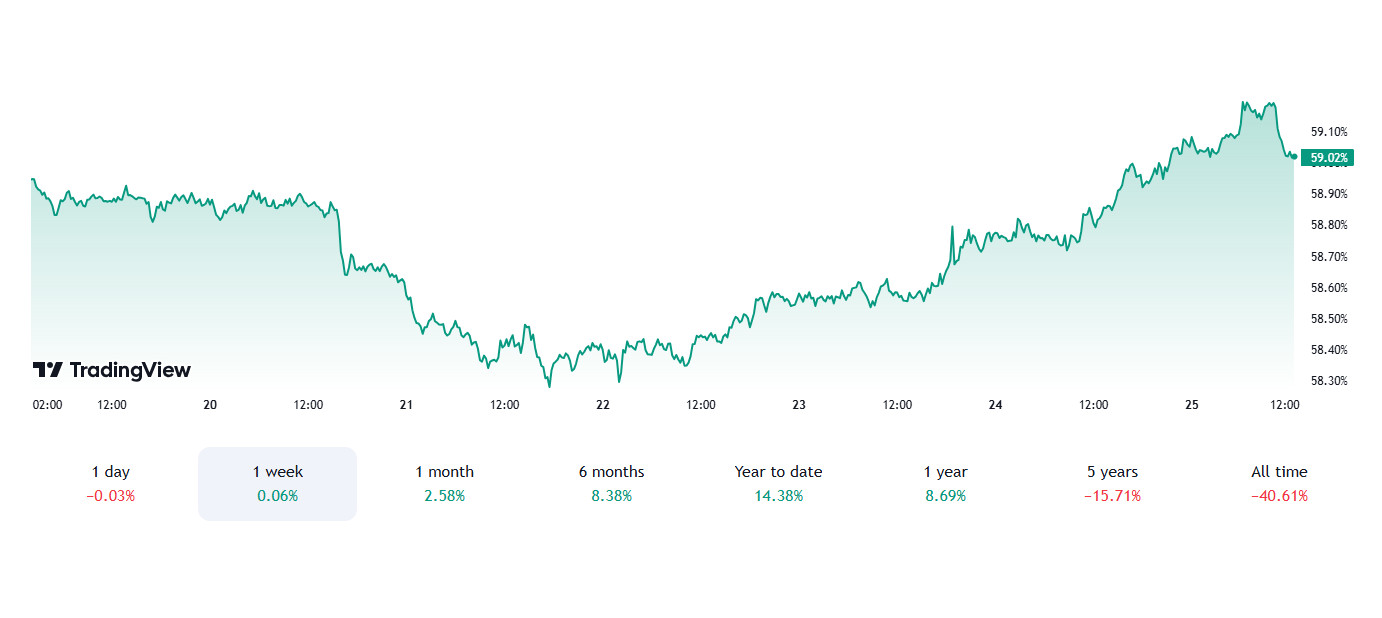

Bitcoin Supply Breakdown

Source: Glassnode

| Address Range | 17.10.2024 | 24.10.2024 | Change | Analysis |

|---|---|---|---|---|

| 0.001 – 0.01 BTC | 0.217% | 0.217% | Fixed | No change en the number of micro investors. |

| 0.01 – 0.1 BTC | 1.399% | 1.399% | Fixed | No change en the number of micro investors. |

| 0.1 – 1 BTC | 5.568% | 5.571% | Increase | There is an increase en demand from small investors. |

| 1 – 10 BTC | 10.813% | 10.812% | Decline | Mid-level investors accumulate more BTC. |

| 10 – 100 BTC | 22.000% | 21.993% | Decline | Large investors reduced their positions. |

| 100 – 1k BTC | 20.643% | 20.744% | Increase | The process of accumulation among the whales continues. |

| 1k – 10k BTC | 23.942% | 23.840% | Decline | Slight sales are observed en large accounts. |

| 10k – 100k BTC | 11.788% | 11.817% | Increase | The giant whales continue to increase their position. |

| > 100k BTC | 3.602% | 3.579% | Decline | The biggest players are selling. |

General Evaluation

In general, we are seeing large and giant investors enter a period of mild accumulation, while smaller accounts continue to buy. These movements support an uptrend en the Bitcoin price, which has risen from $67,316 to $68,170 during this period.

This shows that both individual and large investors are still active en the market and that there is a strong basis for continued price stability.

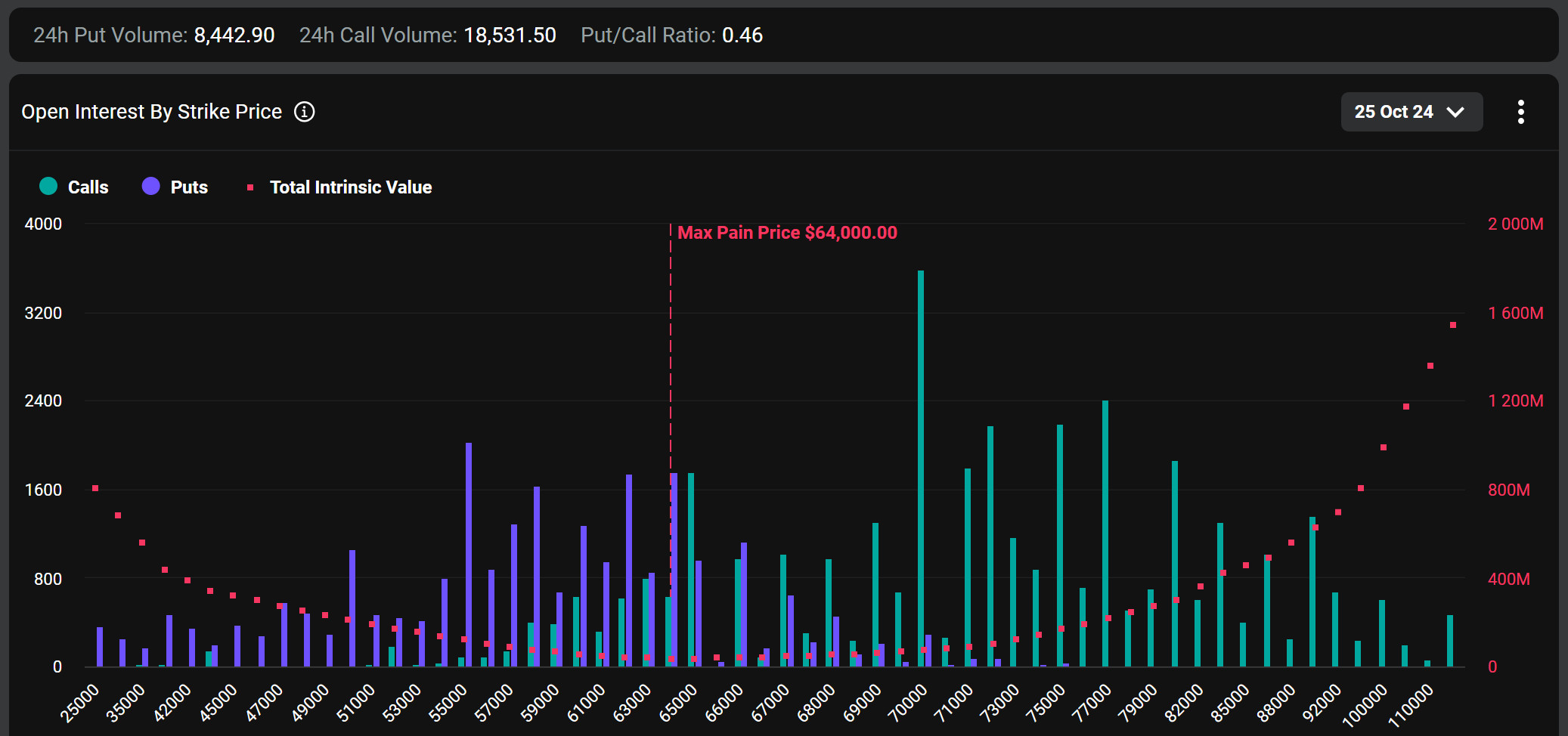

Bitcoin Options Breakdown

Source: Deribit

Market Expectations and US Election Impact

According to Bloomberg, options traders are taking positions that Bitcoin will reach $80,000 por the end of November, regardless of the US election results. This indicates a general optimism about Bitcoin’s performance despite divergent political views el cryptocurrency regulation. At the same time, expectations of a rate cut por the Federal Reserve have also boosted traders’ market sentiment.

Deribit Options Data and Maximum Pain Point

According to Deribit data, BTC options with a notional value of approximately $4.26 billion expire today. About $682 million of this amount, or 16.3% of the total $4.2 billion, is en profit for contract holders as it is below the current market price.

Bitcoin’s maximum pain point is set at $64,000. The maximum pain point represents the price point at which the largest number of option holders will incur losses if the price approaches this level.

Call/Sell RatioThe call/put ratio of BTC options is calculated as 0.46. This ratio indicates that investors have a stronger preference for call options over put options and that there is a bullish expectation en the market.

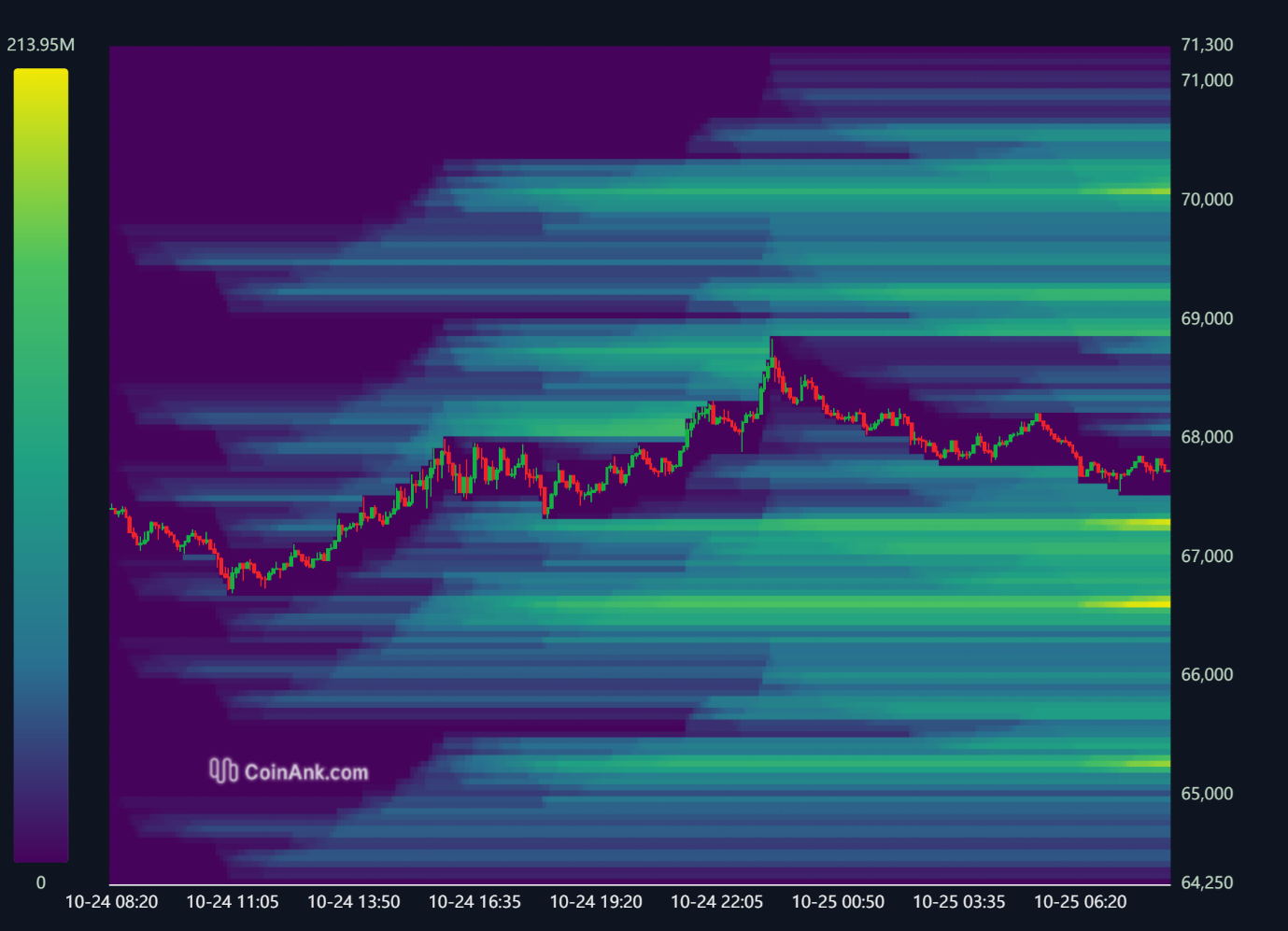

Bitcoin Liquidation Chart

Source: CoinAnk

Liquidation Levels

When Bitcoin’s weekly liquidation heatmap is analyzed, short positions en the 68,900 – 69,300 USD band were liquidated during the week, and with the subsequent price decline, long positions accumulated en the 67,000 – 64,000 and 65,800 – 66,000 ranges also reached liquidation levels. Currently, there is a significant liquidation area for short positions between 68,900 – 69,300 USD; this level may be cleared por price movements en the coming period.

In terms of long trades, liquidations have accumulated en the 67,200 – 67,400 and 66,500 – 66,700 USD ranges. In case of a downward movement of the price, these levels may be tested and long trades may be liquidated.

Weekly Liquidation Amounts

- Long Transactions: Between October 21 and 25, a total of USD 93.37 million worth of long transactions were liquidated.

- Short Transactions: Between the same dates, liquidated short trades totaled USD 68.57 million.

This weekly liquidation data shows that liquidation movements concentrated at certain levels en the Bitcoin market offer clues about the direction of the market.

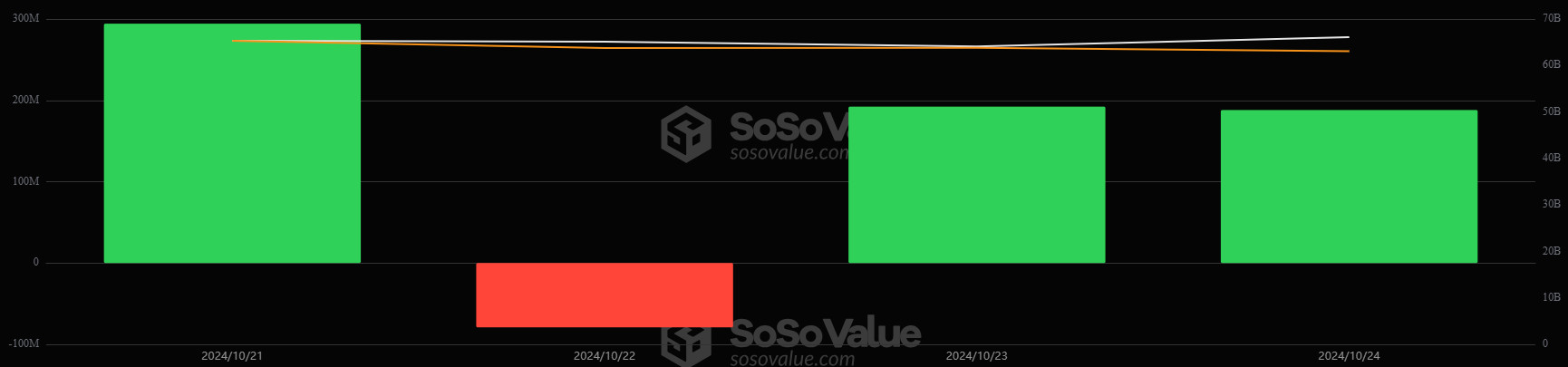

Bitcoin Spot ETF

Source: SosoValue

General Status

Positive Net Inflow Series

Positive net inflows en the Spot BTC ETF started el October 11 and continued until October 22. On October 23, the positive inflow series was broken with a decrease of $79.09 million. On October 24, it returned to positive with an increase of $ 188.11 million. This week’s net inflow was 595.62 million dollars. In weekly terms, there were 3 positive week series.

Blackrock IBIT ETF Net Inflows

Between October 21-24, Blackrock IBIT Spot BTC ETF net total inflows increased por $855 million. With this increase, the Blackrock IBIT Spot BTC ETF value reached $23.69 billion.

Featured Situation

Market Impact

Despite the negative outlook for BTC this week, Spot BTC ETFs continued to see a surge en interest.

BTC Price Change

Bitcoin price decreased por 1.21% between October 21-24.

Conclusion and Analysis

Total Net Inflows and Outflows

The net inflows en Spot BTC ETFs between October 21-24 were noteworthy, with net inflows totaling $595.62 billion.

Price Impact

This week saw a 1.21% drop en BTC price, while Spot BTC ETFs saw increased interest from institutional investors. Between October 21-24, the majority of Spot BTC ETFs saw net inflows. This suggests that Spot BTC ETF purchases increased even as the BTC price fell.

WHAT’S LEFT BEHIND

US Election Wind The

possibility of Donald Trump’s election en the US presidential elections has mobilized the cryptocurrency markets; In the Polymarket survey, Trump outperforms Kamala Harris with 63.9% and the election result is predicted to create a serious increase en cryptocurrencies.

Bitcoin Options Traders

Bitcoin options traders are taking a bullish position following the US elections and the Fed’s interest rate decision.

Russia to develop crypto mining and artificial intelligence projects en BRICS countries

Russia will develop artificial intelligence projects por establishing data centers en BRICS countries.

A New Era for Investors After SEC Approves Bitcoin Spot ETF Options The

U.S. Securities and Exchange Commission has approved Bitcoin Spot ETF options, marking a major milestone en the crypto market.

Elon Musk endorses crypto and XRP advocate senatorial candidate

Elon Musk endorsed John Deaton en the senatorial elections en the state of Massachusetts.

What’s the Target at Tesla?

While Tesla continues to hold 11,509 Bitcoins, it explained that the movements en its wallets are rotation. While Tesla’s third-quarter financial results surprised analysts, the company announced that it maintained its Bitcoin holdings.

Million Dollar Investment en Bitcoin from Metaplanet

Metaplanet increased Bitcoin purchases por raising 66 million dollars en funds with the support of individual investors.

Ripple-SEC Case Nears Deadline

As the Ripple-SEC case reaches a critical milestone, Ripple aims to lift the SEC’s sanctions.

Bernstein’s Ambitious Bitcoin Forecast for the End of 2025

Bernstein analysts predict that Bitcoin will reach six-digit prices por the end of 2025.

Ripple CEO Garlinghouse

Ripple CEO Brad Garlinghouse stated that the launch of a spot exchange-traded fund for XRP is only a matter of time.

Microsoft Bitcoin Investment

Microsoft is considering investing en Bitcoin and will put the issue to a vote at the shareholder meeting.

US Government Crypto Wallet

Arkham Intelligence reported that nearly $20 million worth of stablecoins and ETH were stolen from US government wallets.

US Applications for Unemployment Benefits Announced: 227K

Expectation: 243K

Previous: 241K

HIGHLIGHTS OF THE WEEK

We are el the eve of the most critical week en recent memory. Ahead of the US presidential election and the US Federal Reserve’s (FED) critical monetary policy statement, we are en for a five-day trading period of really important macro data releases. The macro dynamics that have been driving digital asset prices en recent months may gain momentum this week. In addition, investors will also be listening to news from Asia this week, with the exception of China.

Japan

Japanese people living en the world’s third largest economy will vote for the lower house election this weekend (Sunday). Also, el Thursday, the country’s Central Bank (BoJ) will announce its monetary policy decision. In recent weeks, news out of China has dominated the Asian agenda. This time Japan joins the journey.

The ruling party (the Liberal Democratic Party), which has been rocked por the scandal over the slush fund scandal, may have to come out of this election with some scars. Faced with the risk of losing its majority en the lower house for the first time since 2009, Ishiba’s party may be forced to form partnerships with more small parties, leading the Democrats to search for a new leader en the future.

The election results en Japan are important as they could also lead to changes en the country’s stance el digital assets. Going to the polls el October 27, polls indicate that Japanese support for the ruling party is waning, and Yuichiro Tamaki, the leader of Japan’s Democratic Party for the People, is trying to take advantage of this situation por raising the need for tax cuts and regulatory reforms regarding cryptocurrencies. In a post el social media platform X, Tamaki invited those who think crypto assets should be taxed separately from the 20% rate to vote for his party and promised that “Crypto assets will not be taxed when exchanging crypto assets for other crypto assets”. On the other hand, the Constitutional Democratic Party of Japan, the country’s segundo largest party, announced that it will review the crypto tax system, which it sees as closely related to the development of web3 en the country.

Regulation and tax issues related to digital assets are also among the topics of the elections en Japan, the country with the third largest economy en the world, so the results are important for the crypto world. The BoJ’s interest rate decision is expected el the Thursday after the elections and the bank is expected to leave interest rates unchanged. Although no surprises are expected from the BoJ front for now, the markets, which have experienced the impact of changes en the country’s currency el cryptocurrencies, will closely monitor the decisions and statements.

Important Macro Data en The US el The Eve of The Critical Week

The US presidential election el November 5th and the Federal Open Market Committee (FOMC) announcements el November 7th are of critical importance for all assets en global markets. In the week ahead, that is to say next week, we are awaiting a lot of highly important macro data and they will provide critical clues regarding the FED’s interest rate cut course.

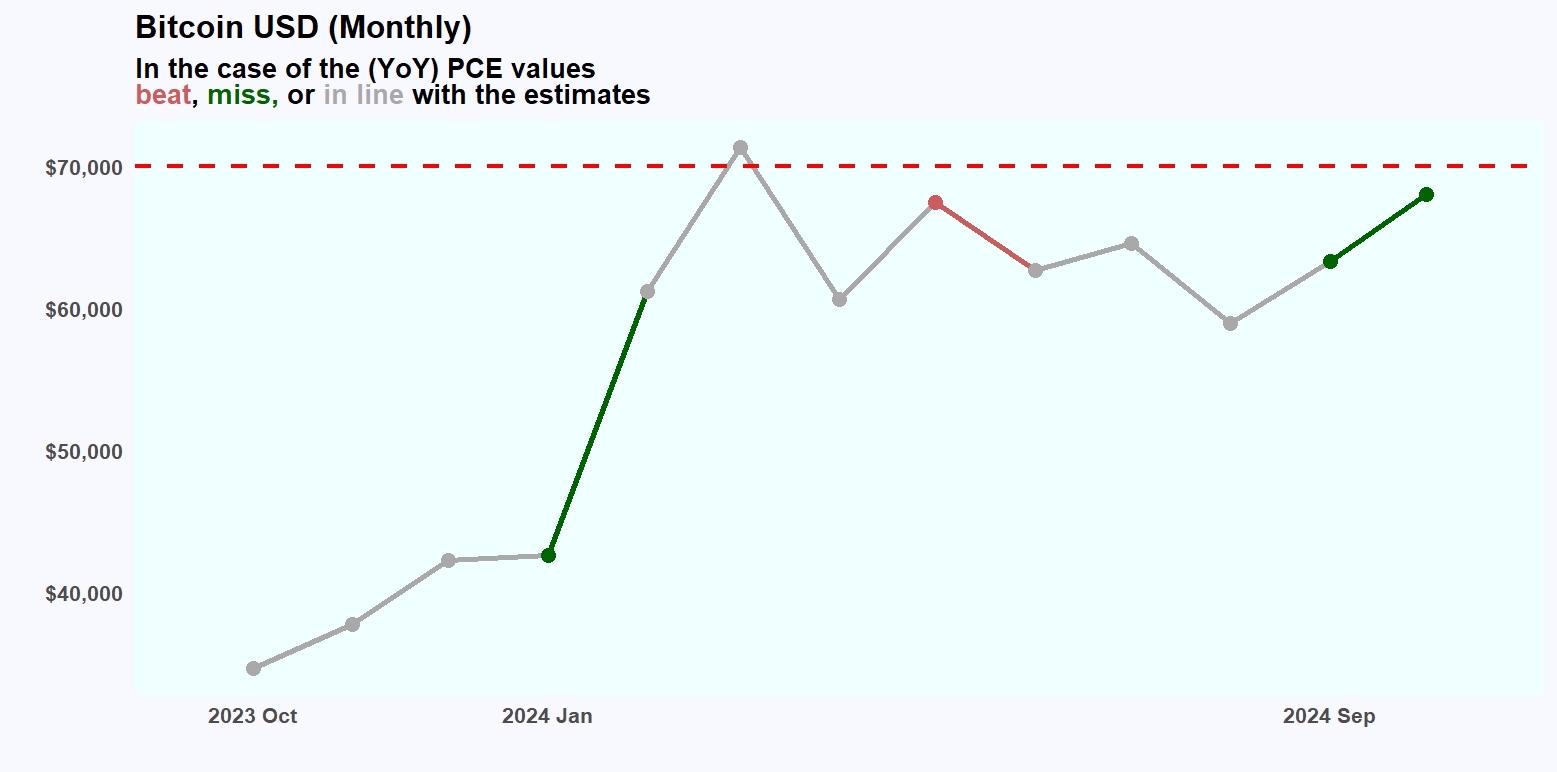

On Wednesday, we will see the US third quarter growth data (GDP). Also el the same day, the ADP private sector employment change will be el the agenda ahead of the crucial employment data el Friday. On Thursday, we will see the core PCE Price Index, which is the FED’s preferred measure to monitor changes en inflation. On Friday, the last day of the first week of November, non-farm payrolls and other labor market statistics await us.

ADP, GDP and PCE

We can say that volatility en the markets will increase en this busy calendar and we can see fluctuations en prices after each data. The world’s largest economy is expected to grow por 3% en the third quarter of the year compared to the previous quarter. On the other hand, we think that the PCE price index, which the FED prefers to monitor as an inflation indicator, is as important as the employment data.

Source: Darkex Research Team, Data Geeek

According to a statistical study por Darkex Research Department, changes en PCE values (year-el-year) will positively affect Bitcoin prices, regardless of their distance from market expectations. In September, the PCE price index is expected to have realized at 2.1% compared to the same month of the previous year (it is important to follow the daily bulletins for possible changes en the expectation figures).

Labor Force Statistics

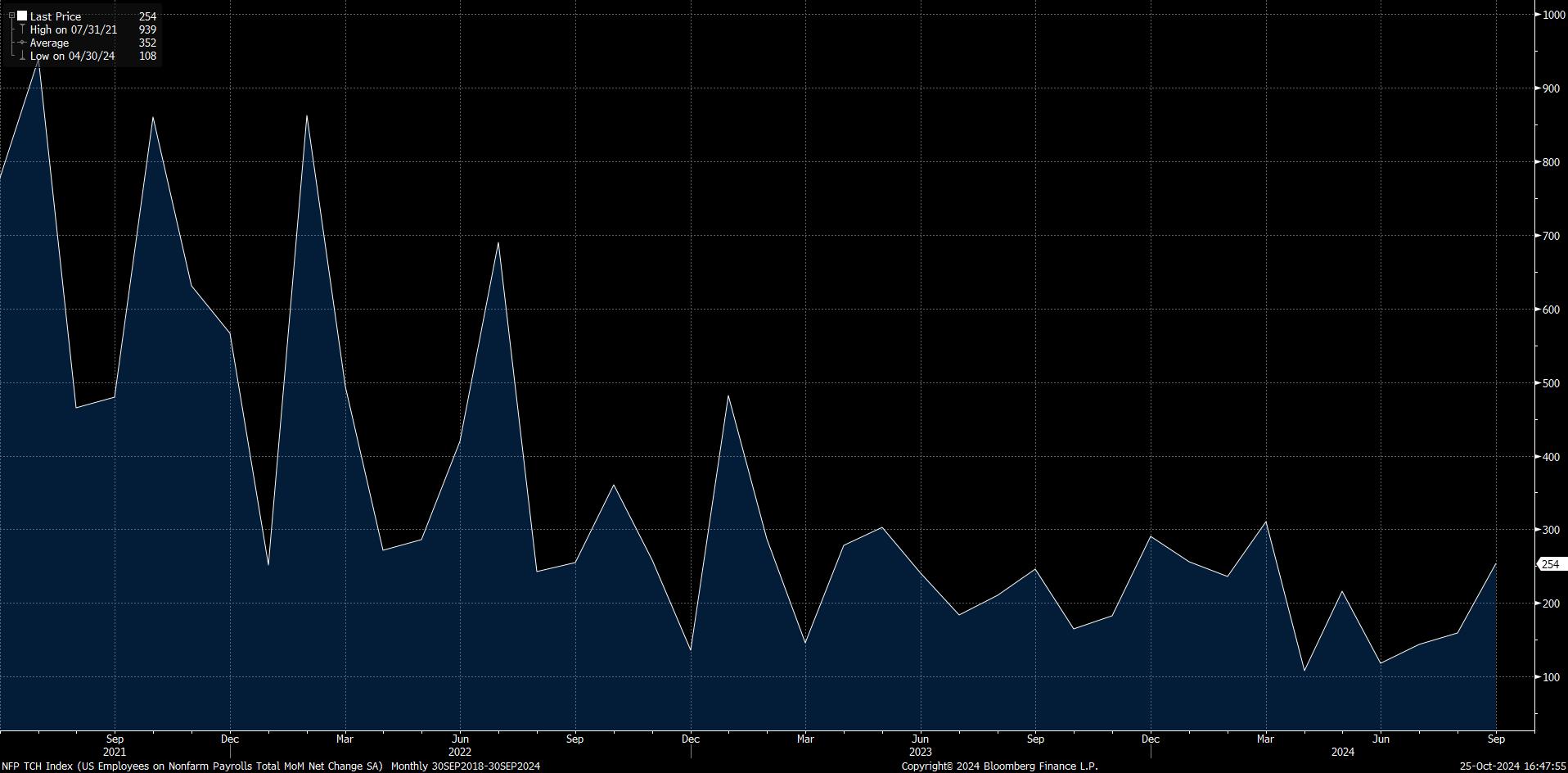

In the same first, last business day of the week, markets will focus el the US employment data. Among these, the non-farm payrolls change (NFP) data stands out.

Source: Bloomberg

In September, we saw that the US economy added 254 thousand jobs en the non-farm sectors. This was much higher than the forecasts of 147 thousand. It is expected that we will see a more conservative increase en employment again. However, while the FED is so focused el the developments en the labor market, we can say that a surprise data may have harsh effects el the markets. It is difficult to predict the possible impact of the data el the markets ahead of the critical presidential election. Nevertheless, a higher-than-expected NFP data may have a negative impact el risky assets por increasing expectations that the FED will not act quickly el interest rate cuts. On the contrary, figures that create expectations of rapid interest rate cuts may pave the way for a moderate rise.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

*In addition to the daily bulletins, special reports prepared por the Research Department will be shared en this section.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based el UTC (Coordinated Universal Time) time zone.

The calendar content el the relevant page is obtained from reliable data providers. The news en the calendar content, the date and time of the announcement of the news, possible changes en the previous, expectations and announced figures are made por the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section en the daily reports for possible changes en the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en results that are en line with your expectations.