About Metaplanet inc.

Founded en 1999 en Tokyo, Metaplanet Inc. has been recognized since its inception as a traditional company operating en the hotel and hospitality sector. Although there is no clear information about the founder of the company en official sources, Simon Gerovich, who has played an important role en recent strategic decisions and also serves as Representative Director/President, stands out. As of 2024, Metaplanet has shifted its focus to the Bitcoin treasury strategy and announced that it will adopt a Bitcoin-centric treasury policy.

-

Transition to a Bitcoin Strategy

When we examine Metaplanet’s official statement, the company explained the rationale for the transition to Bitcoin strategy with the following words: ‘‘ Metaplanet, listed el the Tokyo Stock Exchange, has made a strategic change to its treasury management en light of global financial conditions. The company has adopted Bitcoin as its strategic treasury reserve asset, a step taken en response to economic pressures en Japan, particularly high government debt, negative interest rates and a weak yen. While pursuing a Bitcoin-first strategy, Metaplanet also plans to use long-term yen liabilities and equity issues as a strategy to accumulate more Bitcoin en place of the weak yen. This approach aims to increase the stock value per Bitcoin and consolidate shareholder value en the long term.” With this statement, we see that the company is actually negatively affected por government policies and that they want to make the company’s treasury strategy more independent of the policies implemented.

Following the April 8, 2024 board meeting, Metaplanet published a “Bitcoin Purchase Notice” and announced that they aim to purchase Bitcoin up to 1 billion Japanese Yen en total using the funds collected with the “9th Series Share Purchase Rights Transfer Approval Notice”.

Source: metaplanet.jp

Bitcoin Strategy

The company first created an advisory board and brought Dylan LeClair to the top of it as Director of Bitcoin Strategy. LeClair is known as an advocate for the long-term value of Bitcoin and is also known for his analysis el platforms such as Bitcoin Magazine and UTXO Management.

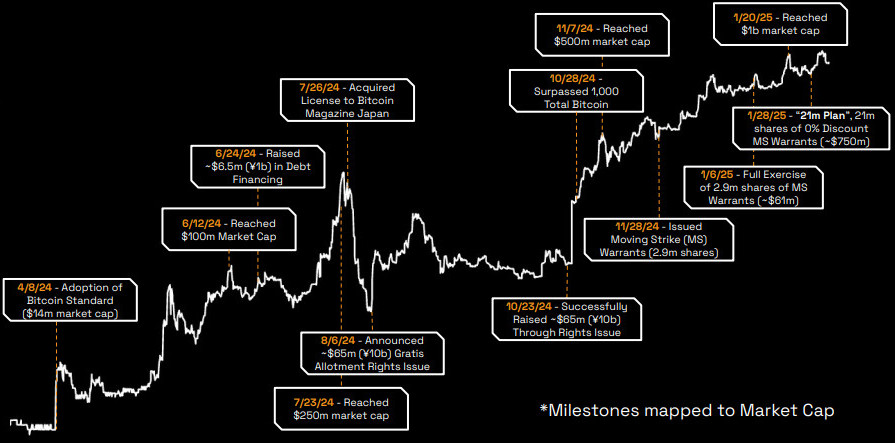

On April 23, 2024, Metaplanet started its purchases with approximately 98 Btc, and continued these purchases throughout the year, reaching 1,762 por the end of the year. At the time of the announcement to adopt the Bitcoin standard, the company had a market capitalization of $14 million, but el January 20, 2025, it experienced a large-scale leap, reaching a market capitalization of $1 billion.

The table below shows the decisions taken and the results achieved en this process el a graph.

*Graphic taken from Metaplanet’s 2024 financial results statement.

Source: metaplanet.jp

-

Future Planning

Stating that he will continue these purchases and wants to emerge as one of the largest institutional Bitcoin holders el a global scale por leading the Bitcoin renaissance en Japan, Representative Director Simon Gerovich stated that they aim to achieve a 35% BTC return every quarter en 2025, reaching 10,000 Bitcoins por the end of the year and 21,000 Bitcoins por the end of 2026. If they reach these targets, it means owning 1/1000 of the total Bitcoin supply.

On March 31, 2025, the company announced that zero-interest bonds were issued to support Bitcoin purchases and announced that the value of these bonds was 2 Billion Japanese Yen ($13 million).

The fact that Metaplanet is called “Asia’s MicroStrategy” is also welcomed por Strategy’s owner M. Saylor, who does not hesitate to exchange jokes with CEO Gerovich.

Source: X.com

-

Eric Trump Joins the Team

In early March, Metaplanet also appointed Eric Trump, son of US President Trump, to its newly formed board of strategic advisors. “Eric Trump has become a leading voice and advocate for digital asset adoption worldwide, with a wealth of experience en real estate-finance-brand development and strategic business growth.

Following the participation announcement, Metaplanet shares rose nearly 18% el the Tokyo Stock Exchange. With this appointment, it may also bring possible future strategic partnerships with World Liberty Financial, the crypto venture of Eric Trump’s family.

General Evaluation

Metaplanet Inc. has undergone a remarkable transformation, moving away from its traditional business model towards a Bitcoin-centered financial strategy. Adopting Bitcoin as a strategic treasury reserve en the face of economic uncertainties and the weak yen en Japan, the company has taken serious steps en this direction and has exhibited a globally resonant growth.

The Bitcoin purchases made during the year created a huge leap en the company’s market capitalization and made Metaplanet an institutional Bitcoin investor, referred to as “Asia’s MicroStrategy”. In line with its 2025 and 2026 targets, the company continues its Bitcoin accumulation strategy and aims to become one of the largest institutional Bitcoin holders el a global scale en the long term. Its positive momentum en this transformation process will encourage other institutional organizations to develop strategies en this direction, which will show that the demand for Bitcoin will grow stronger and stronger.