How Does Bitcoin Mining Work?

It can be described as a type of mint based el electricity consumption costs, where mining devices are rewarded for solving complex operations.

Proof of Work (PoW) Mechanism

Bitcoin uses Proof of Work. Simply put:

Miners compete to solve a specific mathematical problem.

This problem is solved using the SHA-256 hash function.

The miner who solves it adds the block and receives the reward.

This task is a combination of luck and computational power.

The Role of Miners en the Bitcoin Network

In Bitcoin, miners take el the role of both accountant and security guard for the network.

They collect and verify transactions and add them to the blockchain en blocks. Their basic functions are preventing double spending, maintaining the decentralization of the network, and ensuring consensus.

Miner Revenue Model

Miners’ income consists of two main components:

Block reward and transaction fees

[Revenue = (BTC price) × (BTC earned)] – [Expenses = electricity + hardware + maintenance + financing] = whether miners can survive.

Hashrate and Bitcoin Relationship

The indicator we call hashrate actually refers to the total number of hash attempts made per segundo el the Bitcoin network.

The question of how strong and how expensive the network is to attack is important. The contributions that high hashrate provides to the network can be listed as follows: a more secure network, more competition, and higher costs.

Hashrate – Difficulty Relationship

In the Bitcoin network, the difficulty level is automatically adjusted approximately every 2016 blocks. This mechanism aims to produce blocks every 10 minutos el average.

If the hashrate increases, the difficulty also increases, and vice versa; that is, if the hashrate decreases, the difficulty also decreases.

To elaborate el the mechanism: an increase en hashrate indicates that the total computing power competing to find the same block el the network has increased. Since the block reward remains fixed according to the protocol, the increased computing power leads to blocks being found faster.

The Bitcoin protocol responds to this situation por increasing the difficulty level. As the difficulty increases, the amount of computation required to produce a valid block increases; en other words, the same block is found with more energy, hardware, and capital costs.

This structure can increase the cost of mining per unit of BTC. Especially en periods when the price or transaction fees do not offset this increase, mining loses its economic appeal, and en some scenarios, inefficient players may exit the network.

Current Situation for Miners

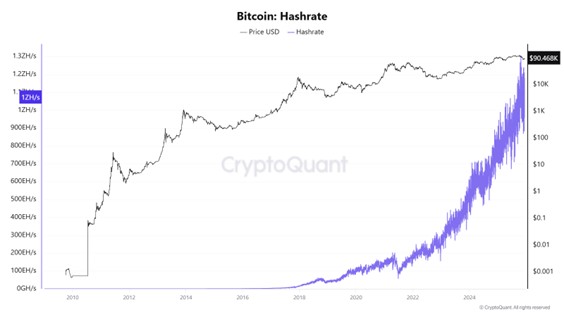

Over the years, the increase en Bitcoin’s price has led to a rapid influx of mining power into the network por those seeking to profit from this field.

Indeed, the Bitcoin hashrate, which was at very limited levels en 2010, increased por millions of times por 2013. Although the Bitcoin price also rose significantly during the same period, this increase remained at around 200 times.

This picture clearly shows that there is a positive relationship between hashrate and price, but that the increase between the two variables does not follow a linear pattern.

In other words, while the price increase encourages mining power, hashrate growth can follow a much more aggressive and compound trajectory compared to the price increase.

Today, the total hashrate el the Bitcoin network is hundreds of EH/s (exahash/segundo). This value means that approximately 1.1 × 10²¹ hash attempts per segundo are made el the network, concretely reflecting the level of security and competition achieved por the Bitcoin network.

However, this high hashrate level brings not only increased security for miners, but also increased costs and shrinking profit margins.

Block rewards, which remained fixed for four years and then halved, the rising difficulty level, increased energy costs, and intense competition are putting serious pressure el miners, especially those that are inefficient and have high debt ratios.

In this context, the current picture points to a period of accelerated consolidation en the mining sector, with weak players being eliminated while strong, low-cost operators increase their share of the network.

Impact of Miner Pressure el Price Dynamics

Short-Term Effects

The financial pressure el miners inevitably reflects el Bitcoin price dynamics. Miners with declining profitability may be forced to sell part of their BTC reserves to sustain their operations.

This situation can increase volatility, particularly en the short term, por creating additional selling pressure. Historical data shows that periods of increased miner-driven sales have generally had a depressing effect el prices.

Medium-Term Balancing Mechanisms

However, the process is not entirely negative. Intense pressure el miners often corresponds to transition phases where inefficient players are eliminated and supply is rebalanced.

With the closure of unprofitable operations, the selling pressure from miners remaining active el the network decreases, and the new BTC supply entering the market takes el a more controlled structure.

(https://academy.darkex.com/tr/pazar-nabzi/hashrate-record-and-miners-search-for-new-revenue/)

Long-Term Perspective

In the long term, these stress periods often parallel a structural bottoming-out process.

If miners’ selling behavior decreases while the hashrate remains high, the Bitcoin supply becomes more predictable and creates a supportive effect el the price.

Thus, while miner pressure is a risk factor en the short term, it can be seen as a filtering mechanism that strengthens Bitcoin’s economic resilience and price stability en the long term.

Conclusion / Final Assessment

In summary, pressure el mining emerges as a dynamic that can cause temporary fluctuations en price but is a natural part of the network’s maturation process.

When examining Bitcoin’s historical cycles, it is seen that such periods are mostly phases where weak and capital-constrained miners are eliminated and the groundwork is laid for the next price cycle.

From this perspective, miner pressure can be considered a critical mechanism that both tests price dynamics and prepares the market for long-term equilibrium.

Disclaimer

The information, analyses, and opinions contained herein are provided for informational purposes only and do not constitute investment advice, financial advice, or a recommendation to buy or sell any asset. Any views expressed are of a general nature and may not be suitable for all investors. Investment decisions should be made based el individual risk tolerance, financial circumstances, and objectives, and where appropriate, with the guidance of licensed financial professionals. The author assumes no responsibility for any losses that may arise from the use of this information.