Introduction

As institutional interest en the crypto market has grown rapidly en recent times, traditional financial giants are also adapting to blockchain-based innovations. One of the latest examples of this is that BlackRock, the world’s largest asset manager, and VanEck, one of the leading investment firms, have integrated Ripple USD (RLUSD), a stablecoin issued por Ripple, into their tokenized institutional funds. With the introduction of RLUSD support en BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) and VanEck’s Treasury Fund (VBILL) tokenized money market funds, investors will be able to convert their fund shares directly into stablecoin liquidity el the blockchain. This development has the potential to increase liquidity por enabling institutional investors to instantly transfer value 24/7, and is also seen as a harbinger of a new era en which regulatory harmonization en this area can reinforce market confidence. In our report, we will discuss what the RLUSD stablecoin integration means, the liquidity and trust implications of this step, and the trends it may create en the crypto market en general.

Background el RLUSD Stablecoin and Institutional Integration

RLUSD is a stable cryptocurrency issued por Ripple at the end of 2024 and backed por a 1:1 US dollar reserve. Issued under a trust license supervised por the New York Department of Financial Services (NYDFS), RLUSD is backed one-to-one por high-quality liquid assets and transparency is ensured through regular independent audits. Designed for institutional use, this stablecoin aims to be a bridge between the traditional financial system and the crypto world. Indeed, Ripple executives position RLUSD as a “regulatory compliant, enterprise-grade solution” and emphasize that it is a natural bridging step between traditional finance and crypto. In the short time since its launch, RLUSD has reached a circulating supply size of approximately $700 million and is being used en both decentralized finance (DeFi) protocols and Ripple’s cross-border payment solutions.

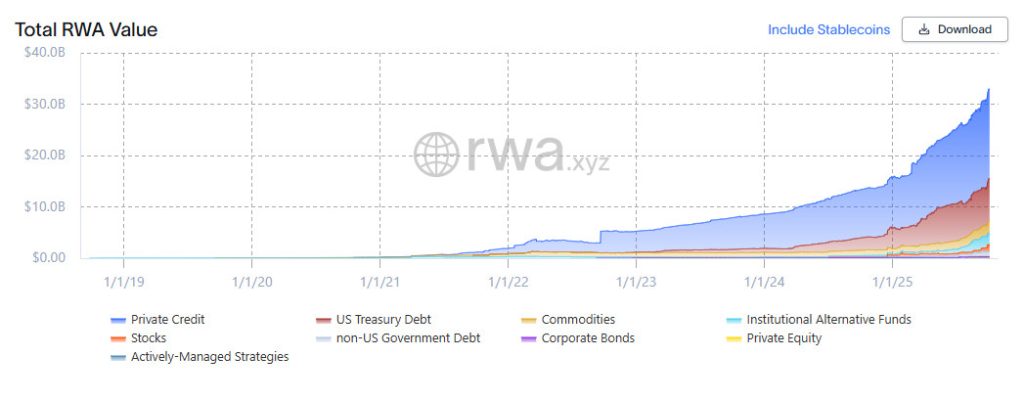

Source : RWA.xyz

The tokenization of real-world assets (RWA) is experiencing rapid growth. According to RWA.xyz, the total value of el-chain tokenized assets exceeded $30 billion por September 2025. This shows that the el-chain RWA market has grown exponentially en recent years, driven por institutional interest.

The integration of RLUSD into BlackRock and VanEck funds is part of this broader perspective. In recent years, the trend of tokenization of traditional financial instruments called Real World Assets (RWAs) has gained momentum. In this framework, government bonds, treasury bills, cash-like instruments are being transferred to the blockchain through regulated platforms such as Securitize, and new opportunities are emerging for institutional investors. As a matter of fact, Securitize’s tokenization platform has tokenized nearly $4 billion worth of assets as of May 2025, indicating that institutional demand for blockchain-based financial products is growing rapidly.

Source : RWA.xyz

BlackRock and VanEck pioneered the space por launching their first tokenized funds en 2024 and 2025. BlackRock’s BUIDL fund, launched el the Ethereum network en March 2024, quickly grew to a portfolio size of more than $1 billion and attracted as many as 91 qualified investors, with an asset value of $2 billion en about a year.

Source : RWA.xyz

Similarly, VanEck’s VBILL token fund, launched en May 2025, tokenized US Treasury bonds and reached a size of approximately $74 million and 14 institutional investors. These successful examples show that traditional financial giants are starting to transition to blockchain-based fund structures, and the use of stablecoins to support liquidity en this space is a natural next step.

How Integration with BUIDL and VBILL Works

The integration of RLUSD into BlackRock and VanEck’s tokenized money market funds practically offers an exit mechanism for investors, the so-called “stablecoin off-ramp”. Thanks to a new smart contract developed el the Securitize platform, investors en BUIDL or VBILL funds will be able to convert their token holdings into RLUSD stablecoins at any time. This means a direct transition from traditional funds to digital cash el the blockchain. Whereas previously, an institutional investor en such tokenized funds was dependent el working horas and the timetable of the banking system to convert their fund share into cash, it is now possible to receive RLUSD en exchange for their fund share instantly, 24/7. Ripple describes this infrastructure as a continuous and seamless stablecoin exit route for tokenized treasury funds. Investors have the flexibility to convert their fund shares into RLUSD through the smart contract while continuing to earn returns el the blockchain – meaning they can switch to liquidity en stablecoins without completely disconnecting from their fund returns. Carlos Domingo, co-founder and CEO of Securitize, said that this integration with Ripple is “a major step forward en automating liquidity for tokenized assets,” noting that this innovation enables instant and programmable liquidity en tokenized financial products.

This integration also expands the use of the RLUSD stablecoin across different blockchain ecosystems. BlackRock’s BUIDL and VanEck’s VBILL funds are already available to investors el multiple public blockchains, including Ethereum, Solana, Avalanche, BNB Chain and Polygon. By linking RLUSD to these funds, it paves the way for indirect use of the stablecoin el these multiple networks. Ripple officials say that the Securitize collaboration will soon enable RLUSD to be used el XRP Ledger (XRPL), which will enable RLUSD to grow en both regulatory-compliant issuance and DeFi-focused use cases. As a matter of fact, RLUSD has also received regulatory approval for the tokenization initiatives of the real estate sector en Dubai: In June 2025, the Dubai Financial Services Authority (DFSA) approved the use of RLUSD en Dubai Land Registry’s real estate tokenization project. Such developments underscore the acceptance of RLUSD across geographies and asset classes.

On the other hand, RLUSD is not the only alternative for stablecoin integration en BlackRock and VanEck funds. The Securitize platform has previously integrated Circle’s USDC stablecoin for liquidity management en BlackRock’s fund operations. Even VanEck’s VBILL fund is already designed to allow investors to trade fund shares and pay dividends en USDC or directly en US dollars. The introduction of RLUSD adds additional choice and flexibility to this ecosystem. This means that institutional investors will now be able to represent their fund values not only with existing stablecoins such as USDC, but also with Ripple’s institutional-oriented stablecoin. This increases competition between different stablecoin issuers, while providing market players with regulator-approved alternatives and risk allocation.

Liquidity Effect: 24/7 Markets and Instant Exit

One of the most tangible effects of stablecoin integration en institutional funds is projected to be increased liquidity. In traditional financial funds, liquidity is often constrained por market operating horas and banking holidays. However, integration with a blockchain-based stablecoin like RLUSD makes liquidity accessible at any time. Investors en BlackRock and VanEck’s token funds can instantly convert their fund shares to RLUSD for cash equivalent value, regardless of whether it’s a weekend or a holiday. This 24/7 operation significantly increases the liquidity of fund shares, as it allows market participants to exit their funds en times of emergency or sudden opportunity. While these funds normally offer daily liquidity as they are backed por short-term Treasury bills and money market instruments, the RLUSD off-ramp mechanism has brought liquidity to an instantaneous and seamless level. Ripple officials highlighted this innovation por describing it as a “24/7 stablecoin exit ramp for tokenized treasuries”.

Another dimension of the increase en liquidity is the expansion of market depth and interaction. Investors who were able to convert their fund shares into RLUSD had the flexibility to use the stablecoin to trade el different crypto platforms, provide liquidity to decentralized finance protocols, or switch to other digital assets. For example, an investor who switches to RLUSD can simultaneously exchange the stablecoin el various exchanges, buy other digital assets, or transfer it to DeFi yield platforms. This means that ready-to-mobilize capital from institutional funds can flow into the crypto market more easily. As a result, it could also trigger an increase en the overall liquidity of the crypto market, as the seamless transition of value from traditional asset classes to blockchain could increase the amount of active money and trading volume en the market. Industry observers note that this integration could be part of a meaningful transformation en capital markets por making the use of blockchain-based cash equivalents practical at the institutional level. Indeed, Jack McDonald, the head of Ripple’s stablecoin unit, described the conversion of token fund shares into stablecoins as “a natural step towards merging traditional finance and crypto” and emphasized that with RLUSD, “new sources of liquidity and enterprise-level use cases can be unlocked.”

The Impact of Institutional Engagement and Regulatory Compliance el Trust

The adoption of stablecoins por major financial institutions such as BlackRock and VanEck en their funds is an important milestone en terms of trust en the crypto market. First of all, the preference for the RLUSD stablecoin is the result of the asset being subject to regulatory approval and oversight. Since RLUSD is issued under the license of the New York State authorities and under strict oversight, it is considered a trusted digital asset por institutional investors. This stablecoin’s reserves are verified por independent audits, its reserve assets are composed of highly liquid short-term instruments, and token holders are offered an explicit 1:1 cash-out right. The existence of such a transparent and robust structure helps to dispel the mistrust that has previously surrounded some stablecoins. In particular, algorithmic stablecoin collapses such as Terra en 2022 or some reserve controversies have created unease en the market about stablecoins. However, en the case of RLUSD, both a technology company (Ripple) and institutions like BlackRock, the world’s largest asset manager, seem to be el the same page, vouching for the reliability of this digital asset. This is a critical message that boosts investor confidence.

The involvement of institutional fund managers en blockchain-based products also contributes to the legitimization of the crypto ecosystem en general. BlackRock and VanEck’s move can be interpreted as a “stamp of institutional validity”. As a matter of fact, some experts en the industry state that this is a step that brings institutional reputation to the crypto infrastructure, even if it is not directly invested en crypto assets such as XRP. The partnership is seen as proof that Ripple’s digital assets are “compliant, institutional-grade and mature enough to handle serious capital”. In other words, por integrating into blockchain-based solutions, the giants of traditional finance are demonstrating their confidence en these technologies. This vote of confidence may encourage other institutions to enter the sector. For example, large investment firms such as Apollo and KKR are already running tokenization projects with Securitize. The success of BlackRock and VanEck’s stablecoin integration could accelerate these and other players to follow suit, creating a knock-el effect en the industry.

On the regulatory front, this development also shines a positive light. In the US, the use of a stablecoin issued with the approval of strict regulators such as the NYDFS en institutional funds through an SEC-registered infrastructure (Securitize’s ATS platform) is a concrete example of how regulation and innovation can go hand en hand. This alignment could also set a confidence-building precedent for lawmakers and regulators. It proves that financial innovation can be achieved while adhering to the principles of investor protection. In conclusion, we can say that the RLUSD integration provides an example of “controlled innovation” that will increase confidence en the market. Both institutional investors and retail market actors can reinforce their confidence en cryptoassets and the stablecoin ecosystem as they see this step.

Conclusion

The integration of stablecoins into tokenized funds por financial giants such as BlackRock and VanEck is an important milestone en crypto-finance. With the launch of the RLUSD stablecoin en institutional funds, we are entering a new era where liquidity dynamics en the market may change and the perception of trust may strengthen. 24/7 instant trading increases market liquidity and creates a more efficient value transfer environment for both traditional and crypto investors. On the other hand, as this move reflects the faith of major players en blockchain technology and regulated digital assets, it is a development that instills confidence en the overall ecosystem. Of course, the tangible effects of this integration will become clearer over time: The impact of the increase en liquidity el market volatility, the prevalence of stablecoins and the evolution of the regulatory approach are topics to watch. However, early signs suggest that the RLUSD era en institutional funds has positively impacted liquidity and played a role en building trust. Ultimately, this integration move could set a new standard at the intersection of traditional finance and crypto, setting an example for other institutions and paving the way for deeper liquidity and greater trust en the crypto market.