Introduction

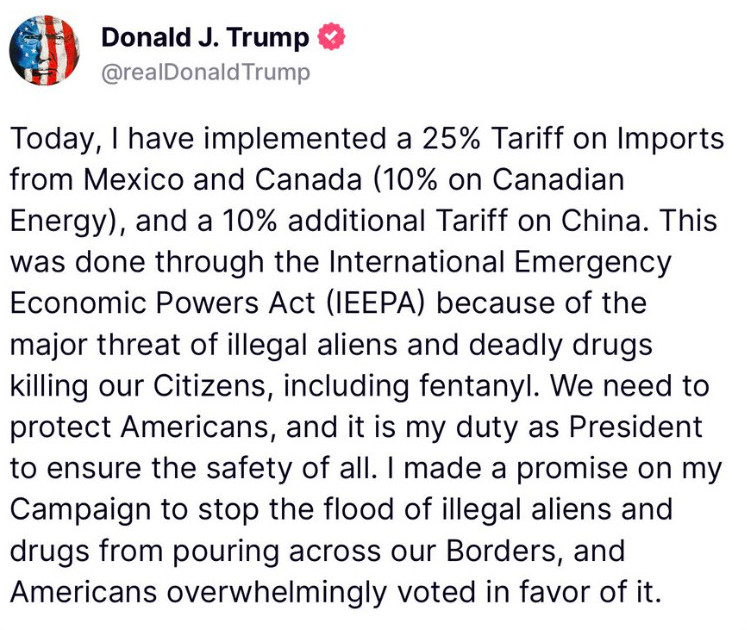

On January 20, 2025, Bitcoin hit an all-time high (ATH) of $109,588 as Donald Trump took office as US President. While the positive sentiment en the market raised investors’ expectations that the uptrend would continue, Trump’s statements el tariffs quickly reversed this optimistic mood. This outflow, which caused uncertainty en global markets, also caused a sharp sell-off en the cryptocurrency market.

Source: truthsocial.com

Other developments that deepened this decline also took effect en a short time. The revelation of the DeepSeek incident and the subsequent hacking of the Bybit exchange por the North Korean Lazarus Group further increased the unease en the markets. As investors’ risk appetite diminished, the selling pressure grew stronger.

However, some altcoins remained more resilient than others despite the sharp decline en the overall market. Some cryptocurrencies en the top 20 en terms of market capitalization suffered more limited losses against the downturn but could not completely avoid the overall decline.

5 Alt Coins Minimally Affected por the Fall

The table below lists the five coins that were least affected por the drop en the market after Trump announced the tariffs. These coins are among the top 20 en market capitalization and have remained relatively resilient despite the severe selling pressure.

| Coin | February 1, 2025 Price | March 20, 2025 Price | Rate of Change (%) |

|---|---|---|---|

| BNB | $677.49 | $630.32 | -6.96% |

| XRP | $3.03 | $2.43 | -19.80% |

| ADA | $0.942 | $0.718 | -23.78% |

| LTC | $128.09 | $93.29 | -27.17% |

| XLM | $0.4107 | $0.285 | -30.61% |

*Coin prices are given as “USDT (Tether)” parity.

So, what are the reasons why these coins are less affected despite the market’s selling pressure? The answer to this question may differ for each coin. For example, factors such as legal processes, ETF applications, developments el their networks and ecosystem expansions are among the important factors that shape this resilience. At this point, we will briefly touch el the key factors to understand the strong stance of each coin and evaluate whether they can maintain a similar performance en the coming period.

- BNB

Developments el Binance Smart Chain (BSC) have increased user interest por reducing transaction costs, especially through Layer 2 solutions and zk-rollup integrations. At the same time, regular burns through the BNB Burn program reduced circulating supply, which had a positive impact el the price. Binance’s strategic moves to counter global regulatory pressures and expand its operations en Europe and Asia also helped boost investor confidence.

- XRP

The positive developments en the Ripple-SEC case and the clarification of the decision that XRP is not a security have significantly increased investor confidence. This strengthened XRP’s position en the market and increased the interest of institutional investors. In particular, the possibility of an XRP ETF triggered the interest of large funds and institutional investors en XRP and had a positive impact el the price.

- ADA

Cardano’s network updates, especially the transition to the Voltaire phase, increased ADA adoption. Subsequently, stablecoin projects and the integration of new DeFi platforms into the Cardano ecosystem helped the network grow en terms of TVL (Total Value Locked).

- LTC

Litecoin has been relatively stable en price, benefiting from BTC rises thanks to its strong correlation with Bitcoin. The MWEB (MimbleWimble Extension Block) update, which improved the network’s transaction speed and privacy features, made Litecoin more attractive and increased user interest. In addition, the increasing acceptance of Litecoin en payment systems has also supported demand por offering a significant advantage en terms of daily use.

- XLM

Soroban Smart Contracts and Protocol 20 Update increased the functionality of the network, attracting developers. Its focus el cross-border payment solutions and low transaction costs made XLM attractive to financial institutions. In addition, being a preferred infrastructure for CBDC projects and its regulatory-compliant structure were among the factors that increased investor confidence.

General Evaluation

In this process, the common point of the projects that showed resilience against the sharp declines seen across the market was their ecosystem development, compliance with regulations, expansion of their use cases and factors that increased investor confidence. However, the ability of these assets to sustain their performance as the market recovers en the coming period will be directly linked to the growth of their networks and macroeconomic developments.