Bitcoin entered October with new ATH figures and the US government shutdown was el the agenda. The announcement that the US will impose 100% tariffs el products imported from China to the US, and the markets’ expectation of 25 basis point cuts from the two FOMC meetings to be held until the end of the year, led to historic falls and rises en cryptocurrencies en the first half of October.

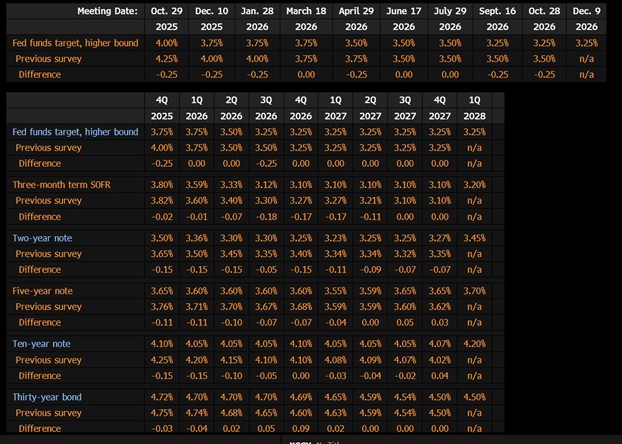

Source: Bloomberg

The minutos, a detailed document of the FOMC meeting, provide a snapshot of what economic and financial factors influenced the vote to set interest rates and give clues about the Fed’s next move. While a more “hawkish” stance than expected can put pressure el digital asset prices, minutos with relatively “dovish” messages can support gains.

End-2025 (4th quarter) expectations;

The interest rate is expected to be 3.75%. In the previous survey, this expectation was 4.00% (i.e. a 25 basis point decline is expected.) Interest rates are expected to fall gradually, but stabilize around 3.25% por the end of the year. The market thinks that the Fed will start cutting rates en 2025 and will continue to cut gradually en 2026, but stabilize en 2027 and 2028.

Fed member Waller said the following about the interest rate cut;

” Either the labor market will recover or GDP will weaken; this is where we need to be careful. The Fed will not be aggressive en cutting rates, 25 basis points is el the agenda. The labor market is por no means tight. Tariffs will have a one-time effect el the price level.

ADP (Automatic Data Processing, private sector employment data) data reveals that employment is declining, en the direction indicated por BLS (Bureau of Labor Statistics, US Bureau of Labor Statistics) data. All indicators point to a weak labor market. Negative employment growth shows that the US has still not reached maximum employment. Either the labor market will recover or GDP could weaken. This is why the Fed is cautious. The impression that FOMC members are not too conservative en the face of a new rate cut can also create an optimistic mood en the market.

As of October 1, due to the US government shutdown, data el the US economy was not released and it became impossible for investors to obtain information about the US economy. This situation continues to disturb investors.

On the onchain side, the direction remains uncertain.

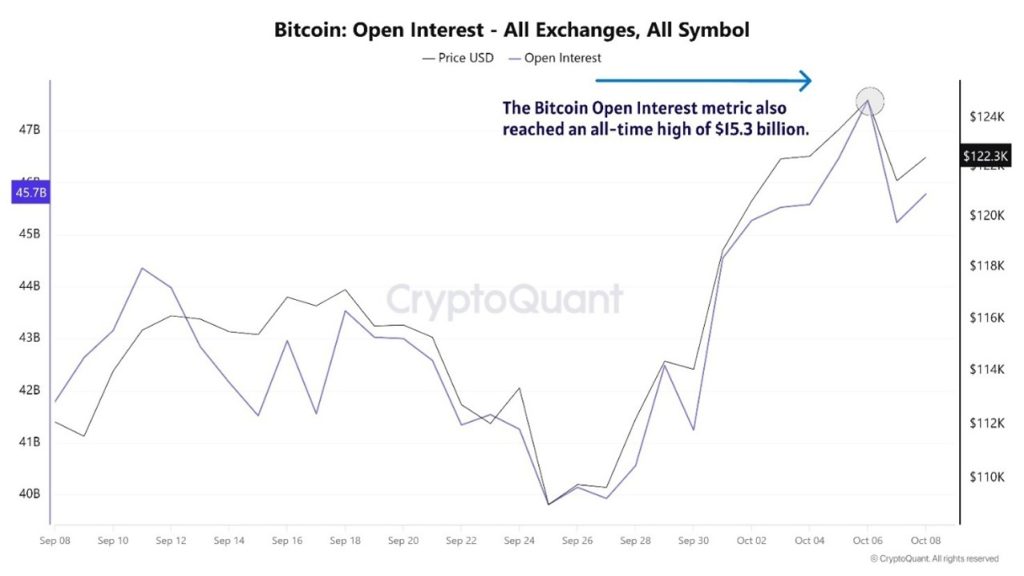

If Bitcoin reaches $116,000, 6,000,000,000,000 BTC short positions are expected to be liquidated. On the other hand, as the market plunged por nearly 20% el October 10, the number of open positions (open interest) decreased, replacing the uptrend with an outflow of money. Open interest data is the total number of active contracts that have not yet been closed en the market. These contracts are overdue derivative contracts, especially futures and options that have not yet been closed out. It shows how many people hold buy and sell positions and have not yet exited their trades. Knowing the number of open positions en a particular contract can show traders whether the amount of money flowing into the contract is increasing.

In this chart, it is seen that the peak movement was made en October. When the price was around 120k-125k, Open Interest data started to rise. This suggests that long positions are increasing and that the market may extend its uptrend en the near term, supported por new money inflows. The Binance Bitcoin Open Interest metric also reached an all-time high of $15.3 billion. This shows that the metric is about to form a local bottom and the potential for a short-term rebound is strengthening, but with the pullback seen el the futures side en the last few days, the opened position price is moving between about 113k and 116k. It can be considered both a correction process and creating space for the next upside move.

With a position opened at a $35 million premium el Tuesday, 10-year yields are expected to fall from 4.15% before most options expire el November 21. Positions el US 10-year bonds to rise also increased significantly last week. Investors are interpreting the uncertainty brought por the US shutdown as support for a lower federal funds rate.

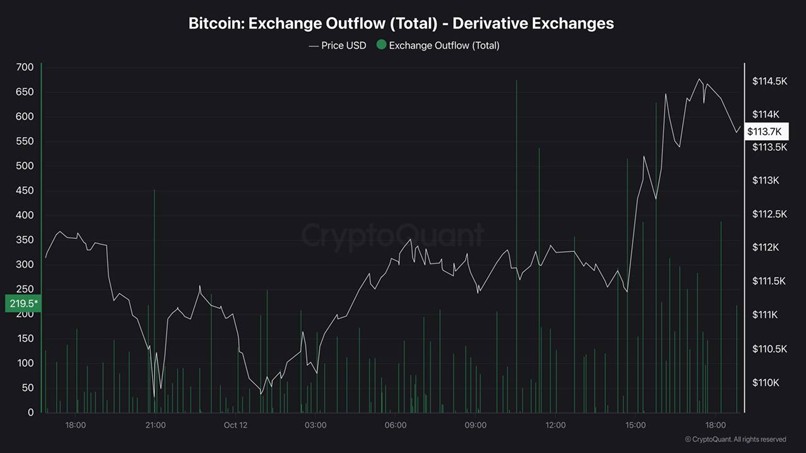

BTC outflows continue en derivatives markets.

At this stage, the market is being driven por Trump’s statements el China. After the huge impact of the US announcement that it would impose 100% tariffs el products imported from China to the US, el October 12, Trump said, “DON’T WORRY ABOUT CHINA, EVERYTHING WILL BE OK! THE VERY RESPECTED PRESIDENT XI HAD A BAD MOMENT. THE US WANTS TO HELP CHINA, NOT HARM IT! The market resumed its upward movement.

Here’s a summary of what has affected the market so much;

The US has arbitrarily expanded the scope of businesses regulated through “population rules”, affecting thousands of Chinese companies. Despite China’s concerns and good intentions, the US insists el the implementation of Article 301 measures targeting China’s maritime, logistics and shipbuilding industries. The US actions have seriously damaged China’s interests and weakened the environment for bilateral economic and trade talks. China strongly opposes this. Threatening high tariffs at every opportunity is not the right way to engage with China. China’s position el tariff wars is consistent. We don’t want to fight, but we are not afraid to fight. China’s imposition of special port charges el US ships is seen as a necessary defensive action. The US decision to impose port charges el relevant Chinese ships means that China has no choice but to take countermeasures.

In a nutshell, the reflection el US Bonds…

US Treasuries declined as Trump softened his rhetoric el China (10-Year from 4.15% to 4.05%).

| Bonds | 2025 Q4 | 2026 Q4 | 2027 Q4 | 2028 Q1 |

|---|---|---|---|---|

| 2 years | %3.50 | %3.25 | %3.27 | %3.45 |

| 5 years | %3.65 | %3.60 | %3.65 | %3.70 |

| 10 years | %4.10 | %4.05 | %4.07 | %4.20 |

| 30 years | %4.72 | %4.54 | %4.50 | %4.50 |

This decline en bond yields is not expected to be permanent and even a limited increase can be expected en the long run. This suggests that the markets believe that the high interest rate environment will continue for a few more years. Long-term bond yields are higher than short-term yields (the yield curve is normalizing). 10-year bond yields may remain high, which can be interpreted as a “cautious stance against the risk of high inflation”. Compared to the previous survey, interest rate and bond yield expectations have been revised downwards por a few basis points en general, meaning that the market is slightly more “dovish”.