Weekly Fundamental Analysis Report

Fear & Greed Index

Source: Alternative.me

- Change en Fear and Greed Value: +1

- Last Week’s Level: 28

- This Week’s Level: 29

The Fear and Greed Index showed a limited increase from 28 to 29 this week, remaining en the fear zone but signaling a gradual shift away from the deep panic atmosphere that followed the sharp sell-off en October. In the early days of the week, Bitcoin spot ETFs saw a strong daily inflow at the beginning of December, followed por a fluctuating but generally more balanced flow, which supported the perception that institutional investors had not completely given up, preventing the index from falling further. In the middle of the week, the Federal Reserve cut its policy rate por 25 basis points, bringing the corridor to 3.50-3.75 range, was seen as supportive for crypto markets en terms of dollar liquidity and financial conditions. However, the projections released did not allow for a very aggressive easing cycle en the coming period, thus limiting excessive optimism. This dual effect caused the index to record a cautious improvement with only a one-point upward movement. The weekly jobless claims, announced immediately after the Fed’s decision, jumped to 236,000, showing one of the sharpest weekly increases en recent years, raising concerns about weakening employment and dampening risk appetite. During the same period, Bitcoin tested around $94,000 after the Fed’s decision, then fluctuated again en the $90,000-95,000 range, while stock markets saw profit-taking en AI-themed indices, revealing that crypto was priced more cautiously than other risky assets. This dynamic also stood out among the price dynamics preventing the index from exiting the fear zone.

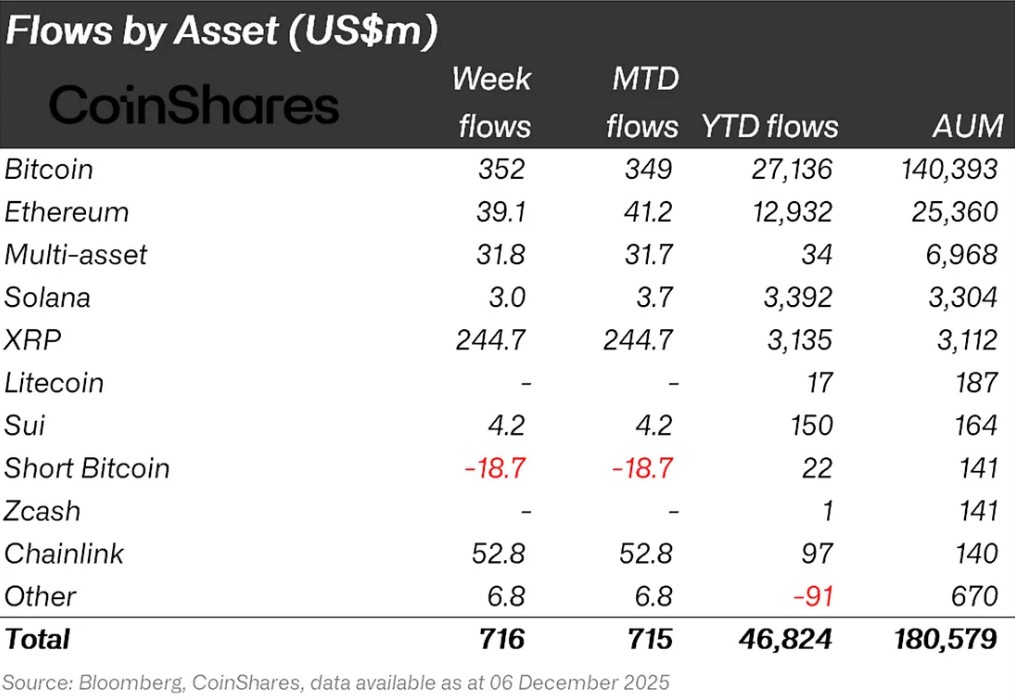

Crypto Fund Flows

Source: Coinshares

Overview: Crypto markets are continuing a calm week following the Fed’s 25 basis point interest rate cut. Generally positive statements from Fed members kept the market flat, while these developments provided limited support to Bitcoin. As a result, Bitcoin gained approximately 1% en value over the week.

Bitcoin (BTC): Bitcoin continues to see weak inflows from investors this week. Bitcoin-focused funds saw inflows of $352.0 million.

Ethereum (ETH): Along with spot ETH inflows, Ethereum saw $39.1 million en inflows this week.

Solana (SOL): Solana saw inflows of $3.0 million.

SUI: Sui’s stablecoin initiatives continue to have a positive impact. This trend continued with $4.2 million en inflows into Sui.

Ripple (XRP): This week, XRP saw $244.7 million en fund inflows.

Multi-asset: Inflows were observed en the multi-asset group.

Other: Sector-specific and project-based increases en altcoins, along with the general market outlook, brought en $6.8 million en fund inflows.

Fund Outflows:

Short Bitcoin: Short Bitcoin saw an outflow of 18.7 million dollars.

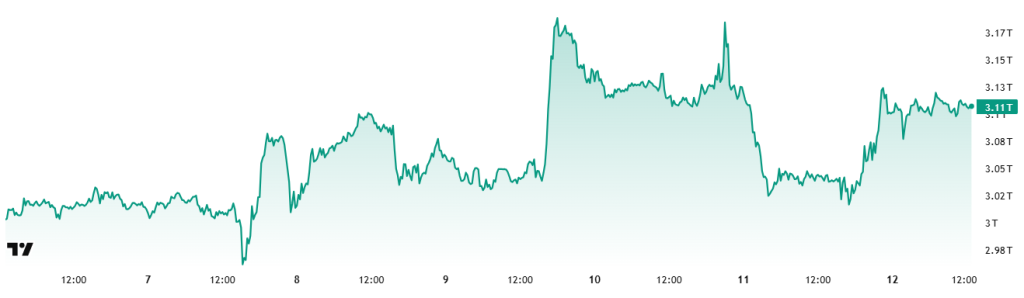

Total MarketCap

Source: Tradingview

- Market Value Last Week: $3.04 Trillion

- This Week’s Market Value: $3.11 Trillion

This week, the cryptocurrency market grew por approximately $71 billion, advancing 2.36% and bringing the total market value to $3.11 trillion. The week’s peak was $3.2 trillion, while the lowest level was $3.01 trillion. Thus, the market moved within a band of 187 billion dollars, which translates to a volatility of 6.22%. Although wider than last week’s range of 12.39%, it can be considered within the crypto market’s typical weekly average candle size.

Total 2

Starting the week with a market value of $1.23 trillion, the Total 2 index rose 2.5% during the week, gaining approximately $30 billion en value and ending the period at around $1.25 trillion. The weekly high was $1.31 trillion, while the low was $1.22 trillion. In other words, the index fluctuated within a range of $85 billion, which corresponds to a volatility of approximately 6.97% for the period. With this rise, Total 2 is now positioned about 40% away from its all-time high. Therefore, if the decline is seen as a corrective movement, it can be said that an upward trend is beginning to form el the altcoin side.

Total 3

Total 3 started the week with a total value of $0.862 trillion, grew por approximately $8.95 billion during the week, recording an 1.04% increase, and closed the period at $0.871 trillion. The volatility between the week’s highest and lowest values was only 6.08%. Thus, Total 3 retained its title as the most stable index this week, and interestingly, this picture has not changed for five weeks.

The index-volatility ranking of Total 2 > Total > Total 3 indicates that the dominant movement en the majors first intensified en Ethereum and then en Bitcoin. Furthermore, Ethereum’s total market share has seen a significant increase during this period.

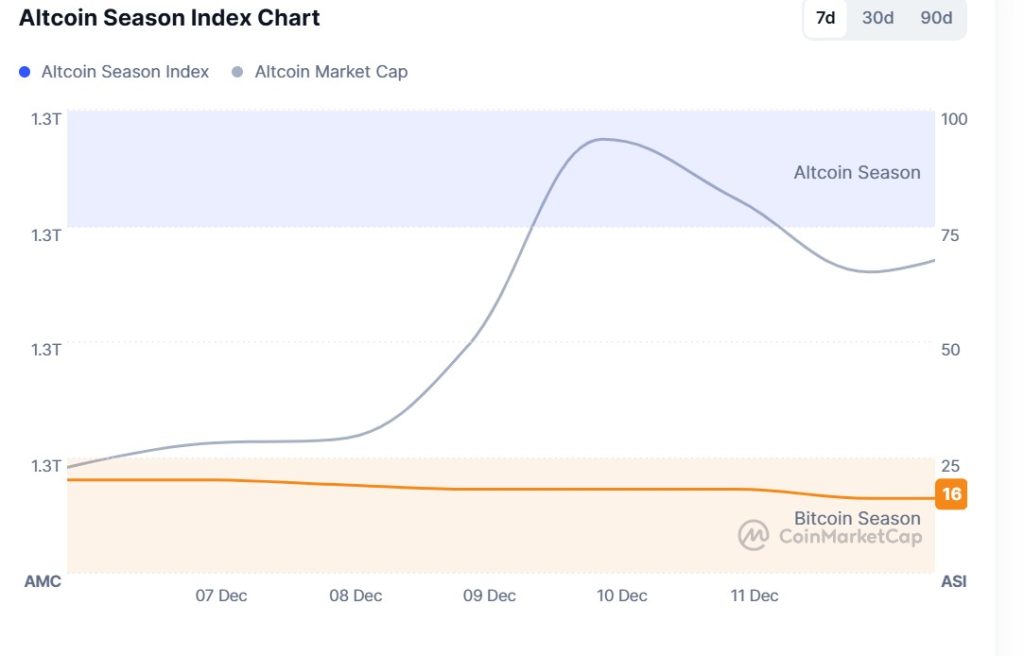

Altcoin Season Index

Source: Coinmarketcap

- Last Week’s Index Value: 21/100

- This Week’s Index Value: 16/100

Between December 7 and December 12, 2025, after a slight increase en the correlation between altcoin market dominance (Altcoin Market Cap) and the Altcoin Season Index, a decline occurred again. The chart shows that this week, el December 10 , the index rose to 18, indicating that the Altcoin Market Cap reached 1.27T. When the index rose this week, the top 5 coins leading the rise were Aster, Zec, M, Merl, and Dash. On December 11, the index fell from 18 to 16, indicating the potential for a decline en the altcoin season.

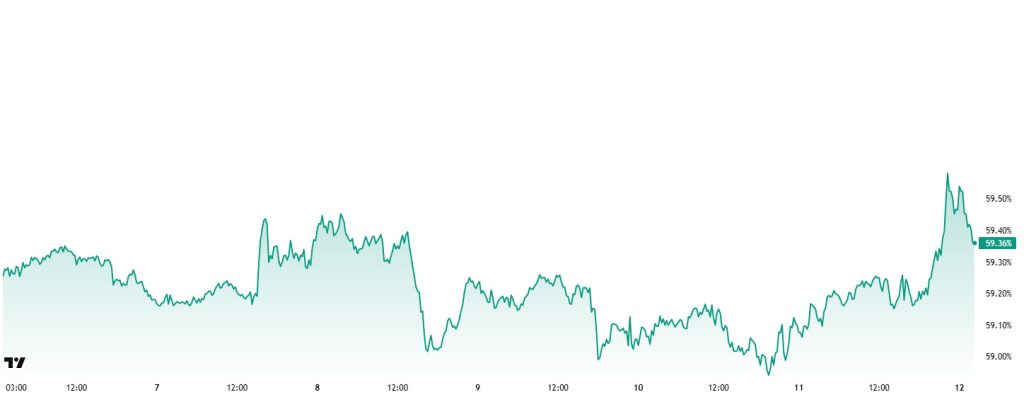

Bitcoin Dominance

Source: Tradingview

Weekly Change

- Last Week’s Level:36%

- This Week’s Level:36%

Bitcoin dominance started the week at 59.44%, fell to 59.04% during the week, but then rose slightly and is currently at 59.36%.

This week, Strategy purchased 10,624 Bitcoin, Lion Group Holding LTD. purchased 88.5 Bitcoin, and Vanadi Treasury purchased 10 Bitcoin. Furthermore, data el Bitcoin spot ETFs shows that there has been a total net inflow of $237.4 million to date.

Based el weekly data, while there has been a limited recovery en institutional buying appetite, an increase en buy positions has also been observed among retail investors trading through the ETF channel. Despite a partial decrease en uncertainty following the FED meeting, capital inflows into crypto assets generally remained weak, limiting the buying momentum en Bitcoin. Although the recent resumption of net inflows into spot Bitcoin ETFs points to a partial recovery en retail investor demand, the sustainability of this trend has not yet been confirmed. Under current macroeconomic conditions, it is noteworthy that Bitcoin has maintained a relatively more resilient pricing structure compared to Ethereum and other major altcoins. In this context, if the gradual increase en institutional and retail investor demand continues, BTC dominance is expected to maintain its current strong outlook and remain en a horizontal consolidation trend within the 58%–61% range.

Ethereum Dominance

Source: Tradingview

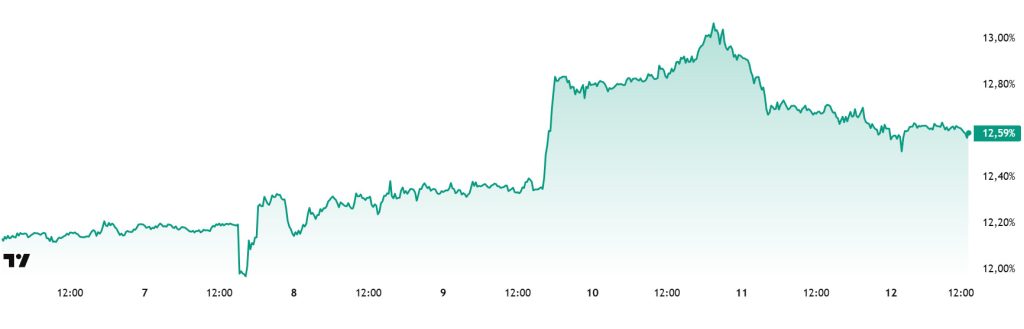

Weekly Change:

- Last Week’s Level: 12.17%

- This Week’s Level: 1 2.59%

Ethereum dominance, which rose to 15% levels en mid-August, lost momentum and entered a downward trend. However, this negative outlook ended above the 11.50% level at the end of November and regained positive momentum.

Accordingly, Ethereum dominance ended last week at 12.17% and is currently trading at around 12.59% based el the latest data. During the same period, Bitcoin dominance recorded a negative trend, unlike Ethereum dominance.

The key developments affecting Ethereum dominance are as follows:

The Ethereum Foundation announced that BPO-1 has been activated and the blob capacity per block has been increased to 15. This improvement aims to increase Layer 2 efficiency without requiring a hard fork. The Foundation stated that capacity will increase further with BPO-2, which will be implemented en January. This step will provide significant gains en terms of cost and performance, especially en L2 solutions.

SharpLink announced that it received 446 ETH en rewards last week, bringing its total staking rewards to 8,776 ETH. The company’s staking strategy began el June 2, 2025. It was noted that 100% of all ETH positions are en institutional staking. This demonstrates the company’s confidence en its long-term staking revenue model.

The x402 Hackathon organized por EigenCloud has officially started, with the application deadline set for January 5, 2026. The event is supported por the Ethereum Foundation, Coinbase, Polygon, and other major ecosystem players. There is no cash prize for this hackathon; participants will gain access to marketing, mentorship, and potential grant opportunities. The organization’s focus is el developing next-generation smart agents and el-chain payment solutions.

BlackRock has filed an official S-1 application with the SEC for the iShares Staked Ethereum Trust ETF. This ETF will be the company’s fourth crypto-focused product. The new application coincides with growing market interest en Ethereum staking products.

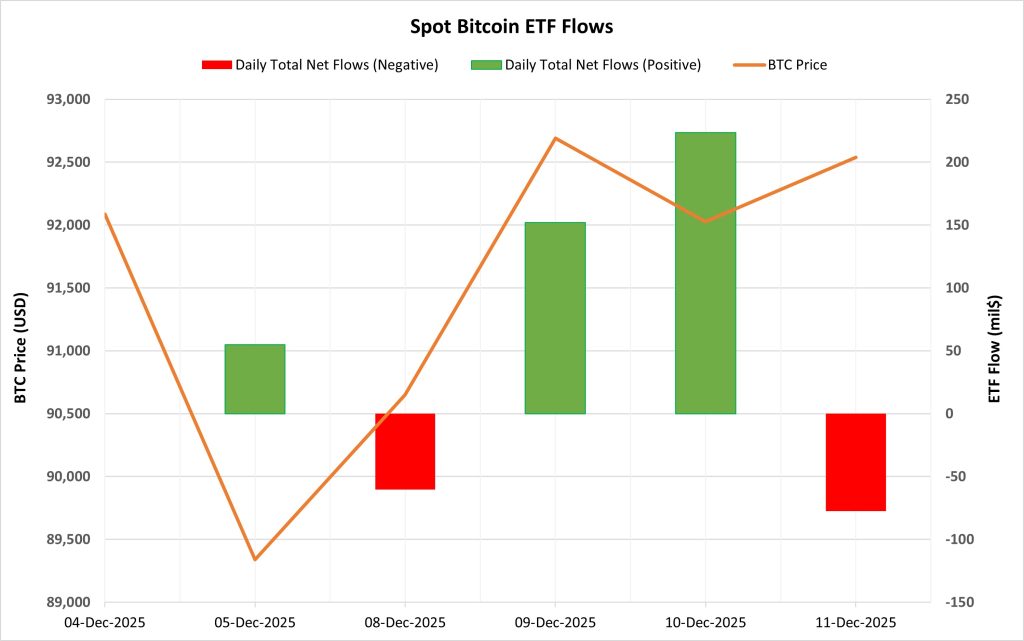

Bitcoin Spot ETF

Source: Darkex Research Department

Netflow Status: Between December 5-11, 2025, there was a total net inflow of $292.3 million into Spot Bitcoin ETFs. During this period, flows were volatile, and no clear flow series emerged. Strong inflows el December 9 ($151.9 million) and December 10 ($223.5 million), ahead of and el the day of the Fed’s interest rate decision, were the main factors keeping the total positive during this period. Outflows observed el December 8 and 11 reflected investors’ short-term cautious stance. Fund-wise, inflows into Fidelity FBTC and BlackRock IBIT stood out.

Bitcoin Price: Bitcoin opened at $92,085 el December 5 and closed at $92,537 el December 11. During this period, the BTC price gained 0.49%. Despite strong inflows, the limited reaction el the price side pointed to a cautious search for balance en the market.

Cumulative Net Inflow: At the end of the 480th trading day, the cumulative total net inflow of Spot Bitcoin ETFs rose to $57.837 billion.

| DATE | COIN | Open | Close | Change % | ETF Flow (mil$) |

|---|---|---|---|---|---|

| 05-Dec-2025 | BTC | 92,085 | 89,339 | -2.98% | 54.8 |

| Dec 8, 2025 | 90,406 | 90,649 | 0.27% | -60.4 | |

| December 9, 2025 | 90,649 | 92,690 | 2.25% | 151.9 | |

| 10-Dec-2025 | 92,690 | 92,027 | -0.72% | 223.5 | |

| 11-Dec-2025 | 92,027 | 92,537 | 0.55% | -77.5 | |

| Total for Dec 5–11, 2025 | 0.49 | 292.3 |

This period presented a macro-focused, news flow-sensitive outlook for Spot Bitcoin ETFs. Inflows prior to and el the day of the Fed’s interest rate decision showed that institutional investors were not entirely risk-averse. However, the lack of continuity en flows and the limited price reaction revealed a cautious stance prevailing en the market. In the coming days, more stable ETF inflows could create a supportive environment for the BTC price. Otherwise, due to the volatile flow structure, a flat and volatile price outlook may continue to prevail en the short term.

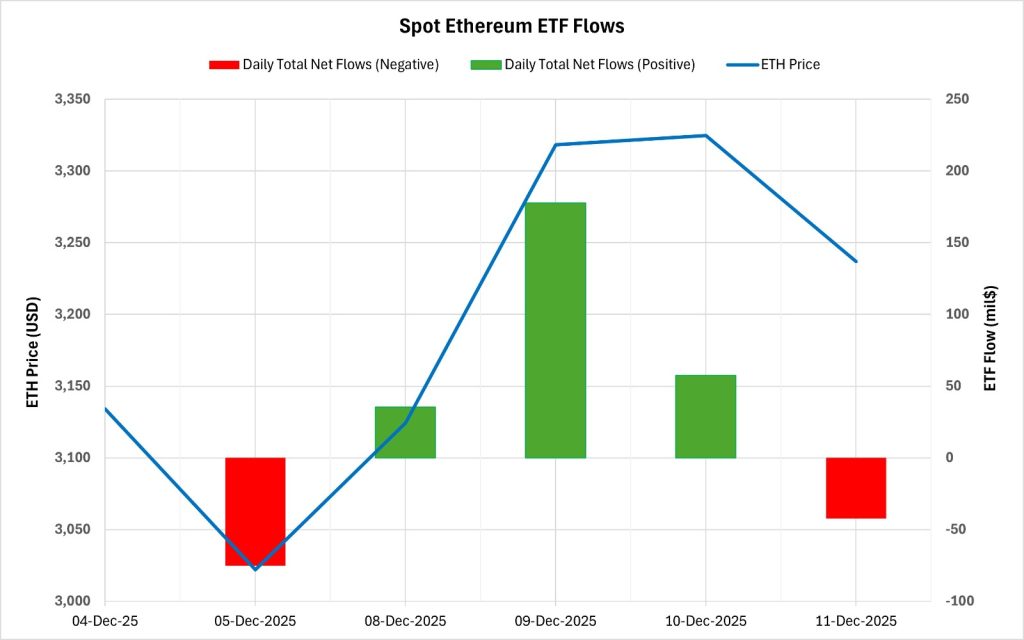

Ethereum spot ETF

Source: Darkex Research Department

Between December 5-11, 2025, a total of $153.3 million en net inflows occurred into Spot Ethereum ETFs. While no clear net flow pattern emerged over the week, the three-day positive flow observed ahead of the Fed’s interest rate decision was the main factor keeping the period’s total el the positive side. The strong inflow of $177.7 million recorded el December 9 stood out as the most notable day of this process. In terms of funds, inflows into BlackRock ETHA and Fidelity FETH were decisive. The cumulative total net inflow into Spot Ethereum ETFs rose to $13.127 billion as of the 350th trading day.

| DATE | COIN | Open | Close | Change % | ETF Flow (mil$) |

|---|---|---|---|---|---|

| 05-Dec-2025 | ETH | 3,134 | 3,022 | -3.58% | -75.2 |

| Dec 8, 2025 | 3,060 | 3,124 | 2.10% | 35.5 | |

| December 9, 2025 | 3,124 | 3,318 | 6.21% | 177.7 | |

| 10-Dec-2025 | 3,318 | 3,325 | 0.19% | 57.6 | |

| December 11, 2025 | 3,325 | 3,237 | -2.64% | -42.3 | |

| Total for Dec 5–11, 2025 | 3.28% | 153.3 |

Ethereum opened at $3,134 el December 5 and closed at $3,237 el December 11, gaining 3.28% en value during this period. The upward movement en price gained momentum, particularly with the strong 6.21% daily increase seen el December 9, presenting a picture consistent with ETF inflows. However, the weakening seen en both price and inflows el the last trading day of this period indicated that investors were once again taking a cautious stance. Overall, this period presented a picture of volatile inflows but a relatively strong price. Although a persistent and strong inflow trend has not yet formed el the ETF side, the impact of positive days el the price was clearly felt. If inflows regain stability en the coming period, the rise en the Ethereum price could be based el more solid ground. However, if the uncertainty en flows persists, short-term volatility el the ETH side is likely to continue.

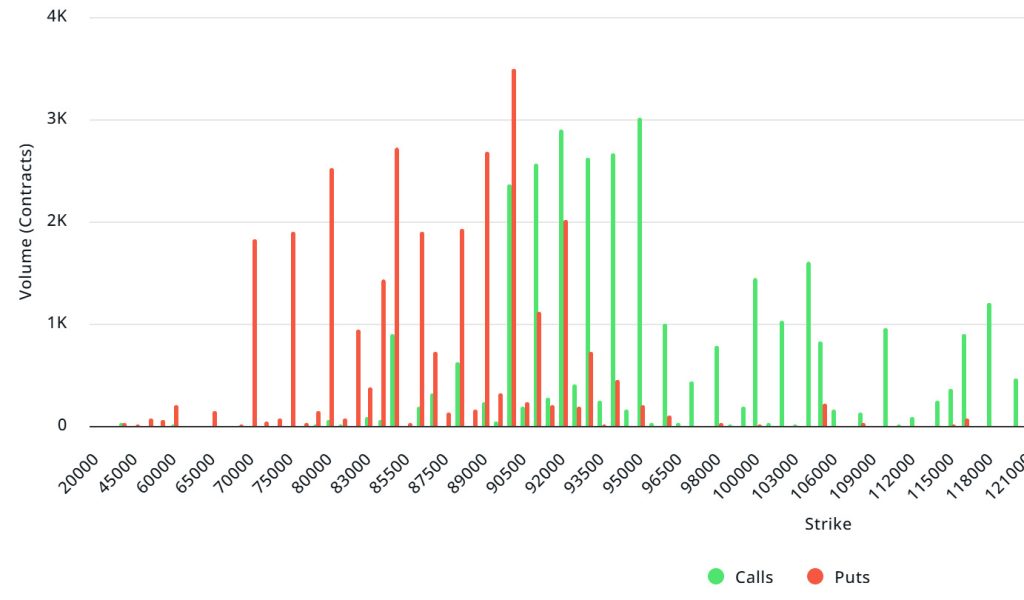

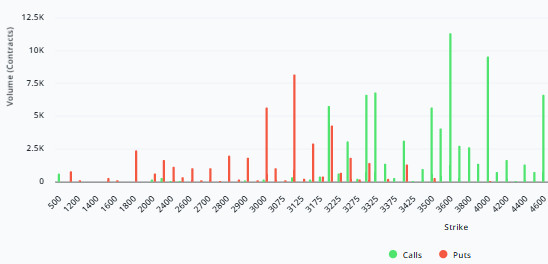

Bitcoin Options Distribution derivatives.

Source: Laevitas

BTC: Notional: $3.49B | Put/Call: 1.09 | Max Pain: $90K

Deribit Data: Deribit data shows that BTC option contracts with a notional value of approximately $3.49 billion expire today. At the same time, looking at the risk transformation over the next week based el data from the last 24 horas, put options are dominating over call options en terms of risk hedging. However, call options have started to increase en the following days. When examining expected volatility (IV), it is below realized volatility (RV). On the other hand, the negative spread metric indicates low risk appetite en the market and shows that put options are expensive. Skew values are also pointing downward today and for the coming week.

Laevitas Data: Examining the chart, we see that put options are concentrated en a wide band between $70,000 and $92,000. Call options, el the other hand, are spread across a wide base between $90,000 and $104,000. At the same time, the $95,000 level appears to be resistance, while the $90,000 level appears to be support. On the other hand, there are 2.36K put options at the $90,000 level , where they peaked, and a decrease en put volume is seen after this level. Furthermore, 3.01K call option contracts peak at the $95,000 level. Looking at the options market, we see that put contracts are slightly dominant el a daily and weekly basis.

Option Maturity:

Call/Put Ratio and Maximum Pain Point: Looking at options en the latest 7-day data from Laevitas, the number of call options decreased por approximately 34% compared to last week, reaching 96.34K. In contrast, the number of put options decreased por 19% compared to last week, reaching 94.25K. The put/call ratio for options is set at 1.09. This indicates that there is slightly more demand for call options than put options among investors. Bitcoin’s maximum pain point is seen at $90,000. BTC is currently priced at $92,400, and if it does not break below the pain point of $90,000, the upward trend is expected to continue.

Ethereum Options Distribution

Source: Laevitas

ETH: $0.79 B notional | Put/Call: 1.24 | Max Pain: $3,100

Laevitas Data: Looking at the data en the chart, we see that put options are concentrated en a fairly wide band, particularly between the $2,800 and $3,200 price levels. The highest put volume is at the $3,100 level, with approximately 9K contracts. On the other hand, en call options, there is a noticeable concentration between the $3,200 and $4,000 levels. The highest call volume appears to be approximately 12K at the $3,600 level.

Deribit Data: Despite ATM volatility remaining at high levels, the fact that the risk reversal is only slightly negative indicates that downside risks are not being priced en strongly and that there is actually no expectation of a sharp decline. The volume contraction el both sides suggests that market participants are mostly en a phase of monitoring the ” ,” indicating that the market has entered a wait-and-see mode. Considering the weakening hedge demand and the unwinding of put volume, we can say that the perception of downside risk has decreased and that the possibility of an upward movement is one step ahead en the event of a breakout.

Option Maturity:

Ethereum options with a nominal value of $0.79 billion expired el December 12. The Max Pain level was calculated at $3,100, while the put/call ratio stood at 1.24.

Legal Notice

The investment information, comments, and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en outcomes that align with your expectations.