Introduction

The first quarter of 2025 witnessed intense volatility en the Bitcoin market. Macroeconomic developments, political events and market dynamics had a significant impact el the Bitcoin price. The US presidential transition, the Federal Reserve’s interest rate policies, stock market cyberattacks and international trade tensions were among the determinants of Bitcoin’s price movements. In this analysis, we will take a detailed look at key events en the Bitcoin market en the first quarter of 2025, el-chain data and indices that measure investor sentiment.

Bitcoin and Global Impacts en the First Quarter of 2025

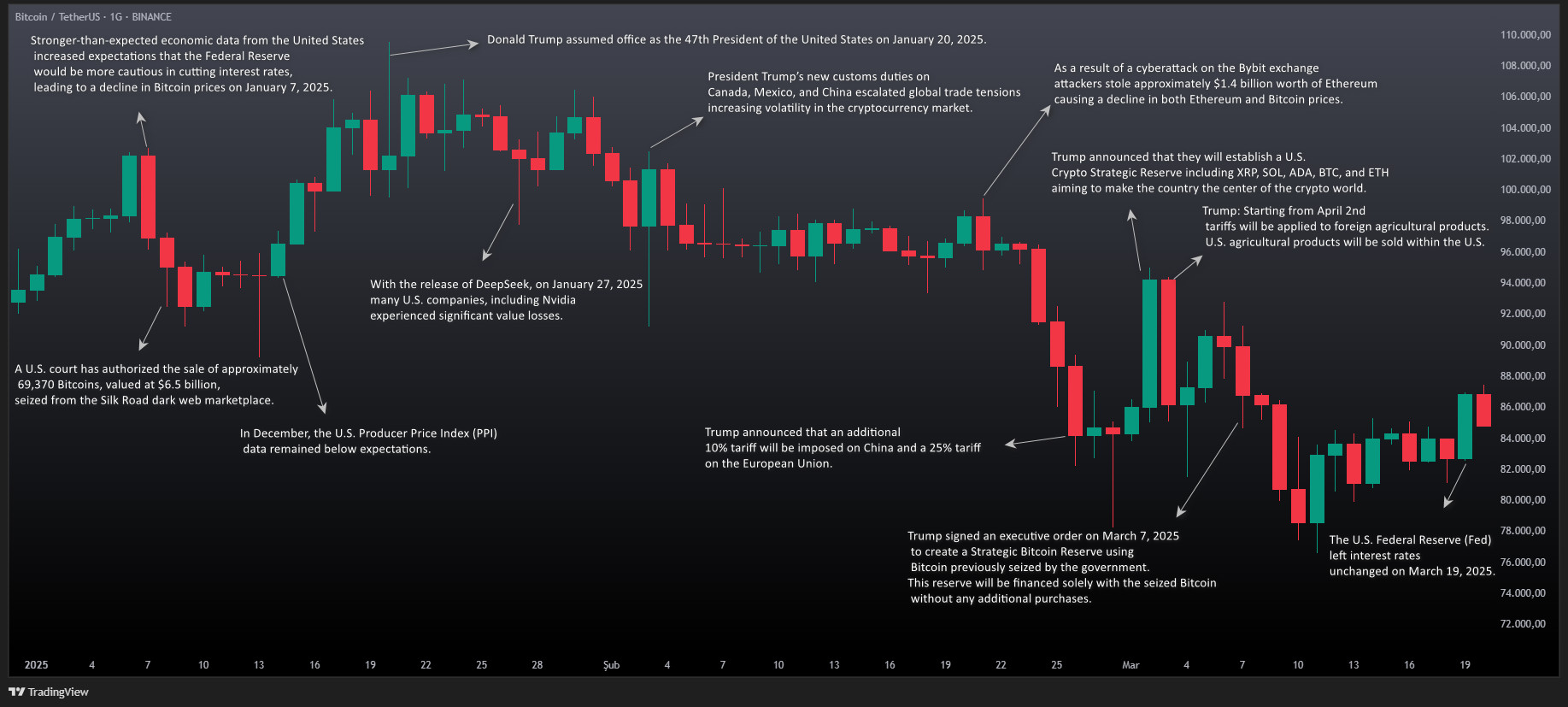

The first quarter of 2025 was characterized por intense macroeconomic and political developments for Bitcoin. Between January 1 and March 20, there was a 10% drop en the Bitcoin price. During this period, Bitcoin peaked at $109,588, but the increasing uncertainties en the market, especially after Donald Trump took over the US presidency el January 20, caused the price to fall as low as $76,606.

Strong economic data from the US en early January raised markets’ expectations that the Federal Reserve would be cautious en cutting interest rates. The higher-than-expected JOLTS Job Openings data and ISM Services PMI data reinforced concerns that rate cuts may be delayed. This triggered a flight from risky assets, leading to a decline en Bitcoin price. In the same period, the US court’s approval of the sale of 69,370 Bitcoins (approximately $6.5 billion) seized en the Silk Road operation increased the selling pressure en the market and accelerated the decline.

On January 20, Donald Trump’s inauguration increased volatility en the markets. Uncertainties about the new administration’s economic policies and steps to reignite global trade wars led to fluctuations en the markets. Launched el January 27, the artificial intelligence model DeepSeek caused sharp losses en major technology companies such as Nvidia, putting pressure el Bitcoin and other digital assets. The Trump administration’s announcement of new tariffs el Canada, Mexico and China increased tensions en global trade and shook investor confidence.

The Bybit exchange attack en February caused a loss of confidence en the markets. The theft of $1.4 billion worth of Ethereum led to sharp declines en Bitcoin and other major crypto assets. The Trump administration’s announcement of 10% tariffs el China and 25% tariffs el the European Union had a negative impact el global markets. These developments accelerated the exit of investors from risky assets, causing Bitcoin to fall below $80,000.

In March, the Trump administration took an important step towards the crypto market. On March 7, a presidential decree announced the creation of a “Strategic Bitcoin Reserve” using Bitcoins seized from Silk Road. However, it was announced that the US aims to establish a “Crypto Strategic Reserve” that includes major crypto assets such as XRP, Solana (SOL), Cardano (ADA), Bitcoin (BTC) and Ethereum (ETH). Although this move shows that the US is pursuing a long-term strategy towards the crypto market, its impact el the markets was limited.

On March 19, the Federal Reserve’s decision to leave interest rates unchanged led to a brief market rebound, but the overall downtrend continued. Declining risk appetite en a high-interest rate environment and the Trump administration’s aggressive trade policies caused Bitcoin to fall as low as $76,606. These developments en the first quarter gave important signals about the direction the Bitcoin market will follow throughout 2025. In particular, the global economy, US regulatory policies and interest rate decisions of central banks will continue to be decisive el crypto markets.

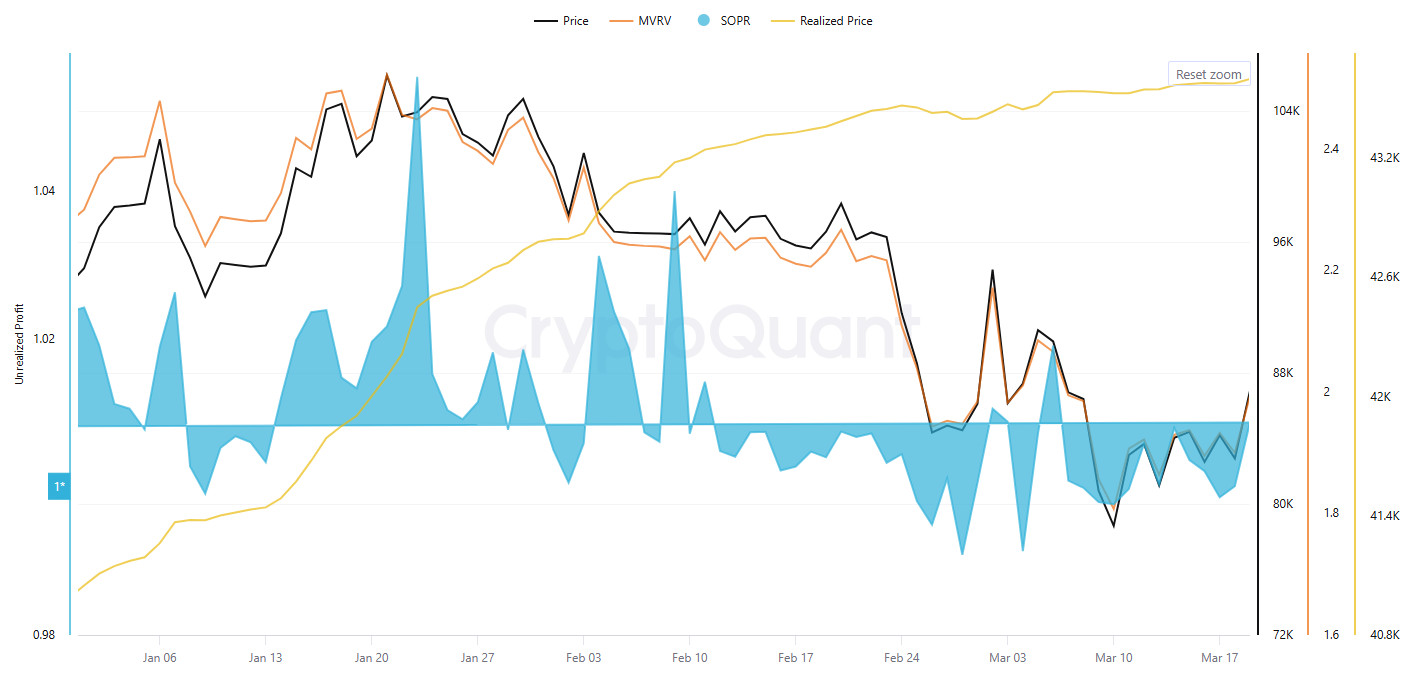

Market Capitalization and Earnings

In the first quarter of 2025, Bitcoin’s el-chain data signaled a decline en investor profitability and market stabilization. The Bitcoin price fell from $94,394 to $86,923, a decline of about 7.9%. The MVRV ratio fell from 2.29 to 1.99, indicating a decrease en the average profitability of investors and a reduced risk of overvaluation. The Realized Price increased from $41.049 to $43.598, indicating that long-term investors were buying. The SOPR metric declined from 1.02 to 1.00, indicating that selling en the market was largely taking place at breakeven.

Overall, the el-chain data suggests that profit realization en the Bitcoin market is waning, and investors are becoming more cautious.

Money Flows en Bitcoin and Ethereum ETFs

An analysis of capital flows into Bitcoin spot ETFs en the first quarter of 2025 shows that the highest inflow was recorded el January 17 with $1.08 billion. A total of $1.967 billion worth of inflows were recorded en the week of January 17, which can be attributed to the expectations for Donald Trump to take over the administration el January 20 and the positive atmosphere en the markets regarding the potential creation of Bitcoin reserves. On the other hand, the largest outflow was $1.14 billion el February 25. During this period, the theft of approximately $1.4 billion worth of Ethereum as a result of a cyber-attack el the Bybit exchange el February 21 caused a decline en both Ethereum and Bitcoin prices, negatively affecting investor confidence. Subsequently, a total outflow of $2.615 billion occurred en the week of February 24-28. In this period, Donald Trump’s announcement of additional 10% tariffs el China and 25% tariffs el the European Union may have further accelerated capital outflows. In line with all these developments, Bitcoin spot ETFs realized a net inflow of $2.4 billion en the first quarter.

In the first quarter, Ethereum spot ETFs saw the highest outflows el January 8 and the highest inflows el February 4. On January 8, strong economic data from the US led to a general decline en the cryptocurrency market as investors expected the Fed to be cautious en cutting interest rates. This negatively impacted interest en Ethereum spot ETFs, with outflows totaling $159.3 million. Most of this outflow came from FETH, Fidelity’s Ethereum ETF. On the other hand, the successful deployment of the EIP-4844 update el testnets el February 4 boosted investor confidence with the potential to improve the scalability and transaction costs of the Ethereum network. This revitalized interest en Ethereum, leading to an increase en daily net inflows to $307.77 million.

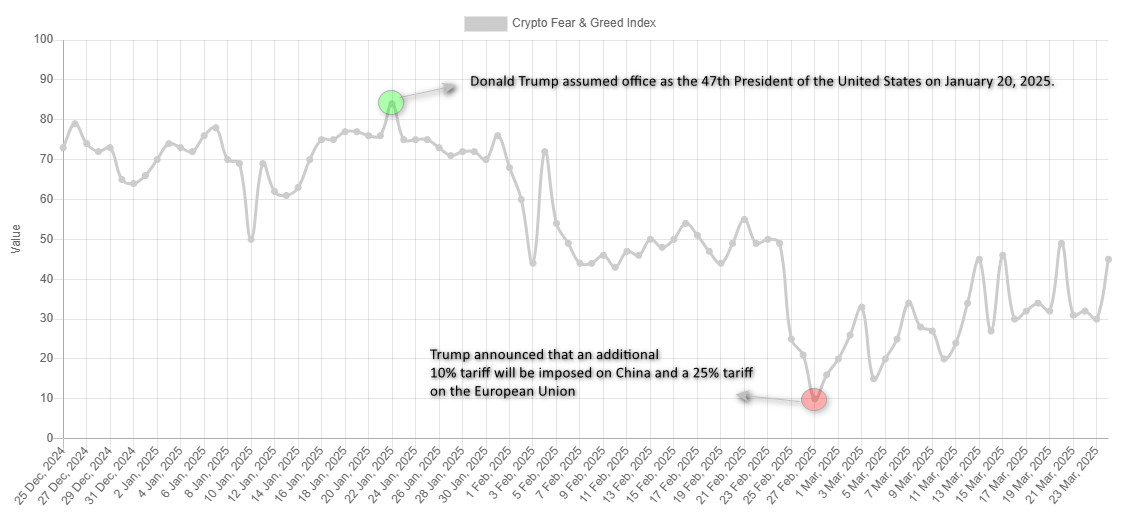

Sharp Changes en the Fear & Greed Index and Market Reactions

The Fear & Greed index fluctuated en the first quarter, clearly reflecting shifts en market psychology. At 66 at the beginning of the quarter, the index indicated that investors had high confidence en the market and were inclined to take risks. With Trump’s inauguration as US President el January 20, 2025, the index rose to 84, marking a period of peak greed. However, from this point onwards, the index gradually declined due to developments that put pressure el the market.

First, with the launch of Deep Seek el January 27th, many major tech companies en the US, especially Nvidia, lost value, putting pressure el the market. Then, Trump’s new tariffs en Canada, Mexico and China increased global trade tensions, causing volatility en the crypto market. During this period, a large-scale cyberattack el the Bybit exchange and the theft of $1.4 billion worth of Ethereum led to sharp declines en both Ethereum and Bitcoin prices. Finally, Trump’s announcement of additional tariffs el China and the European Union further increased uncertainty en the markets and pushed the index down to 10.

These events over the course of the quarter caused a sharp shift en investor sentiment. The market shifted from extreme greed to fear, marking a period of heightened uncertainty and reduced risk appetite. However, por the end of the quarter, the index had recovered to around 45, indicating that some balance had been restored to the market. This suggests that investors are shifting away from excessive fear and towards a more cautious optimism, and that the market is entering a recovery phase.

Conclusion and Evaluation

The first quarter of 2025 was a period of high uncertainty and volatility en the Bitcoin market. Macroeconomic factors, political developments and market conditions significantly affected Bitcoin’s price movements. Increasing policy uncertainties with the Trump administration taking office, the Federal Reserve’s interest rate decisions and stock market cyberattacks put pressure el Bitcoin and other crypto assets. In addition, el-chain data showed that the market is stabilizing and investors are becoming more cautious.

Although capital flows into Bitcoin spot ETFs fluctuated, the net inflow of $2.4 billion signaled that the market was still optimistic about long-term prospects. Likewise, the Fear & Greed index fluctuated sharply during the quarter but stabilized somewhat por the end of the period.

Overall, en the first quarter of 2025, the Bitcoin market has gone through significant trials and, despite high volatility, is well el its way to finding a certain equilibrium. The impact of macroeconomic uncertainties and regulatory policies el crypto assets will continue to be closely monitored and will be among the most important factors that will determine the course of the market later en 2025.

Disclaimer

This content is for informational purposes only and is not investment or financial advice. All investment decisions and risks belong solely to the reader.