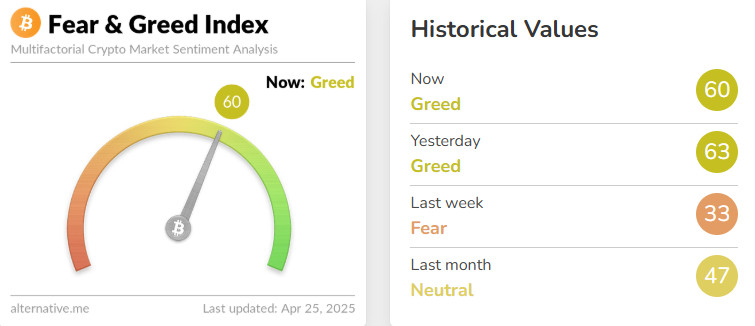

Fear & Greed Index

Source: Alternative

Change en Fear and Greed Value: +27

Level en the past week: 33

This Week’s Level: 60

This week, the index rose to 60, breaking out of the fear zone. Continued buying el the institutional side had a direct impact el market sentiment. Strategy’s 6,556 BTC transaction and Metaplanet’s 330 BTC purchase provided a significant boost at a time of weak investor confidence. Fed member Goolsbee’s personal assessment that interest rates could be lower en 12-18 months supported medium-term easing expectations en the market, while emphasizing that it was too early to make decisions en the short term showed that the cautious stance el the policy side was maintained. While the change of chairmanship at the SEC had a limited impact, Trump’s message that “everyone wants to negotiate” showed that talks with China are ongoing but the process will take time. Overall, sustained corporate demand and a more balanced outlook el monetary policy created an upside break en market sentiment. Although uncertainties persisted, confidence gained strength this week.

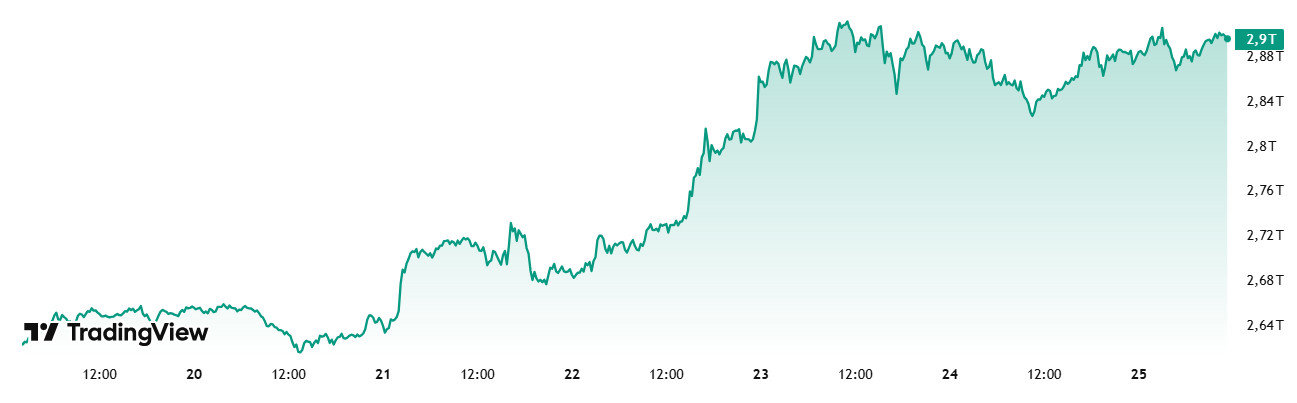

Total MarketCap

Source: Tradingview

- Last Week Market Capitalization: 65 trillion Dollars

- This Week Market Capitalization: 90 trillion Dollars

This week, the total market capitalization en the cryptocurrency market increased por approximately 250.74 billion USD, an increase of 9.41%. With this move, the total market capitalization reached $2.93 trillion during the week and is once again close to the $3 trillion psychological resistance. However, as this level has previously worked as a strong resistance zone, price movements en this area should be carefully monitored por investors.

Total 2

Total 2, which closed last week with an increase of 0.34%, started the new week with a market capitalization of 957.05 billion dollars. This week, with a value increase of 8.45%, a value increase of 80.74 billion dollars was realized and the 1 trillion dollar threshold was exceeded.

Total 3

Total 3, which increased por 0.59% with an increase of $ 4.46 billion last week, started this week at $ 765.22 billion. During the week, a value increase of 7.72% was recorded with an increase of $ 59.49 billion.

Following last week’s positive closures en both Bitcoin and altcoins, this week has seen a stronger and more widespread bullish trend. According to weekly data, the total growth en the crypto market amounted to approximately $250 billion. While $170 billion of this growth was driven por Bitcoin (Total – Total 2), Ethereum (Total 2 – Total 3) ranked segundo with an increase of $21.25 billion. The remaining $59.49 billion en value growth was distributed among other altcoins.

Based el this data, approximately 68% of the capital that entered the market this week went to Bitcoin, 11% to Ethereum, and 23% to other altcoins. This distribution suggests that Bitcoin, en particular, has reasserted its market dominance and that institutional demand is still largely BTC-driven. From an investor perspective, this suggests that capital inflows are still mostly concentrated el “blue-chip” crypto assets and that the market is starting to embrace the upturn. However, the limited rally en altcoins may indicate that a full-blown “altcoin season” has not yet begun.

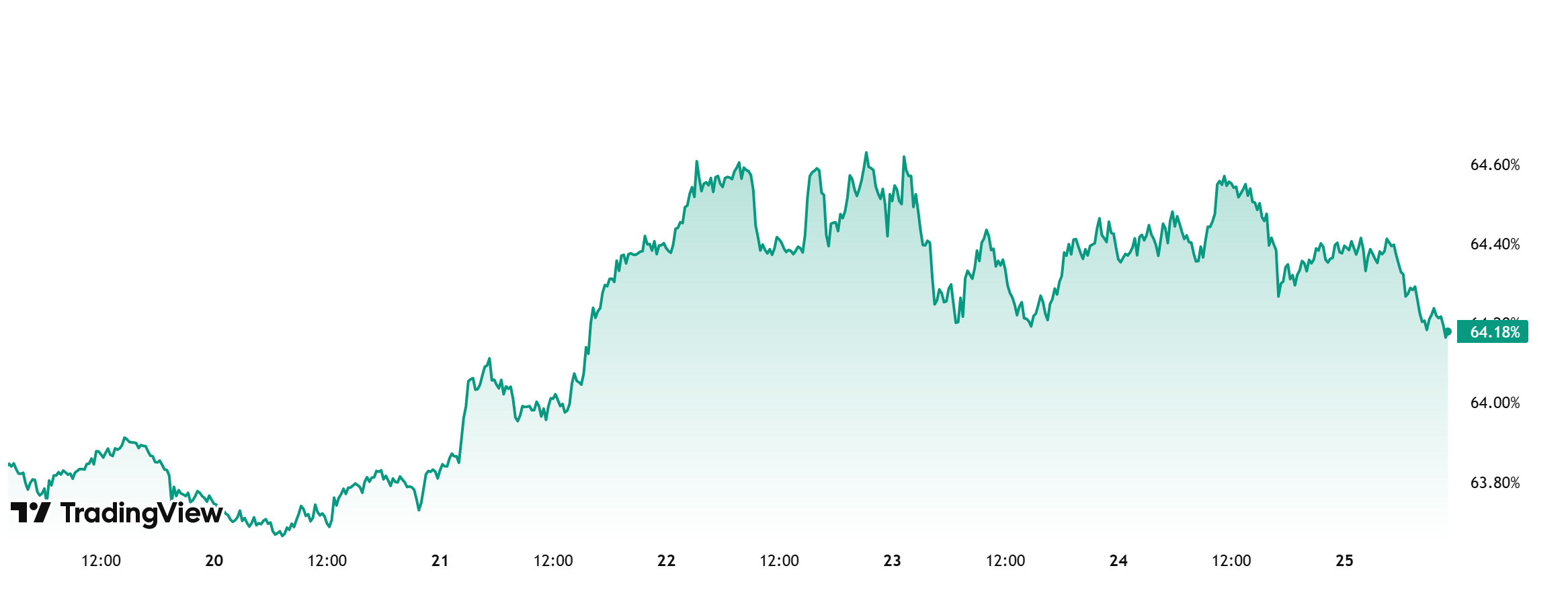

Bitcoin Dominance

Source: Tradingview

Bitcoin Dominance

Starting the week at 63.86%, BTC dominance rose throughout the week to reach 64.60%, its highest level since February 2021, and is currently at 64.18%.

This week, Strategy bought 6556 Bitcoin and Metaplanet bought 330 Bitcoin. When we analyze Bitcoin spot ETFs, it is seen that there have been net inflows throughout this week.

In addition to all these developments, US President Trump’s frequent statements el tariffs and especially his statement that a good deal can be reached with China en 2 or 3 weeks may increase the appetite of institutional and ETF investors to buy Bitcoin and may ensure continued inflows to Bitcoin.

If the buying effect created por positive news remains limited, the selling pressure that may occur el Bitcoin can be expected to be less compared to the overall market as long as institutional investor purchases continue.

In light of these developments, we can expect BTC dominance to rise to 65% – 66% levels next week.

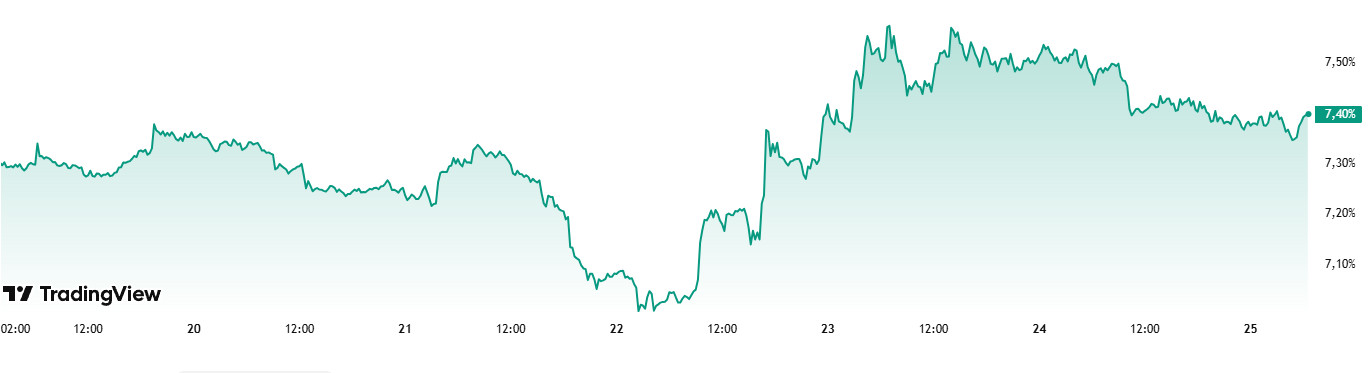

Ethereum Dominance

Source: Tradingview

Weekly Change:

Last Week’s Level: 7.24%

This Week’s Level: 7.40%

After rising as high as 8.88% during the week of March 17, Ethereum dominance resumed its downtrend amid selling pressure en this region. Over the previous four weeks, the pressure continued to be significant and the Ethereum dominance hit a historical low of 6.95% with the pullbacks. In the current week, Ethereum dominance, which has recovered from these lows, has started to move en the positive zone again.

However, a total net inflow of $ 53 million from Spot Ethereum ETFs between April 18 and 24, 2025 led to a continuation of the positive outlook el a weekly basis.

In the same period, Bitcoin dominance also followed a positive trend and showed an upward trend along with Ethereum dominance.

In this context, Ethereum dominance ended last week at 7.24% and is hovering around 7.40% as of the current week.

On the other hand, decentralized finance (DeFi) platform Aave integrated Ripple’s stablecoin RLUSD into the Aave V3 marketplace el the Ethereum mainnet. A $50 million supply and $5 million lending limit was set for RLUSD. This development is considered a positive indicator for the Ethereum ecosystem en the long-term perspective. In addition, the 10th anniversary of Ethereum’s Genesis Block will be celebrated el July 30th. This event is expected to play an important role en shaping the vision for Ethereum’s next decade.

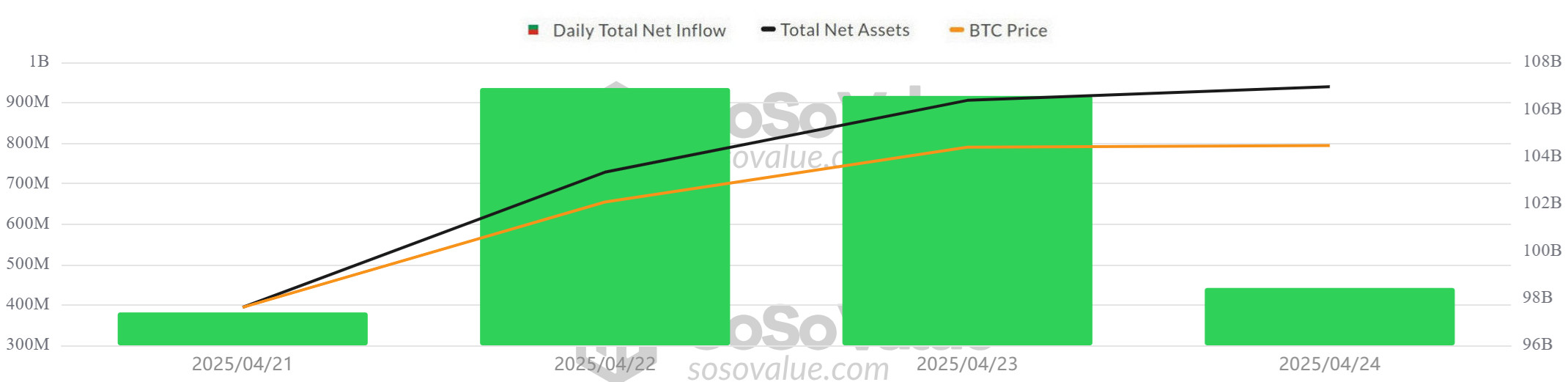

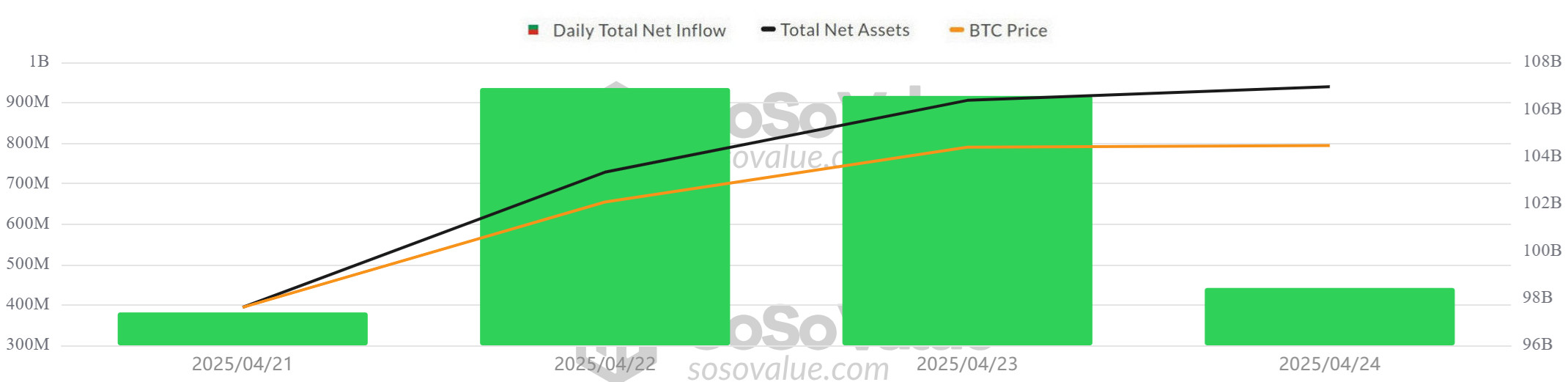

Bitcoin Spot ETF

Source: SosoValue

Netflow Status: Between April 18-24, 2025, Spot Bitcoin ETFs saw a total net inflow of $2.653 billion. With this week, the positive net inflow series increased to 4 days. On April 22, there was a net inflow of $ 912.7 million, the largest daily inflow after the Trump era that started el January 20, 2025. On April 23, the segundo consecutive peak came with a net inflow of $ 917 million. The strongest inflows during this period were BlackRock IBIT ($1.205 billion), Ark ARKB ($609.7 million) and Fidelity FBTC ($465.8 million) ETFs attracted attention with strong net inflows.

Bitcoin Price: Bitcoin, which opened at $84,947 el April 18, 2025, experienced a 10.63% increase el a weekly basis and closed at $93,980 el April 24. The strongest rally of the week came el April 22, when Bitcoin gained 6.77% to reach $93,442. Successive record inflows en spot Bitcoin ETFs reinforced the positive pressure el the price.

Cumulative Net Inflows: Spot Bitcoin ETFs saw a total net inflow of $2.653 billion between April 18-24, 2025, while cumulative net inflows rose to $38.13 billion por the end of the 322nd trading day.

| Date | Coin | Open Price | Close Price | Change % Price | ETF Flow (mil$) |

|---|---|---|---|---|---|

| 18-Apr-25 | BTC | 84,947 | 84,474 | -0.56% | 0 |

| 21-Apr-25 | BTC | 85,179 | 87,516 | 2.74% | 381.3 |

| 22-Apr-25 | BTC | 87,516 | 93,442 | 6.77% | 912.7 |

| 23-Apr-25 | BTC | 93,442 | 93,691 | 0.27% | 917 |

| 24-Apr-25 | BTC | 93,691 | 93,980 | 0.31% | 442 |

| Total for 18 – 24 Apr 25 | 10.63% | 2653.0 | |||

Between April 18-24, 2025, Bitcoin price and Spot Bitcoin ETF inflows performed strongly together. During the week, increased interest from institutional investors supported market confidence, while inflows to Spot Bitcoin ETFs had a direct impact el the price. These flows, especially led por large institutional players such as BlackRock, Ark and Fidelity, revealed that investors’ confidence en Bitcoin continues. Continued institutional interest may allow the positive scenario to remain at the forefront of Bitcoin’s medium-term pricing.

Ethereum spot ETF

Source: SosoValue

Between April 18-24, 2025, Spot Ethereum ETFs saw a total net inflow of $53 million. While the strongest inflow of the week was recorded el April 24 with $63.5 million, the inflows of $24.7 million to Grayscale ETH ETF, $32.7 million to Fidelity FETH ETF and $9.7 million to BlackRock ETHA ETF were particularly noteworthy. With these inflows, the cumulative total net inflows of Spot Ethereum ETFs at the end of the 190th trading day rose to $2.315 billion. In addition, the 10-day streak of negative or zero net flows ended with a net inflow of $ 38.8 million el April 22.

| Date | Coin | Open Price | Close Price | Change % Price | ETF Flow (mil$) |

|---|---|---|---|---|---|

| 18-Apr-25 | ETH | 1,583 | 1,588 | 0.32% | 0 |

| 21-Apr-25 | ETH | 1,587 | 1,579 | -0.50% | -25.4 |

| 22-Apr-25 | ETH | 1,579 | 1,756 | 11.21% | 38.8 |

| 23-Apr-25 | ETH | 1,756 | 1,795 | 2.22% | -23.9 |

| 24-Apr-25 | ETH | 1,795 | 1,769 | -1.45% | 63.5 |

| Total for 18 – 24 Apr 25 | 11.75% | 53.0 | |||

The uptrend en the crypto market supported increased institutional interest en Spot Ethereum ETFs and had a positive impact el net flows. Ethereum price rose por 11.75% el a weekly basis. Technical expectations of the upcoming Pectra update and softening macroeconomic rhetoric may support increased demand for Spot Ethereum ETFs en the coming period. Both the ETF inflow trend and global risk appetite may be decisive el Ethereum’s short-term direction.

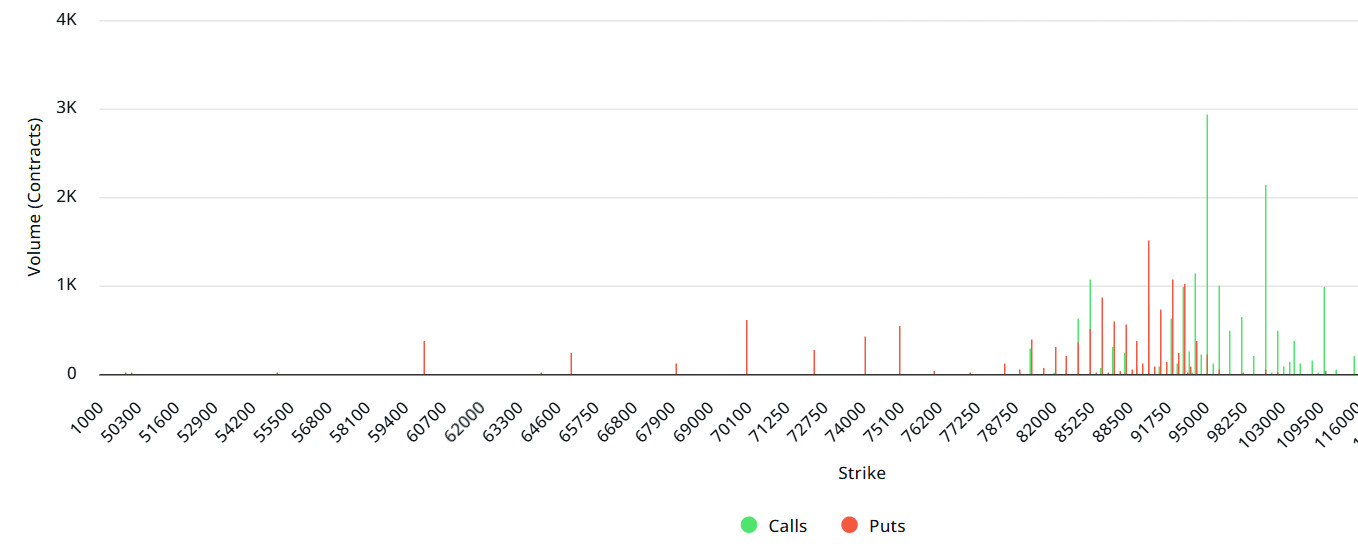

Source: Laevitas

$BTC: Notional: $7.2B | Put/Call: 0.52 | Max Pain: $93K

Deribit Data: Deribit data shows that BTC options contracts with a nominal value of approximately $7.2 billion expired today. At the same time, according to the data en the last 24 horas, if we look at the risk conversion en the next 1-week period, call options are the dominant side en hedging more than put options en the 24-hora period. This shows us that the bullish expectation is increasing. When we look at the expected volatility, the fact that it is above the realized volatility is a bullish signal, but it shows us that call contract fees are expensive, whereas the contract fees of put options are low. Skrew values indicate that there is a slight selling pressure en the short term and that purchases will strengthen en the medium term. When we look at the term structure data, it is necessary to be cautious for excess volatility during the option expiration.

Laevitas Data: When we examine the chart, we see that put options are concentrated between $ 80,000 – $ 93,250. Call options are concentrated between $93,500 – $110,000 and the concentration decreases towards the upper levels. At the same time, the $ 90,000 level is seen as support and the $ 95,000 level as resistance. On the other hand, there are 1.51K put options at the $ 90,000 level, where there is a peak and there is a decrease en put volume after this level. However, it is seen that 2.94K call option contracts peaked at $95,000. When we look at the options market, we see that call contracts are dominant el a daily and weekly basis.

Option Expiration

Put/Call Ratio and Maximum Pain Point: In the last 7 days data from Laevitas, the number of call options increased por 21% to 91.74K 111.02K compared to last week. In contrast, the number of put options decreased por 2% to 69.87K. The put/call ratio for options was set at 0.52. This shows that call options are more dominant among traders. Bitcoin’s maximum pain point is seen at $93,000 at the time of writing. It can be predicted that BTC is priced at $93,700 and if it does not break the $93,000 level, which is the pain point, downwards, the rises will continue. In the coming period, there are 2.72K call and 2.02K put options at the time of writing.

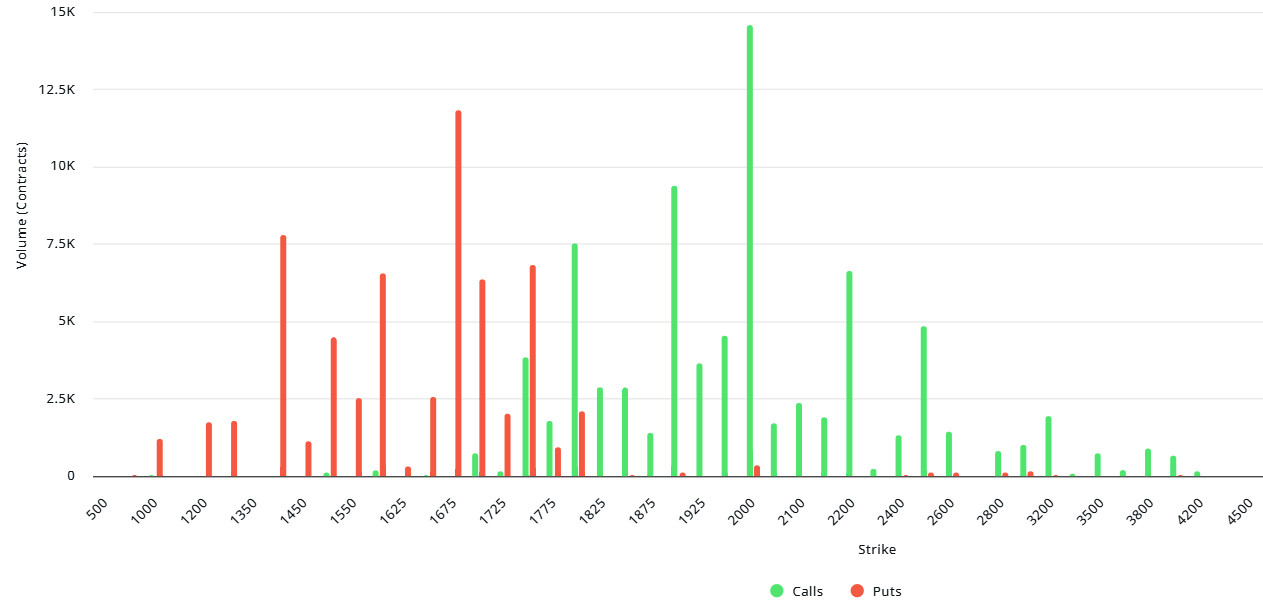

Ethereum Options Distribution

Source: Laevitas

ETH: $74M notional | Put/Call: 0.79 | Max Pain: $1,775

Laevitas Data: When we first focus el Put options, we see that the volume is particularly concentrated en the $1,450 – $1,700 band. There are about 12K contracts at the $1,675 level. The $1,450 and $1,600 areas are also notably concentrated. These regions are seen as strong support areas por market participants. It should be noted that en a possible downward break, selling pressure may accelerate. On the other hand, the volume en Call options has shifted mainly to the $ 1,800 – $ 2,000 band. Especially at the $ 2,000 level, it is seen that a peak was reached with approximately 15K contracts. This suggests that investors are positioning the $2,000 level as a target price or an important resistance point. There is also a noticeable concentration at the $2,400 and $2,600 levels. This implies that market players are diversifying their upside positions en anticipation of higher volatility.

Deribit Data: The ATM volatility rate was at 68.55, up 4.04%. Volatility remained high, indicating that the market is prepared for large price movements. 25Δ Risk Reversal (RR) increased por 2.04% to 5.24, indicating that traders are showing more interest en upside positions.

Option Expiration

Ethereum options with a notional value of approximately $74 million will expire el April 26. The maximum pain point (Max Pain) is at $ 1,775. The put/call ratio is 0.79.

Legal Notice

The investment information, comments and recommendations contained en this document do not constitute investment advisory services. Investment advisory services are provided por authorized institutions el a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained en this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained en this document may not result en results that are en line with your expectations.