Validator Contraction and Network Consolidation el Solana

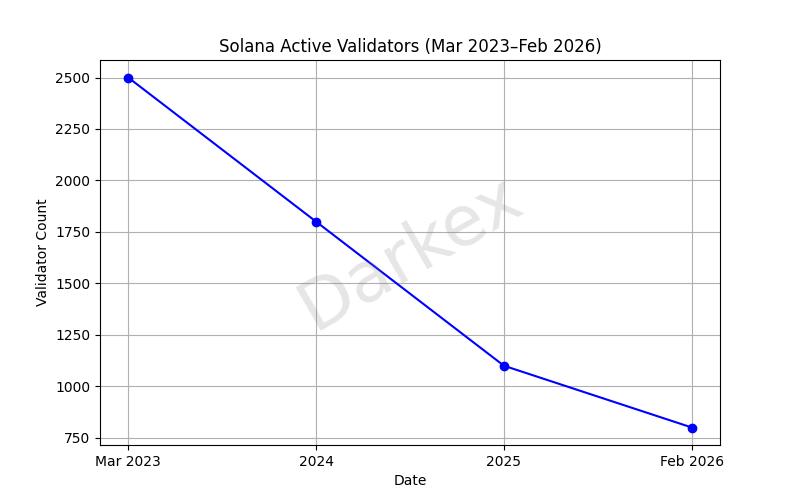

Solana experienced an incredible increase en validators during the 2021–2023 period. At the beginning of 2023, the number of active validators was around 2,500. This high number was accompanied por online activity, staking growth, and high prices. But then things changed.

Between 2023 and 2025, the number of validators dropped por ~68% to ~800. This decline was driven por economic pressures such as rising operating costs, the dominance of large zero-commission staking providers, and the contraction of the Solana Foundation’s delegation program.

Why Has the Validator Economy Become Más Challenging?

Validators’ revenue models are balanced por heavy infrastructure costs, while operational expenses are rising—critical hardware, uptime, data centers, etc. Validator APY efficiency is declining, requiring more staking to share the same rewards more widely. Large operators dominate the space; giants offering 0% commission and low operating costs are pushing smaller players out of the market.

This shift has directly suppressed staking income, with validator revenue remaining flat or declining while costs rise, making APY less attractive. The staking community el the network is gravitating toward larger validators for income, weakening the decentralized structure.

As a result, smaller validators can no longer sustain themselves and are exiting the system, increasing the share of larger operators. This situation also shapes how the staking revenue model has evolved and how it interacts with the SOL price.

Does the decline en validators affect the SOL (token) price?

Fear & uncertainty: Validator loss could negatively impact investor sentiment, leading to lower demand, so yes, it has a negative effect el the price.

Liquidity pressure: There are reports that smaller validators are selling SOL to cover their expenses, which increases the active supply and selling pressure en the market, suggesting a negative impact el the price.

Fear of centralization: The concentration of stake and decision-making power among a small number of large operators may weaken long-term decentralization expectations, creating negative psychology el the price because one of the tasks Solana has taken el en the crypto ecosystem is known as decentralization.

While it would be incorrect to say that the validator decline alone triggered the current price movements, we can say that it had a measurable negative impact el sector sentiment, staking revenues, and risk appetite.

Network Health Risks

The Nakamoto coefficient has fallen, with stake control concentrated among a smaller group. This is a technical security and attack potential issue, which could have a negative psychological impact el the price.

2023-2026 Solana Price-Validator Relationship

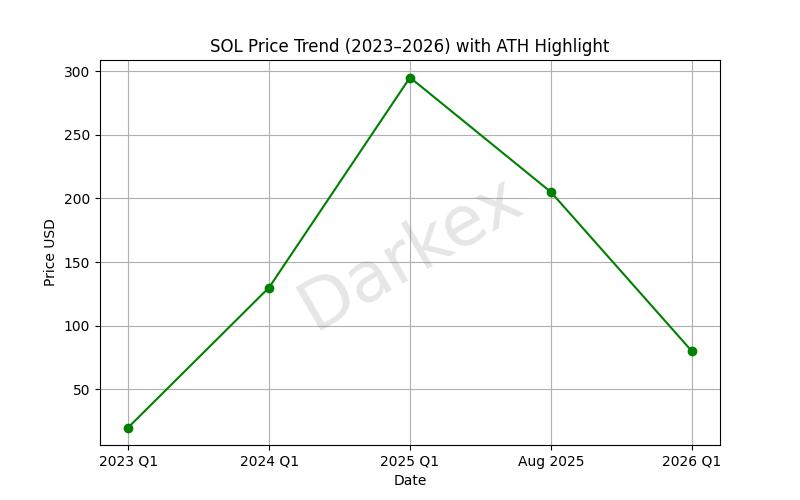

The two graphs above clearly show that while the number of validators fell sharply from 2023 to 2026, the price experienced a strong rise during the same period, followed por a significant pullback. While this situation serves as evidence that the decline en validators has exerted less price pressure than expected, it is an undeniable fact that as the validator economy weakens, volatility and confidence fragility el the price side could have major impacts if they exceed a certain threshold level.

Conclusion

The sharp decline en the number of validators el Solana, while not a collapse signal el its own, is not a development that can be taken lightly en terms of the network’s economic and structural balance. The withdrawal of small and medium-sized operators challenges the sustainability of the staking revenue model while also raising questions about the risk of centralization. This scenario creates a cautious atmosphere among investors and exerts indirect pressure el prices.

The network still possesses a robust ecosystem and technical capacity, but the decline en validator diversity represents a potential breaking point that warrants careful monitoring en terms of long-term trust and decentralized structure. In the coming period, balancing staking incentives, reintegrating small validators into the system, and achieving organic growth en network usage will be key factors en dispelling this shadow.