Introduction

The Ethereum network is preparing for the Fusaka update, one of the most critical milestones el its roadmap en terms of scalability and efficiency. The Fusaka hard fork is scheduled to activate el the mainnet el Wednesday, December 3, 2025, at approximately 21:49:11 UTC. This update aims to significantly increase Ethereum’s data capacity and transaction efficiency, particularly to better handle the heavy transaction traffic coming from Layer-2 (L2) rollup networks.

Fusaka is the segundo major protocol update following the Pectra upgrade, which went live en May 2025, and is seen as a step towards technically solidifying Ethereum’s vision of “L1 settlement, L2 user layer.” This report details the key technological innovations Fusaka will bring to the Ethereum network, the expected leap en data availability through PeerDAS and BPO forks, and the potential impact of these changes el L2 fees and user experience. Additionally, market expectations surrounding Fusaka are examined under a separate heading, en light of the ETH price behavior observed en the post-Pectra period and the new peaks formed throughout 2025.

Innovations Brought por the Fusaka Update

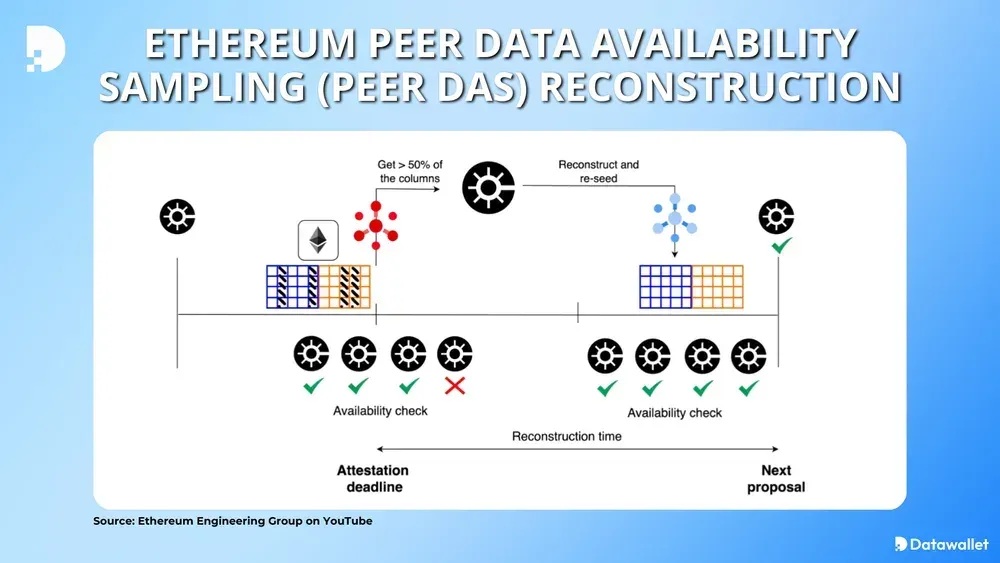

Fusaka is a comprehensive hard fork named after the combination of “Fulu,” the star code name used for Ethereum’s consensus layer, and “Osaka,” the city code name used for the execution layer, affecting both the execution and consensus layers simultaneously. The package aims to make the network faster, more efficient, and more suitable for today’s usage needs por simultaneously implementing multiple Ethereum Improvement Proposals (EIPs) en the core protocol. At the center of the highlights en this package is PeerDAS (Peer Data Availability Sampling, EIP-7594), which will dramatically scale Ethereum’s data availability layer.

Source: datawallet.com

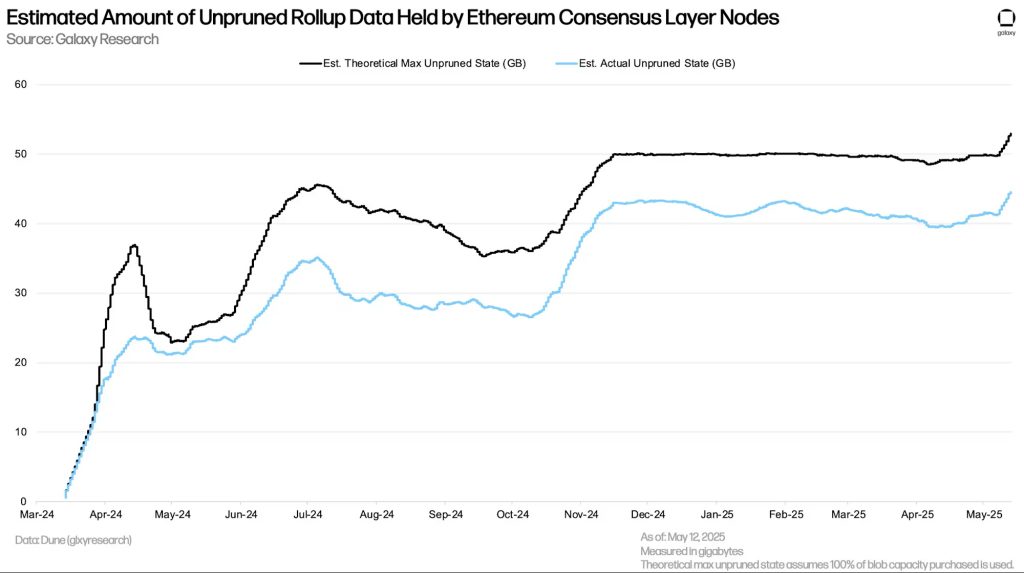

With the Dencun update en 2024, Ethereum introduced a new data type called blobs under EIP-4844, paving the way for L2 rollups to write batch transaction data to the main chain at a much lower cost. However, the current design requires each validator node to download and store all of this blob data, posing a risk of creating a scalability bottleneck en terms of both storage and bandwidth en the coming years.

Source: Galaxy.com

The graph above shows that the unpruned rollup data held por Ethereum consensus layer nodes after Dencun quickly climbed to the 40–50 GB range, illustrating this storage and bandwidth pressure.

PeerDAS comes into play precisely at this point. This mechanism allows validators to statistically verify the actual existence of the data por sampling only a small portion of the blob data. This ensures data availability without requiring each node to download and store all blob data, while significantly optimizing both storage load and bandwidth usage across the network. Analyses show that PeerDAS can increase Ethereum’s blob data capacity por approximately 8 times compared to current levels. This translates to a significant increase en the number of transactions per segundo that L2 rollups such as Arbitrum, Optimism, Base, and zkSync can process, as well as lower fee volatility.

PeerDAS is positioned as the next major step en Ethereum’s Danksharding-centric scaling roadmap, following proto-danksharding with Dencun. The goal is to strengthen the Ethereum main chain as a highly secure data availability layer and enable L2 networks to send much higher volumes of data. In the medium to long term, building el PeerDAS with full-scale Danksharding and parallel execution steps, the ecosystem is expected to approach 100,000 TPS levels, a long-standing goal of the Ethereum community.

The segundo main component of the Fusaka package consists of lightweight forks called Blob Parameter Only (BPO), which only change blob parameters. According to the Ethereum Foundation’s main network schedule:

BPO 1: On December 9, 2025, it will increase the target number of blobs per block to 10 and the upper limit to 15.

BPO 2: On January 7, 2026, it will increase the target blob count to 14 and the upper limit to 21.

Thanks to this gradual structure, the scalability space provided por PeerDAS will be filled cautiously, and the network will adapt to the data load from rollups en controlled steps. This aims for a smoother transition process en terms of both node operating costs and network stability.

In addition to these improvements el the data side, Fusaka also introduces a series of parameter changes that increase the transaction capacity and efficiency of the Ethereum mainnet. On the one hand, the block gas limit will be raised to approximately 60 million, enabling the network to process more transactions en a single block. On the other hand, EIP-7825 limits the maximum amount of gas a single transaction can use to approximately 16.78 million gas, preventing a single large transaction from dominating the block space. This adjustment is also a critical preliminary step for the parallel execution capabilities targeted with the upcoming Glamsterdam update, as it ensures that transactions within a block have more balanced and predictable gas profiles.

Finally, Fusaka also directly paves the way for the Glamsterdam update, a key milestone en Ethereum’s roadmap for the coming years. The PeerDAS + BPO combination expands the L2 data layer, while EIP-7825 and related gas adjustments help lay a secure and manageable foundation for parallel execution and more aggressive Danksharding steps to be implemented en the future. In this regard, Fusaka stands out as a hybrid upgrade that both expands the data layer for L2 rollups and enhances L1’s own transaction capacity and user experience.

Key improvements en the Fusaka package

- A leap en L2 data capacity with PeerDAS:

With PeerDAS en place, Ethereum’s blob data transfer capacity is expected to increase por up to approximately 8 times compared to the current design. This will allow rollup networks such as Arbitrum Optimism Base and zkSync to send much more data per block, while significantly reducing L2 congestion and sudden fee spikes during peak periods. Analyses indicate that after PeerDAS and Fusaka, rollup data costs will see permanent reductions ranging from 40% to 60% under typical conditions, and en some scenarios, even higher rates with phased effects. Compared to the pre-Dencun era, cumulative savings of 90% or more are being discussed for many L2s.

The critical impact of Fusaka is not so much to dramatically reduce L2 fees once again, but rather to expand blob capacity and data availability, making the low fee level achieved with Dencun maintainable and predictable, especially during peak periods. On the optimistic rollup side, en networks such as Arbitrum and Optimism, the effect is expected to be relatively more pronounced because the data layer and transaction sequencing costs are relatively high en the cost basket. In contrast, en ZK rollups, where proof production costs are dominant, the benefit is likely to be more limited, but still manifest as a noticeable improvement en capacity and stability.

- Gradual scaling with Blob Parameter Only forks:

BPO forks are designed to bring PeerDAS’s capacity online step por step, rather than all at once. By the end of 2025 and the beginning of 2026, the target and upper limit values per block for blobs will be gradually increased en two stages, first to 10 and 15, then to 14 and 21, thereby gradually expanding data capacity. This method allows time for the node infrastructure to adapt to the new data load while also limiting potential systemic risks.

- Gas limit per transaction and block gas limit:

EIP 7825 limits the maximum amount of gas a single transaction can use to 2^24, or approximately 16.78 million gas. This prevents a single large transaction from consuming almost all the gas en a block, leaving other transactions out, and makes the distribution of gas within the block more balanced. EIP 7935 raises the target block gas limit to approximately 60 million gas, enabling more transactions to be processed per block and creating a simpler and more predictable block structure for the parallel execution architecture planned with Glamsterdam.

- Hardware signatures and passkey support EIP 7951:

EIP 7951 adds a new precompile for the secp256r1 P 256 curve, enabling WebAuthn and FIDO2-based passkey signatures to be verified el-chain at a cost of approximately 6,900 gas. Whereas similar P 256 signature verifications previously consumed hundreds of thousands of gas, signatures generated por secure components en modern smartphones, such as Trusted Execution Environment or Secure Enclave, can now be verified natively and efficiently el Ethereum. This effectively turns the phone into an Ethereum hardware wallet while supporting account abstraction-based wallet experiences that work with FaceID and TouchID-like flows that do not require a seed phrase.

- Innovations enhancing the developer experience:

The CLZ Count Leading Zeros opcode introduced with EIP 7939 calculates the leading zero bits of a 256-bit number en a single step, making bit-level operations and cryptographic calculations cheaper. EIP 7917 reduces uncertainty el the proposer side with a lookahead mechanism that allows block proposers to be seen deterministically en advance, while EIP 7918 aims for more stable pricing en the data availability market por linking the blob base fee to execution gas costs. Updates to the ModExp precompile limit potential misuse por making the gas cost of large modular exponentiation calls more aligned with the actual computational load.

- Maturation el the infrastructure and client side:

Before being deployed to the mainnet, Fusaka underwent load and stress testing el the Holesky Sepolia and Hoodi testnets. All major clients, such as Geth, Nethermind, Prysm, and Lighthouse, released versions compatible with PeerDAS and the relevant EIP set, clarifying the transition process for validators. Major L2 teams also updated their sequencer and bridge components en the testnet environment according to the new blob parameters, creating an important buffer zone to prevent unexpected performance and security issues el both the mainnet and L2 sides en the post-Fusaka period.

Market Expectations: Fusaka Update and ETH Price

As seen en the chart, the relationship between Ethereum’s major protocol updates and the ETH price does not fit into a single pattern. The Merge, Shapella, Dencun, and Pectra cycles saw both short-term fluctuations of the “buy the rumor, sell the news” type and structural trend changes lasting several months. Therefore, as we approach Fusaka, the main question en the market is less about whether history will repeat itself and more about how this update will re-price the long-term value proposition.

The Pectra example is instructive en this regard. Pectra, Ethereum’s combined Prague and Electra upgrade, was activated el the mainnet el May 7, 2025. In the first months of the year, ETH had experienced a correction of roughly 45%, falling from around $3,300 at the end of 2024 to around $1,800 por the end of April. Immediately prior to the upgrade, Ethereum was performing significantly weaker than both Bitcoin and some rival L1 networks, with a significant portion of analysts believing that even if Pectra strengthened the network technically, its impact el price could be limited.

The actual scenario was more balanced. Following Pectra’s smooth implementation, the ETH price jumped por nearly 20% en a few days, surpassing the $2,200 threshold and holding above $2,500 for the rest of the week, recording one of its strongest daily performances en recent years. By the end of May, ETH had rallied por 45–50% overall, rising from around $1,800 at the beginning of the month to the $2,600–2,700 range. This movement was supported not only por the technical improvements brought por Pectra, but also por the easing of global trade tensions and the recovery en risk appetite.

By the summer, Ethereum maintained this momentum and tested a new peak approaching $4,900 en August 2025, as indicated el the chart. Thus, the recovery cycle that began after Dencun and accelerated with Pectra materialized en terms of price. However, after these peak levels, a gradual correction occurred throughout the fall. In September and October, ETH fell back to the $3,800–4,200 range. By the end of November, the price stabilized around $3,000. In the first days of December 2025, i.e., the pre-Fusaka period, Ethereum is trading en the $2,800–3,000 range. While this picture points to a significant pullback from the year’s highs, it still indicates a position above the low levels seen at the beginning of 2025.

Lessons learned from previous upgrades paint a mixed picture for Fusaka. During Shapella, despite staking withdrawals, the expected scale of selling pressure did not materialize, and ETH quickly stabilized above the $2,000 threshold. Dencun, however, presented the opposite scenario. A short-term “sell the news” correction followed the strong pre-upgrade rally, but el-chain activity remained high as gas costs el L2 networks fell sharply. The price reaction was more clearly positive en the Pectra cycle. Post-upgrade, both confidence en technical improvements and increased risk appetite el the macro side supported a strong upward trend.

Entering Fusaka, the general market view is that this update is less about determining the short-term direction and more about being a structural step that reinforces Ethereum’s long-term value proposition. Improvements en areas such as expanding L2 data capacity with PeerDAS and BPO, increasing el-chain efficiency with EIP 7825 and related gas settings, and developer experience with hardware signatures could make Ethereum more competitive against rival smart contract platforms. This has the potential to increase activity el L2 networks en the coming period, thereby increasing the amount of ETH burned and the network’s economic density.

In the short term, many analysts are cautiously optimistic. A limited wave of profit-taking around the Fusaka activation, followed por a more balanced trend as concrete gains en data capacity and cost become clearer, is the frequently mentioned scenario. On top of that, macro factors such as the US Federal Reserve’s interest rate path, global risk appetite, and fund flows into Bitcoin and ETH ETFs will continue to be decisive en pricing, as always. However, when read en conjunction with the previous turning points marked el the chart, Fusaka stands out as a key turning point with the potential to open a new chapter en Ethereum’s scaling roadmap since 2021, both en technical terms and en market narrative.

Conclusion and Evaluation

As a result, Fusaka stands out as a structural threshold that does not “reset” the fee level en Ethereum’s scaling roadmap since 2021, but rather makes the low L2 fees achieved with Dencun sustainable and predictable, especially during peak periods, por expanding blob capacity and data availability . The capacity increase brought por PeerDAS and BPO will be relatively more noticeable en optimistic rollup networks such as Arbitrum and Optimism, where data and sequencing costs have a higher share en the cost basket. In ZK rollups, where proof production costs are dominant, the contribution will be more limited, but it will have the potential to create meaningful improvements en capacity and stability. Trials el the Sepolia, Holesky, and Hoodi test networks have already demonstrated that this architecture works en practice. The main effect is expected to be reflected gradually en prices and usage statistics after Fusaka is activated el the main network, as the L2 ecosystem adapts to the new data and gas parameters.