Introduction

We have left behind a year en which the impact of macroeconomic and geopolitical events el financial markets was clearly felt. The inflation-interest rate balance, growth expectations, and political uncertainties at the global level formed the main agenda of the markets. Under these conditions, volatility remained high across many asset classes. In particular, interest rate decisions and political decisions en the US increased market volatility throughout the year. Furthermore, with the start of a new presidential term en the US, trade policies, tariffs, and global economic relations remained constantly el the agenda. During this period, risk appetite fluctuated periodically, and no lasting trend emerged en the markets.

In this environment, precious metals performed strongly, while US stock markets ended the year el a positive note with a more balanced and stable outlook. New highs were seen en the cryptocurrency market, but accelerating selling pressure en the final quarter of the year led to a negative close for the year.

The tables en the report were prepared using data from CryptoQuant, the Federal Reserve Bank of St. Louis, and GoldPrice. Opening levels refer to end-2024 closing values, while monthly tables show end-of-month closes en 2025

2025 Asset Performance

When examining the annual performance of selected assets based el their values at the beginning and end of 2025:

Table 1 – 2025 Asset Performance

| Asset | Opening Level | Closing Level | Change (%) |

|---|---|---|---|

| Bitcoin (BTC) | $93,385 | $87,823 | -5.96% |

| Ethereum (ETH) | $3,331 | $2,967 | -10.93% |

| Solana (SOL) | $189 | $124 | -34.12% |

| XRP | $2.08 | $1.84 | -11.54% |

| Gold (USD/oz) | 2,607 | 4,340 | 66.47% |

| Silver (USD/oz) | 28.94 | 75.24 | 159.99% |

| S&P 500 | 5,882 | 6,846 | 16.39% |

| Nasdaq 100 | 21,012 | 25,250 | 20.17% |

| Dow Jones | 42,544 | 48,063 | 12.97% |

Looking at the table, silver clearly delivered the strongest performance en 2025, followed por gold. While US stock markets posted double-digit gains, led por technology stocks.

Although major crypto assets reached new highs during the year, intensified sell-offs en the final quarter led them to close 2025 en negative territory. Solana’s decline of over 34% clearly demonstrated the pressure el altcoins during periods of risk aversion.

2025 Bitcoin vs. Other Assets Comparison

In this section, we will compare Bitcoin’s performance with other crypto assets such as Ethereum, Solana, and XRP, as well as gold, silver, and U.S. stock indices.

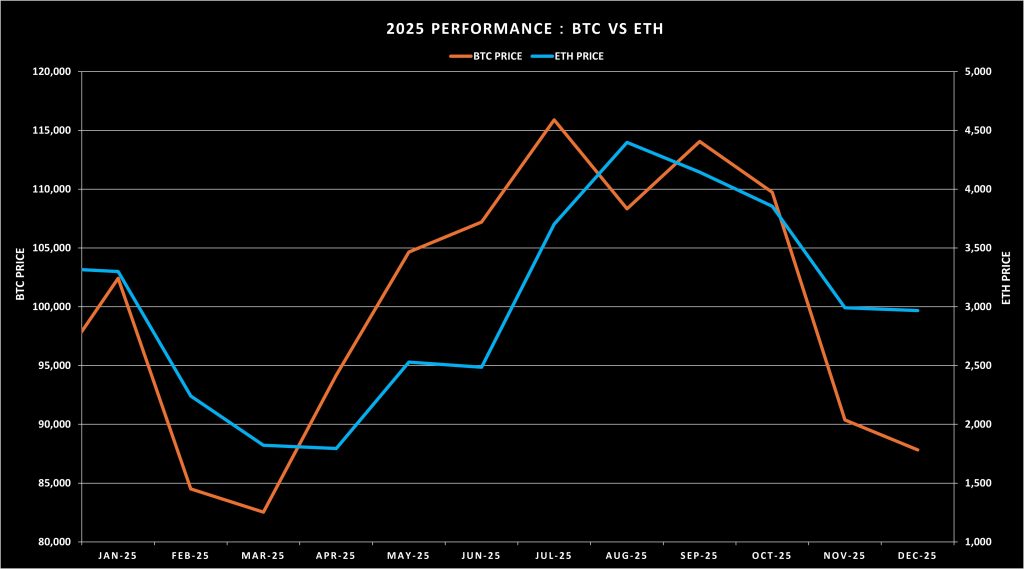

BTC-ETH Comparison

Bitcoin showed more resilient performance compared to Ethereum throughout the year. Although both coins reached all-time highs during the year, Bitcoin ended the year with a 5.96% loss en value, while Ethereum’s loss was 10.93%. This divergence stemmed from Ethereum’s higher volatility compared to Bitcoin and its tendency to move more aggressively during uptrends, yet it failed to sustain this momentum, particularly en the final quarter of the year.

Source: Prepared por Darkex Research Department using CryptoQuant data.

Table 2 – 2025 BTC and ETH Performance

| Datetime | BTC Price ($) | BTC Change | ETH Price ($) | ETH Change |

|---|---|---|---|---|

| Jan-25 | 102,416 | 9.67% | 3,300 | -0.92% |

| Feb-25 | 84,501 | -17.49% | 2,241 | -32.10% |

| Mar-25 | 82,535 | -2.33% | 1,822 | -18.69% |

| Apr-25 | 94,180 | 14.11% | 1,794 | -1.55% |

| May-25 | 104,645 | 11.11% | 2,529 | 41.00% |

| Jun-25 | 107,210 | 2.45% | 2,486 | -1.70% |

| Jul-25 | 115,899 | 8.10% | 3,703 | 48.95% |

| Aug-25 | 108,325 | -6.54% | 4,398 | 18.77% |

| Sep-25 | 114,051 | 5.29% | 4,145 | -5.75% |

| Oct-25 | 109,726 | -3.79% | 3,854 | -7.04% |

| Nov-25 | 90,366 | -17.64% | 2,991 | -22.37% |

| Dec-25 | 87,823 | -2.81% | 2,967 | -0.82% |

| 2025 Total Change | -5,562 | -5.96% | -364 | -10.93% |

Although Ethereum experienced strong periods of growth, volatility-driven declines limited the sustainability of this performance. Bitcoin, el the other hand, experienced more limited losses during periods of decline due to its more stable price structure compared to Ethereum.

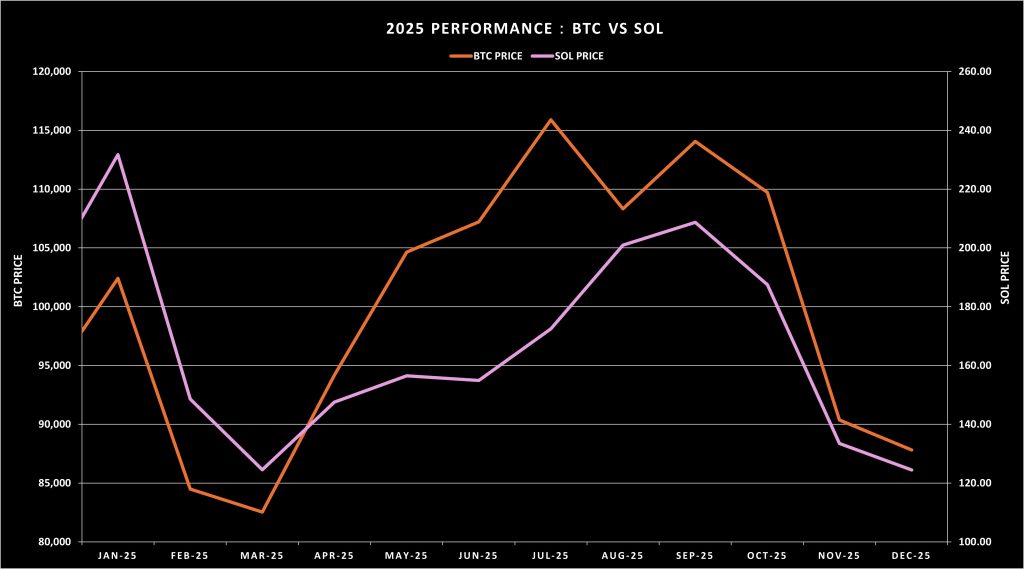

BTC-SOL Comparison

During periods of increased risk appetite, Solana showed much faster increases than Bitcoin. It stood out with double-digit increases en some months. However, these movements were often not sustainable. The declines following sharp increases showed that volatility remained high el the Solana side, while Bitcoin maintained its more balanced price structure.

Source: Prepared por the Darkex Research Department using CryptoQuant data.

Table 3 – 2025 BTC and SOL Performance

| Datetime | BTC Price ($) | BTC Change | SOL Price ($) | SOL Change |

|---|---|---|---|---|

| Jan-25 | 102,416 | 9.67% | 232 | 22.66% |

| Feb-25 | 84,501 | -17.49% | 149 | -35.88% |

| Mar-25 | 82,535 | -2.33% | 125 | -16.20% |

| Apr-25 | 94,180 | 14.11% | 148 | 18.50% |

| May-25 | 104,645 | 11.11% | 156 | 6.06% |

| Jun-25 | 107,210 | 2.45% | 155 | -1.00% |

| Jul-25 | 115,899 | 8.10% | 172 | 11.32% |

| Aug-25 | 108,325 | -6.54% | 201 | 16.51% |

| Sep-25 | 114,051 | 5.29% | 209 | 3.85% |

| Oct-25 | 109,726 | -3.79% | 187 | -10.15% |

| Nov-25 | 90,366 | -17.64% | 133 | -28.80% |

| Dec-25 | 87,823 | -2.81% | 124 | -6.76% |

| 2025 Total Change | -5,562 | -5.96% | -64 | -34.12% |

The sharp corrections experienced por Solana deepened the total loss, causing it to end the year with a 34.12% decline. This table shows that Bitcoin played a more resilient and stabilizing role during periods of risk aversion, while Solana exhibited a more fragile performance due to its high volatility.

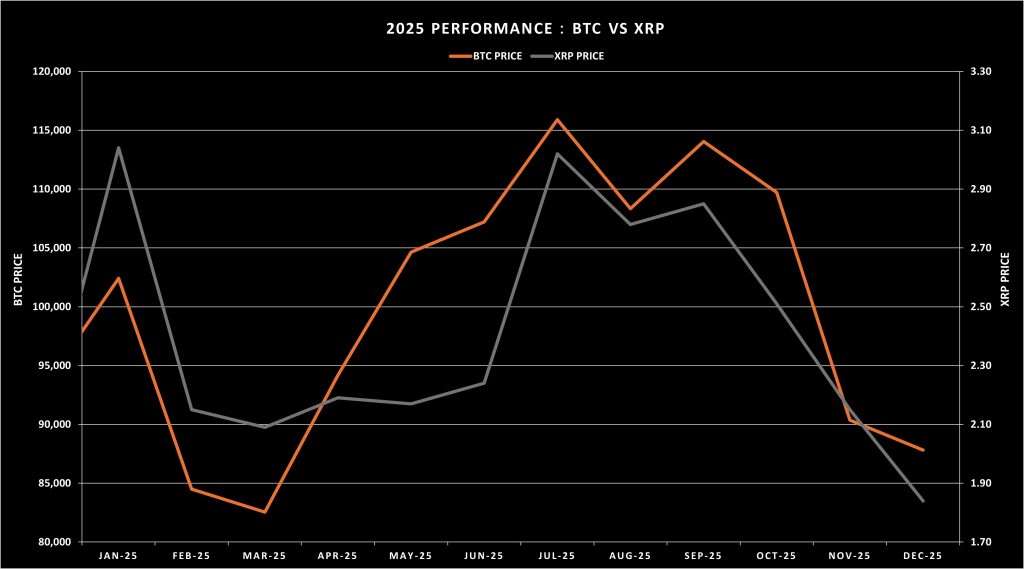

BTC-XRP Comparison

XRP exhibited much sharper and more abrupt price movements compared to Bitcoin throughout the year. The strong rallies seen particularly en January and July highlighted XRP’s high dependence el news flow and market sentiment. However, these rallies failed to translate into a sustained trend. Price movements quickly reversed direction, generating high volatility.

Source: Prepared por Darkex Research Department using CryptoQuant data.

Table 4 – 2025 BTC and XRP Performance

| Datetime | BTC Price ($) | BTC Change (%) | XRP Price ($) | XRP Change (%) |

|---|---|---|---|---|

| Jan-25 | 102,416 | 9.67% | 3.04 | 45.87% |

| Feb-25 | 84,501 | -17.49% | 2.15 | -29.28% |

| Mar-25 | 82,535 | -2.33% | 2.09 | -2.64% |

| Apr-25 | 94,180 | 14.11% | 2.19 | 4.83% |

| May-25 | 104,645 | 11.11% | 2.17 | -0.79% |

| Jun-25 | 107,210 | 2.45% | 2.24 | 2.87% |

| Jul-25 | 115,899 | 8.10% | 3.02 | 35.12% |

| Aug-25 | 108,325 | -6.54% | 2.78 | -8.11% |

| Sep-25 | 114,051 | 5.29% | 2.85 | 2.52% |

| Oct-25 | 109,726 | -3.79% | 2.51 | -11.84% |

| Nov-25 | 90,366 | -17.64% | 2.15 | -14.13% |

| Dec-25 | 87,823 | -2.81% | 1.84 | -14.57% |

| 2025 Total Change | -5,562 | -5.96% | -0.24 | -11.54% |

Increased selling pressure en the segundo half of the year, particularly en the last quarter, caused XRP to give back most of its gains. XRP ended the year down 11.54%. This demonstrated that Bitcoin offered a more balanced and stable price structure compared to XRP.

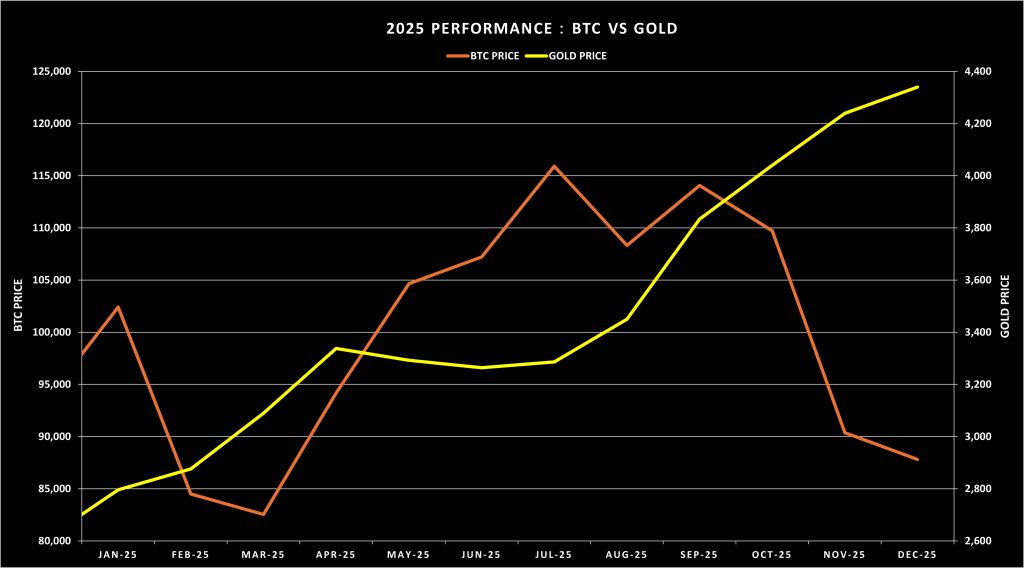

BTC-Gold Comparison

One of the clearest divergences emerged between gold and Bitcoin. Gold ended the year with a 66.48% increase en value. This picture showed that investors, seeking to avoid risk amid increasing uncertainty throughout the year, turned primarily to traditional assets.

Source: Prepared por Darkex Research Department using data from GoldPrice and CryptoQuant.

Table 5 – 2025 BTC and Gold Performance

| Datetime | BTC Price ($) | BTC Change (%) | Gold Price ($) | Gold Change (%) |

|---|---|---|---|---|

| Jan-25 | 102,416 | 9.67% | 2,796 | 7.27% |

| Feb-25 | 84,501 | -17.49% | 2,876 | 2.85% |

| Mar-25 | 82,535 | -2.33% | 3,090 | 7.43% |

| Apr-25 | 94,180 | 14.11% | 3,338 | 8.04% |

| May-25 | 104,645 | 11.11% | 3,292 | -1.38% |

| Jun-25 | 107,210 | 2.45% | 3,264 | -0.85% |

| Jul-25 | 115,899 | 8.10% | 3,286 | 0.66% |

| Aug-25 | 108,325 | -6.54% | 3,450 | 4.99% |

| Sep-25 | 114,051 | 5.29% | 3,833 | 11.12% |

| Oct-25 | 109,726 | -3.79% | 4,040 | 5.41% |

| Nov-25 | 90,366 | -17.64% | 4,239 | 4.91% |

| Dec-25 | 87,823 | -2.81% | 4,340 | 2.39% |

| 2025 Total Change | -5,562 | -5.96% | 1,733 | 66.48% |

Gold stood out with a more stable demand structure throughout the year and served as a balancing asset for investors en volatile market conditions.

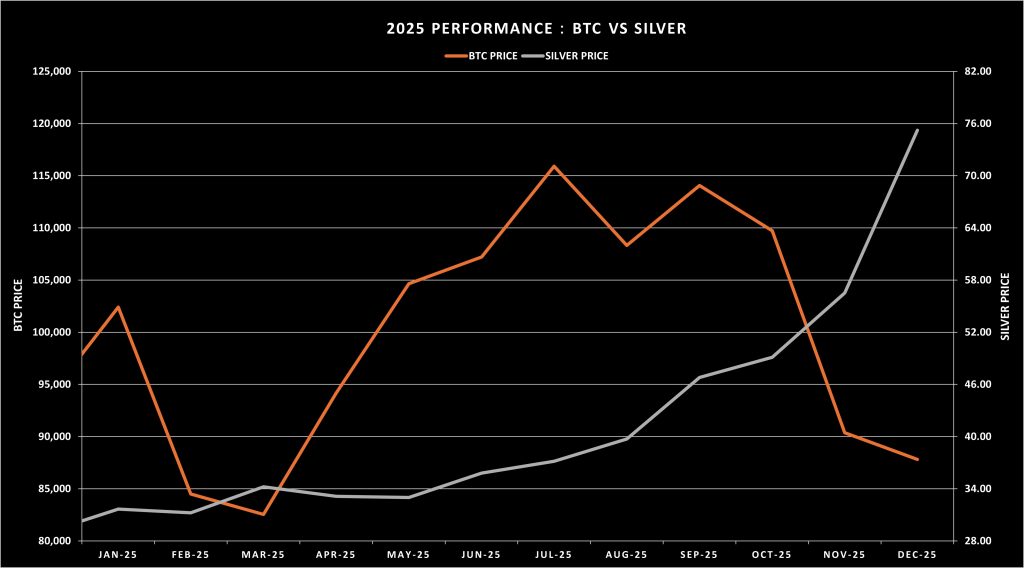

BTC-Silver Comparison

Silver clearly stood out from Bitcoin and many other assets with its strong performance throughout the year. By year-end, the silver price had increased por 159.99%. This table shows that silver saw strong demand throughout the year thanks to both its precious metal qualities and industrial usage expectations.

Source: Darkex Research Department – Prepared using data from Gold Price and CryptoQuant.

Table 6 – 2025 BTC and Silver Performance

| Datetime | BTC Price ($) | BTC Change (%) | Silver Price ($) | Silver Change (%) |

|---|---|---|---|---|

| Jan-25 | 102,416 | 9.67% | 32 | 9.43% |

| Feb-25 | 84,501 | -17.49% | 31 | -1.39% |

| Mar-25 | 82,535 | -2.33% | 34 | 9.57% |

| Apr-25 | 94,180 | 14.11% | 33 | -3.21% |

| May-25 | 104,645 | 11.11% | 33 | -0.36% |

| Jun-25 | 107,210 | 2.45% | 36 | 8.45% |

| Jul-25 | 115,899 | 8.10% | 37 | 3.80% |

| Aug-25 | 108,325 | -6.54% | 40 | 6.92% |

| Sep-25 | 114,051 | 5.29% | 47 | 17.85% |

| Oct-25 | 109,726 | -3.79% | 49 | 4.91% |

| Nov-25 | 90,366 | -17.64% | 57 | 15.09% |

| Dec-25 | 87,823 | -2.81% | 75 | 33.12% |

| 2025 Total Change | -5,562 | -5.96% | 46 | 159.99% |

On the Bitcoin side, the peaks seen during the year were not sustainable, and selling pressure intensified, particularly en the last quarter of the year, as risk aversion increased. This process further highlighted the performance gap between Bitcoin and silver.

Silver emerged as one of the leading alternative assets for investors en 2025.

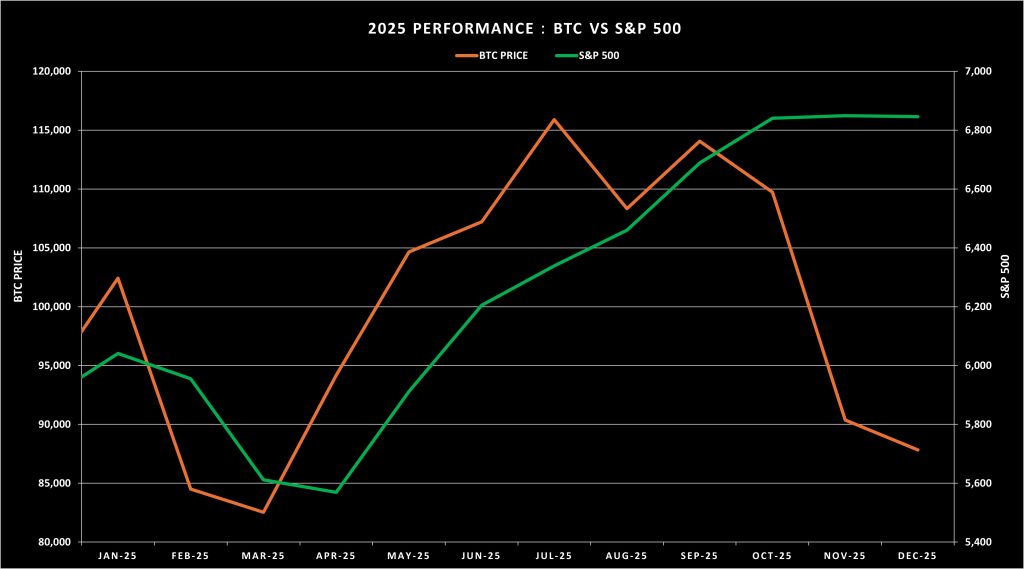

BTC-S&P 500 Comparison

The S&P 500 index ended 2025 with a 16.39% increase en value. With its broad sector distribution, the S&P 500 performed more consistently throughout the year despite volatile market conditions and showed a steady upward trend.

Source: Prepared por Darkex Research Department using data from the Federal Reserve Bank of St. Louis and CryptoQuant.

Table 7 – 2025 BTC and S&P 500 Performance

| Datetime | BTC Price ($) | BTC Change (%) | S&P 500 Level | S&P 500 Change (%) |

|---|---|---|---|---|

| Jan-25 | 102,416 | 9.67% | 6,041 | 2.70% |

| Feb-25 | 84,501 | -17.49% | 5,955 | -1.42% |

| Mar-25 | 82,535 | -2.33% | 5,612 | -5.75% |

| Apr-25 | 94,180 | 14.11% | 5,569 | -0.76% |

| May-25 | 104,645 | 11.11% | 5,912 | 6.15% |

| Jun-25 | 107,210 | 2.45% | 6,205 | 4.96% |

| Jul-25 | 115,899 | 8.10% | 6,339 | 2.17% |

| Aug-25 | 108,325 | -6.54% | 6,460 | 1.91% |

| Sep-25 | 114,051 | 5.29% | 6,688 | 3.53% |

| Oct-25 | 109,726 | -3.79% | 6,840 | 2.27% |

| Nov-25 | 90,366 | -17.64% | 6,849 | 0.13% |

| Dec-25 | 87,823 | -2.81% | 6,846 | -0.05% |

| 2025 Total Change | -5,562 | -5.96% | 964 | 16.39% |

On the Bitcoin side, high volatility caused sharp price movements throughout the year. Losses became more pronounced, especially during periods of decline. In 2025, the S&P 500 offered a more predictable and stable performance compared to Bitcoin.

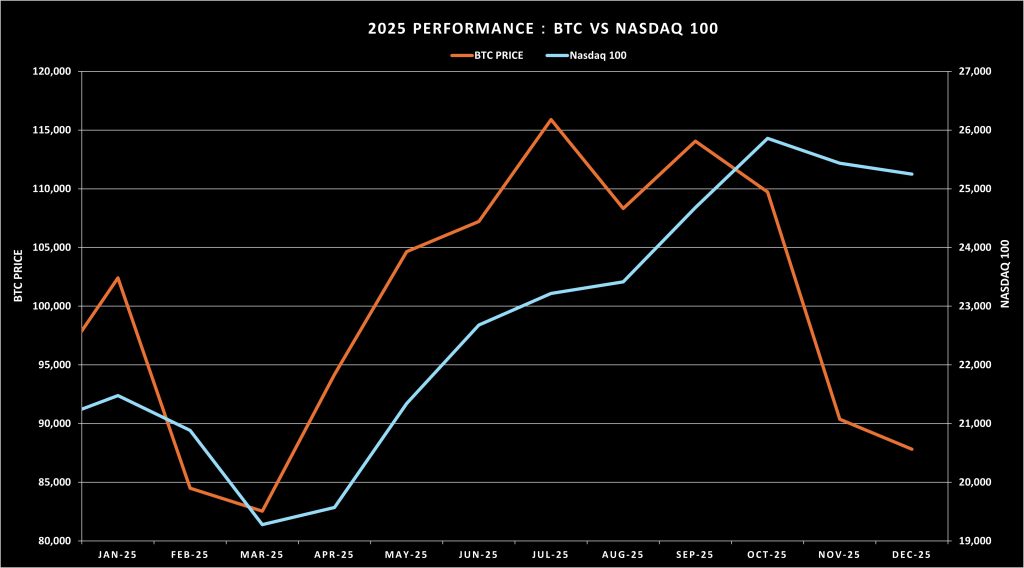

BTC-Nasdaq 100 Comparison

The Nasdaq 100 index ended 2025 with a 20.17% increase en value, led por technology stocks. Strong growth expectations and demand for technology-focused companies enabled the Nasdaq 100 to show a steady rise throughout the year.

Source: Prepared por Darkex Research Department using data from the Federal Reserve Bank of St. Louis and CryptoQuant.

Table 8 – 2025 BTC and Nasdaq 100 Performance

| Date | BTC Price ($) | BTC Change (%) | Nasdaq 100 Level | Nasdaq 100 Change (%) |

|---|---|---|---|---|

| Jan-25 | 102,416 | 9.67% | 21,478 | 2.22% |

| Feb-25 | 84,501 | -17.49% | 20,884 | -2.76% |

| Mar-25 | 82,535 | -2.33% | 19,278 | -7.69% |

| Apr-25 | 94,180 | 14.11% | 19,571 | 1.52% |

| May-25 | 104,645 | 11.11% | 21,341 | 9.04% |

| Jun-25 | 107,210 | 2.45% | 22,679 | 6.27% |

| Jul-25 | 115,899 | 8.10% | 23,218 | 2.38% |

| Aug-25 | 108,325 | -6.54% | 23,415 | 0.85% |

| Sep-25 | 114,051 | 5.29% | 24,680 | 5.40% |

| Oct-25 | 109,726 | -3.79% | 25,858 | 4.77% |

| Nov-25 | 90,366 | -17.64% | 25,435 | -1.64% |

| Dec-25 | 87,823 | -2.81% | 25,250 | -0.73% |

| 2025 Total Change | -5,562 | -5.96% | 4,238 | 20.17% |

This comparison shows that growth-oriented investment preferences en 2025 created stronger performance en technology stocks compared to Bitcoin.

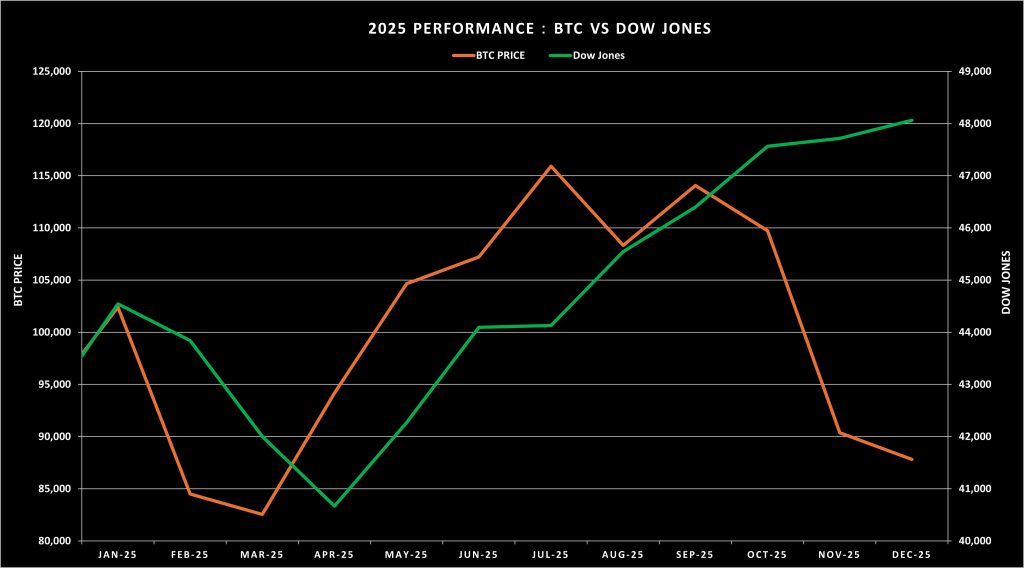

BTC–Dow Jones Comparison

The Dow Jones index, with its structure representing more traditional sectors, ended 2025 with a 12.97% increase en value. The relatively low volatility observed en the Dow Jones throughout the year enabled the index to exhibit a more controlled and stable price movement compared to Bitcoin.

“

“

Source: Prepared por the Darkex Research Department using data from the Federal Reserve Bank of St. Louis and CryptoQuant.

Table 9 – 2025 BTC and Dow Jones Performance

| Date | BTC Price ($) | BTC Change (%) | Dow Jones Level | Dow Jones Change (%) |

|---|---|---|---|---|

| Jan-25 | 102,416 | 9.67% | 44,545 | 4.70% |

| Feb-25 | 84,501 | -17.49% | 43,841 | -1.58% |

| Mar-25 | 82,535 | -2.33% | 42,002 | -4.20% |

| Apr-25 | 94,180 | 14.11% | 40,669 | -3.17% |

| May-25 | 104,645 | 11.11% | 42,270 | 3.94% |

| Jun-25 | 107,210 | 2.45% | 44,095 | 4.32% |

| Jul-25 | 115,899 | 8.10% | 44,131 | 0.08% |

| Aug-25 | 108,325 | -6.54% | 45,545 | 3.20% |

| Sep-25 | 114,051 | 5.29% | 46,398 | 1.87% |

| Oct-25 | 109,726 | -3.79% | 47,563 | 2.51% |

| Nov-25 | 90,366 | -17.64% | 47,716 | 0.32% |

| Dec-25 | 87,823 | -2.81% | 48,063 | 0.73% |

| 2025 Total Change | -5,562 | -5.96% | 5,519 | 12.97% |

This comparison shows that traditional stock indices offered a more balanced performance compared to Bitcoin en 2025.

Overall Assessment and 2026 Forecast

When evaluating the year as a whole, we see that the strongest gains were en silver. This rise was largely driven por industrial demand, supported por individual investor demand amid increasing geopolitical and political risks. Gold, as always during periods of uncertainty, remained one of the indispensable instruments en investor portfolios.

However, it is important to note the following. Gold is an asset that can be quickly liquidated en times of need or when portfolios are being reshaped. Therefore, if current uncertainties ease and risk appetite increases, it is likely that a significant portion of this liquidity will shift toward relatively riskier assets.

Furthermore, considering the upcoming change en the chairmanship of the US Federal Reserve (Fed) and Donald Trump’s statements, expectations that a more dovish chairman may be appointed regarding interest rate cuts have generated market excitement. This situation strengthens expectations of increased liquidity inflows and supports continued upside potential for financial assets.

However, it should not be forgotten that financial markets are not composed of a single variable. Questions about which asset classes the injected liquidity will flow into and which sectors will benefit most may frequently arise.

As of 2026, market uncertainties have not completely disappeared. The US’s political stance toward Venezuela and ongoing global geopolitical issues may continue to support pricing en precious metals. In this process, continued demand for safe havens will keep upward risks el the agenda, particularly for gold and silver.

On the other hand, when Donald Trump’s rhetoric and economic policies are examined, his pro-technology and industrial manufacturing stance may help maintain positive expectations en stock markets.

In the cryptocurrency market, the main performance drivers will continue to be regulatory clarity, institutional investor interest, and global liquidity conditions.

Disclaimer

This content is for informational purposes only and does not constitute investment, financial, or legal advice. Market views and opinions are general en nature and may not be suitable for all investors. Always conduct your own research and consult qualified professionals before making investment decisions.