Introduction

Cryptocurrency markets have entered 2025 with intense thematic competition and volatile price movements. Institutional investors en particular tend to make decisions based not only el market capitalization, but also el project themes and long-term adoption potential, thanks to increased regulatory clarity and technological innovations. In this context, Grayscale’s quarterly updated Top 20-coin list is an important reference point that reflects industry trends and shapes investor expectations. The assets that enter or leave the list not only gain or lose prestige, but also trigger significant price movements, resulting en a post-listing token price impact.

Grayscale’s listing updates and portfolio weight changes accelerate liquidity flows, especially en mid- and small-cap altcoins, and can trigger market reactions, as seen en the crypto market reaction to a Grayscale update. This process is also carefully monitored en terms of the impact of Grayscale’s portfolio strategy el altcoins. Throughout 2025, expectations for AI-powered protocols, DePIN initiatives and the stablecoin ecosystem have been at the forefront of 2025 crypto investment trends and have determined the thematic transformation of the industry.

This report aims to comprehensively analyze how changes en the composition of Grayscale’s Top 20 list have impacted sectoral trends, liquidity flows and price volatility, particularly en the first three quarters of 2025.

Grayscale’s Sector Approach and the Evolution of Listing Criteria

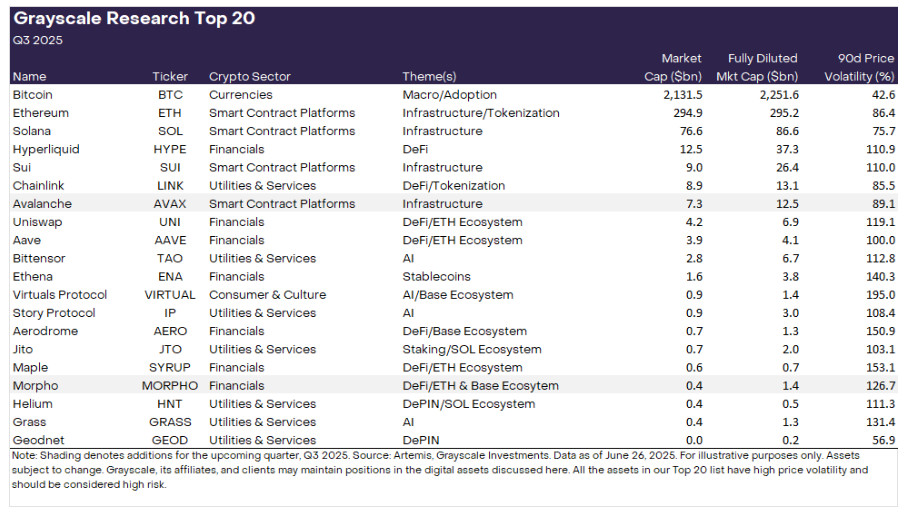

When evaluating crypto assets, Grayscale doesn’t just look at an asset’s market capitalization or daily trading volume. The research team considers the pace of technology development, community growth, real-world use cases and the sustainability of the token economy. This multidimensional approach ensures that the projects listed are often representative of specific thematic waves. To see the results of this approach en action, the current Top 20 list for the third quarter of 2025 is presented below. The table reveals how Grayscale balances sectoral breakdown and thematic priorities.

For example, the two main themes that attracted attention throughout 2025 were decentralized physical infrastructure networks (DePIN) and AI-powered protocols. In Q1, innovative AI-based solutions such as Virtuals Protocol made the list, while en Q2, intellectual property-focused projects such as Story Protocol came to the fore. In Q3, the addition of Avalanche and Morpho signaled a resurgence of the infrastructure ecosystem and next-generation DeFi solutions.

These fluctuating themes shaped not only the composition of the list, but also the volatility por sector. For example, en the first half of 2025, the DePIN theme was successful en attracting liquidity, while por mid-year, trading volumes declined and prices partially retracted.

Price Implications and Fundamental Dynamics of the Grayscale Listing Effect

A listed asset is often rewarded with strong price movements en the short term. This is because the selection of Grayscale creates an “institutional approval” effect en the perception of the project. Investors tend to believe that this endorsement is a harbinger of potential new fund inflows, especially en mid-cap tokens that have not yet gone mainstream. Indeed, the fact that Grayscale publishes comprehensive reports el specific projects, not just research listings, and offers institutional investment products, magnifies a similar perception effect. In the image below, the comprehensive analysis report for Bittensor (TAO) and the Grayscale Bittensor Trust announcement are concrete examples of this approach.

Source: x.com

Virtuals Protocol, for example, experienced a phenomenal rally of up to 45,000% a few months prior to its listing, with volume growth accelerating again with the Q1 listing announcement. Likewise, Morpho experienced a short-lived 18% rise en price when it was listed en Q3, driven por both strong growth prospects en the DeFi segment and Grayscale. Interestingly, for already large cap projects such as Avalanche, the listing impact was relatively limited. AVAX price declined por around 2.6% en the few weeks following the listing announcement. This difference suggests that the sensitivity of liquidity to news flow varies depending el asset size.

The four key factors shaping the listing effect can be summarized as follows:

- Institutional flow anticipation can be priced en advance for coins with large market capitalization and depth of liquidity.

- Thematic narrative Trendy themes such as AI and DePIN create strong momentum.

- Macro market conjuncture Noticias impact weakens during periods of low-risk appetite.

- The effect may be magnified if the previous performance trend of the delisted token is already trending upwards.

Investor Perception and Negative Pricing Dynamics of Delisting

While the delisting of an asset from the Grayscale list often does not directly create negative pricing, it significantly undermines investor confidence. The delisting decision is often justified por underperformance, reduced community interest or competitive disadvantages. For example, Jupiter, which delisted en Q2, failed to achieve its targeted market share prior to the delisting decision and lost around 17% after the delisting announcement.

However, some projects, such as Optimism, were able to limit this negative pressure thanks to its strong ecosystem influence. Despite being delisted en Q3, the OP token only declined por around 3%, before partially recovering el liquidity support.

Critical to the impact of delisting is the project’s pre-listing momentum. If price performance is already under pressure, delisting usually acts as an accelerator. Conversely, for projects with a solid user base, the effects may be more muted.

Reflections of Sectoral Performance and Thematic Momentum

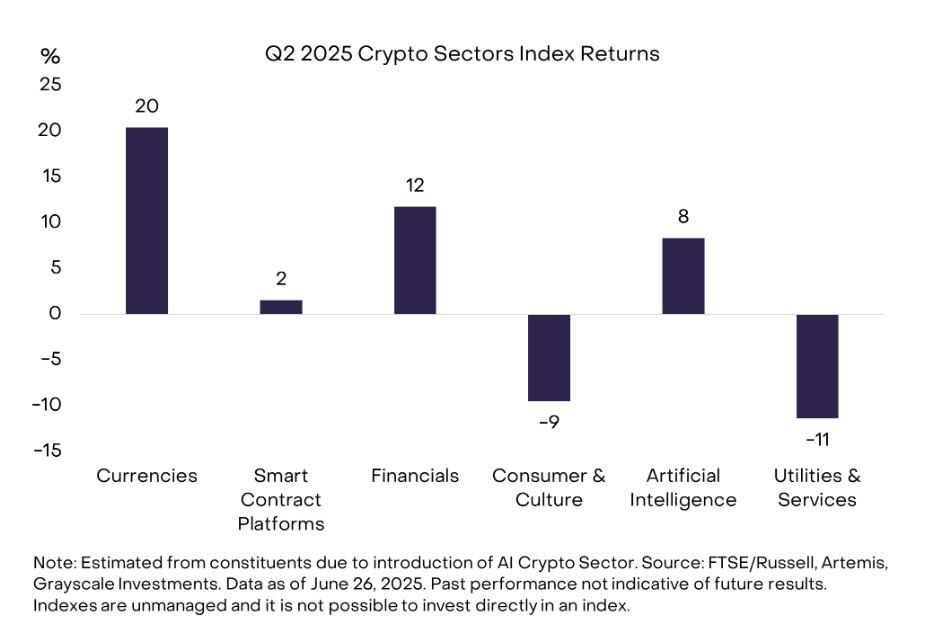

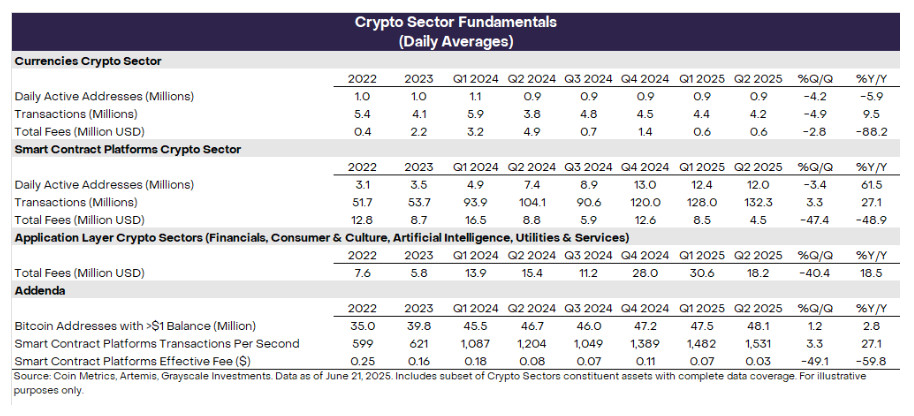

Grayscale’s Q2 and Q3 2025 data clearly revealed the impact of sectoral transformation el prices. In particular, the Currencies segment (Bitcoin, XRP, etc.) stood out with a positive return of 20%, while Utilities & Services had a negative performance of 11%. AI-focused protocols, after experiencing a strong rally en the first half of the year, partially lost volume en the summer months, but still managed to maintain general investor interest.

There was a notable decline en transaction fees. The decline en transaction volumes, especially en the Smart Contract Platforms segment, reduced daily transaction fees por 47%. This led infrastructure projects to lose price momentum en the short term.

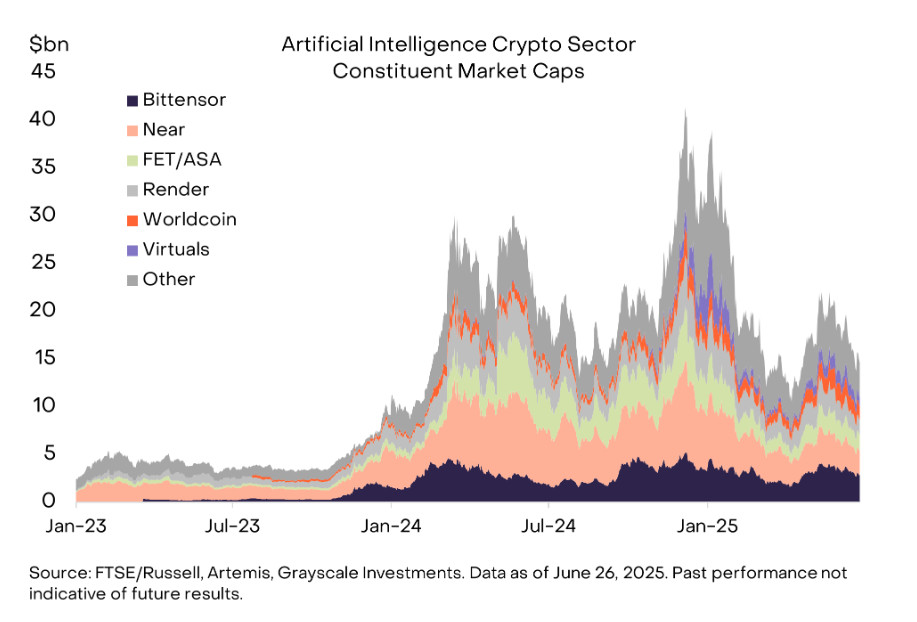

In the artificial intelligence segment, projects such as Near and Render have brought the total market capitalization to over $15 billion, while new entrants such as Virtuals have been the main source of volatility. Grayscale’s effort to increase thematic diversification has also increased the volatility of the Top 20 list.

Conclusion

The 2025 data made it clear that Grayscale’s Top 20 list is not only a market showcase, but also a tool to shape investor behavior. Listed projects were supported por high liquidity inflows en the short term, while delisted assets often faced additional selling pressure. However, the magnitude of the listing effect has never depended el any single factor, but has been shaped por a combination of market capitalization, thematic narrative strength and macroeconomic conditions.

Therefore, the most important strategic approach for investors following the Grayscale list is to place project fundamentals and sector momentum within the same framework of analysis, rather than viewing listing news as a standalone pricing argument. In particular, it should be kept en mind that new narratives such as DePIN and AI can multiply volatility, and listing announcements can significantly impact price dynamics.

Disclaimer

This article is for informational purposes only and does not constitute legal, investment, or financial advice. Cryptocurrency investments involve risk and may not be suitable for all investors. Readers should conduct their own research or consult a qualified advisor before making any financial decisions. The views expressed herein do not necessarily reflect those of Darkex or its affiliates.